Polysilicon Market Size and Growth 2025 to 2034

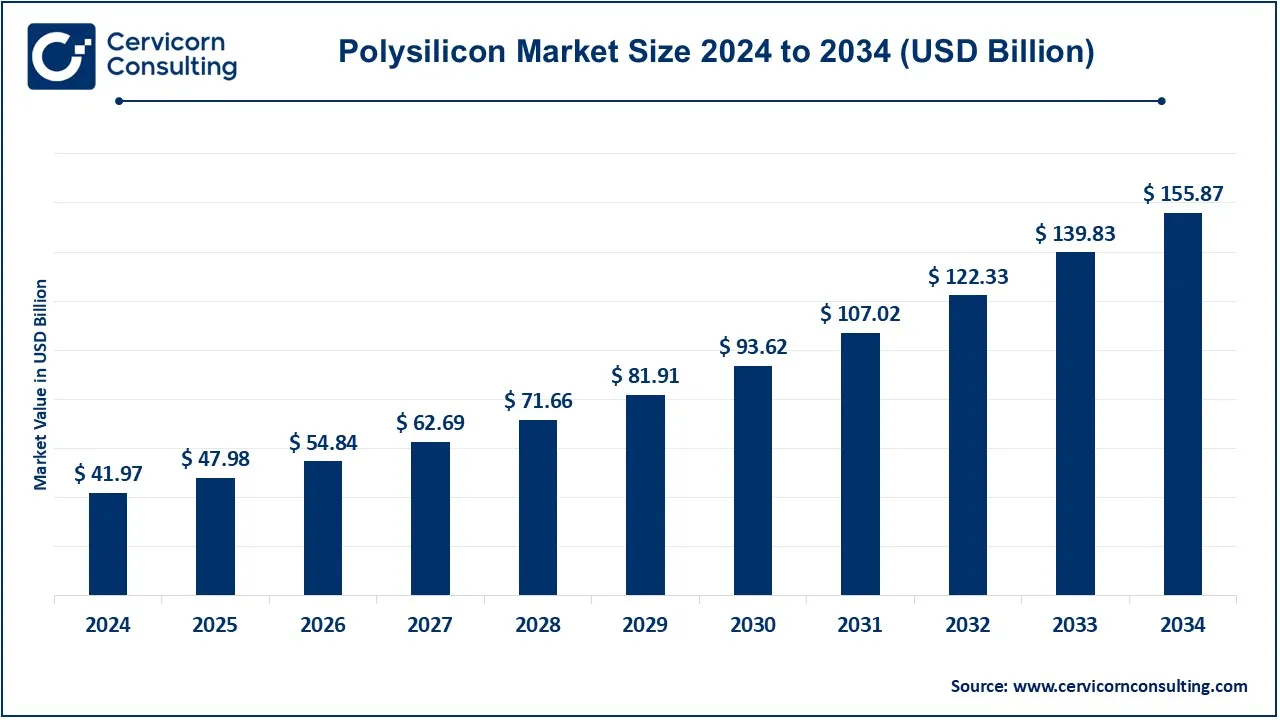

The global polysilicon market size was reached at USD 41.97 billion in 2024 and is expected to be worth around USD 155.87 billion by 2034, growing at a compound annual growth rate (CAGR) of 14.30% from 2025 to 2034.

The polysilicon market is experiencing rapid growth, driven by increasing investments in solar energy projects and the expansion of semiconductor manufacturing. Governments worldwide are promoting clean energy adoption through incentives and policies, boosting the demand for polysilicon-based solar panels. Technological advancements in the production process have also led to cost reductions, making solar energy more accessible and driving further market expansion. Additionally, the semiconductor industry's ongoing innovations, particularly in artificial intelligence (AI) and 5G technology, have fueled demand for high-quality polysilicon. As countries aim for energy independence and sustainability, polysilicon manufacturers are expanding their production capacities to meet rising global needs.

Polysilicon (polycrystalline silicon) is a high-purity form of silicon used as the primary raw material in the manufacturing of solar cells and semiconductor chips. It is produced through a chemical purification process, typically using the Siemens process or Fluidized Bed Reactor (FBR) technology, which transforms metallurgical-grade silicon into ultra-pure polysilicon. This material appears as small, shiny, and metallic chunks or granules. Polysilicon is crucial in the solar photovoltaic (PV) industry, where it forms the base material for monocrystalline and polycrystalline solar panels. Additionally, it plays a vital role in the semiconductor industry, used in integrated circuits and microchips for electronic devices. The demand for polysilicon has surged due to the global shift toward renewable energy, particularly solar power, and the growing need for high-performance electronics.

Key Insights related to the Polysilicon:

- Solar Energy Demand: Over 80% of polysilicon production is used in solar PV manufacturing, with global solar installations increasing by 20% annually.

- Price Trends: Polysilicon prices have fluctuated due to supply chain constraints but have seen an overall downward trend due to improved production efficiencies.

- Government Policies: Countries like China, the U.S., and India have implemented favorable policies, driving solar PV capacity additions.

- Semiconductor Growth: The demand for polysilicon in chip manufacturing is expected to rise significantly due to increasing AI, IoT, and 5G adoption.

Polysilicon Market Report Highlights

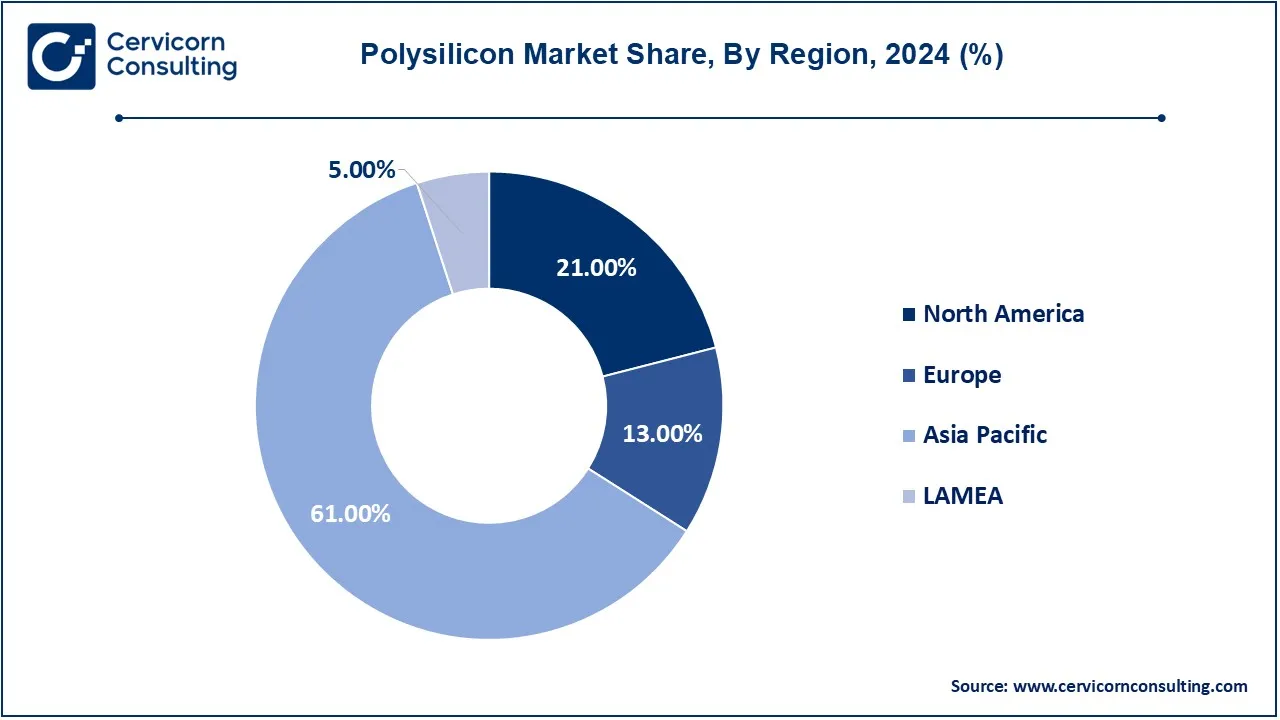

- The Asia-Pacific region has lead the market in 2024 with revenue share of 61% in 2024.

- The North America has generated revenue share of 21% in 2024.

- By application, the solar PV segment accounted for the highest revenue share of 76.20% in 2024 and witnessed notable growth in recent years.

- By polysilicon form, the chips segment has accounted revenue share of 58% in 2024.

Polysilicon Market Growth Factors

- Increasing Demand for Solar Power: The world is increasingly focused on solar power as a renewable energy source, which drives the need for polysilicon, the basis for the manufacture of solar cells. There is a continuing increase in the installation of solar power all over the world because countries have set more aggressive climate goals and renewable energy targets, meaning an increased demand for high-purity polysilicon. The same trend has largely been driven by efforts to reduce carbon footprints and transition to sustainable energy systems, thus polysilicon has been embedded as the material most critical for delivering these energy goals.

- Technological Growth: Innovations in technology surrounding polysilicon production are widening the scope of efficiency and cost-effective production. Advances, such as better purification methods and broadening the scope of industrial manufacturing, permit higher yields and less energy use. It, therefore, comes to play to not only improve production costs but also provide for the sustainability of the solar supply chain. The more technology advances, the more will the industry be able to put forth increasingly rising demands in the marketplace with continuing profitability and less environmental impact.

- Further Expansion of Photovoltaic Installations: The global growth of systems based on photovoltaics is a significant variable for the expansion of the polysilicon market. Across countries everywhere, major investments are being made into solar infrastructure, with utility-scale solar farms becoming the order of the day, along with distributed energy systems. This expansion creates a strong market for polysilicon, which is essential in manufacturing high-efficiency solar panels. Further investments in solar technologies as a result of that drive for essentially renewable energy extend the need for polysilicon.

- More Efficient Solar Cells: Continued progress in developing higher-efficiency solar cells will directly impact the polysilicon industry. Producers increasingly will focus on developing polysilicon of the highest purity and quality for solar cells for even more efficient performance. This will not only improve performance but will also raise polysilicon to a material of particular significance to next-generation solar technologies while complying with the intent of solar industries to optimize energy yields and minimize costs.

Polysilicon Market Trends

- Vertical Integration: A major trend in the polysilicon markets is moving towards the vertical integration of manufacturers. By taking over multiple production steps, companies enhance efficiency, cut costs, and assure quality standards are maintained for polysilicon products. Such strategy allows reduction of supply chain obstruction and pliability in responses towards advancing markets, repairing competitive bargaining positions in solar products.

- Improved Purification Techniques: The features of polycrystalline silicon manufacturing are being changed by several advanced development processes. Manufacturers opt for modern ways in the production of polysilicon that enhance purity, reduce energy consumption, and cut costs. The focus on high-purity polysilicon is essential for advancing solar cell efficiency: high purity means improved performance and greater energy yields, meeting the market demands for high-efficiency solar technologies.

- Increasing Dual-Glass Modules: The increasing preference for dual-glass solar modules shows a notable trend in polysilicon markets. Such modules assure durability and efficiency, thus demanding high-grade polysilicon for better operating conditions. More manufacturers of solar panels have adopted this technology so that it would meet consumer demand for more reliable and long-lasting products; hence, demand in the polysilicon market would be positively impacted due to the technology-induced changes in demand for polysilicon-a fact that buttresses the criticality of polysilicon within solar power solutions today.

- Digital Transformation: Digital technologies have started to get into polysilicon manufacturing processes. Automation, analysis of data, and artificial intelligence are operationalized to facilitate an easy optimization of production with regard to resource allocation and waste minimization. It's digital transformation that takes it a step further in improving operational efficiency and addressing sustainability issues by reducing the environmental impacts of polysilicon production, thereby making it more favorable for greener consumers.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 47.98 Billion |

| Projected Market Size in 2034 |

USD 155.87 Billion |

| Expected CAGR (2025 to 2034) |

14.30% |

| Leading Region |

Asia-Pacific |

| Key Segments |

Polysilicon Form, Application, Region |

| Key Companies |

High-Purity Silicon America Corporation, OCI COMPANY Ltd., Qatar Solar Technologies, REC Silicon ASA, Tongwei Group Co., Ltd, Tokuyama Corporation, Wacker Chemie AG, Xinte Energy Co., Ltd, DAQO NEW ENERGY CO., LTD., GCL-TECH |

Polysilicon Market Dynamics

Drivers

- Emerging Age of Renewable Energy: Flipping of the switch to renewable energy across the world acts as the foremost driver for polysilicon demand. More governments and businesses are increasingly shining towards renewable photovoltaic projects capable of meeting energy needs sustainably while reducing green gas emissions. This increasing renewable energy commitment is not just increasing the demand for polysilicon for further installation with solar cells but also spurring innovation and competition among polysilicon manufacturers in refining the market environment.

- Technological advancement: For some unknown reasons, ongoing technological advancements in solar energy systems are one of the major factors driving the polysilicon market. Innovations such as bifacial solar panels and high-efficiency solar cells always require superior quality polysilicon in order to work to their optimum potential, hence further providing greater energy outputs and reduced levelized cost of electricity, thus enabling solar energy to compete with conventional energy forms and putting up an even bigger demand for polysilicon.

- Funds for Clean Energy: Inflow of investments into clean-energy projects represents a significant growth driver for the polysilicon markets. Investors are waking up to the potential of generating economic growth through creating jobs for renewable energy, which have made funds for solar projects year-on-year growth. Investment, rising on the demand for polysilicon, basically comes in the form of helping research and development on promising technologies related to solar, which guarantees a good flow pipeline for tomorrow.

- Increasing Global Solar Capacity: This increase in solar capacity across the globe is the major contributing factor to the demand for polysilicon. The installation of solar power systems has been advocated from home rooftops to cluster solar farms in different countries, thus calling for a lot of polysilicon. The This overcapacity simply indicates how critical polysilicon is as a material in the manufacture of solar energy equipment in general and therefore in renewable energy in particular.

Restraints

- High production costs: The polysilicon production process uses an overwhelmingly high amount of capital that is channeled majorly into the acquisition of specialized equipment and facilities. High production costs can act to limit either the cost-cutting measures processes of manufacturers in order to devise sizeable profits or potencies available to competitors within price-sensitive markets. The burden of this can thus be to block smaller firms from entering the market or allow them exponential cases of the scale economies limiting the growth of the certain industry in question.

- Pressures from Environmental Regulations: The strict regulations in an environmental context regarding polysilicon production can greatly impede manufacturers. Accompanying these regulations is a long process of upgrading a facility and processes to comply with those regulations. Compliance can be quite costly; therefore, the net profit margin may decrease. In addition, the ever-increasing abuse of polysilicon manufacture may soon compel companies to pursue environmentally friendly alternatives, making operational decisions even more difficult in a highly competitive environment.

- Market saturation: With polysilicon now developing to surplus levels, there is danger of oversaturation, especially in areas with rapid growth in solar energy. Such capacities can only inflate competition levels among manufacturers for downward price adjustments and diminishing profit margins. Thus, companies have to navigate all these waters in a very careful way by searching for ways on how they can differentiate their products and stay profitable in a crowded marketplace.

Opportunity

- Rising Adoption of Solar Energy: This widespread approval of renewable energy in various communities throughout world will always create a positive demand for polysilicon-it's a must-have in photovoltaic cells. On top of that, governments are providing several incentives, subsidies, and mandates for the adoption of solar energy, thereby boosting the nascent market. As solar energy grows rapidly, efficiency improvements in the solar-cell sector open substantial avenues for polysilicon manufacturers to profit on the growing market, in turn, feeding a continuous cycle of demand and penetration into a world market.

- Evolution of Green Polysilicon: The declining future of green polysilicon is being shaped by the growing environmental concerns aligned with tough regulations, thus stimulating the transition towards a more ecologically sustainable integrated system over that of conventional production techniques. Eco-friendly polysilicon is gearing up as sustainability becomes a global priority. Companies engaged in low-carbon manufacturing are poised to seize demand for sustainable materials, capturing high-end segments from environmentally conscious consumers and businesses. This shift is characterized by much wider ecological considerations, allowing the manufacturers scope to reap future growth from environmentally friendly practices.

- Integration with Smart Grid: The global birth of smart grid systems is increasing the requirement for renewable energy sources, especially solar energy. Polysilicon contributes tremendously to the development of solar technologies essential for smart grid infrastructure. Because utilities are now implementing smart grid systems that could greatly assist in optimizing energy distribution and integration, a concurrent increase in the demand for quality polysilicon products for solar applications is only to be expected. This presents an opportunity for the manufacturer to exploit by providing polysilicon specifically shielded for smart grid technologies focused on energy efficiency and future energy management.

Challenges

- Technological Developments: As technology in solar energy pursues exponential growth, producers of polysilicon are placed under threats to keep pace with this ever-changing environment. Companies must continuously improve and innovate their manufacturing processes; failure in finding the right channel to accept changes could cause obsolescence, constrained market position, and dwindling profitability.

- Environmental Sustainability: Meeting environmental sustainability targets in polysilicon production creates a different kind of menace. The producers must lessen their carbon footprints and reduce waste to be at par with production efficiency. This would require a balance between the economics of growth on various fronts while also developing a sustainable attitude toward the environment.

- Intellectual Property Issues: While the requirement for IP protection in the polysilicon market is very high, it is becoming more challenging due to competition. Companies should stifle their innovations, and at the same time face cumbersome global IP laws and regulations. Breaches or confrontations may suppress advancement and divert energies from more important pursuits, hence considering the fact that under these circumstances industry players have to compete in managing IP, that ability is essential to that industry.

Polysilicon Market Segmental Analysis

The polysilicon market is segmented into polysilicon form, application and region. Based on form, the market is classified into chips, chunks and rods. Based on application, the market is classified into solar photovoltaics and electronics.

By Polysilicon Form

Chips: A polysilicon chip is a small, thin, and typically sliced piece of silicon mostly utilized in the solar photovoltaic market. Such chips are essential in the manufacture of solar photovoltaic cells, which take the place of sunlight into powered energy. Chips are on the increase due to solar heat technology improvements and the quest for clean power sources. Thin and effective, these chips are made for high power solar panels and will continue to expand in this section as the number of solar installations increases globally.

Chunks: Polysilicon chunks are bigger pieces of polysilicon and used in making solar cells and many types of components. These chunks undergo additional processing to make slices and rods, which use highest efficiencies of solar panels and semiconductor devices. The renewable energy source demand is to be a significant growth segment for these polysilicon chunks, driven by the stable material requirements for solar and electronic applications. Pure quality chunks are being produced by high-tech chunk-making manufacturers to meet specific high standards.

Polysilicon Market Revenue Share, By Polysilicon Form, 2024 (%)

| Polysilicon Form |

Revenue Share, 2024 (%) |

| Chips |

58% |

| Chunks |

33% |

| Rods |

9% |

Rods: Polysilicon rods are drawn pieces of silicon for solar cell and semiconductor manufacturing, used primarily in semiconductor technology. The floating zone method, where high-purity polysilicon is drawn into long rods, is one of several methods used for producing these rods. The rods are further fabricated into thin slices or wafers used for the manufacturing of solar panels and electronic devices. This polysilicon rod segment is projected to encounter rising demand, given the higher performance electronics and solar technology desires for materials that will produce steadily increased efficiencies in energy conversion.

By Application

Solar Photovoltaics: The solar photovoltaics has been the leading material in the solar-cell production. Growth in solar energy technologies is spurred by concerns in relation to global environmental issues and government incentives, converting solar into a fast-growing market subsegment in the polysilicon recycling supply chain. As long as technological innovations continue improving the performance of solar panels and opened up the prospect of further demand in the solar energy sector, the purge polysilicon demand will consequently grow. Given that solar is cementing its foothold as a mainstream source of energy, this segment should continue growing.

Polysilicon Market Revenue Share, By Application, 2024 (%)

| Application |

Revenue Share, 2024 (%) |

| Solar Photovoltaics |

76.20% |

| Electronics |

23.80% |

Electronics: Polysilicon’s primary use in the electronics industry is in the production of semiconductors. This is because it is the main raw material used in the creation of electronic devices, notably thin film transistors, integrated circuits, among others. The increasing demand for consumer electronics devices such as smartphones, tablets, and the like, is what entirely propels the demand of polysilicon in this industry. Improvement in the technologies has further created an insatiable demand for the polysilicon sector as electronic manufacturers too, strive to design a device that is the most compact and energy efficient, going along with the current trends in the electronics industry.

Polysilicon Market Regional Analysis

The polysilicon market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). The Asia-Pacific region has dominated the market in 2024.

Why is Asia-Pacific leading the polysilicon market?

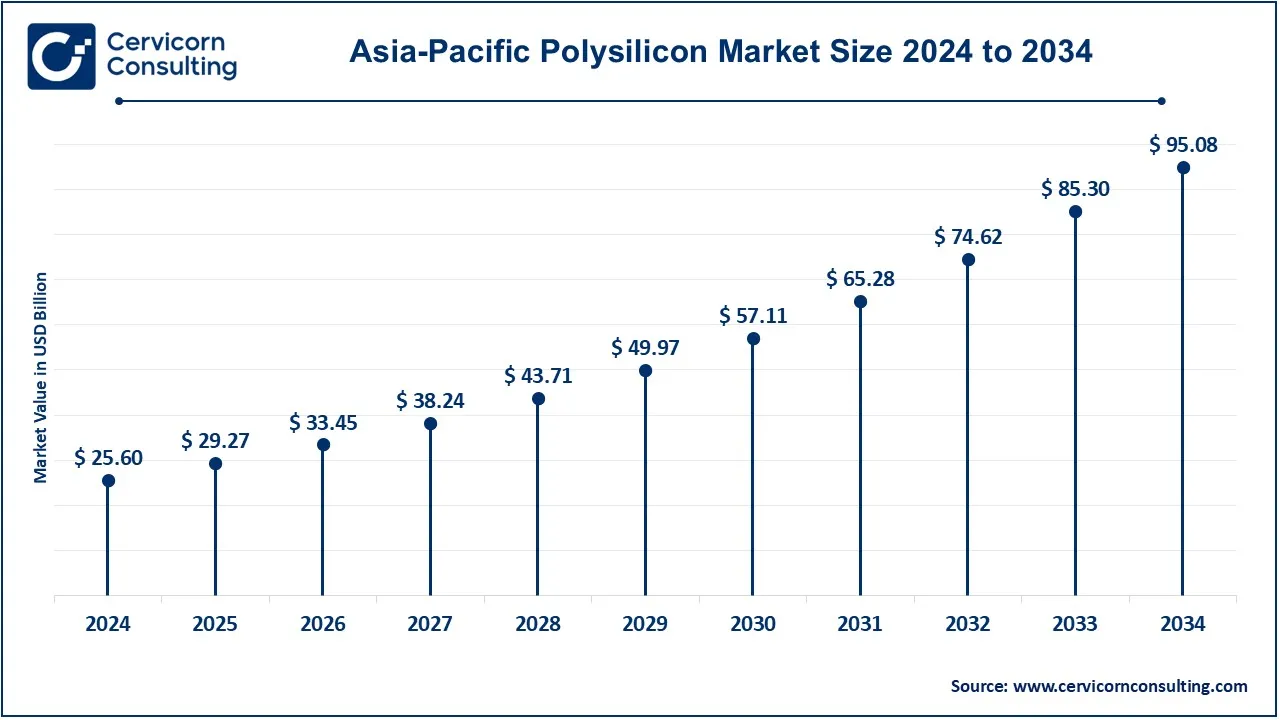

The Asia-Pacific polysilicon market size was valued at USD 25.60 billion in 2024 and is predicted to surpass around USD 95.08 billion by 2034. China remains the leading producing nation and market for polysilicon in the Asia-Pacific region owing to its higher production capacities for solar. In support, GCL-Poly Energy and LONGi Green Energy account for the leading actors in the industry in China. With extended low factors of production cost and the supply chain to grow faster, the region is expected to have further expansion. India's significant increase in photovoltaic installation in addition to sustained governmental support towards a renewable energy initiative puts the country in the route toward affording a huge role within the polysilicon market within the larger context of the Asia-Pacific region.

Why has North America experienced significant growth in the polysilicon market?

The North America polysilicon market size was valued at USD 8.81 billion in 2024 and is expected to reach around USD 32.73 billion by 2034. North America, with the foremost being the USA, one of the regions enjoying a significant influence on the market, is also enjoying favorable conditions due to breakthroughs within the solar sector and new technologies recently adopted in the marketplace. The major companies that include First Solar and REC Silicon are driving to establish new manufacturing and research-and-development plants aimed at achieving better quality and efficiency in polysilicon. In addition, the growth of the market that provides development for polysilicon production is buoyed by government incentives and renewable energy programs in place. Furthermore, in Canada, advances in renewable other energies received support grants to promote solar projects alongside the development of polysilicon projects in the area.

What are the driving factors of Europe polysilicon market?

The Europe polysilicon market size was estimated at USD 5.46 billion in 2024 and is projected to hit around USD 20.26 billion by 2034. In Europe, a significant marketing region, there is quite a large installation of renewable energies, which affects polysilicon production greatly. Some frontline countries, such as Germany and France, triggered by state laws enforcing environmental reforms and ambitious goals on renewable energy installation, have prospectively affected polysilicon production on the continent. The calling of the EU to meet preferably any target of a reduction in carbon emissions had acted as a catalyst to harness investments in solar technology, thus enhancing the demand base for the regions' high purity polysilicon. Nonetheless, manufacturing companies in Europe are undergoing a complete re-orientation toward sustainability through the endeavor to initiate recycling of polysilicon to fall in line with the various initiatives and regulations towards environmental conservation.

LAMEA polysilicon market is developing slowly

The LAMEA polysilicon market was valued at USD 2.10 billion in 2024 and is expected to reach around USD 7.79 billion by 2034. LAMEA region is developing slowly, being principally spurred by growing solar energy in favorable economies such as Brazil and South Africa. Growth prospects for polysilicon are improved by government campaigns encouraging renewable energy sources and international investments by solar developers. Therefore, nations within the Middle East such as the UAE are channelizing enough funds toward the solar energy spectrum, which in return is increasing polysilicon supply. However, slow infrastructure rollout along with the bargaining costs and higher initial outlays continue to hamper polysilicon.

Polysilicon Market Top Companies

- High-Purity Silicon America Corporation

- OCI COMPANY Ltd.

- Qatar Solar Technologies

- REC Silicon ASA

- Tongwei Group Co., Ltd

- Tokuyama Corporation

- Wacker Chemie AG

- Xinte Energy Co., Ltd

- DAQO NEW ENERGY CO., LTD.

- GCL-TECH

- Hemlock Semiconductor Operations LLC and Hemlock Semiconductor, L.L.C.

The polysilicon industry is notably influenced by key players such as High-Purity Silicon America Corporation, OCI COMPANY Ltd., Qatar Solar Technologies, and REC Silicon ASA. These companies are leveraging their expertise in manufacturing high-quality polysilicon to meet the increasing demand from solar photovoltaic applications and electronics. They are investing in advanced production technologies and expanding their production capacities to enhance efficiency and sustainability. Additionally, strategic partnerships and collaborations within the industry are facilitating innovation, ensuring these firms remain competitive in a rapidly evolving market landscape.

CEO Statements

Ming Zhang, CEO of Longi Green Energy

- "As we advance our commitment to sustainable energy solutions, we are investing heavily in R&D to enhance the efficiency of our polysilicon production while minimizing environmental impacts."

Hyeon-Jin Kim, CEO of OCI Company Ltd.

- "We are proud to lead the charge in polysilicon manufacturing, focusing on innovative production techniques that will drive down costs and support the growth of solar energy globally."

John E. Cavanaugh, CEO of REC Silicon

- "Our strategic focus on expanding production capabilities is essential to meet the surging demand for renewable energy solutions, particularly in the solar sector."

Recent Developments

- In August 2022, REC Silicon announced a Memorandum of Understanding (MoU) with Mississippi Silicon, aimed at negotiating a raw material supply agreement. This collaboration is focused on establishing a low-carbon and fully traceable solar supply chain in the U.S., facilitating the transition from raw silicon to polysilicon, and ultimately to fully assembled solar modules.

- In April 2022, OCI entered into a significant MoU to supply polysilicon to South Korean solar manufacturer Hanwha Solutions, with the contract valued at approximately USD 1.2 billion, reinforcing their commitment to enhancing the solar industry’s infrastructure and sustainability.

Market Segmentation

By Polysilicon Form

By Application

- Solar Photovoltaics

- Monocrystalline Solar Panel

- Multicrystalline Solar Panel

- Electronics

By Region

- North America

- APAC

- Europe

- LAMEA

...

...

![]()

![]()

![]()