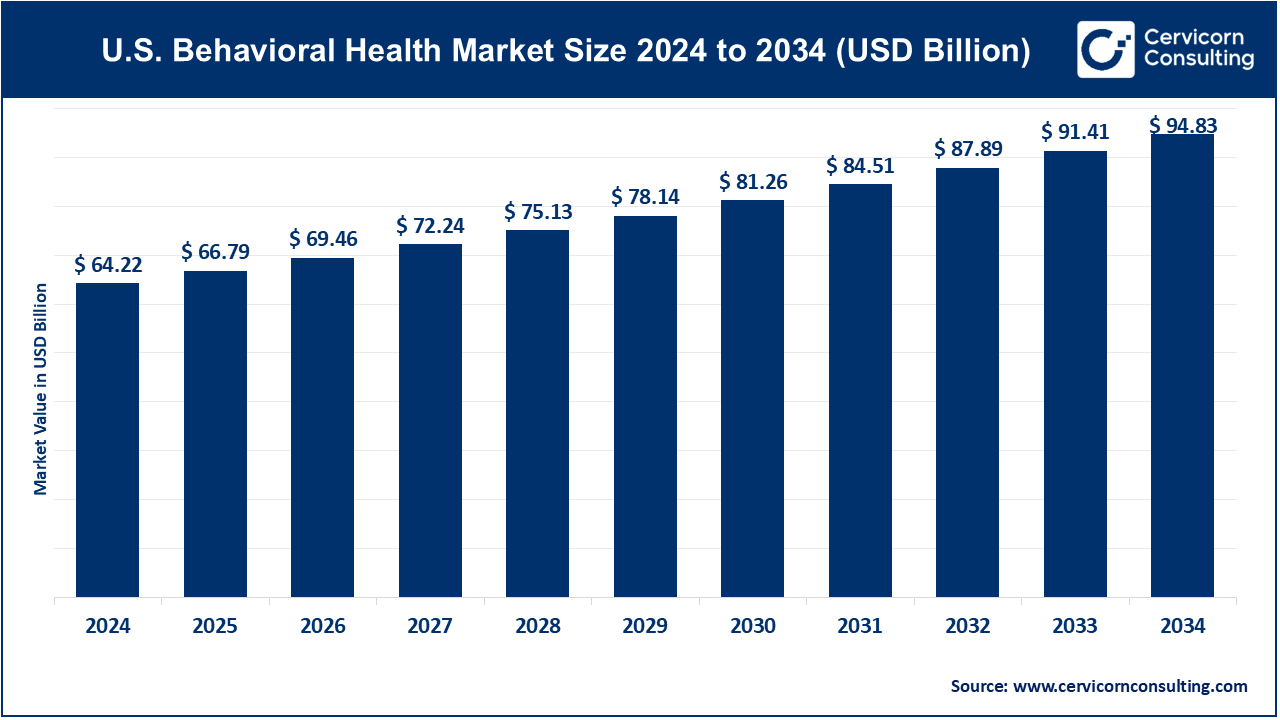

The U.S. behavioral health market size was reported at USD 64.22 billion in 2024 and is expected to reach around USD 94.83 billion by 2034, growing at a compound annual growth rate (CAGR) of 4% over the forecast period 2025 to 2034.

The behavioral health market in the U.S. has experienced significant growth due to a shift in public perception about mental health and a growing recognition of its importance. Increasing numbers of individuals are seeking treatment for mental health issues such as depression, anxiety, and substance use disorders, leading to a higher demand for services. Additionally, government initiatives and reforms, including the expansion of Medicaid and the Affordable Care Act, have played a key role in improving access to mental health care. This has enabled more individuals to receive the necessary treatment for various behavioral health conditions, contributing to a more robust market. Moreover, the market is benefiting from advancements in technology, particularly the rise of telehealth services. The COVID-19 pandemic accelerated the adoption of virtual behavioral health care, making treatment more accessible to a broader population.

Behavioral health refers to the connection between a person's behaviors and their mental and physical well-being. It encompasses a broad range of mental health issues, including depression, anxiety, addiction, and other psychological disorders, as well as behaviors that affect overall health, such as eating habits and substance abuse. Behavioral health treatments often include therapy, counseling, medication management, and lifestyle changes to address mental, emotional, and social well-being. This field also includes programs and services aimed at promoting healthy behaviors, preventing mental health crises, and improving overall quality of life for individuals.

The U.S. behavioral health market is experiencing significant growth driven by rising mental health awareness and increasing demand for comprehensive care solutions. The market encompasses a wide range of services, including outpatient counseling, inpatient treatment, and home-based care, catering to various disorders such as anxiety, depression, and substance abuse. Key factors propelling growth include advancements in telehealth, which enhance accessibility, and expanded insurance coverage for mental health services. Despite progress, challenges such as a shortage of mental health professionals and high treatment costs persist. Opportunities exist in integrating innovative technologies and expanding telehealth services, while ongoing efforts aim to address barriers to care and improve patient outcomes.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 66.79 Billion |

| Market Growth Rate | CAGR of 4% from 2025 to 2034 |

| Market Size by 2034 | USD 94.83 Billion |

| Segment Coverage | Service Type, Disorder Type and End-Users |

Increasing Awareness and Education

Enhanced Insurance Coverage

Shortage of Mental Health Professionals

High Treatment Costs

Expansion of Telehealth Services

Employer-Sponsored Mental Health Programs

Fragmented Care Systems

Stigma and Cultural Barriers

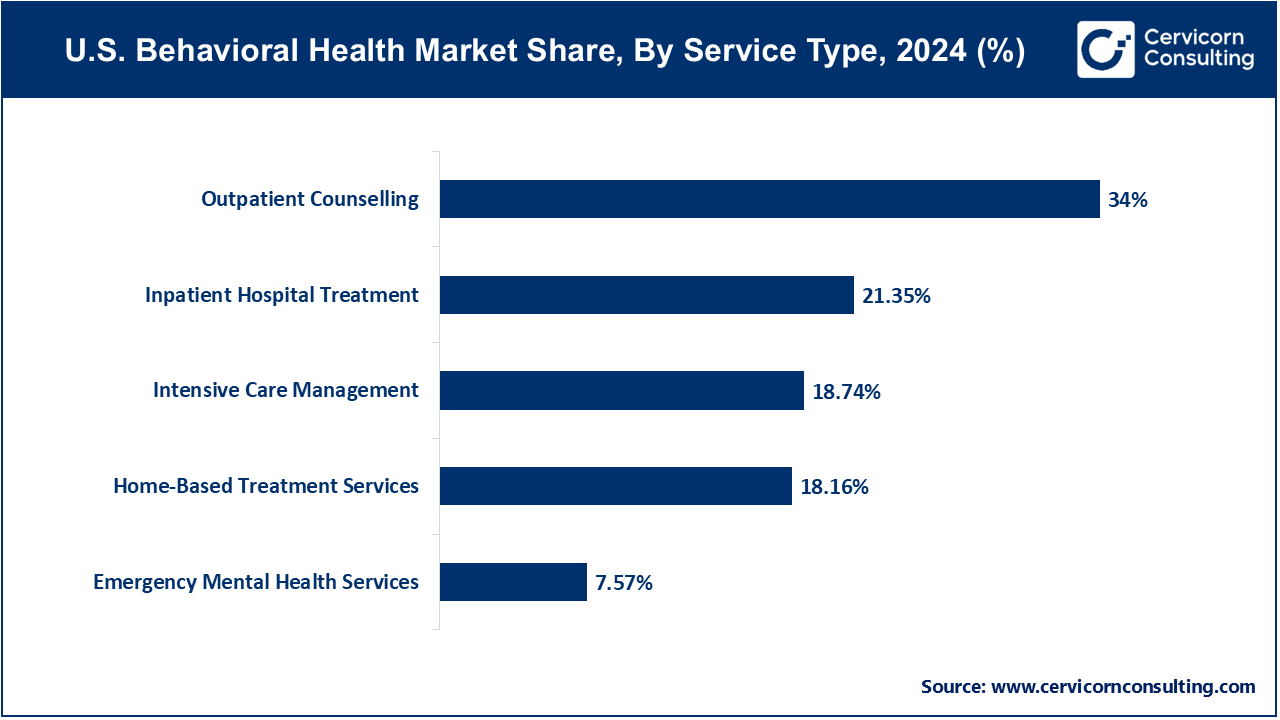

Home-Based Treatment Services: Home-based treatment services are gaining popularity as they offer personalized care within the comfort of patients' homes. The home-based treatment services segment has generated marrket share of 18.16% in 2024. This trend is driven by the increasing demand for flexible, patient-centered care solutions and advancements in telehealth technologies, which enable remote monitoring and support.

Outpatient Counselling: This segment has achieved market share of 34% in 2024. Outpatient counselling remains a cornerstone of behavioral health services, providing accessible and cost-effective therapy options. The rise in mental health awareness and the destigmatization of seeking help are driving more individuals to opt for outpatient services, supported by insurance coverage and community-based programs.

Emergency Mental Health Services: The need for emergency mental health services is growing, driven by the rising incidence of mental health crises. Hospitals and specialized centers are expanding these services to provide immediate intervention, reduce hospitalization rates, and improve outcomes for patients experiencing acute mental health episodes. The emergency mental health services has measured market share of 7.57% in 2024.

Inpatient Hospital Treatment: Inpatient hospital treatment is essential for severe mental health conditions requiring intensive care. The demand is driven by the need for structured environments for treatment and rehabilitation. Enhancements in therapeutic protocols and comprehensive care plans are improving patient recovery rates and the overall efficacy of inpatient services. This segment has garnered market share of 21.53% in 2024.

Intensive Care Management: Intensive care management focuses on providing coordinated, continuous care for individuals with complex mental health needs. This segment has recorded market share of 18.74%. This approach is driven by the necessity to manage high-risk patients effectively, reduce readmission rates, and ensure long-term stability through integrated care teams and personalized treatment plans.

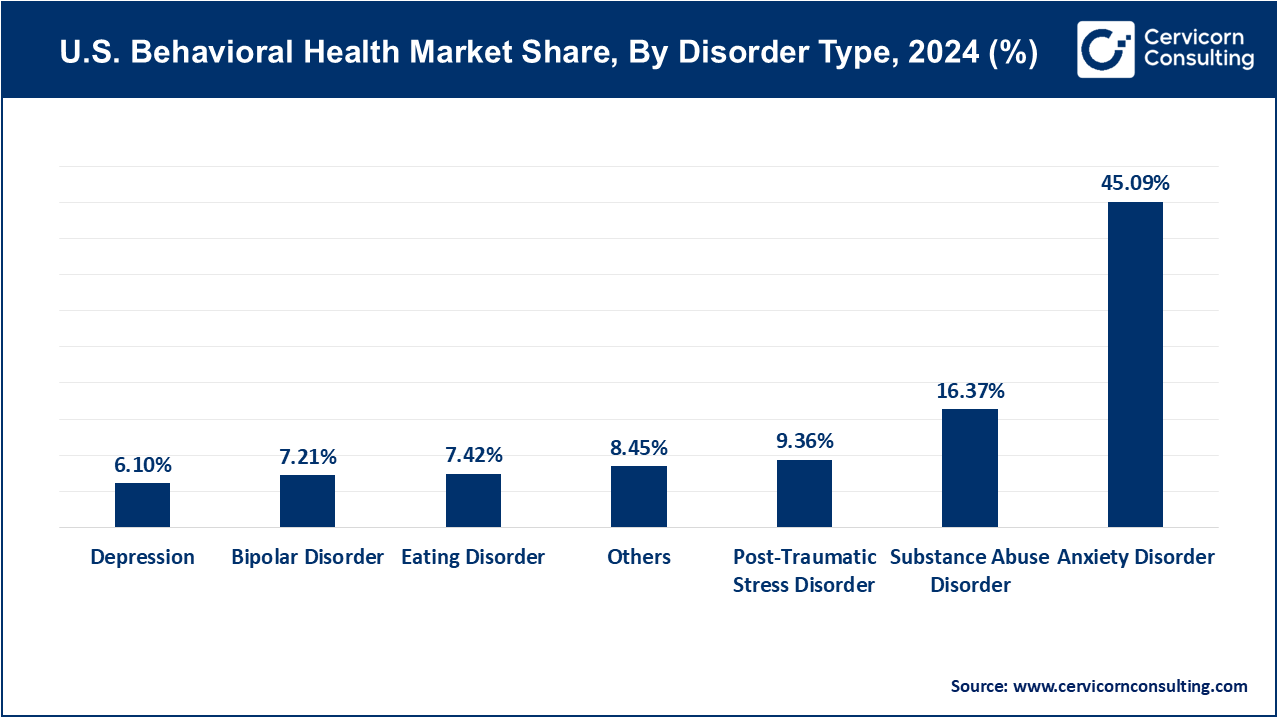

Bipolar Disorder: The treatment of bipolar disorder is driven by advances in pharmacotherapy and psychotherapy techniques. Trends include personalized medicine approaches and the integration of digital health tools for monitoring mood swings and medication adherence, aiming to enhance patient outcomes and quality of life. This segment has recorded 7.21% market share in 2024.

Anxiety Disorder: The anxiety disorder segment has covered market share of 45.09% in 2024. Increasing awareness and destigmatization of mental health issues drive the demand for anxiety disorder treatments. Cognitive-behavioral therapy (CBT) and new medication options are popular, with trends focusing on telehealth delivery and mobile apps offering self-help tools to manage symptoms effectively.

Depression: The depression has considered market share of 6.1% in 2024. The treatment landscape for depression is evolving with innovations in antidepressant medications and non-pharmacological therapies like transcranial magnetic stimulation (TMS). Trends highlight the importance of holistic care approaches, combining lifestyle modifications, therapy, and medication to address this widespread condition comprehensively.

Post-Traumatic Stress Disorder (PTSD): Advancements in trauma-focused therapies, such as EMDR (Eye Movement Desensitization and Reprocessing) and virtual reality exposure therapy, drive PTSD treatment. The increasing recognition of PTSD in various populations, including veterans and first responders, emphasizes the need for specialized, accessible care options. In 2024, this segment has calculated market share of 9.36%.

Eating Disorder: The eating disorder segment has held market share of 7.42% in 2024. Treatment for eating disorders is increasingly multifaceted, involving nutritional rehabilitation, psychotherapy, and medical monitoring. Trends indicate a growing emphasis on early intervention and the integration of family-based treatment models, particularly for adolescents, to improve recovery rates and long-term outcomes.

Substance Abuse Disorder: This segment has generated market share of 16.37% in 2024. Substance abuse disorder treatment trends include the expansion of medication-assisted treatment (MAT) and harm reduction strategies. The opioid crisis has accelerated the adoption of comprehensive care models that combine detoxification, behavioral therapy, and support groups to address addiction more effectively.

Others: The others segment has accounted market share of 8.45% in 2024. Other mental health disorders, such as schizophrenia and obsessive-compulsive disorder (OCD), are seeing advancements in treatment through innovative therapies and personalized care plans. Trends highlight the integration of genetic testing and digital therapeutics to tailor interventions and improve patient adherence and outcomes.

Outpatient Clinics: This segment has accounted 36.57% of market share in 2024. Outpatient clinics are expanding due to the rising demand for accessible and cost-effective behavioral health care. Trends include the integration of telehealth services and enhanced patient management systems, which offer flexibility and convenience for ongoing therapy and treatment outside hospital settings.

Hospitals: This segment has captured market share of 23.98% in 2024. Hospitals are increasingly focusing on comprehensive behavioral health units to address severe mental health crises. Trends are driven by the need for acute care services, including specialized inpatient treatment and emergency mental health services, aiming to provide immediate, intensive care and support.

Rehabilitation Centers: This segment has confired market share of 20.86% in 2024. Rehabilitation centers are growing due to the increased need for specialized, long-term care for substance abuse and severe mental health disorders. Trends emphasize holistic, multidisciplinary approaches, including therapy, medical care, and social support to facilitate long-term recovery and reintegration into society.

Homecare Setting: Homecare setting segment has registered market share of 18.59% in 2024. The demand for homecare settings is rising as patients seek personalized and convenient care options. Trends include the use of telehealth for remote monitoring and support, alongside the development of tailored care plans that enable patients to receive effective behavioral health services from home.

Brightline and Pear Therapeutics are emerging players leveraging digital platforms to revolutionize behavioral health. Brightline focuses on pediatric mental health through virtual care, using technology to offer accessible therapy and support. Pear Therapeutics integrates digital therapeutics with traditional treatments, advancing solutions for substance use and other disorders. Meanwhile, Acadia Healthcare and Magellan Health are dominant players driving market growth through expansive service networks and strategic collaborations. Acadia Healthcare enhances its reach by acquiring and integrating new facilities, while Magellan Health innovates with digital cognitive behavioral therapy (DCBT) programs, addressing increasing mental health needs with advanced technology and expanded service offerings.

Deborah Kilpatrick, CEO of Pear Therapeutics

"Our goal is to transform behavioral health by integrating digital therapeutics into traditional care models, enhancing patient outcomes and accessibility."

Mark G. Kinsler, CEO of Acadia Healthcare

"We are committed to expanding our network of facilities to better serve individuals with severe mental health conditions, ensuring they receive the comprehensive care they need."

Michael L. Apkon, CEO of Tufts Medical Center

"The integration of advanced technology into behavioral health services is crucial for improving patient engagement and treatment efficacy across our network."

Kelly C. McDonald, CEO of Brightline

"Brightline is dedicated to providing accessible, high-quality mental health care for children and families, leveraging virtual platforms to meet the growing demand for pediatric behavioral health services."

Dr. René Lerer, CEO of Magellan Health

"Our investment in digital cognitive behavioral therapy programs reflects our commitment to innovating and expanding mental health services, making effective treatment more accessible for individuals across the country."

David C. M. Harris, CEO of American Addiction Centers

"We are focused on advancing our treatment models to provide comprehensive, evidence-based care for those struggling with substance abuse, utilizing new technologies and therapeutic approaches."

These statements highlight the strategic directions and innovations being pursued by leading companies in the U.S. behavioral health market.

Market Segmentation

By Service Type

By Disorder Type

By End-Users

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of U.S. Behavioral Health

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Service Type Overview

2.2.2 By Disorder Type Overview

2.2.3 By End-Users Overview

2.3 Competitive Overview

Chapter 3 Impact Analysis

3.1 COVID 19 Impact on U.S. Behavioral Health Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Market Implications

3.3 Regulatory and Policy Changes Impacting Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing Awareness and Education

4.1.1.2 Enhanced Insurance Coverage

4.1.2 Market Restraints

4.1.2.1 Shortage of Mental Health Professionals

4.1.2.2 High Treatment Costs

4.1.3 Market Opportunity

4.1.3.1 Expansion of Telehealth Services

4.1.3.2 Employer-Sponsored Mental Health Programs

4.1.4 Market Challenges

4.1.4.1 Fragmented Care Systems

4.1.4.2 Stigma and Cultural Barriers

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 U.S. Behavioral Health Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 U.S. Behavioral Health Market, By Service Type

6.1 U.S. Behavioral Health Market Snapshot, By Service Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Home-Based Treatment Services

6.1.1.2 Outpatient Counselling

6.1.1.3 Emergency Mental Health Services

6.1.1.4 Inpatient Hospital Treatment

6.1.1.5 Intensive Care Management

Chapter 7 U.S. Behavioral Health Market, By Disorder Type

7.1 U.S. Behavioral Health Market Snapshot, By Disorder Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Bipolar Disorder

7.1.1.2 Anxiety Disorder

7.1.1.3 Depression

7.1.1.4 Post-Traumatic Stress Disorder

7.1.1.5 Eating Disorder

7.1.1.6 Substance Abuse Disorder

7.1.1.7 Others

Chapter 8 U.S. Behavioral Health Market, By End-Users

8.1 U.S. Behavioral Health Market Snapshot, By End-Users

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Outpatient Clinics

8.1.1.2 Hospitals

8.1.1.3 Rehabilitation Centers

8.1.1.4 Homecare Setting

Chapter 9 U.S. Behavioral Health Market, By Region

9.1 Overview

9.2 U.S. Behavioral Health Market Revenue Share, By Region 2024 (%)

9.3 U.S. Behavioral Health Market, By Region

9.4 U.S. Market Segmental Analysis

Chapter 10 Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11 Company Profiles

11.1 Acadia Healthcare

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Magellan Health

11.3 Cenpatico Behavioral Health

11.4 Universal Health Services, Inc.

11.5 BHS (Behavioral Health Services)

11.6 Mental Health America (MHA)

11.7 Noble Health Services

11.8 LifeStance Health

11.9 Teladoc Health

11.10 Brightline