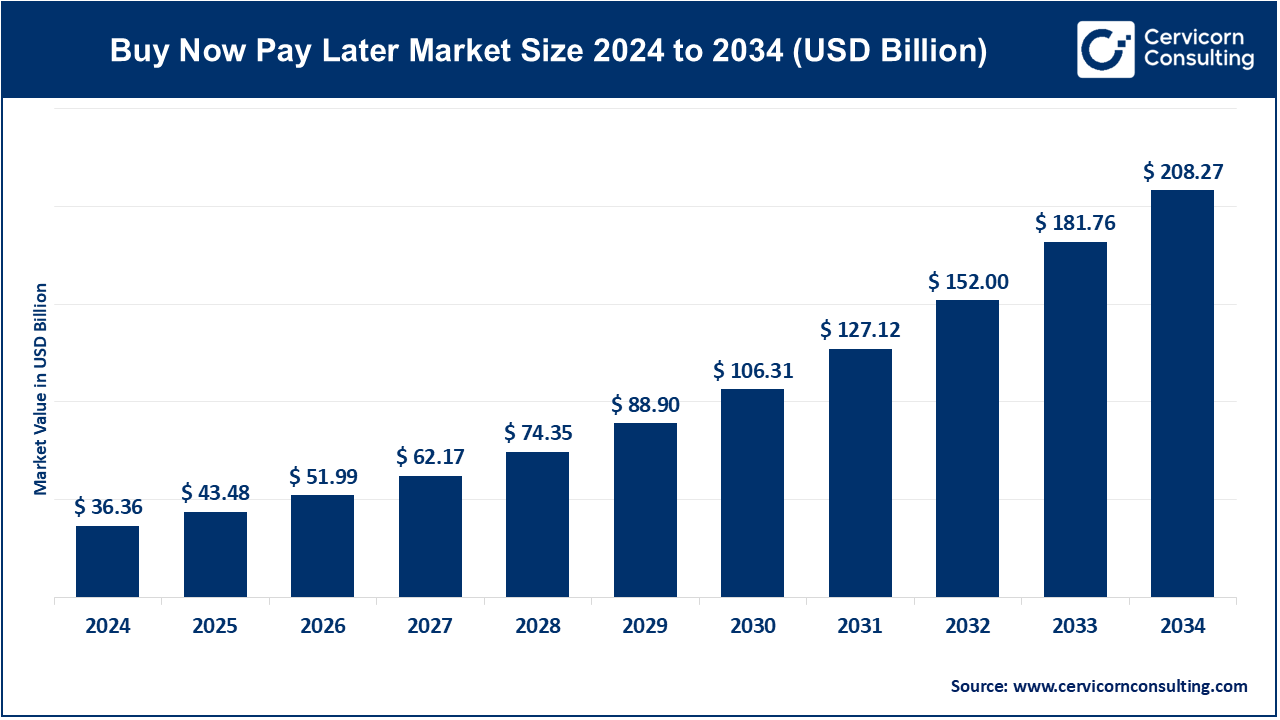

The global buy now pay later market size was valued at USD 36.36 billion in 2024 and is expected to be worth around USD 208.27 billion by 2034, growing at a compound annual growth rate (CAGR) of 19.07% from 2025 to 2034.

The buy now pay later (BNPL) market has seen rapid growth over the past few years. As more consumers shift towards online shopping, the demand for flexible payment options has surged. BNPL providers have capitalized on this trend by offering easy-to-use platforms that integrate with e-commerce websites, allowing consumers to access credit quickly without a credit card. This growth is fueled by millennials and Gen Z shoppers, who prefer flexible, short-term financing without the burden of traditional credit cards. As these generations value instant gratification, BNPL services have become increasingly popular in various sectors, including fashion, electronics, and travel. The BNPL market’s expansion is also supported by increasing merchant adoption. Retailers are drawn to BNPL services because they increase conversion rates and average order values. This has led to BNPL companies forming strategic partnerships with a wide range of brands and online marketplaces.

Buy now pay later (BNPL) is a payment option that allows consumers to make purchases and pay for them over time, instead of paying the full amount upfront. Typically, it involves dividing the total cost of an item into smaller, interest-free installments, which can be paid weekly, bi-weekly, or monthly. BNPL services are usually provided by third-party companies like Klarna, Afterpay, or Affirm, and they partner with retailers to offer this service to customers. In December 2024, Affirm, a leading BNPL provider, secured a significant investment from private credit firm Sixth Street. This partnership involves a USD 4 billion commitment, enabling Affirm to issue over USD 20 billion in new consumer loans over the next three years. This deal underscores the growing trend of fintech companies collaborating with private credit firms to enhance their lending capacities. Consumers can shop online or in-store and choose BNPL as their payment method at checkout. The flexibility of BNPL helps consumers manage their finances by giving them time to pay without incurring high interest rates, provided they meet the payment deadlines.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 43.48 Billion |

| Projected Market Size (2034) | USD 208.27 Billion |

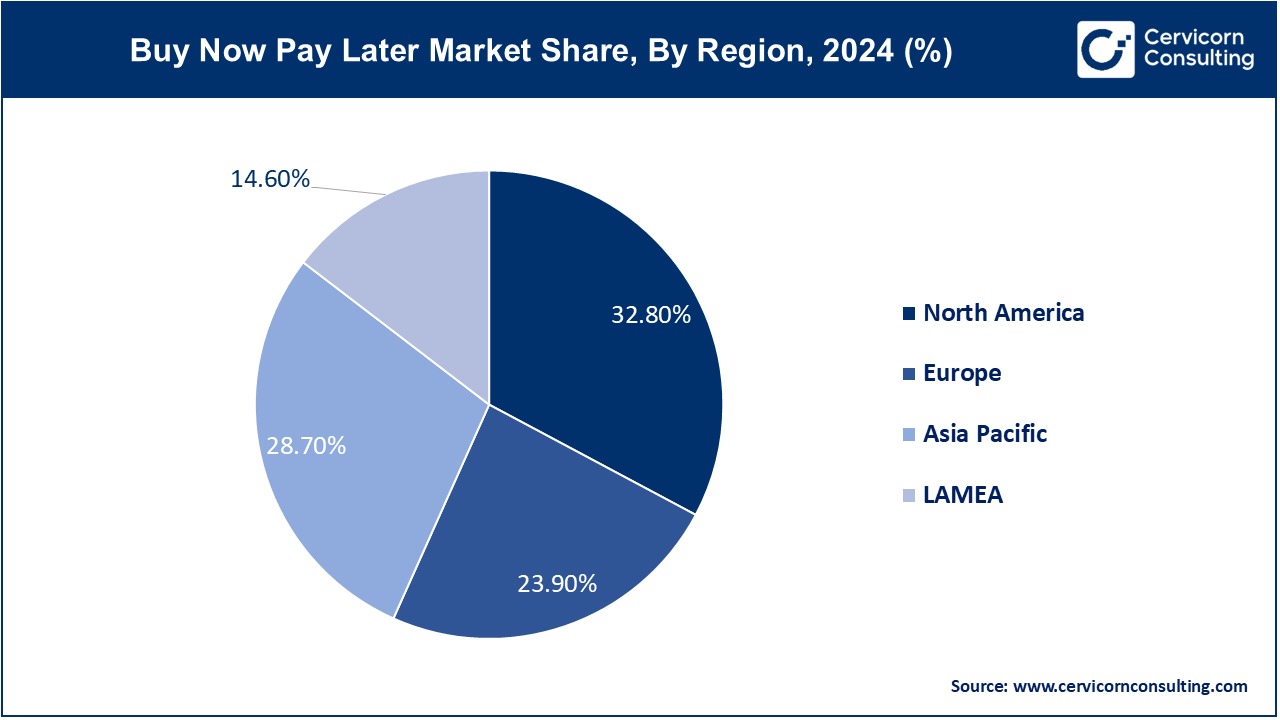

| Leading Region | North America |

| Growing Region | Europe |

| Segments Covered | Application, Channel, Product, Enterprise Size, Technology, Customer, Region |

| Key Players | Afterpay, Klarna, Affirm, Zip (formerly Quadpay), Sezzle, PayPal (Pay in 4), Splitit, Perpay, Openpay, Laybuy, ViaBill, Humm, Bread, Uplift, LatitudePay, Zilch, Scalapay, Sunbit, Tabby, Billie |

Increased Consumer Adoption of Digital Payments

Technological Advancements in Financial Services

Potential for Consumer Debt Accumulation

Limited Profitability for BNPL Providers

Expansion into Emerging Markets

Partnerships with Traditional Financial Institutions

Regulatory Compliance and Changing Legislation

Consumer Awareness and Education

The buy now pay later market is segmented into application, channel, product, enterprise size, customer, technology and region. Based on application, the market is classified into retail, travel, healthcare, and education. Based on channel, the market is classified into point of sale (POS), and online. Based on product, the market is classified into interest-fee installments, pay-in-4, pay later, and split payments. Based on enterprise size, the market is classified into consumers, small and medium enterprises (SMEs), and large enterprises. Based on customer, the market is classified into gen Z (21-25), gen X (41-45), millennials (26-40), and baby boomers (56-75). Based on technology, the market is classified into artificial intelligence (AI), machine learning, mobile payment platforms, and secure payment gateways.

Retail: Popular in retailing, BNPL enables customers to buy products and pay for the same in several installments instead of a lump sum. This application is mostly used in e-commerce and Physical stores because the convenience it provides to the users makes it very flexible.

Travel: Use cases are emerging for the travel sector where BNPL solutions help consumers finance their holidays, flights, and accommodations. This is especially felt where substantial amounts are involved and paying fully strains the pocket.

Healthcare: There are available choices of payment plans to be implemented by the healthcare service providers for their medical, therapeutic, and dental services. This way patients can make their healthcare costs affordable by paying in installments without having to use normal loans or credit cards that attract high interest rates.

Education: School and service industries are adopting BNPL to assist learners and parents in financing classes, credentials, and tuition charges. This is a good way of investing in education without having to pay upfront for the education investment.

Interest-Free Installments: The common type of BNPL products is interest-free installments which let consumers pay for the acquisition in installments without paying any extra interest. This type is most enticing because it is easy and cheap to implement.

Pay-in-4: “Pay-in-4” means spreading of the total amount into four equal installments. The consumer pays the first amount when the product is purchased; the other three installments are made in the next few weeks or months.

Pay Later: With this product, consumers can safely get the products without incurring any charges for at least 30 days or more. It gives some extra cash convenience and is used to pay for a more expensive or non-necessary item.

Split Payments: Other forms are similar to split payment options, which allow the distribution of the full amount over equal parts, depending on consumers’ possibilities. By being able to sacrifice conventional payment terms of relatively lower interest, this product addresses users’ demands for more flexible payment terms.

Consumers: The first target consumer of BNPL services is individual consumers, particularly the young generation, who do not like relying on credit lines. Therefore, BNPL has an obvious benefit because it is not associated with interest payments as credit card technology may be interesting to savvy buyers.

Small and Medium Enterprises (SMEs): This is as BNPL services have been adopted by SMEs to finance their inventory or even business equipment to ease cash flow. For businesses, BNPL is a straightforward financing type that eliminates the need for a loan or business credit card application.

Large Enterprises: Large firms are also availing of BNPL services, especially within the retail and e-commerce industries. These enterprises apply BNPL as a way of increasing customer traffic and therefore sales, especially during festive seasons or for big transactions.

Artificial Intelligence (AI): It provides an extensive contribution to the evaluation of credit risk, the automation of loan granting, and real-time fraud identification. It improves the BNPL services’ speed and security, allowing credit decisions to be made without involving many people.

Machine Learning: Risk assessment is enhanced by machine learning since consumers’ conduct, past purchases, and repayment info are considered by algorithms. It helps BNPL firms to have better-targeted payment installments and less default level.

Mobile Payment Platforms: Mobile applications are becoming more common for accessing BNPL services since most of the services are offering ways to manage purchases and track transactions utilizing smartphones. Mobile platforms remain convenient and easily accessible and this explains why BNPL solutions are so popular among consumers.

Secure Payment Gateways: Growing adoption of online payments and pocket-friendly payment gateways Cybersecurity plays an important role in shielding valuable customer information and facilitating the seamless transactions. Encryption and multi-factor authentication bear technologies that used to increase the security of consumers and businesses.

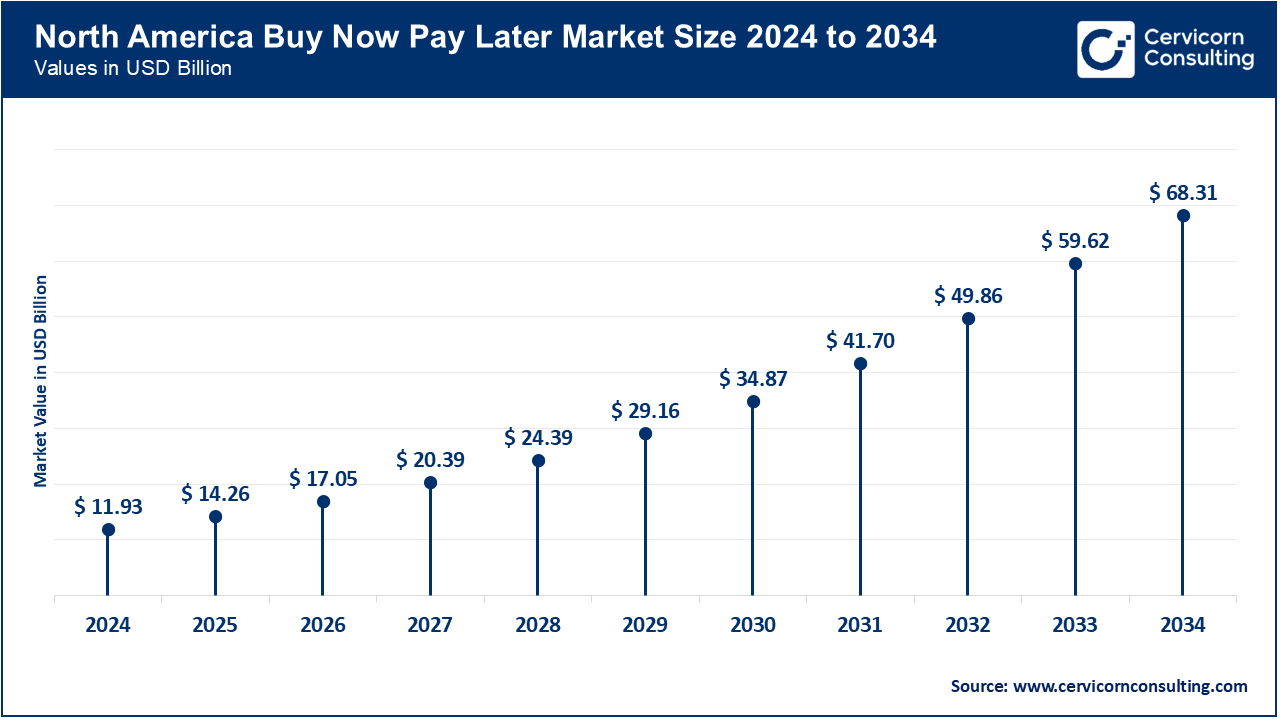

North America: The largest share of transactions is observed in North America because of such factors as the developed infrastructure of online payments and MRC, high demand for BNPL services, and relatively high investment in the fintech industry. Currently, the main BNPL operators and financial technologies pioneers are located in the United States, which stimulates its extensive usage in different fields, including retail. As consumers demand more convenient payment solutions, Canada, having a moderate online consumer base and a rapidly expanding FinTech sector, is also steadily adopting BNPL.

Europe: Europe is demonstrating tremendous growth in the BNPL sector due to governmental initiatives, technological advancement, and high consumer interest in flexible payment solutions. UK, Germany, and France are front runners in the regulation attempt, pushing for improved transparency and consumer protection in BNPL operations. Thus, the market is actively developing due to the EU’s concerns with responsible lending and promoting payment methods enabled by digital payments on retail and e-commerce sites offering BNPL options at the checkout.

Asia-Pacific: The Asia-Pacific region is considered to form the largest and most rapidly growing BNPL market due to growing e-commerce penetration rates, increasing disposable incomes, and a relatively young demographic with high technological literacy. Some countries leading this growth are the Australian, Indian, and Chinese consumers who are shifting more toward BNPL as opposed to credit facilities. Substantial funding in the development of digital payment systems together with increased partnerships between BNPL providers and local merchants and increased partnerships between BNPL providers and local businesses, are encouraging the use of BNPL services across many sectors such as retail, travel, and education.

LAMEA: The LAMEA BNPL market is relatively unknown but holds potential where e-commerce is being adopted and there is a young population. BNPL is popular in Latin America, and countries such as Brazil, and Mexico are experiencing growth in consumer interest in such products due to flexibility. Similarly, the Middle East region is also emerging as another growth area for BNPL service as a part of the broader maturation of digital payment solutions in the UAE while Africa is gradually moving in the same direction effectively leveraging the advancements in fintech infrastructure and online shopping.

Among the new entrants into the buy now pay later (BNPL) industry, such as After Pay are taking advantage of the increasing need for flexible payment solutions for the consumer and delivering zero-interest installment payment services and solutions to retailers across the world. Pay-later specialist Klarna, in contrast, is growing a BNPL portfolio, which includes pay-in-4 and deferred payments for both online and offline purchases, to help consumers make purchasing decisions and manage their finances better. Some such new players are altering how people engage in credit as they offer new modes of payment outside the regular lending channels.

At the same time, large players like PayPal have already enriched BNPL services with their long years of experience in digital payments and have a great competitive advantage in this market. Square also has joined the BNPL market by acquiring After Pay, proving how credit card companies progress to adapt to purchasers’ needs at the present times. These newcomers, as well as today’s industry leaders, consistently introduce inexperienced consumers to new opportunities to take out BNPL through fruitful collaborations and advanced technologies.

CEO Statements

Penny Lee, President and CEO of the Financial Technology Association (FTA):

"We look forward to providing additional comments to the CFPB and distinguishing BNPL from products whose business models rely on revolving debt and high consumer fees."

Grant Halverson, CEO of McLean Roche:

"BNPL is already at saturation point in Australia with 7 million accounts and 3.8 million users out of a 26 million population. ZIP's ANZ business has flatlined as has Afterpay while market leader PayPal is also at single digit growth. All these fintech app players now issue credit cards with high fees. So much for the claim BNPL apps would destroy cards. They have had to join the credit card pack to attempt to become profitable, while getting ready for regulations in 2025 which will slow them down and add costs."

Major players of the BNPL market are investing in digital payment innovations entered mainly on providing short-term, interest-free, and flexible credit payment solutions for consumer and commercial entities. Such companies are at the forefront of advancing technologies such as Artificial Intelligence, and real-time credit scores that are adopted to ease the process of purchasing goods and services. Notable developments in the BNPL market include:

Some of these advances capture the growth of the BNPL market through acquisitions, partnerships, mega funding, and a rising interest in the variety of installment payments among consumers. Companies are pursuing the growth of product portfolios, improving clients’ experiences through mobile applications, and engaging with the authorities to provide the necessary consumer protection in the field of small-ticket lending. All these endeavors have the general objectives of improving consumer credit availability, increasing sales for merchants, and enhancing consumer’s financial options. Other factors such as technological advancement in fraud detection, Artificial Intelligence in credit scoring and smooth integration of BNPL in checkouts are other factors boosting the adoption of BNPL around the world.

Market Segmentation

By Application

By Channel

By Product

By Enterprise Size

By Customer

By Technology

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Buy Now Pay Later

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Application Overview

2.2.2 By Channel Overview

2.2.3 By Product Overview

2.2.4 By Enterprise Size Overview

2.2.5 By Customer Overview

2.2.6 By Technology Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Buy Now Pay Later Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increased Consumer Adoption of Digital Payments

4.1.1.2 Technological Advancements in Financial Services

4.1.2 Market Restraints

4.1.2.1 Potential for Consumer Debt Accumulation

4.1.2.2 Limited Profitability for BNPL Providers

4.1.3 Market Opportunity

4.1.3.1 Expansion into Emerging Markets

4.1.3.2 Partnerships with Traditional Financial Institutions

4.1.4 Market Challenges

4.1.4.1 Regulatory Compliance and Changing Legislation

4.1.4.2 Consumer Awareness and Education

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Buy Now Pay Later Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Buy Now Pay Later Market, By Application

6.1 Global Buy Now Pay Later Market Snapshot, By Application

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Retail

6.1.1.2 Travel

6.1.1.3 Healthcare

6.1.1.4 Education

Chapter 7 Buy Now Pay Later Market, By Channel

7.1 Global Buy Now Pay Later Market Snapshot, By Channel

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Point of Sale (POS)

7.1.1.2 Online

Chapter 8 Buy Now Pay Later Market, By Product

8.1 Global Buy Now Pay Later Market Snapshot, By Product

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Interest-Free Installments

8.1.1.2 Pay-in-4

8.1.1.3 Pay Later

8.1.1.4 Split Payments

Chapter 9 Buy Now Pay Later Market, By Enterprise Size

9.1 Global Buy Now Pay Later Market Snapshot, By Enterprise Size

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Consumers

9.1.1.2 Small and Medium Enterprises (SMEs)

9.1.1.3 Large Enterprises

Chapter 10 Buy Now Pay Later Market, By Customer

10.1 Global Buy Now Pay Later Market Snapshot, By Customer

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Gen Z (21-25)

10.1.1.2 Gen X (41-45)

10.1.1.3 Millennials (26-40)

10.1.1.4 Baby Boomers (56-75)

Chapter 11 Buy Now Pay Later Market, By Technology

11.1 Global Buy Now Pay Later Market Snapshot, By Technology

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

11.1.1.1 Artificial Intelligence (AI)

11.1.1.2 Machine Learning

11.1.1.3 Mobile Payment Platforms

11.1.1.4 Secure Payment Gateways

Chapter 12 Buy Now Pay Later Market, By Region

12.1 Overview

12.2 Buy Now Pay Later Market Revenue Share, By Region 2024 (%)

12.3 Global Buy Now Pay Later Market, By Region

12.3.1 Market Size and Forecast

12.4 North America

12.4.1 North America Buy Now Pay Later Market Revenue, 2022-2034 ($Billion)

12.4.2 Market Size and Forecast

12.4.3 North America Buy Now Pay Later Market, By Country

12.4.4 U.S.

12.4.4.1 U.S. Buy Now Pay Later Market Revenue, 2022-2034 ($Billion)

12.4.4.2 Market Size and Forecast

12.4.4.3 U.S. Market Segmental Analysis

12.4.5 Canada

12.4.5.1 Canada Buy Now Pay Later Market Revenue, 2022-2034 ($Billion)

12.4.5.2 Market Size and Forecast

12.4.5.3 Canada Market Segmental Analysis

12.4.6 Mexico

12.4.6.1 Mexico Buy Now Pay Later Market Revenue, 2022-2034 ($Billion)

12.4.6.2 Market Size and Forecast

12.4.6.3 Mexico Market Segmental Analysis

12.5 Europe

12.5.1 Europe Buy Now Pay Later Market Revenue, 2022-2034 ($Billion)

12.5.2 Market Size and Forecast

12.5.3 Europe Buy Now Pay Later Market, By Country

12.5.4 UK

12.5.4.1 UK Buy Now Pay Later Market Revenue, 2022-2034 ($Billion)

12.5.4.2 Market Size and Forecast

12.5.4.3 UK Market Segmental Analysis

12.5.5 France

12.5.5.1 France Buy Now Pay Later Market Revenue, 2022-2034 ($Billion)

12.5.5.2 Market Size and Forecast

12.5.5.3 France Market Segmental Analysis

12.5.6 Germany

12.5.6.1 Germany Buy Now Pay Later Market Revenue, 2022-2034 ($Billion)

12.5.6.2 Market Size and Forecast

12.5.6.3 Germany Market Segmental Analysis

12.5.7 Rest of Europe

12.5.7.1 Rest of Europe Buy Now Pay Later Market Revenue, 2022-2034 ($Billion)

12.5.7.2 Market Size and Forecast

12.5.7.3 Rest of Europe Market Segmental Analysis

12.6 Asia Pacific

12.6.1 Asia Pacific Buy Now Pay Later Market Revenue, 2022-2034 ($Billion)

12.6.2 Market Size and Forecast

12.6.3 Asia Pacific Buy Now Pay Later Market, By Country

12.6.4 China

12.6.4.1 China Buy Now Pay Later Market Revenue, 2022-2034 ($Billion)

12.6.4.2 Market Size and Forecast

12.6.4.3 China Market Segmental Analysis

12.6.5 Japan

12.6.5.1 Japan Buy Now Pay Later Market Revenue, 2022-2034 ($Billion)

12.6.5.2 Market Size and Forecast

12.6.5.3 Japan Market Segmental Analysis

12.6.6 India

12.6.6.1 India Buy Now Pay Later Market Revenue, 2022-2034 ($Billion)

12.6.6.2 Market Size and Forecast

12.6.6.3 India Market Segmental Analysis

12.6.7 Australia

12.6.7.1 Australia Buy Now Pay Later Market Revenue, 2022-2034 ($Billion)

12.6.7.2 Market Size and Forecast

12.6.7.3 Australia Market Segmental Analysis

12.6.8 Rest of Asia Pacific

12.6.8.1 Rest of Asia Pacific Buy Now Pay Later Market Revenue, 2022-2034 ($Billion)

12.6.8.2 Market Size and Forecast

12.6.8.3 Rest of Asia Pacific Market Segmental Analysis

12.7 LAMEA

12.7.1 LAMEA Buy Now Pay Later Market Revenue, 2022-2034 ($Billion)

12.7.2 Market Size and Forecast

12.7.3 LAMEA Buy Now Pay Later Market, By Country

12.7.4 GCC

12.7.4.1 GCC Buy Now Pay Later Market Revenue, 2022-2034 ($Billion)

12.7.4.2 Market Size and Forecast

12.7.4.3 GCC Market Segmental Analysis

12.7.5 Africa

12.7.5.1 Africa Buy Now Pay Later Market Revenue, 2022-2034 ($Billion)

12.7.5.2 Market Size and Forecast

12.7.5.3 Africa Market Segmental Analysis

12.7.6 Brazil

12.7.6.1 Brazil Buy Now Pay Later Market Revenue, 2022-2034 ($Billion)

12.7.6.2 Market Size and Forecast

12.7.6.3 Brazil Market Segmental Analysis

12.7.7 Rest of LAMEA

12.7.7.1 Rest of LAMEA Buy Now Pay Later Market Revenue, 2022-2034 ($Billion)

12.7.7.2 Market Size and Forecast

12.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 13 Competitive Landscape

13.1 Competitor Strategic Analysis

13.1.1 Top Player Positioning/Market Share Analysis

13.1.2 Top Winning Strategies, By Company, 2022-2024

13.1.3 Competitive Analysis By Revenue, 2022-2024

13.2 Recent Developments by the Market Contributors (2024)

Chapter 14 Company Profiles

14.1 Afterpay

14.1.1 Company Snapshot

14.1.2 Company and Business Overview

14.1.3 Financial KPIs

14.1.4 Product/Service Portfolio

14.1.5 Strategic Growth

14.1.6 Global Footprints

14.1.7 Recent Development

14.1.8 SWOT Analysis

14.2 Klarna

14.3 Affirm

14.4 Zip (formerly Quadpay)

14.5 Sezzle

14.6 PayPal (Pay in 4)

14.7 Splitit

14.8 Perpay

14.9 Openpay

14.10 Laybuy