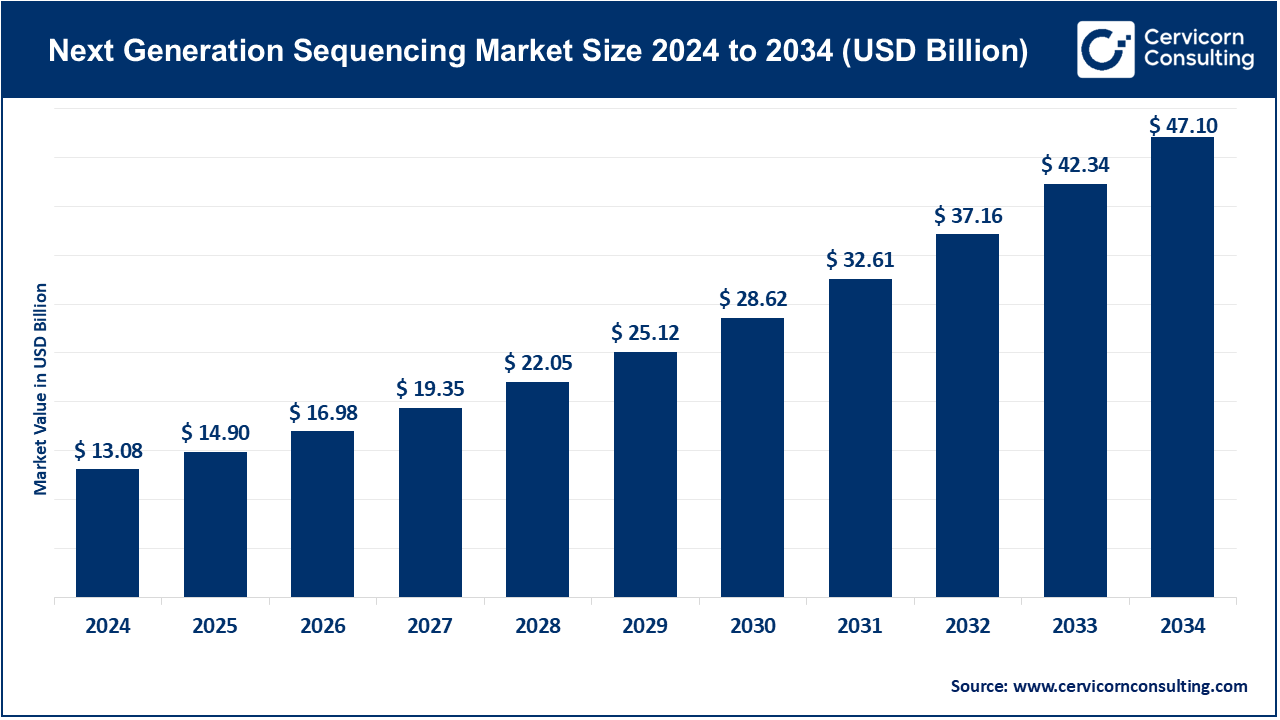

The global next generation sequencing market size was accounted for USD 13.08 billion in 2024 and is expected to be worth around USD 47.10 billion by 2034, growing at a compound annual growth rate (CAGR) of 13.66% from 2025 to 2034.

The next-generation sequencing (NGS) market has experienced significant growth due to advancements in sequencing technologies, a reduction in sequencing costs, and the increasing adoption of NGS across various industries. NGS has revolutionized fields such as personalized medicine, genomics, and diagnostics by enabling more precise and affordable genetic analysis. The global NGS market is expected to continue its rapid growth, driven by the rising demand for genomic research, biomarker discovery, and non-invasive prenatal testing. The integration of NGS with artificial intelligence and machine learning is also enhancing the analysis and interpretation of genetic data. The market's growth is further supported by an increase in government funding for genomics research and the expansion of NGS applications in agriculture and environmental science.

The next neneration sequencing (NGS) market is a rapidly evolving sector in biotechnology that enables high-throughput sequencing of DNA and RNA. NGS technology allows for the simultaneous sequencing of millions of fragments, offering unprecedented speed and accuracy compared to traditional methods. This market is driven by increasing demand for personalized medicine, advancements in genomics, and the need for cost-effective and scalable sequencing solutions. NGS applications span various fields, including clinical diagnostics, drug discovery, agriculture, and genetic research. With ongoing technological advancements, the NGS market continues to expand, facilitating deeper insights into genetic data and enhancing healthcare outcomes.

What is next-generation sequencing?

Next-generation sequencing (NGS) is a high-throughput DNA sequencing technology that allows for rapid and accurate sequencing of entire genomes or targeted regions, providing detailed insights into the genetic makeup of organisms. Unlike traditional sequencing methods, NGS offers a faster and more cost-effective approach to sequencing, enabling researchers to analyze large volumes of genetic data at once. The technology works by breaking down DNA into smaller fragments, sequencing them in parallel, and then using computational tools to reassemble the sequences into complete genomes. NGS has a variety of applications, including whole-genome sequencing, targeted sequencing, RNA sequencing, and metagenomics, among others. The major types of NGS technologies include Illumina sequencing, Ion Torrent sequencing, PacBio sequencing, and Oxford Nanopore sequencing, each offering different advantages in terms of read length, accuracy, and speed.

Report Scope

| Coverage | Details |

| Market Size in 2024 | USD 13.08 billion |

| Market Growth Rate | CAGR of 13.66% from 2025 to 2034 |

| Market Size by 2034 | USD 47.10 billion |

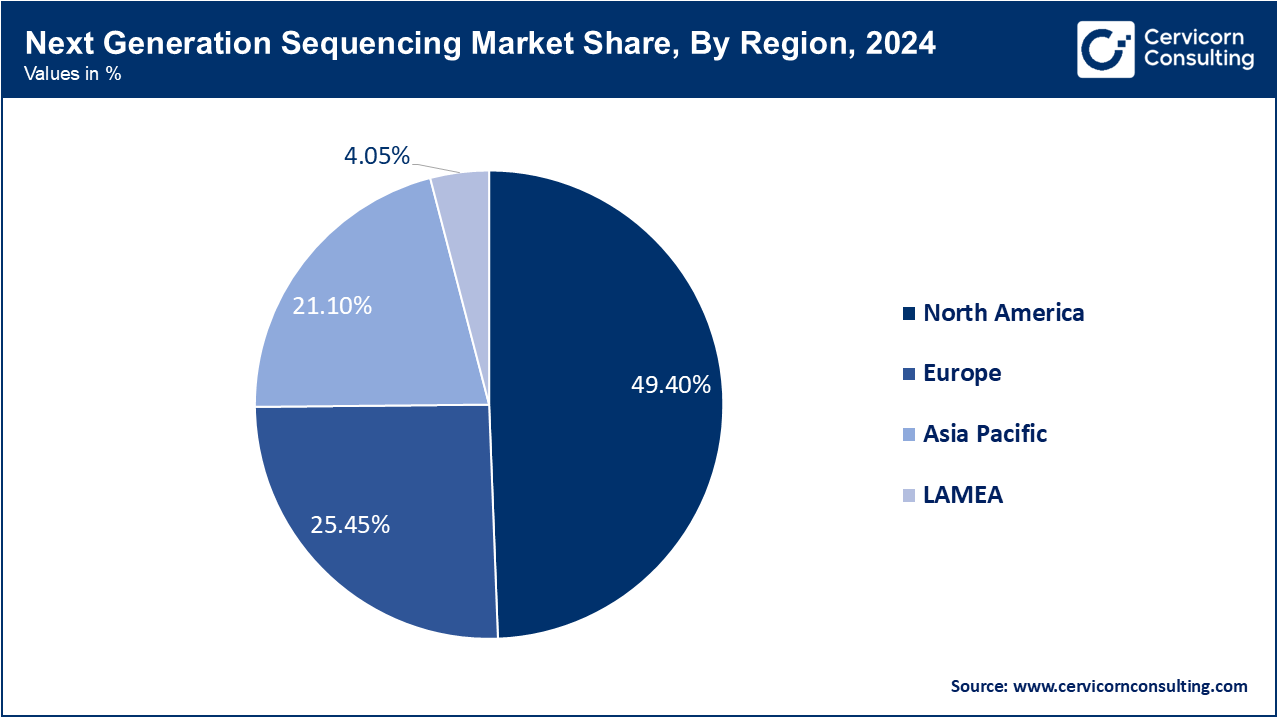

| North America Market Share | 49.4% in 2024 |

| APAC Market Share | 21.1% in 2024 |

Advancements in Sample Preparation Technologies:

Collaboration and Partnerships in Genomics Research:

Data Management and Storage Challenges:

Regulatory and Ethical Concerns:

Expansion into Non-Invasive Prenatal Testing (NIPT):

Application in Microbiome Research:

Interpretation of Complex Genomic Data:

Integration into Clinical Practice:

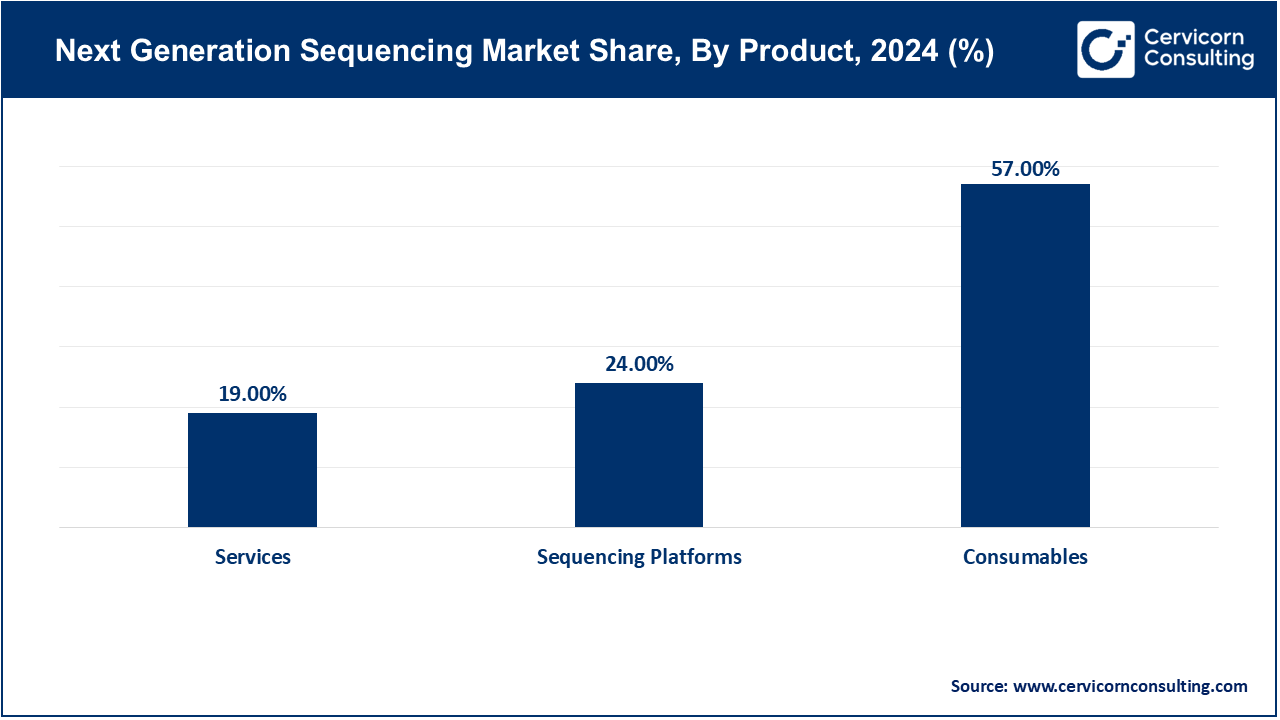

Sequencing Platforms: Sequencing platforms segment has reported reveune share of 24% in 2024. Sequencing platforms are the core technologies used to perform next-generation sequencing (NGS). They have evolved rapidly, offering higher throughput, increased accuracy, and reduced costs per genome. Recent trends include the development of portable sequencers and the integration of real-time sequencing capabilities. Companies are focusing on enhancing speed and scalability to accommodate diverse applications such as clinical diagnostics, personalized medicine, and large-scale genomic research, driving demand for innovative platform solutions.

Consumables: Consumables segment has accounted reveune share of 57% in 2024. Consumables in the NGS market include reagents, kits, and other materials required for sample preparation and sequencing processes. The demand for consumables is rising due to the increasing adoption of NGS in clinical and research settings. Trends include the development of specialized kits for specific applications like cancer genomics and the shift toward automation-friendly consumables to improve efficiency and reduce errors. This segment is crucial for recurring revenue streams in the NGS industry.

Services: Services segment has captured reveune share of 19% in 2024. NGS services encompass sequencing, data analysis, and bioinformatics support provided by specialized firms and institutions. The market for NGS services is growing due to the outsourcing of sequencing tasks by researchers and healthcare providers lacking in-house capabilities. Key trends include the expansion of personalized genomics services and the integration of artificial intelligence for enhanced data interpretation. Service providers are increasingly offering comprehensive solutions, from sample collection to detailed genomic analysis, to meet diverse customer needs.

Whole Genome Sequencing (WGS): Whole Genome Sequencing (WGS) involves sequencing the entire genome of an organism, providing a comprehensive view of its genetic makeup. It is widely used in research, clinical diagnostics, and personalized medicine. Recent trends in WGS include advancements in sequencing speed and accuracy, making it more accessible and cost-effective. The integration of artificial intelligence for data analysis is also enhancing its application in identifying genetic variants and understanding complex diseases.

Whole Exome Sequencing (WES): Whole Exome Sequencing (WES) focuses on sequencing the protein-coding regions of the genome, which comprise about 1% of the entire genome but contain most disease-related variants. WES is popular for its cost-effectiveness and efficiency in diagnosing rare genetic disorders. Trends in WES include improvements in capture techniques and the development of more targeted panels, allowing for faster and more precise identification of clinically relevant variants.

Targeted Sequencing & Resequencing: Targeted Sequencing & Resequencing involve sequencing specific areas of the genome, such as particular genes or regions of interest, making it a cost-effective option for specific applications. This technology is widely used in oncology for identifying mutations in cancer-related genes. Current trends include the development of high-throughput platforms and customizable panels that enable rapid and precise detection of genetic alterations, enhancing its utility in precision medicine.

Others: The "Others" category includes various emerging NGS technologies such as single-cell sequencing, metagenomics, and epigenomics. These technologies are gaining traction due to their ability to provide insights into cellular heterogeneity, microbial communities, and gene regulation. Trends in this segment focus on increasing resolution and sensitivity, enabling researchers to explore complex biological processes and uncover new therapeutic targets across diverse applications in health, agriculture, and environmental sciences.

Clinical Applications: Clinical applications of NGS involve using sequencing technologies for diagnosing diseases, monitoring treatment responses, and personalizing medicine. This includes cancer genomics, rare genetic disorders, and infectious disease diagnostics. The clinical application of NGS is expanding rapidly due to its ability to provide comprehensive genomic insights that enable targeted therapies and early disease detection. Increased adoption in oncology for precision medicine and growing demand for non-invasive prenatal testing are significant trends.

Research Applications: NGS is extensively used in research applications to explore genetic variations, gene functions, and molecular mechanisms underlying diseases. It supports basic research, functional genomics, and biomarker discovery. Research applications are seeing growth due to advancements in sequencing technologies that enhance data accuracy and throughput. There is a growing focus on using NGS for large-scale genomic studies and integrative research across various biological systems.

Reproductive Health: In reproductive health, NGS is used for non-invasive prenatal testing (NIPT) to detect genetic abnormalities in fetuses, and for reproductive genetics to assess the genetic risk of inherited disorders. The trend is towards increased use of NGS for prenatal screening and fertility treatments. Innovations in NIPT are improving accuracy and accessibility, leading to broader adoption in prenatal care and fertility clinics.

HLA Typing/Immune System Monitoring: NGS in HLA typing and immune system monitoring involves identifying human leukocyte antigen (HLA) types to match organ donors with recipients and monitor immune responses. There is a growing focus on using NGS for detailed HLA typing to improve organ transplant outcomes and personalized immunotherapy. Advances in sequencing technology are enhancing the precision of immune monitoring and transplantation matching.

Metagenomics, Epidemiology & Drug Development: Metagenomics involves studying genetic material from environmental samples to understand microbial diversity. In epidemiology, NGS is used to track pathogen outbreaks, while in drug development, it aids in identifying drug targets and biomarkers. NGS is increasingly applied in metagenomics for environmental and microbiome studies. In epidemiology, it is crucial for tracking viral mutations and outbreaks, and in drug development, it accelerates the discovery of new therapeutic targets and personalized treatments.

Agrigenomics & Forensics: Agrigenomics applies NGS to improve crops and livestock through genetic analysis, while forensics uses NGS for identifying individuals and analyzing genetic evidence in criminal investigations. In agrigenomics, there is a trend towards using NGS for developing genetically modified crops with enhanced traits. In forensics, NGS is improving the resolution of genetic profiling and increasing accuracy in criminal investigations.

Consumer Genomics: Consumer genomics involves providing genetic testing services directly to consumers for ancestry, health risk assessment, and personalized wellness insights. The consumer genomics market is expanding with increased interest in direct-to-consumer genetic testing. Advances in NGS are making these tests more accurate and affordable, driving consumer adoption for personalized health and ancestry information.

Pre-Sequencing: Pre-sequencing involves sample preparation steps such as DNA/RNA extraction, library preparation, and quality control. This phase ensures that the genetic material is adequately prepared for sequencing, with processes including fragmentation, adapter ligation, and amplification. Advances in automation and optimization of pre-sequencing protocols are improving efficiency and reducing errors. Innovations in library preparation kits are enhancing throughput and reducing costs, making NGS more accessible and scalable for diverse applications.

Sequencing: Sequencing is the core process of NGS, where the prepared samples are read using sequencing technologies to determine the order of nucleotides in the DNA or RNA. This phase involves the use of various sequencing platforms and technologies such as Illumina, Ion Torrent, and PacBio. Continuous improvements in sequencing technologies are leading to higher accuracy, faster turnaround times, and lower costs. Emerging platforms, like long-read sequencing technologies, are expanding applications and providing deeper insights into complex genomic regions and structural variations.

NGS Data Analysis: NGS data analysis involves processing and interpreting the vast amounts of data generated during sequencing. It includes steps such as alignment, variant calling, annotation, and visualization to extract meaningful biological insights from the raw sequencing data. The integration of advanced bioinformatics tools, AI, and machine learning algorithms is enhancing the efficiency and accuracy of NGS data analysis. Increased use of cloud-based platforms and data-sharing initiatives is facilitating collaborative research and improving data accessibility and management.

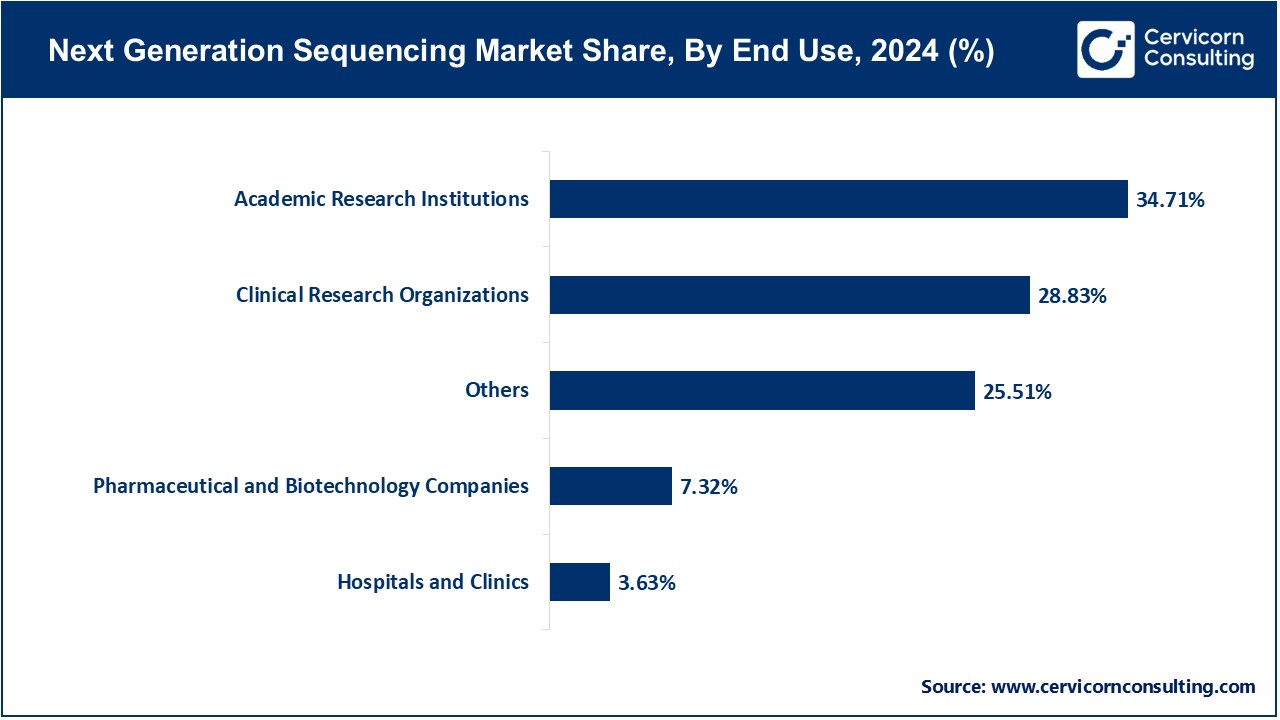

Academic Research Institutions: Academic research institution segment has reported share of 34.71% in 2024. Academic research institutions use NGS for a wide range of research applications, including genomics, functional genomics, and evolutionary studies. NGS enables researchers to explore complex genetic information, identify genetic variants, and understand gene functions. Academic institutions are increasingly adopting NGS due to its high-throughput capabilities and decreasing costs. The technology is being used for large-scale genomic studies, including cancer research, population genetics, and the study of rare diseases. The focus is on generating comprehensive genetic data to drive scientific discoveries.

Hospitals and Clinics: Hospitals and clinics segment has calculated share of 3.63% in 2024. Hospitals and clinics utilize NGS for diagnostic purposes, including genetic testing for rare diseases, cancer genomics, and personalized medicine. NGS provides detailed genetic information that aids in accurate diagnosis and treatment planning. There is a growing trend towards incorporating NGS into routine clinical diagnostics, driven by its ability to provide comprehensive and actionable insights. Hospitals are increasingly offering NGS-based tests for oncology and prenatal screening, as well as integrating NGS data into patient care and treatment strategies.

Pharmaceutical and Biotechnology Companies: Pharmaceutical and biotechnology companies segment has registed share of 7.32% in 2024. Pharmaceutical and biotechnology companies use NGS for drug discovery, development, and personalized medicine. NGS helps in understanding genetic targets, biomarker identification, and assessing drug responses. The adoption of NGS in the pharmaceutical sector is rising due to its role in accelerating drug discovery and development. Companies are leveraging NGS to identify novel drug targets, validate biomarkers, and design precision therapies. The trend includes increasing investment in NGS-based R&D for developing innovative treatments and personalized medicines.

Clinical Research Organizations: Clinical research organizations segment has garnered share of 28.83% in 2024. Clinical research organizations (CROs) employ NGS to support clinical trials and research studies. NGS assists in biomarker discovery, patient stratification, and monitoring treatment efficacy. CROs are increasingly integrating NGS into their services to enhance clinical trial outcomes and support drug development. The use of NGS for identifying biomarkers and understanding patient genetics is becoming more prevalent, leading to more targeted and effective clinical research strategies. The trend includes expanding NGS applications in multi-center trials and precision medicine research.

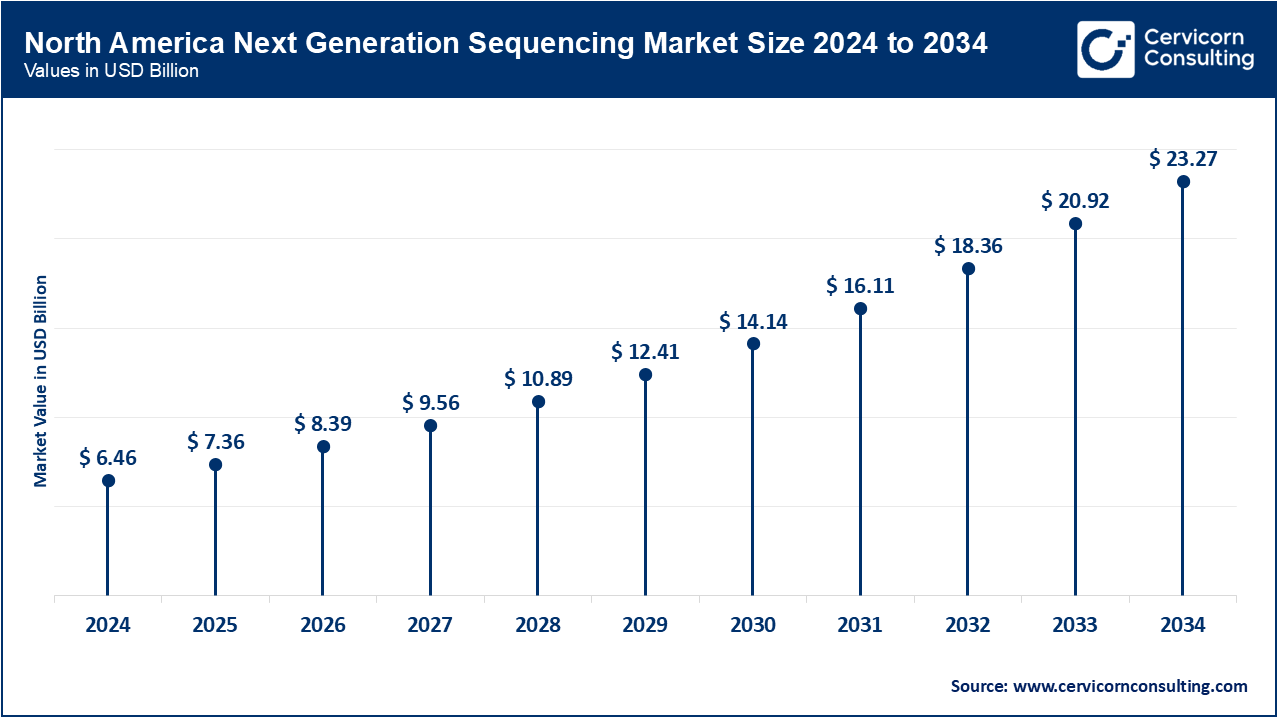

The North America NGS market was valued at USD 6.46 billion in 2024 and is projected to grow USD 23.27 billion by 2034. North America is a leading region in the NGS market, driven by substantial investments in research and development, advanced healthcare infrastructure, and a high prevalence of genetic disorders. The trend includes a strong focus on integrating NGS into clinical diagnostics, with increasing adoption in personalized medicine and oncology. Additionally, the presence of major NGS companies and research institutions in the U.S. and Canada is contributing to rapid technological advancements and widespread application across various sectors.

The Europe NGS market was measured at USD 3.33 billion in 2024 and is projected to grow USD 11.99 billion by 2034 from USD 3.79 billion in 2025. Europe is experiencing significant growth in the NGS market due to increasing government funding for genomic research and the development of national genomics initiatives. The trend includes a rise in collaborative research projects across EU countries, aimed at advancing NGS technology and its applications in health and disease. Europe is also focusing on implementing standardized guidelines and regulations for NGS-based diagnostics, enhancing the integration of NGS into clinical practice and research.

The Asia-Pacific NGS market was reported at USD 2.76 billion in 2024 and is predicted to grow USD 9.94 billion by 2034 from USD 3.14 billion in 2025. The Asia-Pacific region is witnessing rapid growth in the NGS market, driven by rising investments in healthcare infrastructure, increasing genomic research activities, and a growing focus on personalized medicine. The trend includes expanding NGS applications in agricultural genomics and drug development, as well as a surge in collaborations between local and international companies to enhance technological capabilities. The increasing demand for cost-effective NGS solutions and advancements in bioinformatics are also shaping market growth in this region.

In the LAMEA is expanding due to increased awareness of genetic testing, improving healthcare infrastructure, and growing research initiatives. The trend includes a rising adoption of NGS for clinical diagnostics and research, supported by collaborations with international organizations and funding agencies. Additionally, there is a focus on addressing regional healthcare challenges through NGS, including the study of genetic diseases prevalent in specific populations and the development of targeted treatments.

New entrants like Nimble Genomics Inc. and Rhapsody Biosciences, Inc. are focusing on innovative technologies to disrupt the NGS market. Nimble Genomics specializes in novel sequencing platforms with enhanced sensitivity and speed, while Rhapsody Biosciences offers advanced single-cell sequencing solutions, enabling more precise cellular analysis. Illumina, Inc. and Thermo Fisher Scientific Inc. dominate the market due to their extensive product portfolios, advanced technologies, and strong global presence. Illumina leads with its high-throughput sequencing platforms, while Thermo Fisher excels in integrating NGS with comprehensive bioinformatics solutions, driving widespread adoption in research and clinical settings.

Market Segmentation

By Product Type

By Technology

By Application

By Workflow

By End User

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Digital Transformation

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Type Overview

2.2.2 By Technology Overview

2.2.3 By Application Overview

2.2.4 By Workflow Overview

2.2.5 By End User Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Digital Transformation Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Advancements in Sample Preparation Technologies

4.1.1.2 Collaboration and Partnerships in Genomics Research

4.1.2 Market Restraints

4.1.2.1 Data ManProduct Typement and StorProduct Type Challenges

4.1.2.2 Regulatory and Ethical Concerns

4.1.3 Market Opportunity

4.1.3.1 Expansion into Non-Invasive Prenatal Testing (NIPT)

4.1.3.2 Application in Microbiome Research

4.1.4 Market Challenges

4.1.4.1 Interpretation of Complex Genomic Data

4.1.4.2 Integration into Clinical Practice

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Digital Transformation Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Digital Transformation Market, By Product Type

6.1 Global Digital Transformation Market Snapshot, By Product Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

6.1.1.1 Sequencing Platforms

6.1.1.2 Consumables

6.1.1.3 Services

Chapter 7 Digital Transformation Market, By Technology

7.1 Global Digital Transformation Market Snapshot, By Technology

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

7.1.1.1 Whole Genome Sequencing

7.1.1.2 Whole Exome Sequencing

7.1.1.3 Targeted Sequencing & Resequencing

Chapter 8 Digital Transformation Market, By Application

8.1 Global Digital Transformation Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

8.1.1.1 Clinical Applications

8.1.1.2 Research Applications

8.1.1.3 Reproductive Health

8.1.1.4 HLA Typing/Immune System Monitoring

8.1.1.5 Metagenomics, Epidemiology & Drug Development

8.1.1.6 Agrigenomics & Forensics

8.1.1.7 Consumer Genomics

Chapter 9 Digital Transformation Market, By Workflow

9.1 Global Digital Transformation Market Snapshot, By Technology

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

9.1.1.1 Pre-Sequencing

9.1.1.2 Sequencing

9.1.1.3 NGS Data Analysis

Chapter 10 Digital Transformation Market, By End User

10.1 Global Digital Transformation Market Snapshot, By End User

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

10.1.1.1 Academic Research Institutions

10.1.1.2 Hospitals and Clinics

10.1.1.3 Pharmaceutical and Biotechnology Companies

10.1.1.4 Clinical Research Organizations

Chapter 11 Digital Transformation Market, By Region

11.1 Overview

11.2 Digital Transformation Market Revenue Share, By Region 2023 (%)

11.3 Global Digital Transformation Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Digital Transformation Market Revenue, 2021-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Digital Transformation Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Digital Transformation Market Revenue, 2021-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Digital Transformation Market Revenue, 2021-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Digital Transformation Market Revenue, 2021-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Digital Transformation Market Revenue, 2021-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Digital Transformation Market, By Country

11.5.4 UK

11.5.4.1 UK Digital Transformation Market Revenue, 2021-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UK Market Segmental Analysis

11.5.5 France

11.5.5.1 France Digital Transformation Market Revenue, 2021-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 France Market Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Digital Transformation Market Revenue, 2021-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 Germany Market Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Digital Transformation Market Revenue, 2021-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of Europe Market Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Digital Transformation Market Revenue, 2021-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Digital Transformation Market, By Country

11.6.4 China

11.6.4.1 China Digital Transformation Market Revenue, 2021-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 China Market Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Digital Transformation Market Revenue, 2021-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 Japan Market Segmental Analysis

11.6.6 India

11.6.6.1 India Digital Transformation Market Revenue, 2021-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 India Market Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Digital Transformation Market Revenue, 2021-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 Australia Market Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Digital Transformation Market Revenue, 2021-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia Pacific Market Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Digital Transformation Market Revenue, 2021-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Digital Transformation Market, By Country

11.7.4 GCC

11.7.4.1 GCC Digital Transformation Market Revenue, 2021-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCC Market Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Digital Transformation Market Revenue, 2021-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 Africa Market Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Digital Transformation Market Revenue, 2021-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 Brazil Market Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Digital Transformation Market Revenue, 2021-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 12 Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2021-2023

12.1.3 Competitive Analysis By Revenue, 2021-2023

12.2 Recent Developments by the Market Contributors (2023)

Chapter 13 Company Profiles

13.1 Illumina, Inc.

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Thermo Fisher Scientific Inc.

13.3 Pacific Biosciences of California, Inc.

13.4 Oxford Nanopore Technologies Limited

13.5 Genomatix Software GmbH

13.6 QIAGEN N.V.

13.7 BGI Genomics Co., Ltd.

13.8 Roche Holding AG

13.9 Agilent Technologies, Inc.

13.10 Guardant Health, Inc.