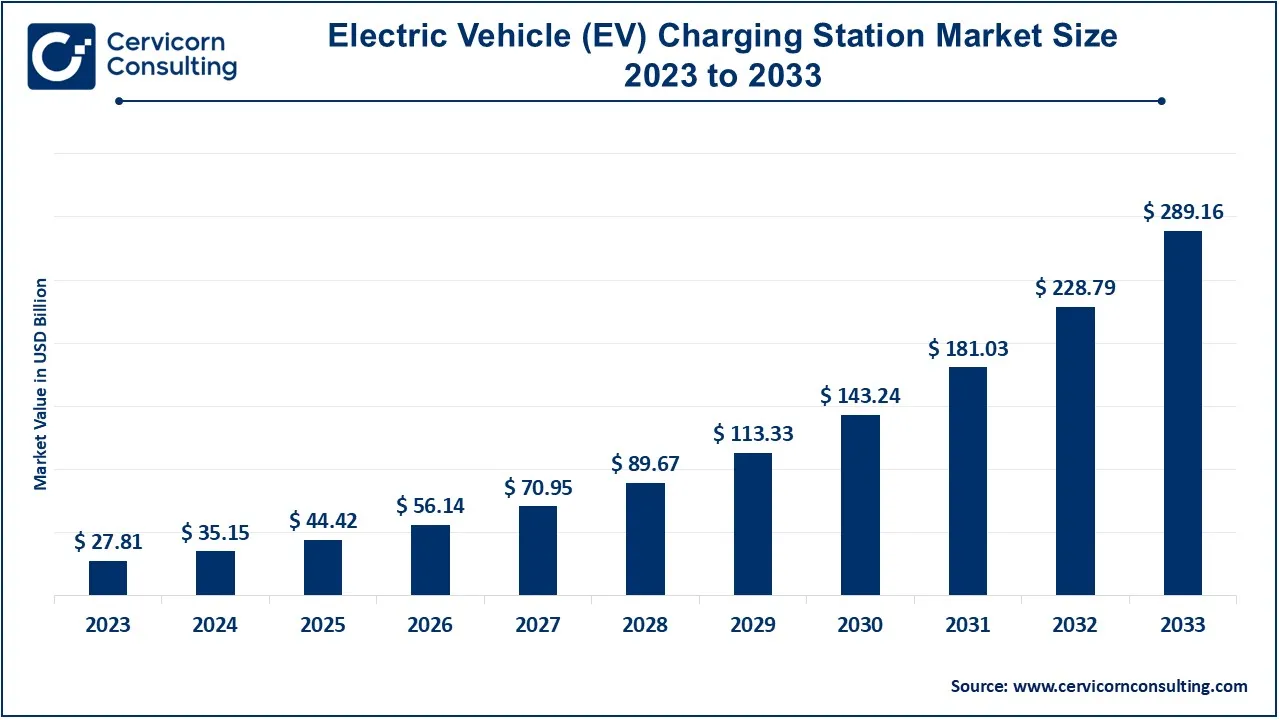

The global electric vehicle (EV) charging station market size was valued at USD 35.15 billion in 2024 and is anticipated to reach around USD 289.16 billion by 2033, growing at a compound annual growth rate (CAGR) of 26.38% from 2024 to 2033.

The electric vehicles (EV) charging station market is experiencing significant growth, driven by several key factors. First, the increasing adoption of electric vehicles (EVs) is a major catalyst, as more consumers and businesses are opting for cleaner alternatives to traditional gasoline-powered vehicles. This shift is largely influenced by stricter emissions regulations and the growing concern over environmental sustainability. Additionally, the development of electric vehicle technology is making EVs more accessible and affordable for a wider audience, thus further boosting the demand for charging infrastructure. Another factor driving the market is the expansion of government initiatives and incentives aimed at promoting electric mobility. Many governments worldwide are offering subsidies, tax incentives, and rebates for the installation of charging stations and the purchase of electric vehicles. The U.S. government has announced nearly USD 50 million to subsidize projects aiming to expand access to convenient charging, with a goal of building a national network of 500,000 public EV charging ports by 2030.

An EV (Electric Vehicle) Charging Station is a facility where electric vehicles can be charged. These stations provide electrical power to recharge the batteries of EVs. The process of charging is done using specialized charging equipment and electrical outlets that are different from regular power outlets. EV charging stations come in various forms, including Level 1 (standard home outlets), Level 2 (faster charging), and Level 3 (also known as DC fast charging, which offers rapid charging). The station's power source can vary, ranging from residential solar panels to public grids. As the adoption of electric vehicles rises, the need for widespread charging infrastructure increases, contributing to the expansion of these stations globally. The stations may be found in public places like shopping malls, parking lots, highways, and at businesses or private homes.

Report Highlights

Report Scope

| Area of Focus | Details |

| Estimated Market Size (2024) | USD 35.15 Billion |

| Projected Market Size (2033) | USD 289.16 Billion |

| Growth Rate (2024 to 2033) | 26.38% |

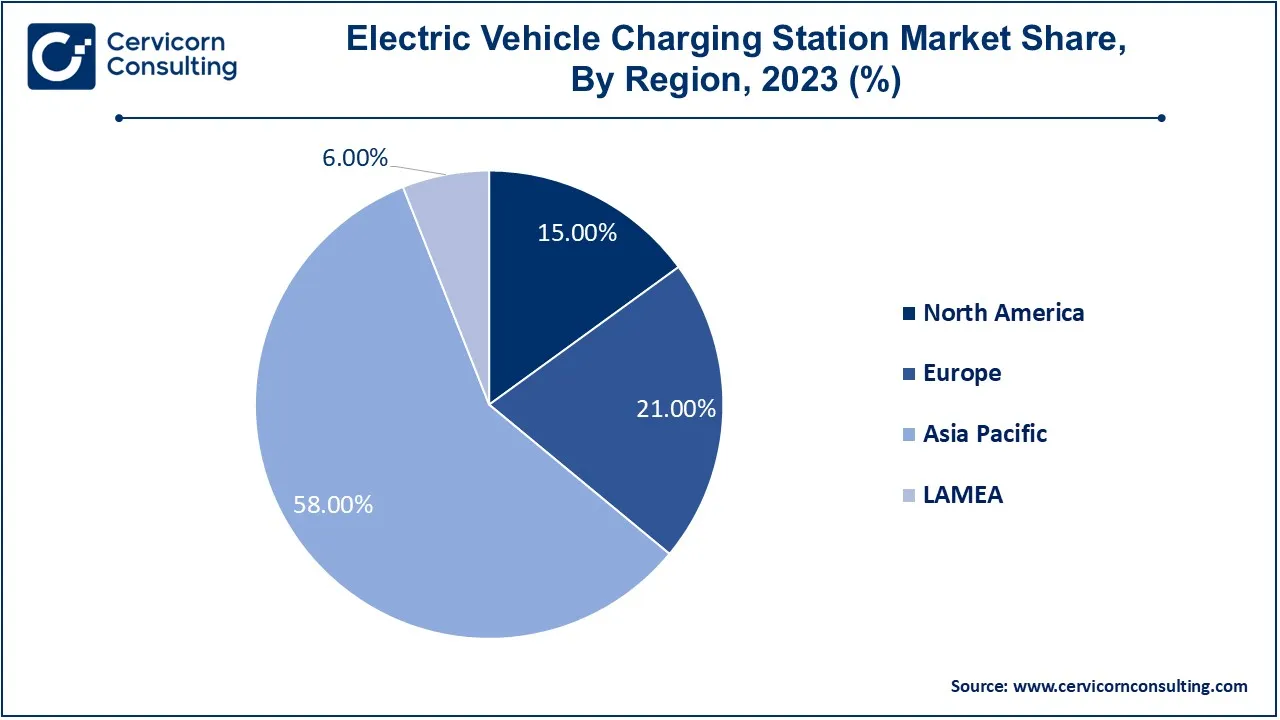

| Largest Revenue Holder Region | Asia Pacific |

| Segments Covered | Charger Type, Application, Level,Vehicle Type, Propulsion, Charging Points, Connector Phase, Charging Service, Charging Infrastructure, Region |

| Top Companies | Tesla, Inc., ChargePoint, Inc., Blink Charging Co., ABB Ltd., BP Chargemaster, Siemens AG, EVgo Services LLC, Shell Recharge, Enel X, Electrify America, Daimler AG, Engie, Schneider Electric, Greenlots (a Shell subsidiary), Eaton Corporation |

Consumer Demand for Convenience

Corporate Sustainability Goals

High Infrastructure Costs

Charging Speed and Compatibility Issues

Integration with Renewable Energy Sources

Expansion into Underserved Regions

Infrastructure and Grid Capacity Limitations

Consumer Adoption and Range Anxiety

Fast: Fast charger segment has generated 71% market share in 2023. Fast chargers are gaining prominence due to their ability to significantly reduce charging time, enhancing convenience for electric vehicle (EV) owners. Trends include the deployment of ultra-fast chargers along major highways and urban centers to support long-distance travel and high-utilization areas. The driver for this segment is the growing demand for quick and efficient charging solutions to improve EV adoption and user experience.

Slow/Moderate: In 2023, the slow charger has accounted 29% market share. Slow and moderate chargers are commonly used in residential and workplace settings due to their lower installation and operational costs. Trends involve integrating these chargers with smart home technologies and energy management systems. The driver for this segment is the need for cost-effective, reliable charging options that cater to daily driving needs and are suitable for overnight or extended charging periods.

Commercial: In 2023, the commerical segment has held revenue share of 45%. In the commercial segment, there is a growing trend toward installing EV charging stations at retail locations, office buildings, and public parking areas to attract customers and support fleet operations. The driver for this segment is the increasing demand from businesses seeking to provide convenient charging options for customers and employees, enhancing their sustainability profile and meeting corporate social responsibility goals.

Residential: In 2023, the residential segment has captured revenue share of around 55%. The residential EV charging market is expanding as more homeowners invest in home charging solutions for convenience and cost savings. Trends include the adoption of smart home integration, allowing users to manage charging schedules and energy use. The driver for this segment is the rising number of electric vehicles and the desire for convenient, at-home charging solutions that complement the growing EV ownership base.

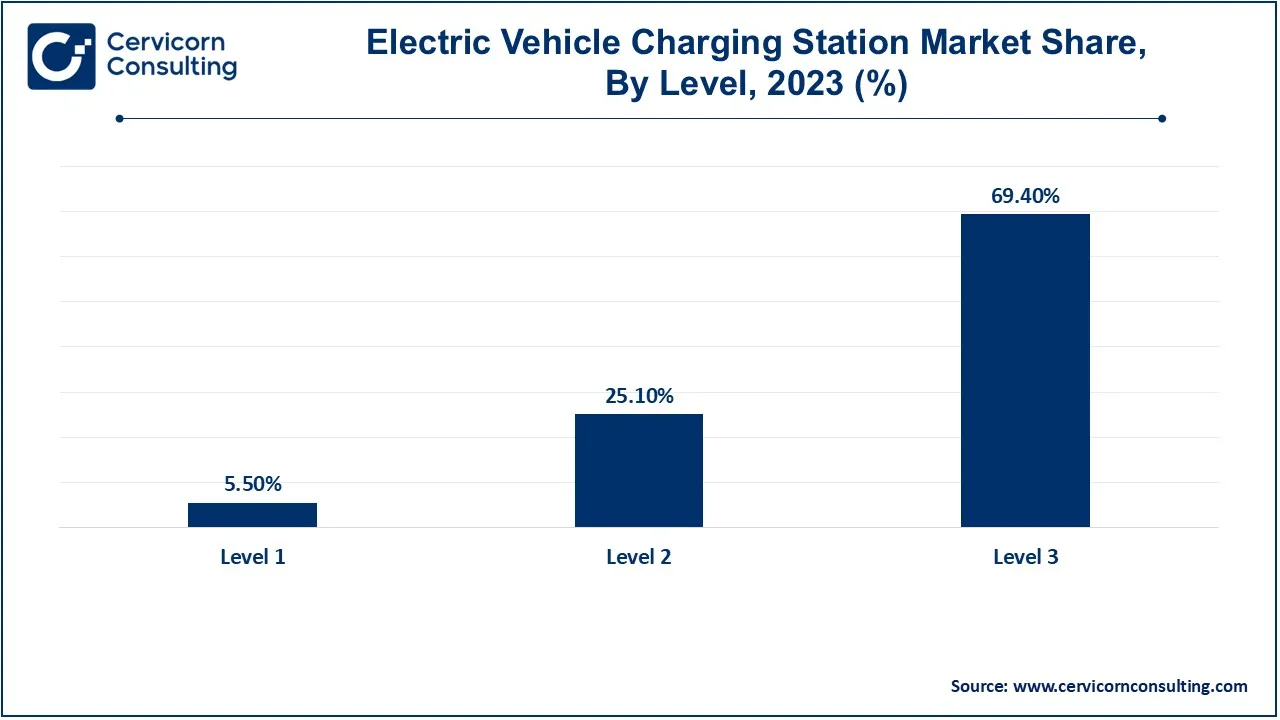

Level 1: In 2023, the level 1 segment has generated 5.50% revenue share. Level 1 chargers use standard 120V outlets, making them the most accessible and cost-effective option for residential users. Trends include their widespread use in home settings for overnight charging. The primary driver is their affordability and ease of installation, though they are slower compared to other levels, catering to users with lower daily driving needs and longer charging times.

Level 2: In 2023, the level 2 segment has generated 25.10% revenue share. Level 2 chargers operate on 240V and offer faster charging than Level 1, making them popular for both residential and commercial applications. Trends include the increasing installation of Level 2 chargers in workplaces and public spaces to reduce charging time. The driver for this segment is the need for a balance between installation cost and charging efficiency, supporting moderate to high daily usage.

Level 3: In 2023, the level 3 segment has accounted 69.40% revenue share. Level 3 chargers, also known as DC fast chargers, provide the fastest charging speeds and are typically installed along highways and in high-traffic areas. Trends include the expansion of high-speed charging networks to facilitate long-distance travel and rapid turnarounds. The driver for this segment is the demand for ultra-fast charging solutions that can quickly recharge EVs, enhancing convenience and reducing range anxiety.

Passenger Cars: The passenger car segment is witnessing rapid growth due to increased consumer adoption of electric vehicles (EVs) and government incentives. Trends include the installation of charging stations in residential areas, shopping centers, and workplaces. The driver for this segment is the rising number of EVs on the road, which creates a growing demand for convenient and accessible charging infrastructure for everyday use.

Commercial Vehicles: The commercial vehicle segment is expanding with the adoption of electric trucks and delivery vans. Trends involve deploying charging infrastructure at fleet depots and logistics centers. The driver for this segment is the need for efficient, high-capacity charging solutions to support the operation of electric commercial fleets, driven by sustainability goals and regulatory pressures for reduced emissions in commercial transport.

BEV (Battery Electric Vehicles): The BEV segment is experiencing significant growth as fully electric vehicles become more popular due to advancements in battery technology and increased range. Trends include the expansion of high-speed charging networks to support longer journeys. The driver for BEVs is the push for zero-emission vehicles, supported by government incentives and growing consumer demand for sustainable transportation options.

PHEV (Plug-in Hybrid Electric Vehicles): PHEVs are gaining traction as they offer the flexibility of both electric and internal combustion propulsion. Trends include the installation of dual-purpose chargers to accommodate both EV and hybrid vehicle needs. The driver for PHEVs is their ability to provide a bridge between traditional and fully electric vehicles, appealing to consumers seeking reduced emissions with extended driving range capabilities.

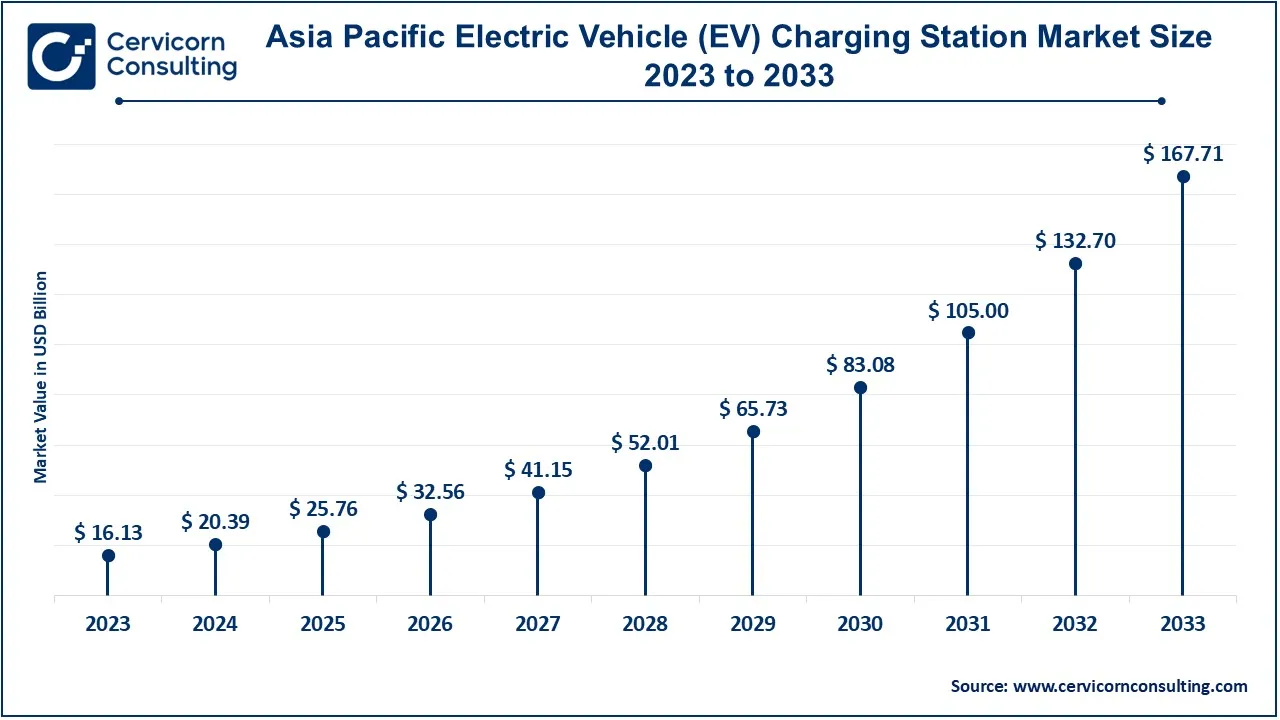

Asia-Pacific: The Asia Pacific EV charging station market size was accounted for USD 16.13 billion in 2023 and is predicted to surpass around USD 167.71 billion by 2033. Asia-Pacific is experiencing rapid growth in EV charging infrastructure due to strong government support, increasing urbanization, and rising electric vehicle sales. Countries like China and Japan are leading the way with large-scale investments in charging networks and technology. Trends include significant advancements in fast-charging technology and expansion into both urban and rural areas. The region is also focusing on integrating charging solutions with renewable energy sources to support its growing EV market and sustainability objectives.

The North America EV charging station market size was valued at USD 4.17 billion in 2023 and is expected to reach around USD 43.37 billion by 2033. North America is a leader in EV charging infrastructure development, driven by substantial government investments and strong consumer demand for electric vehicles. The U.S. government’s $2 trillion infrastructure plan includes significant funding for EV charging networks, and major companies are expanding their charging stations across urban and highway locations. The region's focus is on enhancing fast-charging networks and integrating renewable energy sources, supported by favorable policies and incentives aimed at boosting EV adoption and reducing carbon emissions.

The Europe EV charging station market size was estimated at USD 5.84 billion in 2023 and is projected to hit around USD 60.72 billion by 2033. Europe is at the forefront of EV charging infrastructure expansion, supported by ambitious climate goals and stringent emissions regulations. The European Union has implemented various policies to promote EV adoption and increase the availability of public charging stations. Trends include widespread deployment of both fast and slow chargers, with a strong emphasis on integrating renewable energy and enhancing cross-border charging networks. The region’s collaborative efforts among governments, automotive manufacturers, and energy providers are key to its rapid growth in EV infrastructure.

LAMEA

The LAMEA EV charging station market size was valued at USD 1.67 billion in 2023 and is anticipated to reach around USD 17.35 billion by 2033. In LAMEA, the EV charging market is emerging with varying levels of development across countries. The focus is on building foundational infrastructure to support the gradual increase in electric vehicle adoption. Trends include investments in pilot projects and partnerships to develop charging networks, particularly in urban areas. Drivers for growth include rising environmental awareness and government initiatives aimed at promoting cleaner transportation, although challenges such as limited infrastructure and high costs persist in the region.

New players like Blink Charging Co. and Electrify America are making strides with their innovative approaches to expand the EV charging network. Blink Charging Co. leverages its extensive network of public and private charging stations, while Electrify America focuses on building a nationwide fast-charging network to support long-distance travel. Dominating players such as ChargePoint, Inc. and ABB Ltd. drive the market through their advanced technology and broad infrastructure. ChargePoint excels with its large-scale, scalable charging solutions, and ABB integrates cutting-edge fast-charging technology and grid management systems. Both companies engage in strategic partnerships and innovations, like integrating renewable energy and developing ultra-fast charging capabilities, to enhance their market leadership.

CEO statements

ChargePoint, Inc. – Pasquale Romano, CEO

“At ChargePoint, our mission is to deliver a seamless charging experience for every driver, everywhere. By expanding our network and investing in innovative technology, we are making EV charging more accessible and efficient, supporting the global shift towards sustainable transportation.”

Blink Charging Co. – Michael D. Farkas, CEO

“We are committed to accelerating the transition to electric vehicles by increasing the availability of our charging infrastructure. Our strategy involves deploying a comprehensive network of charging stations across key locations to provide convenient and reliable access for EV drivers.”

Electrify America – Giovanni Palazzo, CEO

“Electrify America is dedicated to building a robust and reliable network of fast chargers to support the growing number of electric vehicles on the road. Our focus is on innovation and expansion to ensure that our infrastructure meets the needs of EV owners nationwide.”

ABB Ltd. – Björn Rosengren, CEO

“ABB is driving the future of transportation with our advanced charging solutions. By integrating cutting-edge technology and sustainable practices, we are enhancing the efficiency of EV charging and supporting the global transition to cleaner energy sources.”

Shell Recharge – István Kapitány, EVP, Shell Retail

“Shell Recharge is at the forefront of transforming energy for mobility. We are investing in smart and scalable charging solutions that integrate seamlessly with our existing infrastructure, aiming to provide our customers with convenient and sustainable charging options.”

Enel X – Francesco Venturini, CEO

“Enel X is leading the way in smart and sustainable EV charging solutions. Our focus is on deploying innovative charging technologies and integrating them with renewable energy sources to provide a comprehensive and eco-friendly charging experience for all users.”

These CEO statements reflect a shared commitment to leveraging technology and personalized approaches in EV Charging Station, aiming to enhance employee health and productivity. Through innovation and comprehensive solutions, these key players are driving significant improvements in workplace well-being and performance.

Recent strategic partnerships and investments in the EV charging infrastructure reflect a strong commitment to advancing sustainable transportation. Key collaborations across Europe and South America are set to enhance charging networks, integrate innovative technologies, and expand the availability of renewable energy-powered charging solutions. Some notable examples of key developments in the EV Charging Station Market include:

These developments underscore a global drive to improve EV charging infrastructure through collaborative efforts and substantial investments. By addressing electrification challenges and expanding networks, these initiatives aim to accelerate the adoption of electric vehicles and support a transition to cleaner, more efficient transportation system.

Market Segmentation

By Charger Type

By Application

By Level

By Vehicle Type

By Propulsion

By Charging Point

By DC Fast Charging Type

By Connector Phase

By Charging Service

By Electric Bus Charging Type

By Charging Infrastructure Type

By Regional

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Electric vehicle (EV) charging station

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Charger Type Overview

2.2.2 By Application Overview

2.2.3 By Level Overview

2.2.4 By Vehicle Type Overview

2.2.5 By Propulsion Overview

2.2.6 By Charging Point Overview

2.2.7 By DC Fast Charging Type Overview

2.2.8 By Connector Phase Overview

2.2.9 By Charging Service Overview

2.2.10 By Electric Bus Charging Type Overview

2.2.11 By Charging Infrastructure Type Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Electric vehicle (EV) charging station Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Consumer Demand for Convenience

4.1.1.2 Corporate Sustainability Goals

4.1.2 Market Restraints

4.1.2.1 High Infrastructure Costs

4.1.2.2 Charging Speed and Compatibility Issues

4.1.3 Market Opportunity

4.1.3.1 Integration with Renewable Energy Sources

4.1.3.2 Expansion into Underserved Regions

4.1.4 Market Challenges

4.1.4.1 Infrastructure and Grid Capacity Limitations

4.1.4.2 Consumer Adoption and Range Anxiety

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Electric vehicle (EV) charging station Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Electric vehicle (EV) charging station Market, By Charger Type

6.1 Global Electric vehicle (EV) charging station Market Snapshot, By Charger Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

6.1.1.1 Fast

6.1.1.2 Slow/Moderate

Chapter 7 Electric vehicle (EV) charging station Market, By Application

7.1 Global Electric vehicle (EV) charging station Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

7.1.1.1 Commercial

7.1.1.2 Residential

Chapter 8 Electric vehicle (EV) charging station Market, By Level

8.1 Global Electric vehicle (EV) charging station Market Snapshot, By Level

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

8.1.1.1 Level 1

8.1.1.2 Level 2

8.1.1.3 Level 3

Chapter 9 Electric vehicle (EV) charging station Market, By Vehicle Type

9.1 Global Electric vehicle (EV) charging station Market Snapshot, By Vehicle Type

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

9.1.1.1 Passenger Cars

9.1.1.2 Commercial Vehicles

Chapter 10 Electric vehicle (EV) charging station Market, By Propulsion

10.1 Global Electric vehicle (EV) charging station Market Snapshot, By Propulsion

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

10.1.1.1 BEV

10.1.1.2 PHEV

Chapter 11 Electric vehicle (EV) charging station Market, By Charging Point

11.1 Global Electric vehicle (EV) charging station Market Snapshot, By Charging Point

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

11.1.1.1 AC Charging

11.1.1.2 DC Charging

Chapter 12 Electric vehicle (EV) charging station Market, By DC Fast Charging Type

12.1 Global Electric vehicle (EV) charging station Market Snapshot, By DC Fast Charging Type

12.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

12.1.1.1 Slow DC (<49 KW)

12.1.1.2 Fast DC (50-150 KW)

12.1.1.3 Level 1 Ultra Fast DC (150-349 KW)

12.1.1.4 Level 2 Ultra Fast DC (>350 KW)

Chapter 13 Electric vehicle (EV) charging station Market, By Connector Phase

13.1 Global Electric vehicle (EV) charging station Market Snapshot, By Connector Phase

13.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

13.1.1.1 Single Phase

13.1.1.2 Three Phase

Chapter 14 Electric vehicle (EV) charging station Market, By Charging Service

14.1 Global Electric vehicle (EV) charging station Market Snapshot, By Charging Service

14.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

14.1.1.1 EV Charging Service

14.1.1.2 Battery Swapping Service

Chapter 15 Electric vehicle (EV) charging station Market, By Electric Bus Charging Type

15.1 Global Electric vehicle (EV) charging station Market Snapshot, By Electric Bus Charging Type

15.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

15.1.1.1 Off-board Top-down Pantograph

15.1.1.2 On-board Top-down Pantograph

15.1.1.3 Charging Via Connector

Chapter 16 Electric vehicle (EV) charging station Market, By Charging Infrastructure Type

16.1 Global Electric vehicle (EV) charging station Market Snapshot, By Charging Infrastructure Type

16.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

16.1.1.1 CCS

16.1.1.2 CHAdeMO

16.1.1.3 Type 1

16.1.1.4 NACS

16.1.1.5 Type 2

16.1.1.6 GB/T Fast

16.1.1.7 Tesla Supercharger

Chapter 17 Electric vehicle (EV) charging station Market, By Region

17.1 Overview

17.2 Electric vehicle (EV) charging station Market Revenue Share, By Region 2023 (%)

17.3 Global Electric vehicle (EV) charging station Market, By Region

17.3.1 Market Size and Forecast

17.4 North America

17.4.1 North America Electric vehicle (EV) charging station Market Revenue, 2021-2033 ($Billion)

17.4.2 Market Size and Forecast

17.4.3 North America Electric vehicle (EV) charging station Market, By Country

17.4.4 U.S.

17.4.4.1 U.S. Electric vehicle (EV) charging station Market Revenue, 2021-2033 ($Billion)

17.4.4.2 Market Size and Forecast

17.4.4.3 U.S. Market Segmental Analysis

17.4.5 Canada

17.4.5.1 Canada Electric vehicle (EV) charging station Market Revenue, 2021-2033 ($Billion)

17.4.5.2 Market Size and Forecast

17.4.5.3 Canada Market Segmental Analysis

17.4.6 Mexico

17.4.6.1 Mexico Electric vehicle (EV) charging station Market Revenue, 2021-2033 ($Billion)

17.4.6.2 Market Size and Forecast

17.4.6.3 Mexico Market Segmental Analysis

17.5 Europe

17.5.1 Europe Electric vehicle (EV) charging station Market Revenue, 2021-2033 ($Billion)

17.5.2 Market Size and Forecast

17.5.3 Europe Electric vehicle (EV) charging station Market, By Country

17.5.4 UK

17.5.4.1 UK Electric vehicle (EV) charging station Market Revenue, 2021-2033 ($Billion)

17.5.4.2 Market Size and Forecast

17.5.4.3 UK Market Segmental Analysis

17.5.5 France

17.5.5.1 France Electric vehicle (EV) charging station Market Revenue, 2021-2033 ($Billion)

17.5.5.2 Market Size and Forecast

17.5.5.3 France Market Segmental Analysis

17.5.6 Germany

17.5.6.1 Germany Electric vehicle (EV) charging station Market Revenue, 2021-2033 ($Billion)

17.5.6.2 Market Size and Forecast

17.5.6.3 Germany Market Segmental Analysis

17.5.7 Rest of Europe

17.5.7.1 Rest of Europe Electric vehicle (EV) charging station Market Revenue, 2021-2033 ($Billion)

17.5.7.2 Market Size and Forecast

17.5.7.3 Rest of Europe Market Segmental Analysis

17.6 Asia Pacific

17.6.1 Asia Pacific Electric vehicle (EV) charging station Market Revenue, 2021-2033 ($Billion)

17.6.2 Market Size and Forecast

17.6.3 Asia Pacific Electric vehicle (EV) charging station Market, By Country

17.6.4 China

17.6.4.1 China Electric vehicle (EV) charging station Market Revenue, 2021-2033 ($Billion)

17.6.4.2 Market Size and Forecast

17.6.4.3 China Market Segmental Analysis

17.6.5 Japan

17.6.5.1 Japan Electric vehicle (EV) charging station Market Revenue, 2021-2033 ($Billion)

17.6.5.2 Market Size and Forecast

17.6.5.3 Japan Market Segmental Analysis

17.6.6 India

17.6.6.1 India Electric vehicle (EV) charging station Market Revenue, 2021-2033 ($Billion)

17.6.6.2 Market Size and Forecast

17.6.6.3 India Market Segmental Analysis

17.6.7 Australia

17.6.7.1 Australia Electric vehicle (EV) charging station Market Revenue, 2021-2033 ($Billion)

17.6.7.2 Market Size and Forecast

17.6.7.3 Australia Market Segmental Analysis

17.6.8 Rest of Asia Pacific

17.6.8.1 Rest of Asia Pacific Electric vehicle (EV) charging station Market Revenue, 2021-2033 ($Billion)

17.6.8.2 Market Size and Forecast

17.6.8.3 Rest of Asia Pacific Market Segmental Analysis

17.7 LAMEA

17.7.1 LAMEA Electric vehicle (EV) charging station Market Revenue, 2021-2033 ($Billion)

17.7.2 Market Size and Forecast

17.7.3 LAMEA Electric vehicle (EV) charging station Market, By Country

17.7.4 GCC

17.7.4.1 GCC Electric vehicle (EV) charging station Market Revenue, 2021-2033 ($Billion)

17.7.4.2 Market Size and Forecast

17.7.4.3 GCC Market Segmental Analysis

17.7.5 Africa

17.7.5.1 Africa Electric vehicle (EV) charging station Market Revenue, 2021-2033 ($Billion)

17.7.5.2 Market Size and Forecast

17.7.5.3 Africa Market Segmental Analysis

17.7.6 Brazil

17.7.6.1 Brazil Electric vehicle (EV) charging station Market Revenue, 2021-2033 ($Billion)

17.7.6.2 Market Size and Forecast

17.7.6.3 Brazil Market Segmental Analysis

17.7.7 Rest of LAMEA

17.7.7.1 Rest of LAMEA Electric vehicle (EV) charging station Market Revenue, 2021-2033 ($Billion)

17.7.7.2 Market Size and Forecast

17.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 18 Competitive Landscape

18.1 Competitor Strategic Analysis

18.1.1 Top Player Positioning/Market Share Analysis

18.1.2 Top Winning Strategies, By Company, 2021-2023

18.1.3 Competitive Analysis By Revenue, 2021-2023

18.2 Recent Developments by the Market Contributors (2023)

Chapter 19 Company Profiles

19.1 Tesla, Inc.

19.1.1 Company Snapshot

19.1.2 Company and Business Overview

19.1.3 Financial KPIs

19.1.4 Product/Service Portfolio

19.1.5 Strategic Growth

19.1.6 Global Footprints

19.1.7 Recent Development

19.1.8 SWOT Analysis

19.2 ChargePoint, Inc.

19.3 Blink Charging Co.

19.4 ABB Ltd.

19.5 BP Chargemaster

19.6 Siemens AG

19.7 EVgo Services LLC

19.8 Shell Recharge

19.9 Enel X

19.10 Electrify America