Biomarkers Market Size and Growth 2025 to 2034

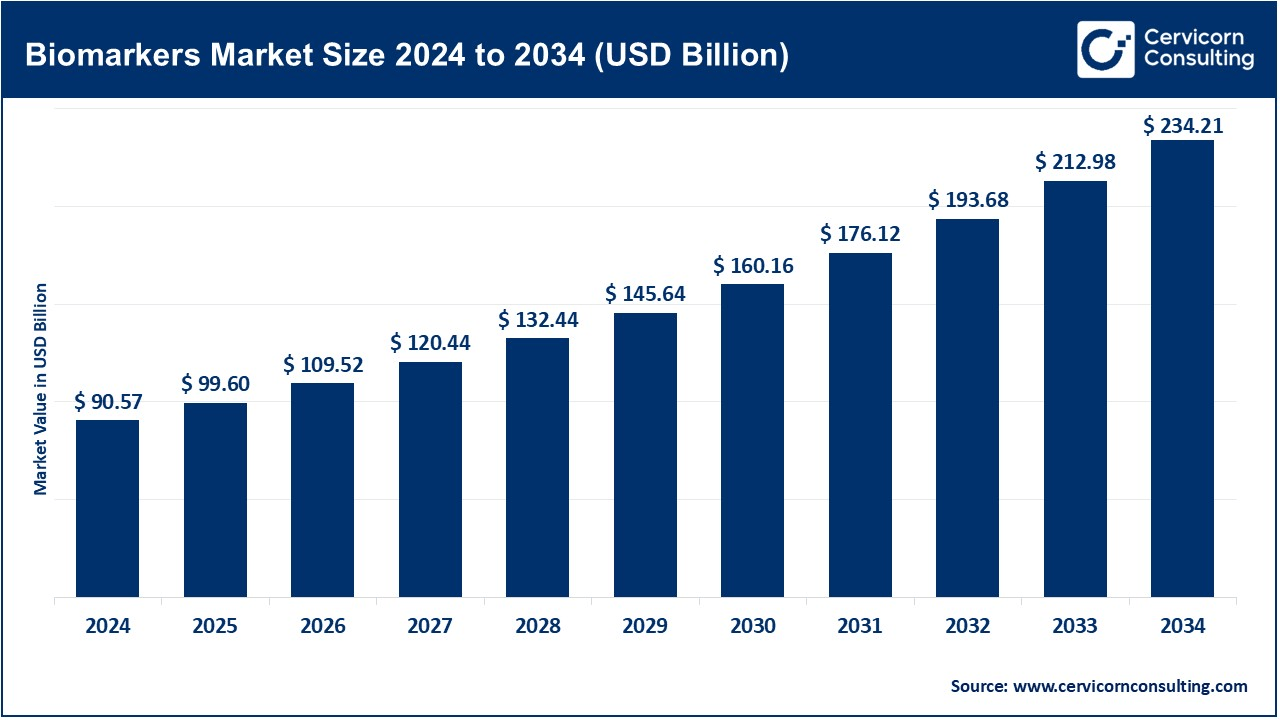

The global biomarkers market will grow at a compound annual growth rate (CAGR) of 9.96% during the forecast period 2025 to 2034. The biomarkers market across the globe was valued at USD 90.57 billion in 2024 and is expected to reach around USD 234.21 billion by 2034. The market future for biomarkers seems bright as a great improvement in health care, rising incidences of chronic diseases, and increased focus on personalized medicine make the market promising. Because the patient population comprises more people with cancer, heart disorders, and neurological diseases, the demand for early detection and diagnosis and better treatment modalities keeps growing. Biomarkers help in early diagnosis, thereby having better therapeutic outcomes. Pharmaceutical companies are harnessing biomarkers in developing targeted medicines to ensure conclusively and minimize adverse events. New technologies such as AI and large data sets accelerate biomarker identification and significantly enhance its quality. Several organizations and governments, therefore, fund research committed to developing new biomarkers that could be even more effective for diseases not easily detected. The biomarker market is bound to grow very fast with greater awareness, health system improvements, and funding.

Biomarkers are biological indicators of the presence of disease, response to treatment, and prediction of health outcome. Research and development in this field improve early detection, personal medicine, and drug development. Future advances will yield highly accurate diagnostics and targeted therapies with better disease management, ultimately improving patient care and reducing health care costs. At the same time, burgeoning investments in biomarker research, such as government funding for otherwise innovative projects, show how important this tool is becoming in shaping the future of health and medicine.

- The UK's Record R&D Investment: The UK's Autumn Budget 2024 has announced the government's £20.4 billion investment in R&D. The funding put a premium on life sciences and will induce innovations in biomarker research, precision medicine, and healthcare technology, thereby retaining the UK's position as a forerunner in scientific development and medical innovation.

Biomarkers Market Report Highlights

- The U.S. biomarkers market size was valued at USD 29.74 billion in 2024 and is projected to surpass around USD 76.90 billion by 2034.

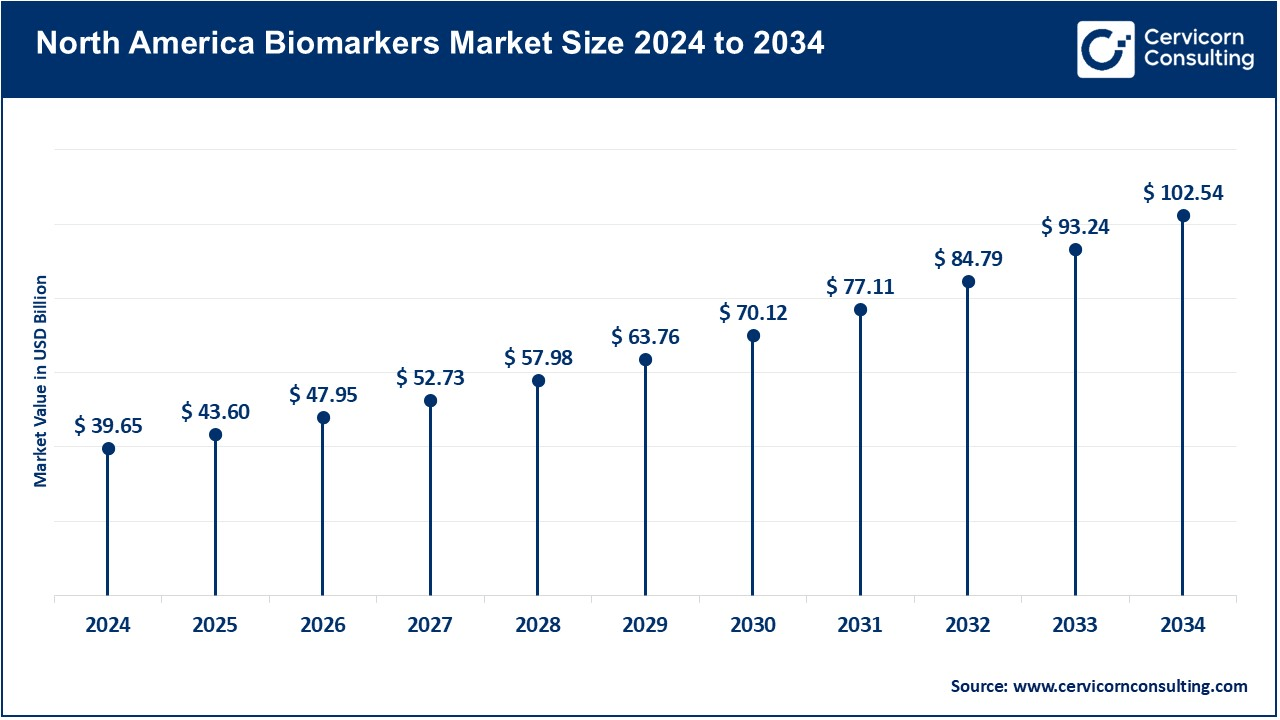

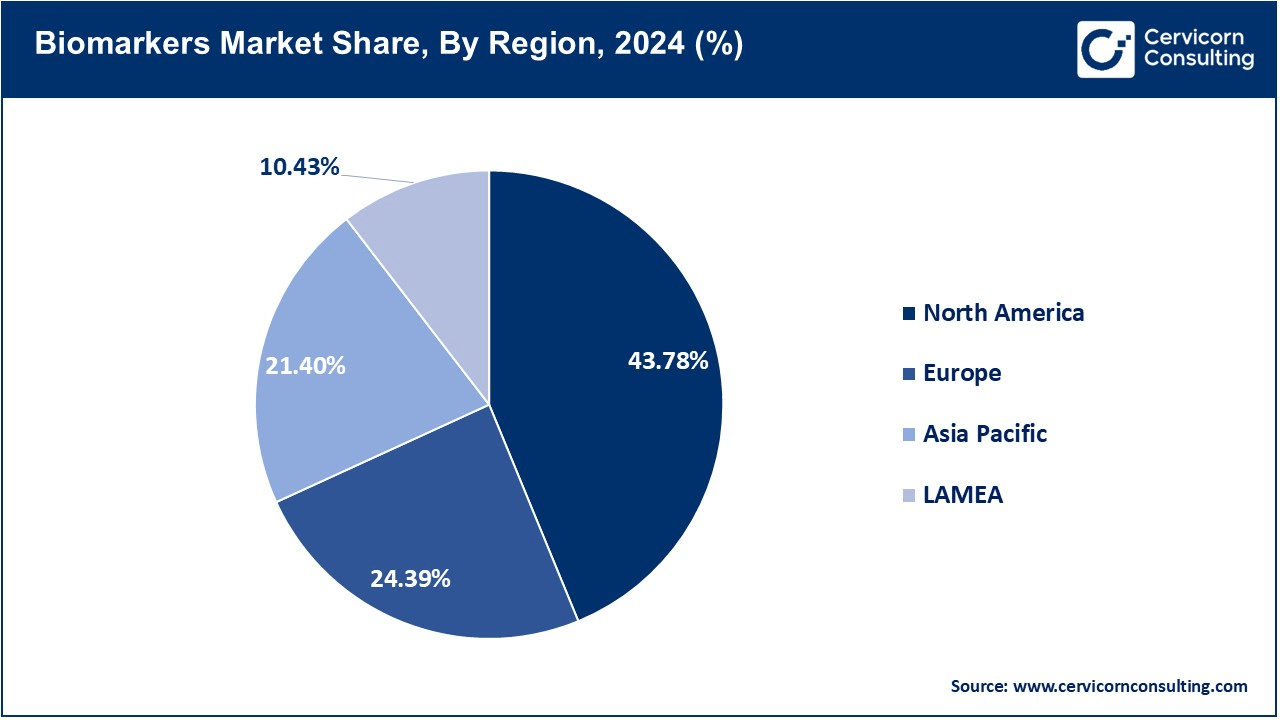

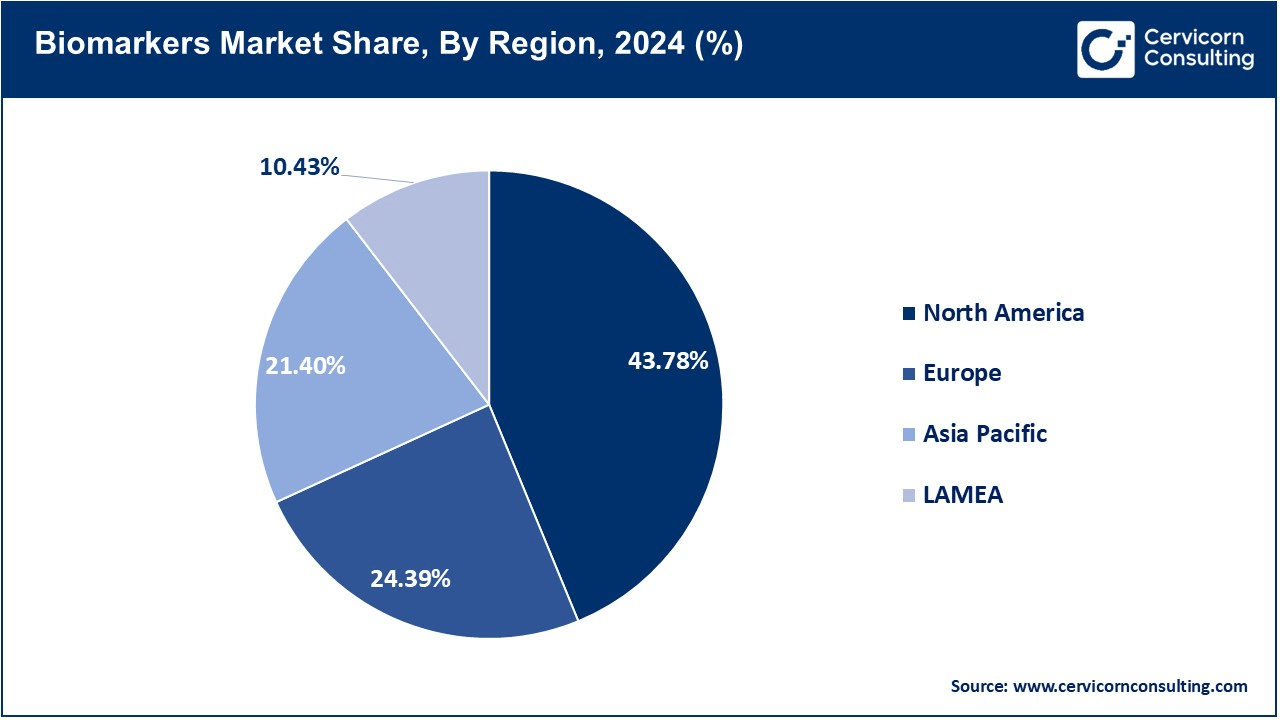

- The North America has accounted highest revenue share of 43.78% in 2024.

- The Asia-Pacific has captured revenue share of 24.39% in 2024.

- By disease, the cancer segment has reported 37% of the total revenue share in 2024.

- By type, the safety biomarkers segment has accounted revemue share of 36.81% in 2024.

- By product type, the consumables segment has recorded highest revenue share in 2024.

- By application, the drug discovery & development segment has dominated the market in 2024.

Biomarkers Market Growth Factors

Rising incidence of chronic ailments

- Then chronic diseases, which include cancer, diabetes, and cardiovascular diseases, meet later on in life. In this case, biomarkers will cover diagnostics and personalized therapy, improve patient health outcomes, and reduce the overhead costs of healthcare. So once the incidence of chronic disease increases globally, the biomarkers market will increase as a spiral effect of this increasing need for an efficient diagnosis and developed tools for early-stage biomarkers to pick up chronic disease conditions, biomarkers essentially become part of any healthcare solution.

Technological Advances Making A Mark Recently In Genomics

- Next-generation sequencing technologies, along with CRISPR technology, constitute those breakthroughs in genomics that propel forward the field of biomarkers. With this, it will become faster and more accurate in associating those biomarkers with several diseases. Greater sequencing capabilities will make it evident that researchers may get closer to decoding the genetic makeup of diseases. As genomics ameliorates, it will further accelerate the identification of new biomarkers. Thus opening the image a lot in the biomarkers market.

Increasing Focus on Personalized Medicine

- With personalized medicine, an individual gets unique treatment with the kind of therapy that an individual receives. Thus, biomarkers come in handy when determining the proper treatment for a certain individual on a given disease profile. With the widened scope of personalized medicine, the demand for biomarkers in targeted therapies will also continue to increase in general. Personalized treatment approaches are expected to further bolster the growth of the biomarkers market in the future because precision diagnostics and therapies are being sought more by patients.

increasing growth of the older population

- An important event that encouraged the growth of the biomarker industry is the increasing growth of the global population. Chronic diseases like cancer, Alzheimer's, and heart diseases tend to afflict the population the most, and they must create a demand for services in efficient diagnosis and monitoring for such diseases. The biomarker studies comprise all the techniques that provide an excellent opportunity for the early detection and monitoring of age-related diseases to promote patient care and treatment outcomes. Biomarker-based diagnostics will expand access to patient care as the elderly population continues to increase.

Expansion of Liquid Biopsy Technologies

- With their non-invasive nature, assays based on blood or other body fluids are progressively being incorporated into liquid biopsy technologies and will be increasingly relevant to the requirements of society. This would open the way to detection of early disease, monitoring treatment response, and mutation profiling. However, this very new yet highly significant area is in cancer diagnostics because it is a much less invasive alternative compared to tissue biopsy. These innovations will provide further momentum in the development of liquid biopsy diagnostics once the sensitivity and costs of liquid biopsy assays improve.

Increased Investment in Research and Development

- Pharmaceutical companies and research institutions have significantly invested in biotech companies to improve the market for biomarkers. This investment is primarily used for the identification of new biomarkers and improved diagnostics. However, high-throughput technologies are innovatively making the pace fast for continuing these research activities toward identifying biomarkers for various diseases. Thus, because of constant innovations and renovations brought through R&D, the scope for expanding biomarker markets opens up in other therapeutic areas.

Better Regulatory Support

- Approval of tests and diagnostics based on biomarkers is becoming more and more common among regulatory agencies like the FDA and EMA. This encourages faster market growth. Some of the other supportive policies, including fast-track approval pathways for drug development with biomarkers, make it easier for pharmaceutical companies to make new treatment options available sooner. That is how regulation favors such clinical adoption of biomarkers for clinical research and, along with companion diagnostics, quickens the pace of commercialization.

Biomarkers Market Trends

Biomarker Discovery through AI and ML

- Artificial intelligence and machine learning: AI and ML are revolutionizing biomarker research, as they can handle enormous sets of data and offer evidence for new biomarker discovery and improved diagnostics accuracy. AI tools can effortlessly explore genetic, protein, and imaging data for patterns denoting a specific disease, enabling quicker and more precise disease detection. While pharmaceutical companies use AI to forecast patient reactions to speed up drug development, an increase in AI usage will make biomarker-based diagnostics and medicines more efficient and accessible. Yet, problems with concerns on data privacy and regulatory approvals will be addressed to better implement these diagnostics and treatments.

Rise of Liquid Biopsy for Cancer Diagnostics

- Liquid biopsy indicates noninvasive methods to identify cancer biomarkers in blood, urine, or saliva samples. It is becoming famous and unavoidable because it is an alternative to traditional biopsy, which is an invasive and painful procedure. The approach to diagnosis helps identify cancer in the early stages, assesses the progress of therapy, and detects genetic mutations. Companies are working on more sophisticated liquid biopsy exams that will be high-performing and low-cost. With the progress made in research, liquid biopsy can be a standard procedure for diagnosing and managing cancer, improving patient outcomes and survivability.

Growth of Companion Diagnostics

- Companion diagnostics (CDx) define biomarker-based tests, which help doctors tailor the right treatment for each patient. Especially in cancer therapeutics, these tests have proven useful in determining whether patients have a better chance of responding to targeted therapies or not. The recent approval of larger numbers of CDx tests by the FDA, along with new drugs, signifies the emerging importance of personalized medicine. Hence, pharmaceutical companies are having a tie-up with diagnostic firms to come up with a CDx for as many diseases as possible. The demand for companion diagnostics should, therefore, escalate as healthcare moves into the new era of personalized or precision medicine, wherein treatments can become more efficacious and fewer side effects are expected.

Multiomics Biomarkers are in the Ascendant Multi-omics

- Gathering data on the genomics, proteomics, metabolomics, and transcriptomics of a given patient to elicit the entire picture of his or her health status. This use of technology enables the researchers to find novel biomarkers that improve disease detection and treatment. In other words, for example, the cancer multi-omics study would include objective measures for genetic mutation, protein, and metabolic changes to yield better-targeted therapies for patients. The advances in bioinformatics and cloud computing are facilitating much easier access to multi-omics research. Though it suffers from data complexity, the future of multi-omics would define precision medicine in the world by providing better and deeper insights into diseases.

Growing Demand for Wearable and Digital Biomarkers

- Digital biomarkers are now becoming the most important and promising wearable devices, consisting of smartwatches or fitness trackers that continuously measure the body parameters in the forms of heart rate, blood oxygen, sleep quality, etc, for many possible health indicators. Digital biomarkers prove their usefulness for early detection of diseases such as heart conditions, diabetes, etc. Pharmaceutical companies are trying to explore the potentials of how wearables will be utilized in clinical trials in tracking responses of study patients to drugs. Real-time and personalized treatment recommendations would become possible by monitoring the disease digitally through progressively developed technologies.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 99.60 Billion |

| Expected Market Size in 2034 |

USD 234.21 Billion |

| Projected CAGR 2025 to 2034 |

9.96% |

| Key Region |

North America |

| Highest Growth Region |

Asia-Pacific |

| Key Segments |

Product Type, Type, Disease, Application, End User, Region |

| Key Companies |

Abbott Laboratories, Agilent Technologies Inc., Bio-Rad Laboratories Inc., Charles River Laboratories International Inc, Epigenomics AG, Eurofins Scientific SE, F. Hoffmann-La Roche Ltd, GE Healthcare, Illumina, Inc., Johnson & Johnson Services, Inc, Merck KGaA, Qiagen N.V, Quanterix Corporation (Aushon Biosystem), Siemens Healthcare Private Limited/Siemens AG, Thermo Fisher Scientific Inc. |

Biomarkers Market Dynamics

Market Drivers

Increasing breast cancer among the population

- The increasing rate of patients with breast cancer is the major factor that drives the market of breast cancer to a larger extent across the regions with an increasing number of medications having maximum efficacy and efficiency in the medications. Improve a number of diagnostic procedures which are increasing in day to day to life for imaging and screening of the disorder with quick results with enhanced accuracy of the procedures expected to drive the breast market to a higher level. Due to increased demands from the medical sector and an increasing number of patients with breast cancer and requirements for efficient treatments for the individual to improve health and extend the life of the individuals these factor helps to boost the market for breast cancer.

Enhance advanced technologies developed in treating breast cancer

- Major factor that helps to increase the market value is new developing technologies with advanced features developed in treatment with increased efficacy of the treatment. Increased developments of the medications with new launches introduced by the key market players with enhanced performance of the treatments with good output seen in the patients with increased efficacy and effectivity of the medications and developed therapies involved in the treatment help to extend the breast cancer market.

Market Restraints

Treatment is very costly

- The treatment for breast cancer is very costly, especially the more recent targeted drugs, immunotherapy, and biologics. Advanced therapies might not reach some patients because of their cost, especially in developing countries or regions that are unable to find enough funding to cater to health services. Even with cover from insurance, out-of-pocket costs remain relatively high for patients. However, the cost aspect remains a major stumbling block to the more complete spread of newer effective treatments against the disorder of breast cancer.

Side effects of treatment

- Most of the treatments for breast cancer, such as chemotherapy, are very toxic. Side effects include nausea, hair loss, fatigue, and a weakened immune system. The newer treatments include targeted therapy and immunotherapy, which are less toxic but carry the risks of allergic reactions or long-term health issues. Some patients might fear the side effects and hence refrain from treatment or completion of prescribed therapy, which may be to the detriment of the effectiveness of the treatment and the outcomes for the patient.

Market Opportunities

Increased support from the government

- Enhance government with increased initiative in developing the treatments with advanced technologies to improve the patient's health and increasing the providence from the government of various regions in improving the research and development in medication for treating breast cancer. Increased number of policies such as reimbursement so that common people can opt for the treatment and take benefit of the medications and treatments available for improving the quality of the life.

Increased research and development

- The advanced developments in the medications involved in the treatment of breast cancer. Increasing the number of therapies with increased efficiency and enhanced output of the treatments with good results. Developing chemotherapies for treating breast cancer with the increased market with increasing demands from the medical sector due to the widespread of cancerous cells if not treated in time also affect the other organs of the body. Increased attention from the market due to enhance developments for treating the disorder and increased results. Which is a great opportunity which drives the market.

Market Challenges

A side effect of the treatment involved in breast cancer

- During the treatment involved in breast cancer such as chemotherapy, medications, and targeted therapy involves various side effects after administration of the medication through different routes. Adverse effects involve such as vomiting, diarrhea, mouth ulcer, skin problems, high blood pressure, gastrointestinal problems, and many more these factors may challenge the market to grow to a larger extent with increasing severe adverse effects that may affect the quality of life and increased weakness among the individual. Immunotherapy and targeted therapy chemotherapy are therapies involved with increased adverse reactions that may alter the market size.

High cost of the treatment

- The advance developed technologies and therapies involved in treating breast cancer with increased results of the treatment and higher efficacy. With the increasing cost of the advanced therapies involved in treating the disorder. Chemotherapy to be most expensive therapy with the increased cost of the medications involved in the therapy where every individual cannot opt for the chemotherapy due enhance cost which may decline the market with decreased revenue share.

Biomarkers Market Segmental Analysis

The biomarkers market is segmented into product type, type, disease, application, end user and region. Based on product type, the market is classified into consumables, instruments and software & services. Based on application, the market is classified into diagnostics, drug discovery & development, personalized medicine and risk assessment & disease monitoring. Based on end-user, the market is classified into pharmaceutical & biotechnology companies, hospitals & diagnostic centers, research institutes & academic laboratories and contract research organizations.

Product Type Analysis

Consumables: The consumables segment has dominated the market in 2024. Consumables take the crown when it comes to biomarkers. They include reagents, assay kits, or even the materials in laboratories for biomarker research and testing. This means that these are permanent fixtures in the laboratories, being used once and immediately thrown away and replaced. Thus, they serve as a never-ending source of income for manufacturing companies. Demand for consumables is rising since more hospitals, labs, and research centers are using biomarkers for disease detection. Companies are focusing on better-quality reagents to ensure better accuracy in testing. The rising demand for personalized medicine and drug discovery, in turn, is feeding the demand for consumables.

Instruments: Instruments such as PCR machines, immunoassay analyzers, and mass spectrometers find a key place in biomarker research. With the advent of these tools, the detection of biomarkers in blood, tissues, and other samples is possible. The market is currently on the rise with advancements in automation and AI-based diagnostics. Although expensive, these machines are too accurate and efficient to ignore. The recent rise in the application of biomarkers for the detection of early diseases and monitoring of therapy has greatly increased the market for ultramodern instruments.

Software & Services: The software & services segment is anticipated to exhibit a lucrative CAGR over the projected period. Software and services aid biomarker research in analyzing extensive medical data. AI-based software is used to find patterns and improve diagnosis accuracy. Biomarker data analysis is being offered by a multitude of companies so that laboratories do not have to develop their systems. These solutions are relied upon by the pharmaceutical industry and academic institutions for drug trials and personalized treatment plans. Cloud platforms are becoming increasingly attractive due to the security and rapid access they provide to medical data.

Application Analysis

Diagnostics: The diagnostics segment is projected to register the fastest CAGR over the forecast period. Biomarkers are very useful in the detection of diseases. They are usually used by doctors to diagnose cancer, heart-related diseases, or infections in the early days. Biomarkers aid in non-invasive testing, causing less inconvenience through fewer biopsies or surgeries. Hence, the diagnostic biomarker market is growing fast as a lot of people look for early detection for an improved treatment outcome. Governments and health organizations are supporting biomarker-related research in the interests of better public health.

Drug Discovery & Development: The drug discovery & development segment dominated the market in 2024. Pharmaceutical companies work on new drugs by using biomarkers. Biomarkers are used to determine whether the drug is reasonably safe and effective for use before marketing. Thus, it helps in reducing drug development costs and time. Many companies have invested in biomarker research for the development of targeted therapies. The increasing acceptance of personalized medicine will further drive the demand for biomarker applications in drug development.

Personalized Medicine: Biomarkers allow for treatment customization according to a person’s unique biological profile. This improves treatment success and reduces side effects. Cancer and genetic disorders are the primary areas of development in personalized medicine. Pharmaceutical companies are developing drugs for groups of patients defined by biomarkers. Governments and research institutions are funding studies to increase personalized medicine-wide application.

Risk Assessment & Disease Monitoring: Biomarkers also forecast the risk for a person to develop other diseases like diabetes or heart disease. They also monitor disease progression and the effectiveness of treatment. Blood test biomarkers can show whether the cancer treatment works or not; therefore, it reduces unnecessary treatment and enhances patient outcomes. This demand is going higher because risk assessment markers came into greater need with the constant increase in chronic diseases.

End User Analysis

Pharmaceutical & Biotechnology Companies: Pharmaceutical companies use biomarkers for new drug discovery and testing. A biomarker is useful in helping to identify the right patients during clinical trials, and drug response is monitored to speed up approval and reduce costs. This has encouraged companies to invest heavily in biomarker research to enhance personalized medicine and target-oriented therapies.

Hospitals and Diagnostic Centers: Biomarkers enable hospitals to make a quick and accurate diagnosis of diseases. The blood tests of biomarkers indeed help doctors rule out conditions caused by heart attacks and cancer at an early stage. Such trends will continue since the new patient demand for tests to be availed in hospitals acts as a pull for such testing. This also includes biomarker tests as part of routine check-ups offered by diagnostic centers.

Research Institutes and Academic Laboratories: Research has been done in universities and research labs to discover more new biomarkers. Research on the capacity of biomarkers to improve the diagnosis and treatment of diseases is ongoing. The area of research is government and private funding for support. Most new biomarkers are first validated in research labs before they find their way to hospitals and drug companies.

Contract Research Organizations (CROs): Better named contract research organizations, CROs conduct biomarker research on behalf of pharmaceutical companies and biotech firms. They offer all services for managing clinical trials and biomarker validation studies. Many companies prefer outsourcing biomarker research activities to CROs to save themselves the trouble of completing and accelerating the development of drugs. Thus, this increases the CRO segment because the demand for trials on drugs developed using biomarkers increases.

Biomarkers Market Regional Analysis

The biomarkers market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

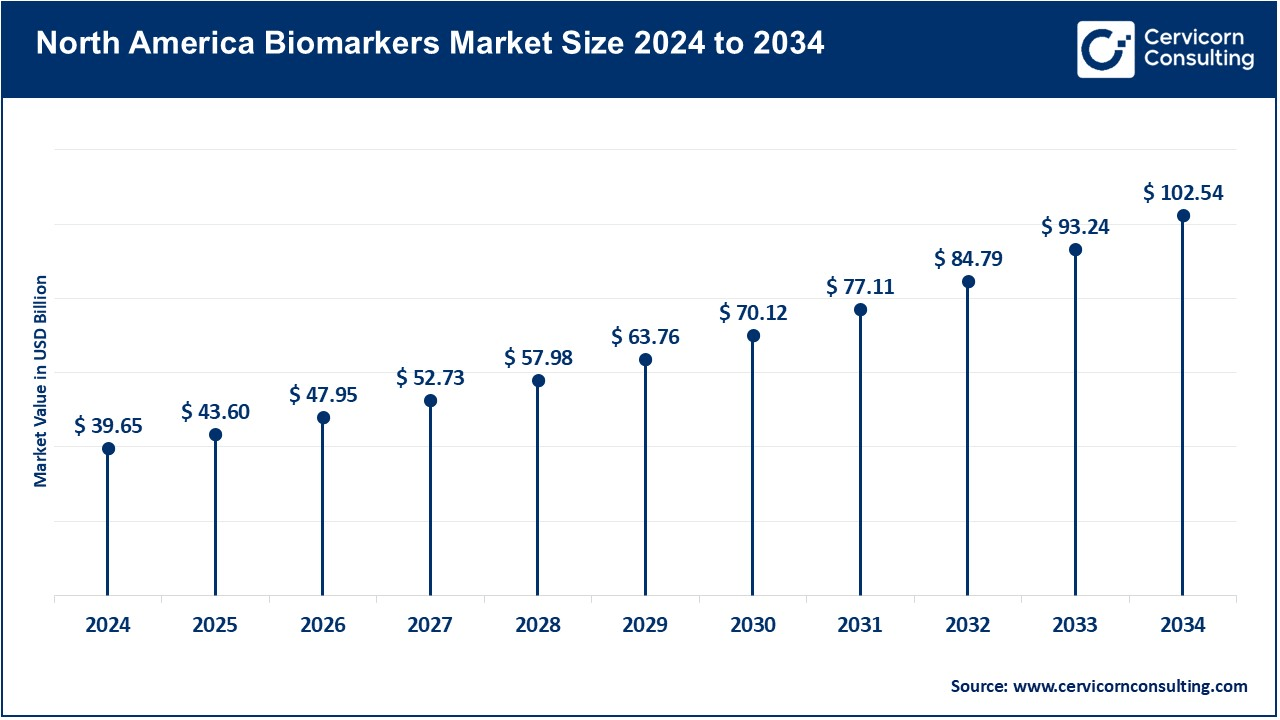

Why is North America region accounted largest area in the biomarkers market?

The North America biomarkers market size was valued at USD 90.57 billion in 2024 and is expected to hit around USD 234.21 billion by 2034. North America is the largest market worldwide. The country's lead in biomarker research is backed by high funding, development in healthcare systems, and the presence of large pharmaceutical sectors. There is a government policy on biomarker-based medicine. These are the main diseases driving the use of biomarkers in this region: cancer and heart disease.

Europe Biomarkers Market Trends

The Europe biomarkers market size was valued at USD 90.57 billion in 2024 and is expected to hit around USD 234.21 billion by 2034. Biomarkers are well established in Europe as the European healthcare system supports biomarker research. Pharmaceutical businesses from Germany, the UK, and France are investing heavily in biomarker-based drug research. European regulations encourage the use of biomarkers in clinical trials. The market is growing due to the demand for personalized medicine.

Why is Asia-Pacific region fastest-growing in the biomarkers market?

The Asia-Pacific biomarkers market size was valued at USD 90.57 billion in 2024 and is expected to hit around USD 234.21 billion by 2034. The Asia-Pacific region is the fastest-growing market. Countries like China, India, and Japan are raising funds for health and medical research. There will be a rise in the number of cancer and heart disease diagnoses, which increase the biomarkers' demand. More government funding is being provided, along with partnerships with biotech companies.

Why is LAMEA region emerging in the biomarkers market?

The LAMEA biomarkers market size was valued at USD 90.57 billion in 2024 and is expected to hit around USD 234.21 billion by 2034. Latin America, an emerging market, is being improved by countries such as Brazil and Mexico to enhance healthcare infrastructure. The use of biomarkers in the detection of infectious diseases is growing. Smaller than North America or Europe, this market already has strong potential for growth. The MEA region has a developing market for biomarkers. Investments by governments in healthcare innovation are evidenced in the UAE and Saudi Arabia. Biomarkers are mainly for infectious disease detection. Limited research facilities slow down development, but international partnerships are helping expand biomarker uptake.

Biomarkers Market Top Companies

- Abbott Laboratories

- Agilent Technologies Inc.

- Bio-Rad Laboratories Inc.

- Charles River Laboratories International Inc

- Epigenomics AG

- Eurofins Scientific SE

- F. Hoffmann-La Roche Ltd

- GE Healthcare

- Illumina, Inc.

- Johnson & Johnson Services, Inc

- Merck KGaA

- Qiagen N.V

- Quanterix Corporation (Aushon Biosystem)

- Siemens Healthcare Private Limited/Siemens AG

- Thermo Fisher Scientific Inc.

CEO Statements

Guido Baechler, CEO of Mainz Biomed

- Guido Baechler emphasized Mainz Biomed’s focus on revolutionizing cancer diagnostics through innovative mRNA-based technologies. He stated, “Our groundbreaking clinical results with our mRNA-based next-generation CRC screening test and our strategic pathway to FDA trials, which we plan to start in 2025, demonstrate our commitment to expanding into the world’s largest healthcare market.” He also highlighted the company’s plans to submit comprehensive data from its ReconAAsense trial to the FDA in 2025, aiming to penetrate the U.S. market and address colorectal cancer screening needs.

Tempus and Genialis Collaboration Announcement

- In August 2025, Tempus and Genialis announced a groundbreaking collaboration to develop RNA-based biomarkers and algorithms. The CEOs of both companies expressed their commitment to revolutionizing precision medicine. They stated, “By leveraging the unique strengths of both companies, this partnership seeks to create a new generation of precision medicine tools that improve patient outcomes and transform the healthcare landscape.” This collaboration aims to provide clinicians with more accurate diagnostic and monitoring tools for complex diseases.

Strategic Vision from PPD (Thermo Fisher Scientific)

- PPD’s leadership highlighted the growing importance of precision medicine and AI in biomarker research. They noted, “Precision medicine, supported by AI, is poised to redefine treatment paradigms in biopharma, offering tailored solutions that align with the industry’s pursuit of maximizing impact and value.” This statement reflects the industry’s shift toward personalized therapies and long-term safety studies for chronic conditions.

Recent Developments

- August 2024: Illumina, Inc. received FDA approval for its TruSight Oncology Comprehensive test, a 500+ gene panel for solid tumor profiling, enabling precise identification of immuno-oncology biomarkers and clinically actionable targets for personalized cancer therapies.

- October 2024, LG and Hanmi Pharmaceutical invested $5 million in MEDiC Life Sciences to advance their MCATTM platform, a cancer biomarker discovery technology aimed at improving solid tumor therapy development and patient outcomes.

- January 2025, Tempus AI, Inc. partnered with Genialis to develop RNA-based biomarker algorithms for cancer treatment, leveraging Tempus' multimodal dataset to enhance precision medicine efforts.

- July 2024, Biogen Inc., Beckman Coulter, Inc., and Fujirebio collaborated to identify and develop blood-based biomarkers for tau pathology in Alzheimer’s disease, aiming to advance diagnostic and therapeutic solutions.

- September 2024, Penn Medicine identified new biomarkers, including type 1 innate lymphoid cells, for targeted treatments in sarcoidosis, marking a significant step in biomarker-driven therapies for autoimmune diseases.

Market Segmentation

By Product Type

- Consumables

- Instruments

- Software & Services

By Type

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

By Disease

- Cancer

- Cardiovascular Diseases

- Neurological Diseases

- Immunological Diseases

- Others

By Application

- Diagnostics

- Drug Discovery & Development

- Personalized Medicine

- Risk Assessment & Disease Monitoring

By End-User

- Pharmaceutical & Biotechnology Companies

- Hospitals & Diagnostic Centers

- Research Institutes & Academic Laboratories

- Contract Research Organizations (CROs)

By Region

- North America

- Europe

- APAC

- LAMEA

...

...