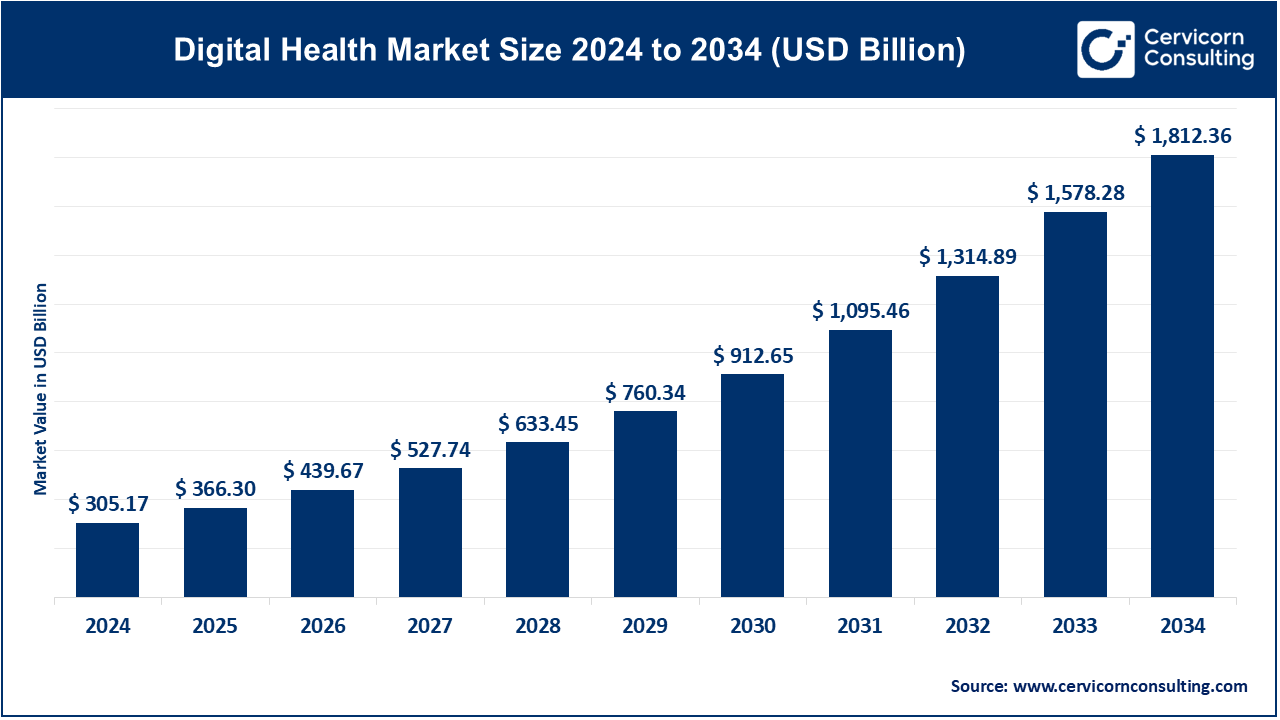

The global digital health market size was valued at USD 305.17 billion in 2024 and is expected to surpass around USD 1,812.36 billion by 2034, growing at a compound annual growth rate (CAGR) of 19.5% from 2025 to 2034.

The digital health market is experiencing significant growth as healthcare systems worldwide recognize the potential of technology to improve care delivery and patient outcomes. This market encompasses various sectors, including telemedicine, digital therapeutics, wearable devices, health apps, and health information technologies. A key factor driving this growth is the increasing demand for remote healthcare solutions, especially in light of the pandemic, which accelerated the adoption of telemedicine. As patients seek more accessible and convenient ways to interact with healthcare providers, telemedicine platforms and virtual consultations have seen a surge in usage, providing a safer alternative to in-person visits. In addition to telemedicine, the growing popularity of wearable devices and mobile health applications has also contributed to the market's expansion. In the first half of 2024, U.S. digital health startups raised USD 5.7 billion across 266 deals. If this momentum continues, 2024 could surpass the investment totals of 2019 and 2023, which were USD 8.2 billion and USD 10.7 billion, respectively.

Digital health refers to the use of technology to enhance the efficiency and delivery of healthcare. It includes a broad range of tools such as mobile apps, wearable devices, telemedicine, and electronic health records (EHRs), all of which aim to improve patient care, health management, and healthcare systems. Digital health technologies allow for real-time monitoring of health, making healthcare more accessible and personalized. These tools help track vital signs, symptoms, and activity levels, enabling better communication between patients and healthcare providers. Additionally, digital health promotes preventive care by offering health recommendations based on individual data, which can lead to healthier lifestyles and reduced healthcare costs.

The increasing use of internet usage and fast internet connections, mobile devices and networks, social networking, etc. were essential preconditions for the rise of digital health. Data transfer and information exchange in real-time is a great benefit for both physicians and patients. Still, many patients don’t trust the exchange of health data due to concerns about cyber-security.

Growing use of Cloud-Based Patient Records

Growing Demand for Curbing Healthcare Costs

Growth in Telehealth and Virtual Care

Rising Government Initiatives

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 366.3 Billion |

| Projected Market Size (2034) | USD 1,812.36 Billion |

| Growth Rate (2025 to 2034) | 22.03% |

| Leading Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Technology, Component, Application, End User, Region |

| Key Companies | Apple Inc., Telefónica S.A., Google, Inc., Oracle (Cerner Corporation), Epic Systems Corporation, QSI Management, LLC, AdvancedMD Inc., AT&T, AirStrip Technologies, Orange, Softserve, Computer Programs and Systems, Inc., Allscripts Healthcare Solutions Inc., Vocera Communications, IBM Corporation, CISCO Systems, Inc., Veradigm, Hims& Hers Health, Inc., Qualcomm Technologies, Inc., Samsung Electronics Co., Ltd. |

Increasing Smartphone Penetration

Growing Demand for Personalized Healthcare

Stringent Regulatory Compliance

Limited Access to Technology

Growing Adoption of Digital Health

Advancements in the Telecommunication Sector

Privacy Concerns

Challenges in EHR Implementation

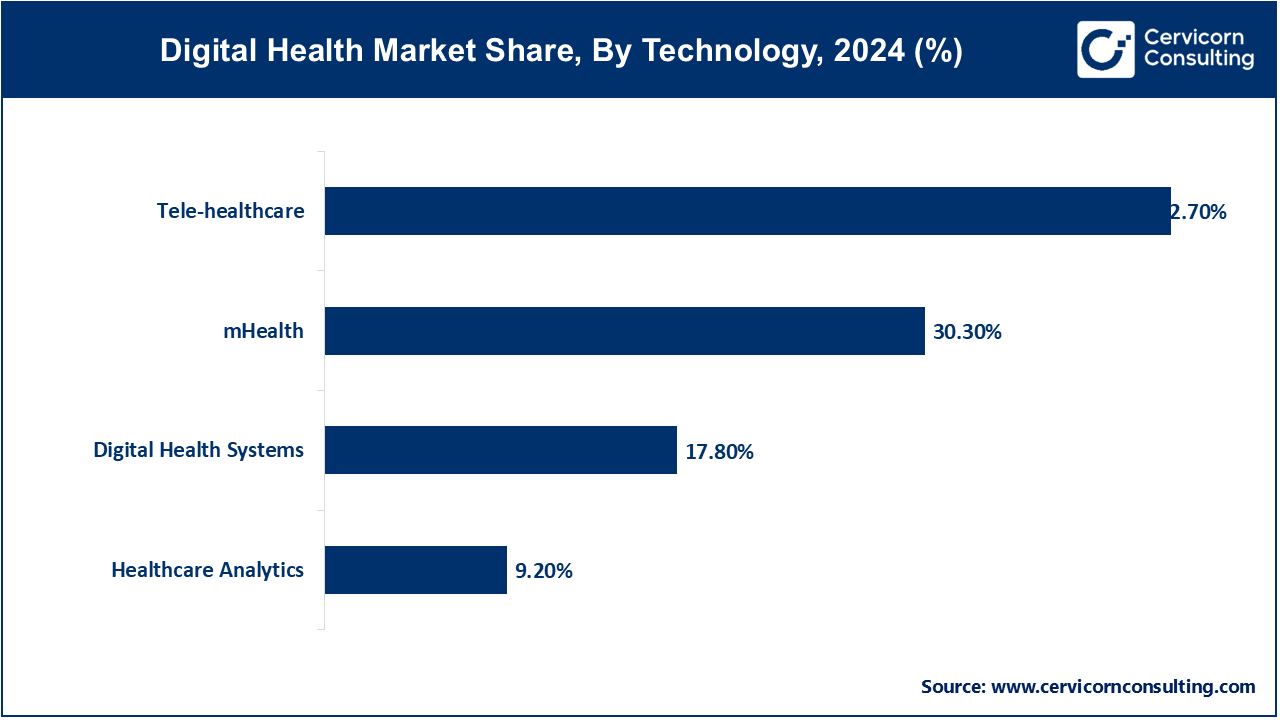

The digital health market is segmented into technology, component, application, end-users and region. Based on technology, the market is classified into digital health systems, tele-healthcare, mHealth, and healthcare analytics. Based on component, the market is classified into software, hardware, services, and application (apps). Based on application, the market is classified into chronic diseases, health & fitness, cardiology, and others. Based on end-users, the market is classified into business-to-business, and business-to-consumer.

Digital Health Systems: The digital health system segment has generated revenue share of 17.80% in 2024. Digital solutions are reshaping eHealth and enriching outdated 20th-century healthcare systems. A new healthcare system built on a fully digital landscape can benefit citizens in a variety of ways. Several studies have demonstrated the value of digital tools in the areas of surveillance, screening programs, awareness campaigns, social media-based therapies for behavioral health conditions, and digital health literacy.

Telehealthcare: The telehealthcare segment has captured revenue share of 42.70% in 2024. Patients' growing inclination toward technology-driven approaches that provide health management tools and enable easy access to services in remote locations. In September 2022, RxDefine, a leading engagement platform committed to educating and empowering healthcare consumers, launched RxTelehealth, a telehealth solution for life sciences brands as part of its mission to ethically empower patients to make their healthcare decisions. The benefits of telemedicine, such as reduced wait times, lead to faster disease diagnosis. In addition, teleconsultations have increased in adoption and usage during the COVID-19 pandemic.

mHealth: The mHealth segment has garnered revenue share of 30.30% in 2024. The growing requirement of mobile apps is driven by people's attention related to their health and well-being. The popularity of healthcare apps has also increased because of the rising focus on daily monitoring and early diagnosis. For instance, Fitbit Luxe was introduced by Fitbit Inc. in April 2021 intending to enhance both physical and mental well-being. Fitbit Luxe is a fitness and wellness tracker app for stress management and sleep monitoring.

Healthcare Analytics: The healthcare analytics segment has held revenue share of 9.20% in 2024. Healthcare analytics uses statistical analysis, data, and prediction models, for enhancing the operational, financial, and medical factors of the healthcare industry. The primary factors impacting the significance of healthcare analytics are the aging population, digitization of data, and patient requirements for personalized treatment. The outcome of healthcare analytics leads to reduced expenses, improved outcomes, and evidence-based.

Software: The software segment has captured share of 19% in 2024. The growing efforts to create novel technology that will improve the software industry. This area is expanding thanks in part to the increasing number of new product launches that are occurring in the market. For example, in June 2022, Bajaj Allianz and Allianz Partners introduced the first-ever "Global Health Care" health insurance plan, which offers coverage for medical expenses anywhere in the world.

Hardware: The hardware segment has accounted share of 30% in 2024. The physical parts of the computer, or delivery systems, that store and process the written instructions given by the software, are referred to as hardware. In this fast-paced, technologically advanced world, digital health platforms are essential. A wide range of ideas from the intersection of technology and innovation in the healthcare system are included in the broad, multidisciplinary concept known as digital healthcare.

Services: The services segment has accounted share of 44% in 2024. Teleconsultation services are quite inexpensive in the services market. The development of businesses offering teleconsultation services contributes to the segment's growth. For example, Sesame, Inc. aims to improve patient accessibility, affordability, and transparency by bringing its Direct-to-Patient Platform services to New York City and Houston in September 2020.

Chronic Diseases Management: Digital health allows patients with chronic illnesses the capability to continuously measure and monitor their health status, communicate with doctors remotely, and access vital information around the clock. Cost-effective solutions for improved healthcare quality, accessibility, affordability, and availability are also made possible by digital health. It also provides a flexible way to educate and improve skills. The availability of consumer-facing health technologies for chronic disease management is increasing rapidly, but most are limited by low adoption rates. Improving adoption requires a better understanding of a target audience's past technology exposure.

Health & Fitness: Digital fitness companies around the world are growing by offering on-demand content services and subscriptions to reach consumers who no longer have access to fitness centers. Wearable fitness technology, streaming content platforms, and new forms of "fit tech" are capitalizing on consumers' changing exercise preferences.

Cardiology: The rise in remote cardiac monitoring solutions, including wearable devices and connected health platforms. For instance, in August 2023, NXGN Management, LLC and Luma Health (US) expanded their alliance to provide ambulatory organizations across the country with artificial intelligence (AI) enhanced patient communication solutions, beginning with intake and self-scheduling.

Others: The others segment includes mental health and obesity. Online technology is used for addressing mental health issues which is known as digital mental health. Personalization of treatment options, boosting patient engagement, and increasing accessibility are some of the few advantages obtained by integrating digital technologies and psychotherapy. Obesity is a complex, multifactorial, chronic condition that increases the risk of a variety of diseases, including type 2 diabetes mellitus, cardiovascular disease, and certain cancers. The prevalence of obesity continues to rise and places a huge economic burden on the healthcare system. Existing technologies such as telemedicine, mobile health apps, and wearable devices offer new opportunities to improve access to obesity care and increase the quality, efficiency, and cost-effectiveness of weight management interventions and long-term patient care.

Business-to-Business: The expanding partnerships amongst industry participants to combine different digital technologies for improved outcomes. For example, in October 2020, Takeda Pharmaceutical Company Limited, Accenture, and Amazon Web Services (AWS) signed a five-year strategic agreement to drive Takeda's cloud-driven business transformation and accelerate Takeda's digital transformation through platform modernization, data services acceleration, and the creation of an internal innovation engine for the benefit of patients.

Business-to-Consumer: Due to the strong demand from customers throughout the world, more and more technologies, including mHealth apps and software, are being released, which has contributed to the segment's growth. Decisions made by healthcare consumers have a significant impact on the services that are eventually made available to people and society. Digital health for consumers is quickly evolving into a crucial part of medical care. The rising aging population, cases of chronic diseases, and demand for digital health technologies are likely to drive the growth of the digital health market.

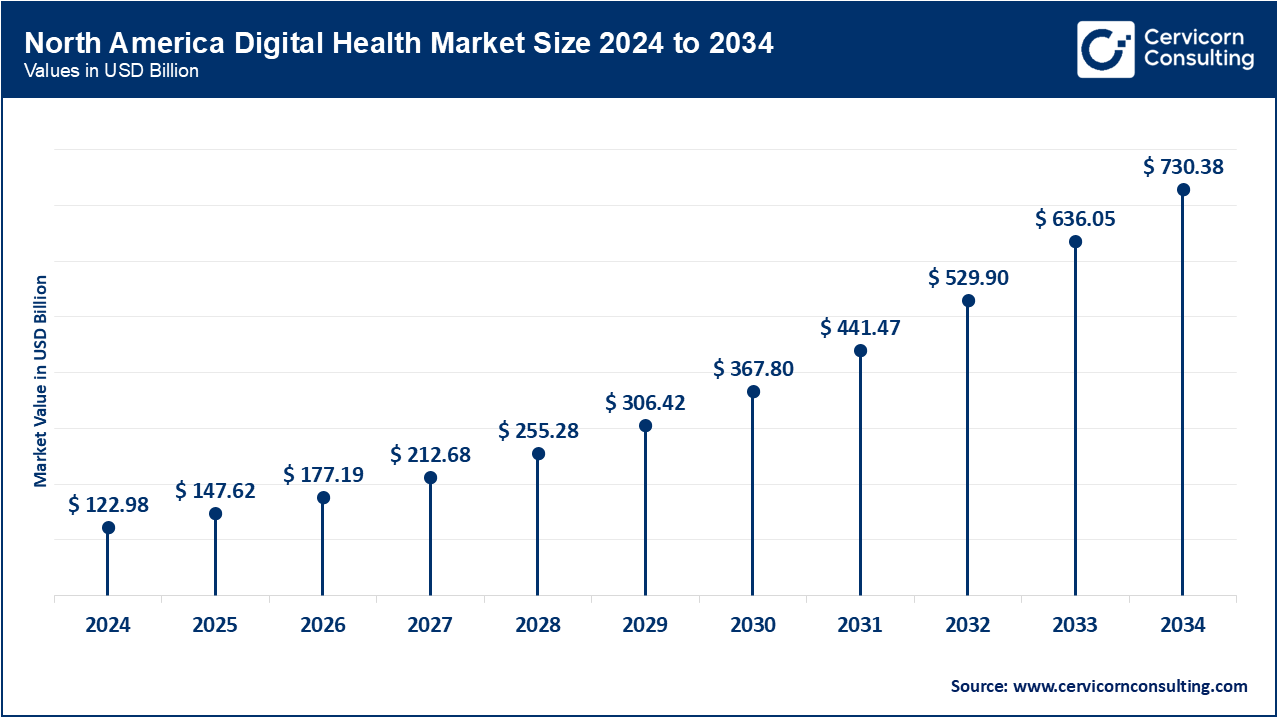

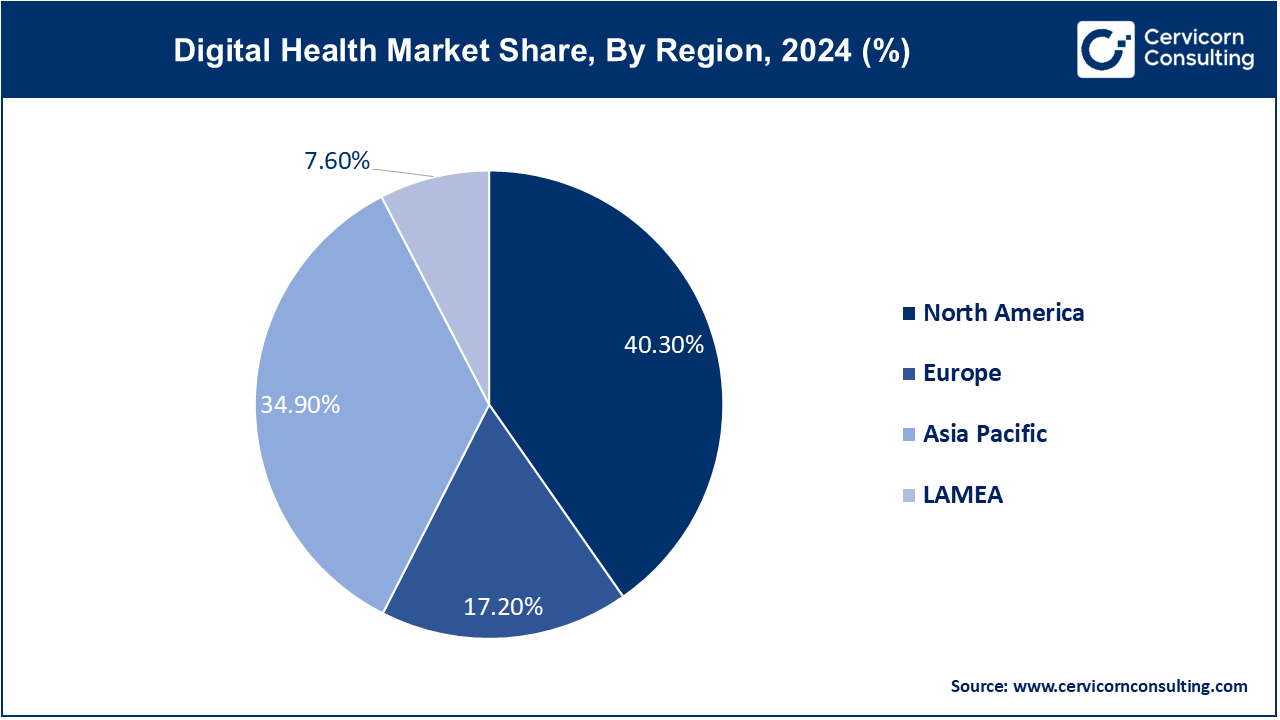

The North America digital health market size was valued at USD 122.98 billion in 2024 and is expected to reach around USD 730.38 billion by 2034. North America market is driven by robust technological infrastructure and a well-established regulatory framework. The U.S. and Canada are key markets where retrofitting existing buildings to improve energy efficiency is a significant growth driver. The region's cold climate also fuels the demand for high-performance insulation, particularly in residential and commercial buildings.

The Europe digital health market was valued at USD 52.49billion in 2024 and is anticipated to hit around USD 311.73 billion by 2034. Europe has strong data protection regulations, such as GDPR, and rising technological advancements in telehealth solutions that drive the region's market growth. The growth of Europe's digital health market is primarily driven by the availability of various telemedicine initiatives and solutions in the region. This growth, coupled with the proliferation of digital technologies, mainly wearables and mobile applications in Europe, is supporting the region's overall market growth.

The Asia-Pacific digital health market size was estimated at USD 106.5 billion in 2024 and is projected to garner around USD 632.51 billion by 2034. The large and diverse population providing a significant market for digital health, and the rising prevalence of chronic diseases are key drivers of the digital health market in the Asia-Pacific region. Emerging economies like China, India, and Southeast Asian countries are experiencing a technological boom, leading to increased demand for digital health. The region’s diverse climate conditions, ranging from tropical to cold, require a variety of insulation solutions to ensure energy efficiency in buildings. Government initiatives to promote green buildings also support market growth.

The LAMEA digital health market size was accounted for USD 23.19 billion in 2024 and is predicted to surpass around USD 137.74 billion by 2034. The LAMEA market is expanding due to the growing incidence of chronic disease, and increasing mobile penetration offers a platform for mHealth applications. Digital health is revolutionizing healthcare in MEA, facilitated by improving internet connectivity and government initiatives. Telemedicine, wearable devices, mHealth apps, and Artificial Intelligence (AI) are key trends transforming healthcare access, costs, & outcomes. Despite challenges including infrastructure, affordability, and data privacy, digital health’s potential to improve MEA healthcare is substantial.

The emerging players include Apple, Inc., Google, Inc., and Qualcomm Technologies, Inc., which have a presence in more than 30 countries and headquarters, manufacturing plants, distribution centers, and offices. In March 2023, Apple Inc. announced plans to upgrade the AirPods by 2025 to add ambient light sensors with health monitoring features such as motion detectors, temperature monitors, blood oxygen levels, and sweat and heart rate measurements. With their innovative approaches and strategic initiatives, these key players are highlighting their leadership and influence in the evolving digital health market.

CEO Statements

Arun Gupta, Chairman and CEO of Big Health:

"Seamless, patient-centered integration between digital and physical modalities is not only critical but, in my view, inevitable. Digital therapeutics are not here to replace physical healthcare modalities; however, they’re effective, they scale efficiently, and can be delivered conveniently. For these reasons, the best-of-both-worlds integration of digital and physical is undoubtedly going to play an important role in enabling a newly evolved mental healthcare ecosystem to take a big bite out of the unacceptable care gap that now exists."

Gianrico Farrugia, President and CEO of Mayo Clinic:

"For emerging technologies like AI to have maximum impact on healthcare, we need to fundamentally rethink how we innovate. We all know the challenges facing the healthcare industry, ranging from patients seeking care in ever-higher numbers to uneven access and quality care. But it has been very difficult to successfully address those challenges relying on legacy models."

Key players in the digital health industry are pivotal in delivering a variety of innovative construction solutions, such as prefabrication techniques, sustainable materials, and advanced digital technologies. Some notable developments in the market include:

These advancements mark a notable expansion in the digital health market, driven by strategic acquisitions and innovative projects. The focus is on boosting sustainability, enhancing construction efficiency, and broadening product offerings to meet diverse building needs.

Market Segmentation

By Technology

By Component

By Application

By End-Users

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Digital Health

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Component Overview

2.2.3 By Application Overview

2.2.4 By End-Users Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Digital Health Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing Smartphone Penetration

4.1.1.2 Growing Demand for Personalized Healthcare

4.1.2 Market Restraints

4.1.2.1 Stringent Regulatory Compliance

4.1.2.2 Limited Access to Technology

4.1.3 Market Opportunity

4.1.3.1 Growing Adoption of Digital Health

4.1.3.2 Advancements in the Telecommunication Sector

4.1.4 Market Challenges

4.1.4.1 Privacy Concerns

4.1.4.2 Challenges in EHR Implementation

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Digital Health Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Digital Health Market, By Technology

6.1 Global Digital Health Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Digital Health Systems

6.1.1.2 Tele-healthcare

6.1.1.3 mHealth

Chapter 7 Digital Health Market, By Component

7.1 Global Digital Health Market Snapshot, By Component

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Software

7.1.1.2 Hardware

7.1.1.3 Services

7.1.1.4 Application (Apps)

Chapter 8 Digital Health Market, By Application

8.1 Global Digital Health Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Chronic Diseases

8.1.1.2 Health & Fitness

8.1.1.3 Cardiology

8.1.1.4 Others

Chapter 9 Digital Health Market, By End-Users

9.1 Global Digital Health Market Snapshot, By End-Users

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Business-to-Business

9.1.1.2 Business-to-Consumer

Chapter 10 Digital Health Market, By Region

10.1 Overview

10.2 Digital Health Market Revenue Share, By Region 2024 (%)

10.3 Global Digital Health Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Digital Health Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Digital Health Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Digital Health Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Digital Health Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Digital Health Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Digital Health Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Digital Health Market, By Country

10.5.4 UK

10.5.4.1 UK Digital Health Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UK Market Segmental Analysis

10.5.5 France

10.5.5.1 France Digital Health Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 France Market Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Digital Health Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 Germany Market Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Digital Health Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of Europe Market Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Digital Health Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Digital Health Market, By Country

10.6.4 China

10.6.4.1 China Digital Health Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 China Market Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Digital Health Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 Japan Market Segmental Analysis

10.6.6 India

10.6.6.1 India Digital Health Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 India Market Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Digital Health Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 Australia Market Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Digital Health Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia Pacific Market Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Digital Health Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Digital Health Market, By Country

10.7.4 GCC

10.7.4.1 GCC Digital Health Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCC Market Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Digital Health Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 Africa Market Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Digital Health Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 Brazil Market Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Digital Health Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 11 Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12 Company Profiles

12.1 Apple Inc.

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Telefónica S.A.

12.3 Google, Inc.

12.4 Oracle (Cerner Corporation)

12.5 Epic Systems Corporation

12.6 QSI Management, LLC

12.7 AdvancedMD Inc.

12.8 AT&T

12.9 AirStrip Technologies

12.10 Orange