Cell and Gene Therapy Market Size and Growth 2025 To 2034

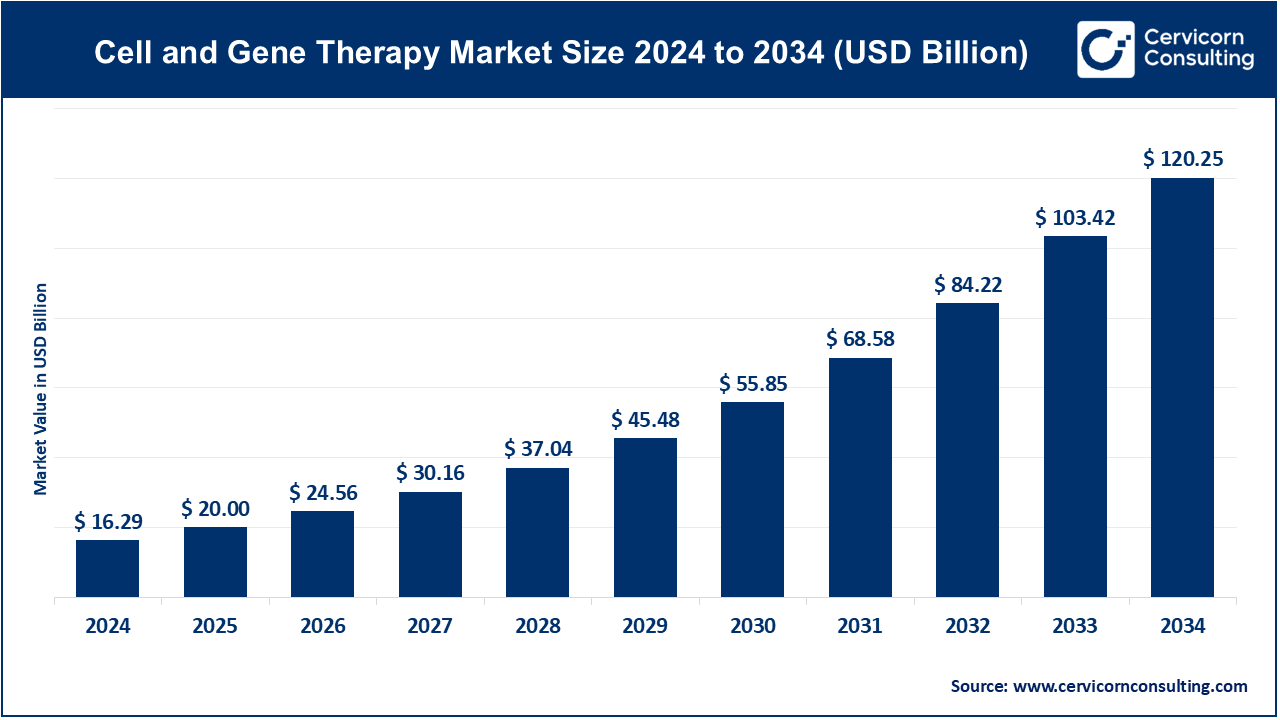

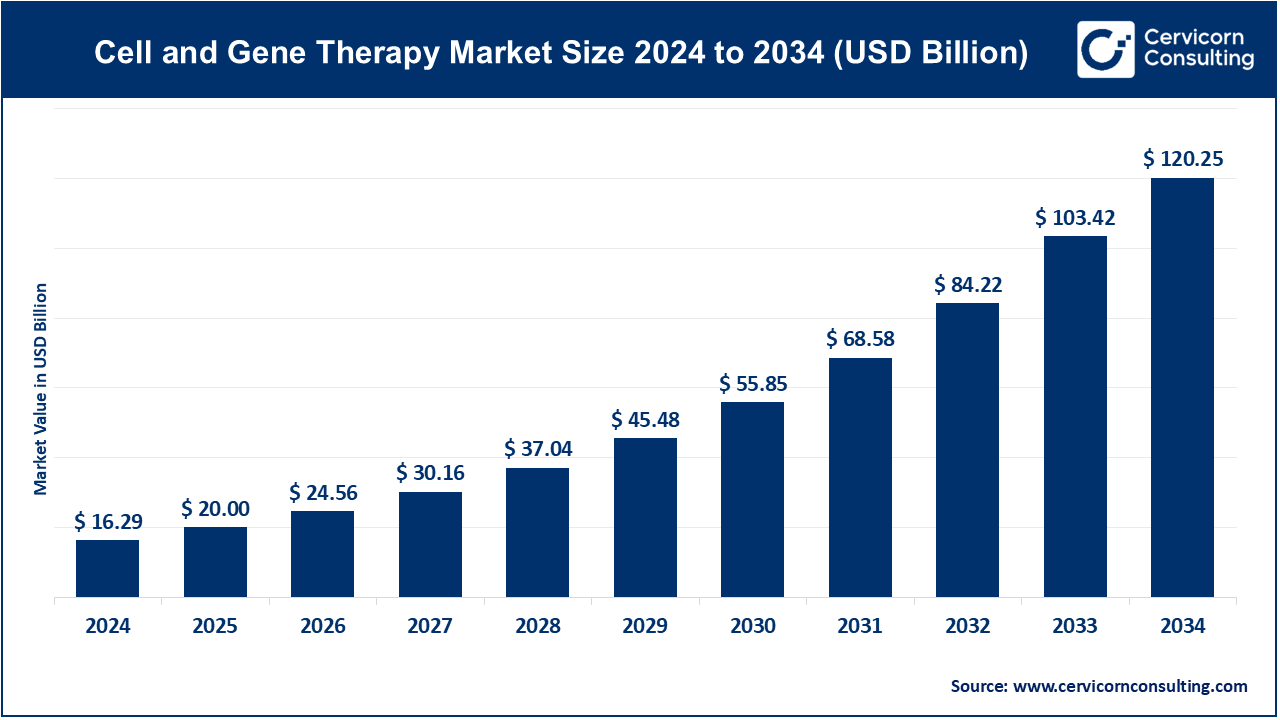

The global cell and gene therapy market size was accounted for USD 16.29 billion in 2024 and is expected to surge around USD 120.25 billion by 2034, expanding at a compound annual growth rate (CAGR) of 22.8% over the forecast period 2025 to 2034.

The cell and gene therapy market has witnessed remarkable growth in recent years, driven by advancements in personalized medicine and an increasing number of FDA-approved therapies. The growing prevalence of chronic and genetic disorders such as cancer, rare inherited diseases, and autoimmune conditions has heightened demand for innovative treatments that go beyond traditional drugs. Governments and private organizations are investing heavily in research and development, further propelling the industry's expansion. In addition, technological innovations in manufacturing, such as automation and improved vector delivery systems, are reducing production costs and enhancing scalability. The cell and gene therapy market are also seeing significant activity in mergers, acquisitions, and collaborations among biotechnology companies, pharmaceutical giants, and research institutions, aiming to accelerate development and commercialization. Regions like North America and Europe dominate the market due to strong regulatory frameworks, advanced healthcare infrastructure, and early adoption of novel treatments.

Cell and gene therapy are innovative medical treatments that involve manipulating cells or genetic material to treat or cure diseases. Cell therapy refers to the introduction of live cells into a patient's body to replace or repair damaged tissues or organs. Gene therapy involves the modification or insertion of genes into a patient's cells to treat or prevent disease, often targeting genetic disorders or cancers. Both therapies are considered cutting-edge treatments in the fields of oncology, genetic disorders, and regenerative medicine. They hold the potential to address previously untreatable conditions by repairing the root cause of the disease at a cellular or genetic level.

- “Regeneron CEO Leonard Schleifer highlighted gene therapy as the next major frontier in biotech during a CNBC interview. Emphasizing the potential to link genes with diseases, Schleifer believes this approach will revolutionize the pharmaceutical industry, marking a pivotal shift towards personalized medicine and targeted therapies.”

- “President Droupadi Murmu of India launched the country's first homegrown CAR T-cell therapy for cancer treatment on April 2024. This development is hailed as a significant breakthrough, offering new hope in the fight against cancer and showcasing India's advancement in cutting-edge medical technologies.”

- “Ori Biotech has unveiled its IRO platform, an automated manufacturing technology aimed at revolutionizing cell and gene therapy production. Developed over five years, IRO promises space- and cost-efficiency while offering flexibility across different stages of therapy development, potentially streamlining processes crucial for advancing treatments in the field.”

Cell and Gene Therapy Market Report Highlights

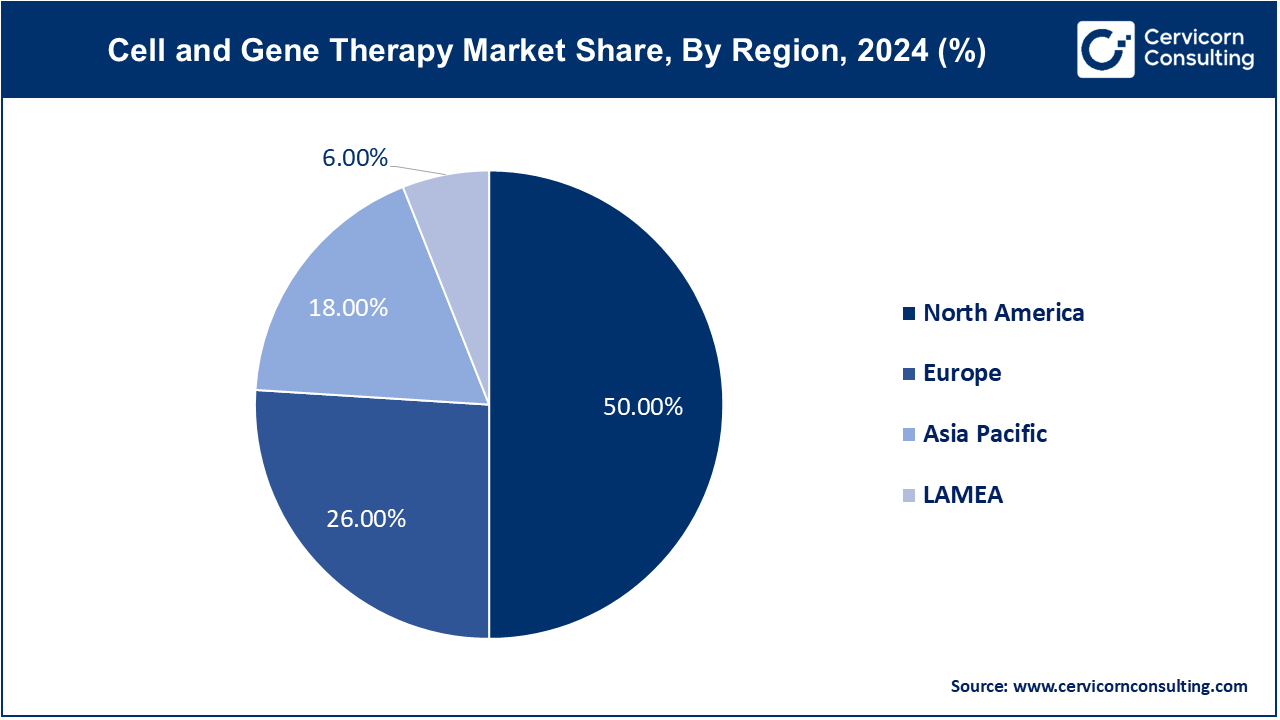

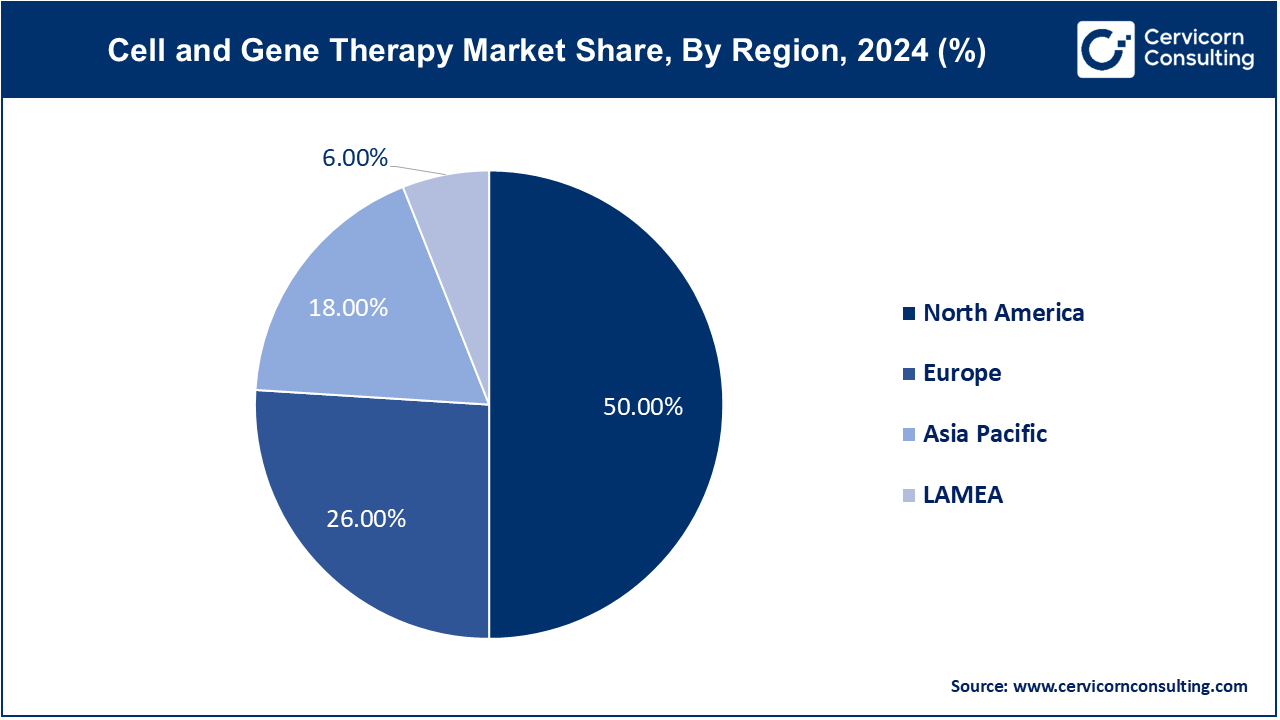

- North America has dominated the market with revenue share of 50% in 2024.

- Europe generated second highest revenue share of 26% in 2024.

- Latin America and Middle East & Africa has recorded combained revenue share of 6% in 2024.

- By therapeutic class, The infectious disease segment has registered revenue share of 28% in 2024.

- By therapeutic class, The others segment has covered revenue share of 25.81% in 2024.

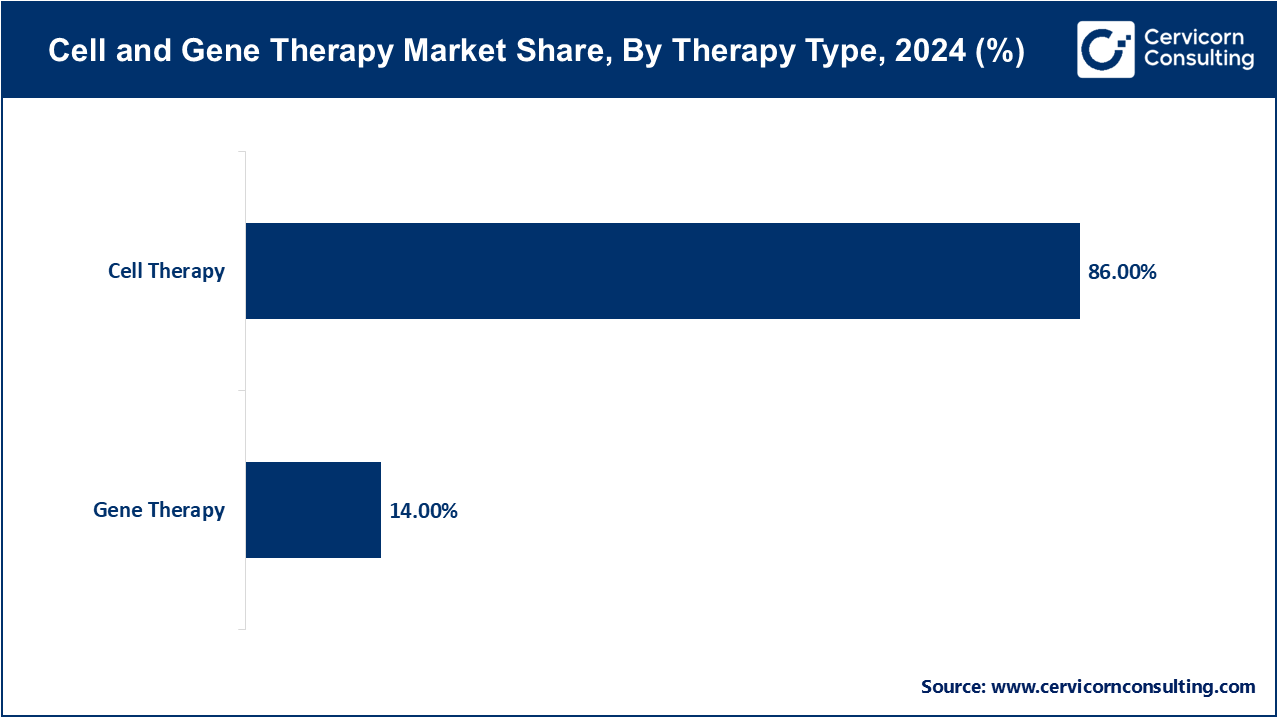

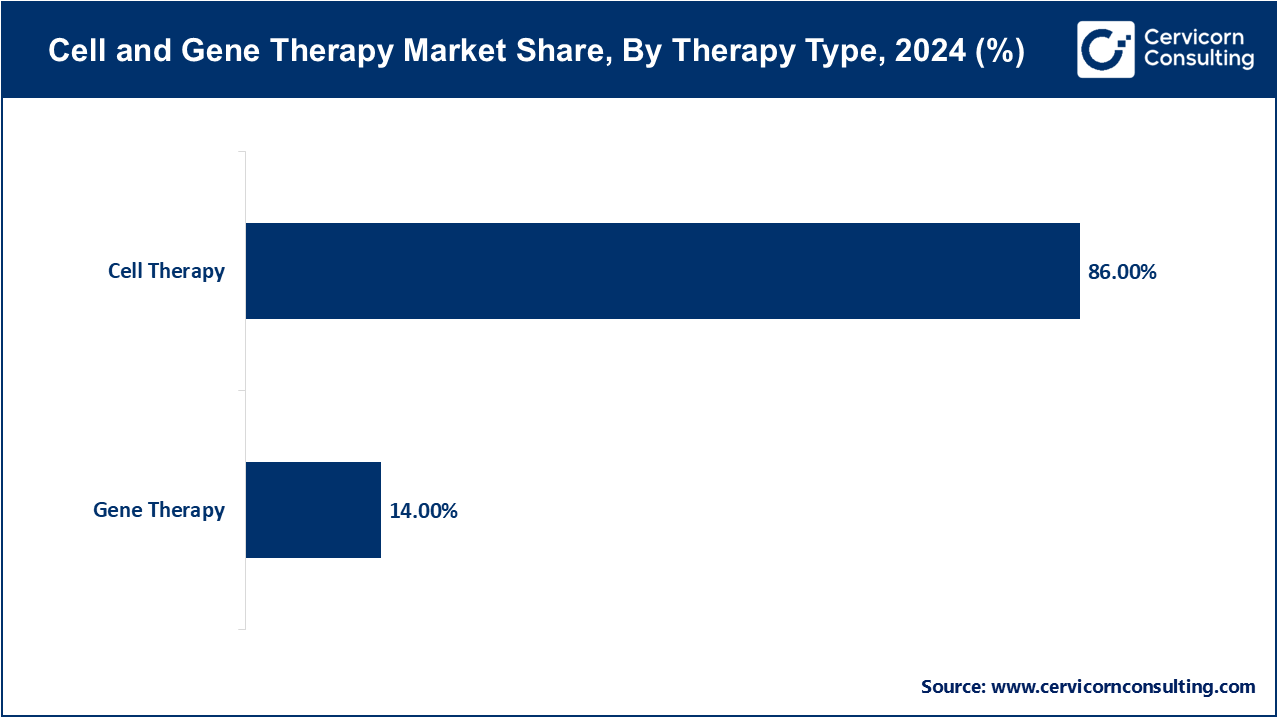

- By therapy type, The cell therapy segment has recorded dominating revenue share of 86% in 2024.

- By cell therapy, The T Cells segment has generated revenue share of 35.89% in 2024.

- By delivery method, The In VIVO segment has accounted dominating revenue share of 79.21% in 2024.

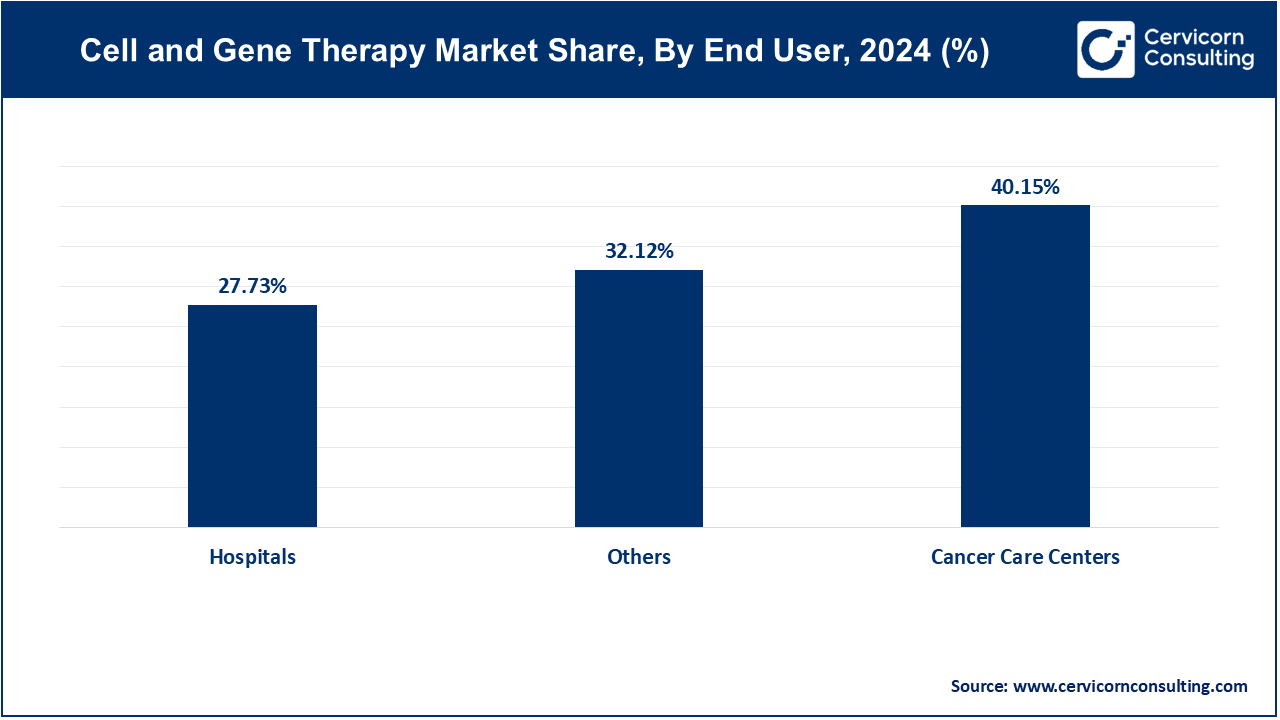

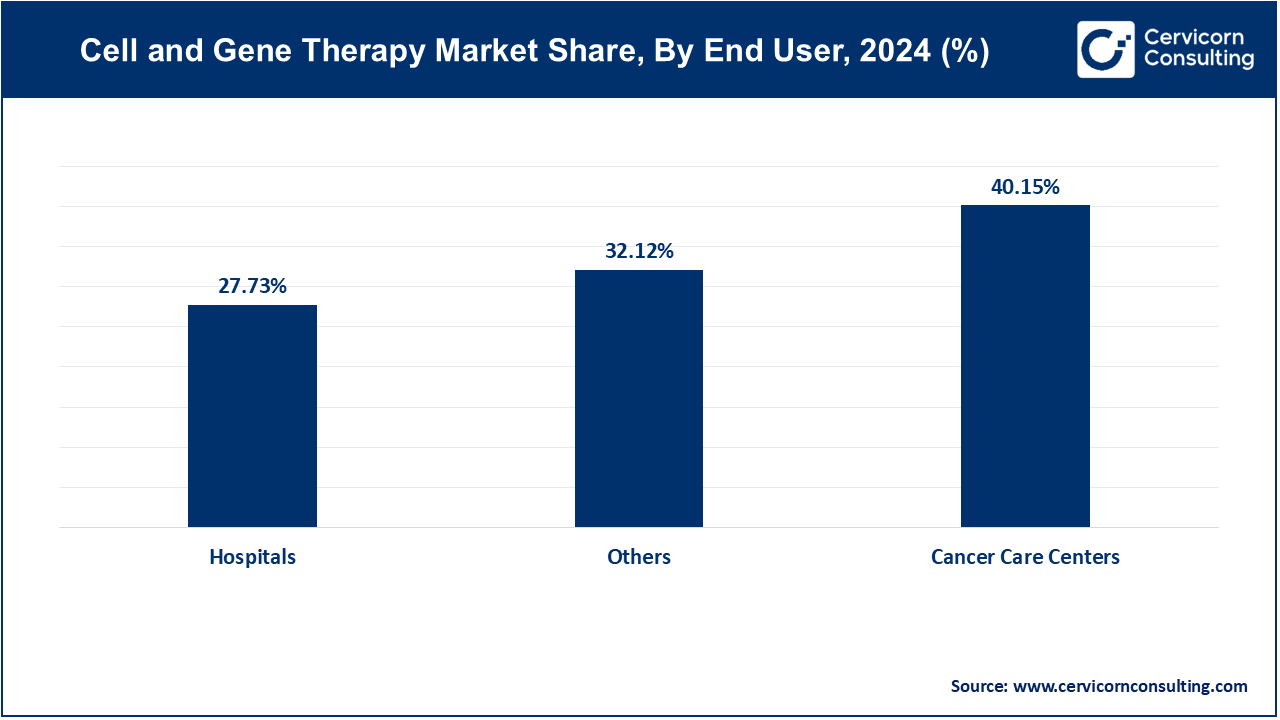

- By end-users, cancer care centers segments has garnered revenue share of 40.15% in 2024.

Cell and Gene Therapy Market Growth Factors

- Increased Investment and Funding: The cell and gene therapy sector is attracting substantial investment from venture capital firms, pharmaceutical companies, and government bodies. This influx of capital supports research and development, clinical trials, and commercialization efforts, facilitating faster innovation and bringing new therapies to market more efficiently.

- Advancements in Manufacturing and Delivery Technologies: Improvements in the manufacturing processes of viral vectors and cell therapies have reduced production costs and increased scalability. Additionally, advancements in delivery systems, such as nanoparticle-based delivery and targeted gene editing techniques, have enhanced the precision and effectiveness of therapies.

- Growing Pipeline of Products: The number of cell and gene therapies in clinical trials has been steadily increasing, indicating a robust pipeline of products poised for future market entry. As more therapies advance through clinical stages, the market is expected to expand rapidly, offering diverse treatment options.

- Rising Awareness and Acceptance: Increasing awareness among healthcare providers, patients, and payers about the potential benefits of cell and gene therapies is driving adoption. As success stories and positive clinical outcomes accumulate, there is a growing acceptance of these therapies as viable treatment options for previously intractable conditions.

- Personalized Medicine Approach: Cell and gene therapies align with the trend toward personalized medicine, offering tailored treatments based on individual genetic profiles. This approach enhances treatment efficacy and reduces side effects, making these therapies increasingly appealing to both patients and healthcare providers. The focus on personalized solutions is expected to drive further growth in the market.

Cell and Gene Therapy Market Trends

- Technological Advancements: Innovations such as CRISPR-Cas9 gene editing, CAR-T cell therapy, and advances in stem cell technology have significantly improved the precision and efficacy of cell and gene therapies. These breakthroughs are accelerating the development and approval of new therapies.

- Rising Prevalence of Chronic and Genetic Diseases: The increasing incidence of chronic conditions like cancer, diabetes, and genetic disorders such as cystic fibrosis and muscular dystrophy is driving demand for innovative treatments that cell and gene therapies can offer.

- Supportive Regulatory Environment: Regulatory bodies like the FDA and EMA are providing expedited approval processes and incentives for cell and gene therapies, encouraging more research and faster market entry for new treatments.

- Expansion into Emerging Markets: Developing regions in Asia-Pacific and Latin America present significant growth opportunities due to increasing healthcare expenditure, improving infrastructure, and growing awareness and acceptance of advanced therapies.

- Collaborations and Partnerships: Collaborations between biotech companies, research institutions, and pharmaceutical giants can accelerate innovation, streamline development processes, and expand the reach of new therapies to a broader patient population. These partnerships can also lead to the sharing of resources and expertise, further driving market growth.

Report Scope

| Area of Focus |

Details |

| Market size in 2025 |

USD 20 Billion |

| Market size in 2034 |

USD 120.25 Billion |

| Market Growth Rate |

CAGR of 22.8% from 2025 to 2034 |

| Largest Region |

North America |

| Fastest Growing Region |

Asia-Pacific |

| Segment Covered |

By Therapy Type, Therapeutic Class, Delivery Method, End-Users, Regions |

Cell and Gene Therapy Market Dynamics

Drivers

Aging Population and Associated Diseases:

- As the global population ages, there is an increased incidence of age-related diseases such as Alzheimer's, Parkinson's, and various types of cancers. Cell and gene therapies offer potential treatment options for these complex conditions, driving demand as more people seek effective solutions for managing and curing age-related health issues.

Development of Innovative Business Models:

- Companies are adopting new business models, such as outcome-based pricing and partnerships with healthcare providers, to make advanced therapies more accessible and affordable. These innovative approaches facilitate broader adoption and integration of cell and gene therapies into healthcare systems, thereby expanding the market reach.

Restraints

Complex Regulatory Challenges:

- The regulatory landscape for cell and gene therapies is complex and constantly evolving, with stringent requirements for safety, efficacy, and quality. Navigating these regulations can be time-consuming and costly for companies, potentially delaying the development and approval of new therapies. The lack of harmonized regulatory frameworks across different regions further complicates global market entry.

Manufacturing and Scalability Issues:

- The production of cell and gene therapies involves sophisticated and resource-intensive processes that can be challenging to scale up for commercial use. Maintaining consistency, quality, and cost-effectiveness in manufacturing remains a significant hurdle. Additionally, the limited availability of specialized manufacturing facilities and the need for skilled personnel can impede the widespread adoption of these therapies.

Opportunities

Technological Integration with Artificial Intelligence (AI) and Machine Learning (ML):

- The integration of AI and ML in drug discovery and development processes can significantly accelerate the identification of new therapeutic targets and optimize clinical trial designs. These technologies can also help in predicting patient responses to therapies, enhancing personalized treatment strategies, and improving overall outcomes. Leveraging AI and ML can streamline research and development, reduce costs, and increase the efficiency of bringing new therapies to market.

Orphan Drug Designation and Market Exclusivity:

- Many cell and gene therapies target rare and orphan diseases, which often qualify for special regulatory designations such as orphan drug status. This designation provides incentives like market exclusivity, tax credits, and reduced fees, encouraging companies to invest in developing treatments for these underserved conditions. The focus on rare diseases presents a unique opportunity for market expansion and profitability, as these therapies often face less competition and can command premium pricing.

Challenges

High Development and Treatment Costs:

- Developing cell and gene therapies is an expensive process due to the advanced technology, extensive research, and rigorous clinical trials involved. These costs often translate into high prices for treatments, which can limit patient access and pose challenges for healthcare systems and payers. Ensuring affordability while maintaining profitability is a significant challenge for companies in this market.

Logistical and Supply Chain Complexities:

- The delivery of cell and gene therapies often requires precise logistical coordination, including the transport of sensitive biological materials and the need for timely administration to patients. Cold chain management, handling of live cells, and ensuring the availability of specialized facilities and personnel are logistical challenges that can impact the efficiency and success of therapy delivery. These complexities necessitate robust infrastructure and coordination, which can be difficult to achieve on a large scale.

Cell and Gene Therapy Market Segmental Analysis

Therapy Type Analysis

Cell Therapy: The cell therapy segement has dominated the market with the share of 86% in 2024. Cell therapy involves using living cells, either from the patient (autologous) or a donor (allogeneic), to treat medical conditions. It aims to replace damaged cells or stimulate repair. Recent trends show a focus on personalized treatments and advancements in manufacturing techniques to scale production.

Gene Therapy: The gene therapy segment has covered market share of 14% in 2024. Gene therapy aims to treat or prevent disease by modifying a patient's genes. It involves introducing genetic material into cells to correct genetic disorders or enhance therapeutic effects. Current trends include the development of viral vectors for efficient gene delivery and regulatory advancements supporting commercialization.

Therapeutic Class Analysis

Cardiovascular Disease: The cardiovascular disease segment has recorded market share of 4.86% in 2024. Therapies target heart conditions by repairing or replacing damaged tissues. Market trends show a focus on regenerative treatments for heart failure and vascular diseases, leveraging stem cell therapies and gene editing to enhance efficacy and patient outcomes.

Cancer: Addressing malignancies by modifying genes or immune cells to target and destroy cancerous cells. Advances include personalized therapies and targeted genetic modifications, supported by robust clinical trials and regulatory approvals driving market expansion.

Genetic Disorder: Thegenetic disorder segment has accounted market share of 10.64% in 2024. Treatments correct defective genes causing inherited conditions like cystic fibrosis. Market growth emphasizes precision medicine and gene editing technologies, with increasing investment in rare disease therapies.

Rare Diseases: Targeting conditions affecting a small population with genetic therapies. Market expansion is driven by orphan drug incentives, breakthroughs in gene editing, and growing awareness of rare disease treatments.

Oncology: The oncology segment has calculated market share of 12.55% in 2024. Focus on cancers, leveraging gene therapy to enhance immune responses or directly target tumors. Market trends highlight CAR-T cell therapies, viral vector advancements, and emerging immunotherapies, driving transformative changes in cancer treatment paradigms.

Hematology: The hematology segment has captured market shar of 7.78% in 2024. Treating blood disorders through gene therapy, including hemophilia and sickle cell disease. Trends include gene editing for blood stem cells, expanded clinical trials exploring curative therapies, and improved patient access.

Ophthalmology: The ophthalmology segment has achived market share of 5.40% in 2023. Correcting genetic defects causing vision loss, with treatments like gene supplementation or editing. Market growth seen in gene therapies for inherited retinal diseases, supported by advances in ocular delivery methods and regulatory approvals.

Infectious Disease: The infectious disease segment has considered highest market share of 28.70% in 2024. Targeting viral infections by modifying host cells or immune responses. Trends include gene-based vaccines, antiviral gene editing technologies like CRISPR, and advancements in viral vector design for efficient gene delivery.

Neurological Disorders: The neurological disorders segment has held market share of 4.26% in 2024. Addressing conditions like Alzheimer's and Parkinson's by modifying brain cells or enhancing neuroprotection. Market focus on gene therapy delivery methods, neuroregeneration techniques, and innovative clinical trial designs to tackle complex neurological challenges.

Others: The others segment has generated second highest market share of 25.81% in 2024. Includes diverse conditions from metabolic disorders to autoimmune diseases. Market growth driven by expanding gene editing applications, novel gene therapies targeting specific disease pathways, and collaborations between biotech firms and academic research centers to accelerate therapeutic development.

End Users Analysis

Hospitals: The Hospitals segment has covered market share of 27.73% in 2024. Hospitals play a critical role in the cell and gene therapy market, offering infrastructure for clinical trials and treatments, facilitating patient access to innovative therapies.

Cancer Care Centers: The cancer care centers segment has recorded markey share of 40.15% in 2024. These centers specialize in oncology, leading the adoption of personalized therapies such as CAR-T and gene editing to precisely target cancer cells, improving treatment efficacy and patient outcomes.

Wound Care Centers: Dedicated to chronic wound management, these centers integrate regenerative cell therapies to promote faster healing and tissue regeneration, addressing unmet medical needs with advanced treatment options.

Others: The others segemet has accounted market share of 32.12% in 2024. This category encompasses research institutions and biotech firms driving innovation in cell and gene therapies. They contribute to market growth through groundbreaking research, technological advancements, and regulatory developments, expanding treatment options and accessibility globally.

Cell and Gene Therapy Market Regional Analysis

Why is North America leading in the cell and gene therapy market?

The North America market size is calculated at USD 8.15 billion in 2024 and is projected to grow around USD 60.12 billion by 2034. Known for robust regulatory frameworks and advanced healthcare infrastructure, North America leads in clinical trials and commercialization of cell and gene therapies. Significant investments in biotech and pharmaceutical sectors drive innovation, focusing on oncology and rare diseases.

Europe Cell and Gene Therapy Market Trends

Europe emphasizes collaborative research initiatives and regulatory harmonization, fostering a competitive landscape for cell and gene therapies. Europe market size is predicted to hit around USD 31.27 billion by 2034 from USD 4.24 billion in 2024. Countries like the UK, Germany, and Switzerland are prominent in biotech innovation and clinical development, with a focus on expanding treatment options for genetic disorders.

Why is Asia-Pacific experiencing rapid growth in the cell and gene therapy market?

Rapidly evolving healthcare systems in countries like China, Japan, and South Korea drive growth in the Asia-Pacific region. Asia Pacific market size is expected to reach around USD 21.65 billion by 2034 increasing from USD 2.93 billion in 2024. Increasing investments in biopharmaceuticals and supportive regulatory reforms accelerate the adoption of cell and gene therapies, particularly in oncology and regenerative medicine.

LAMEA Cell and Gene Therapy Market Trends

The LAMEA market size is calculated at USD 0.98 billion in 2024 and is anticipated to reach around USD 7.22 billion by 2034. Emerging markets in LAMEA are witnessing a gradual uptake of cell and gene therapies, supported by improving healthcare infrastructure and rising healthcare expenditure. Focus areas include genetic disorders and infectious diseases, with growing investments in biotech and partnerships with global pharmaceutical firms.

Global Cell and Gene Therapy Market Top Companies

- Novartis International AG

- Gilead Sciences, Inc.

- Bristol-Myers Squibb Company

- bluebird bio, Inc.

- Spark Therapeutics, Inc. (a Roche company)

- Kite Pharma (a Gilead company)

- Celgene Corporation (a Bristol-Myers Squibb company)

- Sangamo Therapeutics, Inc.

- Regeneron Pharmaceuticals, Inc.

- Editas Medicine, Inc.

- CRISPR Therapeutics AG

- Intellia Therapeutics, Inc.

- Fate Therapeutics, Inc.

- Orchard Therapeutics plc

- Precision BioSciences, Inc.

New players like CRISPR Therapeutics, Intellia Therapeutics, and Fate Therapeutics have adopted innovative gene editing technologies, advancing their entry into the cell and gene therapy market. These companies focus on precision medicine and novel therapeutic approaches, attracting investment and partnerships. Key players dominating the market include established pharmaceutical giants like Novartis, Gilead Sciences, and Bristol-Myers Squibb, leveraging extensive R&D capabilities, global reach, and regulatory expertise. They lead through strategic acquisitions, pipeline expansions, and successful commercialization of therapies such as CAR-T treatments and gene therapies, reinforcing their market dominance and shaping industry standards.

Recent Developments

- In 2022, Moderna announced that Merck (MSD) will exercise its $250 million option to co-develop and commercialize PCV mRNA-4157/V940. This vaccine is currently in a phase II trial as adjuvant therapy for high-risk melanoma patients, in combination with Merck's pembrolizumab.

- In 2022, Novartis AG (Switzerland) obtained FDA approval for KYMRIAH (Tisagenlecleucel) for treating relapsed or refractory follicular lymphoma (FL) after two or more prior systemic therapies. This marks the third indication for KYMRIAH, expanding treatment options for patients with FL.

- In 2022 Alexion's genomic medicines division has acquired LogicBio's technology to enhance their preclinical development and R&D capabilities for rare diseases. LogicBio's gene delivery systems and viral vector platform will bolster Alexion's efforts in genetic disorder treatments.

- In 2022, Pfizer has acquired Biohaven Pharmaceuticals, known for NURTEC ODT (rimegepant), approved for acute therapy and episodic migraine prevention. With Pfizer's global presence, this acquisition aims to expand treatment options for migraine patients worldwide.

Market Segmentation

By Therapy Type

- Cell Therapy

- Stem Cell Therapy

- Hematopoietic Stem Cell Therapy

- Mesenchymal Stem Cell Therapy

- Other

- Non-Stem Cell Therapy

- T-Cell Therapy

- Dendritic Cell Therapy

- NK Cell Therapy

- Gene Therapy

- In vivo Gene Therapy

- Viral Vectors

- Adenovirus

- Lentivirus

- Retrovirus

- Others

- Non-viral Vectors

- Naked DNA

- Oligonucleotides

- Others

- Ex vivo Gene Therapy

By Therapeutic Class

- Cardiovascular Disease

- Cancer

- Genetic Disorder

- Rare Diseases

- Oncology

- Hematology

- Ophthalmology

- Infectious Disease

- Neurological Disorders

- Others

By Delivery Method

By End-Users

- Hospitals

- Cancer Care Centers

- Wound Care Centers

- Others

By Regions

- North America

- APAC

- Europe

- LAMEA

...

...