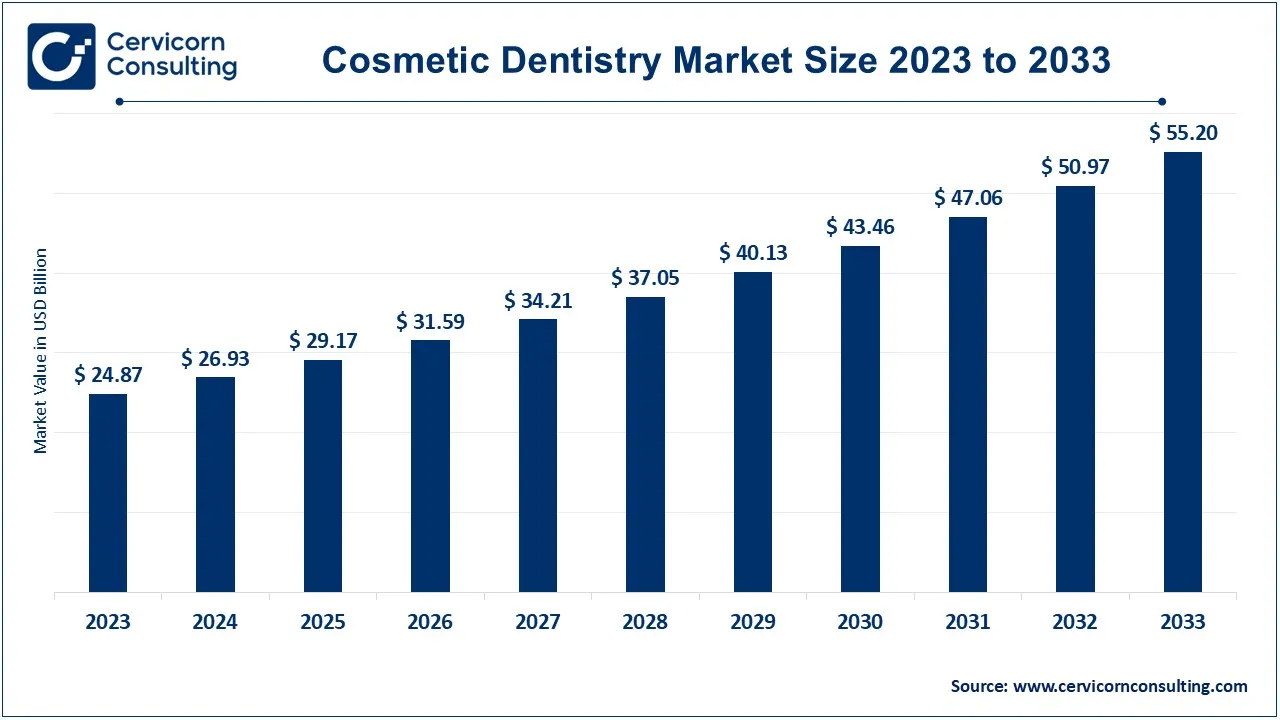

The global cosmetic dentistry market size was accounted for USD 26.93 billion in 2024 and is expected to be worth around USD 55.20 billion by 2033, growing at a compound annual growth rate (CAGR) of 8.29% over the forecast period 2024 to 2033.

The cosmetic dentistry market has experienced significant growth in recent years, driven by increased awareness of aesthetic appearance and the desire for a better smile. As cosmetic dentistry procedures become more affordable and accessible, the market has expanded globally. Factors such as rising disposable incomes, advancements in dental technology, and a growing emphasis on personal appearance have contributed to this growth. Moreover, social media platforms have popularized the concept of an ideal smile, increasing demand for cosmetic dental services. The market is expected to continue growing at a rapid pace, fueled by innovations in minimally invasive treatments and an aging population that seeks to maintain youthful appearances. In 2022, China was the largest importer of beauty products, including those related to cosmetic dentistry, with imports valued at USD 11.1 billion. The United States and Germany also ranked among the top importers. Additionally, the rise of dental tourism, where patients travel abroad for affordable cosmetic treatments, has further accelerated market expansion.

Cosmetic dentistry focuses on improving the appearance of a person's teeth, gums, and smile. It involves various procedures that address dental issues like stained, chipped, or misaligned teeth. Common treatments include teeth whitening, dental veneers, crowns, bridges, and orthodontics. These procedures aim not only to enhance the aesthetic appeal but also to boost confidence and improve oral health. Cosmetic dentists work closely with patients to design personalized treatment plans that meet both functional and cosmetic needs. Advances in technology have made these treatments more accessible, affordable, and comfortable for a wider range of patients.

The American Academy of Cosmetic Dentistry (AACD) estimated in 2020 that 96% of cosmetic dentistry patients are female, with over 70% of these female patients aged between 31 and 50 years.

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 29.17 Billion |

| Market Size by 2033 | USD 55.2 Billion |

| Market Growth Rate | CAGR of 8.29% from 2024 to 2033 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Segment Coverage | By Product, End User and Regions |

Dental Tourism

Increased Insurance Coverage

High Costs

Lack of Awareness and Accessibility

Technological Integration

Emerging Markets

Regulatory Hurdles

Professional Training and Expertise

The cosmetic dentistry market is segmented into product, end user, and region. Based on product, the market is classified into dental systems & equipment, dental implants, dental prosthetics, and others. Based on end user, the market is classified into dental hospitals & clinics, dental laboratories, and others.

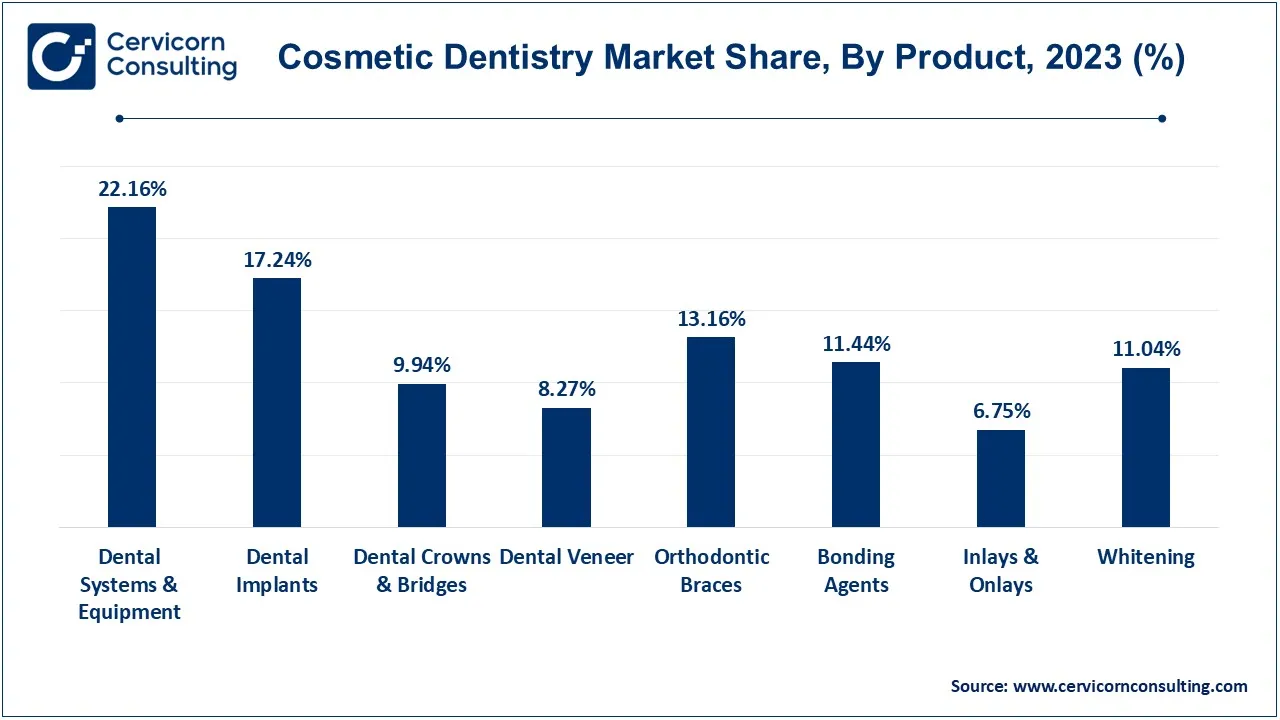

Dental Systems & Equipment: The dental systems and equipment segment has registered highest market share of 22.16% in 2023. This segment is witnessing rapid advancements due to the integration of digital technologies, such as 3D imaging and CAD/CAM systems. These innovations enhance precision and efficiency in cosmetic procedures, driving market growth. Additionally, the demand for high-quality, reliable equipment supports this segment's expansion, with technological advancements continually improving patient outcomes.

Dental Implants: The dental implants segment has covered market share of 17.24% in 2023. The segment is driven by increasing awareness of long-term dental solutions and advancements in implant technology. Implants offer a durable and natural-looking alternative for missing teeth, appealing to patients seeking permanent solutions. Innovations in materials and techniques, such as improved biocompatibility and minimal-invasive methods, contribute to the segment's robust growth and patient satisfaction.

Dental Prosthetics: The dental prosthetics segment is expanding due to advancements in materials and customization technologies. Innovations like digital impressions and 3D printing are enhancing the precision and aesthetic appeal of prosthetics, such as crowns and bridges. As patients seek better-fitting, more natural-looking replacements for missing teeth, the demand for high-quality dental prosthetics continues to rise.

Orthodontics: In 2023, the orthodontics segment has recorded 13.16% of market share. The orthodontics segment is experiencing growth due to the rising popularity of clear aligners and other less visible corrective options. Advances in orthodontic technology, including digital treatment planning and personalized appliances, contribute to the segment's expansion. The increased focus on aesthetic outcomes and patient comfort drives demand for innovative orthodontic solutions, appealing to both adults and adolescents.

Teeth Whitening: The teeth whitening segment has calculated market share of 11.04% in 2023. This segment is flourishing, driven by the high consumer desire for a brighter, more attractive smile. Advances in whitening technology and the availability of both in-office and at-home products contribute to the segment's growth. As more people become conscious of their dental aesthetics, the demand for effective, safe, and convenient whitening solutions continues to increase.

Others: The others segment has measured share of 36.40% in 2023. The others segment encompasses various cosmetic dental procedures and products, including bonding, veneers, and gum reshaping. This segment benefits from the growing interest in comprehensive smile makeovers and the increasing availability of specialized treatments. Innovations and personalized options in this diverse category cater to specific patient needs, contributing to its steady growth and market presence.

Dental Hospitals & Clinics: The dental hospitals and clinics segment has captured highest market share of 62.1% in the year of 2023. Dental hospitals and clinics are experiencing growth due to rising patient demand for cosmetic procedures and the increasing availability of advanced technologies. The trend towards integrating state-of-the-art equipment and offering a range of cosmetic treatments, from teeth whitening to implants, drives their expansion. Additionally, these institutions are investing in patient-centered care and personalized treatment plans to enhance outcomes.

Dental Laboratories: Dental laboratories segment has generated 27.34% of market share in 2023. Dental laboratories are seeing increased demand driven by advancements in dental technology and materials. The trend towards digital workflows, such as 3D printing and CAD/CAM, enhances the precision and efficiency of prosthetics and restorations. Laboratories are also expanding their services to include customized solutions, supporting the growing need for high-quality, personalized cosmetic dental products.

Others: The others segment has garnered 10.56% of market share in the year of 2023. The others segment includes various end users such as dental supply companies and educational institutions. This segment benefits from the expanding market for cosmetic dentistry, driven by increasing consumer awareness and technological advancements. Educational institutions are investing in training programs, while supply companies are developing and distributing innovative products to support the growing demand for cosmetic dental treatments.

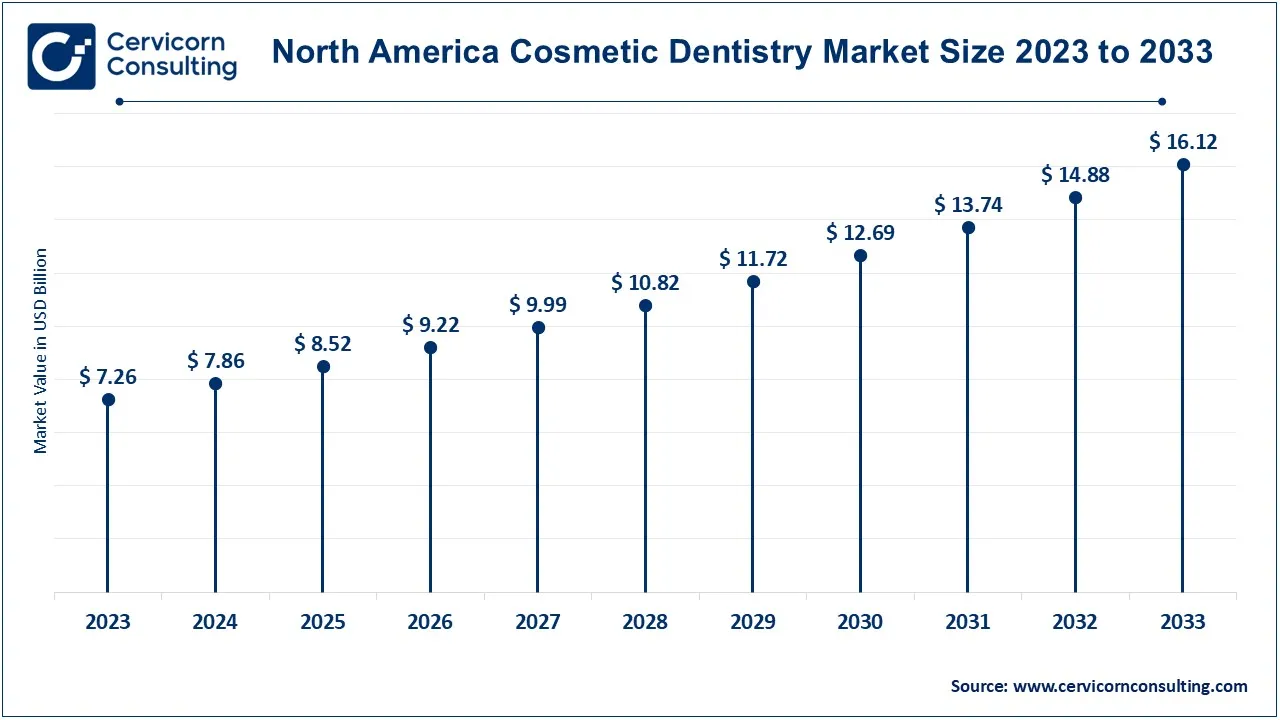

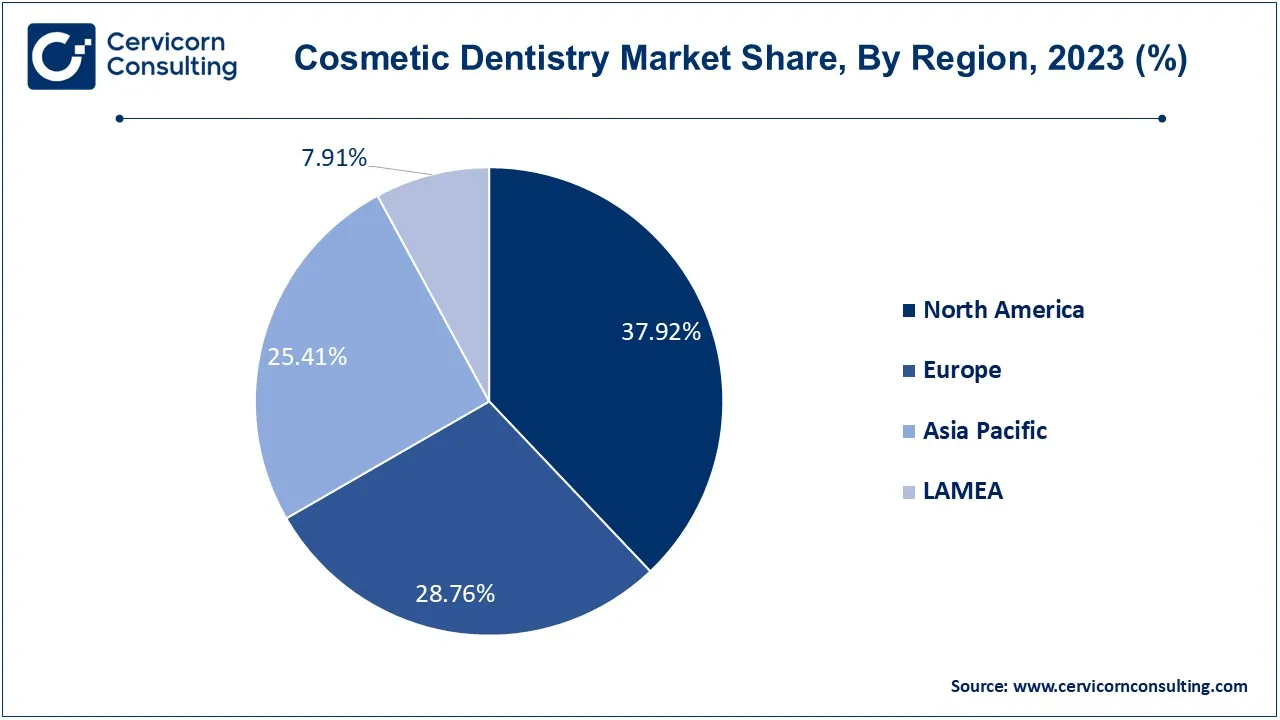

The North America market size is expected to reach around USD 20.93 billion by 2033 increasing from USD 10.21 billion in 2024 with a CAGR of 7.90%. North America dominates the cosmetic dentistry market due to high disposable incomes, advanced healthcare infrastructure, and a strong emphasis on aesthetic appearance. The presence of leading market players and widespread adoption of advanced dental technologies drive growth. Additionally, increasing awareness about dental aesthetics and a high prevalence of dental issues contribute to the robust demand for cosmetic dental procedures in this region.

The Asia Pacific market size is calculated at USD 6.84 billion in 2024 and is projected to grow around USD 14.03 billion by 2033 with a CAGR of 10.27%. Asia-Pacific is witnessing rapid growth in the cosmetic dentistry market, fueled by increasing disposable incomes, improving healthcare infrastructure, and rising awareness about dental aesthetics. Countries like China, India, and Japan are key contributors, with a growing middle class seeking aesthetic enhancements. The expanding dental tourism industry, particularly in countries offering cost-effective treatments, also drives market expansion in this region.

The Europe market size is measured at USD 7.75 billion in 2024 and is expected to grow around USD 15.88 billion by 2033 with a CAGR of 8.52%. Europe represents a significant share of the cosmetic dentistry market, driven by rising aesthetic consciousness and a growing aging population seeking dental restorations. Countries like Germany, the UK, and France lead in technological advancements and adoption. Public and private dental insurance schemes supporting cosmetic procedures, along with a well-established dental care system, further bolster market growth in this region.

The LAMEA market size is forecasted to reach around USD 4.37 billion by 2033 from USD 2.13 billion in 2024 with a CAGR of 6.90%. LAMEA shows promising growth potential in the cosmetic dentistry market, driven by increasing urbanization and rising aesthetic awareness. Countries like Brazil and UAE are notable for their advanced dental care facilities and growing medical tourism sector. However, market growth is tempered by economic disparities and varying levels of access to advanced dental care across the region. Efforts to improve dental health infrastructure and affordability are key to future growth.

New players like Keystone Dental, Inc. and Biolase, Inc. are leveraging cutting-edge technologies and niche market focuses to gain traction in the cosmetic dentistry market. Keystone Dental specializes in advanced implant systems, while Biolase pioneers in laser dentistry for minimally invasive procedures. Dominating players like Align Technology, Inc., and Dentsply Sirona Inc. drive market growth through continuous innovation and strategic collaborations. Align Technology's Invisalign system revolutionized orthodontics, while Dentsply Sirona's integration of digital solutions enhances treatment efficiency. Collaborations, such as Align's partnerships with dental professionals and Dentsply Sirona's alliances with tech firms, further their market dominance through comprehensive and advanced dental care solutions.

Market Segmentation

By Product

By End User

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Cosmetic Dentistry

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Products Overview

2.2.2 By End User Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Cosmetic Dentistry Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Dental Tourism

4.1.1.2 Increased Insurance Coverage

4.1.2 Market Restraints

4.1.2.1 High Costs

4.1.2.2 Lack of Awareness and Accessibility

4.1.3 Market Opportunity

4.1.3.1 Technological Integration

4.1.3.2 Emerging Markets

4.1.4 Market Challenges

4.1.4.1 Regulatory Hurdles

4.1.4.2 Professional Training and Expertise

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Cosmetic Dentistry Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Cosmetic Dentistry Market, By Products

6.1 Global Cosmetic Dentistry Market Snapshot, By Products

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

6.1.1.1 Dental Systems & Equipment

6.1.1.2 Dental Implants

6.1.1.3 Dental Prosthetics

6.1.1.4 Orthodontics

6.1.1.5 Teeth Whitening

6.1.1.6 Others

Chapter 7 Cosmetic Dentistry Market, By End User

7.1 Global Cosmetic Dentistry Market Snapshot, By End User

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

7.1.1.1 Dental Hospitals & Clinics

7.1.1.2 Dental Laboratories

7.1.1.3 Others

Chapter 8 Cosmetic Dentistry Market, By Region

8.1 Overview

8.2 Cosmetic Dentistry Market Revenue Share, By Region 2023 (%)

8.3 Global Cosmetic Dentistry Market, By Region

8.3.1 Market Size and Forecast

8.4 North America

8.4.1 North America Cosmetic Dentistry Market Revenue, 2021-2033 ($Billion)

8.4.2 Market Size and Forecast

8.4.3 North America Cosmetic Dentistry Market, By Country

8.4.4 U.S.

8.4.4.1 U.S. Cosmetic Dentistry Market Revenue, 2021-2033 ($Billion)

8.4.4.2 Market Size and Forecast

8.4.4.3 U.S. Market Segmental Analysis

8.4.5 Canada

8.4.5.1 Canada Cosmetic Dentistry Market Revenue, 2021-2033 ($Billion)

8.4.5.2 Market Size and Forecast

8.4.5.3 Canada Market Segmental Analysis

8.4.6 Mexico

8.4.6.1 Mexico Cosmetic Dentistry Market Revenue, 2021-2033 ($Billion)

8.4.6.2 Market Size and Forecast

8.4.6.3 Mexico Market Segmental Analysis

8.5 Europe

8.5.1 Europe Cosmetic Dentistry Market Revenue, 2021-2033 ($Billion)

8.5.2 Market Size and Forecast

8.5.3 Europe Cosmetic Dentistry Market, By Country

8.5.4 UK

8.5.4.1 UK Cosmetic Dentistry Market Revenue, 2021-2033 ($Billion)

8.5.4.2 Market Size and Forecast

8.5.4.3 UK Market Segmental Analysis

8.5.5 France

8.5.5.1 France Cosmetic Dentistry Market Revenue, 2021-2033 ($Billion)

8.5.5.2 Market Size and Forecast

8.5.5.3 France Market Segmental Analysis

8.5.6 Germany

8.5.6.1 Germany Cosmetic Dentistry Market Revenue, 2021-2033 ($Billion)

8.5.6.2 Market Size and Forecast

8.5.6.3 Germany Market Segmental Analysis

8.5.7 Rest of Europe

8.5.7.1 Rest of Europe Cosmetic Dentistry Market Revenue, 2021-2033 ($Billion)

8.5.7.2 Market Size and Forecast

8.5.7.3 Rest of Europe Market Segmental Analysis

8.6 Asia Pacific

8.6.1 Asia Pacific Cosmetic Dentistry Market Revenue, 2021-2033 ($Billion)

8.6.2 Market Size and Forecast

8.6.3 Asia Pacific Cosmetic Dentistry Market, By Country

8.6.4 China

8.6.4.1 China Cosmetic Dentistry Market Revenue, 2021-2033 ($Billion)

8.6.4.2 Market Size and Forecast

8.6.4.3 China Market Segmental Analysis

8.6.5 Japan

8.6.5.1 Japan Cosmetic Dentistry Market Revenue, 2021-2033 ($Billion)

8.6.5.2 Market Size and Forecast

8.6.5.3 Japan Market Segmental Analysis

8.6.6 India

8.6.6.1 India Cosmetic Dentistry Market Revenue, 2021-2033 ($Billion)

8.6.6.2 Market Size and Forecast

8.6.6.3 India Market Segmental Analysis

8.6.7 Australia

8.6.7.1 Australia Cosmetic Dentistry Market Revenue, 2021-2033 ($Billion)

8.6.7.2 Market Size and Forecast

8.6.7.3 Australia Market Segmental Analysis

8.6.8 Rest of Asia Pacific

8.6.8.1 Rest of Asia Pacific Cosmetic Dentistry Market Revenue, 2021-2033 ($Billion)

8.6.8.2 Market Size and Forecast

8.6.8.3 Rest of Asia Pacific Market Segmental Analysis

8.7 LAMEA

8.7.1 LAMEA Cosmetic Dentistry Market Revenue, 2021-2033 ($Billion)

8.7.2 Market Size and Forecast

8.7.3 LAMEA Cosmetic Dentistry Market, By Country

8.7.4 GCC

8.7.4.1 GCC Cosmetic Dentistry Market Revenue, 2021-2033 ($Billion)

8.7.4.2 Market Size and Forecast

8.7.4.3 GCC Market Segmental Analysis

8.7.5 Africa

8.7.5.1 Africa Cosmetic Dentistry Market Revenue, 2021-2033 ($Billion)

8.7.5.2 Market Size and Forecast

8.7.5.3 Africa Market Segmental Analysis

8.7.6 Brazil

8.7.6.1 Brazil Cosmetic Dentistry Market Revenue, 2021-2033 ($Billion)

8.7.6.2 Market Size and Forecast

8.7.6.3 Brazil Market Segmental Analysis

8.7.7 Rest of LAMEA

8.7.7.1 Rest of LAMEA Cosmetic Dentistry Market Revenue, 2021-2033 ($Billion)

8.7.7.2 Market Size and Forecast

8.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 9 Competitive Landscape

9.1 Competitor Strategic Analysis

9.1.1 Top Player Positioning/Market Share Analysis

9.1.2 Top Winning Strategies, By Company, 2021-2023

9.1.3 Competitive Analysis By Revenue, 2021-2023

9.2 Recent Developments by the Market Contributors (2023)

Chapter 10 Company Profiles

10.1 Align Technology, Inc.

10.1.1 Company Snapshot

10.1.2 Company and Business Overview

10.1.3 Financial KPIs

10.1.4 Product/End User Portfolio

10.1.5 Strategic Growth

10.1.6 Global Footprints

10.1.7 Recent Development

10.1.8 SWOT Analysis

10.2 Dentsply Sirona Inc.

10.3 Danaher Corporation

10.4 3M Company

10.5 Ivoclar Vivadent AG

10.6 Zimmer Biomet Holdings, Inc.

10.7 Nobel Biocare Services AG

10.8 Institut Straumann AG

10.9 Henry Schein, Inc.

10.10 Biolase, Inc.