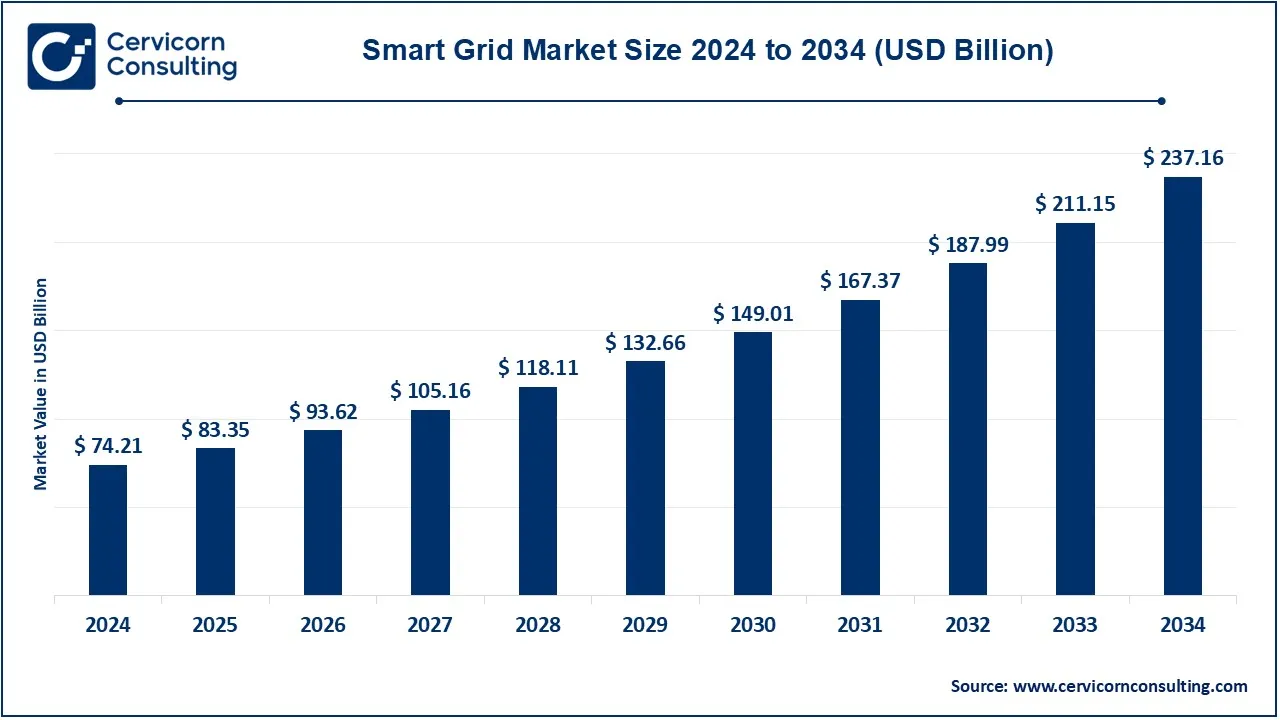

The global smart grid market size was reached at USD 74.21 billion in 2024 and is expected to be worth around USD 237.16 billion by 2034, growing at a compound annual growth rate (CAGR) of 17.20% from 2025 to 2034.

The smart grid market is growing rapidly due to increasing demand for energy efficiency, government initiatives for clean energy, and the rising adoption of renewable energy sources. Smart grids play a key role in reducing power losses, optimizing energy distribution, and ensuring a more resilient electricity network. As a result, utility companies worldwide are investing heavily in smart grid infrastructure. With the advancement of AI, IoT, and cloud computing, smart grid adoption is accelerating across regions, especially in North America, Europe, and Asia-Pacific. The shift towards smart cities and electric vehicles (EVs) is also driving market expansion, as smart grids support EV charging infrastructure and distributed energy resources.

The need for energy has grown as a result of urbanization, rising living standards, and technological developments. Cities account for 80 percent of greenhouse gas emissions and use between 75 and 80 percent of all energy. This is concerning for the preservation of the ecosystem worldwide as well as for the supply of renewable energy. Efficient energy use and dependence on renewable resources will also help reduce the carbon footprint of humanity. The power grid in its current form is unreliable, has high transmission losses and poor power quality, is prone to brownouts and blackouts, provides inadequate power, and prevents the integration of distributed energy sources. There is a lack of monitoring and real-time control in the traditional non-smart systems, which poses a challenge for smart grids to act as real-time solutions.

The electricity utility industry is going through massive changes. The power grid has been around for a long time and it shows. It is costly, ineffective, and untrustworthy. Smart grids are becoming more and more necessary worldwide, and power companies must prioritize cost-effectiveness, smarter storage, and cleaner energy. With the use of cutting-edge automation, control, IT, and Internet of Things technology, the smart grid concept aims to improve the power grid by allowing for real-time monitoring and management of the electrical flow from generation to consumption. Among the many technologies it encompasses are energy storage systems (ESS), AI and ML tools, and advanced metering infrastructure (AMI), also known as smart meters. Power generation is optimized, distribution efficiency is increased, and educated consumer choices are supported by these technologies.

Among the drivers propelling the smart grid market's expansion are growing environmental protection concerns and the growing use of smart grid technology to increase energy conservation and consumption efficiency. Furthermore, some of the key elements propelling the market expansion include encouraging government laws and policies regarding the use of smart meters as well as rising expenditures in digital power infrastructure. However, it is anticipated that the market's expansion will be hampered by a lack of standards and growing privacy and security concerns. In addition, the growing number of electric cars on the road and the impending smart city initiatives in developing nations are anticipated to present significant market expansion prospects in the years to come.

What is a Smart Grid?

A smart grid is an advanced electricity network that uses digital technology, automation, and real-time data to improve the efficiency, reliability, and sustainability of power distribution. Unlike traditional power grids, which follow a one-way flow of electricity, smart grids enable two-way communication between consumers and utilities, optimizing energy usage. Smart grids integrate smart meters, sensors, and artificial intelligence to detect power outages, reduce energy waste, and enable renewable energy sources like solar and wind to be seamlessly integrated into the system. This modern grid enhances energy efficiency, lowers costs, and improves grid stability while reducing carbon emissions. Additionally, it allows consumers to track and control their energy usage through smart home technologies, leading to better energy conservation.

Key Insights related to the Smart Grid:

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 83.35 Billion |

| Expected Market Size in 2034 | USD 237.16 Billion |

| Projected CAGR (2025 to 2034) | 17.40% |

| Leading Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Component, Application, Solution, Technology, End User, Region |

| Key Companies | Wipro Ltd, IBM Corporations, Schneider Electric SA, Landis+Gyr Group AG, Honeywell International Inc., Open Systems International Inc, Oracle Corporations, Trilliant Holdings Inc., Elster Group GmbH, General Electric Company, S&C Electric Company, ABB Ltd, Fujitsu Limited, Itron Inc, Cisco Systems Inc, Toshiba Corporation, Eaton Corporation, Mitsubishi Electric Corporation, Echelon Corporation, Siemens AG, Aclara Technologies LLC |

Increased Government Support

Growing Demand for EMS

High Cost of Implementing a Smart Grid

Lack of Standards

Growing Research Numbers

Adoption of Blockchain Technology

Security Issues

Technological Complexity

The smart grid market is segmented in to component, application, solution, technology, end user and region. Based on component, the market is classified into hardware, software and services, Based on application, the market is classified into generation, transmission, distribution, consumption. Based on solution, the market is classified into advanced metering infrastructure, smart grid distribution management, smart grid communications, smart grid network management, substation automation, smart grid security and thers; Based on end use, the market is classified into residential, utility & industrial and commercial. Based on technology, the market is classified into wired and wireless.

Software: Advanced software solutions are becoming essential for managing grids, data analytics, and predictive maintenance because of the increasing complications associated with the grids as a result of the integration of multiple energy sources. Further, this software also assists companies in optimizing energy distribution, integrating renewable resources effectively, and improving consumer engagement through the utilization of real-time data knowledge and insight. In addition, the governments have also increased the spending on advanced metering infrastructure (AMI) which is likely to spur market growth. For instance, to develop and implement smart grid technology, the Energy Independence and Security Act was approved by the US government in 2007.

Smart Grid Market Revenue Share, By Component, 2024 (%)

| Component | Revenue Share, 2024 (%) |

| Hardware | 38.20% |

| Software | 49.50% |

| Service | 12.30% |

Hardware: Smart meters, sensors, and controllers are required to facilitate real-time monitoring and energy management. The development of sophisticated hardware is necessary for helping in the integration of the smart grid with renewable energy sources. Various governments of different countries have also been leading the charge in the process of installing smart electricity meters. For instance, the Australian Energy Market Commission initiated an independent rule to review electricity meters in December 2020 to install smart electricity meters all over the country further encouraging the adoption of smart grids.

Services: For the operation of the smart grids the services sector allows applications including the installation and integration of various modules. Therefore, companies opt for these services to make the integration and deployment process smooth and reduce costs. Services include consulting, installation, support, and maintenance services which are critical for the successful deployment and operation of smart grids. The complexity of smart grid systems requires specialized expertise, which increases the demand for skilled professionals who can manage these complex networks.

Residential: Growing populations, especially in developing countries, are increasingly demanding energy. There is a higher demand for energy from residential customers to better control costs and consumption. Homeowners are becoming more aware of the benefits of energy saving and are adopting smart grid technologies to optimize electricity consumption, reduce bills, and contribute to environmental sustainability. Furthermore, smart homes that are equipped with Internet of Things devices that need effective energy management are becoming highly popular among the population. Home management systems and smart meters (HEMS) are examples of smart grid technologies that give owners real-time control and monitoring over their day-to-day energy usage.

Utilities and Industry: The use of grid technologies is increasing worldwide. Governments of underdeveloped and emerging countries are also recognizing these technologies as strategic infrastructure investments that will help achieve carbon emission targets. In addition, growing populations, industrialization, and increasing environmental concerns due to fossil fuel power plants are forcing the government to plan regulatory standards related to carbon emissions. The industrial sector is further anticipated to grow significantly because of many favorable policies and tax incentives passed by the government.

Commercial: The increasing need for genuine and efficient energy management in different businesses and public institutions is one of the reasons driving the commercial segment. Malls, hospitals, and offices are among the commercial facilities that are implementing smart grid technologies to reduce operating costs, thereby ensuring a consistent supply of electricity, and improving operational sustainability. The commercial sector is encouraged to use renewable energy sources due to the mounting regulatory pressure of reducing carbon emissions which has also positively affected market expansion. Further, there is a growing number of commercial buildings that are utilizing advanced metering infrastructure and energy management systems for controlling load in a better manner and predictive maintenance is leading to market growth.

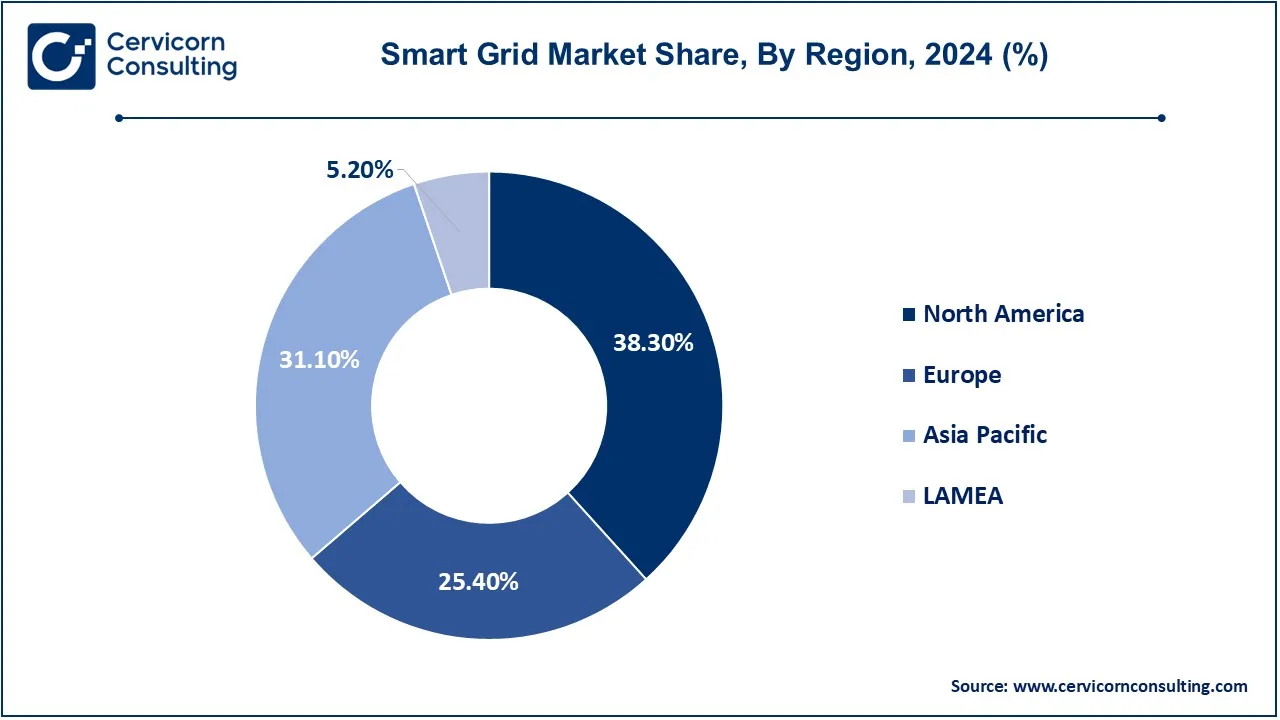

The smart grid market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. The North America has dominated the market in 2024.

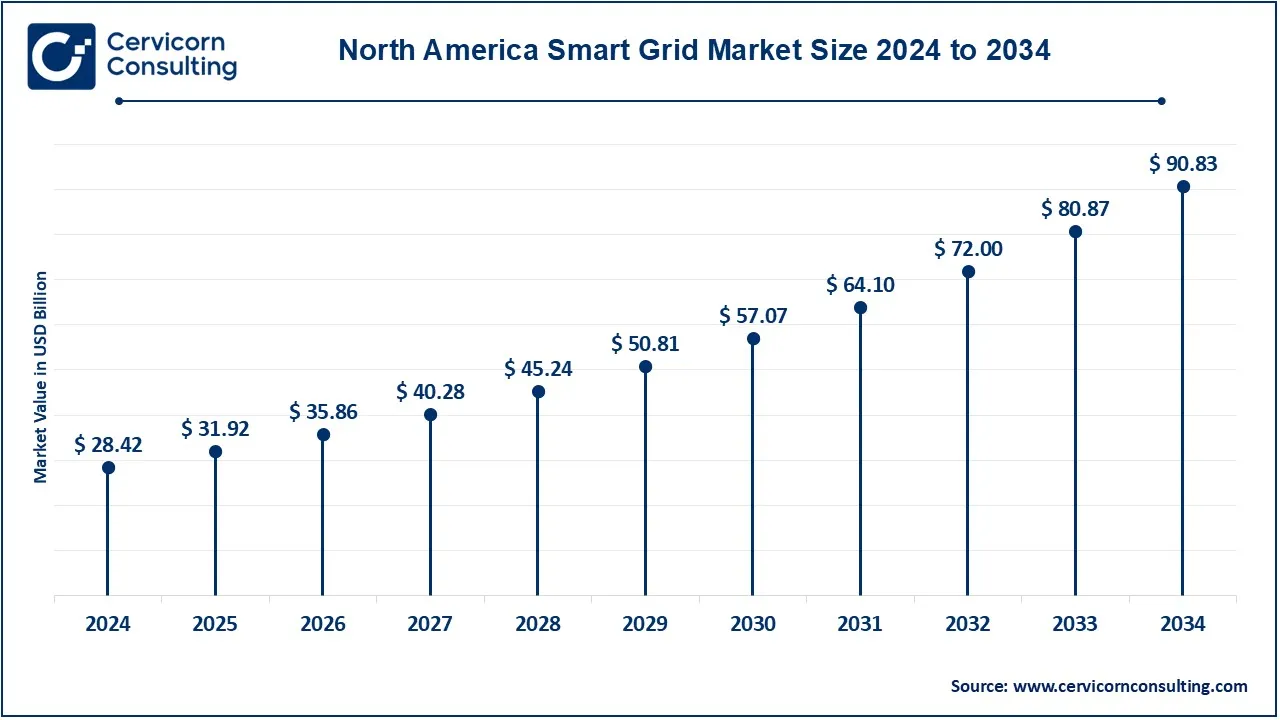

The North America smart grid market size was valued at USD 28.42 billion in 2024 and is expected to reach around USD 90.83 billion by 2034. The growth of the smart grid market in North America is attributed to the adoption of electric vehicles and large investments by private and public as well as government entities in this region. The region has a strong regulatory framework that supports the development of smart grids, including incentives and policies that encourage the use of smart technologies. There is also a growing demand for improved grid reliability and efficiency, especially in the face of extreme weather events. Moreover, the high penetration of advanced metering infrastructure and the drive for energy independence are further stimulating the market in the region.

The Europe smart grid market size was estimated at USD 18.85 billion in 2024 and is projected to hit around USD 60.24 billion by 2034. Europe is expected to grow owing to the encouraging government initiatives towards clean power generation in the region. The UK, France, and Germany are among the countries in Europe that hold a significant market share. Also, the increasing demand for energy efficiency in power supply is likely to drive the regional outlook. The growing investments in distribution automation and the increasing complexity of power distribution infrastructure are expected to enhance the market outlook. For example, the smart metering implementation program launched by the UK government in May 2020 resulted in a total of 26.6 million electricity meters being operated by major energy suppliers in residential homes across the UK.

The Asia-Pacific smart grid market size was valued at USD 23.08 billion in 2024 and is expected to be worth around USD 73.76 billion by 2034. Asia Pacific holds a significant market position due to the wide adoption of these technologies and a strong focus on renewable energy growth. For example, in February 2020, the Indian government announced the installation of 1 million smart meters across the country under the Smart Meter National Program (SMNP). The region's major growth is coming from countries like China, India, Japan, Australia, and South Korea, with China being the most promising frontrunner in adopting these technologies. In addition, the growing smart city development programs in the region are expected to boost market growth.

The LAMEA smart grid market size was valued at USD 3.86 billion in 2024 and is expected to be worth around USD 12.33 billion by 2034. Latin America is also expected to witness significant growth due to the large demand from Brazil and Mexico to support the increasing industrialization in the region. For example, in February 2021, Brazilian energy utility Amazonas Energia selected Landis+Gyr to implement an advanced metering infrastructure project in the Brazilian state of Amazonas. Landis+Gyr will provide the utility with its SGP+M Mesh IP smart central metering solution to serve around 100,000 customers. In the Middle East and Africa, high adoption of solutions to minimize outages and revenue losses and provide enhanced control with low disruption is expected to drive market growth. With the new projects to utilize various conventional and non-conventional energy resources, the region is expected to witness steady growth in the coming years.

Most companies are actively conducting research and development, believing that this will enable them to develop the next generation of active electronic component products that can generate even more energy than previous generations. In October 2022, Eaton announced the launch of its new advanced energy storage system, the EnergyAware UPS. This cutting-edge system helps consumers save money and increase power reliability by intelligently storing and delivering energy during times of high demand. It's easy to integrate Eaton's current energy management technologies. In June 2021, Schneider Electric said they would work together to encourage microgrids to help people and communities affected by climate and weather disasters. The company has deployed more than 170 kWh of mobile battery storage and more than 45 kW of mobile solar power to support more than 100 disaster relief and recovery missions, providing emergency electricity to Americans. Siemens is a major European industrial manufacturing company that specializes in several industries, such as infrastructure, transportation, and healthcare.

CEO Statements

James Aein, CEO of ENERZA

P Raja Manickam, CEO of Tata Electronics OSAT

Market Segmentation

By Component

By Application

By Solution

By Technology

By End Use

By Region