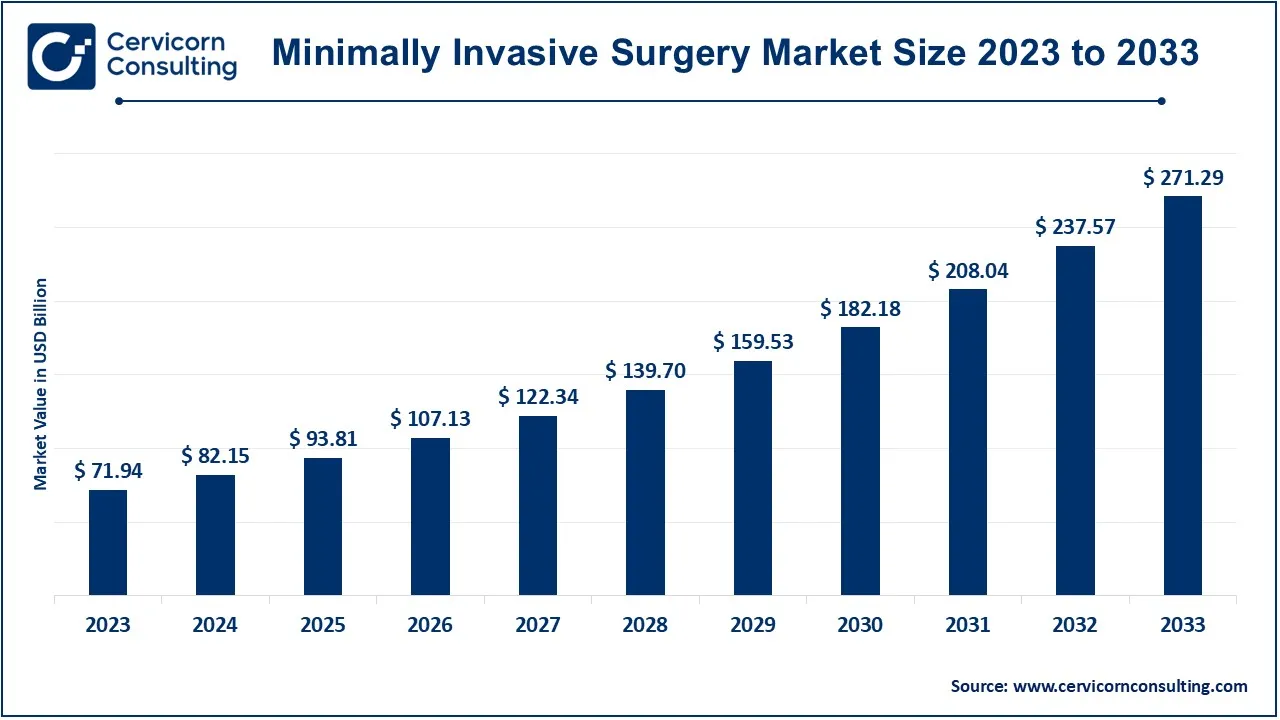

The global minimally invasive surgery market size was reached at USD 82.15 billion in 2024 and is expected to be worth around USD 271.29 billion by 2033, growing at a compound annual growth rate (CAGR) of 14.19% over the forecast period 2024 to 2033.

The global minimally invasive surgery (MIS) market is growing rapidly due to increasing demand for faster recovery and lower healthcare costs. Technological advancements, such as AI-assisted robotic surgeries and improved imaging, are driving growth. The rise in chronic diseases like obesity, cardiovascular conditions, and arthritis is also fueling demand for MIS procedures. Additionally, the growing elderly population and higher healthcare investments worldwide are key factors boosting market expansion. Hospitals and clinics are adopting MIS due to its cost-effectiveness and improved patient outcomes. As awareness about its benefits increases, more people prefer minimally invasive procedures over traditional surgeries. The market is also driven by continuous research and development in robotic-assisted surgeries, AI-based diagnostics, and enhanced surgical instruments.

What is a Minimally Invasive Surgery (MIS)?

Minimally invasive surgery (MIS) is a modern technique where doctors perform surgeries using small cuts instead of large incisions. This method involves using tiny tools, cameras, and robotic assistance to treat medical conditions with less pain and faster recovery. Unlike traditional surgery, MIS reduces blood loss, lowers infection risks, and shortens hospital stays. It is widely used in procedures like laparoscopy (abdominal surgery), arthroscopy (joint surgery), and robotic-assisted surgeries. MIS benefits both patients and doctors. Patients experience less pain, minimal scarring, and quicker recovery, allowing them to return to daily activities sooner. Doctors gain better visibility with high-definition cameras and robotic precision, improving surgical accuracy. Common conditions treated with MIS include hernia repair, gallbladder removal, and heart surgeries.

Key Insights Beneficial to the Minimally Invasive Surgery Market:

Increasing Robotic Surgery

Growing Use of Advanced Cameras

Technological Advancements

MIS for chronic Pancreatitis

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 93.81 Billion |

| Expected Market Size in 2033 | USD 271.29 Billion |

| Growth Rate 2024 to 2033 | 14.19% |

| Front-runner Region | North America |

| Fastest Expanding Region | Asia-Pacific |

| Key Segments | Type, Application, End User, Region |

| Key Companies | Abbott Laboratories, Arthrex, Asenus Surgical, Conmed, Becton, Dickinson & Company, InMode Ltd., Integrated Endoscopy, Boston Scientific Corporation, Eximis Surgical, GE Healthcare, OmniGuide Holdings Inc., Titan Medical Inc., Johnson & Johnson Medtech, Medtronic plc, NuVasive, Orthofix Holdings,Inc, Smith & Nephew, Stryker corporation, Fractyl Inc., Virtual Ports, Zimmer Biomet holdings, Hoya Corporation |

Increased Cases of Chronic Diseases

Growing Prevalence of Orthopedic Diseases

High Costs

Complications Associated with MIS

Expansion into Emerging Markets

Rising Investment in Healthcare Infrastructure

High Market Consolidation

Skilled Labor Shortages

Based on product, the global market is segmented into electrosurgical devices, imaging & visualization systems, surgical devices, medical robots, endoscopy devices and others. The surgical devices segment has dominated the market in 2023 with highest revenue share.

Electrosurgical Devices: A surgical technique used for controlling bleeding and quickly dissecting soft tissues is known as electrosurgery. Heat is generated by the electrical resistance of these soft tissues to an electromagnetic current. The waveform, power used and surgical technique help decide the endpoints in the surgery. In both open and minimally invasive surgery electrosurgery is the most commonly used form of surgical energy. An electrosurgical device comprises a generator and a handpiece with one or more electrodes. A switch on the hand piece or a foot switch is the controller of the device. Electrosurgical generators can generate various electrical waveforms and depending upon these waveforms, the corresponding effects on the tissues also change. Further, advanced electrosurgical devices have revolutionized laparoscopic surgery and led to increasing acceptance of more complex procedures.

Imaging & Visualization Systems: The rise of chronic diseases and less invasive surgical procedures often requires imaging systems to visualize the affected area. In addition, these innovations provide surgeons with improved clarity and precision in observing the surgical site, resulting in less tissue trauma, shorter operative times, faster patient recovery, and improved overall outcomes.

Surgical Devices: Surgical devices are classified into handheld instruments, laparoscopy devices, guiding devices, and inflation systems, all of which play an important role in minimally invasive surgery (MIS) and significantly improve surgical outcomes through their continuous development and innovation. Technological advances in surgical devices are a major driver of the market as the advanced devices aim to improve the precision, flexibility, and safety of the process, ultimately benefiting patients.

Medical Robotics: Medical robots are used in various surgeries, a form of minimally invasive surgery. The medical robots are used in a surgical platform with the surgical instruments attached to the mechanized "arms" and are controlled by a surgeon at the console. Robotic surgery has experienced exponential growth and proliferation over the past decade. Today, most prostate removal surgeries are performed robotically. In addition, there has been tremendous growth in robotic surgical applications for kidney, bladder, and reconstructive surgical procedures.

Endoscopy Devices: An endoscope is a medical device with a light attached. It is used to look inside a body cavity or organ. The endoscope is inserted through a natural opening, such as through the mouth during a bronchoscopy or through the rectum during a sigmoidoscopy. A medical procedure that involves the use of an endoscope of any kind is called an endoscopy. Several endoscopic devices are currently FDA-approved for use in endoluminal tissue apposition. These devices are currently being used with varying degrees of success to reduce the size of a gastric bypass pouch or gastrojejunostomy.

Based on application, the global market is segmented into cardiology, neurology, gastrointestinal, orthopedic, dental, gynecological and others. In 2023, the neurology segment was leading in the market.

Cardiology: Technological advancements, particularly in precise surgical instruments and imaging techniques, have accompanied the adoption of minimally invasive surgery (MIS) in cardiothoracic procedures. With increased proficiency in MIS techniques, medical professionals are demonstrating increased assurance when utilizing these methods in intricate cardiothoracic procedures. The adoption of MIS in cardiothoracic surgery is also being aided by changing healthcare reimbursement frameworks and policies that support efficient and economical care pathways.

Neurology: Several factors are driving the increasing use of minimally invasive surgery (MIS) in neurological treatments. Technological advances have improved the precision of minimally invasive procedures, particularly in imaging techniques and surgical instruments. There is also a strong incentive to reduce postoperative complications, decrease patient morbidity, and shorten recovery times, all of which are benefits of MIS in neurological surgery.

Gastrointestinal: Gastrointestinal and minimally invasive surgery focuses on diagnosing and treating patients with diseases of the gastrointestinal tract. These problems can include both chronic and acute conditions. Minimally invasive surgery can reduce damage to human tissue and is often robot-assisted surgery. Minimally invasive gastrointestinal surgery typically uses a high-resolution video camera to project the surgical field onto a screen in the operating room.

Orthopedic: The orthopedic segment growth is being driven by the rising prevalence of various orthopedic conditions, including carpal tunnel syndrome and osteoarthritis. Numerous orthopedic surgical procedures, such as microscopic treatment of complex musculoskeletal conditions, arthroscopic repairs of sports injuries, and total joint replacements, have been made better owing to new research and technological advancements. Minimally invasive surgery is incorporated into the field of orthopedics by making a large, open incision exposing the entire joint and then using smaller and more focused incisions to treat the specific problem areas. This surgery in turn provides patients with a shorter recovery period, less pain post-surgery, and reduced risk.

Dental: Micro dentistry, another name for minimally invasive dentistry, is a term used to describe a variety of procedures all done with the primary objective of preserving and enhancing the patient's oral health and providing healthy tooth structure. While solving any form of dental issue minimally invasive dentistry aims towards removing as little of the tooth structure as possible thus enhancing the patient's overall oral health.

Gynecological: Minimally invasive gynecological surgery specializes in examining and treating people with a variety of noncancerous (benign) gynecological conditions, such as heavy menstrual bleeding (menorrhagia), pelvic pain, endometriosis, irregular menstrual bleeding (metrorrhagia), and ovarian cysts. Minimally invasive gynecological surgery uses less invasive techniques such as laparoscopy or hysteroscopy to surgically treat gynecological conditions.

Others: The other segments include urological, cosmetic, and vascular. Minimally invasive urological surgery treats urological diseases in a way that causes less damage to your body and carries fewer risks than open surgery. Urologists can use minimally invasive surgery to correct problems affecting your urinary system as well as your female and male reproductive systems. Minimally invasive cosmetic procedures are small, noninvasive surgical treatments that are designed to slightly enhance or alter your face and body. Minimally invasive cosmetic procedures are a perfect option for all the people who cannot undergo cosmetic surgery due to certain reasons or simply cannot afford the high cost of it. The recent and ongoing developments in radiotherapy, gene therapy, imaging technologies, materials, and devices as well as the techniques to implement them have expanded the treatment options for peripheral vascular diseases.

Based on end user, the global market is segmented into hospitals & clinics and ambulatory surgical centers (ASCs) and others.

Hospitals & Clinics: The increase in chronic diseases among the elderly has led to an increase in hospital admissions for the treatment of chronic conditions. In addition, the expansion of operating rooms, favorable reimbursement policies, the increasing availability of high-tech minimally invasive surgical equipment, and the ability of hospitals to perform a variety of minimally invasive surgeries are attracting patients.

Ambulatory Surgical Centers (ASCs): With the introduction of higher-quality health insurance plans and tighter networks, people are becoming more conscious of costs in their medical decisions. Although the opportunity for cost savings varies by program and surgery, research has consistently shown lower prices in outpatient clinics, providing significant incentives for patients to change their treatment location. The growing patient base, quick adoption of the newest technology for minimally invasive procedures, high preference for outpatient surgical services due to their low outpatient service costs, and improvements in ambulatory care settings are expected to drive the segment growth.

Based on geography, the global market is segmented into North America, Asia-Pacific, Europe, Latin America, Middle East and Africa. North America region has dominated the market with highest revenue share in 2023.

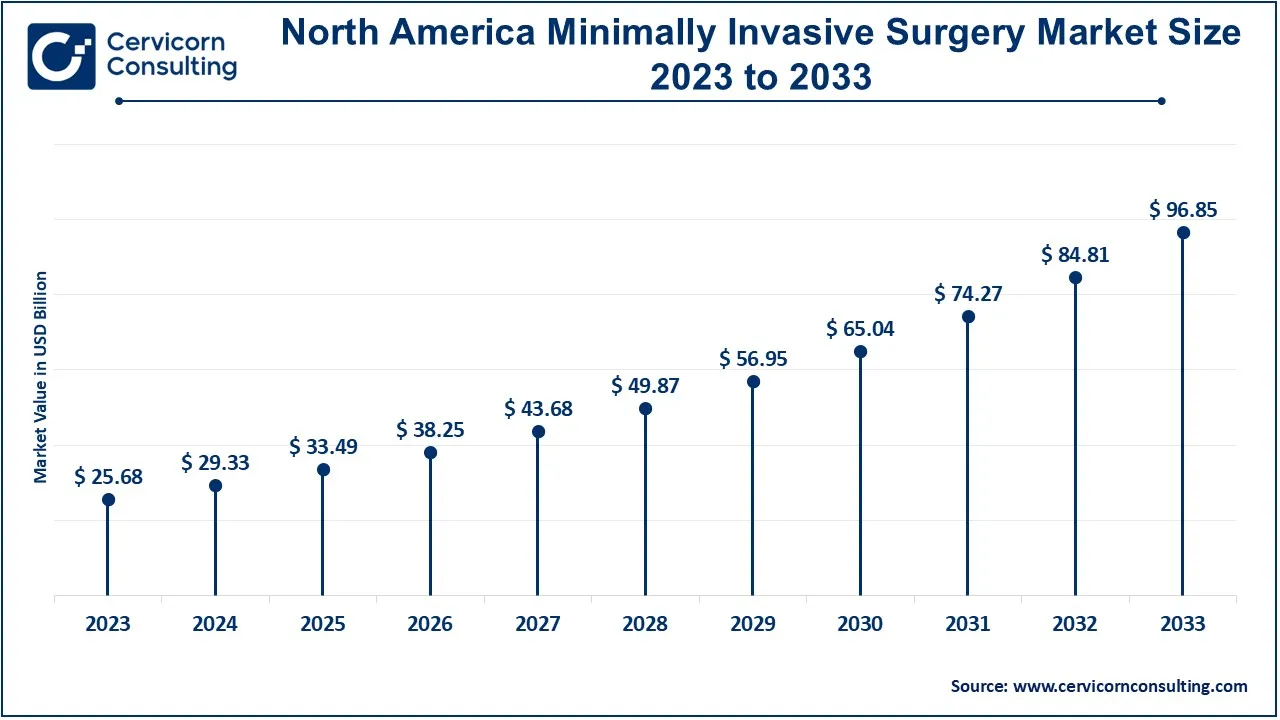

The North America minimally invasive surgery market size was estimated at USD 25.68 billion in 2023 and is expected to reach around USD 96.85 billion by 2033. The North America region is driven by the increasing prevalence of chronic diseases related to lifestyle, and minimally invasive procedures are becoming increasingly popular as compared to more invasive procedures. The growing population and the number of surgeries performed as a result are two factors contributing to the increasing demand for surgical instruments. In addition, chronic diseases like cancer, cardiovascular diseases, and neurological conditions are also very common in the region which is further expected to boost market growth.

The Asia-Pacific minimally invasive surgery market size was accounted for USD 17.19 billion in 2023 and is predicted to surpass around USD 64.84 billion by 2033. The Asia-Pacific market is expected to grow as more people are opting for cosmetic surgeries, the population is growing, the number of accidents is increasing, and chronic diseases are becoming more prevalent. According to the World Economic Forum, India and China are the two most populated countries and hence have the largest number of patients. The minimally invasive surgery market in China held the biggest market share, while the market in India grew at the fastest rate in the Asia Pacific region.

The Europe minimally invasive surgery market size was valued at USD 19.71 billion in 2023 and is projected to hit around USD 74.33 billion by 2033. The increasing aging population susceptible to chronic diseases, the rise in surgical procedures, and the growing awareness of available treatment options are some of the factors driving the market in Europe. Moreover, rising overall surgery rates may be linked to the prevalence of chronic illnesses. In addition, the UK market for minimally invasive surgery devices was growing at the fastest rate in the European Union, while the German market had the biggest market share.

The LAMEA minimally invasive surgery market was valued at USD 9.35 billion in 2023 and is anticipated to reach around USD 35.27 billion by 2033. The LAMEA region's hospital centers are seeing an increase in the use of minimally invasive surgery (MIS). The steady rise in popularity of MIS can be attributed to technological advancements. There has been a bit of a boom in robotic surgery in LAMEA recently, although it has taken some time to become widely accepted there. Due to its many benefits, robotic surgery has been more popular in LAMEA and other markets. The market for minimally invasive surgery is anticipated to benefit from an increase in the release of novel products and the creation of remote-controlled surgical systems.

Maintaining an advantage over rivals and guaranteeing dependability, efficacy, and security, provides an edge to the leading companies in the market that are incessantly enhancing their technological capabilities. In February 2023, Vicarious Surgical Inc. and Encision Inc. signed a proof-of-concept service agreement, wherein the surgical robot designed by Vicarious is expected to enhance the accuracy, control, and visualization of the instruments during robotic-assisted minimally invasive surgery. Also, in November 2022, New View Surgical, Inc. announced the closing of the US$12.1 million series to fund the commercialization of the VisionPort system. The key players are highlighting their leadership and influence in the evolving minimally invasive surgery market with their innovative approaches and strategic initiatives.

Market Segmentation

By Type

By Application

By End-Users

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Minimally Invasive Surgery

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Application Overview

2.2.3 By End-Users Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Minimally Invasive Surgery Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increased Cases of Chronic Diseases

4.1.1.2 Growing Prevalence of Orthopedic Diseases

4.1.2 Market Restraints

4.1.2.1 High Costs

4.1.2.2 Complications

4.1.3 Market Opportunity

4.1.3.1 Expansion into Emerging Markets

4.1.3.2 Rising Investment in Healthcare Infrastructure

4.1.4 Market Challenges

4.1.4.1 High Market Consolidation

4.1.4.2 Skilled Labor Shortages

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Minimally Invasive Surgery Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Minimally Invasive Surgery Market, By Type

6.1 Global Minimally Invasive Surgery Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

6.1.1.1 Electrosurgical Devices

6.1.1.2 Imaging & Visualization Systems

6.1.1.3 Surgical Devices

6.1.1.4 Medical Robotics

6.1.1.5 Endoscopy Devices

Chapter 7 Minimally Invasive Surgery Market, By Application

7.1 Global Minimally Invasive Surgery Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

7.1.1.1 Cardiology Surgery

7.1.1.2 Neurology Surgery

7.1.1.3 Gastrointestinal Surgery

7.1.1.4 Cosmetic Surgery

7.1.1.5 Urological Surgery

7.1.1.6 Orthopedic Surgery

7.1.1.7 Dental Surgery

7.1.1.8 Gynecological Surgery

7.1.1.9 Others

Chapter 8 Minimally Invasive Surgery Market, By End-Users

8.1 Global Minimally Invasive Surgery Market Snapshot, By End-Users

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

8.1.1.1 Hospitals & Clinics

8.1.1.2 Ambulatory Surgical Centers (ASCs)

8.1.1.3 Others

Chapter 9 Minimally Invasive Surgery Market, By Region

9.1 Overview

9.2 Minimally Invasive Surgery Market Revenue Share, By Region 2023 (%)

9.3 Global Minimally Invasive Surgery Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Minimally Invasive Surgery Market Revenue, 2021-2033 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Minimally Invasive Surgery Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Minimally Invasive Surgery Market Revenue, 2021-2033 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Minimally Invasive Surgery Market Revenue, 2021-2033 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Minimally Invasive Surgery Market Revenue, 2021-2033 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Minimally Invasive Surgery Market Revenue, 2021-2033 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Minimally Invasive Surgery Market, By Country

9.5.4 UK

9.5.4.1 UK Minimally Invasive Surgery Market Revenue, 2021-2033 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UK Market Segmental Analysis

9.5.5 France

9.5.5.1 France Minimally Invasive Surgery Market Revenue, 2021-2033 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 France Market Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Minimally Invasive Surgery Market Revenue, 2021-2033 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 Germany Market Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Minimally Invasive Surgery Market Revenue, 2021-2033 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of Europe Market Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Minimally Invasive Surgery Market Revenue, 2021-2033 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Minimally Invasive Surgery Market, By Country

9.6.4 China

9.6.4.1 China Minimally Invasive Surgery Market Revenue, 2021-2033 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 China Market Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Minimally Invasive Surgery Market Revenue, 2021-2033 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 Japan Market Segmental Analysis

9.6.6 India

9.6.6.1 India Minimally Invasive Surgery Market Revenue, 2021-2033 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 India Market Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Minimally Invasive Surgery Market Revenue, 2021-2033 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 Australia Market Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Minimally Invasive Surgery Market Revenue, 2021-2033 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia Pacific Market Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Minimally Invasive Surgery Market Revenue, 2021-2033 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Minimally Invasive Surgery Market, By Country

9.7.4 GCC

9.7.4.1 GCC Minimally Invasive Surgery Market Revenue, 2021-2033 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCC Market Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Minimally Invasive Surgery Market Revenue, 2021-2033 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 Africa Market Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Minimally Invasive Surgery Market Revenue, 2021-2033 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 Brazil Market Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Minimally Invasive Surgery Market Revenue, 2021-2033 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 10 Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2021-2023

10.1.3 Competitive Analysis By Revenue, 2021-2023

10.2 Recent Developments by the Market Contributors (2023)

Chapter 11 Company Profiles

11.1 Abbott Laboratories

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Arthrex

11.3 Asenus Surgical

11.4 Conmed

11.5 Becton, Dickinson & Company

11.6 InMode Ltd.

11.7 Integrated Endoscopy

11.8 Boston Scientific Corporation

11.9 Eximis Surgical

11.10 GE Healthcare