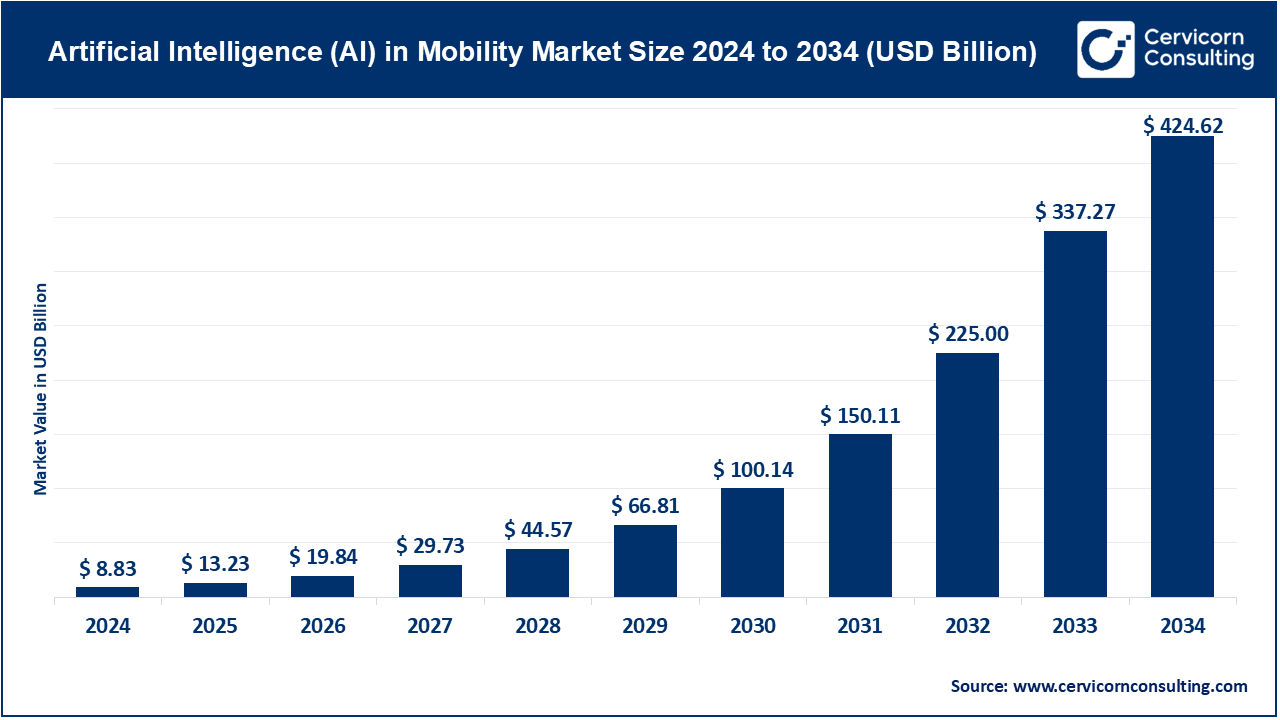

The global artificial intelligence (AI) in mobility market size was valued at USD 8.83 billion in 2024 and is expected to hit around USD 424.62 billion by 2034. It is growing at a compound annual growth rate (CAGR) of 47.3% from 2025 to 2034.

The artificial intelligence (AI) in mobility market is experiencing significant growth, driven by several factors that are reshaping the transportation landscape. One key driver is the increasing demand for autonomous vehicles. Automakers are heavily investing in AI to develop self-driving technology that can enhance vehicle safety, reduce accidents, and improve driving efficiency. The rise of connected vehicles, which can communicate with each other and with infrastructure, also contributes to the market's growth. This interconnectivity allows for smarter traffic management, optimized routes, and improved vehicle-to-vehicle (V2V) communication, reducing congestion and emissions. Additionally, the shift toward electric vehicles (EVs) is another crucial factor influencing market growth. AI plays a vital role in the development of EVs by optimizing battery performance, improving energy management, and ensuring efficient charging. In October 2024, Toyota and Nippon Telegraph and Telephone (NTT) announced a joint investment of USD 3.27 billion by 2030 to develop an AI platform aimed at reducing traffic accidents.

Artificial Intelligence (AI) in mobility refers to the use of AI technologies to enhance transportation systems, making them smarter, more efficient, and safer. It encompasses various applications like self-driving vehicles, predictive maintenance for vehicles, traffic management, route optimization, and personalized travel experiences. AI can process massive amounts of data from sensors, cameras, and GPS systems, enabling vehicles to make real-time decisions, recognize obstacles, and improve driving performance. Additionally, AI supports connected and autonomous systems, allowing vehicles to communicate with each other and infrastructure, reducing accidents and traffic congestion. AI in mobility also extends to smart cities, where AI optimizes traffic flow, reduces pollution, and improves public transport efficiency.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 13.23 Billion |

| Projected Market Size (2034) | USD 424.62 Billion |

| Growth Rate (2025 to 2034) | 47.3% |

| Largest Revenue Holder Region | North America |

| Fastest Growing Region | Asia Pacific |

| Report Segments | Technology, Application, Deployment Mode, Region |

| Top Companies | Waymo, Tesla, Inc., NVIDIA Corporation, IBM Corporation, Baidu, Inc., Intel Corporation Alphabet Inc., Microsoft Corporation, Apple Inc., Aurora Innovation, Inc., Apple Inc., Uber Technologies, Inc., Qualcomm Technologies, Inc., Bosch Mobility Solutions, Daimler AG |

The artificial intelligence (AI) in mobility market is segmented into technology, application, deployment mode, and region. Based on technology, the market is classified into machine learning, natural language processing (NLP), computer vision, robotics, and sensor fusion. Based on application, the market is classified into autonomous vehicles, smart transportation systems, fleet management, mobility-as-a-service (MaaS), and predictive maintenance. Based on deployment mode, the market is classified into cloud-based, and on-premises.

Machine Learning: Machine learning (ML) encompasses algorithms and statistical models that enable systems to learn from data and enhance their performance over time without explicit programming. In the context of AI in mobility, machine learning is pivotal for applications such as predictive analytics, where it processes historical data to forecast future trends and behaviors. For example, ML algorithms can analyze traffic patterns to optimize routing for vehicles, improve fuel efficiency, and enhance the overall driving experience. The continuous learning capability of ML also allows systems to adapt to changing environments, making them increasingly effective in real-time decision-making.

Natural Language Processing (NLP): Natural language processing is a branch of AI focused on enabling machines to understand, interpret, and respond to human language. In mobility applications, NLP enhances user interactions through voice recognition and conversational interfaces, allowing users to engage with navigation systems, ride-sharing platforms, and customer service chatbots more intuitively. By enabling vehicles to respond to voice commands, NLP improves the user experience, making it safer and more convenient for drivers to access information while on the road. The ongoing advancements in NLP are leading to more sophisticated and user-friendly mobility solutions.

Computer Vision: Computer vision is a field of AI that focuses on enabling machines to interpret and understand visual information from the world. In mobility, computer vision plays a crucial role in applications such as autonomous vehicles, where it processes data from cameras and sensors to detect obstacles, recognize traffic signs, and understand road conditions. This technology is essential for ensuring safety and reliability in self-driving systems, as it enables vehicles to make informed decisions based on their surroundings. Furthermore, computer vision is also utilized in driver assistance systems, providing real-time feedback to enhance driver awareness and reduce accidents.

Robotics: Robotics refers to the application of AI in designing and operating machines that can perform tasks autonomously or semi-autonomously. In the mobility sector, AI-driven robotics are increasingly used in applications such as autonomous delivery vehicles and drones for transporting goods. These systems leverage AI to navigate complex environments, avoid obstacles, and make real-time decisions. The integration of robotics in mobility enhances operational efficiency, reduces delivery times, and opens up new possibilities for last-mile logistics. As technology advances, the capabilities of robotic systems in mobility are expected to expand, further revolutionizing transportation and delivery services.

Sensor Fusion: Sensor fusion involves the integration of data from multiple sensors to improve the accuracy and reliability of information processing. In mobility applications, sensor fusion is critical for enhancing the performance of autonomous vehicles and smart transportation systems. By combining data from various sources, such as cameras, LiDAR, radar, and GPS, sensor fusion enables a comprehensive understanding of the vehicle's environment. This technology enhances object detection, obstacle avoidance, and navigation accuracy, leading to safer and more efficient mobility solutions. As sensor technology evolves, the effectiveness of sensor fusion will continue to play a vital role in the advancement of AI in mobility.

Autonomous Vehicles: The application of AI technologies in autonomous vehicles focuses on developing and operating self-driving cars and trucks. AI systems process vast amounts of data from various sensors and cameras to navigate safely, make real-time decisions, and respond to changing road conditions. Key components include machine learning algorithms for perception and decision-making, computer vision for understanding the environment, and sensor fusion for integrating information from multiple sources. Autonomous vehicles aim to improve safety, reduce traffic congestion, and enhance mobility accessibility. As technology advances, the market for autonomous vehicles continues to expand, with significant investments from automotive manufacturers and tech companies.

Smart Transportation Systems: Smart transportation systems leverage AI applications to optimize traffic management, route planning, and public transportation efficiency. These systems analyse real-time data from various sources, including traffic cameras, sensors, and user inputs, to make informed decisions that enhance mobility. For example, AI can dynamically adjust traffic signals based on current traffic flow, reducing congestion and improving travel times. Additionally, smart transportation systems can provide real-time updates to users regarding public transit schedules and delays, improving the overall travel experience. The adoption of smart transportation systems contributes to sustainable urban mobility and supports the development of smart cities.

Fleet Management: AI solutions for fleet management focus on optimizing the operations of commercial vehicle fleets, including maintenance scheduling, route planning, and fuel efficiency analysis. By analysing data from vehicle telematics, AI can identify patterns related to driver behaviour, vehicle performance, and maintenance needs, enabling fleet operators to make informed decisions. Predictive analytics can forecast when vehicles require maintenance, reducing downtime and operational costs. Additionally, AI-powered systems can optimize routes to minimize fuel consumption and enhance delivery efficiency. As businesses increasingly recognize the benefits of AI in fleet management, this application continues to grow in importance.

Mobility-as-a-Service (MaaS): Mobility-as-a-Service (MaaS) refers to AI-driven platforms that integrate various transportation services into a single, accessible on-demand solution. MaaS platforms allow users to plan, book, and pay for multiple transportation modes, including public transit, ride-sharing, bike-sharing, and car rentals, through a single application. AI enhances MaaS by analysing user preferences and real-time data to provide personalized recommendations and optimize travel routes. By offering seamless and convenient transportation options, MaaS encourages the use of public and shared transport, contributing to reduced traffic congestion and environmental impact.

Predictive Maintenance: Predictive maintenance involves the use of AI applications to forecast vehicle maintenance needs, minimizing downtime and costs associated with unexpected repairs. By analysing data from sensors and telematics systems, AI can identify patterns that indicate potential failures or maintenance requirements. This proactive approach allows fleet operators and vehicle manufacturers to schedule maintenance at optimal times, improving operational efficiency and extending the lifespan of vehicles. Predictive maintenance is becoming increasingly important in the mobility sector, as businesses seek to reduce maintenance costs and enhance service reliability.

Cloud-based Solutions: Cloud-based solutions refer to AI applications hosted on cloud platforms, offering scalability and flexibility for businesses in the mobility sector. These solutions allow organizations to store and process vast amounts of data, enabling advanced analytics and machine learning capabilities. Cloud-based platforms facilitate real-time data sharing and collaboration among various stakeholders, including automotive manufacturers, public transportation providers, and logistics companies.

On-Premises Solutions: On-premises solutions involve AI systems deployed within an organization’s infrastructure, providing enhanced control and security over data and operations. This deployment mode is often preferred by businesses that require stringent data privacy and compliance measures, such as automotive manufacturers and logistics companies. On-premises solutions allow organizations to customize their AI applications to fit specific operational needs and maintain direct oversight of data management.

The AI in mobility market is divided into key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s a detailed overview of each region:

The AI in Mobility market in North America is highly advanced, led by the United States and Canada. The U.S. is a leader in deploying AI for autonomous vehicles, traffic management, and smart infrastructure. Canada complements this with innovations in smart mobility solutions and enhanced transportation systems. The region benefits from significant investments in AI technology, a strong tech ecosystem, and a focus on integrating AI into various mobility applications.

Europe is a key player in the AI in Mobility market, with countries like Germany, France, and the UK leading in automotive innovation and smart city initiatives. The European market emphasizes regulatory compliance and sustainability, driving advancements in AI technologies for transportation and infrastructure. The region’s focus on high standards and strategic development supports the deployment of cutting-edge AI solutions in mobility.

The Asia-Pacific region is experiencing rapid growth, driven by major players such as China, Japan, and India. This growth is fuelled by expanding infrastructure, increased adoption of AI technologies, and investments in autonomous vehicles and smart transportation systems. The region’s advancements in AI technology are aimed at improving traffic management, enhancing vehicle automation, and supporting smart city projects.

LAMEA is developing, with growing interest in smart transportation solutions and infrastructure improvements. Brazil and South Africa are leading with investments in mobility technologies, while the Middle East is expanding its focus on AI-driven transportation systems despite economic and infrastructure challenges. The region shows considerable potential for growth, supported by rising investments and ongoing advancements in AI mobility solutions.

The artificial intelligence (AI) in mobility market is characterized by a diverse landscape of key players, ranging from established automotive manufacturers to innovative tech companies and startups. Major automotive manufacturers, such as Tesla, Toyota, Ford, and Volkswagen, are heavily investing in AI technologies to enhance their autonomous driving capabilities, develop advanced driver-assistance systems (ADAS), and improve overall vehicle performance. These companies leverage AI for applications like predictive maintenance, route optimization, and enhanced safety features.

CEO Statements

Elon Musk, CEO of Tesla: “AI is crucial for Tesla's mission to develop self-driving technology. Our AI systems continuously learn and adapt to improve the safety and performance of our autonomous vehicles."

John Krafcik, Former CEO of Waymo: “Our goal with Waymo is to make self-driving cars a reality and to ensure that they are safer and more efficient than human-driven vehicles. AI is at the heart of this mission, driving our innovation and development.”

Jensen Huang, CEO of NVIDIA: " AI and deep learning are transforming the automotive industry, from advanced driver assistance systems to fully autonomous vehicles. NVIDIA’s AI platforms are designed to accelerate this transformation.”

Strategic partnerships and Launches highlight the rapid advancements and collaborative efforts in the AI in mobility industry. Industry players are involved in various aspects of AI in mobility, including production, technologies, and innovation, and play a significant role in advancing the market. Some notable examples of key developments in the AI in mobility market include:

Market Segmentation

By Technology

By Application

By Deployment Mode

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Artificial Intelligence (AI) in Mobility

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Application Overview

2.2.3 By Deployment Mode Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Artificial Intelligence (AI) in Mobility Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Driver 1

4.1.1.2 Driver 2

4.1.2 Market Restraints

4.1.2.1 Restraint 1

4.1.2.2 Restraint 2

4.1.3 Market Opportunity

4.1.3.1 Opportunity 1

4.1.3.2 Opportunity 2

4.1.4 Market Challenges

4.1.4.1 Challenge 1

4.1.4.2 Challenge 2

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Artificial Intelligence (AI) in Mobility Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Artificial Intelligence (AI) in Mobility Market, By Technology

6.1 Global Artificial Intelligence (AI) in Mobility Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Machine Learning

6.1.1.2 Natural Language Processing (NLP)

6.1.1.3 Computer Vision

6.1.1.4 Robotics

6.1.1.5 Sensor Fusion

Chapter 7 Artificial Intelligence (AI) in Mobility Market, By Application

7.1 Global Artificial Intelligence (AI) in Mobility Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Autonomous Vehicles

7.1.1.2 Smart Transportation Systems

7.1.1.3 Fleet Management

7.1.1.4 Mobility-as-a-Service (MaaS)

7.1.1.5 Predictive Maintenance

Chapter 8 Artificial Intelligence (AI) in Mobility Market, By Deployment Mode

8.1 Global Artificial Intelligence (AI) in Mobility Market Snapshot, By Deployment Mode

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Cloud-based

8.1.1.2 On-Premises

Chapter 9 Artificial Intelligence (AI) in Mobility Market, By Region

9.1 Overview

9.2 Artificial Intelligence (AI) in Mobility Market Revenue Share, By Region 2024 (%)

9.3 Global Artificial Intelligence (AI) in Mobility Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Artificial Intelligence (AI) in Mobility Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Artificial Intelligence (AI) in Mobility Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Artificial Intelligence (AI) in Mobility Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Artificial Intelligence (AI) in Mobility Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Artificial Intelligence (AI) in Mobility Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Artificial Intelligence (AI) in Mobility Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Artificial Intelligence (AI) in Mobility Market, By Country

9.5.4 UK

9.5.4.1 UK Artificial Intelligence (AI) in Mobility Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UK Market Segmental Analysis

9.5.5 France

9.5.5.1 France Artificial Intelligence (AI) in Mobility Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 France Market Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Artificial Intelligence (AI) in Mobility Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 Germany Market Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Artificial Intelligence (AI) in Mobility Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of Europe Market Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Artificial Intelligence (AI) in Mobility Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Artificial Intelligence (AI) in Mobility Market, By Country

9.6.4 China

9.6.4.1 China Artificial Intelligence (AI) in Mobility Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 China Market Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Artificial Intelligence (AI) in Mobility Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 Japan Market Segmental Analysis

9.6.6 India

9.6.6.1 India Artificial Intelligence (AI) in Mobility Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 India Market Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Artificial Intelligence (AI) in Mobility Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 Australia Market Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Artificial Intelligence (AI) in Mobility Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia Pacific Market Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Artificial Intelligence (AI) in Mobility Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Artificial Intelligence (AI) in Mobility Market, By Country

9.7.4 GCC

9.7.4.1 GCC Artificial Intelligence (AI) in Mobility Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCC Market Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Artificial Intelligence (AI) in Mobility Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 Africa Market Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Artificial Intelligence (AI) in Mobility Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 Brazil Market Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Artificial Intelligence (AI) in Mobility Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 10 Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11 Company Profiles

11.1 Waymo

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Tesla, Inc.

11.3 NVIDIA Corporation

11.4 IBM Corporation

11.5 Baidu, Inc.

11.6 Intel Corporation

11.7 Alphabet Inc.

11.8 Microsoft Corporation

11.9 Apple Inc.

11.10 Aurora Innovation, Inc.