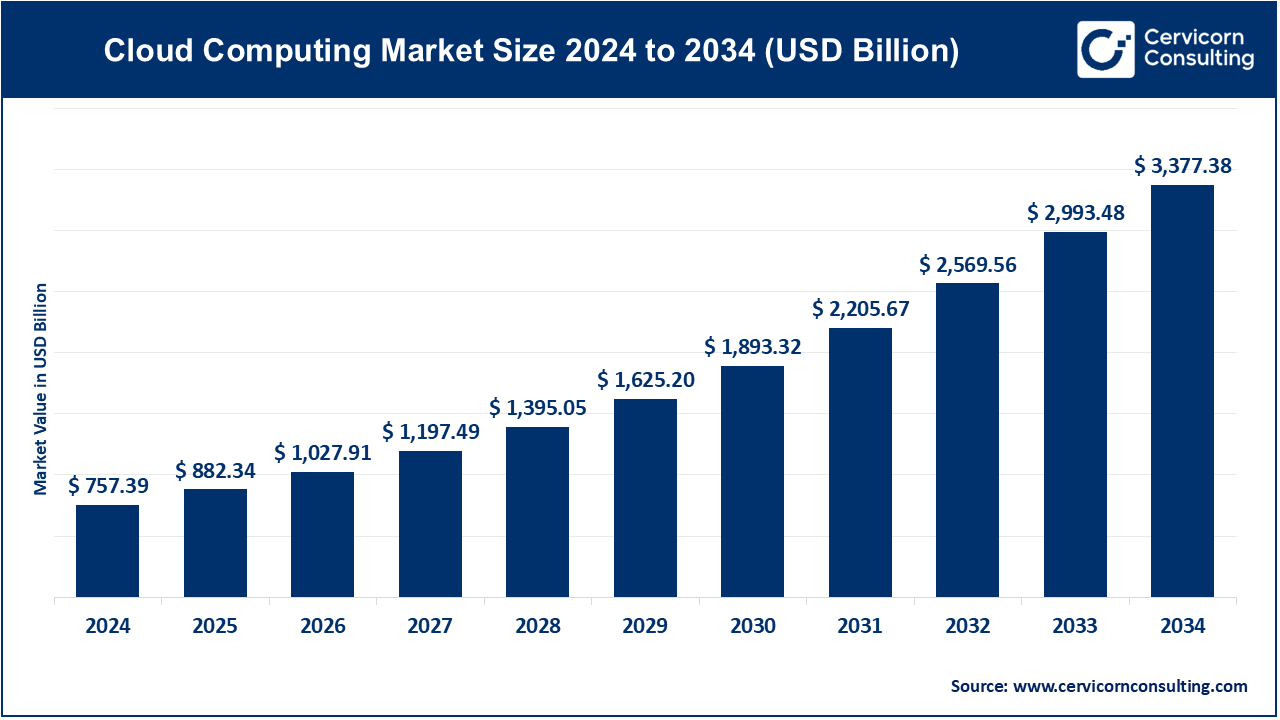

The global cloud computing market size was valued at USD 757.39 billion in 2024 and is expected to hit around USD 3,377.38 billion by 2034. It is growing at a compound annual growth rate (CAGR) of 16.12% from 2025 to 2034.

The cloud computing market has experienced significant growth in recent years, with an increasing number of businesses and industries recognizing the value of cloud services. As organizations transition from traditional on-premise infrastructure to cloud solutions, the market has become more competitive, with major players such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud dominating the space. The cloud offers numerous advantages, including cost reduction, scalability, and enhanced collaboration, all of which have attracted businesses of all sizes. Enterprises across various sectors are adopting cloud services to modernize their IT infrastructure, improve operational efficiency, and support remote work models. Additionally, small and medium-sized businesses (SMBs) are benefiting from affordable cloud solutions that enable them to compete with larger organizations. Major tech companies are investing heavily in cloud infrastructure to support AI advancements. Amazon Web Services (AWS) plans to invest at least USD 11 billion in Georgia to enhance its AI infrastructure. Similarly, Microsoft has announced a USD 3 billion investment over the next two years to bolster its AI and cloud infrastructure in India.

Cloud computing refers to the delivery of computing services, such as storage, processing power, and software, over the internet. Instead of storing data or running applications on your own computer or server, cloud computing allows you to access these resources remotely from servers maintained by cloud service providers. Users can access these services anytime, anywhere, and on various devices, which offers flexibility and scalability. Major cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform offer a wide range of services that help businesses and individuals reduce IT costs, scale their resources, and innovate faster without worrying about physical infrastructure. Cloud computing services are usually categorized into three types: Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS).

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 882.34 Billion |

| Projected Market Size (2034) | USD 3,377.38 Billion |

| Growth Rate (2025 to 2034) | 16.12% |

| Dominating Region | North America |

| Growing Region | Asia-Pacific |

| Report Segmentation | Deployment Mode, Service, Enterprise Size, Workload, End-user, Region |

| Key Players | Akamai Technologies, Alibaba Group Holding Limited, Amazon Web Services Inc., Deutsche Telekom AG, Edgio, Google LLC, IBM Corporation, Intel Corporation, Lumen Technologies, Microsfot Corporation, Oracle Corporation, Rackspace Technology, Inc., Salesforce, Inc., SAP SE, Vmware, Inc. |

Deployment of Private Cloud Computing

Remote Work-Related Policies Across the Globe

Regulatory Compliance and Data Breaching Risk

High Cost for Long Term Usage

Rising Adoption of Internet of Things (IoT) and Connected Devices

Industry-Specific Cloud Solutions

Complexity of Multi-Cloud Model

Risk of Vendor Lock-in

The cloud computing market is segmented into deployment mode, service models, enterprise size, workload, end-user industry and region. Based on deployment mode, the market is classified into public cloud, private cloud, and hybrid cloud. Based on service models, the market is classified into infrastructure as a service (Iaas), platform as a service (Paas), and software as a service (Saas). Based on enterprise size, the market is classified into large enterprises, small & medium enterprises. Based on workload, the market is classified into application development & testing, data storage & backup, resource management, orchestration services, and other. Based on end-user industry, the market is classified into BFSI, IT and telecommunications, government, consumer goods and retail, healthcare, manufacturing, and others.

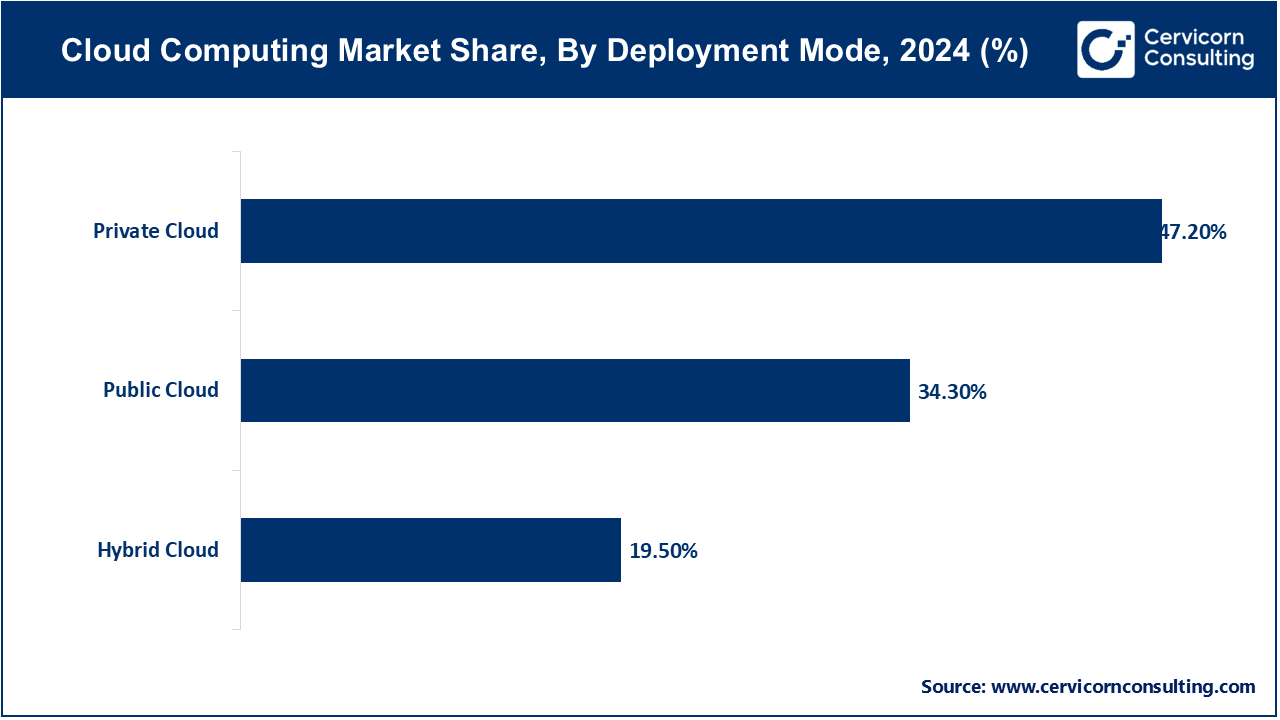

Public Cloud: The public cloud segment has captured a revenue share of 34.30% in 2024. The shared infra-structure called public cloud is owned and operated by a third-party service provider. Thus, public cloud has good scalability and cost-effectiveness, which has attracted massive segments of businesses, both big and small. Nonetheless, public clouds introduce some security concerns since the shared nature of infrastructure is involved.

Private Cloud: The hybrid cloud segment has garnered a revenue share of 47.20% in 2024. Private cloud is a type of cloud infrastructure that can be within an organization. It can either be at the customer's premises or in a data center owned by the organization. Security and customization are higher in private clouds but expensive in terms of construction and maintenance.

Hybrid Cloud: The hybrid cloud segment has captured a share of 19.50% in 2024. A hybrid cloud is a combination of elements from public and private clouds, thus providing organizations with the opportunity to benefit from both choices. model. All these factors help organizations optimize their costs, improve performance, and even strengthen their disaster recovery capabilities. This hybrid cloud environment is, however relatively quite complicated to manage, which requires careful planning as well as integration among several components.

Infrastructure as a Service (Iaas): The IaaS segment has accounted 31.70% revenue share in 2024. IaaS provides raw computer resources like servers, storage and networking as a pay-as-you-go service. They can respond to dynamic changes in demand without burdening themselves with large capital investments. However, technical expertise will be required in managing operating systems, applications, and security under IaaS.

Platform as a Service (Paas): The PaaS segment has garnered revenue share of around 15.10% in 2024. PaaS is defined as the development, deployment, and managing of web applications over the cloud. The PaaS might include tools for developing, programming languages, and the runtime environment. It makes the process of development smoother because it abstracts away the complexity of infrastructure management and lets developers focus on their applications. However, vendors lock-in their customers, and they have very little option when it comes to customization of the platform.

Software as a Service (Saas): The SaaS segment has recorded revenue share of 53.20% in 2024. SaaS offers full-featured applications delivered over the internet on a subscription basis. The SaaS is very accessible to users and requires minimal training; they are therefore appropriate for any size of organizations. However, SaaS may have limited options about changing their options, as well as data privacy issues because of the service being cloud-based.

BFSI: The BFSI segment has accounted 25.60% revenue share in 2024. The BFSI sector is among the biggest adopters of cloud computing because of the need for scalability, cost-effectiveness, and data security. Cloud-based solutions enable banks and financial institutions to process vast data volumes, improve customer experience, and compliance with regulatory requirements.

IT and Telecommunications: The IT & Telecommunications segment has accounted revenue share of 17.80% in 2024. The IT and telecom industry naturally represents the most natural fit for cloud computing because it uses cloud infrastructure during software development, testing, and deployment. These also help IT and telecom companies save costs and raise agility and speed of innovation.

Government: Government agencies around the world increasingly are embracing cloud computing to manage services better, become more efficient, and cut costs. Government agencies use cloud-based solutions to consolidate IT infrastructure, share resources, and strengthen data security.

Consumer Goods and Retail: Within the consumer goods and retail industries, cloud computing is enabling innovations around supply chain management, customer engagement, and data analytics. Cloud-based solutions can, for example allow retailers to not only tailor customer experiences with relevant offers but also optimize inventory management and gain better insights into customer behavior and preferences.

Healthcare: Healthcare is using cloud computing to improve patient care and cost reduction, as well as providing security for data. Cloud-based solutions help health care providers store and analyse patient data, streamline administrative processes, and thereby improve interoperability.

Manufacturing: Cloud computing is put to practice in manufacturing through applications that focus on increasing operational efficiency, the optimization of the entire supply chain, and better design products. Cloud-based solutions for the industry yield data from multiple production lines and contribute to its analysis in improving quality control and faster product innovation.

Others: In addition to healthcare, education, media and entertainment, and energy sectors also deploy cloud computing to enhance their operations and meet their specific business goals.

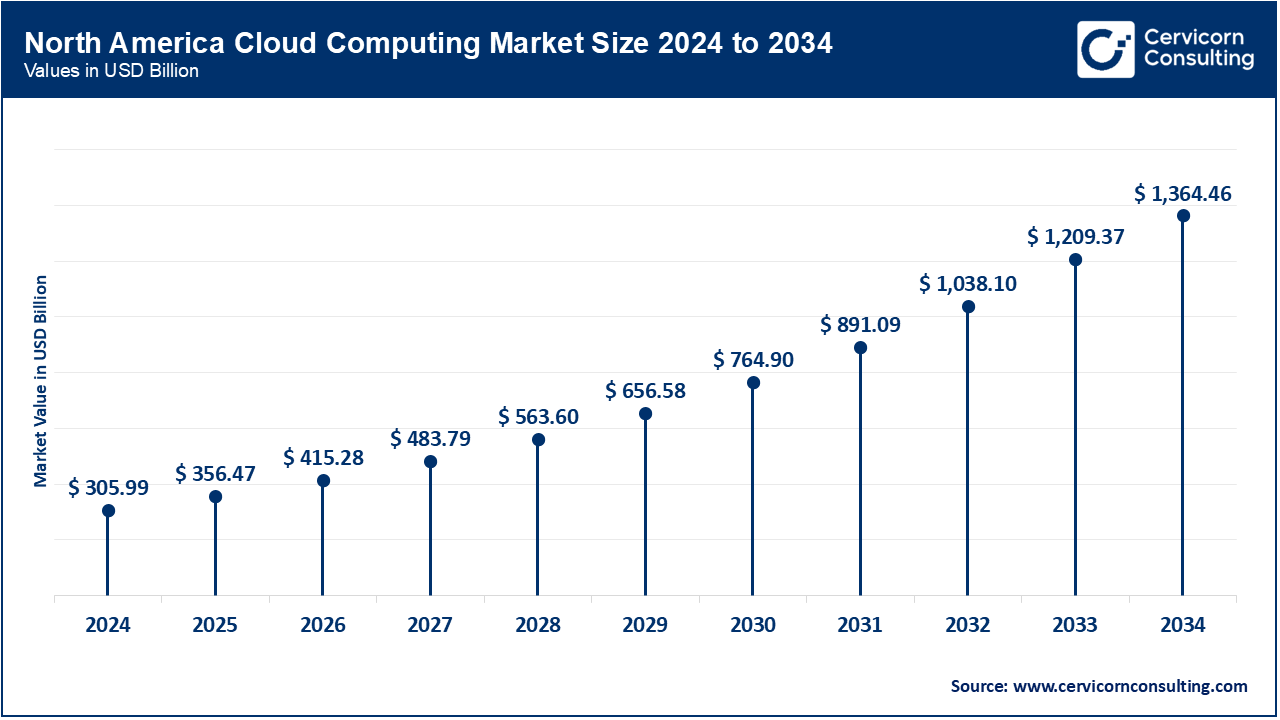

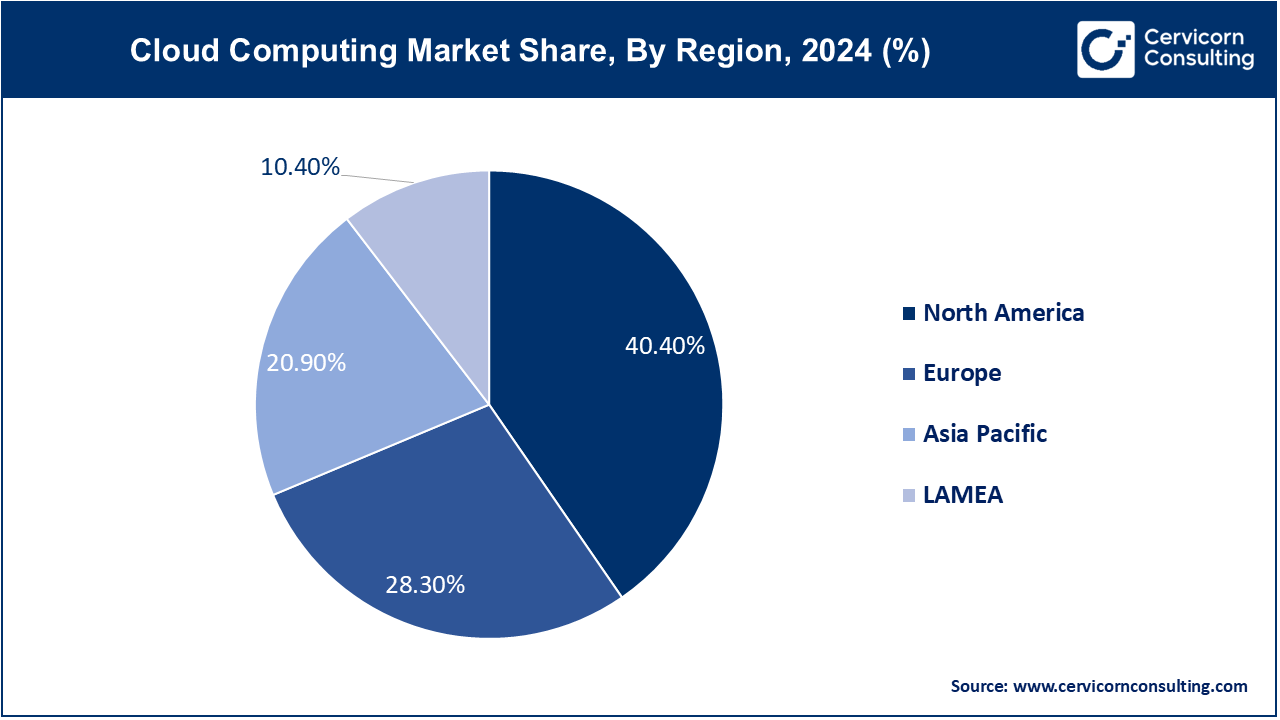

The North America cloud computing market was valued at USD 305.99 billion in 2024 and is expected to hit around USD 1,364.46 billion by 20343. North America is the largest cloud computing market in the world, owing to the headquarters of most significant technology giants located in the continent, along with a high degree of innovation. The region has good, matured infrastructure of cloud and has a large pool of skilled IT professionals.

The Europe cloud computing market size was estimated at USD 214.34 billion in 2024 and is projected to surpass around USD 955.80 billion by 2034. The cloud computing market for Europe is thriving due to increasing digitalization and cost-effective IT solutions, which are spur high growth here. Government initiatives and investments in digital infrastructure add up to the overall adoption of cloud services in Europe by its people.

The Asia-Pacific cloud computing market was valued at USD 158.29 billion in 2024 and is anticipated to reach around USD 705.87 billion by 2034. The Asia Pacific region is said to be one of the fastest-growing regions in the world. Here, rapid economic growth and digitalization are fueling the development of the cloud computing market. There is a huge population base and a rich cultural landscape here, which can be both an opportunity and a challenge for cloud providers in this region.

The LAMEA cloud computing market size was valued at USD 78.77 billion in 2024 and is expected to hit around USD 351.25 billion by 2034. Growth in the LAMEA cloud computing market is steady with increasing deployments across the key sectors of finance, healthcare, and government. The region's challenging cultural and economic diversity uniquely provides the challenges and opportunities for the cloud providers.

New players such as Edgio are focusing on building localized data centers, providing edge computing, edge computing with 5G, and focusing on edge networking services can help transmit user-facing data securely and with improved latency.

Dominating the market, Alibaba Group Holding Limited, Amazon Web Services Inc., Deutsche Telekom AG, and Google LLC are heavily investing in research and development to introduce new products and features that meet evolving customer needs. They are also focusing on acquiring smaller companies can help established players expand their product offerings and market reach.

CEO Statements

IBM Corporation CEO, Arvind Krishna

“IBM has always been at the forefront of technological innovation, and our commitment to cloud computing is no exception. As organizations around the world seek to embrace hybrid cloud solutions, we are proud to offer a secure and flexible environment that enables them to leverage their existing investments while optimizing their IT landscape.”

Google LLC CEO, Sundar Pichai

“At Google Cloud, we understand that the cloud is the backbone of innovation in today’s digital economy. Our mission is to provide businesses with the most powerful tools to foster creativity, collaboration, and efficiency.”

Microsoft Corporation, CEO, Satya Nadella

“Microsoft is deeply committed to empowering every organization and individual to achieve more through the cloud. With Microsoft Azure, we provide a comprehensive and secure cloud platform that enables businesses to innovate and transform their operations.”

Salesforce, Inc., CEO, Marc Benioff

“At Salesforce, we believe that the future of business is powered by the cloud, and our mission is to help companies of all sizes connect with their customers in a whole new way. Our cloud-based solutions enable organizations to harness the power of customer data, driving personalized experiences and fostering lasting relationships.”

Oracle Corporation, CEO, Safra Catz

“Oracle is proud to lead the charge in cloud innovation, providing organizations with a comprehensive suite of cloud applications, platforms, and infrastructure. Our focus on performance, security, and flexibility ensures that businesses can operate efficiently and securely in the cloud.”

These CEO statements reflect a shared commitment to innovation, sustainability, and tailored solutions within the Cloud Computing market. As the industry evolves, these leaders are poised to drive growth and efficiency through strategic investments and partnerships.

The cloud computing market is highly competitive, characterized by numerous players offering similar products. Key developments in the Cloud Computing market by prominent players showcase strategic expansions, technological advancements, and business optimizations aimed at enhancing operational capabilities and market reach. Some notable examples of key developments in the market include:

Recent developments in the cloud computing market reflect a strategic focus on expansion, innovation, and optimization across key players, this development underscore a proactive approach to meeting evolving market demands and enhancing operational efficiencies.

Market Segmentation

By Deployment Mode

By Service Models

By Enterprise Size

By Workload

By End-user Industry

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Cloud Computing

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Deployment Mode Overview

2.2.2 By Service Models Overview

2.2.3 By Enterprise Size Overview

2.2.4 By Workload Overview

2.2.5 By End-user Industry Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Cloud Computing Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Deployment of Private Cloud Computing

4.1.1.2 Remote Work-Related Policies Across the Globe

4.1.2 Market Restraints

4.1.2.1 Regulatory Compliance and Data Breaching Risk

4.1.2.2 High Cost for Long Term Usage

4.1.3 Market Opportunity

4.1.3.1 Rising Adoption of Internet of Things (IoT) and Connected Devices

4.1.3.2 Industry-Specific Cloud Solutions

4.1.4 Market Challenges

4.1.4.1 Complexity of Multi-Cloud Model

4.1.4.2 Risk of Vendor Lock-in

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Cloud Computing Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Cloud Computing Market, By Deployment Mode

6.1 Global Cloud Computing Market Snapshot, By Deployment Mode

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Public Cloud

6.1.1.2 Private Cloud

6.1.1.3 Hybrid Cloud

Chapter 7 Cloud Computing Market, By Service Models

7.1 Global Cloud Computing Market Snapshot, By Service Models

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Infrastructure as a Service (Iaas)

7.1.1.2 Platform as a Service (Paas)

7.1.1.3 Software as a Service (Saas)

Chapter 8 Cloud Computing Market, By Enterprise Size

8.1 Global Cloud Computing Market Snapshot, By Enterprise Size

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Large Enterprises

8.1.1.2 Small & Medium Enterprises

Chapter 9 Cloud Computing Market, By Workload

9.1 Global Cloud Computing Market Snapshot, By Workload

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Application Development & Testing

9.1.1.2 Data Storage & Backup

9.1.1.3 Resource Management

9.1.1.4 Orchestration Services

9.1.1.5 Other

Chapter 10 Cloud Computing Market, By End-user Industry

10.1 Global Cloud Computing Market Snapshot, By End-user Industry

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 BFSI

10.1.1.2 IT and Telecommunications

10.1.1.3 Government

10.1.1.4 Consumer Goods and Retail

10.1.1.5 Healthcare

10.1.1.6 Manufacturing

10.1.1.7 Others

Chapter 11 Cloud Computing Market, By Region

11.1 Overview

11.2 Cloud Computing Market Revenue Share, By Region 2024 (%)

11.3 Global Cloud Computing Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Cloud Computing Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Cloud Computing Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Cloud Computing Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Cloud Computing Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Cloud Computing Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Cloud Computing Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Cloud Computing Market, By Country

11.5.4 UK

11.5.4.1 UK Cloud Computing Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UK Market Segmental Analysis

11.5.5 France

11.5.5.1 France Cloud Computing Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 France Market Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Cloud Computing Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 Germany Market Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Cloud Computing Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of Europe Market Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Cloud Computing Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Cloud Computing Market, By Country

11.6.4 China

11.6.4.1 China Cloud Computing Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 China Market Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Cloud Computing Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 Japan Market Segmental Analysis

11.6.6 India

11.6.6.1 India Cloud Computing Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 India Market Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Cloud Computing Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 Australia Market Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Cloud Computing Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia Pacific Market Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Cloud Computing Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Cloud Computing Market, By Country

11.7.4 GCC

11.7.4.1 GCC Cloud Computing Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCC Market Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Cloud Computing Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 Africa Market Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Cloud Computing Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 Brazil Market Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Cloud Computing Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 12 Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13 Company Profiles

13.1 Akamai Technologies

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Alibaba Group Holding Limited

13.3 Amazon Web Services Inc.

13.4 Deutsche Telekom AG

13.5 Edgio

13.6 Google LLC

13.7 IBM Corporation

13.8 Intel Corporation

13.9 Lumen Technologies

13.10 Microsfot Corporation