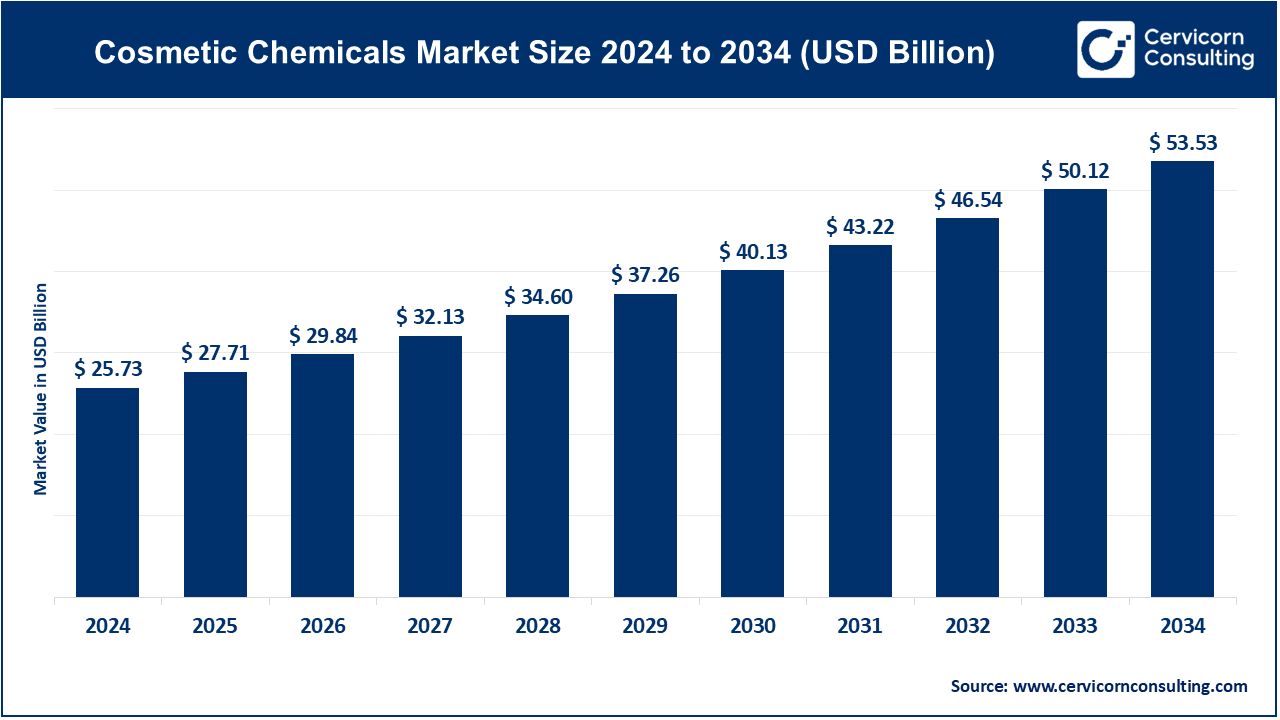

The global cosmetic chemicals market size was valued at USD 25.73 billion in 2024 and is expected to surpass around USD 53.53 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.60% over the forecast period 2025 to 2034.

The cosmetic chemicals market has been growing steadily due to rising consumer awareness about personal grooming and an increasing preference for beauty products. With an expanding global population and growing middle-class segments in emerging economies, the demand for skincare, haircare, and makeup products has surged. The industry is also experiencing innovation, with the emergence of eco-friendly, organic, and cruelty-free products gaining popularity among consumers. Advances in technology have enabled manufacturers to create better-performing ingredients, driving growth in the sector. Worldwide, the leading importers of chemical cosmetics are Vietnam, Russia, and Ukraine. Vietnam holds the top position with 14 thousand shipments, followed by Russia with 11 thousand shipments, and Ukraine in third place with 4 thousand shipments. Looking ahead, the global cosmetic chemicals market is expected to continue its upward trajectory, bolstered by shifting consumer preferences and an expanding beauty-conscious demographic.

Cosmetic chemicals are the ingredients used in various beauty and personal care products like skincare creams, lotions, shampoos, makeup, deodorants, and more. These chemicals serve a wide range of purposes: some help to improve the product's texture, while others enhance its scent, preserve its shelf life, or improve its effectiveness. For example, moisturizers in creams are often derived from chemicals like glycerin, which helps the skin retain moisture, while surfactants like sodium lauryl sulfate help products lather. These chemicals are designed to make personal care products safer, more effective, and enjoyable to use. They are formulated in controlled amounts to avoid any harm to users and are subject to regulations by agencies like the FDA.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 27.71 Billion |

| Market Size by 2034 | USD 53.53 Billion |

| Market Growth Rate | CAGR of 7.60% from 2025 to 2034 |

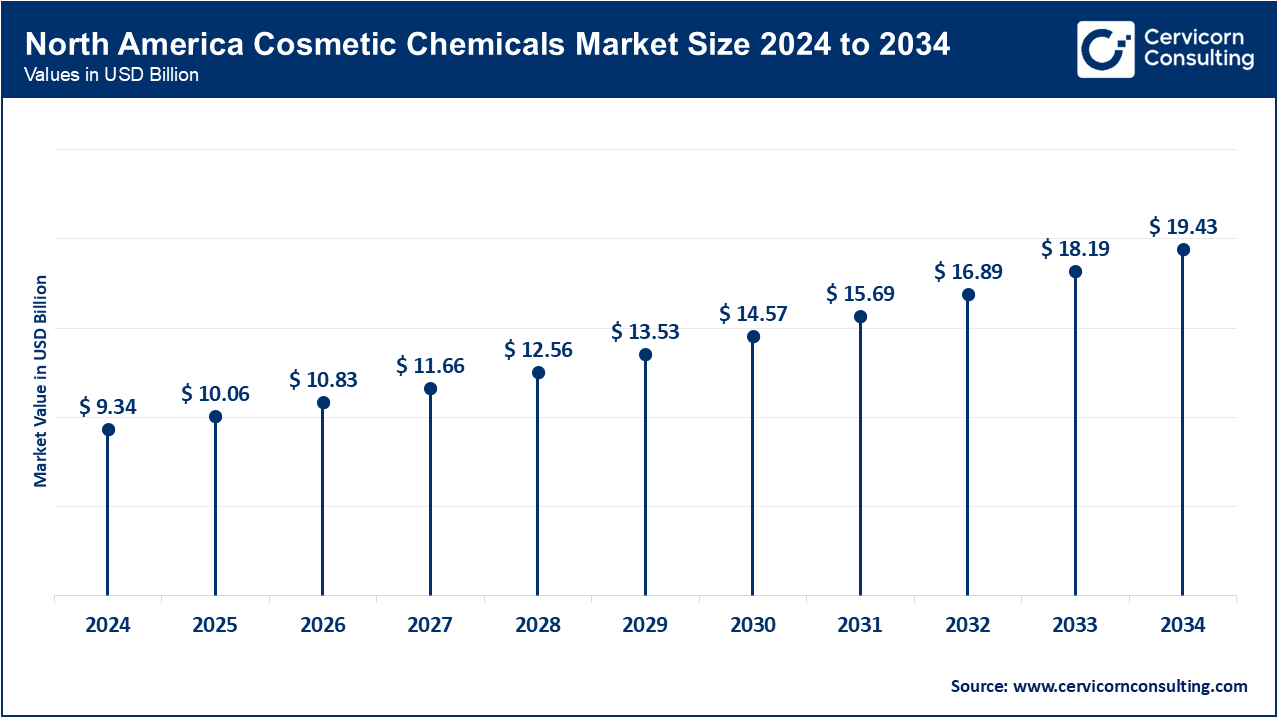

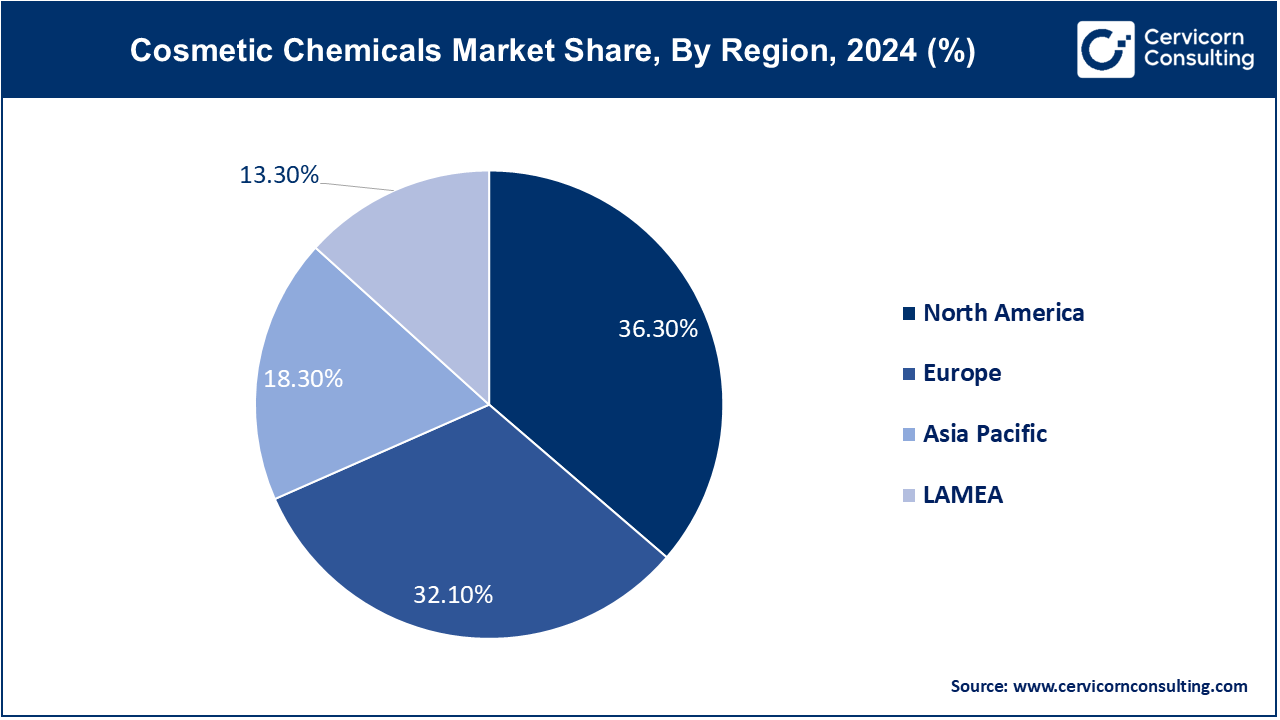

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Segment Coverage | By Products, Application, End-User, Distribution Channel and Regions |

Increased Focus on Anti-Aging Solutions:

Celebrity Endorsements and Social Media Influence:

Stringent Regulatory Standards:

Rising Raw Material Costs:

Growth in Men’s Grooming Products:

Advancements in Biotechnology:

Consumer Concern on Ingredient Safety:

Environmental Impact and Sustainability:

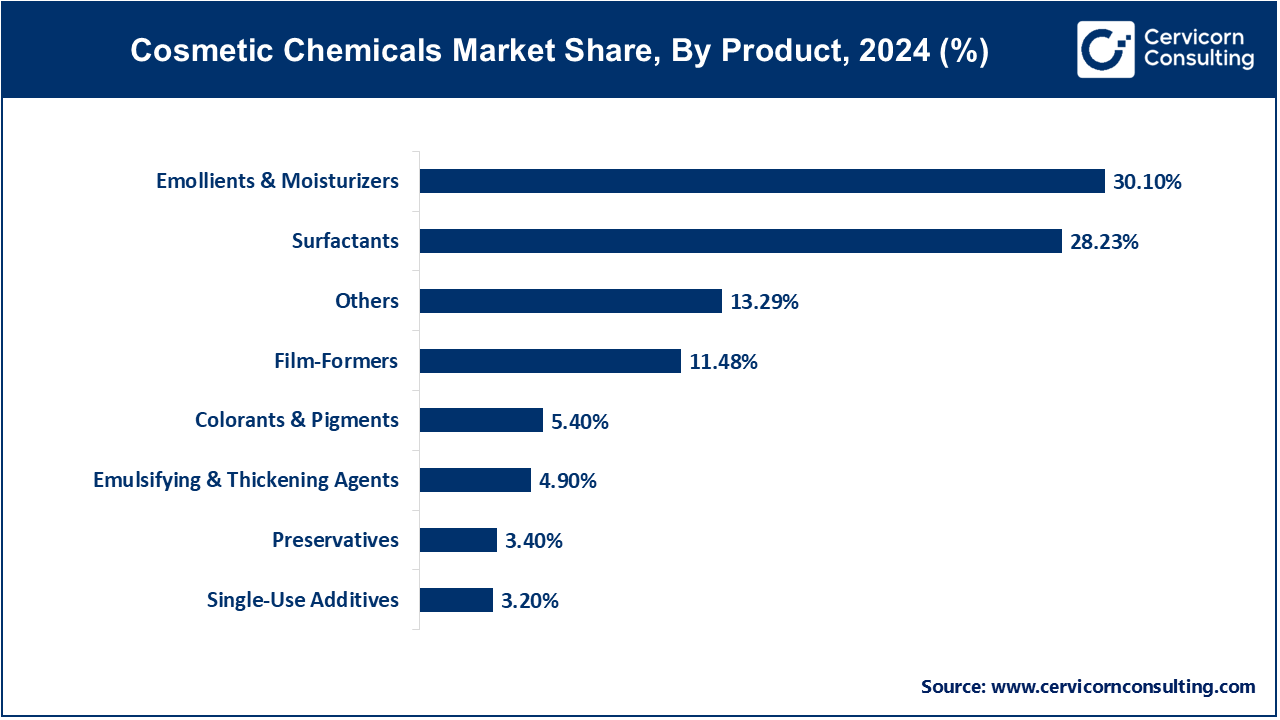

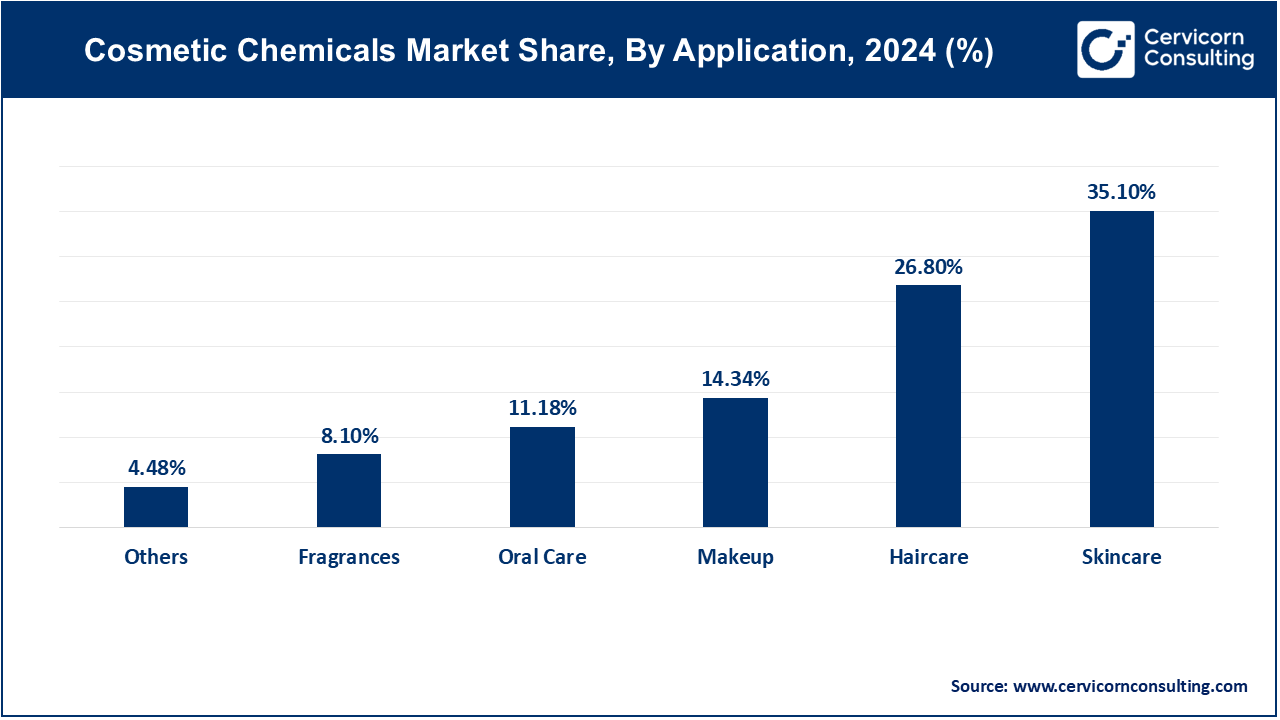

The cosmetic chemicals market is segmented into product, application, end user, distribution channel, and region. Based on product, the market is classified into cosmetic surfactants, cosmetic polymer ingredients, cosmetic colorants, cosmetic preservatives, and others. Based on application, the market is classified into skincare, haircare, makeup, fragrances, and others. Based on end-user, the market is classified into personal care, and professional. Based on distribution channel, the market is classified into direct sales, retail, e-commerce and others.

Cosmetic Surfactants: Cosmetic surfactants segment has registered market share of 28.23% in 2024. Cosmetic surfactants are agents that reduce surface tension, helping products to spread evenly and interact with both water and oils. They are essential in cleansing, foaming, and emulsifying functions in cosmetics. Increasing demand for gentle and sulfate-free surfactants due to consumer preference for milder formulations. There is also a rise in natural and biodegradable surfactants to meet sustainability and eco-friendly standards.

Cosmetic Polymer Ingredients: Cosmetic polymers are long-chain molecules that provide structure, texture, and film-forming properties in cosmetic formulations. They enhance product stability and performance. Growth in the use of advanced polymers for improved texture and skin feel. There is a rising preference for bio-based and biodegradable polymers driven by sustainability trends and consumer demand for eco-friendly products.

Cosmetic Colorants: The cosmetic colorants segment has covered market share of 5.4% in 2024. Cosmetic colorants are compounds added to products to provide color and enhance appearance. They include dyes, pigments, and pearlescents used in makeup and skincare. Increasing use of natural and plant-based colorants due to consumer concerns over synthetic chemicals. The market also sees innovation in vibrant, long-lasting colors and custom formulations to cater to diverse beauty trends.

Cosmetic Preservatives: The cosmetic preservatives segment has recorded market share of 3.4% in 2024. Cosmetic preservatives are chemicals added to prevent microbial growth and extend product shelf life. They ensure the safety and efficacy of cosmetics over time. Rising demand for natural and paraben-free preservatives driven by consumer preference for clean-label products. There is a growing focus on developing effective preservatives with minimal impact on skin health and the environment.

Others: The "Others" category includes miscellaneous cosmetic chemicals that do not fall into the main segments, such as fragrances, emulsifiers, and active ingredients with specialized functions. The others segment has calculated market share of 13.29% in 2024. Innovation in multifunctional ingredients that offer multiple benefits in a single product, like combining anti-aging and moisturizing properties. There is also a push towards natural and sustainably sourced ingredients to align with clean beauty trends.

Skincare: The skincare segment has measured market share of 35.1% in 2024. Skincare products use cosmetic chemicals to enhance and maintain skin health, addressing issues such as hydration, anti-aging, and acne. Growing demand for advanced formulations featuring active ingredients like peptides and hyaluronic acid. There's a strong shift towards natural and organic components, driven by consumer preferences for clean beauty and increased awareness of ingredient safety.

Haircare: The haircare segment has captured market share of 26.8% in 2024. Haircare products utilize cosmetic chemicals to cleanse, condition, and style hair, targeting concerns such as damage, frizz, and color maintenance. Increasing interest in products with innovative ingredients, like silicones and natural oils, and multifunctional formulations. Consumers are also seeking products with sustainability credentials and tailored solutions for different hair types and concerns.

Makeup: The makeup segment has generated market share of 14.34% in 2024. Makeup products incorporate cosmetic chemicals to enhance facial features and provide coverage, including foundations, lipsticks, and eye shadows. Rising popularity of long-wearing and multifunctional makeup products. There is also a growing demand for clean beauty and inclusive shades, driven by consumer preferences for safe, ethical, and diverse options in makeup.

Fragrances: The fragrances segment has garnered market share of 8.1% in 2024. Fragrances use cosmetic chemicals to create pleasing scents in perfumes, colognes, and body sprays, often blending essential oils and synthetic compounds. Increasing consumer interest in personalized and niche fragrances. There’s a notable shift towards natural and sustainable ingredients, with brands focusing on transparency and eco-friendly practices in scent formulation.

Others: The others segment has achieved market share of 4.48% in 2024. This category includes various cosmetic chemicals used in niche products like sunscreens, dental care items, and personal hygiene products. Rising innovation in product formulations, such as sunscreens with advanced UV filters and oral care products with active ingredients. Growing consumer focus on multifunctional products and those with specific benefits for health and wellness is shaping this segment.

Personal Care: Personal care end-users include individual consumers who use cosmetic products for daily grooming, skincare, and beauty routines. This segment covers products like lotions, shampoos, and makeup. Increasing demand for natural and organic ingredients, personalized beauty solutions, and multifunctional products. Growing awareness of skincare and wellness drives the adoption of advanced formulations and eco-friendly packaging.

Professional: Professional end-users consist of beauty salons, spas, and dermatology clinics that use cosmetic chemicals in treatments and services for clients. Rising preference for high-performance, salon-grade products and customized treatments. Enhanced focus on advanced formulations and technology-driven solutions, such as in-salon treatments and professional skincare regimes, supports growth in this segment.

Direct Sales: Direct sales involve manufacturers or brands selling cosmetic chemicals directly to consumers through their own channels, such as company-owned stores or sales representatives. There is a growing trend towards personalized customer service and exclusive product offerings. Brands are leveraging direct sales to build strong customer relationships and gather valuable consumer insights, enhancing their market presence.

Retail: Retail distribution includes physical stores such as supermarkets, pharmacies, and specialty beauty stores where cosmetic chemicals are sold to consumers. The rise of experiential retail and in-store beauty consultations is driving growth. Retailers are increasingly adopting omnichannel strategies, integrating online and offline experiences to attract and engage consumers, enhancing product accessibility and visibility.

E-commerce: E-commerce involves selling cosmetic chemicals through online platforms, including brand websites, online marketplaces, and beauty-specific e-stores. The e-commerce segment is booming due to convenience, global reach, and personalized shopping experiences. Social media integration and influencer partnerships are expanding online sales channels, while advanced technologies like virtual try-ons and AI-driven recommendations enhance consumer engagement.

Others: This category includes alternative distribution methods such as direct-to-salon sales, professional channels, and subscription services. Growing interest in subscription models for convenience and customization is notable. Professional channels are expanding as brands target salons and dermatology clinics with specialized products, and direct-to-professional sales are gaining traction for tailored, high-performance solutions.

The North America market size is expected to reach around USD 19.43 billion by 2034 increasing from USD 9.34 billion in 2024 with a CAGR of 7.70%. The North American market is driven by high consumer spending on premium and innovative cosmetic products. Trends include a strong focus on clean beauty and sustainability, with increasing demand for eco-friendly and cruelty-free ingredients. Additionally, advancements in technology, such as AI and digital marketing, are shaping consumer purchasing behaviours.

The Asia Pacific market size is calculated at USD 4.71 billion in 2024 and is projected to grow around USD 9.80 billion by 2034 with a CAGR of 9.30%. Asia-Pacific is experiencing rapid growth driven by rising disposable incomes, urbanization, and a growing middle class. Trends include a surge in demand for K-beauty (Korean beauty) products and innovations, such as multi-functional and technologically advanced cosmetics. The market is also expanding due to increased consumer awareness and adoption of skincare routines.

The Europe market size is measured at USD 8.26 billion in 2024 and is expected to grow around USD 17.18 billion by 2034 with a CAGR of 7.80%. In Europe, stringent regulatory standards and a strong emphasis on natural and organic products are key trends. The market is growing due to a rising preference for ethical and sustainable cosmetics, alongside a robust presence of luxury and high-end brands. The region is also focusing on reducing plastic use and enhancing product transparency.

The LAMEA market size is forecasted to reach around USD 7.12 billion by 2034 from USD 3.42billion in 2024 with a CAGR of 5.70%. In LAMEA(Latin America, Middle East, and Africa), the cosmetic chemicals market is expanding due to increasing urbanization and consumer spending on beauty products. Trends include a growing interest in localized and culturally relevant products, alongside rising demand for affordable and accessible cosmetics. The market is also witnessing increased investment in beauty infrastructure and distribution networks.

Companies like Givaudan and FMC Corporation are entering the market with innovative solutions, focusing on bio-based ingredients and advanced formulations to meet the demand for sustainable and cutting-edge cosmetic chemicals. BASF SE and The Dow Chemical Company dominate the market through extensive R&D investments and broad product portfolios. Their leadership is supported by advanced technologies, extensive distribution networks, and strong industry partnerships, enabling them to offer a wide range of high-performance cosmetic chemicals and meet evolving consumer demands.

Market Segmentation

By Product

By Application

By End-User

By Distribution Channel

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Cosmetic Chemicals

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Products Overview

2.2.2 By Application Overview

2.2.3 By End-Userr Overview

2.2.4 By Distribution Channel Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Cosmetic Chemicals Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increased Focus on Anti-Aging Solutions

4.1.1.2 Celebrity Endorsements and Social Media Influence

4.1.2 Market Restraints

4.1.2.1 Stringent Regulatory Standards

4.1.2.2 Rising Raw Material Costs

4.1.3 Market Opportunity

4.1.3.1 Growth in Men’s Grooming Products

4.1.3.2 Advancements in Biotechnology

4.1.4 Market Challenges

4.1.4.1 Consumer Concern on Ingredient Safety

4.1.4.2 Environmental Impact and Sustainability

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Cosmetic Chemicals Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Cosmetic Chemicals Market, By Products

6.1 Global Cosmetic Chemicals Market Snapshot, By Products

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Surfactants

6.1.1.2 Emollients & Moisturizers

6.1.1.3 Film-Formers

6.1.1.4 Colorants & Pigments

6.1.1.5 Preservatives

6.1.1.6 Emulsifying & Thickening Agents

6.1.1.7 Single-Use Additives

6.1.1.8 Others

Chapter 7 Cosmetic Chemicals Market, By Application

7.1 Global Cosmetic Chemicals Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Skincare

7.1.1.2 Haircare

7.1.1.3 Makeup

7.1.1.4 Fragrances

7.1.1.5 Oral Care

7.1.1.6 Others

Chapter 8 Cosmetic Chemicals Market, By End-User

8.1 Global Cosmetic Chemicals Market Snapshot, By End-User

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Personal Care

8.1.1.2 Professional

Chapter 9 Cosmetic Chemicals Market, By Distribution Channel

9.1 Global Cosmetic Chemicals Market Snapshot, By Distribution Channel

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Direct Sales

9.1.1.2 Retail

9.1.1.3 E-commerce

9.1.1.4 Others

Chapter 10 Cosmetic Chemicals Market, By Region

10.1 Overview

10.2 Cosmetic Chemicals Market Revenue Share, By Region 2024 (%)

10.3 Global Cosmetic Chemicals Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Cosmetic Chemicals Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Cosmetic Chemicals Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Cosmetic Chemicals Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Cosmetic Chemicals Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Cosmetic Chemicals Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Cosmetic Chemicals Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Cosmetic Chemicals Market, By Country

10.5.4 UK

10.5.4.1 UK Cosmetic Chemicals Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UK Market Segmental Analysis

10.5.5 France

10.5.5.1 France Cosmetic Chemicals Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 France Market Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Cosmetic Chemicals Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 Germany Market Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Cosmetic Chemicals Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of Europe Market Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Cosmetic Chemicals Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Cosmetic Chemicals Market, By Country

10.6.4 China

10.6.4.1 China Cosmetic Chemicals Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 China Market Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Cosmetic Chemicals Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 Japan Market Segmental Analysis

10.6.6 India

10.6.6.1 India Cosmetic Chemicals Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 India Market Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Cosmetic Chemicals Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 Australia Market Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Cosmetic Chemicals Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia Pacific Market Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Cosmetic Chemicals Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Cosmetic Chemicals Market, By Country

10.7.4 GCC

10.7.4.1 GCC Cosmetic Chemicals Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCC Market Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Cosmetic Chemicals Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 Africa Market Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Cosmetic Chemicals Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 Brazil Market Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Cosmetic Chemicals Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 11 Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12 Company Profiles

12.1 BASF SE

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Application Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 The Dow Chemical Company

12.3 Clariant International Ltd.

12.4 Evonik Industries AG

12.5 Solvay S.A.

12.6 Lonza Group Ltd.

12.7 Croda International Plc

12.8 Lubrizol Corporation

12.9 Ashland Global Holdings Inc.

12.10 Shin-Etsu Chemical Co., Ltd.