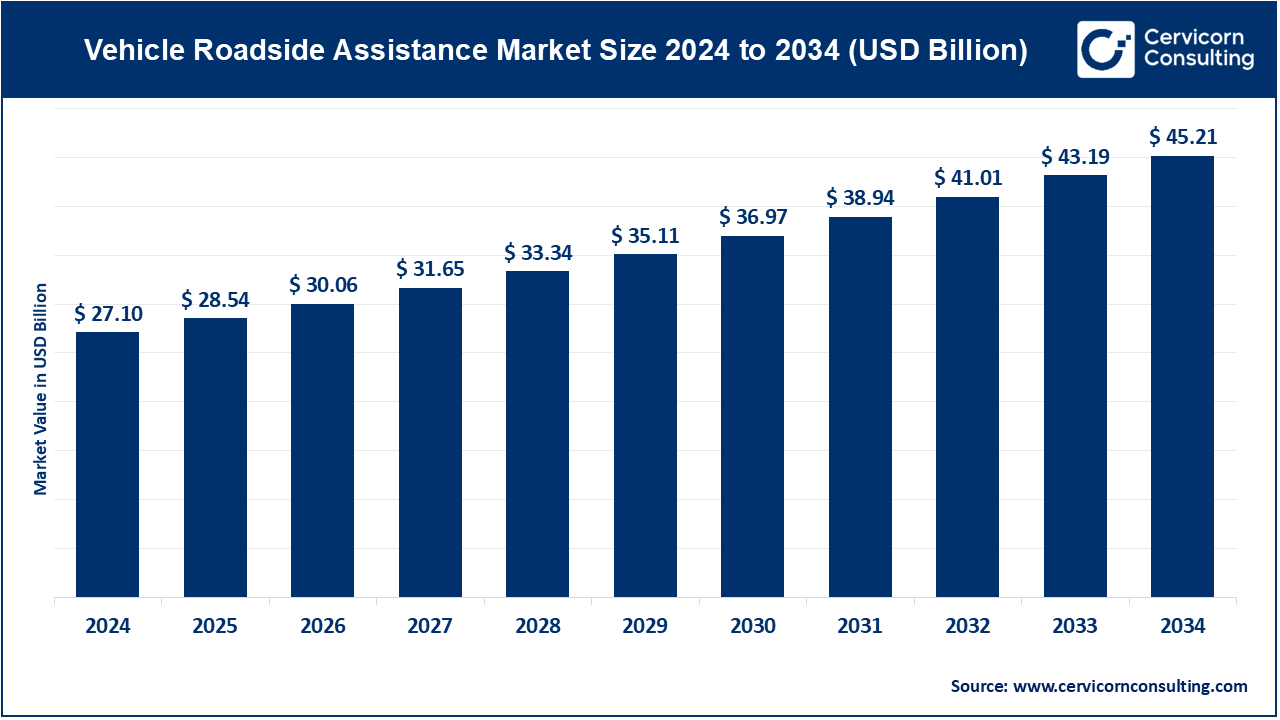

The global vehicle roadside assistance market size was registered USD 27.1 billion in 2024 and is estimated to reach around USD 45.21 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.31% from 2025 to 2034.

The global vehicle roadside assistance market has experienced significant growth in recent years, driven by factors such as increasing vehicle ownership, the rising demand for convenience, and the growing need for emergency services. With more vehicles on the road and an increase in long-distance driving, the demand for roadside assistance services is steadily rising. Consumers increasingly recognize the value of having immediate support in case of breakdowns or emergencies, which has led to the expansion of these services. Additionally, the integration of advanced technologies, such as GPS tracking and mobile applications, has made it easier for service providers to offer quicker and more efficient assistance. The market is expected to continue its upward trajectory, with a growing number of partnerships between automotive manufacturers, insurance companies, and service providers. In particular, the rise of connected vehicles and the advent of autonomous driving technology will create new opportunities for roadside assistance companies.

Vehicle roadside assistance is a service provided by companies to help drivers when their vehicle breaks down or encounters an emergency while on the road. This assistance typically includes services such as battery jump-starts, tire changes, fuel delivery, lockout assistance, and towing. Roadside assistance services can be available through insurance policies, standalone service providers, or as part of a vehicle's warranty plan. The service is accessible 24/7, ensuring drivers have immediate help in case of unexpected issues. Roadside assistance plays a crucial role in ensuring drivers' safety, offering convenience, and minimizing the stress of dealing with vehicle breakdowns. The service is offered through various subscription plans, and many mobile apps allow users to request help in real-time.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 28.54 Billion |

| Market Growth Rate | CAGR of 5.31% from 2025 to 2034 |

| Market Size by 2034 | USD 45.21 Billion |

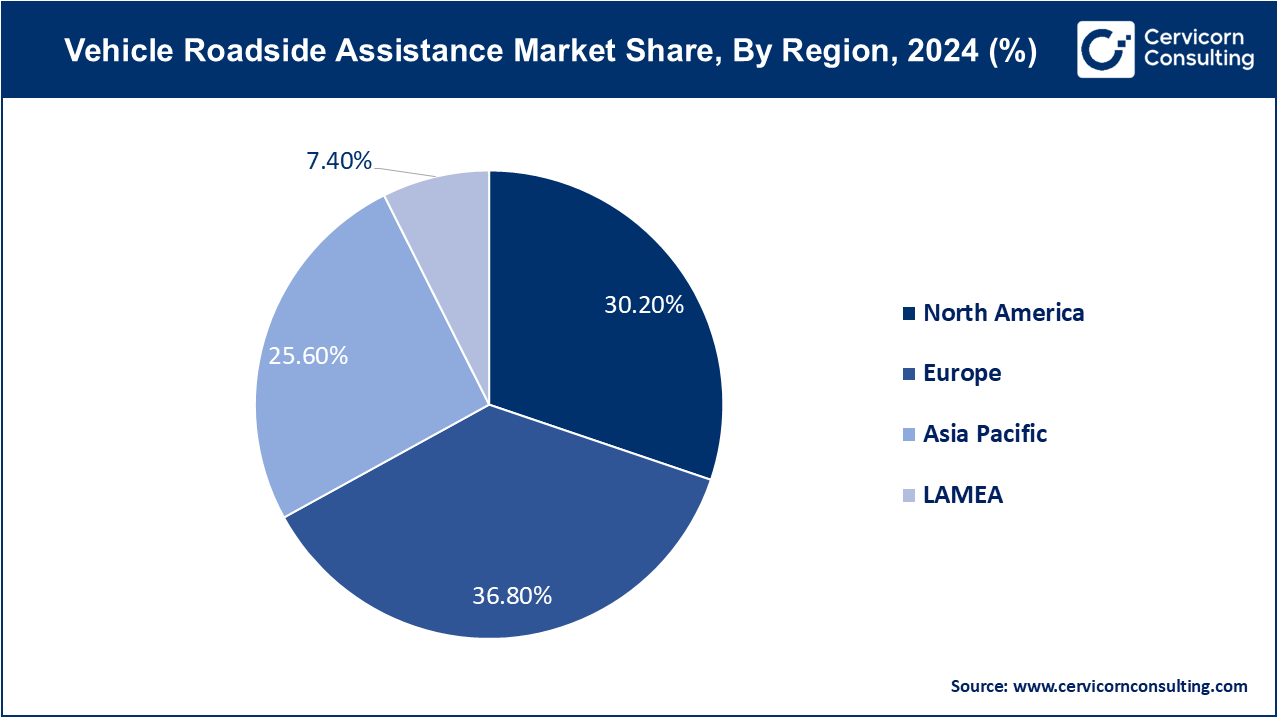

| Largest Market | Europe |

| Fastest Growing Market | Asia Pacific |

| Segment Coverage | By Vehicle Type, Service Type, Providers and Regions |

Increasing Complexity of Vehicles

Rise in Mobility Services

Cost Concerns:

Technological Challenges:

Expansion of Electric Vehicles (EVs)

Integration of Artificial Intelligence (AI) and Machine Learning

Geographical Coverage and Accessibility

Customer Expectations and Service Differentiation

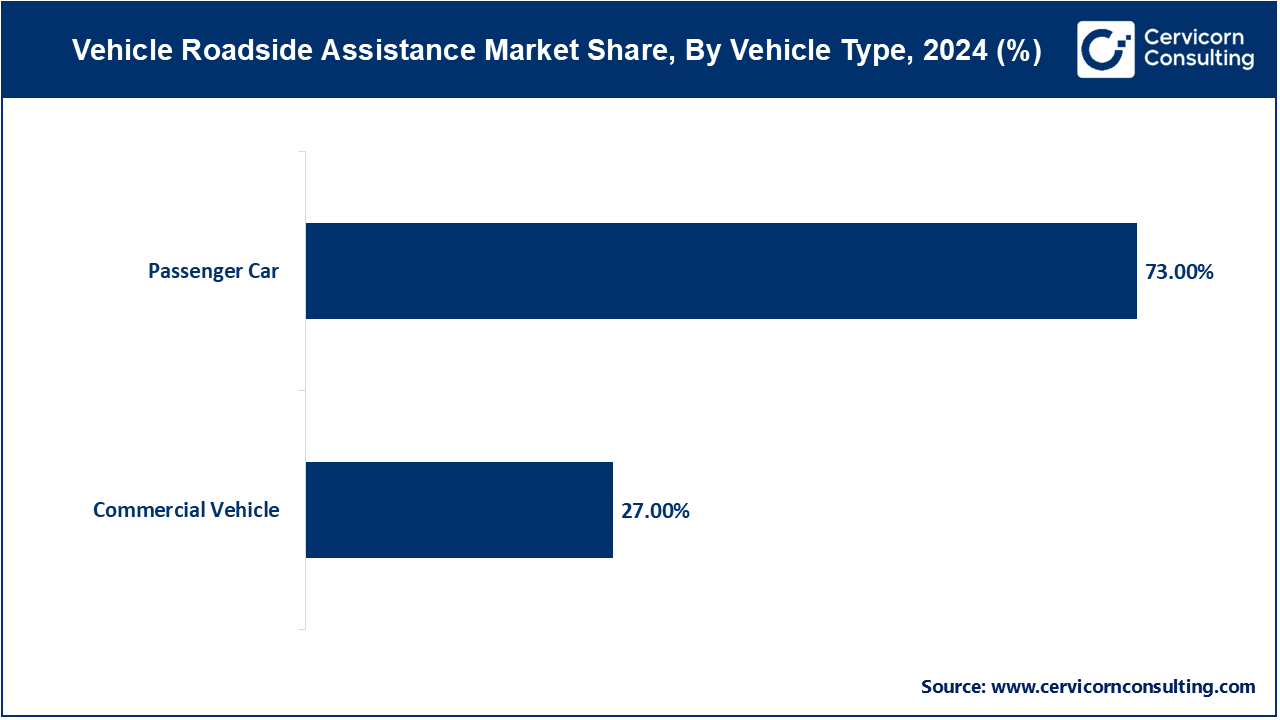

Passenger Car: The passenger car segment has recorded dominating market share of 73% in 2024. The increasing number of passenger cars on the roads globally drives the demand for roadside assistance services. Passenger car owners seek immediate assistance for common issues like flat tires, battery failures, and lockouts. Service providers are focusing on fast response times, mobile app integration for easy requests, and specialized services such as battery jump-starts and towing tailored for smaller vehicles.

Commercial Vehicle: This segment has captured market share of 27% in 2024. Commercial vehicles, including trucks, buses, and delivery vans, require specialized roadside assistance due to their size, load capacity, and unique mechanical issues. Service providers in this segment offer heavy-duty towing, tire replacements for large vehicles, and expedited repair services to minimize downtime. With the growth of logistics and transportation sectors, there's a rising need for fleet-specific services, real-time tracking, and regulatory compliance support in the commercial vehicle roadside assistance market.

Towing: Towing services remain a core offering in the roadside assistance market, driven by the need to transport vehicles involved in accidents, breakdowns, or collisions to repair facilities. Trends include the integration of GPS-enabled dispatch systems for faster response times and specialized towing equipment capable of handling diverse vehicle types, including electric and hybrid vehicles.

Tire Replacement: As flat tires are a common roadside issue, tire replacement services are essential. Market trends include mobile tire replacement units equipped to handle various tire sizes and vehicle types swiftly. Providers are adopting eco-friendly tire disposal practices and offering tire warranty programs to enhance service reliability and customer satisfaction.

Fuel Delivery: Fuel delivery services cater to drivers who run out of gas unexpectedly. Providers leverage real-time GPS tracking and mobile app functionalities to dispatch assistance swiftly. Market drivers include increasing vehicle mileage and the popularity of long-distance travel, necessitating reliable fuel delivery solutions to prevent roadside incidents.

Others: Additional roadside assistance services encompass a range of offerings such as battery jump-starts, lockout assistance, and minor mechanical repairs. Market trends include the integration of smart roadside assistance technologies like automated diagnostics and remote vehicle monitoring. Providers are expanding service portfolios to include more comprehensive and personalized assistance options to meet evolving customer needs and enhance service differentiation.

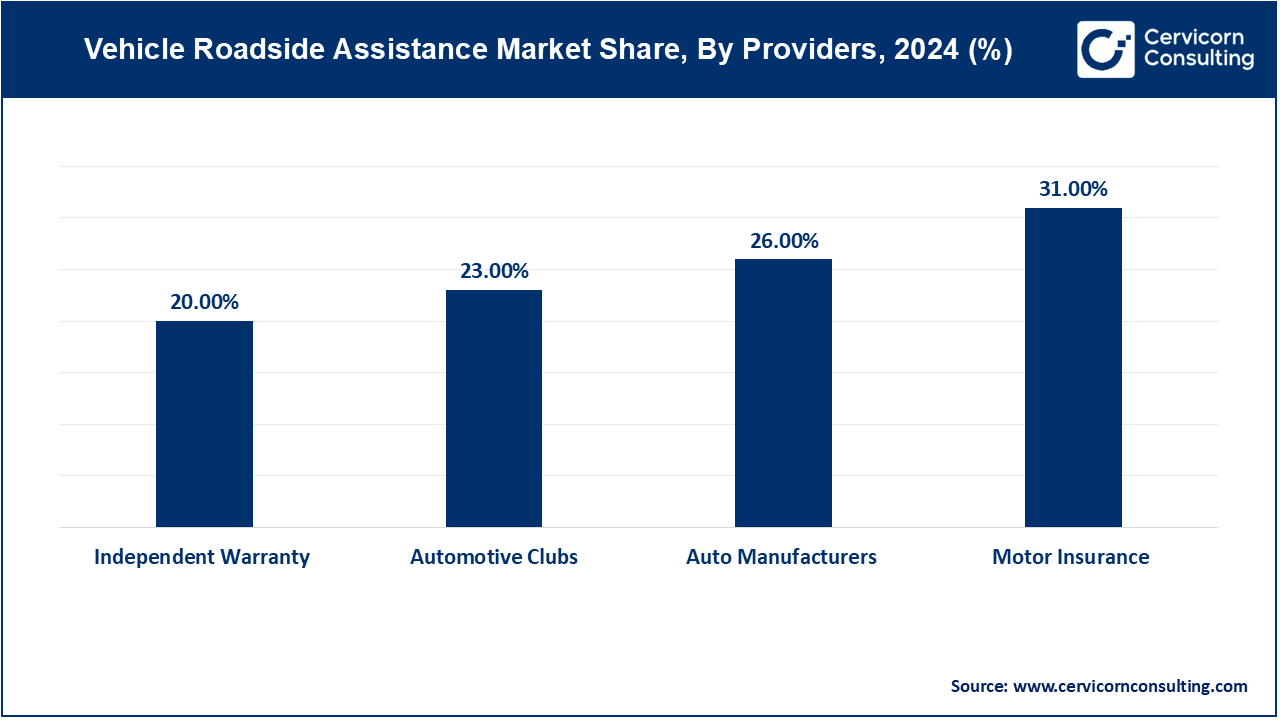

Auto Manufacturers: This segment has measured market share of 26% in 2024. Auto manufacturers are increasingly integrating roadside assistance into vehicle purchase packages to enhance customer satisfaction and brand loyalty. Trends include OEMs offering extended service plans, proactive maintenance alerts, and mobile app integrations for seamless assistance. Manufacturers leverage their dealer networks and global reach to provide timely roadside services tailored to their vehicles' specific needs.

Motor Insurance: The motor insurance segment has reported share of 31% in the year of 2024. Motor insurance companies include roadside assistance in their policies to attract and retain customers. Market trends focus on pay-per-usage plans, personalized service bundles, and digital claims processing to streamline customer interactions. Insurers collaborate with roadside assistance providers to offer comprehensive coverage options, roadside repair reimbursements, and automated claims management, optimizing customer convenience and satisfaction.

Independent Warranty: In 2024 this segment has generated market share of 20%. Independent warranty providers offer roadside assistance as an add-on service to vehicle warranties, catering to consumers seeking extended coverage beyond manufacturer warranties. Market drivers include competitive pricing, flexible service plans, and partnerships with national service networks to ensure nationwide coverage. Trends include enhanced roadside service options, such as emergency lodging and rental vehicle reimbursement, to differentiate offerings in a crowded market.

Automotive Clubs: The automotive clubs segment has acquired market share of 23% in 2024. Automotive clubs like AAA provide members with comprehensive roadside assistance services as part of membership benefits. Market trends include loyalty programs, digital membership platforms, and specialized services like travel planning and vehicle diagnostics. Clubs leverage their extensive service networks, roadside assistance history, and customer trust to innovate in service delivery and expand membership benefits in competitive markets.

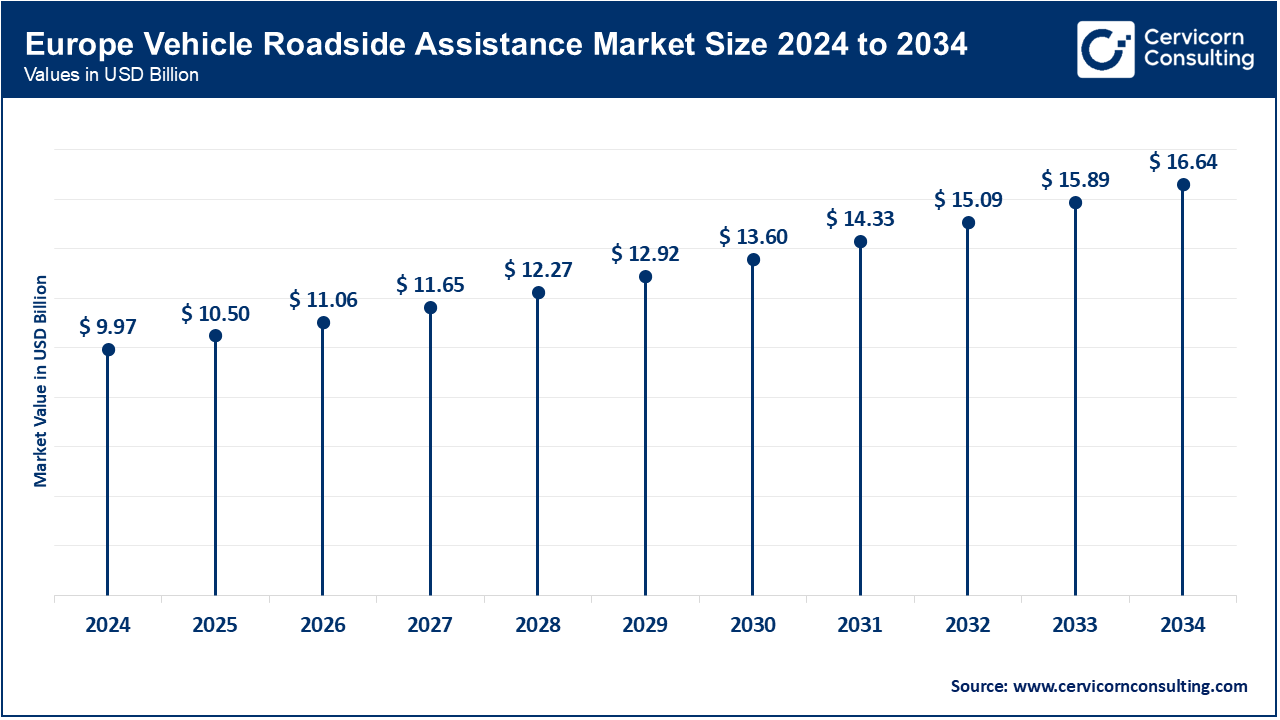

Europe Vehicle Roadside Assistance market benefits from a dense road network and stringent vehicle safety standards. Key drivers include a growing fleet of electric vehicles, increasing demand for eco-friendly roadside services, and regulatory mandates for vehicle maintenance. Europe market size is measured at USD 9.97 billion in 2024 and is expected to grow around USD 16.64 billion by 2034. Service providers in Europe emphasize sustainable practices, mobile app integration for service requests, and specialized assistance for hybrid and electric vehicles to meet evolving customer expectations.

Asia-Pacific emerges as a significant growth region in the Vehicle Roadside Assistance market due to expanding urbanization, rising disposable incomes, and increasing vehicle sales. Asia Pacific market size is calculated at USD 6.94 billion in 2024 and is projected to grow around USD 11.57 billion by 2034. Market trends include the adoption of mobile-based roadside assistance platforms, growth in fleet management services, and partnerships with automotive manufacturers. Providers focus on enhancing service reach in populous cities and remote regions, offering tailored solutions for diverse vehicle types and customer preferences.

North America leads the Vehicle Roadside Assistance market with a robust infrastructure and high vehicle ownership rates. The region's market is driven by a large fleet of passenger and commercial vehicles, stringent safety regulations, and technological advancements in roadside assistance services. North America market size is expected to reach around USD 13.65 billion by 2034 increasing from USD 8.18 billion in 2024. Providers in North America focus on rapid response times, advanced towing capabilities, and digital service enhancements to cater to diverse customer needs across urban and rural areas.

LAMEA Vehicle Roadside Assistance market experiences steady growth driven by improving road infrastructure, economic development, and increasing vehicle penetration. LAMEA market size is forecasted to reach around USD 3.35 billion by 2034 from USD 2.01 billion in 2024. Market dynamics include a focus on affordability, expanding service networks in rural areas, and partnerships with local automotive service providers. Providers in LAMEA emphasize responsive customer service, bilingual support, and customized roadside solutions to address regional challenges and enhance market penetration.

Emerging players are leveraging advanced technology and customer-centric strategies to introduce disruptive innovations, such as newcomers like Honk Technologies prioritize mobile app-based service functionalities, providing real-time tracking and transparent pricing models. These initiatives emphasize enhanced convenience, digital connectivity, and tailored service options aimed at appealing to a tech-savvy customers. Dominating players such as AAA and Agero are leading through expansive service networks, swift response capabilities, and comprehensive service portfolios. They drive market innovation by collaborating closely with automotive manufacturers to integrate roadside assistance seamlessly into vehicle platforms.

Additionally, these market leaders employ AI-powered dispatch systems and predictive analytics to optimize service operations, ensuring operational efficiency and delivering superior customer satisfaction.

AAA (American Automobile Association), CEO

"AAA remains committed to providing our members with unparalleled roadside assistance, ensuring peace of mind on every journey."

Allstate Roadside Services, CEO

"At Allstate Roadside Services, we are dedicated to delivering fast, reliable assistance that helps keep drivers safe and on the move."

Agero CEO

"Agero is focused on innovation and customer-centric solutions to redefine roadside assistance and support drivers wherever they are."

National General Motor Club CEO

"Our commitment at National General Motor Club is to provide responsive and dependable roadside assistance that exceeds our members' expectations."

These statements reflect the companies' dedication to providing high-quality roadside assistance services and their emphasis on customer satisfaction and innovation in the industry.

Market Segmentation

By Vehicle Type

By Service Type

By Providers

By Regions

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Vehicle Roadside Assistance

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Vehicle Type Overview

2.2.2 By Service Type Overview

2.2.3 By Providers Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Vehicle Roadside Assistance Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing Complexity of Vehicles

4.1.1.2 Rise in Mobility Services

4.1.2 Market Restraints

4.1.2.1 Cost Concerns

4.1.2.2 Technological Challenges

4.1.3 Market Opportunity

4.1.3.1 Expansion of Electric Vehicles (EVs)

4.1.3.2 Integration of Artificial Intelligence (AI) and Machine Learning

4.1.4 Market Challenges

4.1.4.1 Geographical Coverage and Accessibility

4.1.4.2 Customer Expectations and Service Differentiation

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Vehicle Roadside Assistance Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Vehicle Roadside Assistance Market, By Vehicle Type

6.1 Global Vehicle Roadside Assistance Market Snapshot, By Vehicle Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Passenger Car

6.1.1.2 Commercial Vehicle

Chapter 7 Vehicle Roadside Assistance Market, By Service Type

7.1 Global Vehicle Roadside Assistance Market Snapshot, By Service Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Towing

7.1.1.2 Tire Replacement

7.1.1.3 Fuel Delivery

7.1.1.4 Others

Chapter 8 Vehicle Roadside Assistance Market, By Providers

8.1 Global Vehicle Roadside Assistance Market Snapshot, By Providers

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Auto Manufacturers

8.1.1.2 Motor Insurance

8.1.1.3 Independent Warranty

8.1.1.4 Automotive Clubs

Chapter 9 Vehicle Roadside Assistance Market, By Region

9.1 Overview

9.2 Vehicle Roadside Assistance Market Revenue Share, By Region 2024 (%)

9.3 Global Vehicle Roadside Assistance Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Vehicle Roadside Assistance Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Vehicle Roadside Assistance Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Vehicle Roadside Assistance Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Vehicle Roadside Assistance Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Vehicle Roadside Assistance Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Vehicle Roadside Assistance Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Vehicle Roadside Assistance Market, By Country

9.5.4 UK

9.5.4.1 UK Vehicle Roadside Assistance Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UK Market Segmental Analysis

9.5.5 France

9.5.5.1 France Vehicle Roadside Assistance Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 France Market Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Vehicle Roadside Assistance Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 Germany Market Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Vehicle Roadside Assistance Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of Europe Market Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Vehicle Roadside Assistance Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Vehicle Roadside Assistance Market, By Country

9.6.4 China

9.6.4.1 China Vehicle Roadside Assistance Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 China Market Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Vehicle Roadside Assistance Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 Japan Market Segmental Analysis

9.6.6 India

9.6.6.1 India Vehicle Roadside Assistance Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 India Market Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Vehicle Roadside Assistance Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 Australia Market Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Vehicle Roadside Assistance Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia Pacific Market Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Vehicle Roadside Assistance Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Vehicle Roadside Assistance Market, By Country

9.7.4 GCC

9.7.4.1 GCC Vehicle Roadside Assistance Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCC Market Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Vehicle Roadside Assistance Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 Africa Market Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Vehicle Roadside Assistance Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 Brazil Market Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Vehicle Roadside Assistance Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 10 Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11 Company Profiles

11.1 Veolia Environnement S.A.

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Suez S.A.

11.3 Ecolab Inc.

11.4 Xylem Inc.

11.5 Danaher Corporation

11.6 Pentair plc

11.7 Aquatech International LLC

11.8 Evoqua Water Technologies LLC

11.9 Kurita Water Industries Ltd.

11.10 3M Company