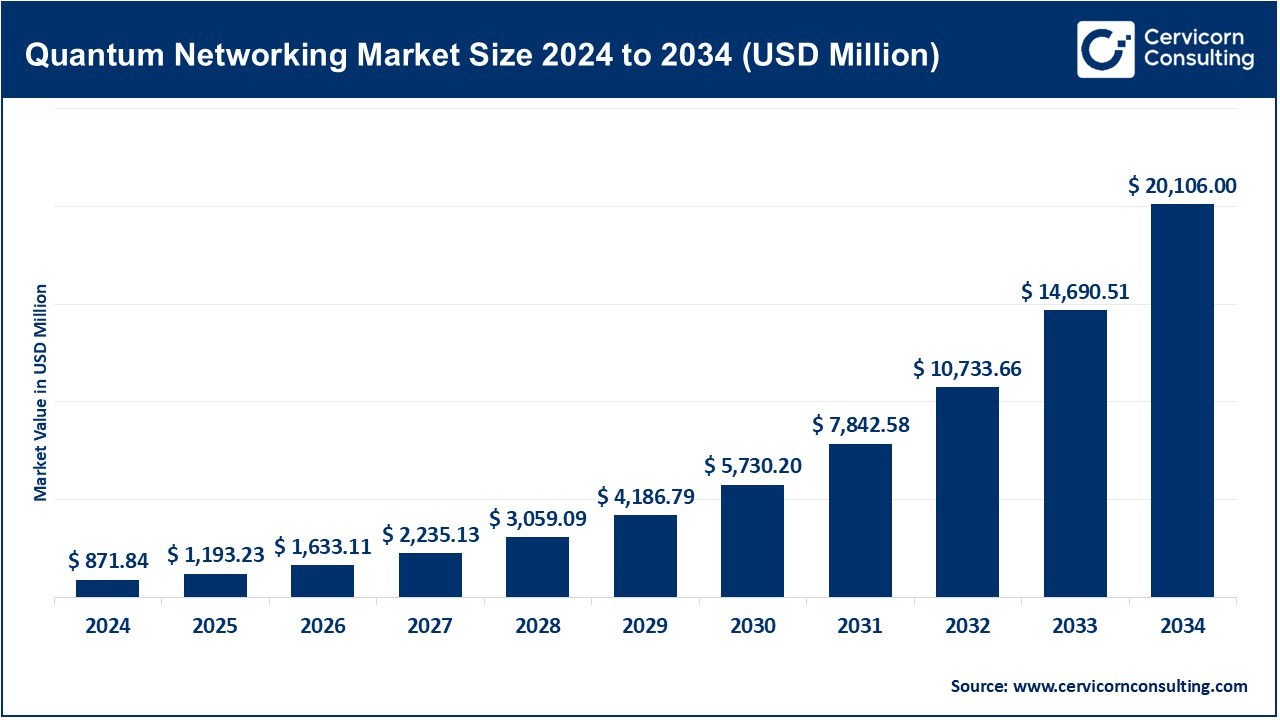

The global quantum networking market size was valued at USD 871.84 million in 2024 and is projected to be worth around USD 21,106 million by 2034, expanding at a CAGR of 36.86% from 2025 to 2034. The demand for quantum networking is rising across the globe due to the growing emphasis on national security. Governments and security bodies across nations are investing heavily in quantum networking to facilitate secure communication. It allows unbreakable encryption, which makes it ideal for transmitting sensitive information in various sectors, such as government, BFSI, and defense. Moreover, advancements in quantum devices led to faster data transfer and processing, encouraging industries to shift their focus toward quantum communication solutions.

Quantum networking is an emerging field, which refers to standard networks that are utilized in everyday life to share and transmit digital information. However, this concept differs from classical network technology. Quantum networks utilize principles of quantum mechanics to facilitate secure communication. They encode information in the form of quantum bits or qubits. This technology facilitates secure communication and information transfer between quantum devices. Quantum networking is applied to the banking, healthcare, cybersecurity, and manufacturing sectors to optimize uptime, reliability, scalability, efficiency, and error detection.

Major Benefits of Quantum Networking Across Industries

| Benefits | Offering |

| Data Privacy | Holds the capability to create communication systems that are immune to make ideal eavesdropping solutions for managing sensitive data. |

| Distributed Quantum Computing | Enables internet where multiple systems are connected in order to increase computational power to solve complex problems. |

| Access to Quantum Processors | Allow users to access systems with cloud-based approach to democratize quantum computing capabilities. |

| Data Transfer without Physical Medium | Allows quantum teleportation to transmit data securely and efficiently across multiple networks. |

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 1,193.23 Million |

| Expected Market Size in 2034 | USD 20,106 Million |

| Projected CAGR 2025 to 2034 | 36.86% |

| Dominant Region | North America |

| Fastet Expanding Region | Asia-Pacific |

| Key Segments | Offering, Application, End User, Region |

| Key Companies | Aegiq Ltd, Aliro Technologies, Inc., Arqit, Cisco Systems, Inc., Crypta Labs Limited, HEQA Security, IBM, ID Quantique, MagiQ Technologies, Miraex, TOSHIBA CORPORATION, Terra Quantum, QuantumCTek Co., Ltd., Quantum Xchange, Qubitekk, Inc., Qunnect Inc., QuBalt GmbH |

Rising Demand for Advanced Computational Power to Support the Market

Rising Number of Start-ups: Quantum Networking to Receive Supplement

High Costs and Lack of Standardization: Market’s Barriers

Cybersecurity Advancements to Promote the Market’s Expansion

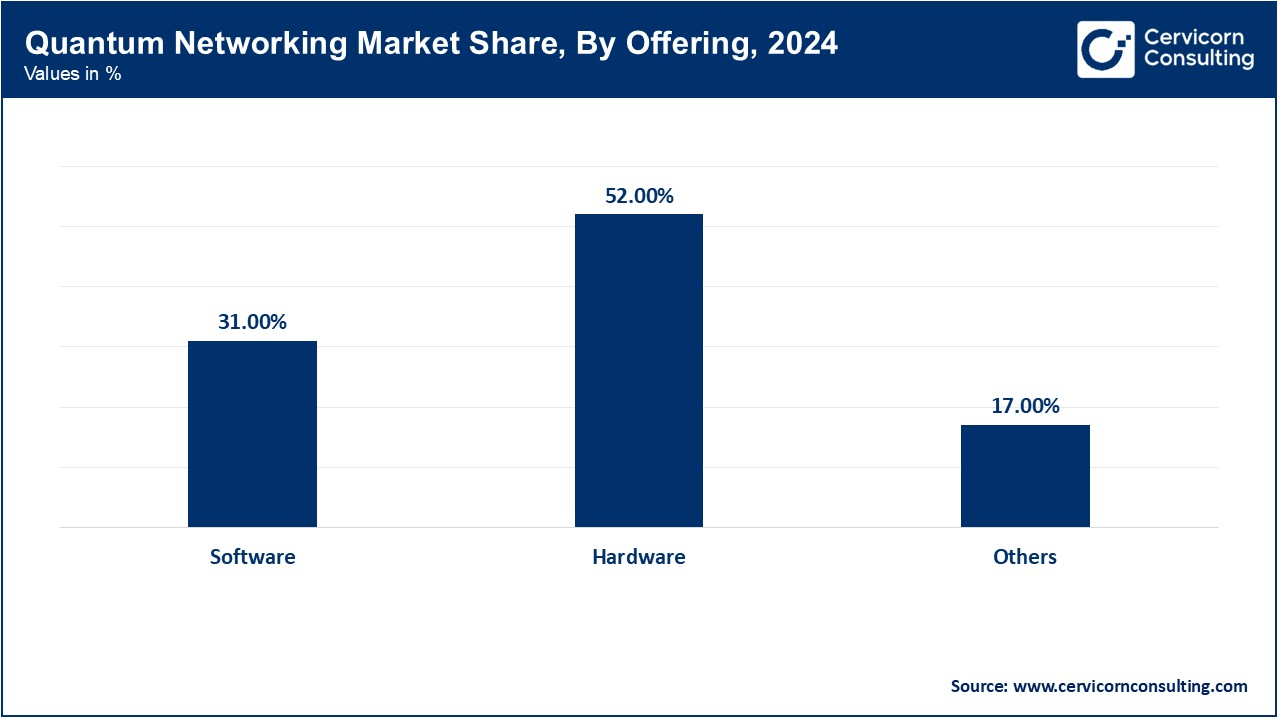

The quantum networking market is segmented into offering, end user, application and region. Based on offering, the market is classified into software, hardware and services. Based on application, the market is classified into distributed quantum computing, quantum clock synchronization, quantum sensing and metrology, secure communication, secure financial transactions and secure voting. Based on end-user, the market is classified into government & defense, BFSI, IT & telecom and others.

Emphasis Over Security: QRNG Segment to Sustain the Position

The quantum random number generator (QRNG) segment dominated the market with the largest share in 2024. The QRNG segment holds the capacity to generate random numbers that are crucial for boosting the security in several quantum communication systems. On the other hand, QRNDs enhance quantum mechanics while ensuring predictability. A few of major reasons for the segment’s dominance are offered integration and scalability and rising demand for secure communication.

As cyber threats and breaches are rising, the requirement for secure communication has surged. Considering a recent breakthrough for this, ID Quantique, a major lease in quantum security has created strides in QRNG technology which are being integrated into cars and other IoT devices to offer secure communications.

QKD Segment to Grow at a Rapid Pace

The quantum key distribution (QKD) system segment is anticipated to grow rapidly over the studied period. QKD holds the ability to offer unparalleled security in the era of growing adoption of secure communication solutions by finance and government sectors. For example, China has always been at the forefront that has supported the development of QKD since 2016. Countries like the United States, EU and Japan are seen heavily investing QKD-based technologies.

As the requirement for 5G and 6G technology rises, the amount of date being transmitted will also rise. This creates a long-term and sustainable potential for QKD solutions to expand in the market. The commercialization of QKD systems is also seen to act as a major breakthrough for the industry. Toshiba, in 2023, started working on the commercialization of QKD systems while announcing the deployment of large-scale QKD technology in Tokyo and London.

Government & Defense Sectors are the Major Contributor to Market Expansion

The government & defense segment captured the largest share of the quantum networking market in 2024. Government across the globe are focused on making significant investments in quantum technologies as part of their national security plannings. For instance, the European Union has launched the Quantum Internet Alliance that aims to deploy a quantum internet across Europe to focus over collaboration with defense sectors. Governments and defense sector bodies are focused on collaborating with private companies for networking solutions. Notable partnerships and alliances will help the segment to grow in the upcoming years.

IT & Telecom Sectors to Support the Market

The IT & telecom segment is expected to expand at the highest CAGR in the coming years. For the IT and telecom sector, integration of quantum computing offers exponential data growth and secure communication. IT and telecom companies require prevention from unauthorized access and security for data transmission. Recently, the IT and telecom sectors have started engaging in collaborations with technology companies to work on advancement of their quantum research. These sort of business activities are seen to boost commercialization of quantum networking technologies.

Major players such as BT and Verizon have announced investments in quantum communication systems that can enhance network security.

North America held the largest share of the quantum networking market in 2024. The dominance is observed to be sustained with the expansion of IT and finance-based businesses. Along with this, government entities in the region, have precisely recognize the importance of secure communication, thus resulted in investments for research and development of products and services that are associated with quantum computing.

It is anticipated that upcoming quantum innovations are observed to underpin major advancements and breakthroughs in multiple fields in North America. Canada has also taken a major step in quantum science while making an investment of C$1 billion till 2022. Toronto-based Xanadu launched PennyLane, a software for quantum computers with Machine Learning dedicated systems.

The U.S. government has recently started taking proactive measures in order to promote technology measures through research and fundings. To consider the same, the National Quantum Initiative Act aimed at accelerating quantum development which includes networking technologies.

Asia Pacific is expected to grow at a rapid pace in the quantum networking market during the forecast period. Rapid expansion of technological infrastructure is the key factor contributing to the regional market growth. The rising number of tech companies in countries such as India and China are investing in quantum technologies. Moreover, governments have recognized the importance of quantum networking in national security. Thus, governments of various nations are investing in quantum technology to enhance national security protocols, thus boosting the market.

India and China Quantum Networking Trends

On July 25, 2024, the Chinese government announced the creation of a new national quantum research center, "China Quantum Institute," which will receive a $1.2 billion investment over the next decade. The center aims to consolidate China’s quantum research efforts and accelerate the development of quantum computing technologies. It will focus on both theoretical and applied research, with an emphasis on achieving quantum supremacy. The institute will also collaborate with international partners to enhance global cooperation and share advancements in quantum technology.

On June 10, 2024, the Indian government launched a national quantum mission, "Quantum India," with an initial funding of ₹2,000 crore (approximately $250 million). The mission aims to develop indigenous quantum computing technologies and establish a network of quantum research centers across the country. This initiative seeks to position India as a key player in the global quantum computing landscape and drive technological innovation. The mission also includes plans for talent development and public-private partnerships to advance quantum research and applications.

Quantum Networking Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 44% |

| Asia-Pacific | 20% |

| Europe | 29% |

| LAMEA | 7% |

Market Segmentation

By Offering

By Application

By End-user

By Region