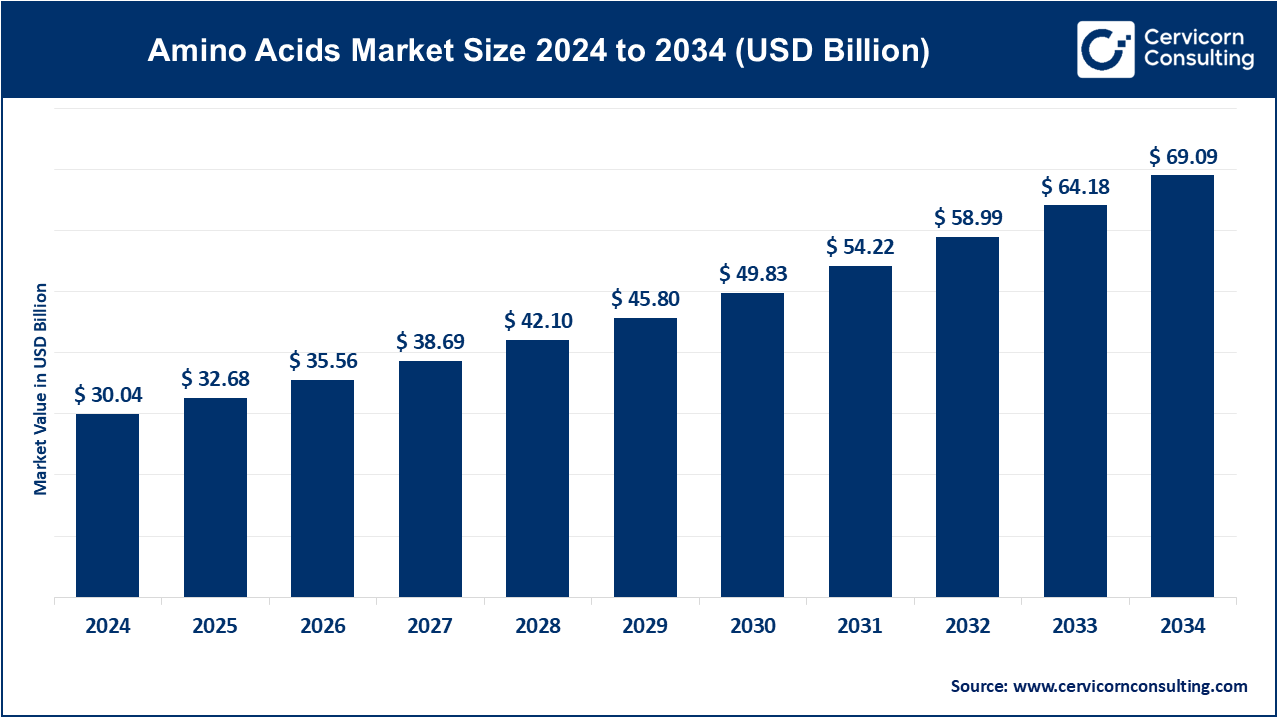

The global amino acids market size was estimated at USD 30.04 billion in 2024 and is expected to surpass around USD 69.09 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.69% from 2025 to 2034.

The amino acid market has seen significant growth over the past few years, driven by increased demand in various industries such as healthcare, animal feed, and food & beverages. In healthcare, amino acids are used in supplements and intravenous feeding for patients with dietary restrictions or medical conditions. The growth in the global population and rising health consciousness have further fueled demand for amino acid-based products. Additionally, amino acids are a key ingredient in the animal feed industry, as they contribute to the growth and health of livestock, particularly in the form of feed additives. The growing need for high-protein diets and functional foods has also spurred the demand for amino acid-enriched products. Looking ahead, the amino acid market is expected to continue expanding, driven by advancements in biotechnology and a greater understanding of their benefits in human nutrition. As consumers become more health-conscious, the demand for amino acid supplements and fortified food products is set to increase.

Amino acids are the building blocks of proteins, which are essential for various functions in the human body. There are 20 amino acids, of which 9 are essential because the body cannot produce them, and they must be obtained from food. These include leucine, isoleucine, and valine. The remaining amino acids are non-essential, meaning the body can synthesize them. Amino acids play a crucial role in the body's metabolism, helping to build muscle, repair tissues, and support immune function. They also help in the production of enzymes and hormones that regulate critical processes like digestion and mood. Amino acids are categorized into essential, non-essential, and conditionally essential amino acids, with the latter being needed in specific situations, such as illness or stress.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 32.68 Billion |

| Projected Market Size (2034) | USD 69.09 Billion |

| Growth Rate (2025 to 2034) | 8.69% |

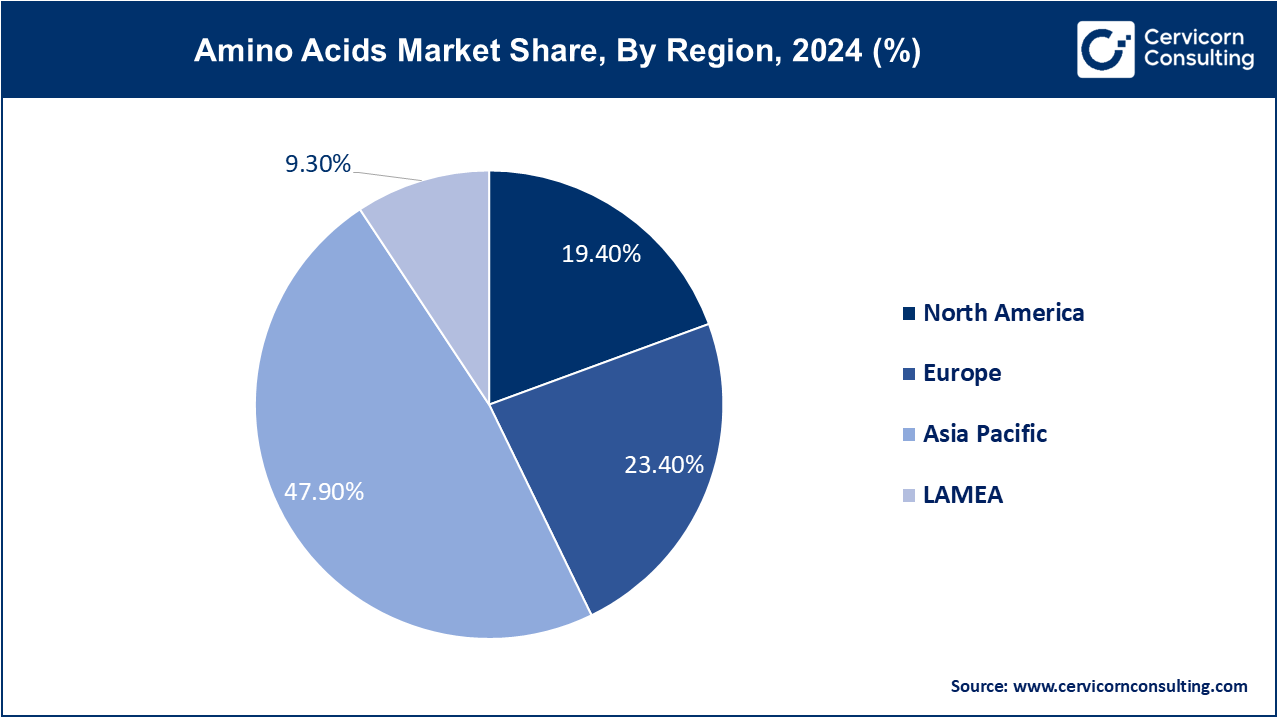

| Dominating Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Segments Covered | Type, Grade, Raw Material, Livestock, End User, Region |

| Key Players | Adisseo, ADM, Ajinomoto Co., Inc., AMINO GmbH, Bill Barr & Company, BI Nutraceuticals, Blue Star Corp., CJ CheilJedang Corp., DAESANG, DSM, Donboo Amino Acid Co., Ltd., Evonik Industries AG, Fermentis Life Sciences, Global Bio-chem Technology Group Company Limited, IRIS BIOTECH GmbH, KYOWA HAKKO BIO CO., LTD., Novus International |

The amino acids market is segmented into type, grade, raw material, livestock, end user and region. Based on type, the market is classified into essential, and non-essential. Based on grade, the market is classified into food grade, feed grade, pharma grade, and other grade. Based on raw material, the market is classified into plant-based, and animal-based. Based on livestock, the market is classified into poultry, swine, cattle, and others. Based on end user, the market is classified into food & beverage, animal feed, pharmaceuticals, agriculture, and others.

Glutamic Acids: Commonly used as flavor enhancers, glutamic acids improve the taste profile of foods, particularly in sauces, snacks, and processed products, making them more appealing to consumers.

Lysine: An essential amino acid that supports protein synthesis, lysine is crucial in animal feed formulations, promoting growth and enhancing the overall health of livestock and poultry.

Methionine: Known for its role in metabolism, methionine is added to animal feed and dietary supplements, aiding in muscle development and promoting optimal health in animals and humans.

Threonine: This amino acid is vital for maintaining protein balance in the body, commonly utilized in feed formulations to support the growth and development of livestock.

Phenylalanine: As a precursor for neurotransmitters, phenylalanine is often included in dietary supplements aimed at improving cognitive function and enhancing mood and overall well-being.

Tryptophan: Recognized for its calming effects, tryptophan is frequently found in supplements aimed at supporting sleep and mood regulation, making it a popular choice in wellness products.

Citrulline: This amino acid is gaining traction in sports nutrition, promoting enhanced blood flow and recovery after exercise, making it popular among athletes and fitness enthusiasts.

Glycine: Essential for collagen production, glycine is widely used in dietary supplements and food products to promote skin health, joint function, and overall wellness.

Glutamine: Often marketed for its recovery benefits, glutamine is commonly included in dietary supplements targeting athletes, aiding in muscle recovery and gastrointestinal health after intense workouts.

Others: This category includes various specialty amino acids with specific applications in industries such as cosmetics, pharmaceuticals, and nutraceuticals, catering to diverse consumer need.

Food Grade: Food-grade amino acids meet safety standards for human consumption, enhancing nutritional value in various food products while ensuring compliance with food safety regulations.

Feed Grade: Designed specifically for animal nutrition, feed-grade amino acids support livestock growth, improve feed efficiency, and enhance overall health, contributing to higher productivity in farming.

Pharma Grade: The pharma grade segment has accounte highest revenue share in 2024. High-purity amino acids used in pharmaceuticals are critical for drug formulations, ensuring efficacy and safety in medical applications, including therapeutic uses and clinical trials.

Other Grades: Specialty amino acids not categorized as food, feed, or pharma grades find applications in cosmetics and industrial sectors, tailored for unique uses and regulatory standards.

Food & Beverage: The food and beverage segment has generated highest revenue share in 2024. In the food and beverage sector, amino acids enhance flavors, improve nutritional profiles, and are used in functional foods, appealing to health-conscious consumers

Animal Feed: The animal feed segment has captured 12.10% in 2024. Amino acids in animal feed formulations are essential for optimizing growth rates and health in livestock and poultry, ensuring efficient production in the agricultural sector. Moreover, the inclusion of amino acids in pet food formulations provides balanced nutrition, supporting the health and well-being of pets, and addressing specific dietary needs.

Pharmaceuticals: The pharmaceuticals segment has accounted revenue share of 9.60% in 2024. In pharmaceuticals, amino acids are utilized in drug formulations and therapies, playing a vital role in treating various health conditions and enhancing therapeutic efficacy. Moreover, amino acids are integral to vaccine development, contributing to the stabilization and efficacy of vaccines, ensuring they remain effective throughout their shelf life.

Agriculture: Amino acids are utilized in agricultural applications to promote plant growth and resilience, enhancing crop yields and sustainability in farming practices.

Other: This segment includes various applications of amino acids across diverse industries, such as textiles and bioengineering, catering to niche markets and specialized requirements.

The North America amino acids market size was exhibited at USD 5.83 billion in 2024 and is expected to surpass around USD 13.40 billion by 2034, expanding at CAGR of 8.90% from 2025 to 2034. This region is a significant player in the amino acids market, driven by high demand from the dietary supplements and animal feed sectors. The United States and Canada lead this growth, with a focus on health-conscious consumers and advancements in agricultural practices. Increased investments in research and development further bolster market expansion.

The Europe amino acids market size was valued at USD 7.03 billion in 2024 and is predicted to be worth around USD 16.17 billion by 2034, rising at a CAGR of 8.60% from 2025 to 2034. Europe is another key market for amino acids, largely influenced by the growing trend toward health and wellness. Countries like Germany, France, and the United Kingdom are major contributors, utilizing amino acids in food and beverage products, pharmaceuticals, and animal nutrition. Strict regulatory standards in the EU promote high-quality amino acids, enhancing consumer trust.

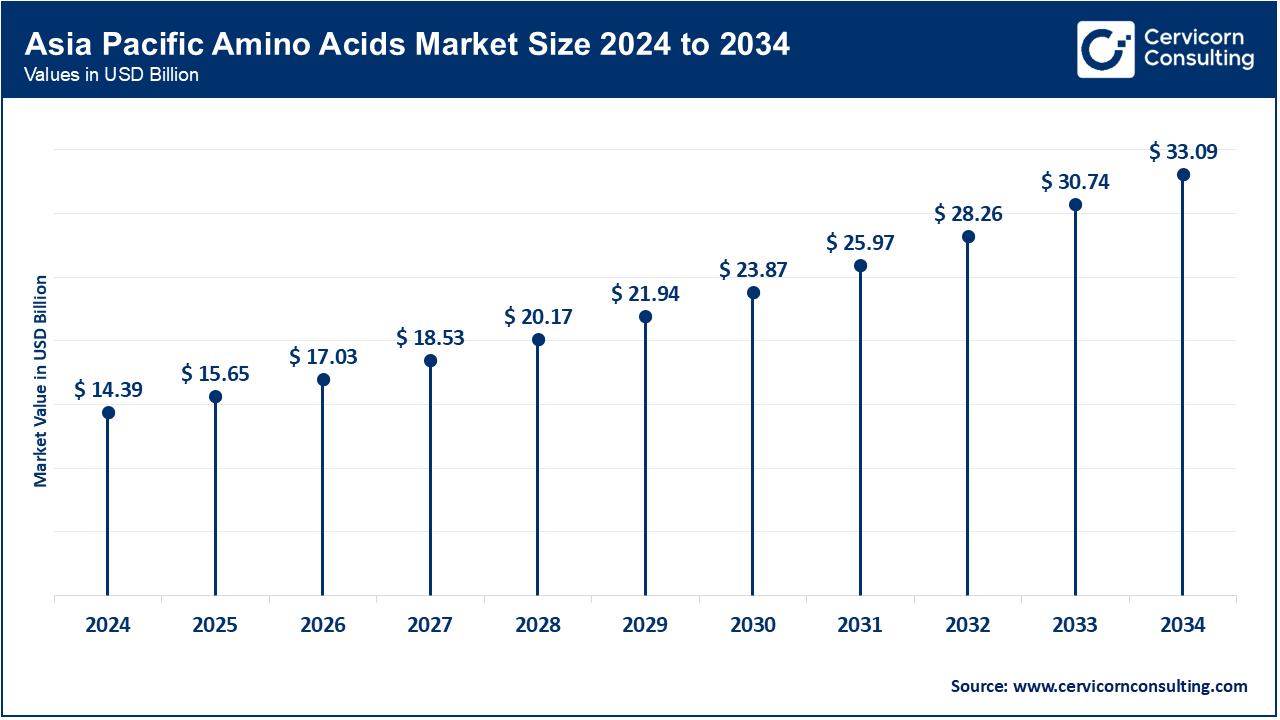

The Asia-Pacific amino acids market size was valued at USD 14.39 billion in 2024 and is projected to hit around USD 33.09 billion by 2034, with a CAGR of 9.50% from 2025 to 2034. The Asia-Pacific region is leading in the market, primarily due to the rising population and increasing disposable income. China, Japan, and India are at the forefront, with expanding industries in food and beverage, pharmaceuticals, and agriculture. The region's growing awareness of nutritional supplements drives demand for amino acids across various applications.

The LAMEA amino acids market was worth at USD 2.79 billion in 2024 and is expanding to USD 6.43 billion by 2034. This region is emerging as a significant market for amino acids, with Brazil, Mexico, and South Africa leading the charge. The increasing focus on animal nutrition and dietary supplements, combined with a growing middle class, is expected to propel market growth. Additionally, the Middle East sees a rising demand for functional foods and health products, further boosting the amino acids sector.

The amino acids industry is dominated by a few central players, including Ajinomoto Co., Bill Barr & Company, Wacker Chemie AG, Evonik Industries AG, Kyowa Hakko Bio Co., Ltd., AMINO GmbH. and among others.

CEO Statements

Takaaki Nishii – CEO of Ajinomoto Co., Inc:

"We are committed to driving innovation in the amino acids sector, particularly focusing on plant-based solutions. As consumer demand for sustainable and health-oriented products increases, our research and development efforts are aimed at enhancing the nutritional profiles of our offerings while minimizing environmental impact."

Christian Kullmann – CEO of Evonik Industries AG:

"The rising demand for amino acids in various industries, especially in pharmaceuticals and animal nutrition, presents significant growth opportunities. We are investing heavily in our production capabilities to ensure we meet this demand while maintaining the highest quality standards."

Yoshinori Ohsawa – CEO of Kyowa Hakko Bio Co., Ltd.

"Our focus remains on leveraging biotechnology to produce high-quality amino acids that cater to both health and wellness markets. We see a growing trend towards functional foods and dietary supplements, and we are well-positioned to lead in this area through continuous innovation."

The amino acids industry is undergoing significant transformation driven by strategic investments, product launches, and sustainability initiatives. Industry leaders are prioritizing eco-friendly innovations and enhancing production processes to meet the rising demand for sustainable products. These collective efforts not only enhance sustainability in the Amino acids market but also optimize resource management and improve overall environmental performance. Key developments highlight the industry's dedication to advancing eco-friendly solutions and meeting evolving market demands. Some notable examples of key developments in the market include:

Market Segmentation

By Type

By Grade

By Raw Material

By Livestock

By End User

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Amino Acids

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Grade Overview

2.2.3 By Raw Material Overview

2.2.4 By Livestock Overview

2.2.5 By End User Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Amino Acids Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rise in Demand for Amino Acids in Various Industries

4.1.1.2 Integrating Insights from Biotechnology into the Production of Amino Acids

4.1.1.3 Growing Demand for Amino Acids in Nutraceuticals

4.1.2 Market Restraints

4.1.2.1 Availability of alternatives such as synthetic proteins

4.1.2.2 Price fluctuation of raw materials

4.1.2.3 Side effects or health concerns

4.1.3 Market Opportunity

4.1.3.1 Increased demand for nutrition and supplements personalized for individuals

4.1.3.2 Opportunities to grow in the food and beverage sector

4.1.3.3 Rising awareness about amino acids in the emerging economies

4.1.3.4 Expanding applications for medical nutrition

4.1.4 Market Challenges

4.1.4.1 High production costs

4.1.4.2 Environmental concerns

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Amino Acids Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Amino Acids Market, By Type

6.1 Global Amino Acids Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Essential

6.1.1.2 Non-essential

Chapter 7 Amino Acids Market, By Grade

7.1 Global Amino Acids Market Snapshot, By Grade

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Food Grade

7.1.1.2 Feed Grade

7.1.1.3 Pharma Grade

7.1.1.4 Other Grade

Chapter 8 Amino Acids Market, By Raw Material

8.1 Global Amino Acids Market Snapshot, By Raw Material

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Plant-based

8.1.1.2 Animal-based

Chapter 9 Amino Acids Market, By Livestock

9.1 Global Amino Acids Market Snapshot, By Livestock

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Poultry

9.1.1.2 Swine

9.1.1.3 Cattle

9.1.1.4 Others

Chapter 10 Amino Acids Market, By End User

10.1 Global Amino Acids Market Snapshot, By End User

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Food & Beverage

10.1.1.2 Animal Feed

10.1.1.3 Pharmaceuticals

10.1.1.4 Agriculture

10.1.1.5 Others

Chapter 11 Amino Acids Market, By Region

11.1 Overview

11.2 Amino Acids Market Revenue Share, By Region 2024 (%)

11.3 Global Amino Acids Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Amino Acids Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Amino Acids Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Amino Acids Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Amino Acids Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Amino Acids Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Amino Acids Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Amino Acids Market, By Country

11.5.4 UK

11.5.4.1 UK Amino Acids Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UK Market Segmental Analysis

11.5.5 France

11.5.5.1 France Amino Acids Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 France Market Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Amino Acids Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 Germany Market Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Amino Acids Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of Europe Market Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Amino Acids Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Amino Acids Market, By Country

11.6.4 China

11.6.4.1 China Amino Acids Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 China Market Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Amino Acids Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 Japan Market Segmental Analysis

11.6.6 India

11.6.6.1 India Amino Acids Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 India Market Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Amino Acids Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 Australia Market Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Amino Acids Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia Pacific Market Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Amino Acids Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Amino Acids Market, By Country

11.7.4 GCC

11.7.4.1 GCC Amino Acids Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCC Market Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Amino Acids Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 Africa Market Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Amino Acids Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 Brazil Market Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Amino Acids Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 12 Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13 Company Profiles

13.1 Adisseo

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 ADM

13.3 Ajinomoto Co., Inc.

13.4 AMINO GmbH

13.5 Bill Barr & Company

13.6 BI Nutraceuticals

13.7 Blue Star Corp.

13.8 CJ CheilJedang Corp.

13.9 DAESANG

13.10 DSM