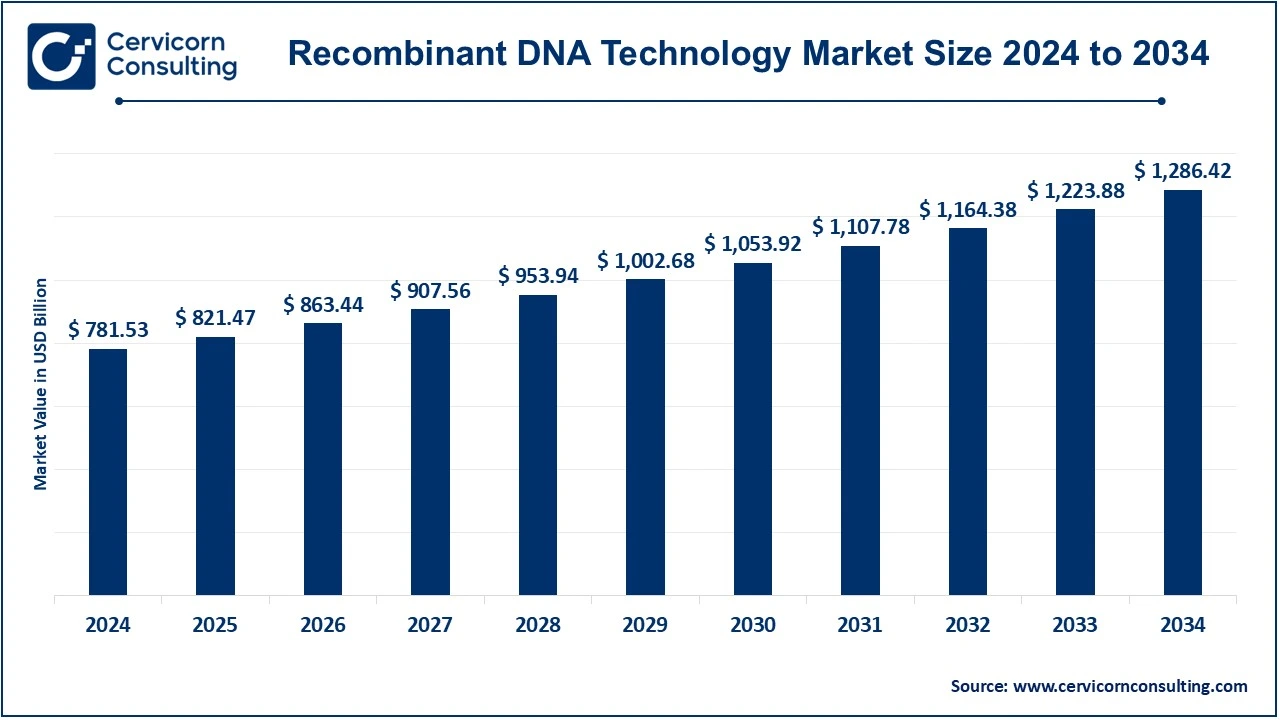

The global recombinant DNA technology market size was valued at USD 781.53 billion in 2024 and is expected to be worth around USD 1,286.42 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.10% over the forecast period 2025 to 2034. The U.S. recombinant DNA technology market size was estimated at USD 199.52 billion in 2024.

High demand for advanced biopharmaceuticals, gene therapies, and personalized medicines creates an opportunity for growth within the recombinant DNA technology market. Newer methods in the treatment of genetic disorders, cancer, and autoimmune diseases were introduced with advancements in genetic engineering, CRISPR technology, and synthetic biology. More interest in precision medicine, research biotechnology, and a high demand for more efficient solutions in agriculture also contribute to further growth in this market. Recombinant DNA technology has a wide spectrum of applications from drug and vaccine production, agriculture, and diagnostics to many more. As a result, the market is benefiting from additional research work in molecular biology along with increasing investment in biotech R&D and also supporting regulatory framework.

Recombinant DNA technology generally refers to a series of molecular techniques that involve manipulating an organism's genetic material by combining DNA from various sources. Isolation of an interest gene followed by cutting and modification of DNA, using enzymes that comprise, but are not limited to restriction endonucleases, allows for the insertion of the modified gene into a host organism - bacteria or yeast that can either replicate or express an inserted gene. Such wide application of this technology is found in medicine, agriculture, and research where proteins may be produced, vaccines manufactured, genetically altered crops engineered, and gene function and regulation studied.

Report Scope

CEO Statements

Robert A. Bradway, CEO of Amgen Inc.

"Recombinant DNA technology has revolutionized the field of biotechnology, allowing Amgen to develop innovative therapies that address some of the most pressing healthcare challenges. As we continue to harness the power of science and technology, our commitment to improving patient lives remains at the core of everything we do."

Rory Riggs, CEO of Cibus

"As a leader in precision gene editing, we believe recombinant DNA technology is a transformative tool for advancing agricultural sustainability. By applying these cutting-edge methods, we can create crops that are more resilient, efficient, and capable of addressing global food security challenges. Our approach focuses on harnessing the power of nature's own processes to improve plant traits without the introduction of foreign genes, which allows us to deliver innovations that benefit farmers and consumers alike."

Thomas Schinecker, CEO of F. Hoffmann-La Roche Ltd

"At Roche, we recognize that recombinant DNA technology is at the core of modern biotechnology, enabling groundbreaking advancements in diagnostics and personalized medicine. Our commitment to innovation in this area is driven by our mission to improve patients' lives and address the most pressing healthcare challenges worldwide."

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 781.53 Billion |

| Projected Market Size in 2034 | USD 1,286.42 Billion |

| Estimated CAGR | 5.10% |

| Leading Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Product, Component, Application, End User, Region |

| Key Companies | Amgen Inc, Cibus, F.Hoffmann-La Roche Ltd, GenScript, GlaxoSmithKline plc., Horizon Discovery Group plc, Merck KGaA, New England Biolabs, Novo Nordisk A/S, Pfizer Inc., Sanofi S.A, Syngene International Ltd (Biocon Limited) |

The recombinant DNA technology market is segmented into product, component, application, end user, region. Based on product, the market is classified into medical and non-medical. Based on component, the market is classified into vectors and expression system. Based on application, the market is classified into diagnostics, therapeutic, food and agriculture. Based on end user, the market is classified into biotechnology and pharmaceutical companies, diagnostic laboratories, academic and government research institutes.

Vaccines: Recombinant DNA technology provides ease in the manufacturing of vaccines; genetically engineered microorganisms are used as vectors for the production of antigens. These vaccines, once prepared, can induce immunogenicity to specific pathogens without inducing diseases; examples are the recombinant hepatitis B vaccine, in which yeast cells have been exploited for the production of a surface antigen of the virus, and DNA vaccines that have been considered for preventing and treating diseases such as COVID-19.

Therapeutic Agents: Recombinant DNA technology also has contributed to the development of therapeutic agents, such as insulin, growth hormones, clotting factors, and monoclonal antibodies. It is possible to have a quantity of these biologically active proteins produced through the insertion of human genes into host cells like bacteria or mammalian cells. This has thus opened up more effective treatments for diseases like diabetes, hemophilia, and cancer.

Recombinant Protein: Recombinant proteins are the output of GMOs. It is designed for miscellaneous medical, industrial, and research purposes. For instance, recombinant human insulin is prepared in E. coli, while recombinant vaccines such as the HPV vaccine are used to induce immunity by the use of viral proteins that are genetically engineered, among many more. This section also includes enzymes for industrial applications.

Vectors: The vector segment has dominated the market in 2024. DNA molecules that carry new genetic material into host cells are called vectors. Vectors in the recombinant DNA technology could be plasmids, viral vectors, or artificial chromosomes used to house foreign genes. All this has led to cloning, gene expression, and gene therapy. Other elements, such as antibiotic resistance markers to select successful transformations or promoters to increase gene expression can also be engineered.

Recombinant DNA Technology Market Revenue Share, By Component, 2024 (%)

| Component | Revenue Share, 2024 (%) |

| Vectors | 59.40% |

| Expression System | 40.60% |

Expression System: An expression system is the cell environment used to manufacture recombinant proteins. This comprises a few classes, including the bacterium species: E. coli; yeast; insect cells; and mammalian cells. Each of these systems has advantages over the other depending on the proteins one wants to produce. While bacterial systems are fast and cheap, mammalian systems are preferred when complex proteins that will fold and have proper post-translational modification are needed.

Diagnostics: Recombinant DNA technology is a tool for diagnostics to obtain highly specific molecular tests for diseases. Some of these include genetic mutation detection and identification of pathogens and biomarkers leading to earlier and more accurate diagnoses.

Therapeutic: Recombinant DNA is used therapeutically for the production of insulin, and growth hormone among many medicines and monoclonal antibodies. It also has been used to treat genetic disorders as errant genes can be replaced or corrected in gene therapy.

Food and Agriculture: Recombinant DNA technology enhances crop yields, the resistance of organisms to pests, and nutritional content. GMOs can be developed to be resistant to environmental stresses; this increases food production efficiency.

Biotech and Pharmaceutical Firms: These firms make use of rDNA technology for developing drugs and vaccines and engineering organisms for health requirements. They form the backbone of biopharmaceutical research.

Diagnostic Laboratories: These labs use rDNA to create sophisticated diagnostics, which will expedite the diagnosis and help diagnose diseases and conditions at the molecular level with greater accuracy.

Academic and Govt. Research Institutes: Researchers in such institutions work on new applications of recombinant DNA technology to enrich scientific knowledge and breakthroughs in genetics, medicine, and agriculture.

Recombinant DNA Technology Market Revenue Share, By End User, 2024 (%)

| End User | Revenue Share, 2024 (%) |

| Biotechnology and Pharmaceutical Companies | 49.20% |

| Diagnostic Laboratories | 14.70% |

| Academic and Government Research Institutes | 36.10% |

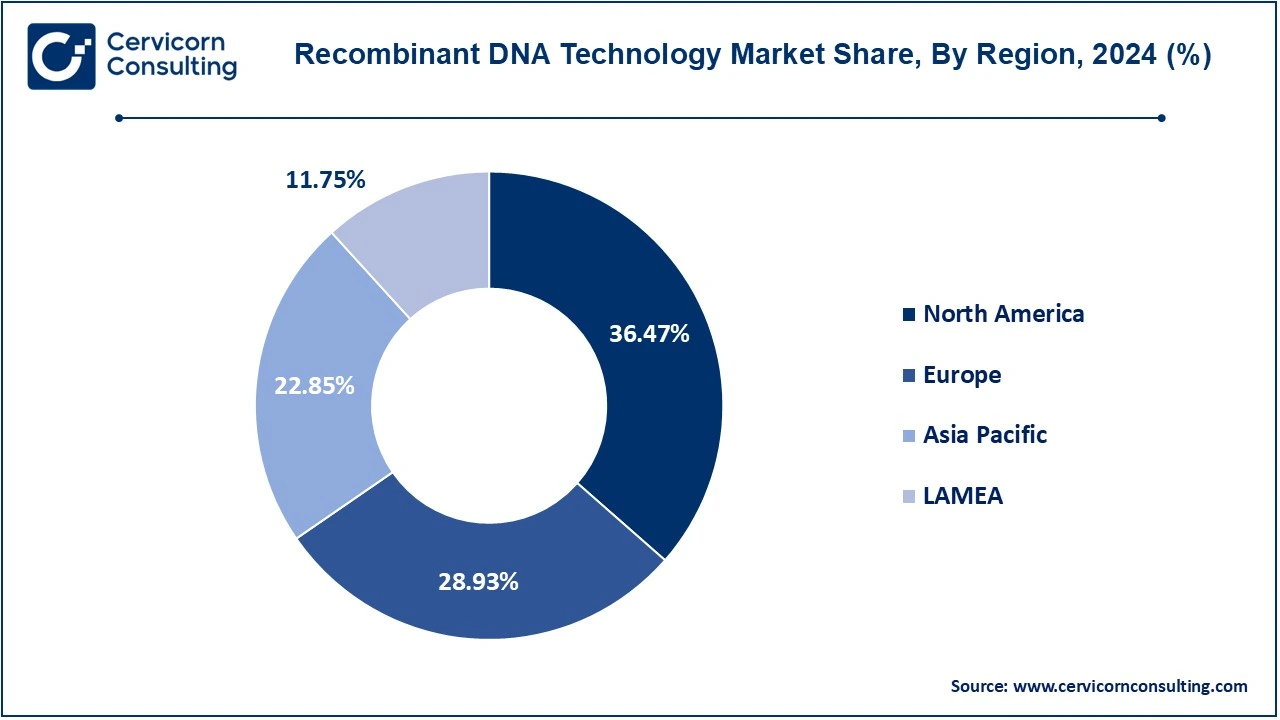

The recombinant DNA technology market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region

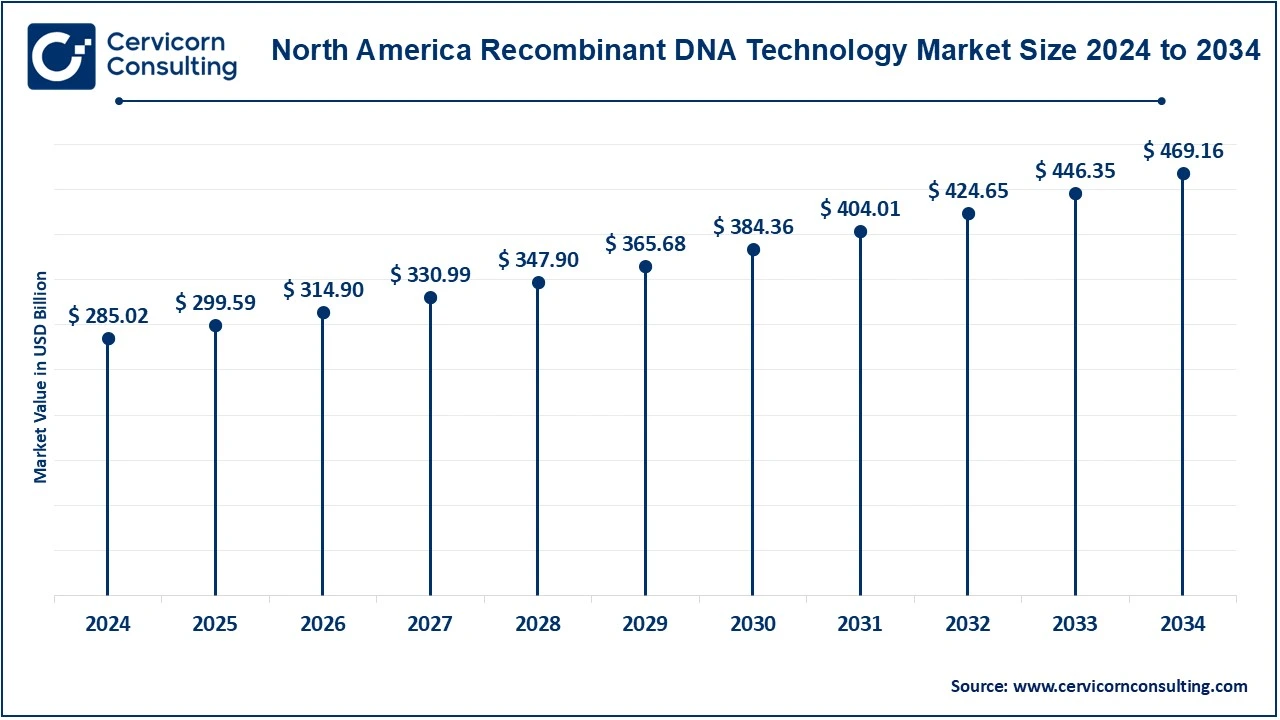

The North America recombinant DNA technology market size was valued at USD 285.02 billion in 2024 and is expected to reach around USD 469.16 billion by 2034. The U.S. and Canada have great leadership in North America, due to their satisfactory research in biotechnology, innovation, and widespread commercialization in areas of pharmaceuticals, agriculture, and diagnostics. Funding by the government, huge biotech companies, reputable academic institutions, and high-technology research-based infrastructure boost biotech innovation in the U.S. For instance, agencies like the FDA, EPA, and USDA released a joint plan for regulatory reform and codification of oversight of biotechnology products that would make oversight more transparent to the public. With its stronger healthcare system, more research institutions, and government-approved biotechnological initiatives, Canada further solidifies North America's stature in genetic engineering.

The Europe recombinant DNA technology market size was estimated at USD 226.10 billion in 2024 and is projectged to hit around USD 372.16 billion by 2034. Europe is one of the key players in the market. Germany, the UK, France, and Switzerland are principal players at the forefront. Germany is exceptionally good at developing recombinant vaccines, biosimilars, and genetic therapies. Biopharmaceuticals, having tremendous research from renowned institutions such as the Francis Crick Institute, dominate the list of the UK's applied sciences. Novartis and Roche are headquartered in Switzerland, which is one of the world's largest pharmaceutical company leaders. The European Union supports policies and biotech innovation grants. £108.1 billion is what the UK tallies for 2021/22 in the biopharmaceutical sector mainly due to medicine discovery in AI and advanced therapeutics, but also by huge investments in vaccines, biologics, and precision medicine. New funding initiatives will further spur the UK to be at the forefront globally in medical innovation.

The Asia-Pacific recombinant DNA technology market size was accounted for USD 178.58 billion in 2024 and is predicted to surpass around USD 293.95 billion by 2034. Asia-Pacific won't lag far behind and will take the lead as early adopters in the market, spurred by speedy economic growth, increasing investment in biotechnology, and escalating health needs. Among them, China apart, comes Japan, India, and South Korea, but a country that's really at the forefront of so many interests in genomics, gene editing, and personalized medicine is China, and this is largely due to government support.Japan has a good well-established biotech industry focused on pharmaceutical innovation. India invests significantly in genetic research but mainly on biosimilars and vaccines. South Korea is moving ahead in genetic engineering and gene therapies. Worth mentioning here is the example of Chinese biotech companies entering into partnership agreements with U.S. venture capitalists to establish new startups in the U.S. The structure, known as the "NewCo" model, allows it to raise capital and tap into Western talent better to get around the geopolitics and to face fewer obstacles to success in testing on humans as well as to market access.

The LAMEA recombinant DNA technology market was valued at USD 91.83 billion in 2024 and is anticipated to reach around USD 151.15 billion by 2034. The LAMEA region presents an interesting landscape. Countries and development status vary considerably. Latin America remains dominated by Brazil in terms of agricultural biotech, with Mexico emerging as a significant player in the biopharmaceutical sector. Argentina also has its place. African countries are minimal, though South Africa shows promise, especially in agriculture and healthcare. The Middle East biotech research is growing, thanks to leaders from Israel and the UAE, as the country of Israel heads the world. Biotechnology in its early stages of adoption has its foothold because of healthcare and agricultural needs.

New product launches in the recombinant DNA technology industry represent an evolving innovation trend coupled with strategic partnerships of major players in the industry. In this respect, Amgen Inc., Cibus, F. Hoffmann-La Roche Ltd, GenScript, GlaxoSmithKline plc., and Horizon Discovery Group plc. would be one of the key players that pave the way in gene therapy, biomanufacturing, and precision medicine through these new recombinant DNA technologies. Such partnerships had found a focusing point in the best exploitation of the new gene editing tools such as CRISPR technology and optimized expression systems of proteins; all of these are aimed at improved clinical efficacy, smooth production processes, and meeting unmet medical needs.In order to manage complex diseases and improve crop yield, this dynamic forces advancements in the biotechnology, pharmaceutical, and agricultural industries to work together in a sustainable way.

Market Segmentation

By Product

By Component

By Application

By End User

By Region