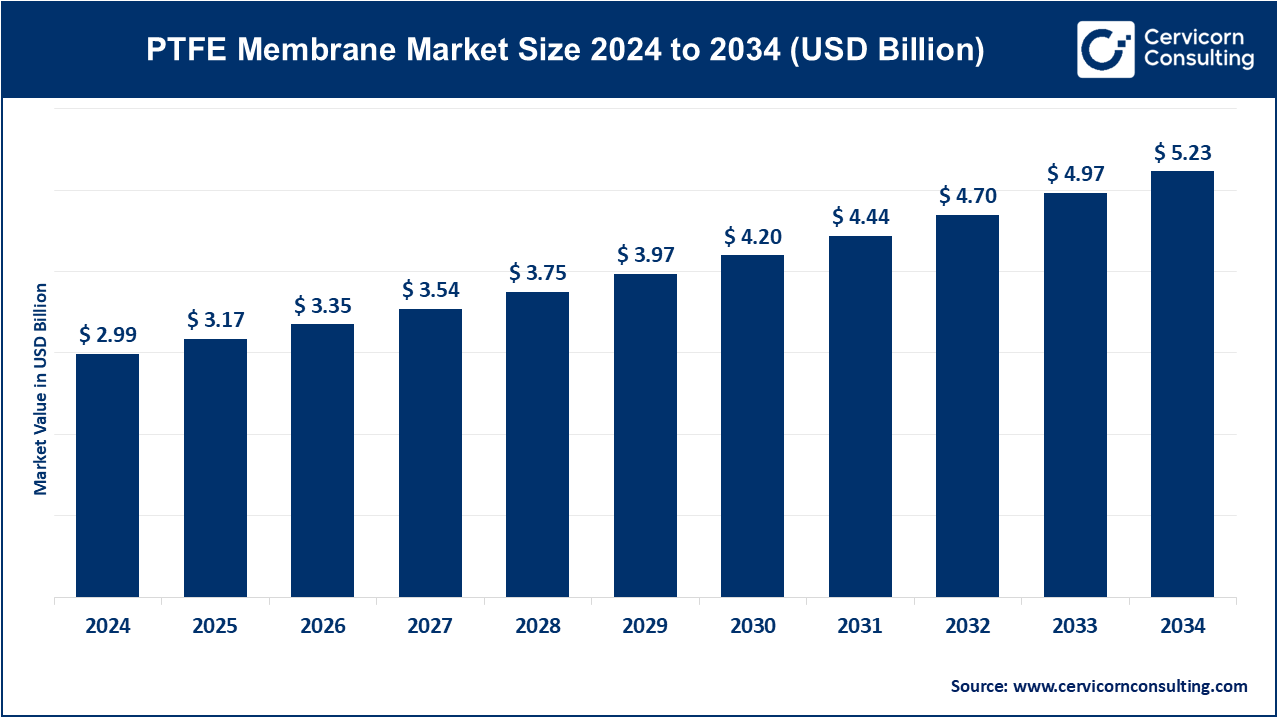

The global PTFE membrane market size was accounted for USD 2.99 billion in 2024 and is expected to reach around USD 5.23 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.79% over the forecast period 2025 to 2034.

The PTFE membrane market is witnessing substantial growth, mainly driven by increasing industrial and environmental concerns. As global awareness of air and water pollution rises, industries are adopting more efficient filtration systems, which has created a strong demand for PTFE membranes. These membranes are crucial in various applications, such as filtration, medical devices, and protective coatings, offering superior performance due to their chemical resistance, high durability, and ability to withstand extreme temperatures. Industries like pharmaceuticals, chemicals, and electronics rely on PTFE membranes for precise filtration and moisture protection. In addition, the growing focus on sustainable practices and regulations pushing for cleaner production methods are fueling the demand for high-performance filtration technologies. India is the largest importer of PTFE membranes, accounting for 30% of global imports with 2,154 shipments. The market is also benefiting from the expanding healthcare sector, where PTFE membranes are used in applications like wound healing and drug delivery.

PTFE (Polytetrafluoroethylene) membrane is a high-performance material made from PTFE, a type of plastic known for its non-stick and water-resistant properties. These membranes are thin, flexible layers that allow gases or liquids to pass through while blocking particles, water, or contaminants. PTFE membranes are widely used in filtration systems, waterproof clothing, medical devices, and chemical processing due to their durability, chemical resistance, and ability to function in extreme temperatures. PTFE membranes are available in hydrophobic (water-repelling) and hydrophilic (water-attracting) forms, making them versatile for different applications. In industrial filtration, they help purify air and liquids by capturing fine particles.

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 3.17 Billion |

| Market Size by 2034 | USD 5.23 Billion |

| Market Growth Rate | CAGR of 5.79% from 2025 to 2034 |

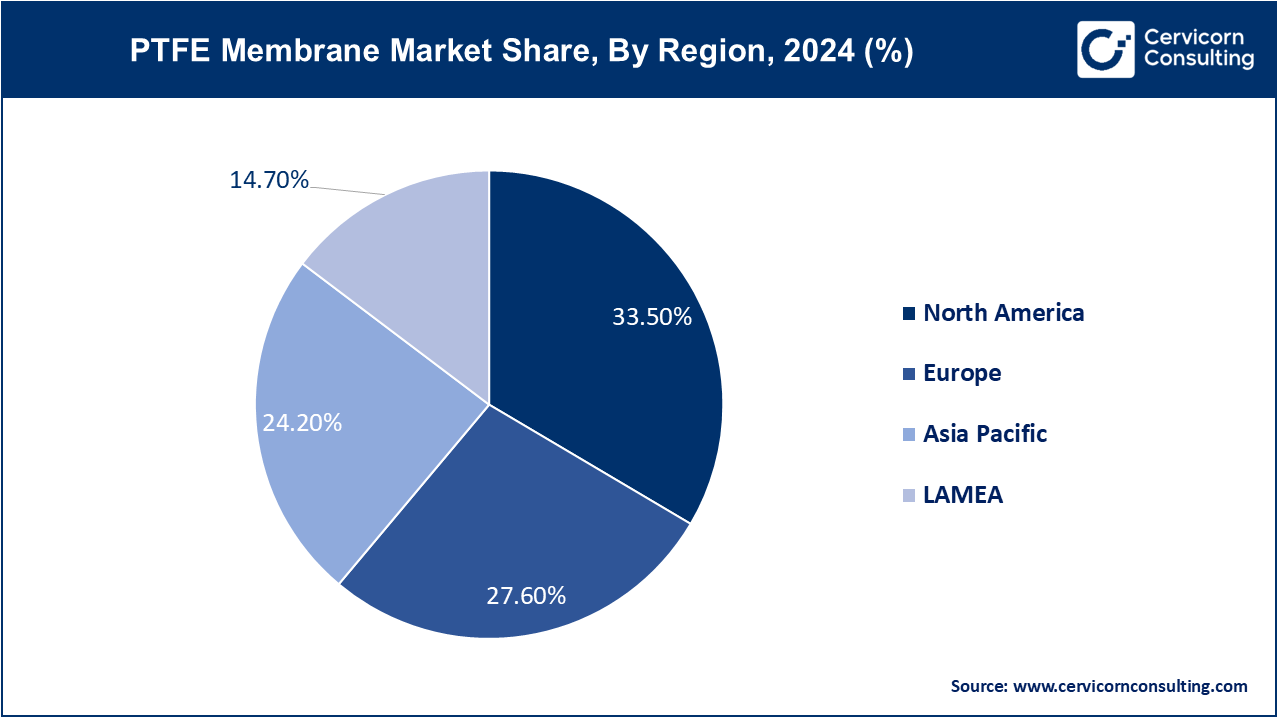

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Segment Coverage | By Type, Application and Regions |

Regulatory Push for Environmental Sustainability:

Rising Demand for High-Quality Medical Devices:

High Cost of PTFE Materials:

Limited Manufacturing Capacity:

Development of Customized Solutions:

Expansion in Emerging Markets:

Complex Installation and Maintenance:

Limited Recycling Options:

The PTFE membrane market is segmented into type, application, and region. Based on type, the market is classified into hydrophobic membranes, hydrophilic membranes, oleophobic membranes, and others. Based on application, the market is classified into industrial filtration, medical and pharmaceuticals, textiles, water and wastewater treatment, architecture, and others.

Hydrophobic Membranes: In 2024, this segment has accounted 57% of market share. Hydrophobic membranes repel water and are used to prevent moisture from passing through while allowing air and gases to pass. They are commonly used in applications where water resistance is crucial. The demand for hydrophobic PTFE membranes is increasing in sectors like filtration and construction, driven by their effectiveness in preventing water ingress and their durability in harsh environments.

Hydrophilic Membranes: Hydrophilic membranes attract and allow water to pass through while blocking other substances. They are used in applications that require water permeability and are essential for certain filtration processes. Growing applications in medical and industrial filtration are driving the demand for hydrophilic PTFE membranes. Innovations aimed at enhancing permeability and performance in aqueous environments are advancing this segment.

Oleophobic Membranes: Oleophobic membranes repel oils and fats, making them ideal for environments where oil resistance is required. These membranes are used to filter or separate substances involving oils or other hydrophobic liquids. The rise in industries such as food processing and petrochemicals, where oil and grease handling is prevalent, is boosting the adoption of oleophobic PTFE membranes. Technological advancements are enhancing their efficiency and durability.

Others: This category includes various specialized PTFE membranes not covered by the standard types, such as composite or multi-layer membranes, designed for specific applications and performance needs. Custom and advanced membrane technologies are emerging to meet unique industry requirements. Innovations in composite membranes are expanding applications across various sectors, offering tailored solutions for complex challenges.

Industrial Filtration: The industrial filtration segment has recorded market share of 38% in 2024. PTFE membranes in industrial filtration are used for separating particles and contaminants from gases and liquids, providing high chemical resistance and durability. The market is growing due to increased industrial activities and regulatory requirements for clean air and water. Innovations focus on enhancing membrane efficiency and lifespan, driving demand for advanced filtration solutions in sectors such as chemicals and pharmaceuticals.

Medical & Pharmaceuticals: The medical and pharmaceutical segment has reported market share of 20% in 2024. In the medical and pharmaceutical industries, PTFE membranes are employed in filters and barriers for maintaining sterility and ensuring the purity of medical solutions. There's a rising demand for high-performance, sterile materials due to advancements in medical technologies and stricter regulatory standards. PTFE membranes are increasingly used in drug manufacturing and medical device filtration, driven by innovations in health care and biopharmaceuticals.

Textiles: This segment has calculated market share of 18% in the year of 2024. PTFE membranes are used in textiles for applications that require water resistance, breathability, and durability, such as in outdoor and performance fabrics. The demand for high-performance fabrics in sportswear and protective clothing is expanding. Innovations focus on improving membrane integration into textiles to enhance durability and comfort, responding to the growing consumer preference for functional and high-quality apparel.

Water & Wastewater Treatment: The water and wastewater treatment segment has captured market share of 9% in 2024. PTFE membranes in water and wastewater treatment are utilized for their high filtration efficiency and resistance to fouling, helping in the purification process. Increased environmental regulations and the need for efficient water management drive the demand for PTFE membranes. Advancements in membrane technology aim to enhance performance and reduce operational costs in both municipal and industrial wastewater treatment applications.

Architecture: In architecture, PTFE membranes are used for building facades, roofs, and other structural applications due to their durability, flexibility, and resistance to environmental conditions. The use of PTFE membranes is growing in architectural designs for their aesthetic and functional benefits. Trends include increased adoption in large-span structures and innovative designs that leverage the material's versatility and weather resistance, contributing to modern architectural projects.

Others: The others segment has generated market share of 15% in 2024. This category includes various niche applications of PTFE membranes such as in aerospace, automotive, and electronics. Emerging applications and ongoing research drive growth in this segment. Innovations are focused on expanding PTFE membrane uses in advanced technology sectors, exploring new material combinations and applications to meet evolving industry needs.

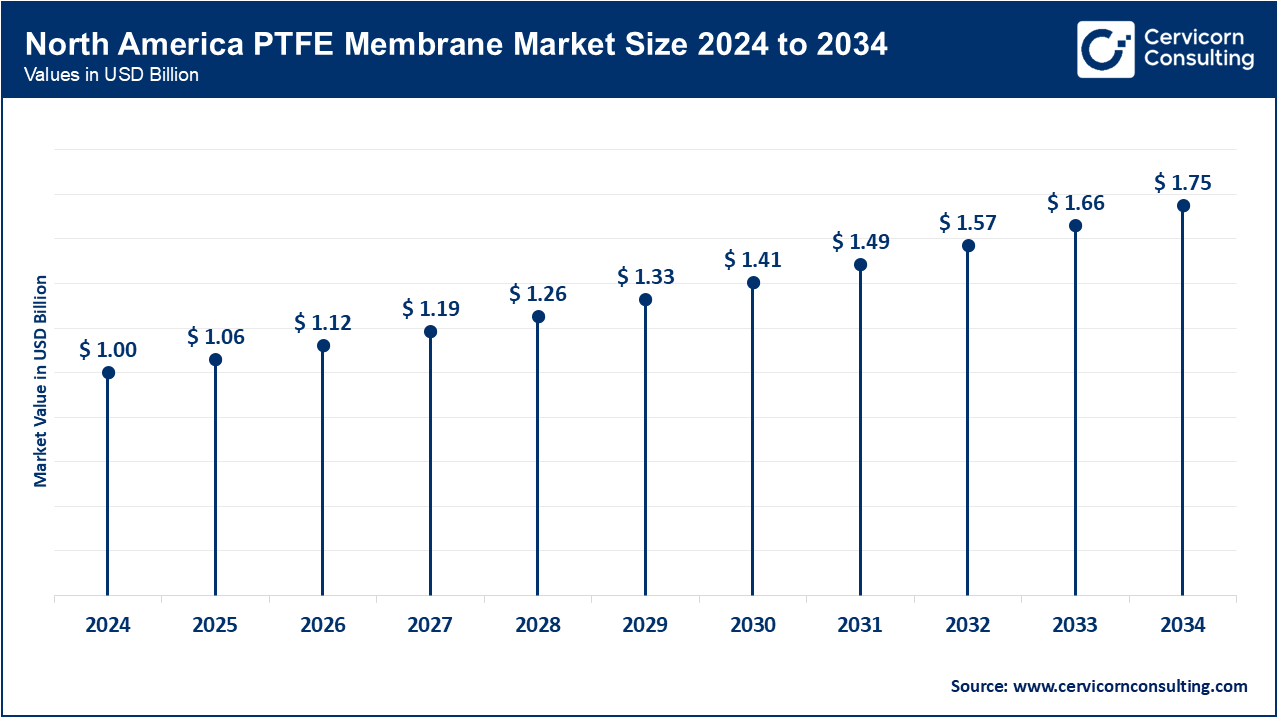

The North America market size is expected to reach around USD 1.75 billion by 2034 increasing from USD 1 billion in 2024 with a CAGR of 5.80%. The North American PTFE membrane market is characterized by advanced technology adoption and high demand for high-performance materials. Key trends include a focus on innovation and sustainability, driven by stringent environmental regulations and a strong emphasis on R&D in industries such as aerospace, automotive, and construction. The region's established infrastructure and regulatory environment support continued growth and technological advancements. U.S market size is estimated to reach around USD 1.31 billion by 2034 increasing from USD 0.75 billion in 2024 with a CAGR of 5.90%.

The Asia Pacific market size is calculated at USD 0.72 billion in 2024 and is projected to grow around USD 1.27 billion by 2034 with a CAGR of 6.40%. The Asia-Pacific region is experiencing rapid industrialization and urbanization, driving significant growth in the PTFE membrane market. Trends include expanding applications in water and wastewater treatment, construction, and manufacturing due to rising infrastructure development and increasing industrial activities. The region is also seeing growth in consumer demand for advanced textiles and filtration solutions, leading to increased adoption of PTFE membranes.

The Europe market size is measured at USD 0.83 billion in 2024 and is expected to grow around USD 1.44 billion by 2034 with a CAGR of 5.60%. In Europe, the PTFE membrane market is influenced by strong environmental regulations and a growing emphasis on sustainability. Trends include increased use of PTFE membranes in green building projects and water treatment systems, driven by the European Union’s commitment to reducing carbon emissions and improving environmental quality. Innovations are focused on enhancing energy efficiency and reducing the environmental impact of construction and industrial processes.

The LAMEA market size is forecasted to reach around USD 0.77 billion by 2034 from USD 0.44 billion in 2024 with a CAGR of 5.10%. In the LAMEA (Latin America, Middle East, and Africa) region, the PTFE membrane market is growing due to increasing investments in infrastructure and industrial projects. Trends include rising demand for water treatment solutions and construction materials as governments focus on improving utilities and infrastructure. The region is also seeing emerging applications in sectors like mining and energy, with a growing interest in adopting advanced materials for better performance and sustainability.

Emerging companies like Membrane Solutions, LLC and Tetratec AG are adopting innovative technologies to enter the PTFE membrane market. They focus on developing advanced filtration and industrial solutions that cater to evolving customer needs and regulatory standards. Established companies such as W. L. Gore & Associates, Inc. and 3M Company dominate the market through their extensive R&D capabilities and broad application range. Their leadership stems from high-performance products, strong brand presence, and significant investments in technological advancements, maintaining a competitive edge in the industry.

Market Segmentation

By Type

By Application

By Regions

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of PTFE Membrane

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Application Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on PTFE Membrane Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Regulatory Push for Environmental Sustainability

4.1.1.2 Rising Demand for High-Quality Medical Devices

4.1.2 Market Restraints

4.1.2.1 High Cost of PTFE Materials

4.1.2.2 Limited Manufacturing Capacity

4.1.3 Market Opportunity

4.1.3.1 Development of Customized Solutions

4.1.3.2 Expansion in Emerging Markets

4.1.4 Market Challenges

4.1.4.1 Complex Installation and Maintenance

4.1.4.2 Limited Recycling Options

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global PTFE Membrane Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 PTFE Membrane Market, By Type

6.1 Global PTFE Membrane Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Hydrophobic Membranes

6.1.1.2 Hydrophilic Membranes

6.1.1.3 Oleophobic Membranes

6.1.1.4 Others

Chapter 7 PTFE Membrane Market, By Application

7.1 Global PTFE Membrane Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Industrial Filtration

7.1.1.2 Medical & Pharmaceuticals

7.1.1.3 Textiles

7.1.1.4 Water & Wastewater treatment

7.1.1.5 Architecture

7.1.1.6 Others

Chapter 8 PTFE Membrane Market, By Region

8.1 Overview

8.2 PTFE Membrane Market Revenue Share, By Region 2024 (%)

8.3 Global PTFE Membrane Market, By Region

8.3.1 Market Size and Forecast

8.4 North America

8.4.1 North America PTFE Membrane Market Revenue, 2022-2034 ($Billion)

8.4.2 Market Size and Forecast

8.4.3 North America PTFE Membrane Market, By Country

8.4.4 U.S.

8.4.4.1 U.S. PTFE Membrane Market Revenue, 2022-2034 ($Billion)

8.4.4.2 Market Size and Forecast

8.4.4.3 U.S. Market Segmental Analysis

8.4.5 Canada

8.4.5.1 Canada PTFE Membrane Market Revenue, 2022-2034 ($Billion)

8.4.5.2 Market Size and Forecast

8.4.5.3 Canada Market Segmental Analysis

8.4.6 Mexico

8.4.6.1 Mexico PTFE Membrane Market Revenue, 2022-2034 ($Billion)

8.4.6.2 Market Size and Forecast

8.4.6.3 Mexico Market Segmental Analysis

8.5 Europe

8.5.1 Europe PTFE Membrane Market Revenue, 2022-2034 ($Billion)

8.5.2 Market Size and Forecast

8.5.3 Europe PTFE Membrane Market, By Country

8.5.4 UK

8.5.4.1 UK PTFE Membrane Market Revenue, 2022-2034 ($Billion)

8.5.4.2 Market Size and Forecast

8.5.4.3 UK Market Segmental Analysis

8.5.5 France

8.5.5.1 France PTFE Membrane Market Revenue, 2022-2034 ($Billion)

8.5.5.2 Market Size and Forecast

8.5.5.3 France Market Segmental Analysis

8.5.6 Germany

8.5.6.1 Germany PTFE Membrane Market Revenue, 2022-2034 ($Billion)

8.5.6.2 Market Size and Forecast

8.5.6.3 Germany Market Segmental Analysis

8.5.7 Rest of Europe

8.5.7.1 Rest of Europe PTFE Membrane Market Revenue, 2022-2034 ($Billion)

8.5.7.2 Market Size and Forecast

8.5.7.3 Rest of Europe Market Segmental Analysis

8.6 Asia Pacific

8.6.1 Asia Pacific PTFE Membrane Market Revenue, 2022-2034 ($Billion)

8.6.2 Market Size and Forecast

8.6.3 Asia Pacific PTFE Membrane Market, By Country

8.6.4 China

8.6.4.1 China PTFE Membrane Market Revenue, 2022-2034 ($Billion)

8.6.4.2 Market Size and Forecast

8.6.4.3 China Market Segmental Analysis

8.6.5 Japan

8.6.5.1 Japan PTFE Membrane Market Revenue, 2022-2034 ($Billion)

8.6.5.2 Market Size and Forecast

8.6.5.3 Japan Market Segmental Analysis

8.6.6 India

8.6.6.1 India PTFE Membrane Market Revenue, 2022-2034 ($Billion)

8.6.6.2 Market Size and Forecast

8.6.6.3 India Market Segmental Analysis

8.6.7 Australia

8.6.7.1 Australia PTFE Membrane Market Revenue, 2022-2034 ($Billion)

8.6.7.2 Market Size and Forecast

8.6.7.3 Australia Market Segmental Analysis

8.6.8 Rest of Asia Pacific

8.6.8.1 Rest of Asia Pacific PTFE Membrane Market Revenue, 2022-2034 ($Billion)

8.6.8.2 Market Size and Forecast

8.6.8.3 Rest of Asia Pacific Market Segmental Analysis

8.7 LAMEA

8.7.1 LAMEA PTFE Membrane Market Revenue, 2022-2034 ($Billion)

8.7.2 Market Size and Forecast

8.7.3 LAMEA PTFE Membrane Market, By Country

8.7.4 GCC

8.7.4.1 GCC PTFE Membrane Market Revenue, 2022-2034 ($Billion)

8.7.4.2 Market Size and Forecast

8.7.4.3 GCC Market Segmental Analysis

8.7.5 Africa

8.7.5.1 Africa PTFE Membrane Market Revenue, 2022-2034 ($Billion)

8.7.5.2 Market Size and Forecast

8.7.5.3 Africa Market Segmental Analysis

8.7.6 Brazil

8.7.6.1 Brazil PTFE Membrane Market Revenue, 2022-2034 ($Billion)

8.7.6.2 Market Size and Forecast

8.7.6.3 Brazil Market Segmental Analysis

8.7.7 Rest of LAMEA

8.7.7.1 Rest of LAMEA PTFE Membrane Market Revenue, 2022-2034 ($Billion)

8.7.7.2 Market Size and Forecast

8.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 9 Competitive Landscape

9.1 Competitor Strategic Analysis

9.1.1 Top Player Positioning/Market Share Analysis

9.1.2 Top Winning Strategies, By Company, 2022-2024

9.1.3 Competitive Analysis By Revenue, 2022-2024

9.2 Recent Developments by the Market Contributors (2024)

Chapter 10 Company Profiles

10.1 Gore-Tex (W. L. Gore & Associates, Inc.)

10.1.1 Company Snapshot

10.1.2 Company and Business Overview

10.1.3 Financial KPIs

10.1.4 Product/Service Portfolio

10.1.5 Strategic Growth

10.1.6 Global Footprints

10.1.7 Recent Development

10.1.8 SWOT Analysis

10.2 3M Company

10.3 Donaldson Company, Inc.

10.4 Pall Corporation

10.5 Membrane Solutions, LLC

10.6 Hyundai Department Store Group

10.7 Tetratec AG

10.8 Sartorius AG

10.9 Holland Shielding Systems B.V.

10.10 AGC Inc. (Asahi Glass Co., Ltd.)