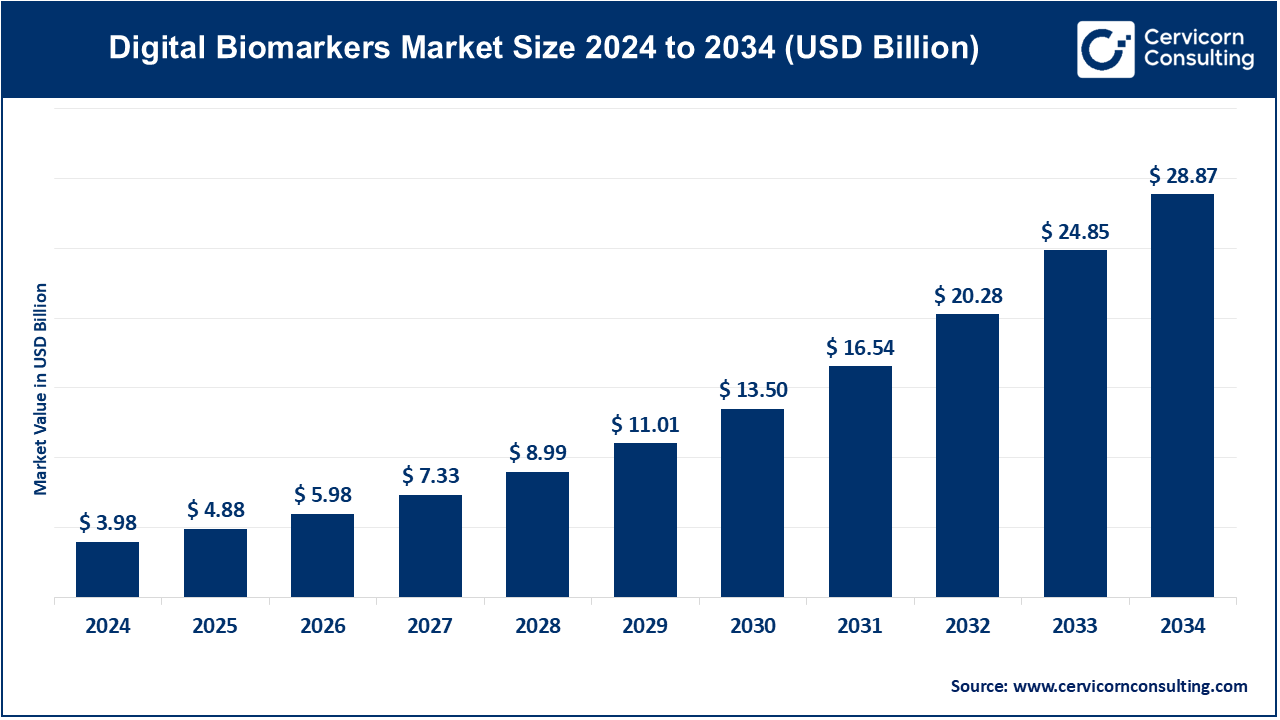

The global digital biomarkers market size was valued at USD 3.98 billion in 2024 and is expected to hit around USD 28.87 billion by 2034, growing at a CAGR of 21.91% from 2025 to 2034.

The digital biomarker market is rapidly expanding due to increased adoption of wearable health devices, AI-driven analytics, and the rising demand for remote patient monitoring. Pharmaceutical companies and healthcare providers are investing in digital biomarkers for drug development and real-world evidence collection. With the growth of telemedicine and personalized healthcare, digital biomarkers are becoming a crucial tool for preventive medicine. Regulatory support and advancements in IoT and cloud computing further drive the market. The integration of AI and machine learning improves data accuracy, enhancing decision-making in healthcare. As more companies collaborate to develop standardized frameworks, digital biomarkers are expected to revolutionize precision medicine and clinical research.

Digital biomarkers are health-related data collected through digital devices like smartphones, wearables, and sensors. These biomarkers help monitor, diagnose, and predict diseases by analyzing real-time physiological and behavioral data. Unlike traditional biomarkers (blood tests, imaging, etc.), digital biomarkers provide continuous monitoring, allowing early detection of health issues. For example, smartwatches can track heart rate variability to detect early signs of cardiovascular diseases, while smartphone apps can assess cognitive function through speech and movement patterns. Digital biomarkers are widely used in remote patient monitoring, chronic disease management, and clinical trials. They improve patient outcomes, reduce hospital visits, and enable personalized treatment plans.

Key Insights Beneficial to the Digital Biomarkers Market:

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 4.88 Billion |

| Projected Market Size (2034) | USD 28.87 Billion |

| Growth Rate (2025 to 2034) | 21.91% |

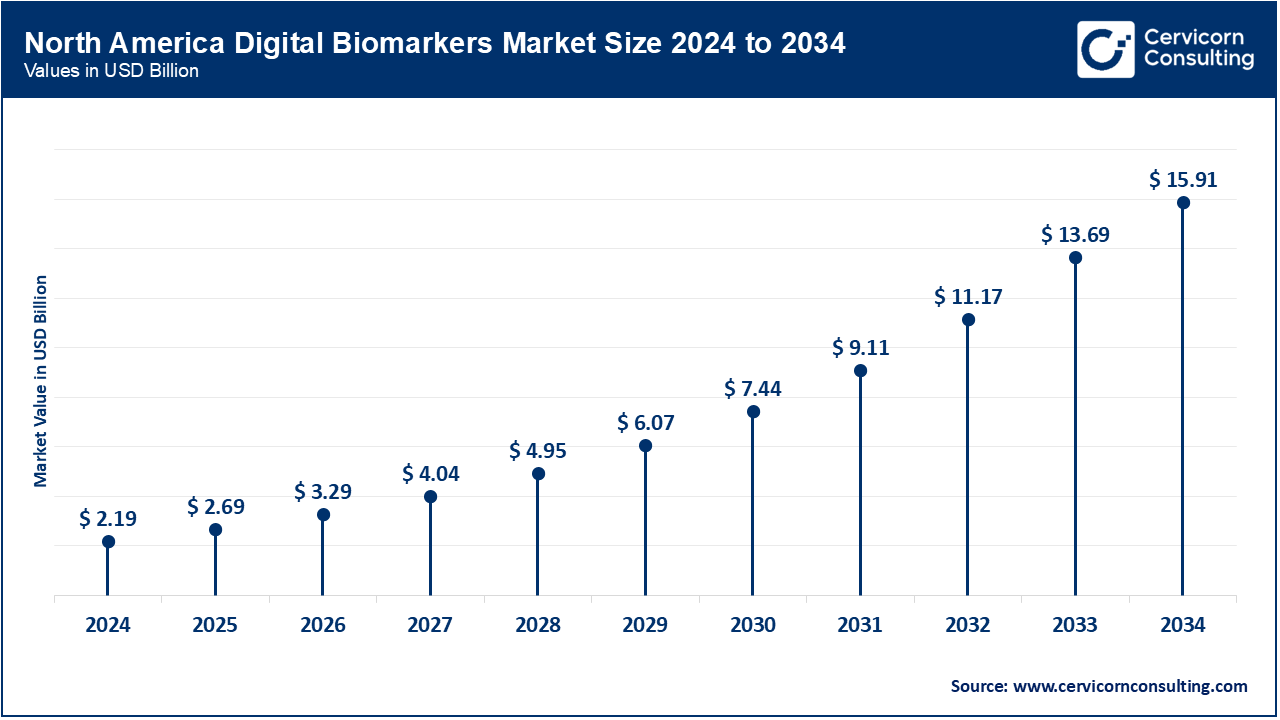

| Leading Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Type, Therapeutic Area, Clinical Practice, End-Users, Region |

| Key Companies | Feel Therapeutics, Amgen Inc., Verily Life Sciences LLC, Brainomix, Empatica, Koneksahealth, ActiGraph LLC, Sonde Health, Inc., Clario, AliveCor, Altoida Inc., Vivo Sense |

Growing Demand for Personalized Medicine

Consumer Awareness and Engagement

Interoperability Issues

Cost and Reimbursement

Expanding Applications

Integration with Electronic Health Records

Lack of Clinical Evidence

Technical Limitations

Wearable: Digital health wearable biomarkers constitute certain health-related data points which are retrieved through the wearable such as smartwatches, fitness trackers, and biosensors. The information they provide is real-time and it consists of a person's physiological and behavioural states. These devices monitor a variety of metrics, including heart rate, physical activity, sleep patterns, glucose levels, and even stress markers, allowing continuous patient monitoring outside of usual clinical settings. The information collected via wearable digital biomarkers is of the prime importance in the field of early disease detection, chronic disease management, and personalized medical aids.

Mobile Application: Mobile application digital biomarkers are data driven health technology that is gathered and computed through the devices such as a smartphone (medical apps), providing an accessible and convenient way for individuals to track their well-being through various activities. These biomarkers include metrics like how often you are exercising, sleep quality, your memory and mood, and even the heart rate which people can measure through smartphone sensors or wearable devices that are compatible with smartphones.

Neurological Disorders: The digital biomarker application in the neurological disorders area is a fast-developing field of innovation and it opens up new opportunities for monitoring, diagnosing, and controlling diseases such as Alzheimer's, Parkinson's, multiple sclerosis, and epilepsy. Digital biomarkers gathered by means of wearable tools, smartphone apps, and sensors give real-time and objective estimations of motor function, cognitive ability, sleep patterns, and emotional status. These digital biomarkers are used to find small deviations in the function of the nervous system that might not be visible during the regular doctor check-up period; thereby making the diagnostic procedure more proper.

Respiratory Disease: Digital biomarkers play an increasingly important part in the management and monitoring of respiratory diseases such as asthma, chronic obstructive pulmonary disease (COPD), and COVID-19. These biomarkers, collected through wearable devices, mobile apps, and smart inhalers, provide real-time data on respiratory function, including lung capacity, breathing patterns, oxygen saturation, and even coughing frequency. Through continuously monitoring these metrics, digital biomarkers allow for the early identification of exacerbations or asthma attacks by enabling personalized treatment adjustments to happen timely.

Cardiovascular Disease: Biomarkers that are digital in nature are playing a significant role in improving the management and treatment of cardiovascular diseases (CVD) like hypertension, atrial fibrillation, and heart failure through continuous and real-time monitoring of important health metrics. Wearable devices have become quite popular among people. These devices include smartwatches and fitness trackers. Measurements like heart rate, blood pressure, and electrocardiogram (ECG) patterns can be completed easily with these devices. This allows early stage diagnosis of problems such as arrhythmias or irregular heartbeats.

Diabetes: Patients with diabetes get precious help on their way as the disease is fought off with advancement in technology. This is achievable through continuous, real-time monitoring of blood sugar levels, activity patterns, and some health parameters with a new term as digital biomarkers. Wearable devices, like CGMs, and smart insulin pens have become the new unrecognized assistants that give the ultimate inspiration for customers developing diabetes or unhealthy lifestyle habit are finally realizing that practical electronics can bring overall health under control. Physical activities and food utilize technology to record, analyze and predict health aspects, enabling preventive health and healthier lifestyle.

Monitoring Clinical Practice: Monitoring the clinical practice with the help of digital biomarkers is a very significant part of the present-day health industry, which is improving the exactness of treatment, the efficacy of medicine, and the personalization of patient care. Digital biomarkers, which are gathered through wearable devices, mobile applications, and sensors, can track the real-time health parameters such as heart rate, glucose levels, sleep patterns, and activity levels of the patients. Aside from the clinical settings, these biomarkers also offer the healthcare providers the opportunity to have continuous and objective data, which in turn notifies them how well a patient is doing outside the more typical medical settings.

Diagnostic Clinical Practice: Digital biomarkers are rapidly becoming a defining factor in the diagnosis of clinical practice by providing information that significantly enhances the speed and accuracy of the diagnosis of various health issues. With the help of sensors wearable devices, and mobile apps digital biomarkers have emerged as the most promising tools for the continuous monitoring of physiological and behavioral data like heart rate, respiratory function, glucose levels, and cognitive performance. These observing entry points help the physician distinguish the health of the patient considerably and systematically from traditional clinical settings.

Prognostic Clinical Practice: The digital biomarkers on the patients has transformed the prognostics clinical practice because these devices give more exact real time information. Digital health applications are the next healthcare success as they can be applied in diagnosing and managing diseases which usually require long hours of observation, or regular monitoring of health data. Among these are the biomarkers of collective through wearable devices, mobile applications, and biosensors. The "Digital Health Applications and IoT Devices" the occurrence guide the patient through their condition in real-time and hence enabling patients to be better informed treatment seekers.

Healthcare Providers: The digital biomarkers are highly instrumental for healthcare providers along with offering cutting-edge technologies for patient care, decision making in clinics and ultimately effective treatment. Furthermore, physicians can assess the patients' health metrics, including but not limited to their heart rates, the breadth of the pulse, glucose readings which were achieved by them through mobile health applications, wearable devices, and biosensors. This piece of information that will be used to tailor treatment specifically to the patient on real-time, dynamic basis, and thus patient monitoring will become thorough.

Healthcare Consumers: Digital biomarkers are being adopted by consumers who play an important part in their fitness and health lifestyle as key tools for managing their health and wellness, thereby, allowing them to be in control of their health. Wearable devices, mobile health applications, and sensors that are used, make it possible for people to observe not only the physical movement they take but also the activities of the heart, the quantity and quality of sleep, and sugar levels in time. In turn, the data provided through the regular updating of their health information sources was seen as crucial by consumers. Indeed, it will allow them to become healthy thereby recognizing the problems around them and associating them with the behaviours that caused it and deciding which way will get them to be better.

The entrance of new key players in the digital biomarkers industry has been witnessed to be a dynamic process that not only accelerates the innovation but also the enlargement of the landscape through the introduction of top-notch technologies and creative solutions that foster the monitoring and care of patients. These start-ups in this industry are seizing the opportunities that artificial intelligence, machine learning, and data analytics are giving to produce the most sophisticated algorithms that enhance the accuracy and prognostic power of digital biomarkers.

One of the key growth areas is getting to make digital health tools more flexible and easily used by application of tech in mental health monitoring, remote chronic disease management, and personalized wellness solutions.

CEO Statements

Savan Devani, CEO of BioTrillion:

"By generating “LIFEdata,” a subset of health data collected via common smart device sensors, then using advancements in AI to convert them into digital biomarkers of key diseases, BioEngine4D can yield more effective and scalable applications to detect serious diseases earlier than would otherwise be possible."

Key players in the digital biomarkers market are instrumental in driving advancements in cancer diagnostics and personalized medicine. They are at the forefront of developing innovative solutions that enhance the accuracy and efficiency of cancer detection and monitoring. Notable developments in the market include:

These developments underscore a significant expansion in the digital biomarkers market, driven by strategic acquisitions and groundbreaking projects. Companies are focusing on enhancing cancer diagnostics through advanced technologies, improving the precision of detection and monitoring, and broadening the applications of digital biomarkers in personalized medicine.

Market Segmentation

By Type

By Therapeutic Area

By Clinical Practice

By End-Users

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Digital Biomarkers

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Therapeutic Area Overview

2.2.3 By Clinical Practice Overview

2.2.4 By End-Users Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Digital Biomarkers Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Growing Demand for Personalized Medicine

4.1.1.2 Consumer Awareness and Engagement

4.1.2 Market Restraints

4.1.2.1 Interoperability Issues

4.1.2.2 Cost and Reimbursement

4.1.3 Market Opportunity

4.1.3.1 Expanding Applications

4.1.3.2 Integration with Electronic Health Records

4.1.4 Market Challenges

4.1.4.1 Lack of Clinical Evidence

4.1.4.2 Technical Limitations

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Digital Biomarkers Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Digital Biomarkers Market, By Type

6.1 Global Digital Biomarkers Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Mobile Application

6.1.1.2 Wearable

6.1.1.3 Sensors

6.1.1.4 Others

Chapter 7 Digital Biomarkers Market, By Therapeutic Area

7.1 Global Digital Biomarkers Market Snapshot, By Therapeutic Area

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Diabetes

7.1.1.2 Cardiovascular And Metabolic Disorders (CVMD)

7.1.1.3 Respiratory Disorders

7.1.1.4 Psychiatric Disorders

7.1.1.5 Sleep & Movement Disease

7.1.1.6 Neurological Disorders

7.1.1.7 Musculoskeletal Disorders

7.1.1.8 Others

Chapter 8 Digital Biomarkers Market, By Clinical Practice

8.1 Global Digital Biomarkers Market Snapshot, By Clinical Practice

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Prognostic

8.1.1.2 Diagnostic

8.1.1.3 Monitoring

8.1.1.4 Others (Safety, Pharmaco Dynamics/ Response, Susceptibility)

Chapter 9 Digital Biomarkers Market, By End-Users

9.1 Global Digital Biomarkers Market Snapshot, By End-Users

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Healthcare Companies

9.1.1.2 Healthcare Providers

9.1.1.3 Payers

9.1.1.4 Others (Patient, Caregivers)

Chapter 10 Digital Biomarkers Market, By Region

10.1 Overview

10.2 Digital Biomarkers Market Revenue Share, By Region 2024 (%)

10.3 Global Digital Biomarkers Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Digital Biomarkers Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Digital Biomarkers Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Digital Biomarkers Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Digital Biomarkers Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Digital Biomarkers Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Digital Biomarkers Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Digital Biomarkers Market, By Country

10.5.4 UK

10.5.4.1 UK Digital Biomarkers Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UK Market Segmental Analysis

10.5.5 France

10.5.5.1 France Digital Biomarkers Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 France Market Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Digital Biomarkers Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 Germany Market Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Digital Biomarkers Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of Europe Market Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Digital Biomarkers Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Digital Biomarkers Market, By Country

10.6.4 China

10.6.4.1 China Digital Biomarkers Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 China Market Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Digital Biomarkers Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 Japan Market Segmental Analysis

10.6.6 India

10.6.6.1 India Digital Biomarkers Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 India Market Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Digital Biomarkers Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 Australia Market Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Digital Biomarkers Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia Pacific Market Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Digital Biomarkers Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Digital Biomarkers Market, By Country

10.7.4 GCC

10.7.4.1 GCC Digital Biomarkers Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCC Market Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Digital Biomarkers Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 Africa Market Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Digital Biomarkers Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 Brazil Market Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Digital Biomarkers Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 11 Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12 Company Profiles

12.1 Feel Therapeutics

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Amgen Inc.

12.3 Verily Life Sciences LLC

12.4 Brainomix

12.5 Empatica

12.6 Koneksahealth

12.7 ActiGraph LLC

12.8 Sonde Health, Inc.

12.9 Clario

12.10 AliveCor