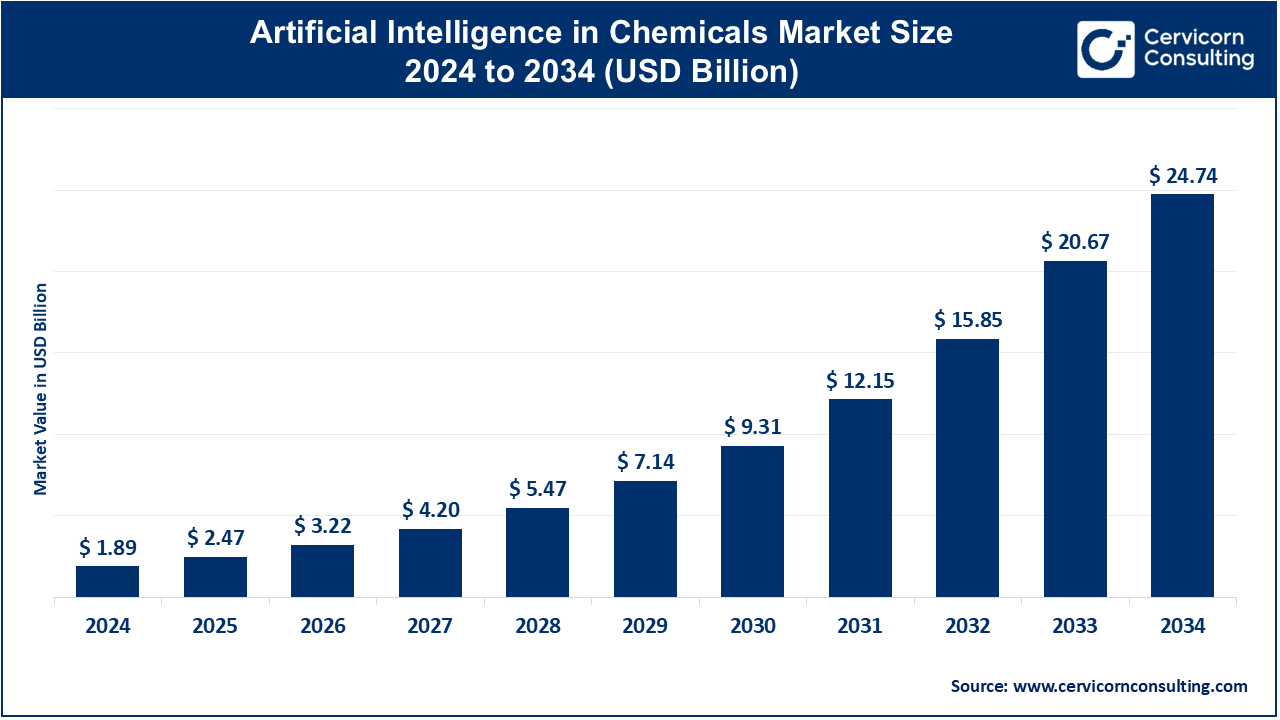

The global artificial intelligence (AI) in chemicals market size was accounted for USD 1.89 billion in 2024 and is expected to reach around USD 24.74 billion by 2034, growing at a compound annual growth rate (CAGR) of 29.33% over the forecast period 2025 to 2034.

The Artificial Intelligence (AI) in chemicals market is witnessing significant growth, driven by increasing demand for automation and efficiency within the industry. The adoption of AI technologies helps chemical companies reduce production costs, improve product quality, and optimize resource utilization. In particular, AI-powered tools assist in enhancing R&D capabilities, helping firms develop innovative products and solutions faster. The market for AI applications in the chemical industry is expanding rapidly due to the rising need for sustainable manufacturing practices and the shift towards digital transformation across industries. This growth is further fueled by investments from major chemical companies in AI-driven technologies, aiming to remain competitive in a rapidly evolving market. As AI continues to revolutionize chemical production and R&D, market forecasts suggest that the global market for AI in chemicals will experience substantial growth in the coming years.

Artificial Intelligence (AI) in chemicals refers to the application of AI technologies such as machine learning, data analytics, and optimization techniques to improve various processes in the chemical industry. AI in chemicals helps to streamline operations by enhancing research and development (R&D), accelerating chemical discovery, and optimizing production processes. By analyzing large sets of data, AI can identify patterns and predict chemical behaviors, aiding in the development of new materials, chemicals, and efficient production methods. It also plays a role in predictive maintenance, reducing equipment downtime, and increasing the safety and sustainability of operations. AI-powered tools are increasingly being used in chemical simulations, helping scientists and engineers predict reactions and optimize formulations.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 2.47 Billion |

| Market Growth Rate | CAG of 30.43% from 2025 to 2034 |

| Market Size by 2034 | USD 24.74 Billion |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Segment Coverage | By Type, Application, End Use and Regions |

Regulatory Pressure for Innovation

Rising Demand for Customized Chemicals

High Initial Investment and Implementation Costs

Data Privacy and Security Concerns

Enhanced Predictive Maintenance

Sustainable Chemical Production

Data Quality and Integration:

Skill Gap and Workforce Adaptation:

The AI in chemicals market is segmented into type, application, end use and region. Based on type, the market is classified into hardware, software, and services. Based on application, the market is classified into discovery of new materials, production optimization, pricing optimization, and others. Based on end use, the market is classified into base chemicals & petrochemicals, specialty chemicals, and agrochemicals.

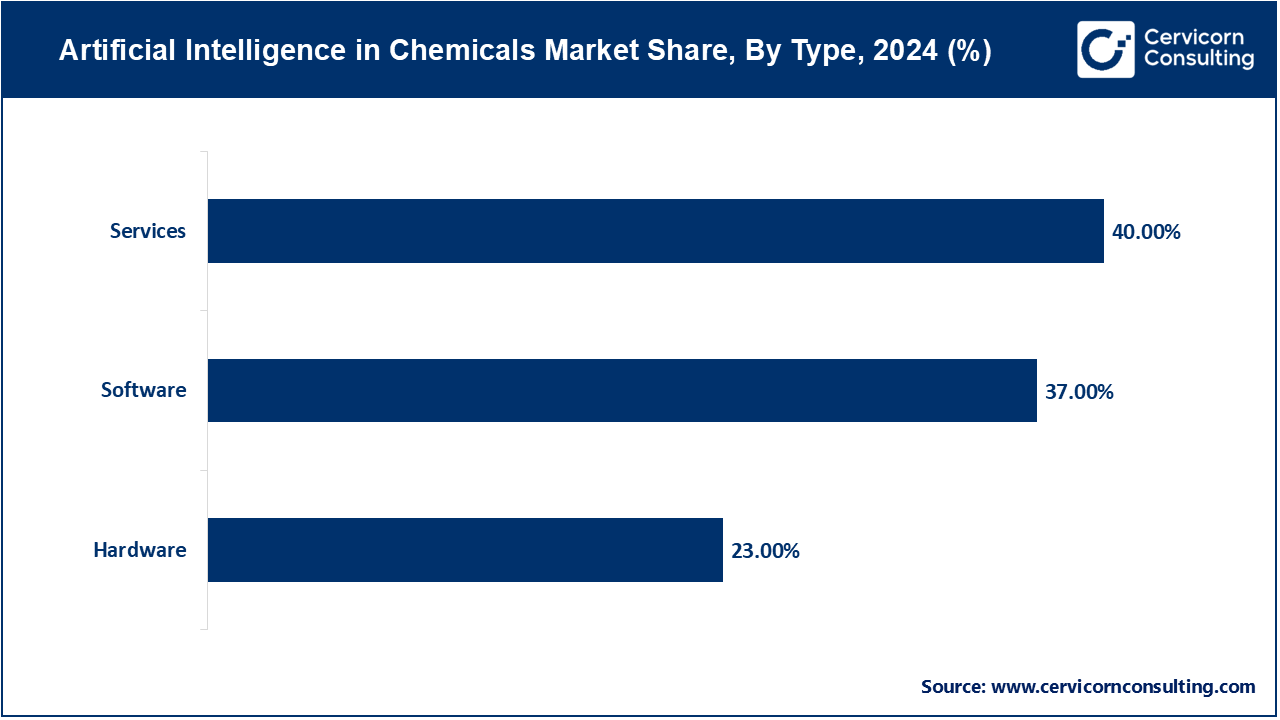

Hardware: The hardware Segment has covered market share of 23% in 2024. The hardware segment in the AI chemicals market includes specialized processors, sensors, and devices essential for AI implementation. The trend towards edge computing and increased processing power in AI hardware is driving innovation in real-time data analysis and automation. Advanced AI hardware enhances precision in chemical experiments, supports large-scale simulations, and accelerates complex computations in research and development.

Software: In 2024 this segment has generated second highest market share of 37%. AI software in the chemicals market encompasses machine learning algorithms, data analytics platforms, and predictive modeling tools. The growing adoption of AI-driven software for optimizing chemical processes, improving safety, and enhancing product quality is a significant trend. Software advancements enable more accurate simulations, faster drug discovery, and efficient management of supply chains, thereby driving operational efficiency and cost reduction.

Services: The services segment has registered highest market share of 40% in 2024. The services segment involves consulting, implementation, and maintenance of AI systems in the chemicals industry. There is a rising demand for AI integration services to ensure seamless adoption and customization of AI solutions to meet specific industrial needs. The trend towards outsourcing AI expertise and managed services is driving growth, as companies seek to leverage external expertise for continuous improvement and innovation in their AI initiatives.

Discovery of New Materials: The discovery of new materials segment has reported market share of 10.6% in 2024. AI accelerates the discovery of new materials in the chemicals market by utilizing machine learning algorithms to predict material properties and behaviors. This speeds up R&D, reduces costs, and enables the development of innovative products with enhanced performance and sustainability, meeting the growing demand for advanced and eco-friendly materials.

Production Optimization: This segment has accounted market share of 10.22% in 2024. In production optimization, AI enhances efficiency and reduces waste by analyzing data from various stages of the manufacturing process. Predictive analytics and machine learning models identify bottlenecks, optimize production schedules, and fine-tune operations, leading to increased yield, lower costs, and improved overall productivity in chemical manufacturing.

Pricing Optimization: The pricing optimization segment has calculated market share of 10.15% in 2024. AI-driven pricing optimization leverages data analytics to set competitive prices for chemical products. By considering factors such as market demand, competitor pricing, production costs, and customer behavior, AI algorithms help companies maximize profits, improve market share, and respond dynamically to market changes, ensuring optimal pricing strategies.

Load Forecasting of Raw Materials: This segment has confirmed market share of 9.95% in 2024. AI in load forecasting predicts the demand and supply of raw materials, helping chemical companies maintain optimal inventory levels. Machine learning models analyze historical data, market trends, and external factors to accurately forecast raw material needs, minimizing stockouts and overstock situations, and ensuring a smooth and cost-effective supply chain.

Product Portfolio Optimization: The product portfolio optimization segment has garnered market share of 9.4% in the year of 2024. AI aids in product portfolio optimization by analyzing market trends, customer preferences, and competitive landscapes. This enables chemical companies to streamline their product offerings, focus on high-demand and high-margin products, and identify gaps in the market, ultimately enhancing profitability and aligning with strategic business goals.

Feedstock Optimization: In 2024 this segment has achieved market share of 9.14%. AI optimizes feedstock utilization by analyzing feedstock properties, availability, and costs. Advanced algorithms recommend the best mix of raw materials for production, ensuring cost efficiency, sustainability, and consistent product quality. This helps chemical manufacturers adapt to fluctuating raw material markets and reduce overall production costs.

Process Management & Control: The process management and control segment market share was valued at 9.98% in 2024. AI enhances process management and control by providing real-time monitoring and predictive maintenance. Machine learning models detect anomalies, predict equipment failures, and suggest optimal operational parameters. This ensures smooth and efficient production processes, reduces downtime, and extends the lifespan of machinery, leading to cost savings and higher productivity.

Base Chemicals & Petrochemicals: This segment has captued highest market share of 57.55% in 2024. In the base chemicals and petrochemicals sector, AI enhances production efficiency, safety, and sustainability. It optimizes feedstock usage, predicts equipment failures, and streamlines operations through real-time data analytics. AI-driven innovations help reduce costs, improve yield, and ensure compliance with environmental regulations, driving the adoption of AI in this segment.

Specialty Chemicals: The specialty chemicals segment has reported market share of 26.35% in 2024. AI in specialty chemicals focuses on innovation and customization. Machine learning algorithms enable the development of tailored chemical formulations, enhancing performance and meeting specific customer needs. AI also optimizes production processes, reduces time-to-market, and improves quality control, making it a key driver for growth and competitiveness in the specialty chemicals industry.

Agrochemicals: The agrochemicals has confired 16.1% market share in 2024. AI revolutionizes the agrochemicals market by improving crop protection, yield prediction, and resource efficiency. Advanced analytics and machine learning models aid in the development of more effective and sustainable agrochemical products. AI-driven precision agriculture techniques optimize pesticide and fertilizer usage, enhancing productivity and supporting sustainable farming practices, thus driving the market forward.

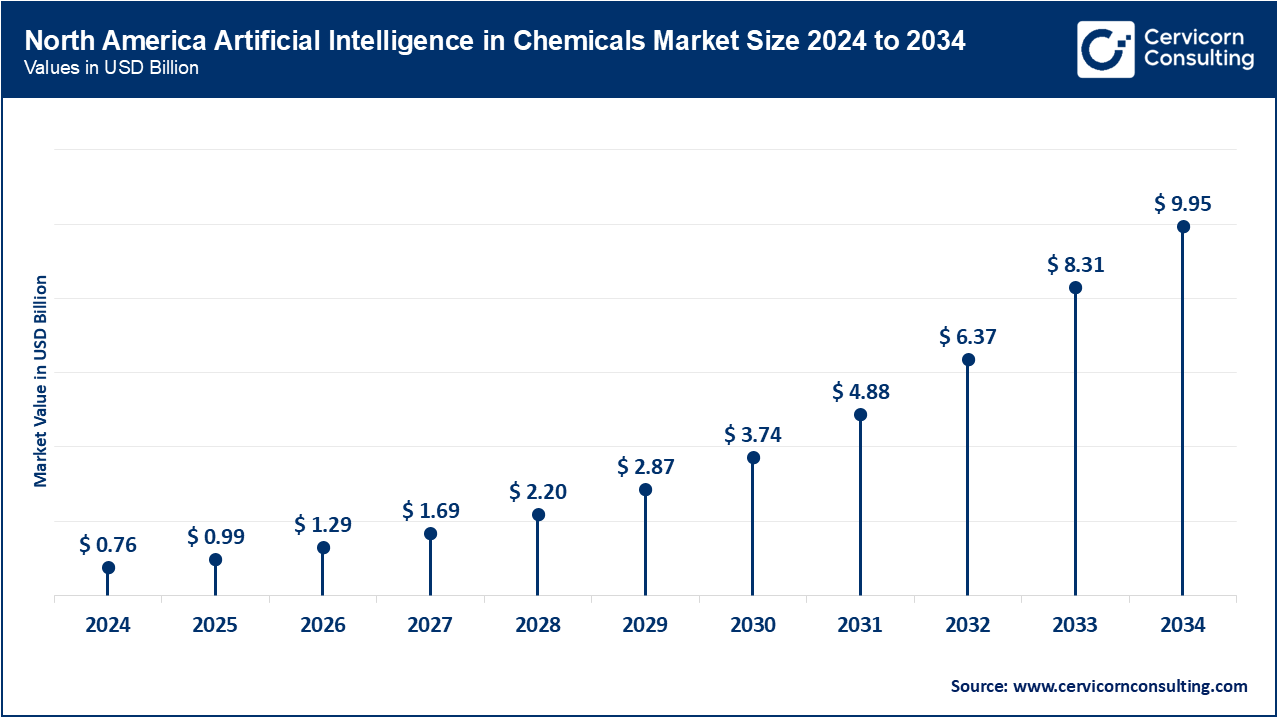

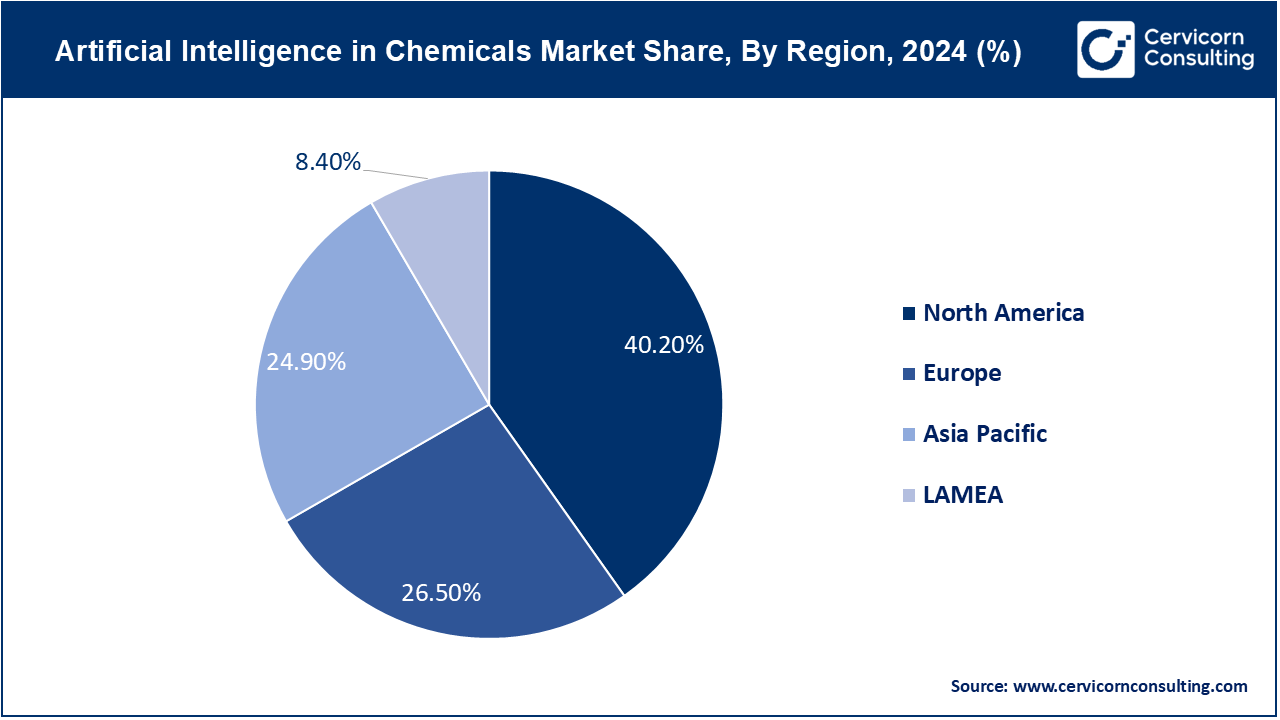

The North America market size is expected to reach around USD 9.95 billion by 2034 increasing from USD 0.76 billion in 2024 with a CAGR of 30.50%. North America leads in the AI in chemicals market due to its advanced technological infrastructure and significant investments in AI research and development. The region’s chemical industry benefits from strong collaboration between tech companies and chemical manufacturers. The presence of major AI and chemical companies, along with supportive government policies, accelerates AI adoption. Key drivers include optimizing production processes, reducing operational costs, and enhancing safety standards. The U.S. and Canada are the primary contributors, with a focus on innovation and sustainability in chemical manufacturing.

The Asia Pacific market size is calculated at USD 0.47 billion in 2024 and is projected to grow around USD 6.16 billion by 2034 with a CAGR of 30.62%. The Asia-Pacific is experiencing rapid growth in the AI in chemicals market, driven by the region’s expanding industrial base and increasing demand for chemicals. China, Japan, and South Korea lead in AI adoption, leveraging advanced technologies to optimize production, improve quality control, and reduce costs. The region benefits from significant investments in AI and a growing focus on smart manufacturing. Additionally, supportive government policies and initiatives to promote digitalization and innovation in the chemical industry contribute to the market’s expansion, making Asia-Pacific a key player in the global AI in chemicals market.

The Europe market size is measured at USD 0.50 billion in 2024 and is expected to grow around USD 6.56 billion by 2034 with a CAGR of 30.58%. Europe AI in chemicals market is driven by stringent environmental regulations and a strong focus on sustainability. The region is home to several leading chemical companies investing in AI to enhance production efficiency, reduce emissions, and develop eco-friendly products. Germany, the UK, and France are at the forefront of AI adoption, supported by robust R&D activities and government initiatives promoting digital transformation. The European Union’s emphasis on Industry 4.0 and smart manufacturing further propels AI integration in the chemical sector, aiming for greener and more efficient operations.

The LAMEA market size is forecasted to reach around USD 2.08 billion by 2034 from USD 0.16 billion in 2024 with a CAGR of 30.41%. The AI in chemicals market in LAMEA is growing, driven by increasing industrialization and the need for enhanced production efficiency. In Latin America, Brazil and Mexico lead AI adoption, focusing on optimizing manufacturing processes and improving competitiveness. The Middle East, with countries like Saudi Arabia and UAE, invests in AI to boost the petrochemical sector and diversify economies. Africa, although at an early stage, is gradually embracing AI to enhance chemical production and sustainability. Government initiatives and international collaborations play a crucial role in driving AI integration in the LAMEA chemical industry.

New players like Covestro AG and Clariant are leveraging AI for process optimization, sustainability, and product innovation. Covestro focuses on developing advanced material solutions and improving production efficiency, while Clariant enhances chemical manufacturing through AI-driven process improvements. Dominating players such as BASF SE, Dow Inc., and Royal Dutch Shell plc drive AI adoption through significant investments in R&D, strategic collaborations, and innovations. For instance, BASF partners with tech companies to enhance AI capabilities, Dow Inc. uses AI for predictive maintenance and supply chain optimization, and Shell employs AI to minimize environmental impact and improve operational efficiency. These efforts collectively propel the AI in chemicals market forward.

Market Segmentation

By Type

By Application

By End Use

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Artificial Intelligence (AI) in Chemicals

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Application Overview

2.2.3 By End Use Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Artificial Intelligence (AI) in Chemicals Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Regulatory Pressure for Innovation

4.1.1.2 Rising Demand for Customized Chemicals

4.1.2 Market Restraints

4.1.2.1 High Initial Investment and Implementation Costs

4.1.2.2 Data Privacy and Security Concerns

4.1.3 Market Opportunity

4.1.3.1 Enhanced Predictive Maintenance

4.1.3.2 Sustainable Chemical Production

4.1.4 Market Challenges

4.1.4.1 Data Quality and Integration

4.1.4.2 Skill Gap and Workforce Adaptation

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Artificial Intelligence (AI) in Chemicals Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Artificial Intelligence (AI) in Chemicals Market, By Type

6.1 Global Artificial Intelligence (AI) in Chemicals Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Hardware

6.1.1.2 Software

6.1.1.3 Services

Chapter 7 Artificial Intelligence (AI) in Chemicals Market, By Application

7.1 Global Artificial Intelligence (AI) in Chemicals Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Discovery of new materials

7.1.1.2 Production optimization

7.1.1.3 Pricing optimization

7.1.1.4 Load forecasting of raw materials

7.1.1.5 Product portfolio optimization

7.1.1.6 Feedstock optimization

7.1.1.7 Process management & control

7.1.1.8 Others

Chapter 8 Artificial Intelligence (AI) in Chemicals Market, By End Use

8.1 Global Artificial Intelligence (AI) in Chemicals Market Snapshot, By End Use

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Base Chemicals & Petrochemicals

8.1.1.2 Specialty Chemicals

8.1.1.3 Agrochemicals

Chapter 9 Artificial Intelligence (AI) in Chemicals Market, By Region

9.1 Overview

9.2 Artificial Intelligence (AI) in Chemicals Market Revenue Share, By Region 2024 (%)

9.3 Global Artificial Intelligence (AI) in Chemicals Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Artificial Intelligence (AI) in Chemicals Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Artificial Intelligence (AI) in Chemicals Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Artificial Intelligence (AI) in Chemicals Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Artificial Intelligence (AI) in Chemicals Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Artificial Intelligence (AI) in Chemicals Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Artificial Intelligence (AI) in Chemicals Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Artificial Intelligence (AI) in Chemicals Market, By Country

9.5.4 UK

9.5.4.1 UK Artificial Intelligence (AI) in Chemicals Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UK Market Segmental Analysis

9.5.5 France

9.5.5.1 France Artificial Intelligence (AI) in Chemicals Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 France Market Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Artificial Intelligence (AI) in Chemicals Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 Germany Market Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Artificial Intelligence (AI) in Chemicals Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of Europe Market Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Artificial Intelligence (AI) in Chemicals Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Artificial Intelligence (AI) in Chemicals Market, By Country

9.6.4 China

9.6.4.1 China Artificial Intelligence (AI) in Chemicals Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 China Market Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Artificial Intelligence (AI) in Chemicals Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 Japan Market Segmental Analysis

9.6.6 India

9.6.6.1 India Artificial Intelligence (AI) in Chemicals Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 India Market Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Artificial Intelligence (AI) in Chemicals Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 Australia Market Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Artificial Intelligence (AI) in Chemicals Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia Pacific Market Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Artificial Intelligence (AI) in Chemicals Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Artificial Intelligence (AI) in Chemicals Market, By Country

9.7.4 GCC

9.7.4.1 GCC Artificial Intelligence (AI) in Chemicals Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCC Market Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Artificial Intelligence (AI) in Chemicals Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 Africa Market Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Artificial Intelligence (AI) in Chemicals Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 Brazil Market Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Artificial Intelligence (AI) in Chemicals Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 10 Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11 Company Profiles

11.1 BASF SE

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Dow Inc.

11.3 ExxonMobil

11.4 Royal Dutch Shell plc

11.5 SABIC

11.6 LyondellBasell Industries

11.7 Air Products and Chemicals, Inc.

11.8 Johnson Matthey

11.9 Eastman Chemical Company

11.10 Solvay SA