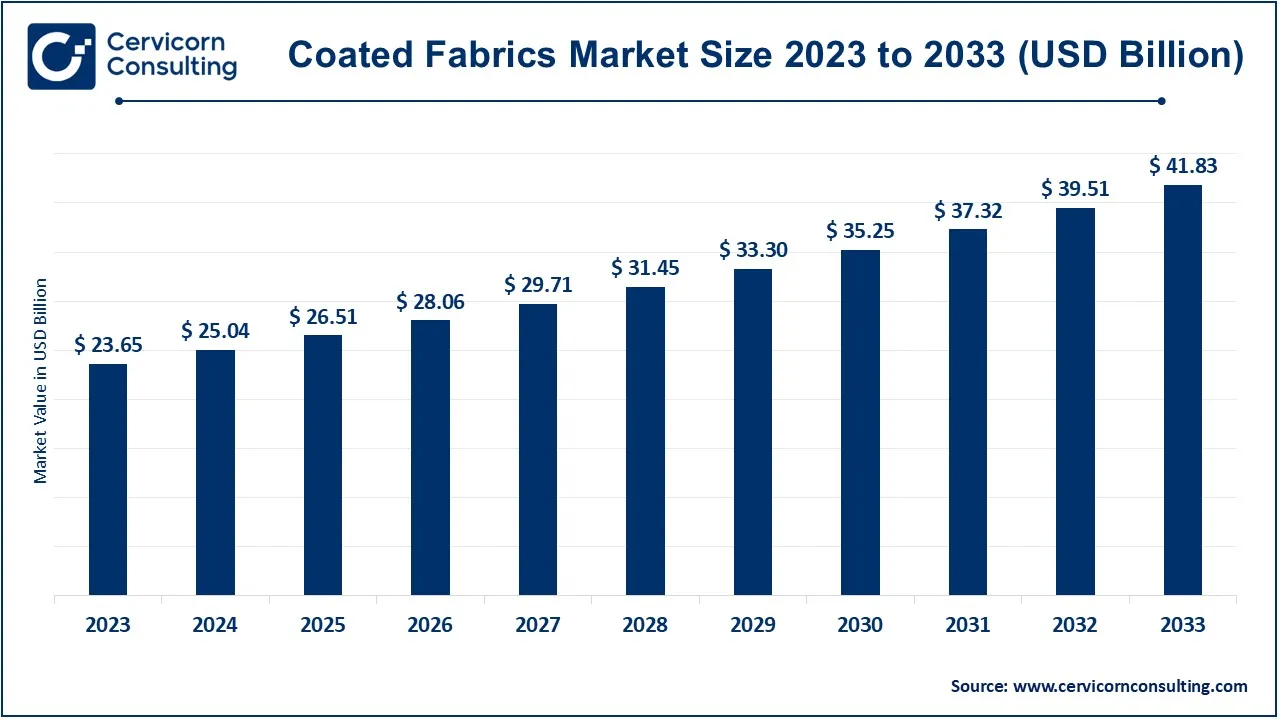

The global coated fabrics market size was valued at USD 25.04 billion in 2024 and is expected to be worth around USD 41.83 billion by 2033, growing at a compound annual growth rate (CAGR) of 5.86% over the forecast period 2024 to 2033.

The coated fabrics market has been growing steadily due to increased demand in sectors such as automotive, healthcare, and protective textiles. The rise in industrialization, infrastructure development, and safety regulations has fueled market expansion. Additionally, advancements in eco-friendly coatings and sustainable manufacturing processes are driving further adoption. The growing preference for lightweight, durable, and cost-effective materials in transportation and protective applications continues to boost demand. Emerging economies, particularly in Asia-Pacific, are experiencing rapid market growth due to increasing automotive production and construction activities.

Coated fabrics are those textiles that have been subjected to treatment by some specific visual substances like rubber, polymer, or varnish to enhance their functionality and performance. The coating process introduces properties such as waterproofing, UV resistance, chemical protection, and durability, rendering them suitable for industrial, automotive, and consumer applications. Typical applications include protective clothing, upholstery, tarpaulins, and vehicle interiors. The global coated fabrics market is driven by the transport, construction, and healthcare industries because these advanced materials provide fundamental protection with aesthetic attributes for functional and decorative purposes.

Key Insights Beneficial to the Coated Fabrics Industry:

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 26.51 Billion |

| Expected Market Size in 2033 | USD 41.83 Billion |

| Growth Rate 2024 to 2033 | 5.86% |

| Prominent Region | Asia-Pacific |

| Rapidly Expanding Region | North America |

| Key Segments | Product, Application, Region |

| Key Players | BASF SE, Contitech AG, Graniteville, Mauritzon, Inc., OMNOVA Solutions Inc., Regatta Professional, Saint-Gobain, Seamen Corporation, Spradling International, Inc., Trelleborg AB |

Based on product, the coated fabrics market is segmented into polymer-coated fabrics, fabric-backed wall coverings and Rubber-coated fabrics. The polymer-coated fabrics is projected to dominate the market over the forecast period.

Polymer Coated: In polymer-coated fabrics, it is mostly the combination of relatively high durability, suppleness, and resistance to different environments that are the plus points for their application. Various polymers, including, by example, PVC, polyurethane, or polyethylene, are used; therefore, these fabrics meet the right standards for such application sectors as protective clothing, transport, and upholstery. Their waterproofness and high fire resistance are great advantages for use in some of the more demanding industries, for example, automotive, construction, and industrial markets.

Fabric Backed Wall Coverings: Fabric-backed wall coverings have aesthetic appeal as well as such functional benefits as sound insulation and durability. They are used in both residential and commercial settings for interior design. The fabric backing provides added durability, making it arc ideal for high-traffic areas, and is usually finished with coatings to increase resistance to stains and damage. Because of these qualities, they are favored in hospitality, healthcare, and corporate environments.

Rubber Coated: Rubber-coated fabrics are known for having a flexible body that can resist weather, therefore rendering them airtight. Some applications are widely used in varied industries, for example, in protective gear, conveyor belts, and inflatable structures that require chemical, oil, and thermal resistance. A much more durable application for rubber-coated fabrics is in the automotive and marine sectors, wherein they are used to make seat covers, protective coverings, etc.

Based on application, the coated fabrics market is segmented into automobile & transport, protective clothing, furniture, industrial and others. The automobile & transport segment is predicted to lead the market through the forecast period.

Automobile: Its use in the automobile industry and transport is wide and varied-from linings for airbags, seat covers, and roof linings to vehicle interiors. For applications where performance is important, they perform particularly well due to their durability, moisture resistance, and fire-retardant formulation. In addition, as a lighter alternative to heavy textiles, this also translates into growing demand for coated fabrics in automotive applications, with a corresponding increase in efficiency and mobility.

Protective Clothing: Coated fabrics find use in applications with the general goal of providing high-performance protection gear, including fire-retardant uniforms, chemical-resistant suits, and waterproof clothing. Such fabrics have been developed to provide a higher protection factor against exposure to extremely hazardous conditions. Consequently, typical applications for such fabrics are in the construction, firefighting, healthcare, and military, wherein operation safety and durability in extreme working conditions are required while still being in compliance with strict regulations.

Coated Fabrics Market Revenue Share, By Application, 2023 (%)

| Application | Revenue Share, 2023 (%) |

| Automotive & Transportation | 29.70% |

| Protective Clothing | 15.30% |

| Furniture | 19.40% |

| Industrial | 14.10% |

| Others | 21.50% |

Furniture: Coated fabrics are employed in the furniture industry as upholstery, thereby providing strength as well as elegant finish. Their resistance to moisture, wear, and stains renders them suitable for both indoor and outdoor furniture. Among other things, the recent trend of using eco-friendly coatings and materials gives additional impetus to the growth of coated fabrics for sustainable furniture, thereby pushing market demand within the residential, hospitality, and commercial sectors.

Industrial: These find industrial applications in conveyor belts, tarpaulins, and other protective coverings made of coated fabrics. They can tolerate the most demanding conditions due to their durability, chemical resistance, and flexibility. Coated fabrics provide protection for machinery and personnel within sectors that demand the longevity of such equipment and worker safety in operationally demanding or dangerous contexts, including oil, gas, mining, and construction.

Other: The other applications include sports and leisure items, marine upholstery, and architectural membranes. Due to their lightweight and weather-resistant properties, coated fabrics find use in tents, inflatable structures, and other sports equipment. The very versatility of coated fabrics makes them capable of addressing all the requirements of various niche markets, expanding their application among a multitude of their respective industries.

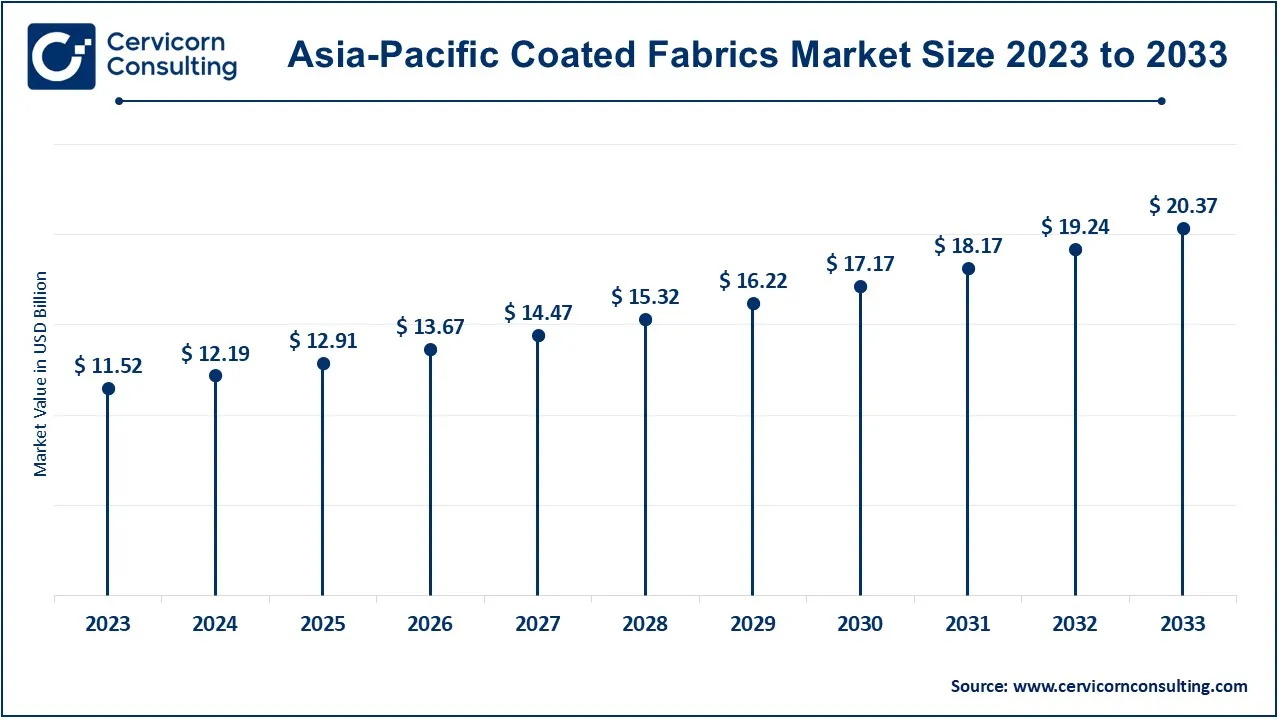

The coated fabrics market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). The Asia-pacific region is expected to lead the market over the forecast period. Here’s an in-depth look at each region

The Asia-Pacific coated fabrics market size was valued at USD 11.52 billion in 2023 and is expected to be worth around USD 20.37 billion by 2033. Asia-Pacific, with a dynamic growth rate, is mainly driven by the fast-paced industrialization, urbanization, and expansion of the automotive sectors of China, India, Japan, and South Korea. China provides huge input to this sector due to its strong automotive and construction industries while Japan and South Korea lead in technologically advanced coated fabrics. This region is expected to benefit from steady growth in protective clothing demand from the healthcare and industrial sectors.

The North America coated fabrics market size was valued at USD 6.29 billion in 2023 and is expected to reach around USD 11.13 billion by 2033. North America region hit notably on the back of automotive, aerospace, and construction industries. The U.S. leads this market, thanks to stringency in safety standards in automotive and protective clothing Operations. Growth is being fueled, furthermore, by technological advancement and heightened consumer demand for high-performance, durable materials. Canada is another contributor, particularly by way of the construction and upholstery industries, where weather-resistant coated fabrics have become essential for both outdoor and indoor applications.

| Region | Revenue Share, 2023 (%) |

| North America | 26.60% |

| Europe | 18.50% |

| Asia-Pacific | 48.70% |

| LAMEA | 6.20% |

The Europe coated fabrics market size was valued at USD 4.38 billion in 2023 and is expected to be worth around USD 7.74 billion by 2033. Europe is an important player in the market; countries leading this market include Germany, the UK, France, and Italy, relying on automotive and protective textiles. Stringent safety regulations, environmental concerns, and an ever-growing demand for sustainable and eco-friendly materials are propelling growth. Germany maintains a strongly performing automotive sector, and Italy and France are more focused on furniture and home décor industries, where coated fabrics find application in upholstery and protective coverings.

The LAMEA coated fabrics market was valued at USD 1.47 billion in 2023 and is anticipated to reach around USD 2.59 billion by 2033. Opportunities persist for substantial growth of the coated fabrics industry, with the necessary auspices presented by emerging economies such as Brazil, South Africa, and the UAE. In Latin America, Brazil is the primary coated fabrics market driving industry on the back of automotive and construction, while the Middle East has growing infrastructure projects and the onset of stringent standard safety regulations attached to it. The industrialization and infrastructure upgrades taking place in Africa have also greatly influenced the growth in coated fabrics, especially within the protective and construction applications.

The coated fabrics industry is significantly influenced by key players like BASF SE, Contitech AG, Graniteville, and Mauritzon, Inc., who leverage their strong R&D capabilities, expansive distribution networks, and advanced manufacturing technologies. These companies focus on product innovation and sustainability to cater to growing demand in sectors such as automotive, aerospace, and protective clothing. By continually improving material performance, durability, and eco-friendliness, they maintain competitive advantages in a market driven by stringent regulatory standards and evolving customer needs.

CEO Statements

Dr. Katja Scharpwinkel, a member of BASF's Board of Executive Directors

Nikolai Setzer, ContiTech AG

Recent partnerships and acquisitions in the coated fabrics industry highlight a strong trend towards innovation and strategic collaboration among leading industry players. Companies like BASF SE, Contitech AG, Graniteville, and Mauritzon, Inc. are actively enhancing their technologies to support sustainability and improve product performance. These collaborations focus on developing advanced materials that meet the growing demand for eco-friendly solutions across various applications, such as automotive, protective clothing, and furniture. This strategic alignment not only fosters innovation but also strengthens market positions, ensuring competitiveness in an evolving landscape. Additionally, advancements in waterproof and fire-retardant coatings are meeting the stringent safety and performance standards required in the automotive sector. Such innovations not only enhance the functionality of automotive fabrics but also contribute to sustainability goals within the industry.

Some notable examples of key developments in the coated fabrics industry include:

Market Segmentation

By Product

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Coated Fabrics

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Overview

2.2.2 By Application Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Coated Fabrics Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing Growth in End-use Industries

4.1.1.2 Safety Regulations Named Businesses

4.1.1.3 Increasing Demand for Upholstery

4.1.1.4 Export Growth with Global Trade

4.1.2 Market Restraints

4.1.2.1 High Production Costs

4.1.2.2 Environmental Concerns

4.1.2.3 Strict Environmental Regulations

4.1.3 Market Challenges

4.1.3.1 Availability of Raw Material

4.1.3.2 Technological Barriers

4.1.3.3 Evolving Consumer Trends

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Coated Fabrics Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Coated Fabrics Market, By Product

6.1 Global Coated Fabrics Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

6.1.1.1 Polymer Coated

6.1.1.2 Fabric Backed Wall Coverings

6.1.1.3 Rubber Coated

Chapter 7. Coated Fabrics Market, By Application

7.1 Global Coated Fabrics Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

7.1.1.1 Automotive & Transportation

7.1.1.2 Protective Clothing

7.1.1.3 Furniture

7.1.1.4 Industrial

7.1.1.5 Others

Chapter 8. Coated Fabrics Market, By Region

8.1 Overview

8.2 Coated Fabrics Market Revenue Share, By Region 2023 (%)

8.3 Global Coated Fabrics Market, By Region

8.3.1 Market Size and Forecast

8.4 North America

8.4.1 North America Coated Fabrics Market Revenue, 2021-2033 ($Billion)

8.4.2 Market Size and Forecast

8.4.3 North America Coated Fabrics Market, By Country

8.4.4 U.S.

8.4.4.1 U.S. Coated Fabrics Market Revenue, 2021-2033 ($Billion)

8.4.4.2 Market Size and Forecast

8.4.4.3 U.S. Market Segmental Analysis

8.4.5 Canada

8.4.5.1 Canada Coated Fabrics Market Revenue, 2021-2033 ($Billion)

8.4.5.2 Market Size and Forecast

8.4.5.3 Canada Market Segmental Analysis

8.4.6 Mexico

8.4.6.1 Mexico Coated Fabrics Market Revenue, 2021-2033 ($Billion)

8.4.6.2 Market Size and Forecast

8.4.6.3 Mexico Market Segmental Analysis

8.5 Europe

8.5.1 Europe Coated Fabrics Market Revenue, 2021-2033 ($Billion)

8.5.2 Market Size and Forecast

8.5.3 Europe Coated Fabrics Market, By Country

8.5.4 UK

8.5.4.1 UK Coated Fabrics Market Revenue, 2021-2033 ($Billion)

8.5.4.2 Market Size and Forecast

8.5.4.3 UKMarket Segmental Analysis

8.5.5 France

8.5.5.1 France Coated Fabrics Market Revenue, 2021-2033 ($Billion)

8.5.5.2 Market Size and Forecast

8.5.5.3 FranceMarket Segmental Analysis

8.5.6 Germany

8.5.6.1 Germany Coated Fabrics Market Revenue, 2021-2033 ($Billion)

8.5.6.2 Market Size and Forecast

8.5.6.3 GermanyMarket Segmental Analysis

8.5.7 Rest of Europe

8.5.7.1 Rest of Europe Coated Fabrics Market Revenue, 2021-2033 ($Billion)

8.5.7.2 Market Size and Forecast

8.5.7.3 Rest of EuropeMarket Segmental Analysis

8.6 Asia Pacific

8.6.1 Asia Pacific Coated Fabrics Market Revenue, 2021-2033 ($Billion)

8.6.2 Market Size and Forecast

8.6.3 Asia Pacific Coated Fabrics Market, By Country

8.6.4 China

8.6.4.1 China Coated Fabrics Market Revenue, 2021-2033 ($Billion)

8.6.4.2 Market Size and Forecast

8.6.4.3 ChinaMarket Segmental Analysis

8.6.5 Japan

8.6.5.1 Japan Coated Fabrics Market Revenue, 2021-2033 ($Billion)

8.6.5.2 Market Size and Forecast

8.6.5.3 JapanMarket Segmental Analysis

8.6.6 India

8.6.6.1 India Coated Fabrics Market Revenue, 2021-2033 ($Billion)

8.6.6.2 Market Size and Forecast

8.6.6.3 IndiaMarket Segmental Analysis

8.6.7 Australia

8.6.7.1 Australia Coated Fabrics Market Revenue, 2021-2033 ($Billion)

8.6.7.2 Market Size and Forecast

8.6.7.3 AustraliaMarket Segmental Analysis

8.6.8 Rest of Asia Pacific

8.6.8.1 Rest of Asia Pacific Coated Fabrics Market Revenue, 2021-2033 ($Billion)

8.6.8.2 Market Size and Forecast

8.6.8.3 Rest of Asia PacificMarket Segmental Analysis

8.7 LAMEA

8.7.1 LAMEA Coated Fabrics Market Revenue, 2021-2033 ($Billion)

8.7.2 Market Size and Forecast

8.7.3 LAMEA Coated Fabrics Market, By Country

8.7.4 GCC

8.7.4.1 GCC Coated Fabrics Market Revenue, 2021-2033 ($Billion)

8.7.4.2 Market Size and Forecast

8.7.4.3 GCCMarket Segmental Analysis

8.7.5 Africa

8.7.5.1 Africa Coated Fabrics Market Revenue, 2021-2033 ($Billion)

8.7.5.2 Market Size and Forecast

8.7.5.3 AfricaMarket Segmental Analysis

8.7.6 Brazil

8.7.6.1 Brazil Coated Fabrics Market Revenue, 2021-2033 ($Billion)

8.7.6.2 Market Size and Forecast

8.7.6.3 BrazilMarket Segmental Analysis

8.7.7 Rest of LAMEA

8.7.7.1 Rest of LAMEA Coated Fabrics Market Revenue, 2021-2033 ($Billion)

8.7.7.2 Market Size and Forecast

8.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 9. Competitive Landscape

9.1 Competitor Strategic Analysis

9.1.1 Top Player Positioning/Market Share Analysis

9.1.2 Top Winning Strategies, By Company, 2021-2023

9.1.3 Competitive Analysis By Revenue, 2021-2023

9.2 Recent Developments by the Market Contributors (2023)

Chapter 10. Company Profiles

10.1 BASF SE

10.1.1 Company Snapshot

10.1.2 Company and Business Overview

10.1.3 Financial KPIs

10.1.4 Product/Service Portfolio

10.1.5 Strategic Growth

10.1.6 Global Footprints

10.1.7 Recent Development

10.1.8 SWOT Analysis

10.2 Contitech AG

10.3 Graniteville

10.4 Mauritzon, Inc.

10.5 OMNOVA Solutions Inc.

10.6 Regatta Professional

10.7 Saint-Gobain

10.8 Seamen Corporation

10.9 Spradling International, Inc.

10.10 Trelleborg AB