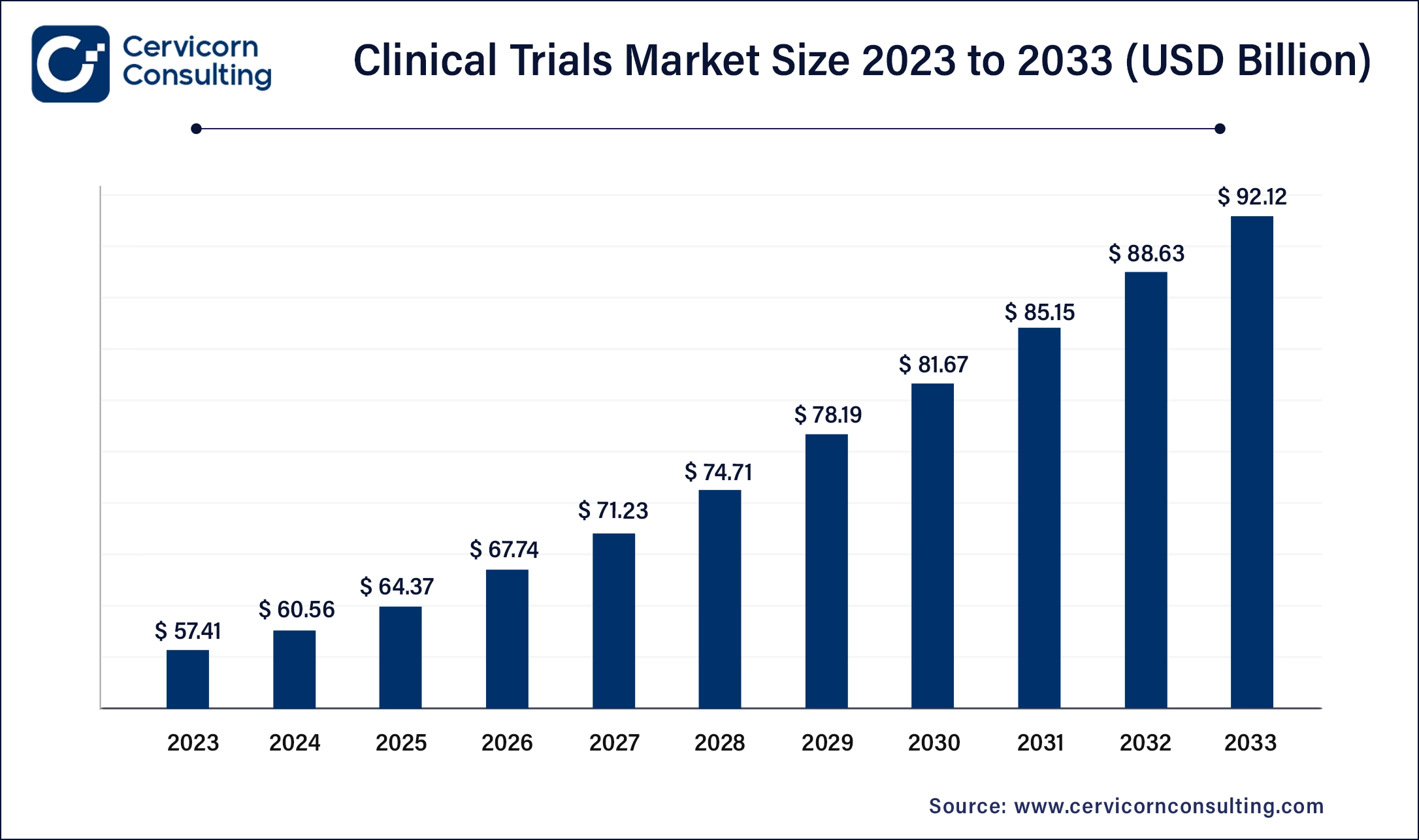

The global clinical trials market size was valued at USD 60.56 billion in 2024 and is expected to be worth around USD 95.60 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.67% over the forecast period 2025 to 2034.

The global clinical trials market has been experiencing steady growth, driven by increasing demand for innovative treatments, a rise in chronic diseases, and technological advancements in research methodologies. Key factors fueling this growth include the adoption of artificial intelligence in trial design, the expansion of biopharmaceutical companies, and the surge in personalized medicine, which tailors treatments to individual patient profiles. Additionally, the COVID-19 pandemic accelerated the adoption of virtual and decentralized trials, allowing patients to participate remotely and reducing logistical challenges. Regions like North America and Europe dominate the clinical trials market due to their robust healthcare infrastructure, while emerging markets in Asia-Pacific, including India and China, are becoming increasingly significant due to lower operational costs and large patient pools.

The clinical trials market encompasses the systematic investigation of new drugs, treatments, or medical devices in human subjects to assess their safety, efficacy, and potential side effects. It plays a crucial role in pharmaceutical and biotechnology industries, guiding the development and regulatory approval of new therapies. The market's growth is driven by advancements in medical research, increasing prevalence of chronic diseases, and stringent regulatory standards demanding rigorous clinical validation of new healthcare innovations.

Clinical trials are research studies conducted to evaluate the safety, efficacy, and side effects of medical interventions such as drugs, devices, or treatment regimens. These trials are essential in advancing medical science by ensuring new treatments meet regulatory standards before being made available to the public. Clinical trials typically occur in phases, starting with small-scale studies (Phase I) to assess safety, followed by Phase II and III trials that evaluate effectiveness and compare the new intervention to existing treatments. Some common types of clinical trials include interventional trials, observational studies, and expanded access trials, each designed to address specific research questions. With advancements in technology, decentralized trials and adaptive trials are emerging, making clinical research more accessible and efficient.

Major Statements

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 64.37 Billion |

| Projected Market Size in 2034 | USD 95.60 Billion |

| Expected CAGR 2025 to 2034 | 4.67% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Phase, Indication, Therapeutic Area, Design, End-Users, Region |

| Key Companies | IQVIA, Holdings Inc., PPD, Inc., ICON plc, Parexel International Corporation, Covance Inc. (LabCorp Drug Development), Syneos Health, Inc., Medpace Holdings, Inc., PRA Health Sciences, Inc., Charles River Laboratories International, Inc., WuXi AppTec Inc. |

Patient-Centric Approaches

Digital Transformation in Healthcare

Recruitment and Retention Challenges

High Costs and Budget Constraints

Virtual and Decentralized Trials

Real-World Evidence (RWE) Generation

Patient Recruitment and Retention

Data Quality and Integrity

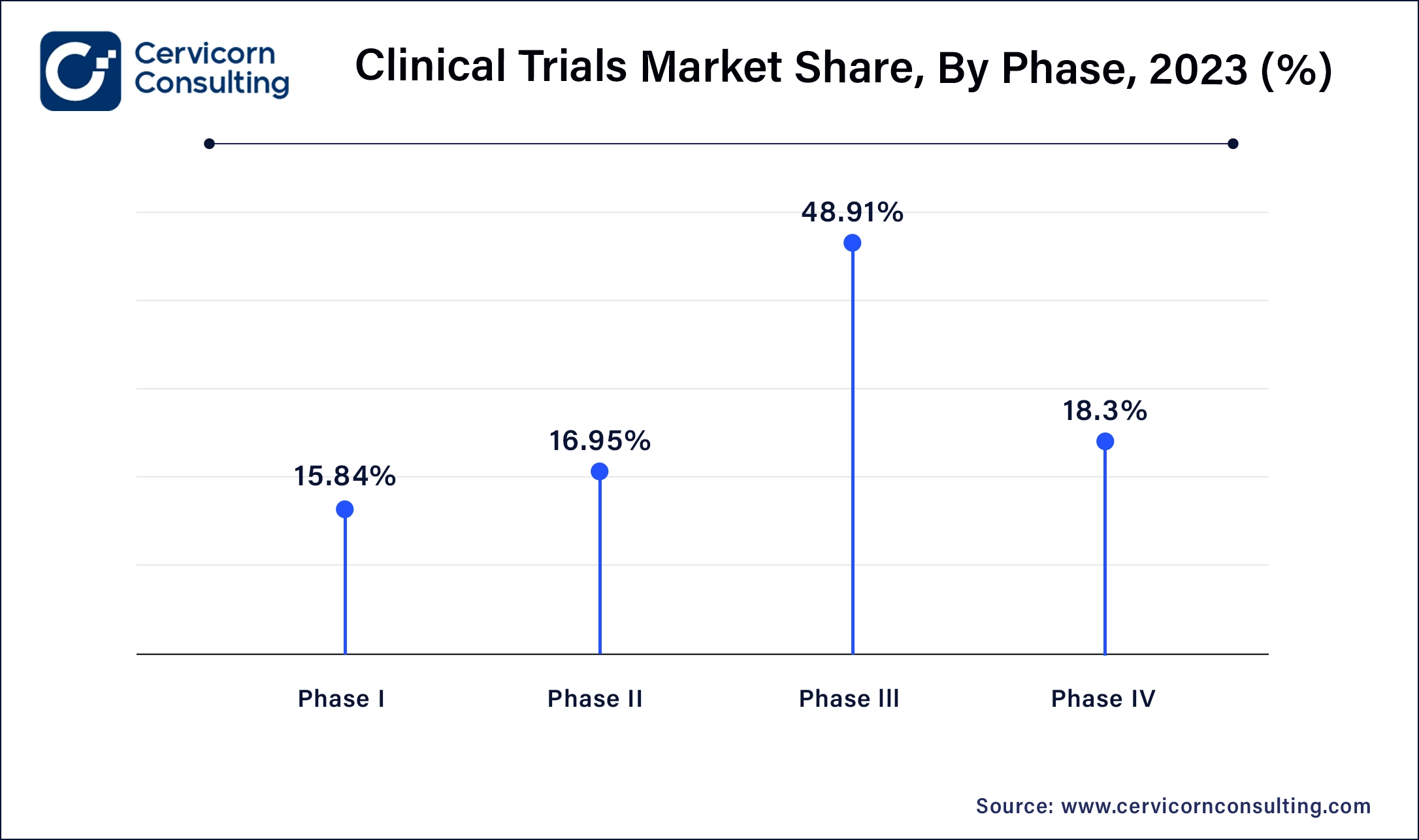

Phase I: Phase I segment has generated market share of 15.84% in 2024. Phase I clinical trials involve testing a new drug or treatment in a small group of healthy volunteers to evaluate its safety, dosage range, and potential side effects. Trends include increased focus on biologics and personalized medicine, advancements in adaptive trial designs, and the integration of biomarkers to enhance early-stage drug development efficiency.

Phase II: Phase II segment has captured 16.95% market share in 2024. Phase II segment assess the effectiveness and further evaluate safety of a drug or treatment in a larger group of patients with the targeted disease or condition. Trends include the use of adaptive trial designs for flexible protocols, emphasis on patient-centric approaches to improve recruitment and retention, and growing utilization of real-world evidence to supplement trial data.

Phase III: Phase III segment has accounted market share of 48.91% in 2024 and is aim to confirm the efficacy and safety of a drug or treatment in a larger patient population, often across multiple sites and regions. Trends include globalization of trials to access diverse patient populations, adoption of virtual and decentralized trial models for improved efficiency, and increased regulatory scrutiny on data quality and patient safety.

Phase IV: Phase IV segment has captured market share of 18.3% in 2024, Phase IV also known as post-marketing studies, monitor the drug or treatment after it has been approved for market use. Trends include the use of real-world data to assess long-term safety and effectiveness, expansion of observational studies and registries, and focus on comparative effectiveness research to inform healthcare decisions and regulatory policies.

Autoimmune/Inflammation: Autoimmune and inflammatory conditions focus on developing therapies to modulate immune responses. Trends include biologics targeting specific cytokines, personalized medicine approaches using biomarkers, and novel anti-inflammatory agents addressing unmet medical needs.

Pain Management: Pain management aim to innovate treatments for acute and chronic pain. Trends include opioid alternatives, non-pharmacological interventions, and personalized pain management strategies integrating digital health technologies.

Oncology: Oncology evaluate new cancer treatments, including immunotherapies, targeted therapies, and combination therapies. Trends include biomarker-driven trials for precision medicine, immunotherapy advancements, and CAR-T cell therapies for hematologic malignancies.

CNS Conditions: CNS disorders focus on neurodegenerative diseases and psychiatric disorders. Trends include neuroprotective therapies, disease-modifying treatments for Alzheimer's and Parkinson's, and digital therapeutics for mental health.

Diabetes: Diabetes explore treatments for type 1 and type 2 diabetes, emphasizing insulin therapies, oral antidiabetic agents, and regenerative medicine approaches. Trends include continuous glucose monitoring, personalized diabetes management, and therapies addressing diabetes-related complications.

Obesity: Obesity seek to develop interventions for weight management and obesity-related comorbidities. Trends include pharmacotherapy for appetite control, metabolic surgery innovations, and behavioral interventions using digital health platforms.

Cardiovascular: Cardiovascular diseases focus on treatments for heart disease, hypertension, and stroke. Trends include novel anticoagulants, gene therapy for cardiovascular disorders, and digital health tools for remote monitoring and prevention.

Others: Other indications encompass diverse areas such as dermatology, rheumatology, and rare diseases. Trends include orphan drug development, gene therapy advancements for rare disorders, and innovative treatments for skin conditions leveraging biotechnology and personalized medicine.

Oncology: Oncology segment has generated 38.41% market share in 2024. Oncology focus on developing new treatments for cancers. Trends include personalized medicine, immunotherapy advancements, and targeted therapies based on genetic mutations, aiming to improve survival rates and reduce side effects.

Infectious Diseases: Infectious diseases segment has captured market share of 9.51% in 2024. Infectious diseases evaluate vaccines, antivirals, and antibiotics. Trends include global efforts against emerging infections, vaccine development for pandemics, and novel approaches for antibiotic-resistant pathogens.

Neurology: Neurology investigate treatments for neurological disorders like Alzheimer's and Parkinson's disease. Trends include biomarker-driven trials, gene therapies for rare neurogenetic disorders, and interventions targeting neuroinflammation and neurodegeneration.

Metabolic Disorders: Metabolic disorders focus on diabetes, obesity, and metabolic syndrome. Trends include innovative therapies for insulin resistance, personalized nutrition approaches, and biopharmaceuticals targeting metabolic pathways and hormone regulation.

Immunology: Immunology study treatments for autoimmune diseases and immune system disorders. Trends include biologics targeting cytokines and immune cells, personalized immunotherapies, and novel therapies for chronic inflammatory conditions.

Cardiology: Cardiology segment has generated market share of 9.17% in 2024. Cardiology explore treatments for heart diseases and conditions. Trends include regenerative medicine for cardiac repair, advanced devices for heart failure management, and personalized approaches in preventive cardiology.

Genetic Diseases: Genetic diseases focus on inherited disorders like cystic fibrosis and muscular dystrophy. Trends include gene therapy advancements, CRISPR-based approaches for genetic correction, and clinical trials targeting specific gene mutations.

Women's Health: Women's health investigate treatments for conditions like breast cancer, osteoporosis, and reproductive health issues. Trends include hormone replacement therapies, novel contraceptives, and personalized approaches in gynecological care.

Others: Other segemt has garnered market share of 31.56% in 2024. Other therapeutic areas include dermatology, rheumatology, and rare diseases. Trends include orphan drug development, biologics for skin disorders, and personalized treatments for rare genetic conditions, expanding the scope of clinical trials across diverse medical specialties.

Interventional: Interventional study segment has captured 76.5% in 2024. Interventional studies involve testing the effects of a treatment or intervention on participants, aiming to evaluate efficacy and safety. Trends include increasing use of randomized controlled trials (RCTs), adaptive trial designs, and incorporation of biomarkers to personalize treatments.

Treatment Studies: Focused on assessing the effectiveness of therapies, treatment studies evaluate new drugs or combinations against existing standards. Trends include comparative effectiveness research, patient-centered outcomes, and regulatory incentives for orphan drugs.

Observational Studies: Observational studies segment has accounted market share of 20.52% in 2024. Observational studies observe participants without intervening, analyzing real-world data to understand health outcomes. Trends include cohort and case-control studies, leveraging electronic health records (EHRs), and conducting pragmatic trials to assess interventions' effectiveness in diverse populations.

Expanded Access: Known as compassionate use, expanded access trials provide investigational treatments to patients outside clinical trials. Trends include streamlined access programs, regulatory frameworks ensuring patient safety, and ethical considerations in balancing access with clinical trial integrity.

Others: This category includes diverse trial designs such as crossover studies, bioequivalence studies, and dose-escalation trials. Trends encompass innovative trial methodologies like virtual trials, decentralized trials, and adaptive designs to enhance efficiency and patient-centricity in clinical research.

Hospitals: Hospitals participate by providing facilities and medical expertise to conduct trials on-site. Increasing hospital participation in clinical trials due to advanced medical infrastructure, access to diverse patient populations, and collaborative partnerships with pharmaceutical companies and CROs to streamline trial management and patient recruitment.

Laboratories: Laboratories contribute by conducting specialized tests and analyses on biological samples collected during trials. Growing demand for specialized laboratory services in clinical trials, driven by advancements in biomarker research, genomic testing, and personalized medicine. Laboratories are adopting automation and digital technologies to enhance efficiency, accuracy in data processing, and compliance with regulatory standards.

Clinics: Clinics serve as trial sites, providing outpatient care and medical supervision to trial participants. Increasing prevalence of decentralized clinical trials conducted in clinics, leveraging telemedicine, mobile health apps, and remote monitoring technologies. This trend enhances patient convenience, reduces trial costs, and accelerates recruitment timelines by reaching broader geographic areas and diverse patient demographics.

Others: Includes academic research institutions, contract research organizations (CROs), and patient advocacy groups involved in various aspects. Academic institutions drive innovation in clinical trial methodologies and therapeutic discoveries. CROs offer specialized services in trial management, data analytics, and regulatory compliance, catering to pharmaceutical and biotech companies. Patient advocacy groups influence trial design and recruitment strategies, emphasizing patient-centric approaches and ethical considerations in research.

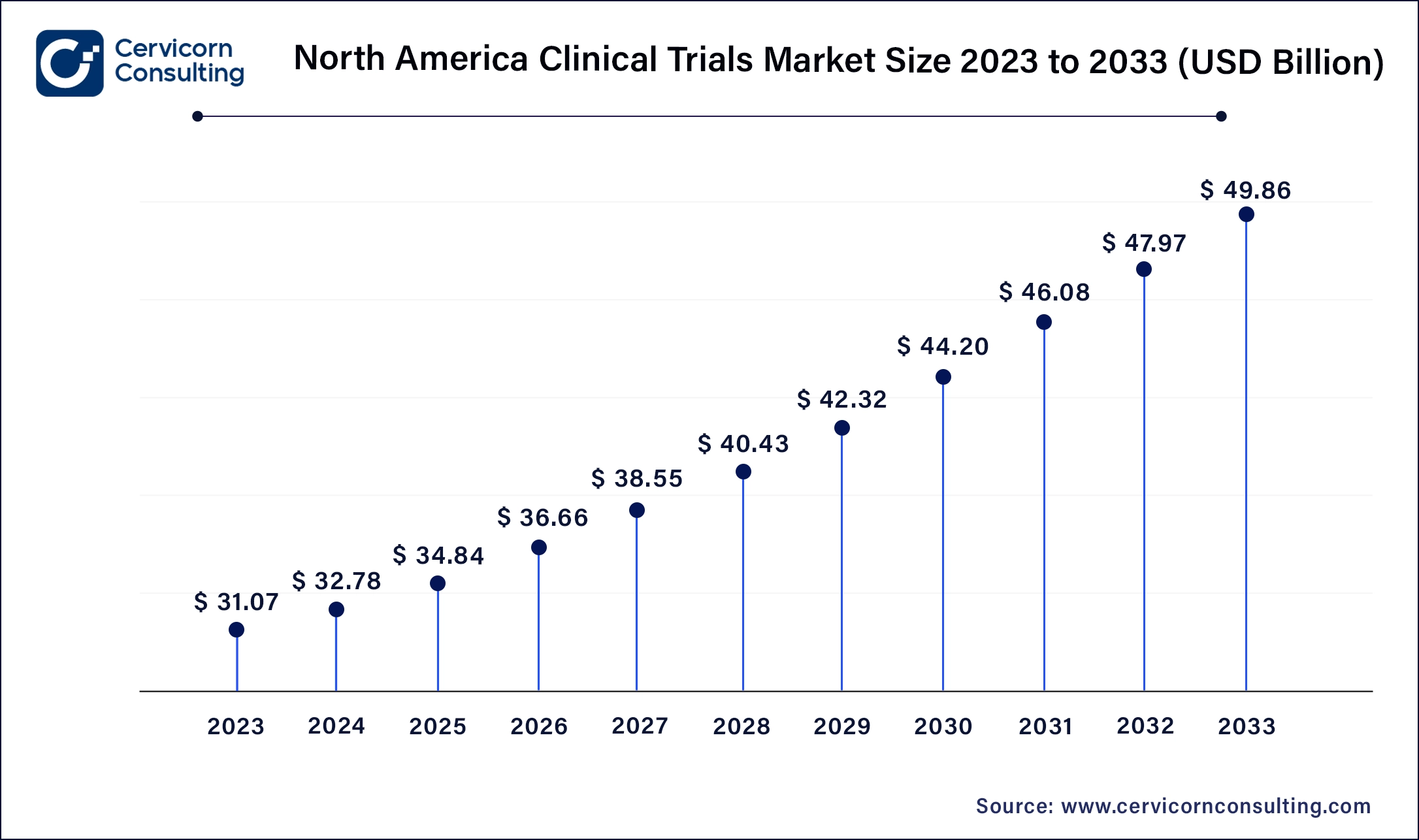

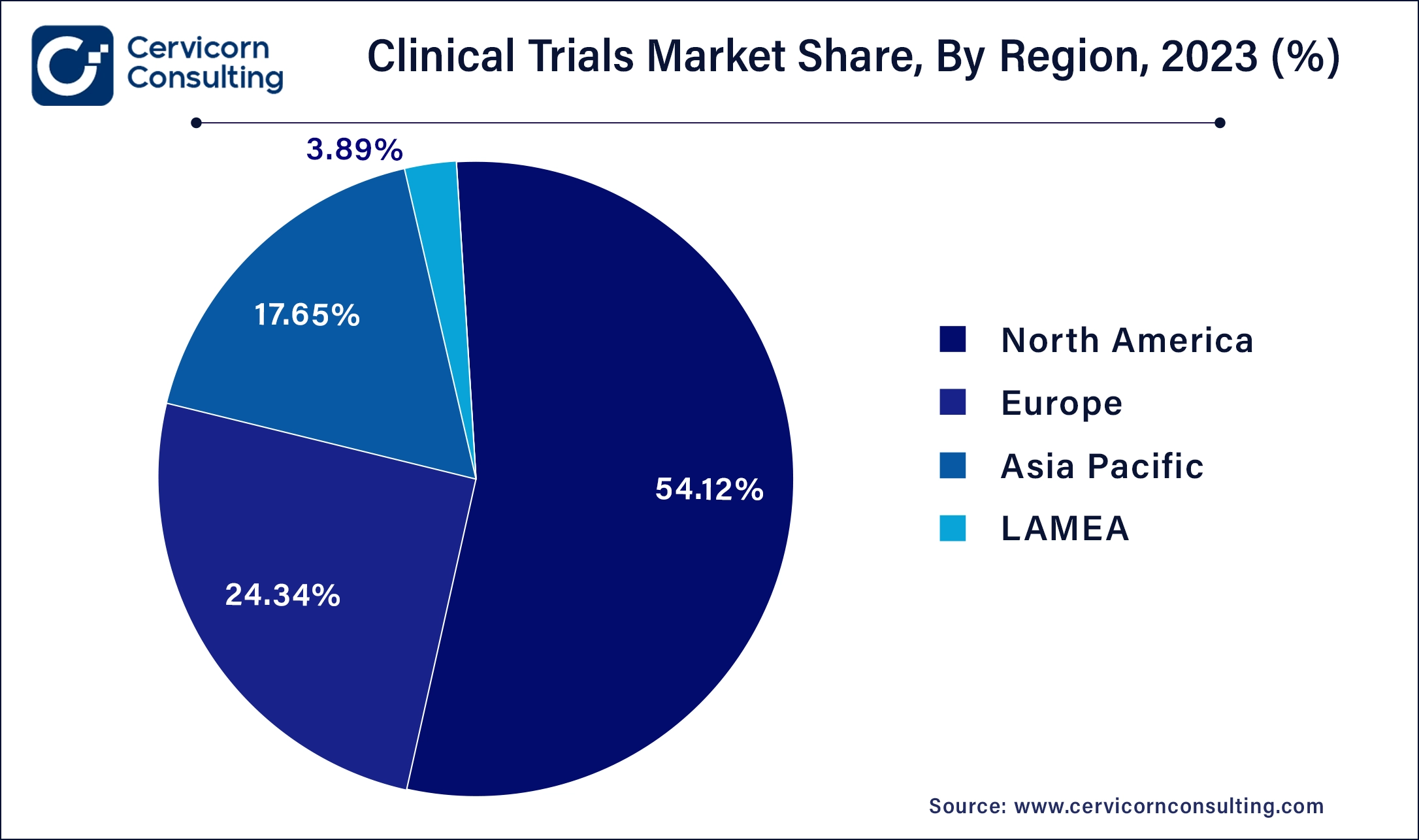

North America leads in the market with revenue share 53.9% in 2024 due to robust healthcare infrastructure, advanced research facilities, and strong regulatory frameworks. Trends include a focus on precision medicine, incorporating genomic data in trials, and increasing adoption of decentralized trials leveraging telemedicine and digital health technologies. The North America market size was valued at USD 32.64 billion in 2024 and is anticipated to reach around USD 51.53 billion by 2034. The United States has accounted 80% revenue share in 2023.

Asia-Pacific is growing rapidly at a CAGR of 6.34% during the forecast period, driven by a large patient pool, lower trial costs, and evolving regulatory environments. The Asia Pacific market size is calculated at USD 10.79 billion in 2024 and is projected to hit around USD 17.03 billion by 2034. Trends include a shift towards conducting more phase I and II trials, increasing adoption of virtual and hybrid trials, and investments in biotech hubs like China and India for oncology and infectious diseases research.

Europe has accounted revenue share of 24.4% in 2024. The europe market is expected to reach around USD 23.33 billion by 2034 from USD 14.78 billion in 2024. Europe emphasizes patient-centric trials, with a strong emphasis on ethical standards and regulatory compliance. Trends include a rise in adaptive trial designs, collaborative efforts among academic institutions and pharmaceutical companies, and expansion of trials in rare diseases and orphan drugs.

LAMEA has captured revenue share of around 3.89% in 2023. LAMEA regions are emerging as attractive destinations for market due to improving healthcare infrastructure and cost-effectiveness. Trends include a rise in vaccine trials, infectious disease research, and collaborations with global pharmaceutical companies to conduct multinational trials in diverse patient populations.

In the clinical trials market, new players adopting innovation include Veristat, a CRO specializing in biotech and pharmaceutical trials with a focus on rare diseases and oncology. Additionally, Clincierge offers patient recruitment solutions through technology-driven approaches. Key players dominating the market include IQVIA, known for its comprehensive data analytics and clinical trial management solutions. PPD, with its global reach and broad therapeutic expertise, and ICON plc, renowned for its strategic consulting and operational excellence, are also significant players. These leaders maintain dominance through extensive service offerings, global presence, and strong client relationships, ensuring robust growth and market leadership.

The clinical trials industry has seen several key developments in recent years, with companies seeking to expand their market presence and leverage synergies to improve their product offerings and profitability.

Market Segmentation

By Phase

By Indication

By Therapeutic Area

By Design

By End-Users

By Region