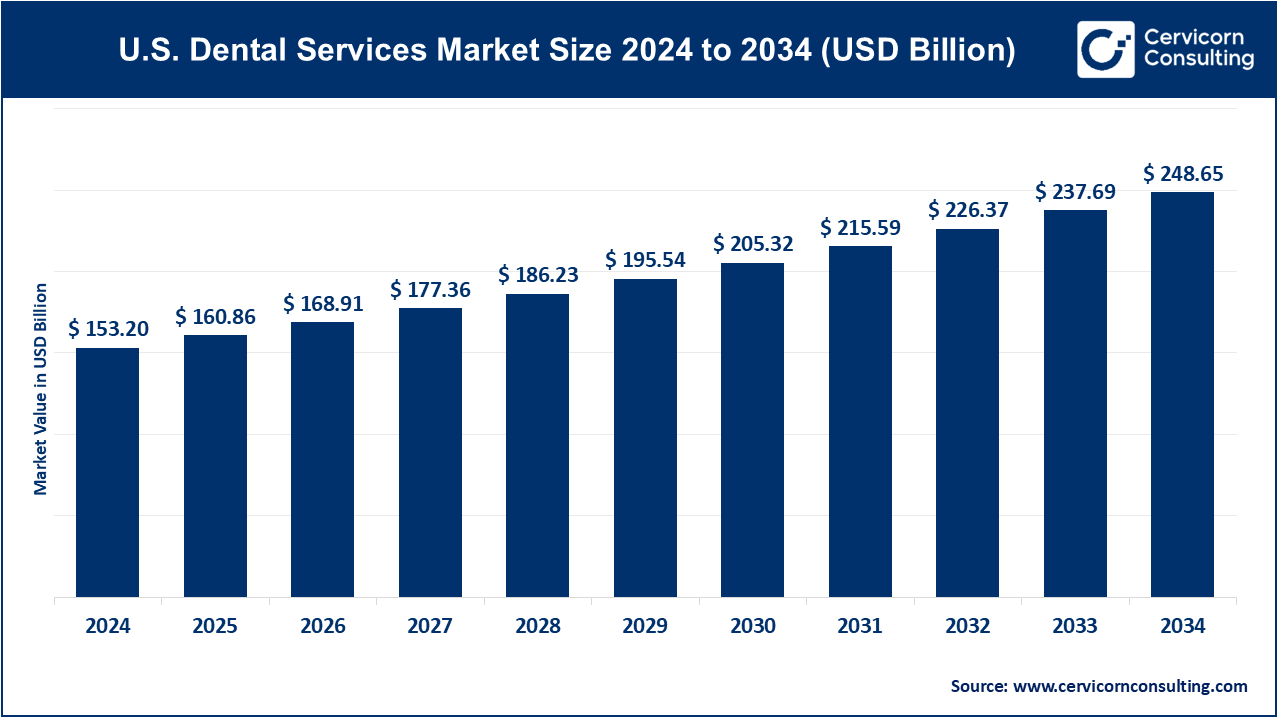

The U.S. dental services market size was measured at USD 153.20 billion in 2024 and is forecasted to reach around USD 248.65 billion by 2034, growing at a compound annual growth rate (CAGR) of 5% from 2025 to 2034.

The U.S. dental services market has seen substantial demand in recent years, driven by a combination of factors such as an aging population, increased public awareness of dental health, and advancements in technology. People are becoming more conscious of the importance of oral care, leading to a rise in routine dental check-ups and preventive treatments. In addition, there is a growing interest in cosmetic dentistry, including teeth whitening and orthodontics, as individuals seek improved aesthetics. As a result, the dental services sector has expanded, with consumers seeking a wide range of offerings from routine cleanings to complex surgeries. Moreover, the industry benefits from the expansion of dental insurance coverage and an increase in dental care access, especially in underserved areas. The rise of dental service organizations (DSOs), which centralize management functions for dental practices, has also contributed to the market's development by improving operational efficiency and patient care.

Dental services encompass a wide range of healthcare practices dedicated to diagnosing, preventing, and treating oral diseases and conditions. These services are provided by dental professionals, including general dentists, specialists, dental hygienists, and dental assistants. The scope of dental services includes routine check-ups, cleanings, fillings, extractions, orthodontics, periodontics, endodontics, cosmetic dentistry, and oral surgeries. Advancements in dental technology have led to improved diagnostic tools, minimally invasive procedures, and enhanced patient care, contributing to the overall growth and evolution of the dental industry.

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 153.2 Billion |

| Market Growth Rate | CAGR of 5% from 2025 to 2034 |

| Market Size by 2034 | USD 248.65 Billion |

| Segment Coverage | By Type and By End-use |

Rising Incidence of Dental Diseases

Regulatory and Policy Support

High Cost of Dental Procedures

Shortage of Dental Professionals

Growth of Digital Dentistry

Expansion of Teledentistry

Regulatory Compliance and Standards

Integration of Emerging Technologies

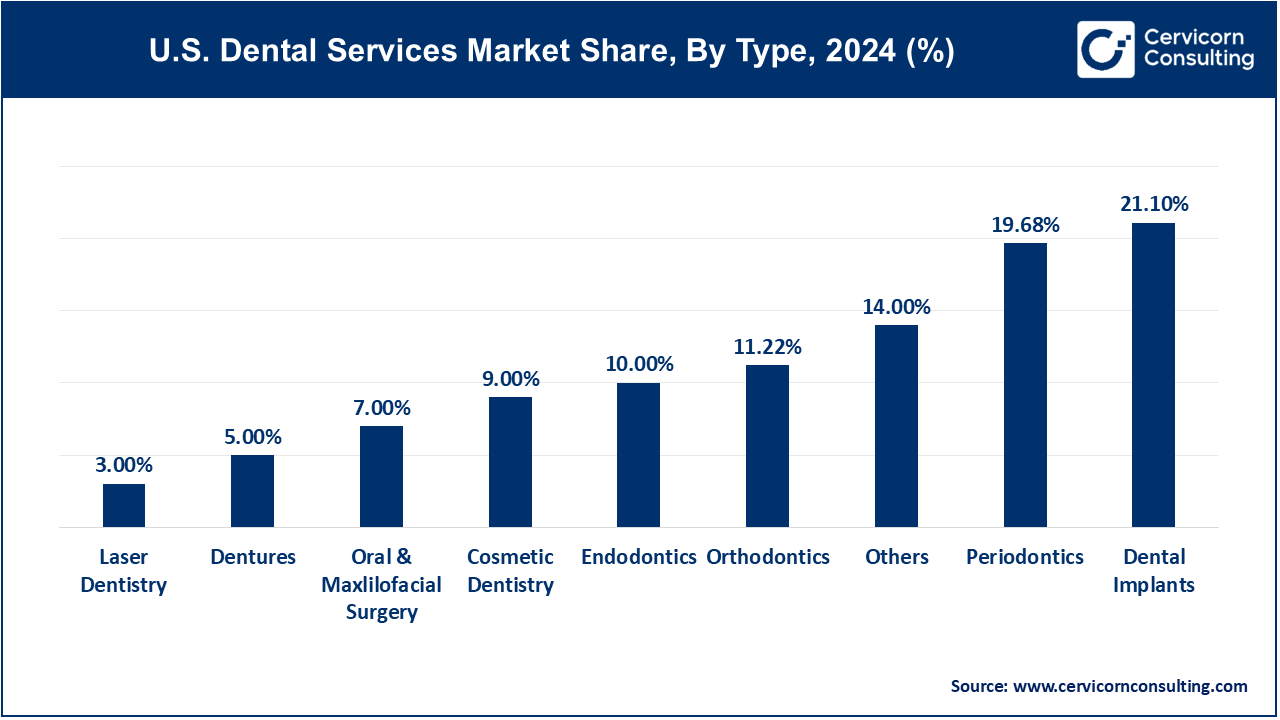

Dental Implants: Dental Implants segment has registered market share of 21.10% in 2024. The U.S. dental implants segment is growing due to advancements in implant technology and increasing demand for tooth replacement solutions. Enhanced durability and aesthetic appeal of implants drive their popularity, alongside rising awareness of their benefits over traditional dentures.

Orthodontics: Orthodontics segment has accounted market share of 11.22% in 2024. Orthodontics is experiencing growth driven by rising cosmetic concerns and increased access to clear aligner technologies. Modern, less noticeable braces and aligners appeal to both adults and adolescents, expanding the market and improving patient outcomes.

Periodontics: Periodontics segment has covered market share of 19.68% in 2024. The periodontics segment is expanding as awareness of gum health’s impact on overall well-being grows. Increased prevalence of periodontal diseases, combined with advancements in treatment options, drives demand for periodontal care and preventive measures.

Endodontics: Endodontics segment has generated market share of 10% in 2024. Endodontics is advancing with improved root canal technologies and techniques, addressing complex cases with greater precision. Rising awareness about preserving natural teeth through endodontic treatments fuels demand, alongside innovations in pain management and procedural efficiency.

Cosmetic Dentistry: Cosmetic dentistry segment has captured 9% of market share 2024. Cosmetic dentistry is driven by heightened aesthetic awareness and demand for procedures such as teeth whitening, veneers, and bonding. Increasing focus on appearance and self-image boosts the market for aesthetic dental treatments and personalized cosmetic solutions.

Laser Dentistry: Laser dentistry segment has recorded market share of 3% in 2024. Laser dentistry is gaining traction due to its minimally invasive nature and enhanced precision. Benefits such as reduced discomfort and faster recovery times drive adoption among patients and practices, revolutionizing traditional dental procedures.

Dentures: Dentures segment has considered market share of 5% in 2024. The dentures segment is driven by the aging population and advancements in denture materials and designs. Modern dentures offer improved comfort and functionality, meeting the needs of an increasing number of elderly patients requiring tooth replacement.

Oral & Maxillofacial Surgery: Oral and maxillofacial surgery segment has garnered 7% in 2024. Oral and maxillofacial surgery is growing due to advancements in surgical techniques and increased treatment options for complex conditions. Rising cases of trauma, tumors, and corrective surgeries contribute to the demand for specialized surgical interventions.

Others: Others segment has held market share of 14% in 2024. The Others segment includes various niche dental services such as pediatric dentistry and preventive care. Increased focus on specialized care and early intervention drives growth, catering to diverse patient needs beyond traditional dental treatments.

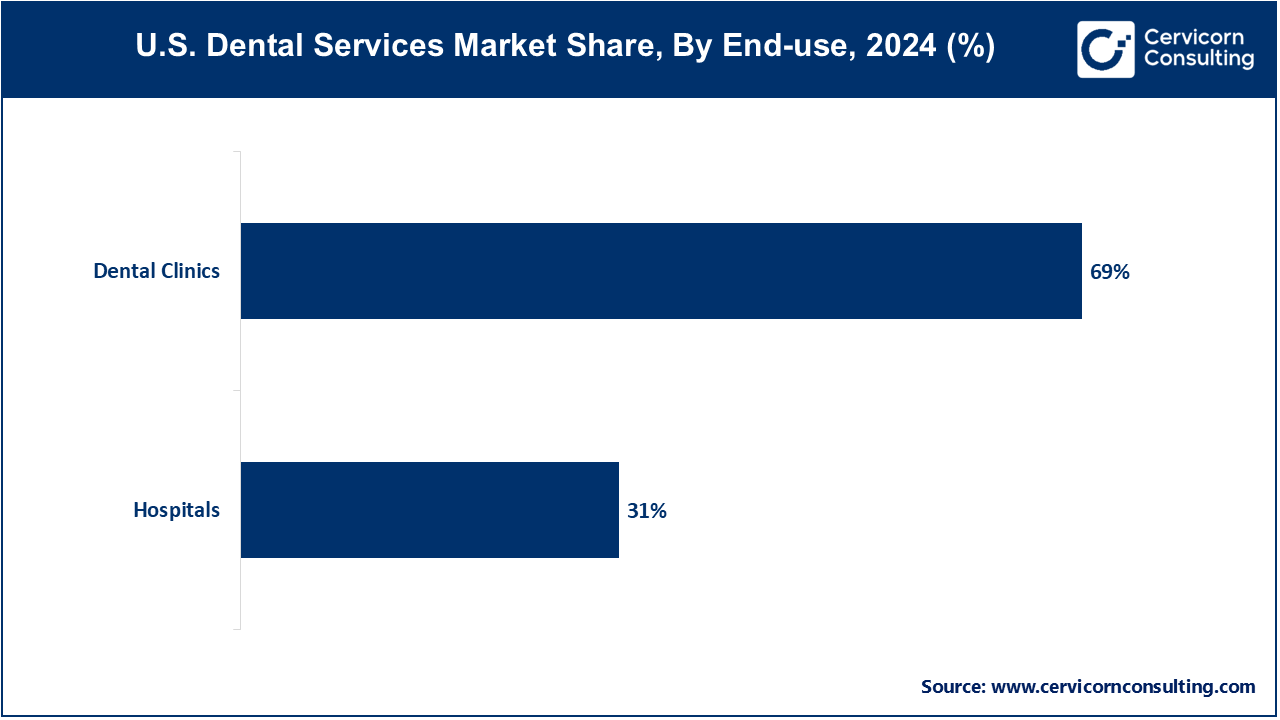

Hospitals: Hospitals segment has accounted market share of 31% in 2024. Hospitals are increasingly incorporating comprehensive dental services due to rising patient needs for specialized care and emergency treatments. Advanced hospital facilities enable complex procedures and multidisciplinary care, driving growth in this segment. The integration of dental services within hospital settings enhances overall patient management and expands service accessibility.

Dental Clinics: The dental clinics sgement has covered market share of 69% in 2024. Dental clinics are experiencing significant growth driven by rising demand for routine and elective dental procedures. Enhanced patient awareness of oral health and advances in dental technology boost clinic visits. The convenience and specialized care provided by clinics cater to a broad demographic, supporting their expansion and market presence.

Among the new players, Sonalake Dental leverages advanced digital technologies and tele-dentistry to offer innovative and accessible dental care solutions. Bright Now! Dental focuses on expanding its network through strategic acquisitions and leveraging a strong marketing presence to attract a broad patient base. Dominating players like Aspen Dental Management, Inc. and Heartland Dental drive market leadership through extensive practice networks and high-quality care standards. Aspen Dental is known for its aggressive expansion strategy and integration of cutting-edge technology, while Heartland Dental excels in operational efficiency and support services, enhancing the overall patient experience and maintaining a competitive edge in the market.

Here are some recent CEO statements from key players in the Dental services market:

Robert Fontana, CEO of Aspen Dental Management, Inc.

"Our mission at Aspen Dental is to provide accessible, affordable dental care to everyone who needs it. We're committed to expanding our network of practices and integrating innovative technologies to improve patient outcomes and convenience."

Steve Bilt, CEO of Smile Brands Inc.

"At Smile Brands, we are focused on creating a supportive environment for both patients and dental professionals. Our approach combines advanced dental technologies with personalized care to deliver exceptional experiences and maintain the highest standards of oral health."

Rick Workman, CEO of Heartland Dental

"Heartland Dental’s growth is driven by our commitment to enhancing practice operations and providing unparalleled support to our affiliated dentists. We believe in empowering dental professionals with the tools and resources they need to deliver top-quality care."

Dr. Michael K. Reitano, CEO of Pacific Dental Services, Inc.

"Pacific Dental Services is dedicated to revolutionizing the dental industry through innovation and technology. Our focus on integrating cutting-edge solutions with patient-centric care allows us to offer a superior dental experience and set new standards in the industry."

Dr. Larry H. Eder, CEO of Dental One Partners

"Dental One Partners is committed to leading the dental services market by fostering growth and excellence. We invest in the latest technologies and training to ensure that our practices provide the best possible care for our patients."

Dr. Michael J. Goss, CEO of Great Expressions Dental Centers

"Great Expressions Dental Centers strives to enhance patient care through a combination of comprehensive services and advanced dental technology. Our focus on patient education and accessible care drives our efforts to improve oral health outcomes across the communities we serve."

Key players in the U.S. dental services market have implemented diverse strategic initiatives to ensure continued growth, including mergers, collaborations, product development, and regional expansions. The initial phase of the COVID-19 pandemic, marked by stringent social distancing measures, led to widespread closures of dental practices, significantly impacting the industry. In response, service providers are now concentrating on developing innovative approaches to enhance patient care and adapt to the evolving landscape of dental services. Some notable examples of key developments in the Dental services Market include:

These strategic developments highlight a trend towards consolidation and technological innovation within the dental services market. Companies are broadening their service offerings and leveraging advanced technologies to enhance patient care and expand their market presence.

Market Segmentation

By Type

By End-use

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of U.S. Dental Services

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By End-use Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on U.S. Dental Services Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising Incidence of Dental Diseases

4.1.1.2 Regulatory and Policy Support

4.1.2 Market Restraints

4.1.2.1 High Cost of Dental Procedures

4.1.2.2 Shortage of Dental Professionals

4.1.3 Market Opportunity

4.1.3.1 Growth of Digital Dentistry

4.1.3.2 Expansion of Teledentistry

4.1.4 Market Challenges

4.1.4.1 Regulatory Compliance and Standards

4.1.4.2 Integration of Emerging Technologies

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global U.S. Dental Services Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 U.S. Dental Services Market, By Type

6.1 Global U.S. Dental Services Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2033

6.1.1.1 Dental Implants

6.1.1.2 Orthodontics

6.1.1.3 Periodontics

6.1.1.4 Endodontics

6.1.1.5 Cosmetic Dentistry

6.1.1.6 Laser Dentistry

6.1.1.7 Dentures

6.1.1.8 Oral & Maxillofacial Surgery

6.1.1.9 Others

Chapter 7 U.S. Dental Services Market, By End-use

7.1 Global U.S. Dental Services Market Snapshot, By End-use

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2033

7.1.1.1 Hospitals

7.1.1.2 Dental Clinics

Chapter 8 U.S. Dental Services Market, By Region

8.1 Overview

8.2 U.S. Dental Services Market Revenue Share, By Region 2024 (%)

8.3 Global U.S. Dental Services Market, By Region

8.3.1 Market Size and Forecast

8.4 North America

8.4.1 North America U.S. Dental Services Market Revenue, 2022-2034 ($Billion)

8.4.2 Market Size and Forecast

8.4.3 North America U.S. Dental Services Market, By Country

8.4.4 U.S.

8.4.4.1 U.S. U.S. Dental Services Market Revenue, 2022-2034 ($Billion)

8.4.4.2 Market Size and Forecast

8.4.4.3 U.S. Market Segmental Analysis

8.4.5 Canada

8.4.5.1 Canada U.S. Dental Services Market Revenue, 2022-2034 ($Billion)

8.4.5.2 Market Size and Forecast

8.4.5.3 Canada Market Segmental Analysis

8.4.6 Mexico

8.4.6.1 Mexico U.S. Dental Services Market Revenue, 2022-2034 ($Billion)

8.4.6.2 Market Size and Forecast

8.4.6.3 Mexico Market Segmental Analysis

8.5 Europe

8.5.1 Europe U.S. Dental Services Market Revenue, 2022-2034 ($Billion)

8.5.2 Market Size and Forecast

8.5.3 Europe U.S. Dental Services Market, By Country

8.5.4 UK

8.5.4.1 UK U.S. Dental Services Market Revenue, 2022-2034 ($Billion)

8.5.4.2 Market Size and Forecast

8.5.4.3 UK Market Segmental Analysis

8.5.5 France

8.5.5.1 France U.S. Dental Services Market Revenue, 2022-2034 ($Billion)

8.5.5.2 Market Size and Forecast

8.5.5.3 France Market Segmental Analysis

8.5.6 Germany

8.5.6.1 Germany U.S. Dental Services Market Revenue, 2022-2034 ($Billion)

8.5.6.2 Market Size and Forecast

8.5.6.3 Germany Market Segmental Analysis

8.5.7 Rest of Europe

8.5.7.1 Rest of Europe U.S. Dental Services Market Revenue, 2022-2034 ($Billion)

8.5.7.2 Market Size and Forecast

8.5.7.3 Rest of Europe Market Segmental Analysis

8.6 Asia Pacific

8.6.1 Asia Pacific U.S. Dental Services Market Revenue, 2022-2034 ($Billion)

8.6.2 Market Size and Forecast

8.6.3 Asia Pacific U.S. Dental Services Market, By Country

8.6.4 China

8.6.4.1 China U.S. Dental Services Market Revenue, 2022-2034 ($Billion)

8.6.4.2 Market Size and Forecast

8.6.4.3 China Market Segmental Analysis

8.6.5 Japan

8.6.5.1 Japan U.S. Dental Services Market Revenue, 2022-2034 ($Billion)

8.6.5.2 Market Size and Forecast

8.6.5.3 Japan Market Segmental Analysis

8.6.6 India

8.6.6.1 India U.S. Dental Services Market Revenue, 2022-2034 ($Billion)

8.6.6.2 Market Size and Forecast

8.6.6.3 India Market Segmental Analysis

8.6.7 Australia

8.6.7.1 Australia U.S. Dental Services Market Revenue, 2022-2034 ($Billion)

8.6.7.2 Market Size and Forecast

8.6.7.3 Australia Market Segmental Analysis

8.6.8 Rest of Asia Pacific

8.6.8.1 Rest of Asia Pacific U.S. Dental Services Market Revenue, 2022-2034 ($Billion)

8.6.8.2 Market Size and Forecast

8.6.8.3 Rest of Asia Pacific Market Segmental Analysis

8.7 LAMEA

8.7.1 LAMEA U.S. Dental Services Market Revenue, 2022-2034 ($Billion)

8.7.2 Market Size and Forecast

8.7.3 LAMEA U.S. Dental Services Market, By Country

8.7.4 GCC

8.7.4.1 GCC U.S. Dental Services Market Revenue, 2022-2034 ($Billion)

8.7.4.2 Market Size and Forecast

8.7.4.3 GCC Market Segmental Analysis

8.7.5 Africa

8.7.5.1 Africa U.S. Dental Services Market Revenue, 2022-2034 ($Billion)

8.7.5.2 Market Size and Forecast

8.7.5.3 Africa Market Segmental Analysis

8.7.6 Brazil

8.7.6.1 Brazil U.S. Dental Services Market Revenue, 2022-2034 ($Billion)

8.7.6.2 Market Size and Forecast

8.7.6.3 Brazil Market Segmental Analysis

8.7.7 Rest of LAMEA

8.7.7.1 Rest of LAMEA U.S. Dental Services Market Revenue, 2022-2034 ($Billion)

8.7.7.2 Market Size and Forecast

8.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 9 Competitive Landscape

9.1 Competitor Strategic Analysis

9.1.1 Top Player Positioning/Market Share Analysis

9.1.2 Top Winning Strategies, By Company, 2022-2024

9.1.3 Competitive Analysis By Revenue, 2022-2024

9.2 Recent Developments by the Market Contributors (2024)

Chapter 10 Company Profiles

10.1 Aspen Dental Management, Inc.

10.1.1 Company Snapshot

10.1.2 Company and Business Overview

10.1.3 Financial KPIs

10.1.4 Product/Service Portfolio

10.1.5 Strategic Growth

10.1.6 Global Footprints

10.1.7 Recent Development

10.1.8 SWOT Analysis

10.2 Pacific Dental Services, Inc.

10.3 Smile Brands Inc.

10.4 Dentistry for Children

10.5 Heartland Dental

10.6 Western Dental & Orthodontics

10.7 Dental Care Alliance (DCA)

10.8 Great Expressions Dental Centers

10.9 Sonalake Dental

10.10 Bright Now! Dental