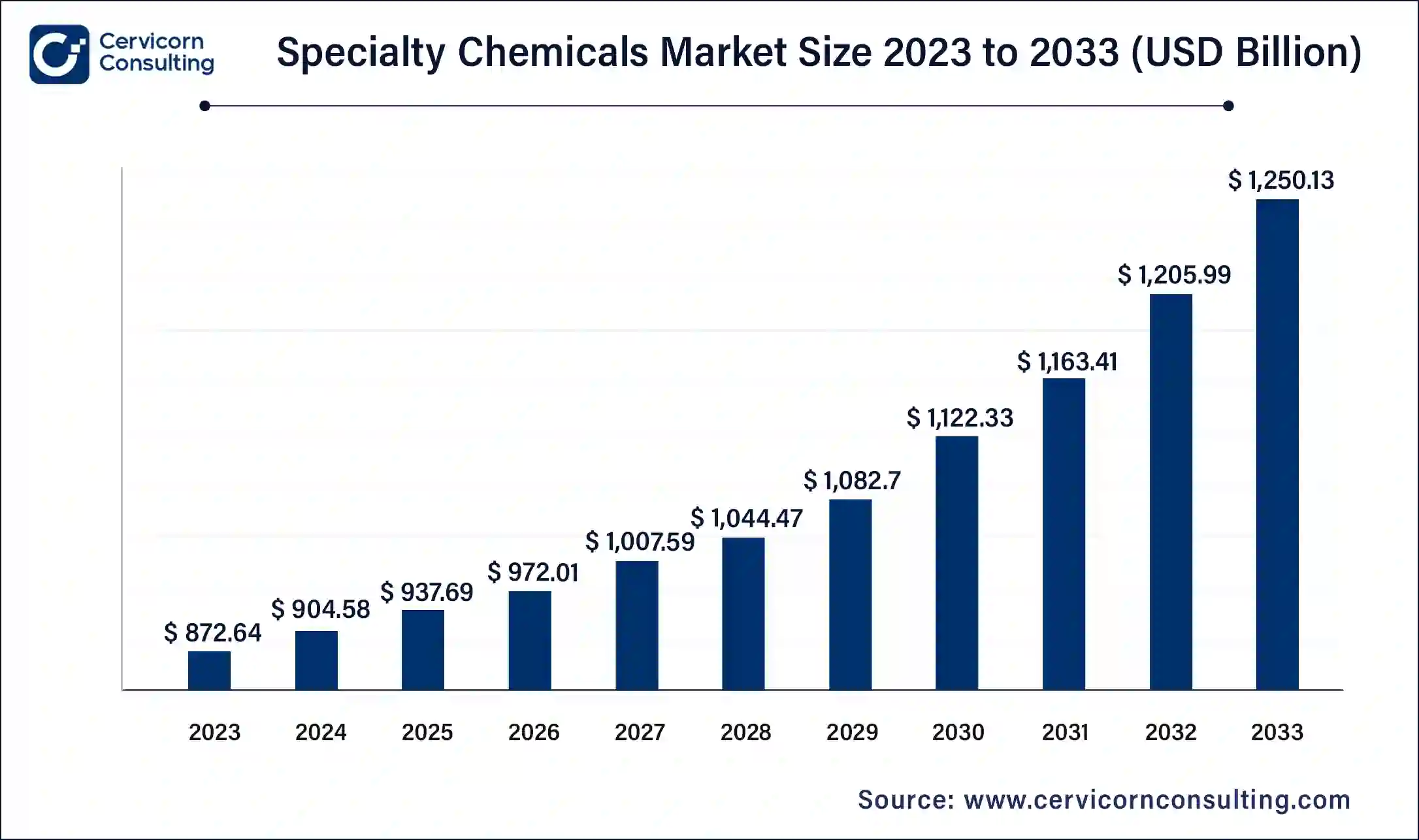

The global Specialty Chemicals Market size was reached at USD 904.58 billion in 2024 and is expected to reach around USD 1250.13 billion by 2033, growing at a compound annual growth rate (CAGR) of 3.66% from 2024 to 2033.

The global specialty chemicals market has been witnessing significant growth over the past few years, driven by increased demand across various sectors such as automotive, construction, agriculture, and electronics. This growth is propelled by the need for more innovative, efficient, and sustainable solutions in industries where performance, safety, and durability are critical. The expanding urbanization, rising consumer awareness for eco-friendly products, and advancements in technology are contributing to the rising adoption of specialty chemicals in diverse applications. As industries shift toward more specialized, high-performance products, the demand for these chemicals is expected to continue growing. The specialty chemicals market growth is further accelerated by advancements in chemical formulations, enabling the development of newer, more efficient products that align with regulatory requirements and consumer preferences.

Specialty chemicals are unique products that are specifically engineered to perform specific functions in various industrial applications. They differ from commodity chemicals in that they are often produced in smaller quantities, tailored to meet the specific requirements of a customer, and are more focused on performance rather than volume. Examples include catalysts, adhesives, coatings, electronic chemicals, flavors, fragrances, and cleaning agents. These chemicals are integral to a wide range of industries, such as automotive, pharmaceuticals, food and beverage, agriculture, and electronics, where their properties, like durability, efficiency, and effectiveness, are essential for the end-product’s performance. Specialty chemicals are typically more expensive than their commodity counterparts due to their unique formulations, advanced technologies, and high customization for specific industrial needs.

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 904.58 Billion |

| Market Growth Rate | CAGR of 3.66% from 2024 to 2033 |

| Market Size by 2033 | USD 1250.13 Billion |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Segment Coverage | By Application and Regions |

Global Supply Chain Resilience

Advanced Manufacturing Technologies

Regulatory Challenges

Volatility in Raw Material Prices

The specialty chemicals industry is highly dependent on raw materials derived from petrochemicals and natural resources. Fluctuations in commodity prices, geopolitical tensions, and supply chain disruptions can lead to cost volatility and impact profit margins. Managing these price fluctuations requires robust supply chain management strategies and pricing flexibility to mitigate risks and maintain competitiveness in the market.

Sustainability

Digital Transformation

Technological Obsolescence

Environmental Impact

Adhesives: The adhesives segment is driven by the expanding construction and automotive industries, which demand advanced adhesives for enhanced performance and sustainability. Innovations in bio-based adhesives and increasing use in packaging due to e-commerce growth are notable trends. The shift towards lightweight materials in automotive manufacturing also fuels demand for high-strength adhesives.

Water Treatment Chemicals: Rising environmental concerns and stringent regulations on water pollution are key drivers for the water treatment chemicals market. Trends include the development of eco-friendly and cost-effective chemicals to improve water quality. Increasing urbanization and industrialization, particularly in developing regions, are boosting demand for effective water treatment solutions.

Electronic Chemicals: The electronic chemicals segment is propelled by the rapid advancement in electronics and semiconductor industries. Key trends include the miniaturization of electronic devices and the development of high-purity chemicals for manufacturing semiconductors. The growing demand for consumer electronics and renewable energy technologies also drives this market.

Rubber Additives: Demand in the rubber additives segment is driven by the automotive industry's need for high-performance tires and rubber components. Trends include the development of additives that enhance durability and environmental resistance. The increasing focus on sustainable and recyclable rubber products also influences market dynamics.

Lubricating Oil Additives: Growth in the lubricating oil additives market is driven by the automotive and industrial sectors' need for efficient lubrication solutions. Trends include the development of additives that improve fuel efficiency and reduce emissions. The shift towards synthetic and bio-based lubricants also impacts this segment.

Cosmetic Ingredients: The cosmetic ingredients segment benefits from rising consumer demand for natural and organic products. Trends include the use of innovative, sustainable ingredients and the increasing focus on anti-aging and skincare solutions. Regulatory pressures and consumer preferences for clean-label products also drive market growth.

Advanced Ceramic Materials: Advanced ceramic materials are driven by their application in electronics, aerospace, and medical devices. Trends include the development of materials with superior properties such as high-temperature resistance and biocompatibility. The push for lightweight, durable materials in various industries also propels this market.

Plastic Additives: The plastic additives segment is driven by the need for enhanced performance and durability in plastic products. Trends include the development of additives that improve recyclability and reduce environmental impact. The growing use of plastics in packaging, automotive, and construction industries fuels demand for innovative additives.

Specialty Oilfield Chemicals: Specialty oilfield chemicals are driven by the need for efficient extraction and processing in the oil and gas industry. Trends include the development of chemicals that enhance recovery rates and minimize environmental impact. The exploration of unconventional oil and gas resources also boosts demand for specialized chemicals.

Textile Chemicals: The textile chemicals market is driven by the demand for high-performance and sustainable textiles. Trends include the development of eco-friendly dyes and finishes, and the increasing use of smart textiles with advanced properties. The growth of the fashion industry and consumer preference for sustainable products also influence this market.

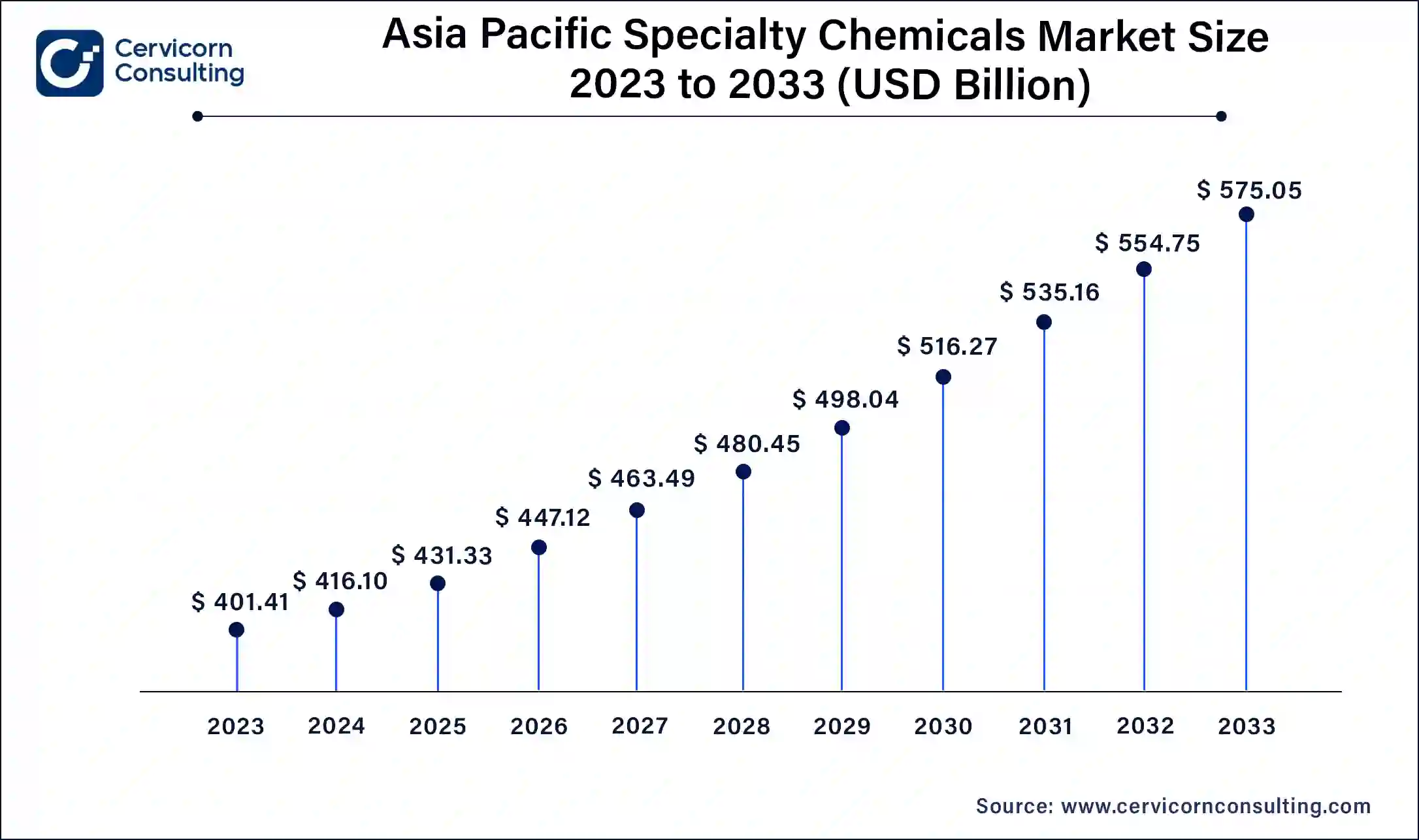

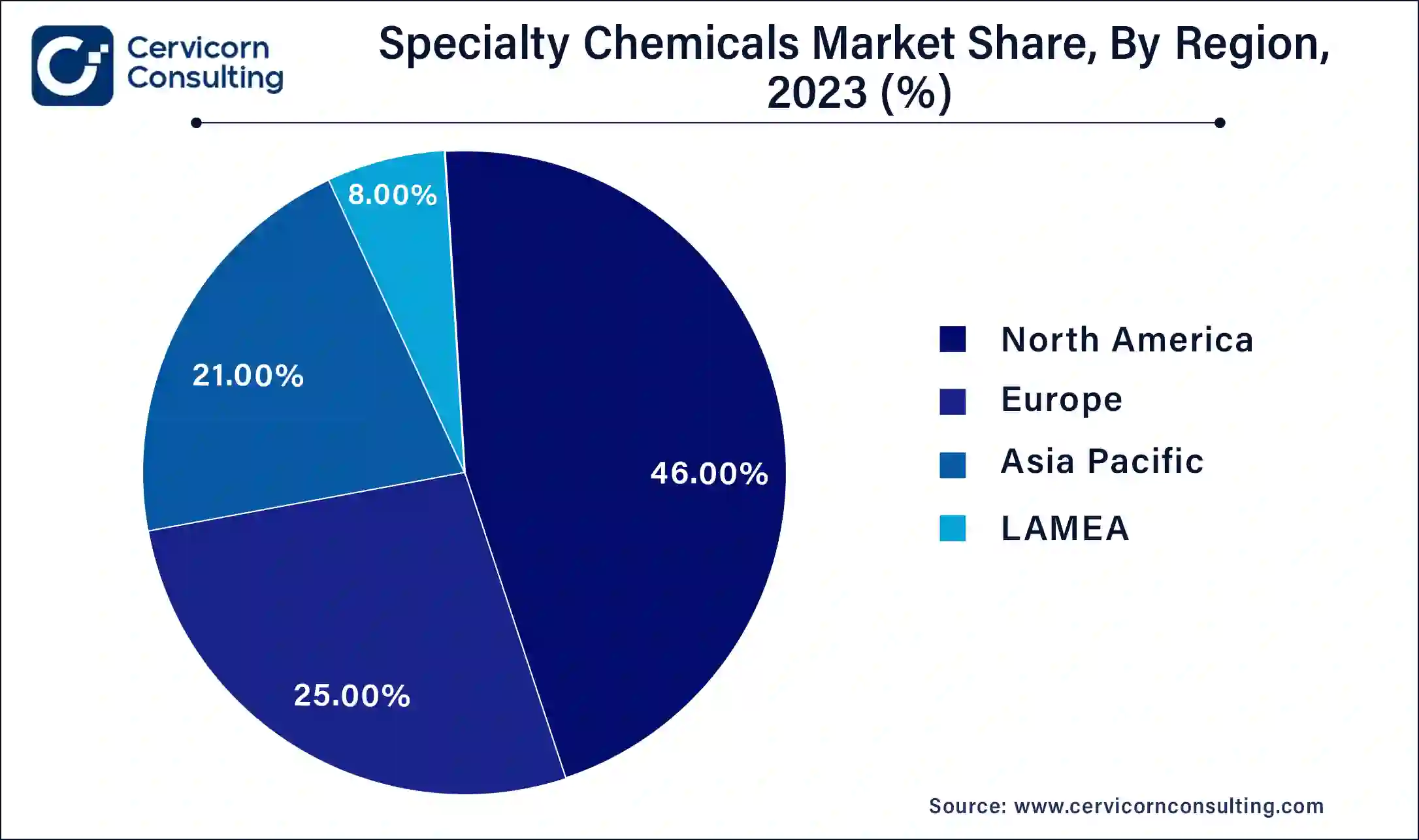

The Asia-Pacific region is the fastest-growing market for specialty chemicals, driven by rapid industrialization and urbanization in countries like China, India, and Japan. Asia Pacific market size is calculated at USD 416.11 billion in 2024 and is projected to grow around USD 575.06 billion by 2033. The region benefits from a large consumer base and increasing investments in infrastructure and manufacturing. Cost-effective production and availability of raw materials are key advantages. However, environmental concerns and regulatory challenges are emerging as significant factors that companies must navigate to maintain sustainable growth.

The North American specialty chemicals market is characterized by advanced technological infrastructure and significant R&D investments. North America market size is expected to reach around USD 262.53 billion by 2033 increasing from USD 189.96 billion in 2024. The United States is a key player, driven by strong demand in sectors like automotive, construction, and healthcare. Environmental regulations and sustainability trends are major influences, pushing companies toward eco-friendly innovations. The presence of large multinational corporations and a robust supply chain further bolster market growth. However, competition and high operational costs pose challenges.

Europe specialty chemicals market benefits from stringent environmental regulations and a strong focus on sustainability. Countries like Germany, France, and the UK are leading in innovations, particularly in green chemistry and bio-based chemicals. The automotive and construction industries are major consumers. Europe market size is measured at USD 226.15 billion in 2024 and is expected to grow around USD 312.53 billion by 2033. The European Union’s regulatory framework drives compliance and safety standards, promoting high-quality products. However, economic fluctuations and Brexit-related uncertainties present potential challenges to market stability and growth.

The LAMEA specialty chemicals market is diverse, with growth driven by industrialization and infrastructural developments, particularly in Brazil, South Africa, and the UAE. LAMEA market size is forecasted to reach around USD 100.01 billion by 2033 from USD 72.37 billion in 2024. The oil and gas sector in the Middle East is a significant contributor to the market. Agricultural chemicals see high demand in Latin America. However, the region faces challenges such as political instability, economic volatility, and varying regulatory standards, which can impact market dynamics and growth prospects.

Arkema SA and Albemarle Corporation are emerging players in the specialty chemicals market, focusing on sustainable materials and eco-friendly solutions, and concentrating on lithium production for electric vehicle batteries. Dominating players like BASF SE, Dow Inc., and Evonik Industries AG lead through extensive R&D, diversified product portfolios, and specialization in high-performance materials. These leaders drive market innovation through strategic collaborations: BASF has partnered with Siemens to enhance digitalization in chemical production, Dow Inc. works with tech companies on sustainable packaging, and Evonik advances biotechnology and nanotechnology through partnerships with universities and research institutions. These efforts are crucial for sustaining growth and leadership in the market.

BASF SE - Dr. Martin Brudermüller, Chairman of the Board of Executive Directors and Chief Technology Officer

"At BASF, we are committed to driving sustainable innovation through cutting-edge R&D. Our collaboration with industry leaders and investment in digitalization ensures we remain at the forefront of the specialty chemicals market, delivering value to our customers and society."

Dow Inc. - Jim Fitterling, Chairman and CEO

"Dow's focus on advanced material science and sustainable solutions positions us to meet the evolving needs of our customers. By leveraging our technological expertise and collaborating with partners, we are shaping a more sustainable future for the chemical industry."

Evonik Industries AG - Christian Kullmann, Chairman of the Executive Board and CEO

"Innovation and sustainability are at the heart of Evonik's strategy. Our investments in high-performance materials and biotechnology, combined with strategic partnerships, enable us to drive growth and deliver solutions that meet the global demand for advanced specialty chemicals."

Arkema SA - Thierry Le Hénaff, Chairman and CEO

"Arkema's commitment to sustainable development is reflected in our focus on eco-friendly materials and solutions. We are dedicated to advancing our portfolio through innovation and strategic collaborations, addressing the critical challenges of today and tomorrow."

Albemarle Corporation - Kent Masters, Chairman, President, and CEO

"At Albemarle, we are leveraging our expertise in lithium production to support the growing electric vehicle market. Our focus on sustainability and technological innovation ensures we are well-positioned to meet the increasing global demand for clean energy solutions."

Market Segmentation

By Application

By Regions

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Specialty Chemicals

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Application Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Specialty Chemicals Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Global Supply Chain Resilience

4.1.1.2 Advanced Manufacturing Technologies

4.1.2 Market Restraints

4.1.2.1 Regulatory Challenges

4.1.2.2 Volatility in Raw Material Prices

4.1.3 Market Opportunity

4.1.3.1 Sustainability

4.1.3.2 Digital Transformation

4.1.4 Market Challenges

4.1.4.1 Technological Obsolescence

4.1.4.2 Environmental Impact

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Specialty Chemicals Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Specialty Chemicals Market, By Application

6.1 Global Specialty Chemicals Market Snapshot, By Application

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

6.1.1.1 Adhesives

6.1.1.2 Water Treatment Chemicals

6.1.1.3 Electronic Chemicals

6.1.1.4 Rubber Additives

6.1.1.5 Lubricating Oil Additives

6.1.1.6 Cosmetic Ingredients

6.1.1.7 Advanced Ceramic Materials

6.1.1.8 Plastic Additives

6.1.1.9 Specialty Oilfield Chemicals

6.1.1.10 Textile Chemicals

Chapter 7 Specialty Chemicals Market, By Region

7.1 Overview

7.2 Specialty Chemicals Market Revenue Share, By Region 2023 (%)

7.3 Global Specialty Chemicals Market, By Region

7.3.1 Market Size and Forecast

7.4 North America

7.4.1 North America Specialty Chemicals Market Revenue, 2021-2033 ($Billion)

7.4.2 Market Size and Forecast

7.4.3 North America Specialty Chemicals Market, By Country

7.4.4 U.S.

7.4.4.1 U.S. Specialty Chemicals Market Revenue, 2021-2033 ($Billion)

7.4.4.2 Market Size and Forecast

7.4.4.3 U.S. Market Segmental Analysis

7.4.5 Canada

7.4.5.1 Canada Specialty Chemicals Market Revenue, 2021-2033 ($Billion)

7.4.5.2 Market Size and Forecast

7.4.5.3 Canada Market Segmental Analysis

7.4.6 Mexico

7.4.6.1 Mexico Specialty Chemicals Market Revenue, 2021-2033 ($Billion)

7.4.6.2 Market Size and Forecast

7.4.6.3 Mexico Market Segmental Analysis

7.5 Europe

7.5.1 Europe Specialty Chemicals Market Revenue, 2021-2033 ($Billion)

7.5.2 Market Size and Forecast

7.5.3 Europe Specialty Chemicals Market, By Country

7.5.4 UK

7.5.4.1 UK Specialty Chemicals Market Revenue, 2021-2033 ($Billion)

7.5.4.2 Market Size and Forecast

7.5.4.3 UK Market Segmental Analysis

7.5.5 France

7.5.5.1 France Specialty Chemicals Market Revenue, 2021-2033 ($Billion)

7.5.5.2 Market Size and Forecast

7.5.5.3 France Market Segmental Analysis

7.5.6 Germany

7.5.6.1 Germany Specialty Chemicals Market Revenue, 2021-2033 ($Billion)

7.5.6.2 Market Size and Forecast

7.5.6.3 Germany Market Segmental Analysis

7.5.7 Rest of Europe

7.5.7.1 Rest of Europe Specialty Chemicals Market Revenue, 2021-2033 ($Billion)

7.5.7.2 Market Size and Forecast

7.5.7.3 Rest of Europe Market Segmental Analysis

7.6 Asia Pacific

7.6.1 Asia Pacific Specialty Chemicals Market Revenue, 2021-2033 ($Billion)

7.6.2 Market Size and Forecast

7.6.3 Asia Pacific Specialty Chemicals Market, By Country

7.6.4 China

7.6.4.1 China Specialty Chemicals Market Revenue, 2021-2033 ($Billion)

7.6.4.2 Market Size and Forecast

7.6.4.3 China Market Segmental Analysis

7.6.5 Japan

7.6.5.1 Japan Specialty Chemicals Market Revenue, 2021-2033 ($Billion)

7.6.5.2 Market Size and Forecast

7.6.5.3 Japan Market Segmental Analysis

7.6.6 India

7.6.6.1 India Specialty Chemicals Market Revenue, 2021-2033 ($Billion)

7.6.6.2 Market Size and Forecast

7.6.6.3 India Market Segmental Analysis

7.6.7 Australia

7.6.7.1 Australia Specialty Chemicals Market Revenue, 2021-2033 ($Billion)

7.6.7.2 Market Size and Forecast

7.6.7.3 Australia Market Segmental Analysis

7.6.8 Rest of Asia Pacific

7.6.8.1 Rest of Asia Pacific Specialty Chemicals Market Revenue, 2021-2033 ($Billion)

7.6.8.2 Market Size and Forecast

7.6.8.3 Rest of Asia Pacific Market Segmental Analysis

7.7 LAMEA

7.7.1 LAMEA Specialty Chemicals Market Revenue, 2021-2033 ($Billion)

7.7.2 Market Size and Forecast

7.7.3 LAMEA Specialty Chemicals Market, By Country

7.7.4 GCC

7.7.4.1 GCC Specialty Chemicals Market Revenue, 2021-2033 ($Billion)

7.7.4.2 Market Size and Forecast

7.7.4.3 GCC Market Segmental Analysis

7.7.5 Africa

7.7.5.1 Africa Specialty Chemicals Market Revenue, 2021-2033 ($Billion)

7.7.5.2 Market Size and Forecast

7.7.5.3 Africa Market Segmental Analysis

7.7.6 Brazil

7.7.6.1 Brazil Specialty Chemicals Market Revenue, 2021-2033 ($Billion)

7.7.6.2 Market Size and Forecast

7.7.6.3 Brazil Market Segmental Analysis

7.7.7 Rest of LAMEA

7.7.7.1 Rest of LAMEA Specialty Chemicals Market Revenue, 2021-2033 ($Billion)

7.7.7.2 Market Size and Forecast

7.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 8 Competitive Landscape

8.1 Competitor Strategic Analysis

8.1.1 Top Player Positioning/Market Share Analysis

8.1.2 Top Winning Strategies, By Company, 2021-2023

8.1.3 Competitive Analysis By Revenue, 2021-2023

8.2 Recent Developments by the Market Contributors (2023)

Chapter 9 Company Profiles

9.1 BASF SE

9.1.1 Company Snapshot

9.1.2 Company and Business Overview

9.1.3 Financial KPIs

9.1.4 Product/Service Portfolio

9.1.5 Strategic Growth

9.1.6 Global Footprints

9.1.7 Recent Development

9.1.8 SWOT Analysis

9.2 Dow Inc.

9.3 Evonik Industries AG

9.4 Clariant AG

9.5 AkzoNobel N.V.

9.6 Solvay SA

9.7 Huntsman Corporation

9.8 Arkema SA

9.9 Albemarle Corporation

9.10 Eastman Chemical Company