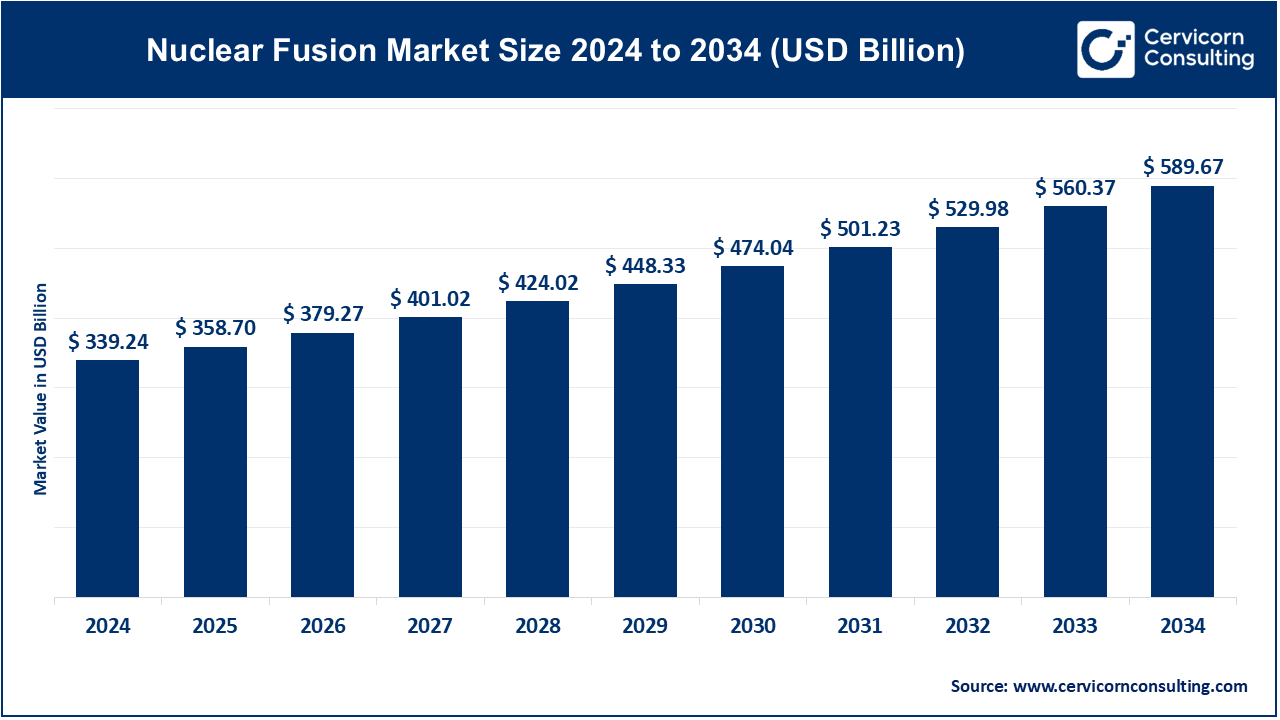

The global nuclear fusion market size was accounted for USD 358.7 billion in 2025 and is projected to surpass around USD 619.69 billion by 2035, growing at a compound annual growth rate (CAGR) of 5.62% over the forecast period 2026 to 2035.

The nuclear fusion market is experiencing accelerated growth due to technological advancements, increasing private investments, and rising global energy demands for clean, sustainable solutions. Governments and private companies are investing heavily in research and development to make fusion commercially viable. Notable initiatives include ITER, a multinational project in France, and private ventures like TAE Technologies, which are attracting billions in funding. The market's growth is further supported by breakthroughs in materials science, AI for simulation and optimization, and more efficient reactor designs like tokamaks and stellarators. Key industries such as power generation, aerospace, and defense are exploring fusion technology for its potential to provide abundant and reliable energy without environmental downsides.

The nuclear fusion market encompasses the development and commercialization of technologies for harnessing nuclear fusion, the process where atomic nuclei combine to release massive energy. Unlike fission, fusion promises cleaner, virtually limitless power with minimal radioactive waste. Companies and governments worldwide are investing in fusion research, aiming to achieve net-positive energy output. Key players include startups like Commonwealth Fusion Systems and multinational ventures like ITER. As advancements continue, the market potential is immense, targeting applications in electricity generation and beyond. Success in this field could revolutionize global energy landscapes, addressing sustainability and energy security challenges.

What is nuclear fusion?

Nuclear fusion is the process by which two light atomic nuclei combine to form a heavier nucleus, releasing a massive amount of energy. This process powers stars, including our Sun, as hydrogen atoms fuse into helium under extreme temperature and pressure. Unlike nuclear fission, which splits heavy atoms and generates radioactive waste, fusion is cleaner and produces negligible long-lived radioactive byproducts. Achieving fusion on Earth requires replicating the Sun’s extreme conditions, typically using deuterium and tritium as fuel. Common approaches include magnetic confinement fusion (e.g., tokamaks and stellarators) and inertial confinement fusion, where lasers compress fuel to trigger fusion. Emerging methods like aneutronic fusion promise even cleaner energy with minimal neutron production.

Nuclear Fusion Specifications

| Fusion | Reaction description of the specific fusion reaction (e.g., Deuterium-Tritium) |

| Fuel | Primary fuel isotopes used (e.g., Deuterium, Tritium) |

| Confining Mechanism | Method used to confine hot plasma (e.g., Tokamak, Stellarator) |

| Plasma Temperature | Required temperature for fusion to occur (Millions of Kelvin) |

| Plasma Density | Necessary plasma density for sustained fusion (particles per cubic meter) |

| Triple Point Condition | Combination of temperature, density, and confinement time needed for net energy gain |

| Energy Gain | Expected ratio of energy released to energy used for heating and confinement |

| Reaction Products | Primary products of the fusion reaction (e.g., Helium, Neutrons) |

Report Scope

| Area of Focus | Details |

| Market size in 2026 | USD 379.27 Billion |

| Market size in 2035 | USD 619.69 Billion |

| Market Growth Rate | CAGR of 5.62% from 2025 to 2035 |

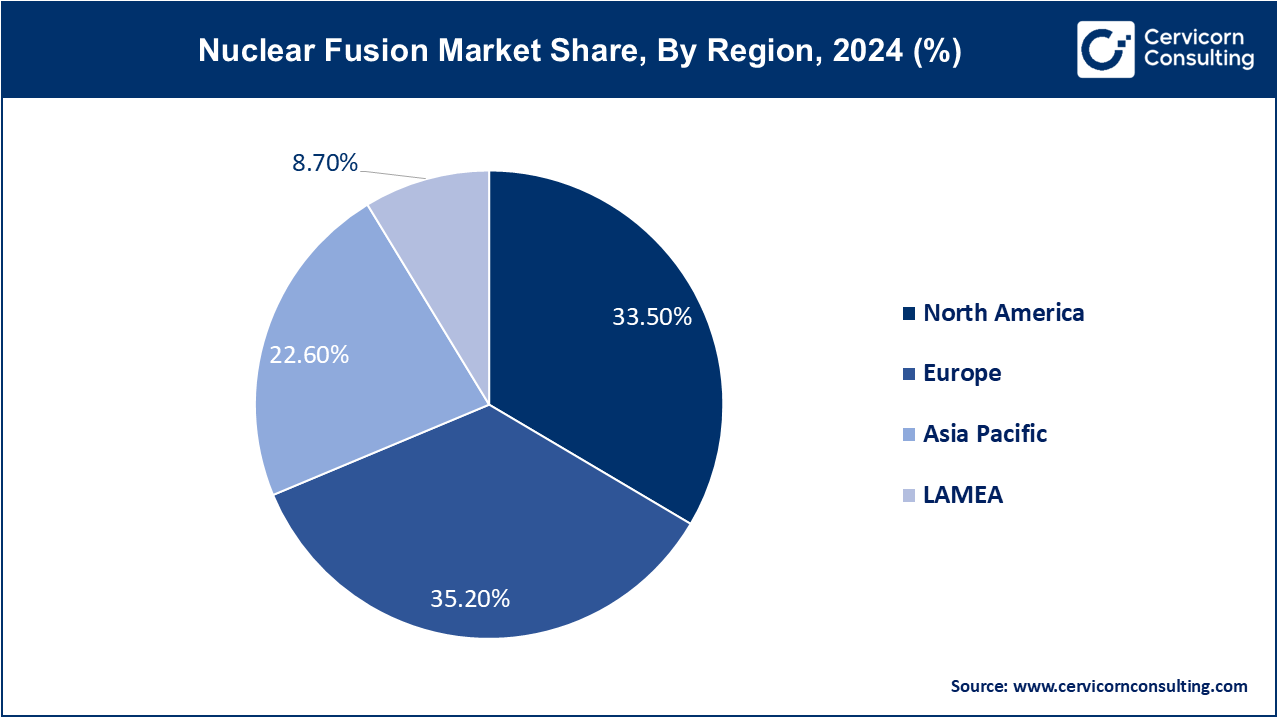

| Largest Region | Europe |

| Fastest Growing Region | Asia-Pacific |

| Segment Covered | By Technology, Fuels, Application, End-Use, Regions |

Enhanced International Collaboration:

Advancements in Artificial Intelligence and Machine Learning:

High Initial Capital Expenditure:

Long Development Timelines:

Integration with Renewable Energy Systems:

Advancements in Modular and Smaller-Scale Fusion Reactors:

Navigating New Regulations:

Nuclear fusion, while distinct from fission, still faces stringent regulatory hurdles due to its association with nuclear energy. Establishing appropriate safety standards, licensing processes, and regulatory frameworks for fusion reactors can be complex and time-consuming. These frameworks need to address the unique aspects of fusion technology, such as dealing with tritium handling, neutron activation, and high-energy plasma environments. The lack of established regulatory pathways can create uncertainties and delays, complicating the deployment and commercialization of fusion energy.

Public Perception and Acceptance:

Despite its promise, fusion energy is often met with skepticism and confusion by the public, partly due to historical challenges and delays in achieving practical results. Misconceptions about fusion being similar to nuclear fission and concerns about its feasibility and safety can hinder public support and investment. Building public trust and understanding requires extensive outreach, transparent communication about progress and challenges, and clear differentiation between fusion and fission technologies. Without broad public acceptance, garnering the necessary political and financial backing for fusion projects can be difficult.

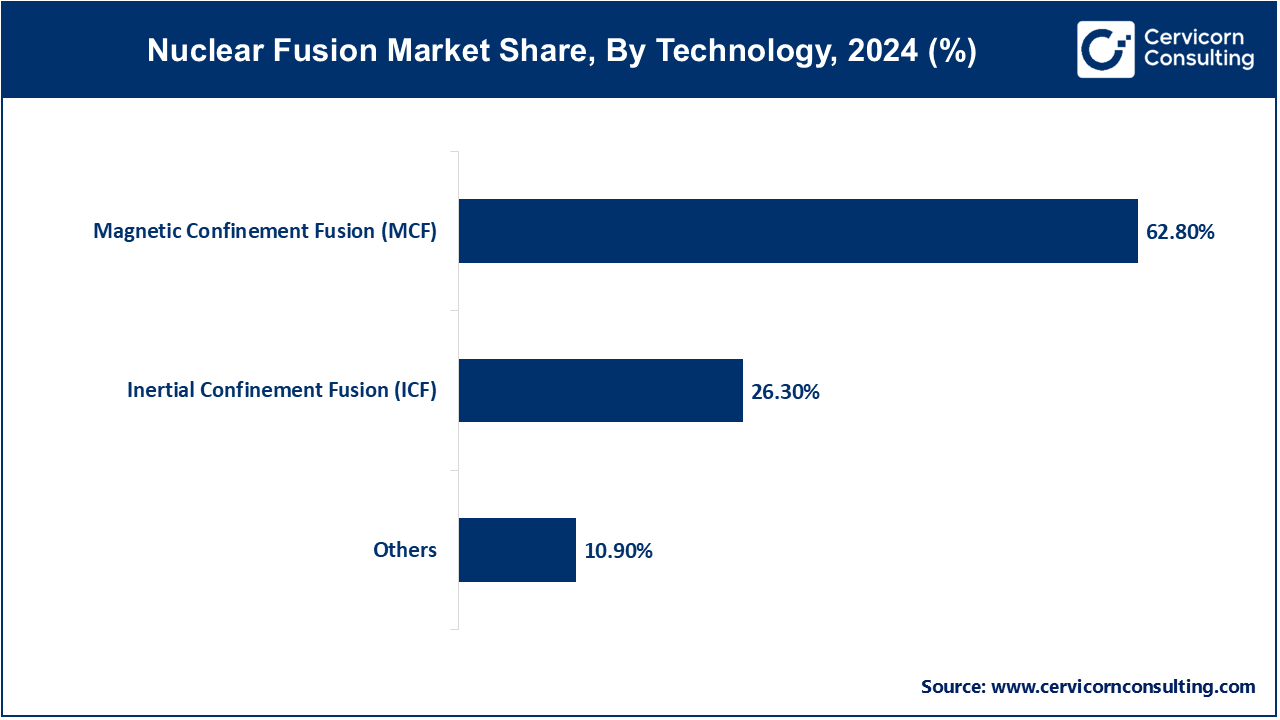

Magnetic Confinement Fusion (MCF): The magnetic confinement fusion (MCF) segment has registered highest market share of 63% in 2025. onfinement Fusion uses powerful magnetic fields to confine hot plasma within a defined space, enabling nuclear fusion reactions. Examples include tokamaks and stellarators. Advancements in superconducting magnets and plasma stability are driving progress. Projects like ITER aim to demonstrate net-positive energy. Increasing investments from governments and private sectors are accelerating development, with startups exploring compact and modular designs.

Inertial Confinement Fusion (ICF): The inertial confinement fusion segment has covered market share of 26% in 2025. Inertial Confinement Fusion involves compressing fuel pellets using high-energy lasers or ion beams to achieve the conditions necessary for nuclear fusion. Laser-based systems, such as the National Ignition Facility (NIF), are making significant strides. Innovations in laser technology and target design are enhancing efficiency. There’s growing interest in magnetized target fusion, combining elements of MCF and ICF for potentially more practical solutions.

Others: Other segament has recorded market share of 11% in 2025. This category includes alternative fusion approaches, such as compact fusion reactors and fusion-fission hybrids, which do not fit traditional MCF or ICF methods. Startups are pioneering smaller, scalable reactors that promise quicker deployment and lower costs. Fusion-fission hybrids are being explored to utilize fusion reactions to drive fission, potentially offering a transitional technology. These innovations aim to make fusion energy more accessible and commercially viable sooner.

Electricity Generation: Nuclear fusion aims to produce clean, sustainable electricity by harnessing the energy released from fusion reactions, potentially offering a virtually limitless energy source with minimal environmental impact. Trends include advancements in magnetic and inertial confinement technologies to achieve sustained fusion, supported by global collaborative efforts.

Industrial Heat Production: Fusion's high-temperature plasma could revolutionize industrial processes, offering a reliable and emission-free heat source for applications like steelmaking and hydrogen production, potentially reducing industrial carbon footprints significantly.

Scientific Research: Fusion devices serve as essential tools for advancing plasma physics and materials science, contributing to fundamental research in energy generation and enabling innovations in reactor design and operation.

Space Propulsion: Fusion propulsion promises efficient and high-thrust propulsion systems for interplanetary travel, offering potential advancements in space exploration and reducing travel times for deep space missions.

Others: Fusion technology also holds promise for producing medical isotopes, desalinating water, and powering remote off-grid locations, diversifying its potential applications beyond traditional energy sectors.

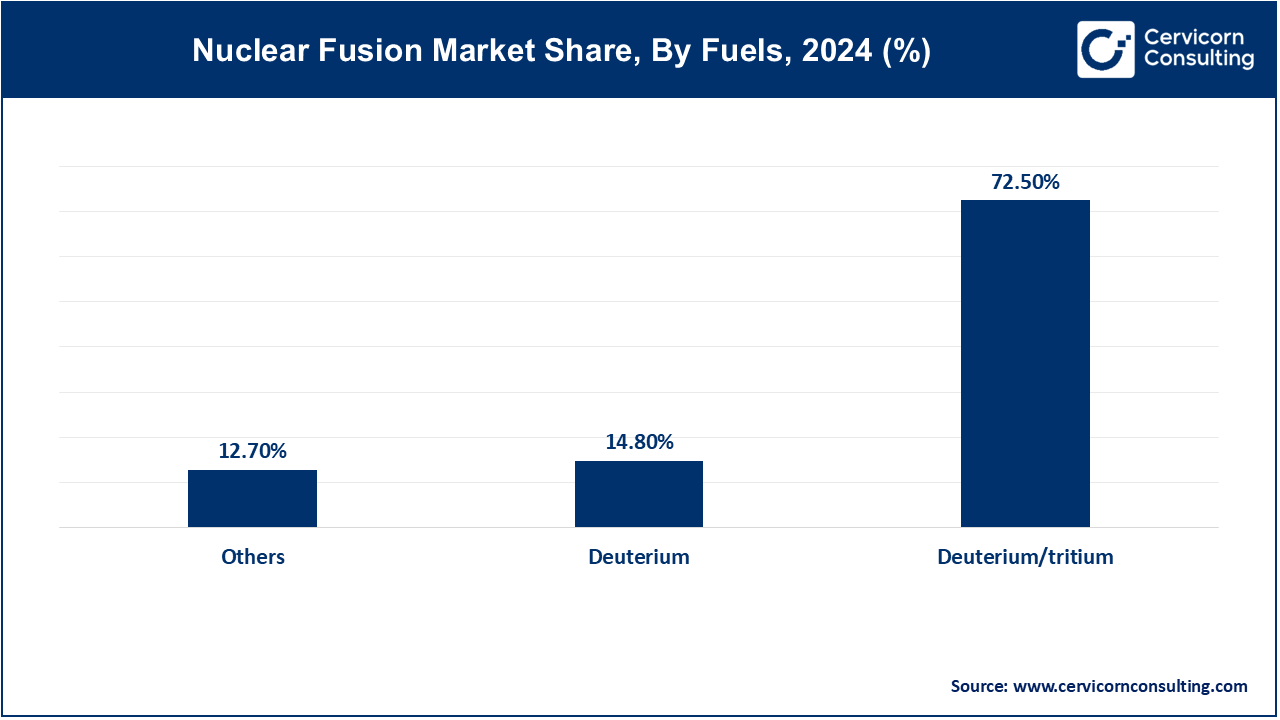

There are major three fuel types which are deuterium/tritium, deuterium, others:

Deuterium/tritium: The Deuterium/tritium segment has dominated the market with the share of 72% in 2025.

Deuterium: In 2025, the deuterium segment has accounted second highest market share of 15%.

Others: The others segment in fuel analysis has generated market share of 13% in 2025.

Utilities: Utilities involve energy companies deploying fusion reactors to generate electricity. This segment focuses on providing reliable, low-carbon power to meet growing energy demands sustainably, driving towards a future with clean energy sources.

Government and Defense: Governments and defense sectors invest in fusion for energy security and technological leadership. Research in this segment aims at dual-use technologies for civilian power and national defense applications, fostering innovation and strategic advantages.

Commercial and Industrial: Industries adopt fusion for sustainable energy to power heavy manufacturing and data centers, reducing reliance on fossil fuels and operational costs, promoting green practices and economic efficiency.

Others: This category includes diverse applications such as medical isotope production and space propulsion, leveraging fusion's unique capabilities for specialized needs, expanding potential beyond traditional energy markets.

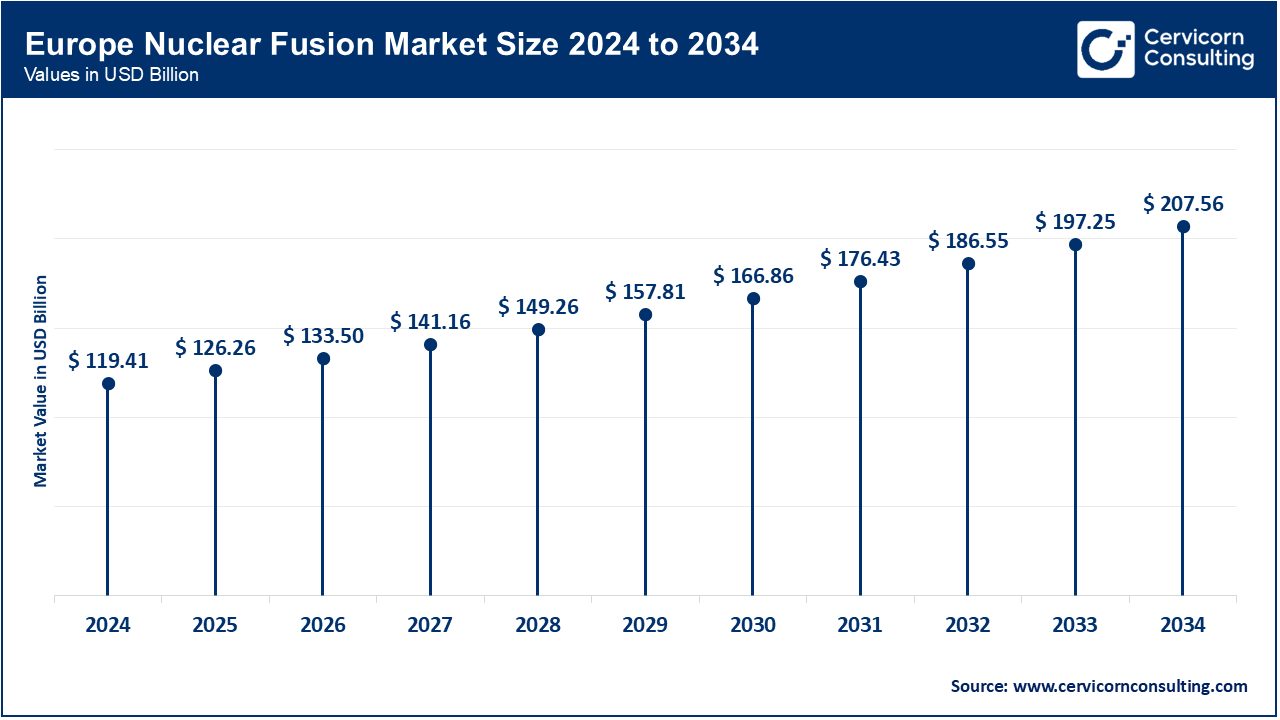

The Europe nuclear fusion size is measured USD 125.55 billion in 2025 and is forecasted to hit around 216.89 billion by 2035 with a CAGR of 5.85%. Europe hosts ITER, a major international collaboration aiming to demonstrate the feasibility of fusion power. Besides ITER, European countries like Germany and the UK are advancing magnetic confinement technologies like tokamaks and stellarators. The emphasis is on sustainable energy solutions to meet regional energy demands while reducing carbon footprints.

The North America fusion size is registered USD 118.37 billion in 2025 and is estimated to reach around 204.50 billion by 2035. North America leads in private investments and technological innovations in fusion. Companies like Commonwealth Fusion Systems and Helion Energy are pioneering compact reactors. Public-private partnerships, such as with national laboratories and universities, are accelerating research and development towards commercialization, aiming to establish a robust fusion energy sector.

The Asia-Pacific nuclear fusion market size is accounted USD 82.50 billion in 2025 and is projected to surpass around USD 142.53 billion by 2035 with a CAGR of 6%. The Asia-Pacific region, spearheaded by China, Japan, and South Korea, is investing significantly in domestic fusion projects. These countries aim to enhance energy security and support industrial growth through advanced fusion research. Focus areas include developing next-generation reactors and fostering international partnerships to leverage expertise and resources.

LAMEA regions are exploring fusion technology for diverse applications. In the Middle East, countries are investing in fusion as a means to diversify their energy mix and reduce dependence on fossil fuels. Latin America and Africa are focusing on scientific advancements and potential energy solutions, contributing to global fusion research efforts with local expertise and resources.

New players like Commonwealth Fusion Systems and Tokamak Energy are leveraging innovative approaches in compact fusion reactors and advanced magnetic confinement technologies to enter the market. They focus on accelerating commercialization timelines and overcoming technical barriers. Established key players such as ITER, General Fusion, and TAE Technologies dominate through significant funding, global collaborations, and pioneering large-scale projects. They lead in demonstrating feasibility and scalability of fusion power, influencing regulatory frameworks and attracting substantial public and private investments. Their expertise and infrastructure position them at the forefront of advancing fusion energy towards practical implementation.

Market Segmentation

By Technology

By Fuels

By Application

By End-Use

By Regions

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Nuclear Fusion

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Fuels Overview

2.2.3 By Application Overview

2.2.4 By End-Use Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Nuclear Fusion Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Enhanced International Collaboration

4.1.1.2 Advancements in Artificial Intelligence and Machine Learning

4.1.2 Market Restraints

4.1.2.1 High Initial Capital Expenditure

4.1.2.2 Long Development Timelines

4.1.3 Market Opportunity

4.1.3.1 Integration with Renewable Energy Systems

4.1.3.2 Advancements in Modular and Smaller-Scale Fusion Reactors

4.1.4 Market Challenges

4.1.4.1 Navigating New Regulations

4.1.4.2 Public Perception and Acceptance

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Nuclear Fusion Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Nuclear Fusion Market, By Technology

6.1 Global Nuclear Fusion Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2023-2035

6.1.1.1 Magnetic Confinement Fusion (MCF)

6.1.1.2 Inertial Confinement Fusion (ICF)

6.1.1.3 Others

Chapter 7 Nuclear Fusion Market, By Fuels

7.1 Global Nuclear Fusion Market Snapshot, By Fuels

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2023-2035

7.1.1.1 Deuterium/tritium

7.1.1.2 Deuterium

7.1.1.3 Deuterium, helium-3

7.1.1.4 Proton Boron

Chapter 8 Nuclear Fusion Market, By Application

8.1 Global Nuclear Fusion Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2023-2035

8.1.1.1 Electricity Generation

8.1.1.2 Industrial Heat Production

8.1.1.3 Scientific Research

8.1.1.4 Space Propulsion

8.1.1.5 Others

Chapter 9 Nuclear Fusion Market, By End-Use

9.1 Global Nuclear Fusion Market Snapshot, By End-Use

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2023-2035

9.1.1.1 Utilities

9.1.1.2 Government and Defense

9.1.1.3 Commercial and Industrial

9.1.1.4 Others

Chapter 10 Nuclear Fusion Market, By Region

10.1 Overview

10.2 Nuclear Fusion Market Revenue Share, By Region 2025 (%)

10.3 Global Nuclear Fusion Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Nuclear Fusion Market Revenue, 2023-2035 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Nuclear Fusion Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Nuclear Fusion Market Revenue, 2023-2035 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Nuclear Fusion Market Revenue, 2023-2035 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Nuclear Fusion Market Revenue, 2023-2035 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Nuclear Fusion Market Revenue, 2023-2035 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Nuclear Fusion Market, By Country

10.5.4 UK

10.5.4.1 UK Nuclear Fusion Market Revenue, 2023-2035 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UK Market Segmental Analysis

10.5.5 France

10.5.5.1 France Nuclear Fusion Market Revenue, 2023-2035 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 France Market Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Nuclear Fusion Market Revenue, 2023-2035 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 Germany Market Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Nuclear Fusion Market Revenue, 2023-2035 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of Europe Market Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Nuclear Fusion Market Revenue, 2023-2035 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Nuclear Fusion Market, By Country

10.6.4 China

10.6.4.1 China Nuclear Fusion Market Revenue, 2023-2035 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 China Market Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Nuclear Fusion Market Revenue, 2023-2035 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 Japan Market Segmental Analysis

10.6.6 India

10.6.6.1 India Nuclear Fusion Market Revenue, 2023-2035 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 India Market Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Nuclear Fusion Market Revenue, 2023-2035 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 Australia Market Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Nuclear Fusion Market Revenue, 2023-2035 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia Pacific Market Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Nuclear Fusion Market Revenue, 2023-2035 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Nuclear Fusion Market, By Country

10.7.4 GCC

10.7.4.1 GCC Nuclear Fusion Market Revenue, 2023-2035 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCC Market Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Nuclear Fusion Market Revenue, 2023-2035 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 Africa Market Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Nuclear Fusion Market Revenue, 2023-2035 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 Brazil Market Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Nuclear Fusion Market Revenue, 2023-2035 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 11 Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2023-2025

11.1.3 Competitive Analysis By Revenue, 2023-2025

11.2 Recent Developments by the Market Contributors (2025)

Chapter 12 Company Profiles

12.1 ITER (International Thermonuclear Experimental Reactor)

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 General Fusion

12.3 TAE Technologies

12.4 Tokamak Energy

12.5 Commonwealth Fusion Systems

12.6 Tri Alpha Energy (TAE)

12.7 Helion Energy

12.8 Lawrence Livermore National Laboratory

12.9 Sandia National Laboratories

12.10 Princeton Plasma Physics Laboratory