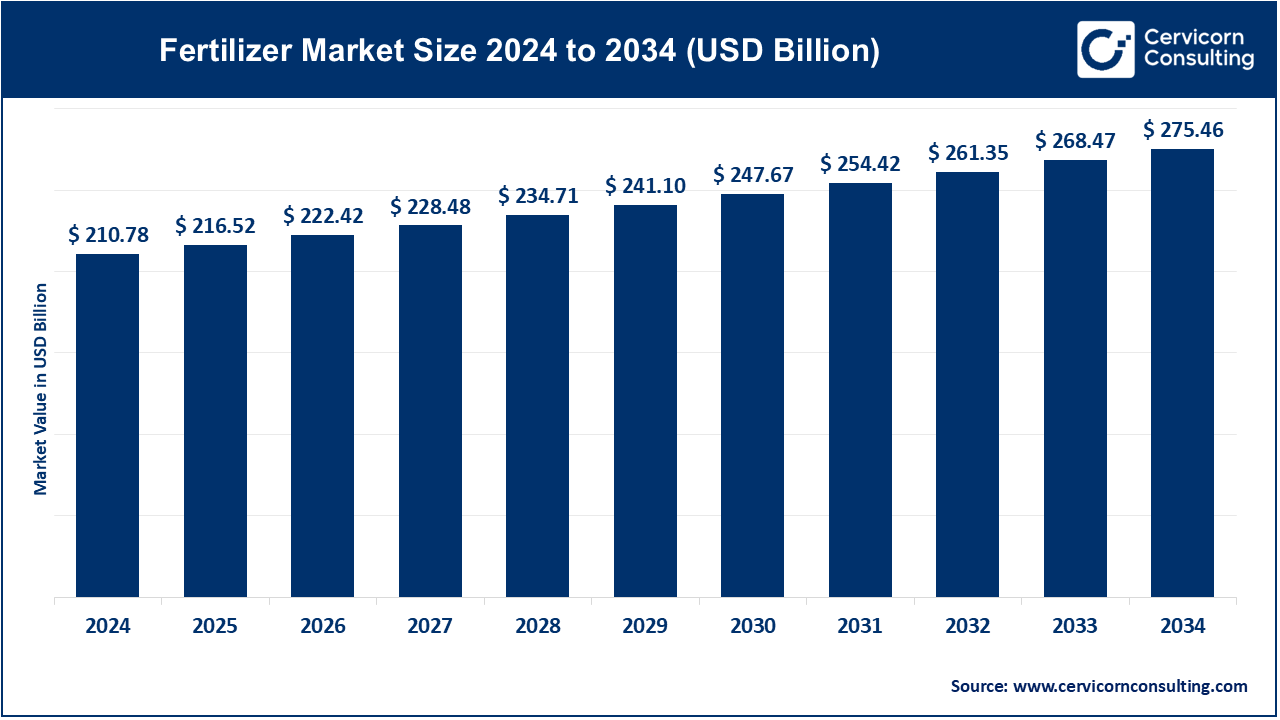

The global fertilizer market size was accounted at USD 210.78 billion in 2024 and is projected to surpass around USD 275.46 billion by 2034, growing at a compound annual growth rate (CAGR) of 2.72% over the forecast period 2025 to 2034.

The fertilizer market is driven by the rising global population and increasing food demand, necessitating higher agricultural productivity. Farmers are increasingly adopting fertilizers to address soil nutrient deficiencies and enhance crop yields. Key regions such as Asia-Pacific lead the market due to extensive agricultural activities in countries like India and China. These countries rely heavily on fertilizers to support their agricultural economies and ensure food security. Additionally, there is a growing shift towards sustainable and eco-friendly fertilizers, fueled by environmental regulations and consumer awareness about reducing chemical impacts on soil and water. Organic and bio-based fertilizers are gaining traction, especially in Europe and North America, where sustainable farming practices are widely promoted. The market also sees significant technological advancements, such as precision farming and controlled-release fertilizers, enabling efficient nutrient delivery and minimizing waste.

Fertilizers are substances that provide essential nutrients to plants, enhancing their growth and productivity. They are used to replenish soil nutrients depleted by farming and ensure optimal crop yield. Fertilizers can be broadly categorized into organic and inorganic types. Organic fertilizers, derived from natural sources like compost, manure, and bone meal, improve soil structure and long-term fertility. Inorganic fertilizers, also known as chemical fertilizers, are synthesized from minerals and chemicals, offering precise nutrient delivery for rapid plant growth. These fertilizers are further divided into nitrogen-based, phosphorus-based, potassium-based, and multi-nutrient varieties, catering to the specific needs of different crops and soil types.

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 210.78 Billion |

| Market Size in 2034 | USD 275.46 Billion |

| Market Growth Rate | CAGR of 2.72% from 2025 to 2034 |

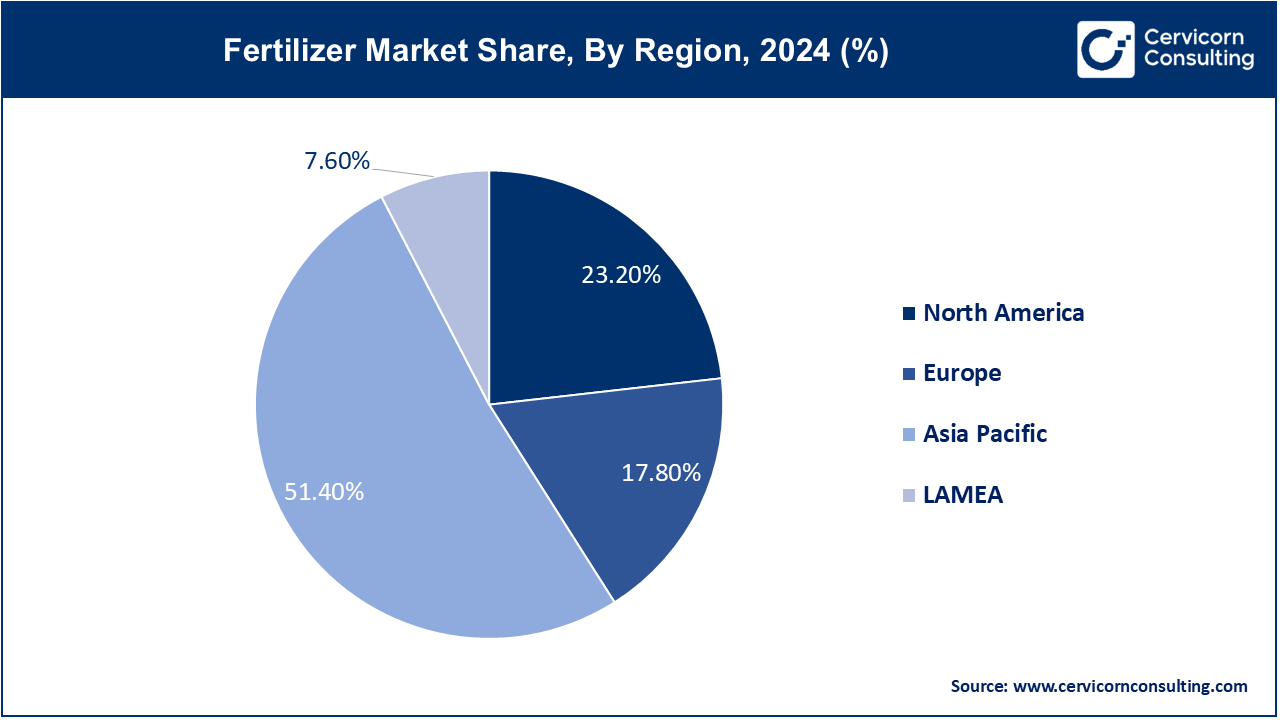

| Largest Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Segment Covered | By Type of Fertilizers, Type, Nutrient Content, Application, Crop Type, Regions |

Climate Change Adaptation and Resilience:

Global Trade and Market Liberalization:

Environmental Regulations and Sustainability Concerns:

Volatility in Raw Material Prices:

Integration of Digital Agriculture Technologies:

Development of Sustainable and Biodegradable Fertilizers:

Resistance to Fertilizer Overuse and Nutrient Saturation:

Sustainable Nutrient Management in Intensive Agriculture:

Nitrogenous Fertilizers: These fertilizers are rich in nitrogen, essential for leaf and stem growth. Trends indicate a growing preference for urea and ammonium nitrate due to their high nitrogen content and cost-effectiveness. Innovations focus on improving nitrogen use efficiency to minimize environmental impact and optimize crop yields in intensive farming systems.

Phosphatic Fertilizers: High in phosphorus, these fertilizers are crucial for root development, flowering, and seed formation. Market trends show increasing use of phosphoric acid-based fertilizers like diammonium phosphate (DAP) and triple superphosphate (TSP) due to their solubility and ease of application. There is a push towards developing phosphorus-efficient fertilizers to address global phosphorus scarcity concerns.

Potassic Fertilizers: These fertilizers provide potassium, essential for overall plant health, water regulation, and disease resistance. Demand trends favor potassium chloride (MOP) and potassium sulfate (SOP) for their ability to supply potassium efficiently to crops. Innovations focus on enhancing nutrient uptake efficiency and minimizing chloride toxicity in sensitive crops.

Micronutrient Fertilizers: These fertilizers supply essential trace elements like zinc, iron, manganese, copper, and boron, vital for specific plant functions such as enzyme activation and photosynthesis. Market trends indicate a rise in demand for chelated micronutrient fertilizers, which enhance nutrient availability and uptake by plants, especially in soils with micronutrient deficiencies.

Others: This category includes specialty fertilizers such as organic and bio-based products, which are gaining popularity due to their environmental benefits and suitability for organic farming practices. Trends show increasing consumer demand for organic fertilizers derived from natural sources like compost, manure, and plant residues, driven by concerns over synthetic chemical use and environmental sustainability.

Single Nutrient Fertilizers: These fertilizers provide only one type of nutrient, such as nitrogen, phosphorus, or potassium. Trends show a steady demand for single-nutrient fertilizers tailored to specific crop needs or soil deficiencies, offering simplicity in nutrient management and cost-effectiveness in agricultural applications.

Multi-nutrient Fertilizers: These fertilizers blend multiple nutrients in varying ratios to meet the comprehensive nutritional requirements of crops. Market trends indicate a growing preference for balanced fertilizers that optimize nutrient uptake and enhance crop yields. Innovations focus on developing customized blends that cater to specific soil conditions and crop types, promoting efficient nutrient use and sustainable agricultural practices.

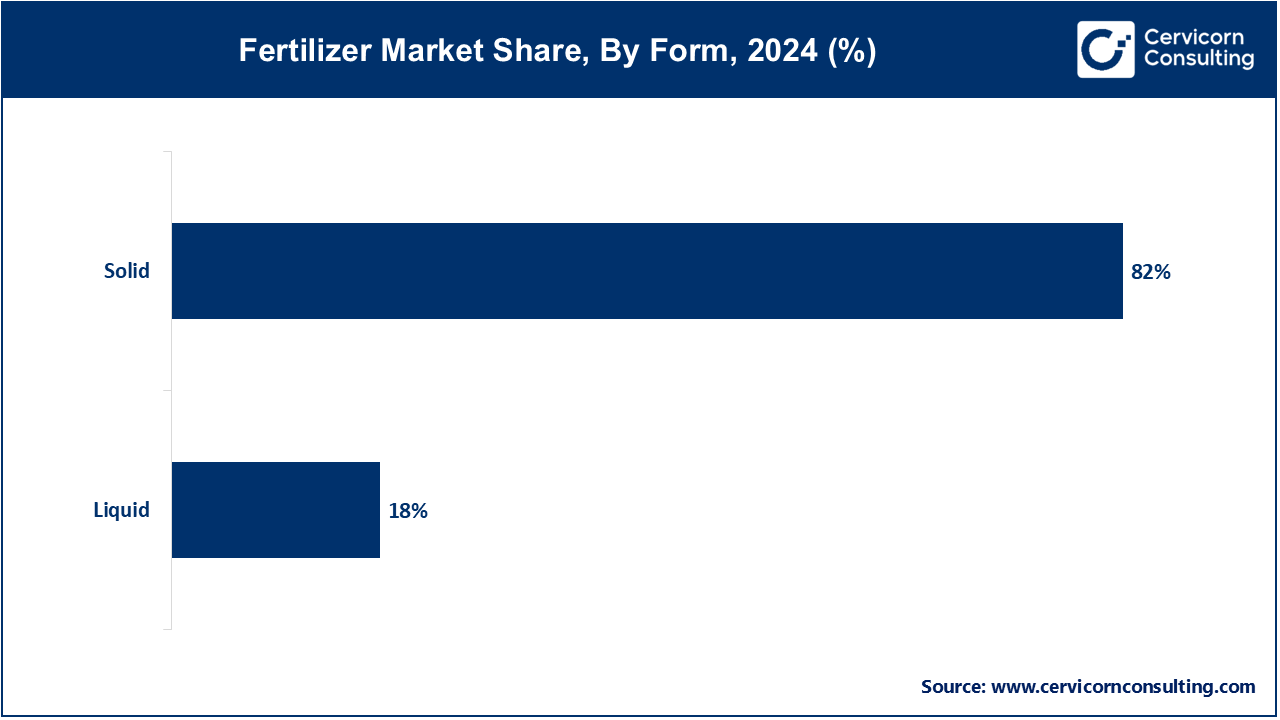

Solid Fertilizers: The solid fertilizers segment has generated highest market share of 82% in 2024. These fertilizers are in granular or powdered form, applied directly to the soil. Trends indicate a preference for solid fertilizers due to their ease of handling, storability, and precise application methods such as broadcast spreading and drilling. Innovations focus on developing coated and slow-release solid fertilizers to improve nutrient efficiency and reduce environmental impact through controlled nutrient release.

Liquid Fertilizers: The liquid fertilizers segment has garnered market size of 18% in 2024. These fertilizers are in liquid form, applied via irrigation systems or foliar spraying. Market trends show increasing adoption of liquid fertilizers for their rapid nutrient uptake by plants and ease of application in precision agriculture. There is a growing demand for liquid fertilizers formulated with micronutrients and bio-stimulants to enhance crop nutrition and productivity, particularly in intensive cropping systems.

Others: This category includes specialty fertilizers such as gaseous fertilizers (e.g., ammonia), which are applied through specialized equipment for soil and plant treatment. Trends focus on developing innovative application technologies and formulations for niche agricultural applications, including controlled-release fertilizers, biodegradable fertilizers, and fertilizers tailored for specific soil conditions and crop needs.

Cereals & Grains: Fertilizers for cereals and grains focus on balanced nutrients to support yield and quality. Trends include the adoption of nitrogenous fertilizers for higher grain production and phosphatic fertilizers for root development. Sustainable practices and precision agriculture technologies are increasingly integrated to optimize nutrient use efficiency and mitigate environmental impacts.

Oilseeds & Pulses: Fertilizers aim to enhance oil and protein content crucial for oilseeds and pulses. Trends show increased use of potassic fertilizers for seed quality improvement and micronutrient fertilizers to address specific crop health needs. There is a growing emphasis on integrated nutrient management systems to tailor fertilizer applications according to crop growth stages and soil conditions.

Fruits & Vegetables: Fertilizers for fruits and vegetables emphasize micronutrients essential for flavor, color, and nutritional value. Trends include the rising popularity of organic fertilizers derived from natural sources to meet consumer preferences for pesticide-free produce. Innovations focus on bio-stimulants and soil conditioners that improve nutrient uptake efficiency and enhance crop resilience against diseases and pests.

Others: Specialty crops such as coffee and spices require tailored fertilizers to optimize quality and yield. Trends indicate a shift towards sustainable fertilization practices and precision agriculture technologies for optimal crop management. Market developments also highlight the importance of nutrient balance and soil health management to support the unique nutritional and growth requirements of specialty crops.

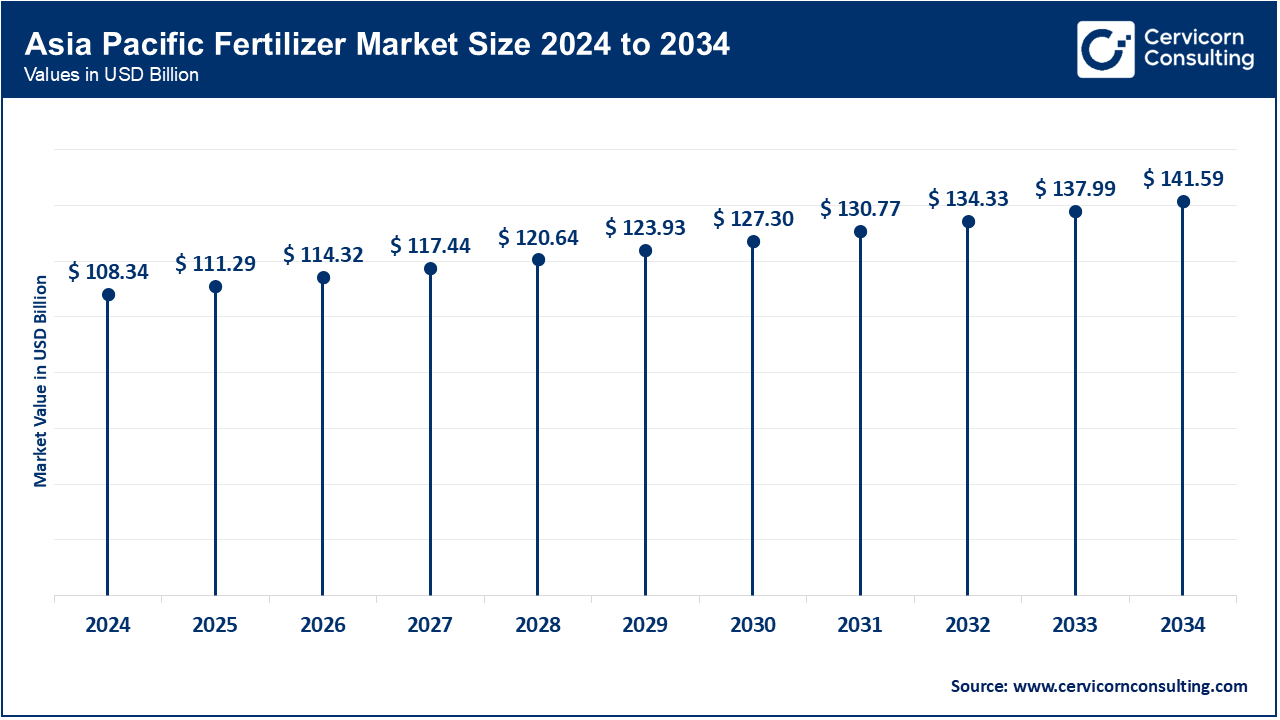

The Asia-Pacific fertilizer market size is registered USD 108.34 billion in 2024 and is forecasted to reach around 141.59 billion by 2034. Asia-Pacific leads global fertilizer consumption, driven by increasing agricultural intensification and initiatives to enhance food security. There is a growing trend towards balanced nutrition in fertilizers, tailored to meet diverse crop needs and soil conditions. Government support through subsidies and investments in agricultural infrastructure and technology further boosts fertilizer use across the region, ensuring agricultural productivity and resilience against climate challenges.

The North America fertilizer market size is recorded USD 48.9 billion in 2024 and is projected to surpass around USD 63.91 billion by 2034. The fertilizer market in North America is characterized by advanced adoption of precision agriculture technologies, facilitating precise fertilizer applications through GPS-guided equipment and data analytics. There is a growing emphasis on sustainable practices, with increasing demand for organic fertilizers and controlled-release nutrients. Stringent environmental regulations also play a crucial role in shaping fertilizer formulations and nutrient management practices, influencing market dynamics and product innovations.

The Europe fertilizer market size is measured USD 37.52 billion in 2024 and is estimated to reach around 49.03 billion by 2034. In Europe, there is a notable shift towards organic farming practices, driving the demand for organic and bio-based fertilizers. The region places a strong focus on improving nutrient use efficiency and reducing nitrogen and phosphorus runoff to minimize environmental impact. Integration of smart farming technologies and digital solutions is gaining traction to enhance fertilizer application precision and support sustainable agriculture initiatives across diverse landscapes.

The LAMEA region focuses on expanding arable land and improving soil fertility, contributing to robust demand for essential nutrients like nitrogen, phosphorus, and potassium. Market liberalization policies and trade agreements facilitate fertilizer imports and technological advancements, supporting agricultural productivity. With climate resilience a priority, there is increasing adoption of fertilizers designed to enhance crop tolerance to environmental stresses, reinforcing food security measures in the region.

Key players like Nutrien, Yara International, and CF Industries dominate the market due to their extensive production capacities, global distribution networks, and continuous innovation in fertilizer products and technologies. These companies leverage economies of scale to influence pricing and market dynamics, while also investing heavily in research and development to maintain leadership through advanced nutrient formulations and precision agriculture solutions.

Market Segmentation

By Type of Fertilizers

By Type

By Nutrient Content

By Application

By Crop Type

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Fertilizer

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type of Fertilizers Overview

2.2.2 By Type Overview

2.2.3 By Nutrient Content Overview

2.2.4 By Application Overview

2.2.5 By Crop Type Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Fertilizer Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Climate Change Adaptation and Resilience

4.1.1.2 Global Trade and Market Liberalization

4.1.2 Market Restraints

4.1.2.1 Environmental Regulations and Sustainability Concerns

4.1.2.2 Volatility in Raw Material Prices

4.1.3 Market Opportunity

4.1.3.1 Integration of Digital Agriculture Technologies

4.1.3.2 Development of Sustainable and Biodegradable Fertilizers

4.1.4 Market Challenges

4.1.4.1 Resistance to Fertilizer Overuse and Nutrient Saturation

4.1.4.2 Sustainable Nutrient Management in Intensive Agriculture

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Fertilizer Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Fertilizer Market, By Type of Fertilizers

6.1 Global Fertilizer Market Snapshot, By Type of Fertilizers

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Nitrogenous

6.1.1.2 Phosphatic

6.1.1.3 Potassic

6.1.1.4 Micronutrient

6.1.1.5 Others

Chapter 7 Fertilizer Market, By Type

7.1 Global Fertilizer Market Snapshot, By Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Organic

7.1.1.2 Inorganic

Chapter 8 Fertilizer Market, By Nutrient Content

8.1 Global Fertilizer Market Snapshot, By Nutrient Content

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Single Nutrient

8.1.1.2 Multi-nutrient

Chapter 9 Fertilizer Market, By Application

9.1 Global Fertilizer Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Solid Fertilizers

9.1.1.2 Liquid Fertilizers

9.1.1.3 Others

Chapter 10 Fertilizer Market, By Crop Type

10.1 Global Fertilizer Market Snapshot, By Crop Type

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Cereals & Grains

10.1.1.2 Oilseeds & Pulses

10.1.1.3 Fruits & Vegetables

10.1.1.4 Others

Chapter 11 Fertilizer Market, By Region

11.1 Overview

11.2 Fertilizer Market Revenue Share, By Region 2024 (%)

11.3 Global Fertilizer Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Fertilizer Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Fertilizer Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Fertilizer Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Fertilizer Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Fertilizer Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Fertilizer Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Fertilizer Market, By Country

11.5.4 UK

11.5.4.1 UK Fertilizer Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UK Market Segmental Analysis

11.5.5 France

11.5.5.1 France Fertilizer Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 France Market Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Fertilizer Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 Germany Market Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Fertilizer Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of Europe Market Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Fertilizer Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Fertilizer Market, By Country

11.6.4 China

11.6.4.1 China Fertilizer Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 China Market Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Fertilizer Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 Japan Market Segmental Analysis

11.6.6 India

11.6.6.1 India Fertilizer Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 India Market Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Fertilizer Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 Australia Market Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Fertilizer Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia Pacific Market Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Fertilizer Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Fertilizer Market, By Country

11.7.4 GCC

11.7.4.1 GCC Fertilizer Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCC Market Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Fertilizer Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 Africa Market Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Fertilizer Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 Brazil Market Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Fertilizer Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 12 Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13 Company Profiles

13.1 K+S Group

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 OCI Nitrogen

13.3 EuroChem Group AG

13.4 CF Industries Holdings, Inc.

13.5 Israel Chemicals Ltd (ICL)

13.6 Nutrien Ltd.

13.7 The Mosaic Company

13.8 Yara International ASA

13.9 Sinofert Holdings Limited

13.10 Agrium Inc.