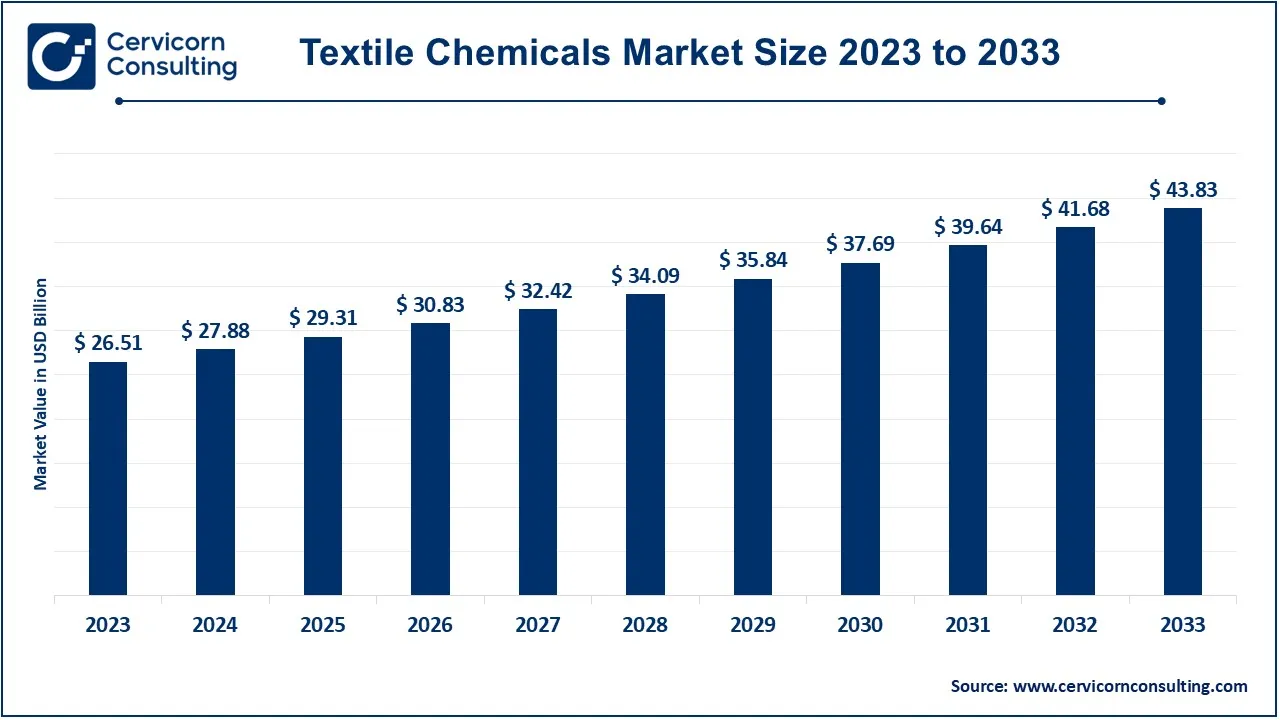

Textile Chemicals Market Size and Growth 2024 to 2033

The global textile chemicals market size was valued at USD 27.88 billion in 2024 and is expected to be worth around USD 43.83 billion by 2033, growing at a compound annual growth rate (CAGR) of 5.15% from 2024 to 2033.

The textile chemicals market is witnessing a dynamic shift driven by technological innovations and growing environmental awareness. The increased demand for high-performance textiles across various applications, such as apparel, home textiles, and industrial textiles, is one of the key factors contributing to the market's expansion. As consumers increasingly seek textiles that offer improved durability, functionality, and comfort, manufacturers are adopting advanced chemical solutions to meet these requirements. The rising demand for eco-friendly products has led to the development of sustainable textile chemicals, such as water-based finishes, bio-based dyes, and eco-friendly coatings, addressing concerns about the environmental impact of textile processing. The market is also shaped by regulatory pressures from governments and international organizations aimed at reducing the environmental footprint of textile production. Between March 2023 and February 2024, the global textile chemicals industry saw 105,426 export shipments, marking a 132% growth compared to the previous year. The top three importers Russia, Vietnam, and Uzbekistan collectively accounted for 80% of these exports. China, Turkey, and Bangladesh were the leading exporters, contributing to 68% of the total global textile chemicals exports.

Textile chemicals are substances used during the production and processing of textiles to enhance their quality, functionality, and appearance. These chemicals are employed in various stages, such as pre-treatment, dyeing, printing, and finishing. Examples include dyes, softeners, flame retardants, and water repellents. They play a vital role in achieving desired properties like color vibrancy, softness, durability, and resistance to water, stains, or wrinkles. For instance, detergents and bleaching agents prepare raw fabrics for dyeing, while finishing chemicals like silicone softeners make fabrics smooth and wearable. Textile chemicals are also used to meet industry standards for performance and safety, ensuring the materials are suitable for end-use applications in clothing, home furnishings, and industrial textiles.

Report Highlights

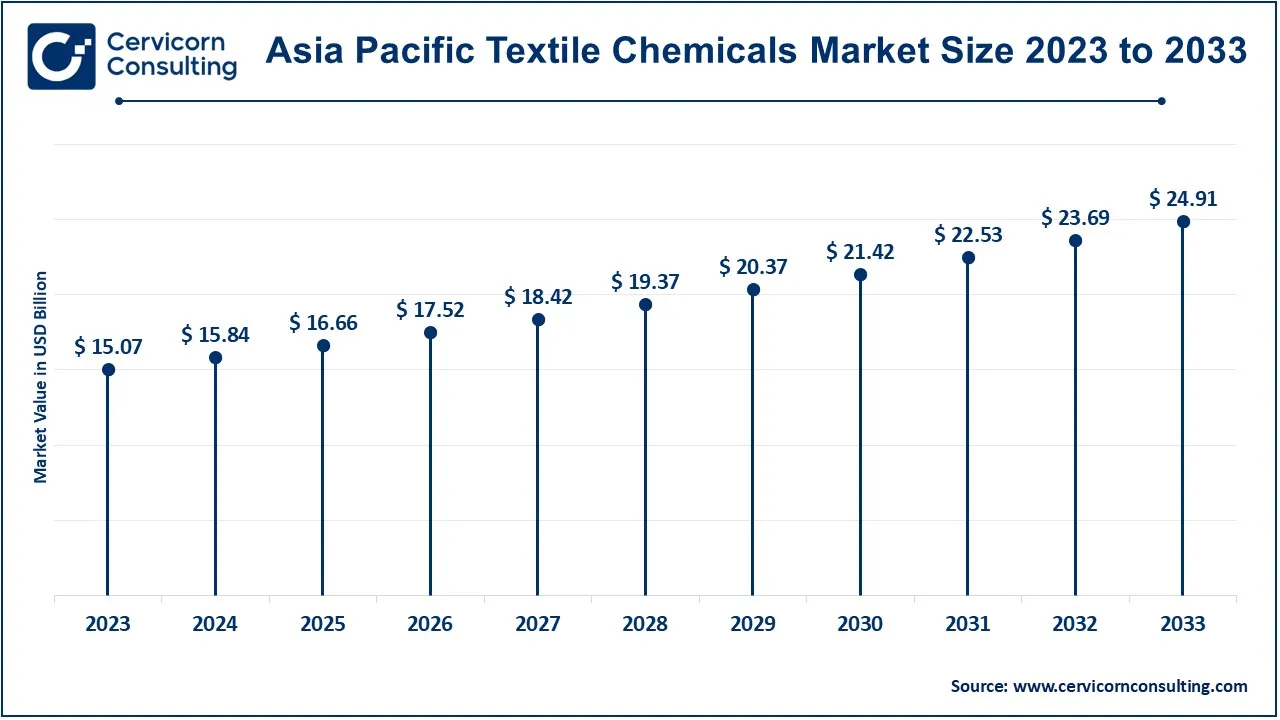

- Asia-Pacific region has leading the market, accounted revenue share of 56.83% in 2023.

- North America has accounted 23.26% of the total revenue share in 2023.

- By process type, in 2023, the coating segment accounted for a revenue share of 71.26%.

- By application, the apparel segment has held revenue share of 44.50% in 2023.

Textile Chemicals Market Growth Factors

- The growth of the technical textiles sector: The growth of technical textiles within the automotive, medical, and construction industries would play a vital role in creating new opportunities for the textile chemicals market. These mainly consist of textiles where chemicals are meant to further enhance their intended functioning, durability, and special uses, thus promoting investment and innovation in their manufacture.

- Rise of Smart Textiles: The rise of smart textiles, with embedded technologies such as sensors, conductive fibers, and responsive materials, greatly drives the demand for advanced textile chemicals. Such textile chemicals provide their application in healthcare, sports, and wearable technology by enhancing the functionality, durability, and performance of textiles, thus opening a window of opportunity for market growth and innovation in the textile industry.

- Escalation of the fashion industry: The fast emergence of the global fashion industry ought to drive demand for several textile chemicals. As brands search for innovative fabrics and finishes to differentiate their offerings, there will be an escalation in demand for advanced dyeing and finishing agents, stimulating the textile chemicals market and enhancing design creativity.

- Urbanization and Population Growth: Urbanization and population growth, leading to increased demand for clothing and home textiles, are raising the demands for textile chemicals since the innovation pathways will help propel new investment to enable new models for charitable ventures involved in sustainable growth.

- Expansion of E-commerce: Due to rapid growth within e-commerce fashion, there is massive demand for innovative textile solutions. In order to gain customer attention, online retailers think the use of fabrics of high quality must be attractive in every sense. Hence, there is a growing trend of resorting to textile chemicals used to enhance color, texture, and performance that would guarantee the satisfaction of customers alongside the competitive edge.

Textile Chemicals Market Trends

- Triple-A Sustainable Chemicals: The textile industry is very supportive of sustainable and eco-friendly chemicals as consumers become increasingly aware of the environmental impact as defined by government or other regulatory bodies. The manufacturers are plying their trade by creating biodegradable substitutes that contain minimal pollution and energy consumption. This change meets governmental requirements and caters to the needs of consumers who prefer products with less environmental impact, which in turn enhances their brand potential.

- Digitalisation: Automation with brilliant minds will become a partner in revolutionising manufacturing processes in textile production while enhancing efficiency, precision, and product quality. As technologies such as IoT, AI, and analytics are empowering manufacturers to better optimise chemical usage, real-time process monitoring, waste reduction, and overall minimisation of environmental impact based on carbon footprint reduction trends, all these will greatly aid in simplifying the efficiency with which production is run, reducing costs, and implementing sustainable practices that allow reactive engagement in the marketplace, thereby supporting increased product quality.

- R&D Investment Growth: There is a broadening emphasis on R&D in the textile chemicals market in order to create innovative solutions to meet the demands of changing consumer preferences. Companies are spending larger resources on R&D in the development of advanced chemicals that would enhance performance, function, and sustainable development. Investment leads to the innovation that would enable the manufacturers to differentiate the quality of their products and respond to changing trends, creating a competitive edge over their competitors.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 29.31 Billion |

| Expected Market Size (2033) |

USD 43.83 Billion |

| Growth Rate (2024 to 2033) |

5.15% |

| Dominant Region |

Asia-Pacific |

| Rapidly Expanding Region |

North America |

| Key Segments |

Type, Fiber Type, Process, Application, Region |

| Key Companies |

AB Enzymes, Archroma, BASF SE, BioTex Malaysia, Dow, Ethox Chemicals, LLC, Evonik Industries AG., Fibro Chem, LLC, German Chemicals Ltd., Govi N.V., Huntsman International LLC, Kemira Oyj, Kiri Industries Ltd., LANXESS, OMNOVA Solutions Inc., Omya United Chemicals, Organic Dyes and Pigments, Resil Chemicals Pvt. Ltd., Solvay S.A, The Lubrizol Corporation |

Textile Chemicals Market Market Dynamics

Drivers

Robust Growth in Textile Production In Developing Economies

- The farmore robust growth for textile production projected from big developing economies drives these textile chemicals for demand phenomenally. Because these regions are expanding their manufacturing and attempts for penetration into the global markets, demand for advanced chemical solutions for dye stuff, finishing, and fabric treatments should rise, thus fostering the growth of this market and stimulating innovation within the industry.

Growing Demand for Industrial Textiles

- The growing demand for industrial textiles in sectors such as automotive, construction, and healthcare aids propelling the demand for the textile chemicals market. These industrial textiles require specialist chemical treatments to enhance properties for durability and performance; manufacturers thus would go for innovative solutions for industry-specific requisites, leading to demand in the overall market.

Awareness Regarding the Benefits of Textile Chemistry in Manufacturing to Aid Growth

- Rising awareness regarding the immense benefits of textile chemistry in manufacturing processes encourages investment in specialized chemical solutions to be adopted. Manufacturers realize that with modern textile chemicals, product quality is enhanced with reduced environmental impact and process efficiency. The knowledge created made organizations transmute their chemical formulations innovatively, thereby driving the growth of the textile chemicals market.

Restrictions

High price of raw materials

- The high price of raw materials is an Achilles' heel for the textile chemicals market because they sweep production costs and, thereby, profits. The maximum burden of these costs, which manufacturers may find it difficult to push across to the consumer, results in reduced competitiveness where financial pressure restricts innovation and investment in research and development into sustainable alternatives.

Environmental pollution from the textile dyeing and finishing industry

- Pollution of the environment from the textile dyeing and finishing industry remains a serious inhibitor of this market segment because chemical runoff and waste could contaminate water sources, leading to regulatory scrutiny and public backlash. This environmental impact pushes manufacturers into adopting cleaner technologies, which only complicate and drive up the costs of production processes.

Health and Safety Issues

- Certain textile chemicals may impede market growth due to health and safety concerns. Pollutants and toxic substances are risks to the health of workers and consumers, prompting stricter regulations and the establishment of safety standards. These developments mean manufacturers now have to come up with safer alternatives, which makes product development strategies complex.

Opportunities

A surge of sustainable and eco-friendly chemical

- The global rise of sustainable and eco-friendly chemicals provides a golden opportunity for the textile chemicals market. With sustainable, eco-friendly, and biodegradable materials in demand by consumers, manufacturers now look to create biodegradable and less-toxic-based textiles. Not only does such a move assist manufacturer in meeting their regulatory obligations, but it also serves to bolster brand reputations while attracting wider customer bases.

Innovations in smart clothing and wearable technology

- Innovations in smart clothing and wearable technology provide lucrative opportunities for the textile chemicals market. Demand for high-tech textiles is driving textile manufacturers to develop special chemicals that increase product functionality, durability, and performance. The trend would result in increased cooperation between the textile and technology sector in fostering revolutionary breakthroughs and the market expansion.

An increasing focus on high-performance technical textiles for automotive, healthcare, and construction industries

- The increasing focus on high-performance technical textiles for automotive, healthcare, and construction is fueling an increasing demand for textile chemicals. These applications require advanced chemical solutions to meet high performance and durability standards. As industries evolve, such demand enables manufacturers to innovate and differentiate their products.

Challenges

Integration of new technologies

- Integration challenges arise out of the need to introduce new technologies in present textile chemical processes. Another challenge is that manufacturers will resist such changes, thus requiring investments in training and infrastructure. Additionally, the rapid pace of technological advancement places manufacturers under pressure to adapt continuously, a situation that tends to waste precious resources and affect productivity in traditional manufacturing environments.

Educating consumers on the benefits of advanced textile chemicals

- Educating consumers on the benefits of advanced textile chemicals is crucial yet challenging. Many consumers lack awareness of the performance advantages these chemicals offer, hindering market growth. Effective communication strategies and marketing efforts are essential to inform consumers about product benefits, fostering acceptance and driving demand for innovative textile solutions.

Market Fragmentation

- Market fragmentation presents a challenge in the textile chemicals industry, characterized by numerous players with varying capabilities and offerings. This fragmentation complicates competition and makes it difficult for companies to achieve significant market share. It also creates challenges in standardization, pricing strategies, and customer loyalty, impacting overall market dynamics.

Textile Chemicals Market Segmental Analysis

Type Analysis

Coating and Sizing Chemicals: In general, coating and sizing chemicals have a wide palette for treating textiles, improving their durability or surface properties, or imparting water or stain resistance. Coating and sizing agents smooth processing throughout the weaving and finishing processes. Their use is, however, primarily in synthetic fibres and blended fabrics to ensure fabric resistivity during production.

Dyes and Auxiliaries: Dyes and pigments are colorants necessary for coloring textile products. Auxiliaries supplement dyeing procedures to improve color fastness properties and bring fabric together for a better overall appearance. The colors from this segment need to be vibrantly colored, fast, and environmentally friendly.

Finishing Agents: Finishing agents used improve the aesthetic properties and functional characteristics of textiles. Specific properties such as resistance to wrinkling, softness, flame retardancy, and water repellency are properties imparted with finishing agents. The rise in demand for high-performance fabrics for end use is spurring the creation of highly specialized finishing agents.

Desizing Agents: Desizing agents are elucidated during textile processing to remove the size materials from the woven fabric to ensure proper dye absorption. This is a crucial process to obtain even dyeing and total quality improvement of the fabric. The trend toward sustainability has led to biodesizing agents that are now seeing great interest.

Others: This can represent various specialty chemicals, including antistatic agents, softeners, and antimicrobial agents. These chemicals cater to the specific needs of end-users, such as comfort, hygiene, and safety. Evolving preferences among consumers further push demand for specialty chemicals.

Application Analysis

Apparel: The apparel segment has accounted revenue share of 44.60% in 2023. The apparel segment is the largest consumer of textile chemicals, encompassing a wide range of products from casual wear to high-performance sportswear. Chemicals used in this segment enhance aesthetics, comfort, durability, and functionality, catering to diverse consumer preferences and trends in fashion.

Home Furnishing: The home furnishing segment has captured 18.50% of the total revenue share in 2023. This segment includes textiles used in household items such as curtains, upholstery, and bed linens. Textile chemicals in this category focus on durability, stain resistance, and aesthetic appeal. The increasing trend toward home décor and interior design drives demand for innovative chemical solutions that meet consumer expectations.

Technical Textiles: The technical textiles segment has generated revenue share of 31.70% in 2023. Technical textiles are engineered for specific performance requirements across various industries, including automotive, healthcare, and construction. This segment requires specialized textile chemicals to enhance properties such as strength, moisture management, and flame resistance. The growing demand for high-performance materials in these sectors propels the market for technical textiles.

Textile Chemicals Market Regional Analysis

Why is Asia-Pacific dominates the global textile chemicals market?

The Asia-Pacific textile chemicals market size was estimated at USD 15.07 billion in 2023 and is expected to reach around USD 24.91 billion by 2033. Asia-Pacific dominates the market, led by major textile manufacturing hubs such as China, India, and Bangladesh. These countries are key suppliers to global apparel brands, driving high demand for dyes, colorants, and finishing agents. Rapid urbanization, rising disposable incomes, and increased industrial textiles usage propel growth. Governments in India and China are pushing for greener production processes, spurring the adoption of sustainable chemicals. The region's expanding technical textile segment and innovation in functional fabrics contribute to market expansion.

Why is North America experiencing the fastest growth in the textile chemicals market?

The North America textile chemicals market size was estimated at USD 6.17 billion in 2023 and is projected to hit around USD 10.19 billion by 2033. The North America is driven by the demand for technical textiles and sustainable solutions. The U.S. leads the region due to its advanced textile industry, emphasizing eco-friendly chemicals and performance-enhancing solutions. Canada and Mexico also contribute, with growing textile production for automotive and healthcare sectors. Regulatory frameworks, particularly in the U.S., promote the adoption of low-impact chemicals. The rising demand for innovative, high-performance fabrics in fashion and industrial applications further boosts growth across the region.

Europe textile chemicals market trends

The Europe textile chemicals market size was accounted for USD 3.93 billion in 2023 and is poised to reach around USD 6.49 billion by 2033. In Europe is characterized by a strong focus on sustainability, driven by stringent environmental regulations like REACH. Germany, Italy, and France are leading contributors, with thriving textile industries that prioritize eco-friendly chemicals for technical textiles and high-end fashion. The region’s advanced R&D capabilities drive innovation in functional finishes and smart textiles. Demand for biodegradable chemicals and the adoption of circular economy models are prominent trends. The automotive and home furnishing sectors also create significant growth opportunities for textile chemicals.

LAMEA shows growing potential in the textile chemicals market

The LAMEA textile chemicals market size was valued at USD 1.35 billion in 2023 and is predicted to surpass around USD 2.24 billion by 2033. The LAMEA market growth is driven by expanding textile production in Brazil, Turkey, and South Africa. Brazil’s home furnishing and fashion industries are key drivers, while Turkey’s well-established textile industry focuses on exports. The Middle East's growing technical textiles market, particularly for automotive and construction, boosts demand. Africa’s textile industry is gaining momentum with government incentives and investments, though challenges like limited access to sustainable chemicals exist. The region’s demand for eco-friendly and performance-driven chemicals is rising.

Textile Chemicals Market Top Companies

- AB Enzymes

- Archroma

- BASF SE

- BioTex Malaysia

- Dow

- Ethox Chemicals, LLC

- Evonik Industries AG.

- Fibro Chem, LLC

- German Chemicals Ltd.

- Govi N.V.

- Huntsman International LLC

- Kemira Oyj

- Kiri Industries Ltd.

- LANXESS

- OMNOVA Solutions Inc.

- Omya United Chemicals

- Organic Dyes and Pigments

- Resil Chemicals Pvt. Ltd.

- Solvay S.A

- The Lubrizol Corporation

The textile chemical market is dominated by a few central players, including Dow, Huntsman International LLC, The Lubrizol Corporation, Archroma, Evonik Industries AG, Solvay S.A. and among others.

CEO Statements

Heike van de Kerkhof, CEO of Archroma

“Our commitment to sustainability is unwavering. With the introduction of our new vegan textile softener, EARTH SOFT, we are providing our customers with a solution that significantly reduces reliance on fossil fuel-based ingredients. This aligns with our goal to lead the industry towards more sustainable practices."

Peter R. Huntsman, CEO of Huntsman International

“The acquisition of Huntsman Corporation's Textile Effects division is a strategic move to enhance our portfolio and meet the growing demand for sustainable solutions in the textile industry. We believe that innovation in chemical solutions will empower our customers to produce high-performance textiles while minimizing environmental impact.”

Recent Developments

Strategic investments, product launches, and sustainability initiatives are driving the dynamic evolution of the textile chemical industry, with industry leaders prioritizing eco-friendly innovations and enhanced production processes. Major companies are focusing on various aspects of textile chemicals, including the development of sustainable products, as seen with BASF SE's launch of RCS-certified polyamides PA6 and PA6.6 in April 2024, supporting the growing demand for recycled raw materials.

Additionally, events like Devan Chemicals’ participation in Heimtextil 2024, where they will showcase sustainable textile finishes, demonstrate the industry's push toward eco-friendly solutions. Innovations in energy-efficient dyeing processes, such as DyStar's eco-advanced indigo dyeing technology launched in May 2023, highlight the industry's focus on reducing environmental impact. Solvay's introduction of rapidly decomposing polyamide fibers in November 2023 further emphasizes the shift toward minimizing oceanic pollution. These collective efforts not only promote sustainability but also aim to optimize resource management and enhance the overall environmental performance of the textile chemicals market.

Some notable examples of key developments in the textile chemical industry include:

- In January 2024, Devan Chemicals, a leader in sustainable textile finishes, announced its participation in Heimtextil 2024. Devan will showcase its latest sustainable innovations at Hall 11.0, booth A21, offering visitors an opportunity to explore their newly developed eco-friendly textile finishes firsthand.

- In April 2024, BASF SE introduced its portfolio of sustainable polyamides, PA6 and PA6.6, for textile applications. Certified under the Recycled Claim Standard (RCS), these polyamides enable BASF to produce and market textiles using recycled raw materials, aligning with the industry's growing demand for sustainable solutions.

- In May 2023, DyStar launched its eco-advanced indigo dyeing technology, designed to cut energy consumption by up to 30% and water usage by up to 90% during production, offering a highly sustainable alternative in textile dyeing processes.

- In November 2023, Solvay introduced an eco-friendly polyamide textile fiber designed to decompose rapidly in oceans, reducing microplastic pollution by 40 times compared to conventional fibers. Manufactured at its facility in Brazil, this innovation reflects the rising market demand for sustainable textile solutions and aims to mitigate the environmental impact on marine ecosystems.

Market Segmentation

By Type

- Coating and Sizing Chemical

- Colorants and Auxiliaries

- Dispersants/levelant

- Fixative

- UV absorber

- Others

- Finishing Agents

- Antimicrobial or anti-inflammatory

- Flame retardants

- Repellent and release

- Others

- Desizing Agents

- Surfactants

- Detergents & Dispersing Agents

- Emulsifying Agents

- Lubricating Agents

- Wetting Agents

- Denim Finishing Agents

- Anti-back Staining Agents

- Bleaching Agents

- Crush Resistant Agents

- Defoamers

- Enzymes

- Resins

- Softeners

- Others

By Fiber Type

By Process Type

- Pretreatment

- Bleaching Agents

- Desizing Agents

- Scouring Agents

- Others

- Coating

- Anti-Piling

- Protection

- Water Proofing

- Water Repellant

- Others

- Treatment of Finished Products

- Softening

- Stiffening

- Others

By Application

- Apparel

- Sportswear

- Innerwear

- Outerwear

- Others

- Home Furnishing

- Carpet

- Furniture

- Drapery

- Others

- Technical Textiles

- Agrotech

- Geotech

- Buildtech

- Medtech

- Mobiltech

- Indutech

- Packtech

- Protech

- Others

- Others

By Region

- North America

- Europe

- Asia-Pacific

- LAMEA

...

...