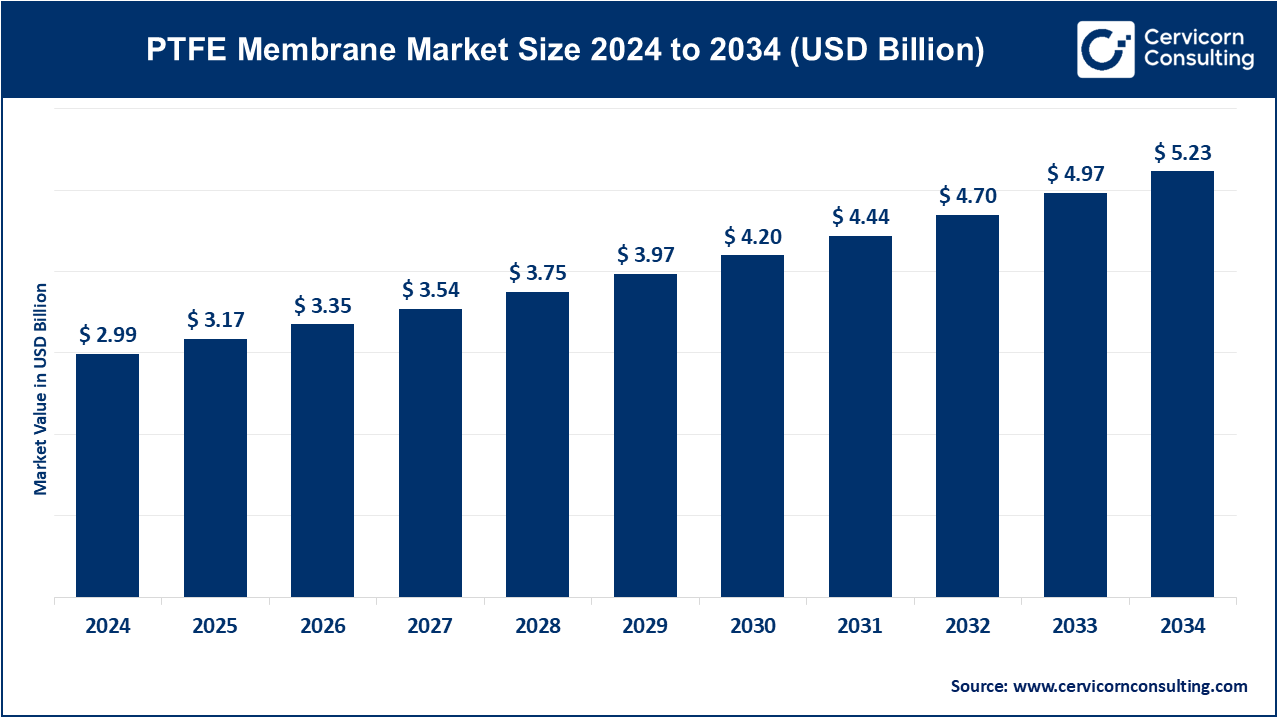

The global PTFE membrane market size was accounted for USD 2.99 billion in 2024 and is expected to reach around USD 5.23 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.79% over the forecast period 2025 to 2034.

The PTFE membrane market is witnessing substantial growth, mainly driven by increasing industrial and environmental concerns. As global awareness of air and water pollution rises, industries are adopting more efficient filtration systems, which has created a strong demand for PTFE membranes. These membranes are crucial in various applications, such as filtration, medical devices, and protective coatings, offering superior performance due to their chemical resistance, high durability, and ability to withstand extreme temperatures. Industries like pharmaceuticals, chemicals, and electronics rely on PTFE membranes for precise filtration and moisture protection. In addition, the growing focus on sustainable practices and regulations pushing for cleaner production methods are fueling the demand for high-performance filtration technologies. India is the largest importer of PTFE membranes, accounting for 30% of global imports with 2,154 shipments. The market is also benefiting from the expanding healthcare sector, where PTFE membranes are used in applications like wound healing and drug delivery.

PTFE (Polytetrafluoroethylene) membrane is a high-performance material made from PTFE, a type of plastic known for its non-stick and water-resistant properties. These membranes are thin, flexible layers that allow gases or liquids to pass through while blocking particles, water, or contaminants. PTFE membranes are widely used in filtration systems, waterproof clothing, medical devices, and chemical processing due to their durability, chemical resistance, and ability to function in extreme temperatures. PTFE membranes are available in hydrophobic (water-repelling) and hydrophilic (water-attracting) forms, making them versatile for different applications. In industrial filtration, they help purify air and liquids by capturing fine particles.

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 3.17 Billion |

| Market Size by 2034 | USD 5.23 Billion |

| Market Growth Rate | CAGR of 5.79% from 2025 to 2034 |

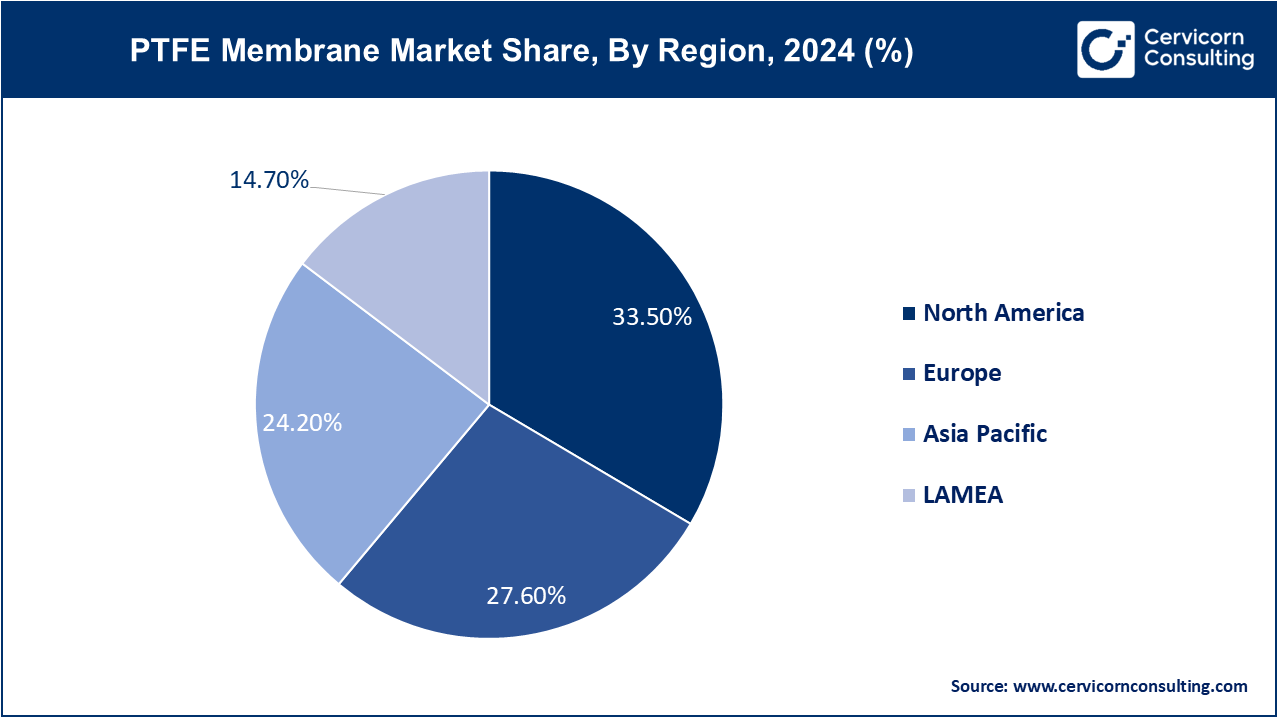

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Segment Coverage | By Type, Application and Regions |

Regulatory Push for Environmental Sustainability:

Rising Demand for High-Quality Medical Devices:

High Cost of PTFE Materials:

Limited Manufacturing Capacity:

Development of Customized Solutions:

Expansion in Emerging Markets:

Complex Installation and Maintenance:

Limited Recycling Options:

The PTFE membrane market is segmented into type, application, and region. Based on type, the market is classified into hydrophobic membranes, hydrophilic membranes, oleophobic membranes, and others. Based on application, the market is classified into industrial filtration, medical and pharmaceuticals, textiles, water and wastewater treatment, architecture, and others.

Hydrophobic Membranes: In 2024, this segment has accounted 57% of market share. Hydrophobic membranes repel water and are used to prevent moisture from passing through while allowing air and gases to pass. They are commonly used in applications where water resistance is crucial. The demand for hydrophobic PTFE membranes is increasing in sectors like filtration and construction, driven by their effectiveness in preventing water ingress and their durability in harsh environments.

Hydrophilic Membranes: Hydrophilic membranes attract and allow water to pass through while blocking other substances. They are used in applications that require water permeability and are essential for certain filtration processes. Growing applications in medical and industrial filtration are driving the demand for hydrophilic PTFE membranes. Innovations aimed at enhancing permeability and performance in aqueous environments are advancing this segment.

Oleophobic Membranes: Oleophobic membranes repel oils and fats, making them ideal for environments where oil resistance is required. These membranes are used to filter or separate substances involving oils or other hydrophobic liquids. The rise in industries such as food processing and petrochemicals, where oil and grease handling is prevalent, is boosting the adoption of oleophobic PTFE membranes. Technological advancements are enhancing their efficiency and durability.

Others: This category includes various specialized PTFE membranes not covered by the standard types, such as composite or multi-layer membranes, designed for specific applications and performance needs. Custom and advanced membrane technologies are emerging to meet unique industry requirements. Innovations in composite membranes are expanding applications across various sectors, offering tailored solutions for complex challenges.

Industrial Filtration: The industrial filtration segment has recorded market share of 38% in 2024. PTFE membranes in industrial filtration are used for separating particles and contaminants from gases and liquids, providing high chemical resistance and durability. The market is growing due to increased industrial activities and regulatory requirements for clean air and water. Innovations focus on enhancing membrane efficiency and lifespan, driving demand for advanced filtration solutions in sectors such as chemicals and pharmaceuticals.

Medical & Pharmaceuticals: The medical and pharmaceutical segment has reported market share of 20% in 2024. In the medical and pharmaceutical industries, PTFE membranes are employed in filters and barriers for maintaining sterility and ensuring the purity of medical solutions. There's a rising demand for high-performance, sterile materials due to advancements in medical technologies and stricter regulatory standards. PTFE membranes are increasingly used in drug manufacturing and medical device filtration, driven by innovations in health care and biopharmaceuticals.

Textiles: This segment has calculated market share of 18% in the year of 2024. PTFE membranes are used in textiles for applications that require water resistance, breathability, and durability, such as in outdoor and performance fabrics. The demand for high-performance fabrics in sportswear and protective clothing is expanding. Innovations focus on improving membrane integration into textiles to enhance durability and comfort, responding to the growing consumer preference for functional and high-quality apparel.

Water & Wastewater Treatment: The water and wastewater treatment segment has captured market share of 9% in 2024. PTFE membranes in water and wastewater treatment are utilized for their high filtration efficiency and resistance to fouling, helping in the purification process. Increased environmental regulations and the need for efficient water management drive the demand for PTFE membranes. Advancements in membrane technology aim to enhance performance and reduce operational costs in both municipal and industrial wastewater treatment applications.

Architecture: In architecture, PTFE membranes are used for building facades, roofs, and other structural applications due to their durability, flexibility, and resistance to environmental conditions. The use of PTFE membranes is growing in architectural designs for their aesthetic and functional benefits. Trends include increased adoption in large-span structures and innovative designs that leverage the material's versatility and weather resistance, contributing to modern architectural projects.

Others: The others segment has generated market share of 15% in 2024. This category includes various niche applications of PTFE membranes such as in aerospace, automotive, and electronics. Emerging applications and ongoing research drive growth in this segment. Innovations are focused on expanding PTFE membrane uses in advanced technology sectors, exploring new material combinations and applications to meet evolving industry needs.

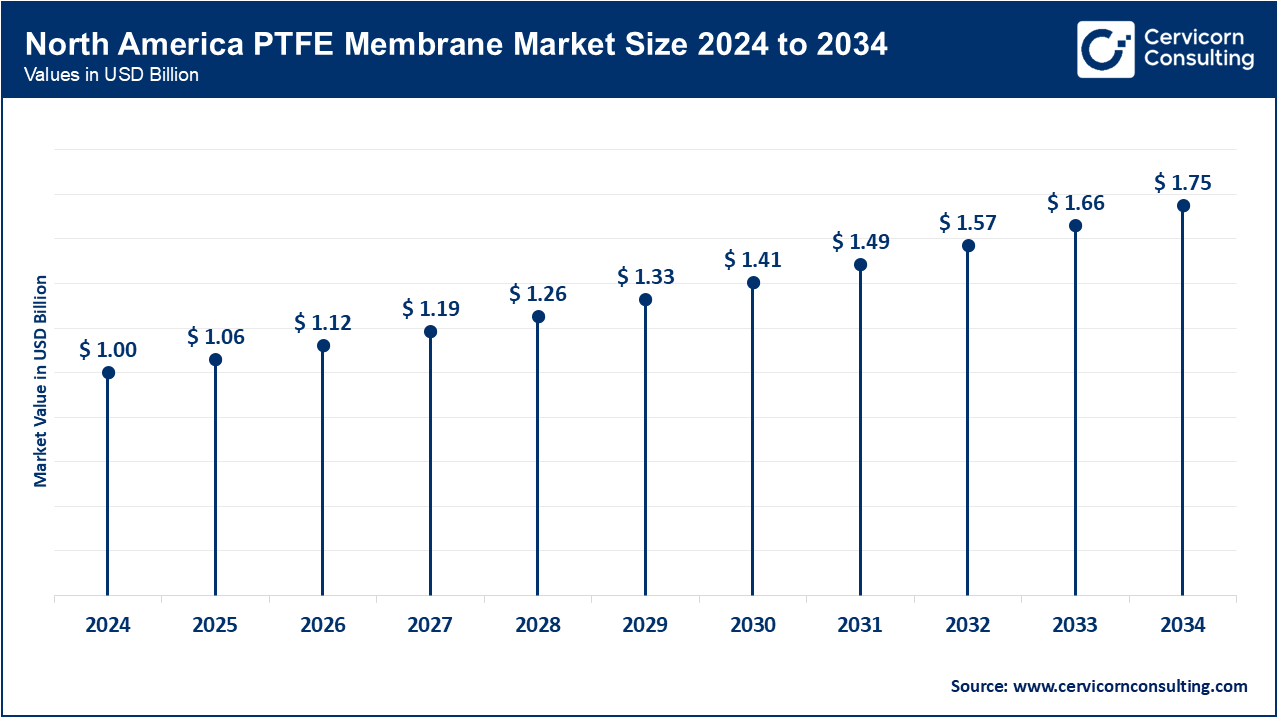

The North America market size is expected to reach around USD 1.75 billion by 2034 increasing from USD 1 billion in 2024 with a CAGR of 5.80%. The North American PTFE membrane market is characterized by advanced technology adoption and high demand for high-performance materials. Key trends include a focus on innovation and sustainability, driven by stringent environmental regulations and a strong emphasis on R&D in industries such as aerospace, automotive, and construction. The region's established infrastructure and regulatory environment support continued growth and technological advancements. U.S market size is estimated to reach around USD 1.31 billion by 2034 increasing from USD 0.75 billion in 2024 with a CAGR of 5.90%.

The Asia Pacific market size is calculated at USD 0.72 billion in 2024 and is projected to grow around USD 1.27 billion by 2034 with a CAGR of 6.40%. The Asia-Pacific region is experiencing rapid industrialization and urbanization, driving significant growth in the PTFE membrane market. Trends include expanding applications in water and wastewater treatment, construction, and manufacturing due to rising infrastructure development and increasing industrial activities. The region is also seeing growth in consumer demand for advanced textiles and filtration solutions, leading to increased adoption of PTFE membranes.

The Europe market size is measured at USD 0.83 billion in 2024 and is expected to grow around USD 1.44 billion by 2034 with a CAGR of 5.60%. In Europe, the PTFE membrane market is influenced by strong environmental regulations and a growing emphasis on sustainability. Trends include increased use of PTFE membranes in green building projects and water treatment systems, driven by the European Union’s commitment to reducing carbon emissions and improving environmental quality. Innovations are focused on enhancing energy efficiency and reducing the environmental impact of construction and industrial processes.

The LAMEA market size is forecasted to reach around USD 0.77 billion by 2034 from USD 0.44 billion in 2024 with a CAGR of 5.10%. In the LAMEA (Latin America, Middle East, and Africa) region, the PTFE membrane market is growing due to increasing investments in infrastructure and industrial projects. Trends include rising demand for water treatment solutions and construction materials as governments focus on improving utilities and infrastructure. The region is also seeing emerging applications in sectors like mining and energy, with a growing interest in adopting advanced materials for better performance and sustainability.

Emerging companies like Membrane Solutions, LLC and Tetratec AG are adopting innovative technologies to enter the PTFE membrane market. They focus on developing advanced filtration and industrial solutions that cater to evolving customer needs and regulatory standards. Established companies such as W. L. Gore & Associates, Inc. and 3M Company dominate the market through their extensive R&D capabilities and broad application range. Their leadership stems from high-performance products, strong brand presence, and significant investments in technological advancements, maintaining a competitive edge in the industry.

Market Segmentation

By Type

By Application

By Regions