Point of Care Molecular Diagnostics Market Size and Growth 2025 to 2034

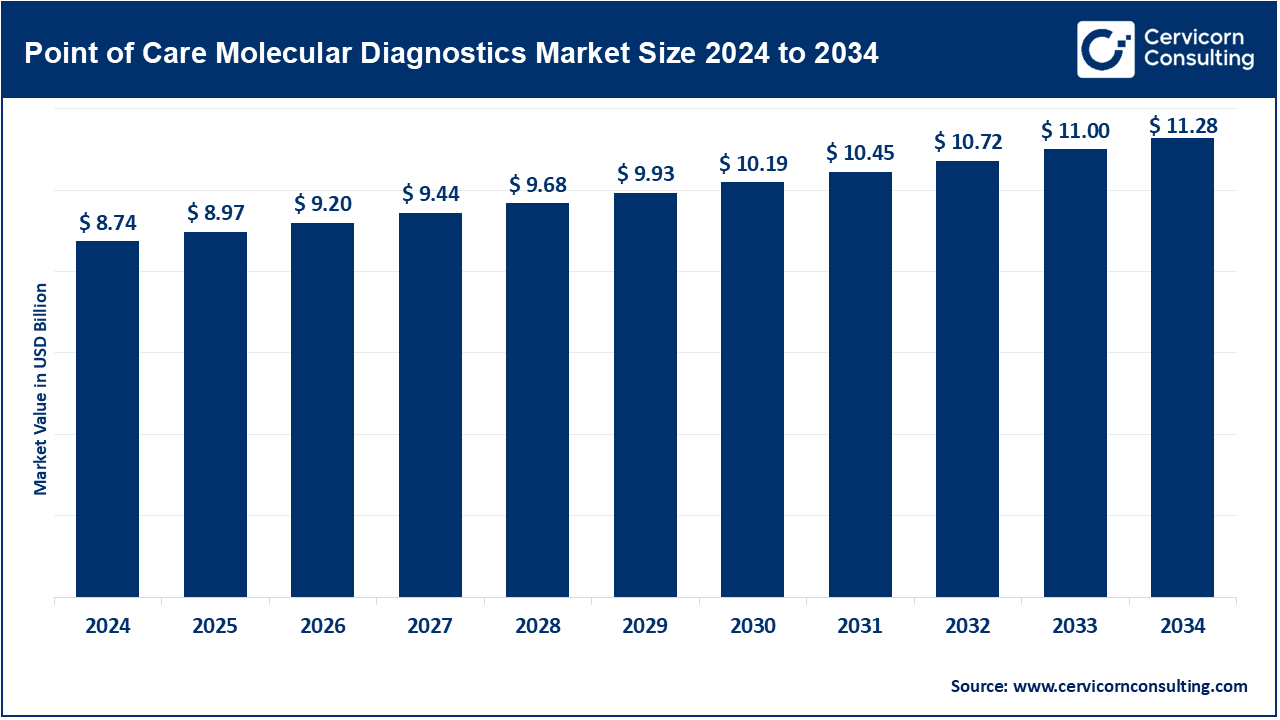

The global point of care molecular diagnostics market size was valued at USD 8.74 billion in 2024 and is expected to be worth around USD 11.28 billion by 2034, growing at a compound annual growth rate (CAGR) of 2.58% over the forecast period from 2025 to 2034. The demand for quick and accurate diagnoses, particularly in emergency and outpatient settings, is prompting robust growth in the global point of care molecular diagnostics market. Other major factors driving that demand are the rising prevalence of infectious diseases and genetic disorders, together with ever-increased focus on personalized medicine. The technological advancements in PCR and NGS platforms are continuing to drive the market. More and more investments in portable, user-friendly devices are, nonetheless, driving growth. Cost of healthcare is increasingly being demanded, while decentralization of health service provision plays another major driving factor.

Molecular diagnostics are those diagnostics that detect nucleic acid from the patients' site of treatment, mostly outsides of centralized laboratory settings. Assays employing molecular techniques include PCR and next-generation sequencing, are used to quickly and accurately diagnose infections and genetic disorders. POC molecular diagnostics allow quicker decision-making, personalized treatment, and enhanced patient results through almost instant test results. Hence, the technology is even more relevant for use in emergency care, remote locations, and contexts in which timely diagnosis is vital for effective treatment.

Point of Care Molecular Diagnostics Market Report Highlights

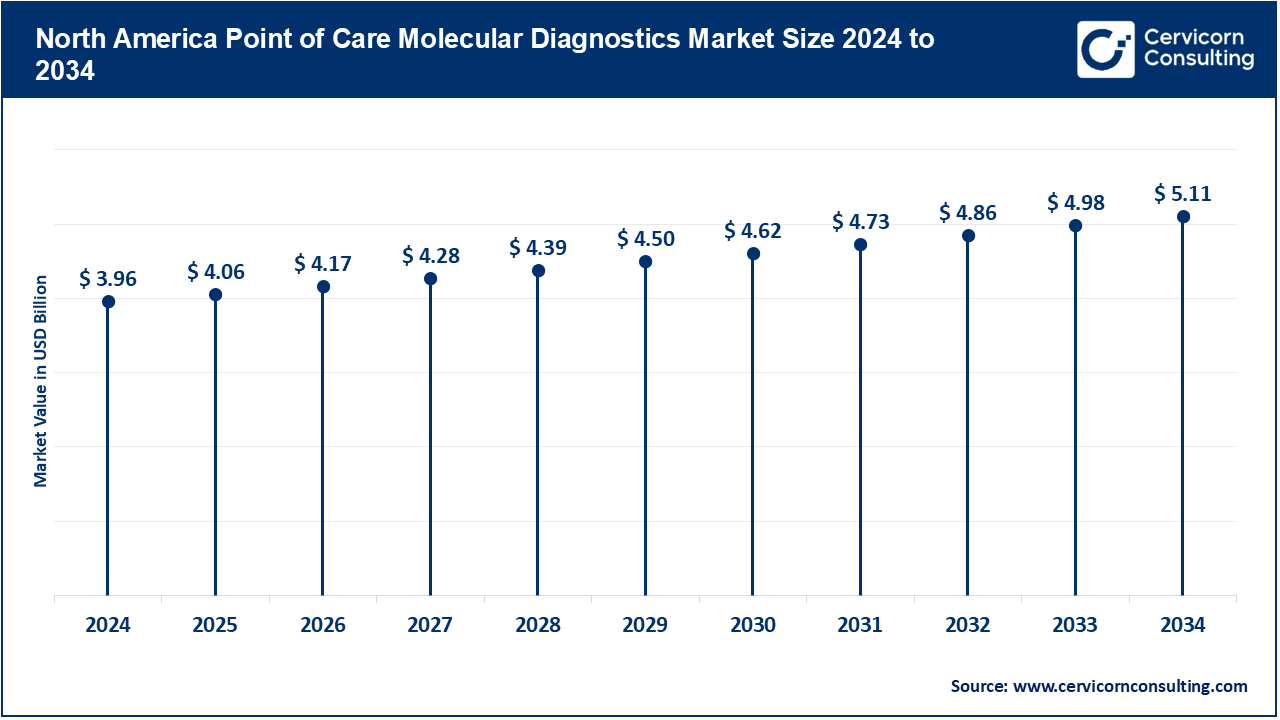

- The U.S. point of care molecular diagnostics market size was valued at USD 2.77 billion in 2024 and is expected to be worth around USD 3.58 billion by 2034.

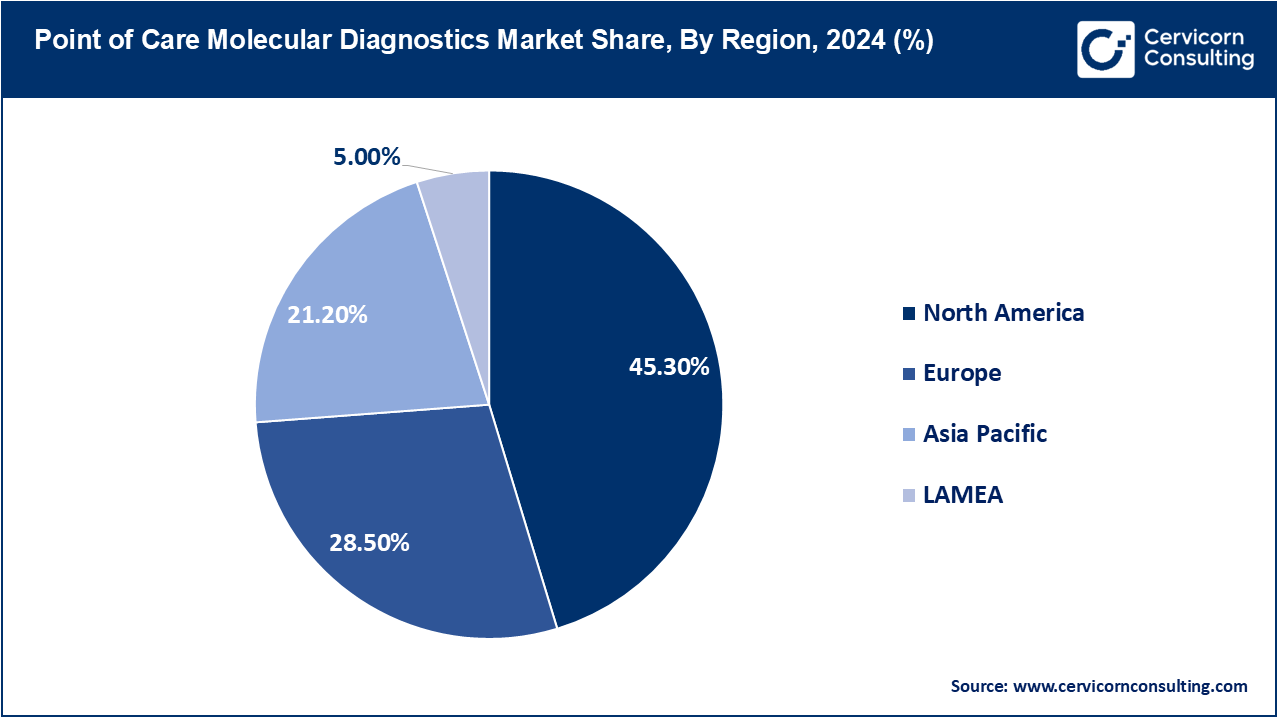

- The North America has accounted highest revenue share of 45.30% in 2024.

- The Europe has held revenue share of 28.50% in 2024.

- By technology, the PCR-based segment has accounted revenue share of 64.80% in 2024.

- By end user, the decentralized labs segment has generated revenue share of 42.50% in 2024.

- By application, the infectious diseases segment has garnered revenue share of 31.30% in 2024.

- By test location, the OTC segment has recorded revenue share of 51.60% in 2024.

Point of Care Molecular Diagnostics Market Growth Factors

- A growth in infectious and chronic diseases: The surge in infectious diseases, including COVID-19, malaria, and respiratory infections, and chronic diseases such as diabetes and cardiovascular diseases drives the point-of-care molecular diagnostics market. Such diseases require rapid and accurate diagnosis to improve treatment, and this increases the adoption of molecular diagnostic solutions that give real-time and accurate results directly at the point of care, thereby reducing delay and improving efficiency.

- Advances in molecular technologies: Advances in molecular diagnostic technologies, for example, in PCR, CRISPR, and next-generation sequencing, are drastically changing the face of health care. With such technologies, the detection of pathogens, genetic disorders, and cancers becomes quick, and more precise. They add to increased capabilities in point-of-care diagnostics in some of the most varied healthcare settings, be it hospitals, home care, or even communities.

- Rise in awareness for early disease detection and preventive care: With growing awareness of the crucial importance of early detection and prevention of disease, demand for diagnostic tools that are rapid, simple, and accurate is on the increase. Point-of-care molecular diagnostics acts as a key enabler, offering the possibility of better health outcomes with lower treatment costs due to the early stage of detection to individuals and healthcare providers, thus fueling growth in this market.

Point of Care Molecular Diagnostics Market Trends

- Artificial intelligence and machine learning are integrated into diagnostic equipment: The advent of AI and ML will integrate with point-of-care molecular diagnostic devices that will increasingly achieve accuracy, speed, and a proper decision to work with valuable predictions for the inputs of the algorithms that would run on enormous amounts of data and provide real-time analysis. This trend reduces human errors further, improves the performance of diagnosis, and permits more personalized treatment plans, hence adding to the growth in the market.

- The application of biosensors and lab-on-a-chip technologies: Advances in both biosensors and lab-on-a-chip technologies contribute to the improved efficiency and availability of point-of-care molecular diagnostics. These tiny devices can evaluate samples in real-time at high accuracy, are user-friendly, portable, and of low cost, making them very suitable for healthcare environments such as remote clinics and even home settings. This is therefore a leading edge in the market because it can ease transition towards decentralized health solutions.

- Increasing demands for personalized healthcare solutions: Increased demands in personalized medicine have seen people develop more molecular diagnostics since these help establish treatment depending on one's genetic makeup. Genetic tests enable providers to know better their patient's predisposition or vulnerabilities in some disease condition by revealing such variation and mutation of the genetics in one. As these results get provided to health practitioners more rapidly than earlier traditional types, there has been increased usage in the diagnosis in a more localized healthcare.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 8.97 Billion |

| Expected Market Size in 2034 |

USD 11.28 Billion |

| Projected CAGR 2025 to 2034 |

2.58% |

| Dominant Region |

North America |

| Region with the Quickest Growth |

Asia-Pacific |

| Key Segments |

Technology, Application, Test Location, Product and Service, End-use, Region |

| Key Companies |

F. Hoffmann-La Roche AG, Abbott, QIAGEN, Bayer AG, Nova Biomedical, Danaher, Nipro Diagnostics, Bio-Rad Laboratories, Inc., Agilent Technologies, Inc., bioMérieux, OraSure Technologies, Abaxis |

Point of Care Molecular Diagnostics Market Dynamics

Market Drivers

- Advances in point-of-care testing technologies that reduce time-to-results: This makes the time lag between the onset of the tests and the report of results obtained from molecular diagnostics significantly reduced by technological advancements. Faster turnaround times are critical because decisions on the treatment need to be made soon in clinical settings. These are miniaturized devices and incorporation with mobile technologies, ensuring that even complex molecular tests can be completed at the point of care without compromise in accuracy, thereby driving their popularity.

- A growing preference for non-invasive testing methods: There is an increasingly growing need for non-invasive testing modalities, which have included molecular diagnostics that use minimal samples, namely saliva, urine, or blood samples. The new generation of patients is seeking easy, less invasive, and very comfortable diagnostic services. Non-invasive methods prevent such invasive methods such as biopsy in the hospital makes a medical provider turn toward point-of-care molecular diagnostics because it boosts patients' satisfaction levels and promotes quick access to diagnostic accuracy.

- Shortage of skilled labor in remote areas encourages easy-to-use diagnostic devices: Generally, remote or rural regions usually lack adequate professional medical personnel, which may limit the level at which quality diagnostics can be delivered. Many devices under point-of-care molecular diagnostics are easy to use and do not require much technical expertise. They enable trained basic healthcare professionals to conduct highly accurate tests, expand quality diagnostics for areas with less access, and thereby accelerate growth in these regions.

- Increased adoption of molecular diagnostics during global health crises: Rapid diagnostics tools are becoming more and more crucial during a global health crisis, such as the COVID-19 pandemic. Point-of-care molecular diagnostics become crucial in fast detection of infection, thereby fast treatment and control. Success stories during such times have increased their adoption for various infectious diseases and conditions, so these technologies remain a part of mainstream healthcare, further driving growth in the market.

Market Restraints

- Limited awareness in developing countries about advanced diagnostic technologies: Awareness of advanced diagnostic technologies, such as molecular testing, is low in developing countries and therefore limits the adoption of such technologies. The healthcare professionals are not aware of these technologies, and the patients are not educated about the benefits of these technologies. Education, training, and investment in infrastructure are needed to ensure that such innovations are well understood and accessible, and this is one of the significant challenges in expanding the market in these regions.

- Difficult sample preparation and processing: This is one of the reasons that may prevent point-of-care molecular diagnostics from becoming widespread. At times, such devices require special reagents, storage conditions, and handling processes that may not make them very practical to use outside the laboratory setting.Such processes require simplification so that molecular diagnostics can be applied in various settings, including remote clinics and home care.

- Issues concerning data privacy and security: All the issues connected to remote monitoring and diagnostics through digital systems and the use of devices for remote monitoring raise wide array issues with the patient's data in relation to their privacy and security. Cloud-based systems expose sensitive health information to cyber-attacks, breaches, and unauthorized access. There is a way of overcoming such challenges in such a manner that the patient data remains safe; proper cyber-secure measures coupled with adherence to data protection regulations can overcome this hurdle.

Market Opportunities

- Expansion into emerging markets with underserved healthcare needs: Growth opportunities abound in the point-of-care molecular diagnostics area for emerging markets such as those found in Africa, Asia, and Latin America. Most of these regions are afflicted with health care infrastructure and shortage of skilled workers and less availability of central laboratories. It thus creates the need for point-of-care diagnostics with regards to the potential of the current gaps it was filling by means of fulfilling an under-served group's requirements for much accessible, speedy, and more economical testing.

- Development of low-cost, user-friendly, and portable diagnostic devices:This is a very large opportunity to develop more affordable, portable, and user-friendly molecular diagnostic devices. These devices will therefore be much easier to use for patients and their healthcare providers as well in the low-resource setting, thereby bringing down the cost of production. As a result, this would give rise to market penetration on a larger scale while offering advanced diagnostic tools to an even wider set of consumers and medical professionals.

- Opportunities for fast diagnostics for epidemics and pandemics: The demand for rapid diagnostic tools has increased sharply during disease outbreaks and pandemics such as COVID-19. Point-of-care molecular diagnostics can be used rapidly and accurately for the detection of infections, which are essential in controlling the spread of diseases. Such tools have seen success during global health emergencies, allowing them to stay in the market for other infectious disease outbreaks.

Market Challenges

- Out-of-lab accuracy and reliability: Molecular point-of-care diagnostics must establish validity and reproducibility in environments other than the typical laboratory. Performance tests can be sensitive to non-laboratory environmental conditions such as temperature, but also by the absence of properly trained staff in the deployment environments. Reliability and accuracy in different settings are considered to be very crucial for mass adoption and usage of these devices within health care.

- Complexity in regulatory and reimbursement land: Regulation of point-of-care molecular diagnostics is pretty tough. There would be standards accepted and followed by different approval processes by various regions. Such a scenario caused delay in product entry into most markets by successfully crossing those lines of regulations. Most healthcare structures are pretty stern, with unfathomable and ambiguous policies dealing with the reimbursement policies for conducting a molecular diagnostics test in most geographical locations. These are some of the challenges that should be addressed to bring extension and ensure that the access to markets would follow long-term growth.

- Breaking through the resistance of established diagnostic laboratories and healthcare institutions: Established diagnostic laboratories and healthcare institutions will resist point-of-care molecular diagnostics due to the issue of cost, perceived dependability, and disruption of the existing workflow. It is very challenging to convince the hospital stakeholders that these are effective, less costly, and result in better patient outcomes. The resistance from the entrenched players will hamper the widespread acceptance of point-of-care solutions.

Point of Care Molecular Diagnostics Market Segmental Analysis

Technology Analysis

PCR-based: The PCR segment dominated the market in 2024. The PCR (Polymerase Chain Reaction)-based technology is heavily used in point-of-care molecular diagnostics as it allows amplification of DNA or RNA to detect pathogen and genetic conditions. The PCR tests are extremely sensitive and specific and, thus, are highly recommended for diagnosis of infectious diseases, genetic mutations, and cancers. This technology provides quick results that are quite accurate even in low resource settings. It has hence become the most popular technology in decentralized healthcare environments.

Genetic Sequencing-based: The Genetic Sequencing-based segment is anticipated to register the highest CAGR over the forecast period. These technologies of next-generation sequencing are usually based on complete study of genetic material to describe the changes in mutations and their relevance in terms of the origin of a disorder, thus leading towards the establishment of a possible biomarker for cancer. It finds significant usage in the case of point-of-care diagnostics while bringing in personal medicine with an aid in discovering individualized variations associated with specific conditions and a specific reaction of therapy.

Hybridization-based: Technologies based on hybridization rely on the hybridization of complementary nucleic acid strands to detect specific sequences. It detects pathogens or genetic mutations, with fluorescence in situ hybridization and Southern blotting among them. Hybridization-based tests are specific and sensitive in diagnosing infections or genetic abnormalities. These tests, therefore, can be highly advantageous in point-of-care molecular diagnostics, particularly in a setting where quick and reliable results are demanded within a clinical or home environment.

Microarray-based: Microarray-based technology uses a microscopic grid to simultaneously detect thousands of genes or specific genetic markers by their expression. In point-of-care molecular diagnostics, microarrays allow multi-disease or multi-marker testing, which would help clinicians in making a quick and proper decision. It is mainly used in oncology, infectious disease testing, and genetic screening because of its high throughput without compromising the sensitivity and specificity required to provide a correct diagnosis.

Application Analysis

Infectious Diseases: The infectious diseases segment has dominated the market in 2024. Technologies like PCR and genetic sequencing are used to detect a variety of pathogens, including viruses, bacteria, and fungi. The ability to quickly and accurately diagnose infectious diseases like COVID-19, HIV, and tuberculosis helps in timely treatment and containment, improving patient outcomes and minimizing the spread of infection, especially in resource-limited settings.

Oncology: The Oncology segment is estimated to emerge as the most lucrative segment. In oncology, point-of-care molecular diagnostics are a key tool in assessing cancer biomarkers, mutations, and genetic profiles linked with different types of cancers. Diagnostics at the point of care enable early detection, surveillance for disease progression, and individualized treatment plans tailored to a patient's genetic makeup. Rapid, detailed cancer testing at the point of care can greatly improve the accuracy and speed of diagnosis in cancer, potentially offering a greater chance for better treatment outcomes.

Hematology: Molecular diagnostics at the point of care for hematological diseases, such as anemia, leukemia, and hemophilia, helps identify genetic mutations, chromosomal abnormalities, or changes in the composition of blood cells. They are relatively quick to diagnose and can result in quicker clinical decisions and management of hematological conditions, especially critical in urgent care settings. This is the reason why molecular diagnostics in hematology is being rapidly expanded in relation to the growing need for an accurate and timely diagnosis of diseases of the blood.

Prenatal testing: Prenatal testing through point-of-care molecular diagnostics allows for early screening of genetic abnormalities, fetal infections, and chromosomal conditions such as Down syndrome. These tests are conducted using advanced techniques such as PCR and genetic sequencing, which provide accurate results with minimal discomfort to the mother. Through early intervention and personalized care, prenatal molecular diagnostics improve maternal and fetal health outcomes, making them an essential part of modern pregnancy management, especially in high-risk pregnancies.

Endocrinology: This is the determination of hormonal imbalance and endocrine disorders, such as diabetes, thyroid conditions, metabolic diseases, based on molecular information. Molecular analysis can help detect the genetic defect underlying these endocrine disorders so that appropriate diagnosis and management treatment can be advised. The faster diagnosis, better handling of the diseases, and an effective personalized form of therapy using molecular tests provided at the point of care is bound to advance the quality of care for patients presenting with endocrine-related conditions.

End User Analysis

Decentralized Labs: The decentralized labs segment has dominated the market in 2024. POC molecular diagnostics are now increasing in decentralized labs based in remote, low-resource environments. Advanced infrastructures may not be available, yet they can continue to carry out important molecular tests on infections, genetic disorder, and cancers through portable devices that are not only easy to use but offer accurate results within shorter time spans. Decentralized labs are critical to the current global health services, particularly where there is underserved area and lack of basic facility.

Hospitals: These technologies allow clinicians to make immediate, well-informed decisions regarding the clinical care of patients, thus initiating appropriate treatment for better patient outcomes. Point-of-care diagnostics is used in hospitals for the quick diagnosis of several conditions, ranging from infectious diseases to genetic disorders. Its usage assists hospitals in managing a large number of patients who need immediate diagnosis, as well as integrating these technologies into the overall clinical operations of the hospital for greater efficiency and patient management.

Point of Care Molecular Diagnostics Market Revenue Share, By End-use, 2024 (%)

| End-use |

Revenue Share, 2024 (%) |

| Decentralized Labs |

42.50% |

| Hospitals |

20.40% |

| Home-care |

18.70% |

| Assisted Living Healthcare Facilities |

14.20% |

| Others |

4.20% |

Home-care: Point-of-care molecular diagnostics is increasingly being utilized in home-care settings because there is a high demand for at-home testing and remote monitoring solutions. Devices that enable patients to diagnose diabetes, infections, or genetic disorders from their homes save them time and money as the results come immediately. These innovations are making the patients more aware of their health and thus helping them to catch problems at early stages and treat them; consequently, this reduces hospital visits as well as helps in proper management of chronic diseases.

Assisted Living Healthcare Facilities: Point-of-care molecular diagnostics in assisted living healthcare facilities helps monitor the health status of elderly residents better, particularly when relating to infection diagnosis, chronic conditions, and genetic disorders. Such facilities have, therefore arisen with a need for rapid, efficient diagnostic tools that could meet their diverse healthcare needs among their seniors. This would facilitate point-of-care molecular testing for earlier detection of the conditions, minimize hospitalization while enhancing the quality of care and providing timely intervention to support general well-being for elderly people staying in assisted living environments.

Point of Care Molecular Diagnostics Market Regional Analysis

The point of care molecular diagnostics market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

What makes North America the leader in the point of care molecular diagnostics market?

The North America point of care molecular diagnostics market size was estimated at USD 3.96 billion in 2024 and is expected to reach around USD 5.11 billion by 2034. The North America, mainly the United States and Canada, has the maximum hold. Advanced health infrastructure in the U.S. provides this market with good grounds, with strong adoption of novel technologies, coupled with personalized medicine. It is influenced by governmental drives, huge investment in researches, and immense demand for speed diagnosis in terms of rapid infectious diseases diagnosis and personalization in health. In fact, an article from The Commonwealth Fund reports in September 2024 how the United States ranks last among ten affluent nations while its people are paying almost double for their health care. Some critical issues in such rankings include health equity, access to care, and general outcomes. Experts believe that sweeping reforms can solve these issues through quality and accessible healthcare facilities for everyone as many suffer inequalities and unaffordable medical costs.

Why Europe hit sustainable growth in the point of care molecular diagnostics market?

The Europe point of care molecular diagnostics market size was reached at USD 2.49 billion in 2024 and is expected to be worth around USD 3.21 billion by 2034. The regional market is inclusive of Europe; the main regional markets include Germany, United Kingdom, France, and Italy. Major drivers of growth for this regional market are an improved healthcare system; growing awareness concerning personalized medicine and government funding and support to make innovations in health care. Requirements for molecular diagnostic tests are emerging because of diseases concerning infectious, cancers, and gene testing. Europe's regulatory frameworks further support the growth opportunities of the point-of-care diagnostics market. As part of its plan to restore its position at the helm of European health, the June 2022 French Health Innovation Plan invests USD 7.6 billion through the France 2030 banner. The funding is targeted for research, maturation of technologies, and support to start-ups in three areas: biotherapies, digital health, and emerging diseases. In this way, it will trigger innovation and help France prepare better for future health crises by bettering its ecosystem of healthcare.

Why is Asia-Pacific growing faster in the point of care molecular diagnostics market?

The Asia-Pacific point of care molecular diagnostics market size was accounted for USD 1.85 billion in 2024 and is expected to hit around USD 2.39 billion by 2034. Asia-Pacific is growing due to higher investments in health care, a large population base, and increasing incidences of chronic diseases. Improving health infrastructures in these countries, mainly in China and India, have marked this region as the main market for low-cost rapid diagnostics. Besides this, the necessity for decentralized testing solutions in the urban and rural areas is going up. An example of such a move from the Japanese government is nudging impact investing to contribute to health improvement globally while having a Return on Investment, which has a financial return, as well as measurable social return, in June 2023. SHIBUSAWA Ken, a chairman of the study group under Japan's government, said Japan follows a human security and health care approach in the South. This is supported by the G7 in terms of the private sector model as an investment opportunity for health care.

LAMEA Point of Care Molecular Diagnostics Market Trends

The LAMEA point of care molecular diagnostics market was valued at USD 0.44 billion in 2024 and is anticipated to reach around USD 0.56 billion by 2034. The LAMEA region, including Brazil, Mexico, South Africa, Saudi Arabia, and the UAE, is slowly adopting point-of-care molecular diagnostics. In the LAMEA region, healthcare access and infrastructure are not up to the mark; however, increased awareness of healthcare, government support, and an increased disease burden, such as infectious diseases, are driving the market. With increased investment in healthcare and a focus on improving medical diagnostics, the LAMEA region offers significant growth opportunities. For example, in December 2024, the healthcare sector in the UAE grew remarkably with a focus on performance improvement and quality of life. This meant allocating USD 1.56 billion as an effort to strengthen better health services and constitutes 8% of the federal budget in 2025. Relatedly, a community-based employee integrated insurance scheme has been brought by the government as a motivating scheme for people towards healthy living lifestyles and better easy access of medical services at community levels.

Point of Care Molecular Diagnostics Market Top Companies

CEO Statements

Francis C. Manganaro , CEO of Nova Biomedical

- "At Nova Biomedical, we are committed to advancing the future of healthcare by developing innovative solutions in point-of-care molecular diagnostics. Our focus is on providing fast, accurate, and accessible diagnostic tools that enable healthcare professionals to make informed decisions, ultimately improving patient outcomes. We believe that molecular diagnostics at the point of care will be a game-changer, particularly in areas like infectious disease detection and personalized treatment plans."

Scott Verner, CEO of Nipro Diagnostics:

- "At Nipro Diagnostics, we are excited to be at the forefront of innovation in point-of-care molecular diagnostics. The ability to rapidly detect and diagnose diseases directly at the point of care can significantly enhance patient care by enabling immediate decision-making and treatment. We are committed to providing healthcare professionals with the tools they need to improve patient outcomes, reduce the time to diagnosis, and support personalized medicine."

Alexandre Mérieux, CEO of bioMérieux:

- "At bioMérieux, we are focused on transforming patient care through innovations in point-of-care molecular diagnostics. The ability to deliver fast, reliable molecular testing at the patient’s side is a key advancement in modern healthcare, allowing for quicker decision-making and personalized treatments. We are dedicated to expanding access to cutting-edge diagnostic technologies that improve outcomes and help healthcare professionals provide timely, effective care."

Recent Developments

- In June 2022, Bio-Rad Laboratories has associated itself with SANBS to ensure that the sophisticated immunohematology systems are offered to accurately facilitate blood compatibility testing; thereby, helping in improvement of patient safety. New systems that will streamline operations of SANBS, boost effectiveness, and provide support toward mission delivery on supplying safe blood products. The benefit of this aspect of the equipment to transfusion service in South Africa means they will add good quality in general, making a positive difference among healthcare providers as well as benefiting patients in all respects.

- In December 2024, OraSure Technologies has recently acquired the next-generation molecular diagnostics platform of Sherlock Biosciences. This platform will help reinforce its diagnostic capacity. Its speedy testing products designed for sexually transmitted diseases, Chlamydia, and Gonorrhea, shall be improved on, and a result is also expected within 30 minutes. As sources indicate, this joint venture would capture the market of USD 1.5 billion while expanding OraSure's portfolio through this existing infrastructure with the potential of future growths pending the regulatory approvals. New technologies of Sherlock include CRISPR-based technologies which most likely are to make diagnostic techniques more sensitive and accessible in the health care.

- In March 2024 Bayer AG and Thermo Fisher Scientific partner for the development of next-generation sequencing (NGS)-based companion diagnostics (CDx) that will open doors to more cancer patients for precise treatments, the form being NGS-based CDx development. The test would be enabled on the Ion Torrent Genexus Dx System, allowing fast genomic testing within 24 hours of obtaining the results. This program complements the strategy that Bayer has to improve the oncology of personal treatment; this makes sure appropriate therapies get to eligible patients within the shortest time possible and is likely to improve outcomes for cancer patients.

Market Segmentation

By Technology

- PCR-based

- Genetic Sequencing-based

- Hybridization-based

- Microarray-based

By Application

- Infectious Diseases

-

- HIV POC

- Clostridium difficile POC

- HBV POC

- Pneumonia or Streptococcus associated infections

- Respiratory syncytial virus (RSV) POC

- HPV POC

- Influenza/Flu POC

- HCV POC

- MRSA POC

- TB and drug-resistant TB POC

- HSV POC

- Other

- Oncology

- Hematology

- Prenatal Testing

- Endocrinology

- Others

By Test Location

By Product and Service

- Assays and Kits

- Instruments and Analysers

- Software and Services

By End-use

- Decentralized Labs

- Hospitals

- Home-care

- Assisted Living Healthcare Facilities

- Others

By Region

- North America

- APAC

- Europe

- LAMEA

...

...