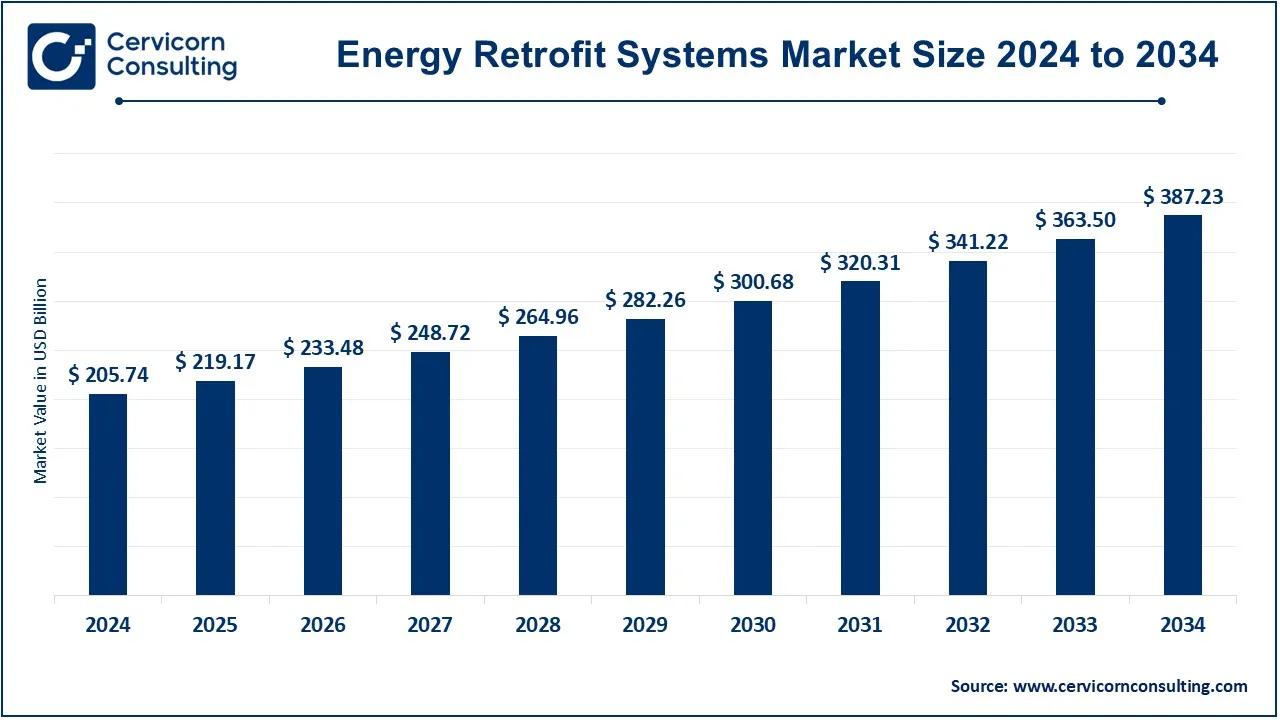

The global energy retrofit systems market size was valued at USD 205.74 billion in 2024 and is expected to be worth around USD 387.23 billion by 2034, growing at a CAGR of 7.6% over the forecast period 2025 to 2034. The global demand for energy retrofit systems is rapidly increasing due to rising energy costs and growing awareness of sustainability. Government regulations and initiatives promoting energy efficiency in residential and commercial sectors have further fueled market growth. Additionally, businesses are investing in energy retrofits to meet carbon reduction targets, improve operational efficiency, and comply with green building standards. The integration of IoT and AI in energy management has also contributed to the market’s expansion.

According to recent studies, energy retrofits can reduce energy consumption in buildings by 30-50%, leading to significant cost savings. Data suggests that countries implementing strict energy efficiency policies have witnessed an annual 10-15% increase in retrofit projects. Additionally, financial incentives have resulted in a 20-30% growth in adoption rates among commercial buildings. As climate change concerns and energy efficiency targets become more prominent, the energy retrofit market is expected to grow at a steady pace over the next decade.

What is an Energy Retrofit Systems?

Energy retrofit systems involve upgrading existing buildings with modern energy-efficient technologies to reduce energy consumption, enhance performance, and lower carbon footprints. These retrofits can include improvements such as better insulation, advanced HVAC systems, LED lighting, solar panels, smart energy management systems, and high-performance windows. By optimizing energy usage, these systems help reduce operational costs while making buildings more environmentally friendly.

Energy retrofitting is crucial for older buildings, as they often lack modern energy-efficient designs. The process can range from minor upgrades, such as installing energy-efficient appliances, to major renovations like integrating renewable energy sources. Governments and organizations worldwide promote energy retrofit initiatives through incentives, tax benefits, and policies aimed at reducing carbon emissions. Retrofitting not only helps businesses and homeowners save money but also contributes to global sustainability efforts.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 219.17 Billion |

| Projected Market Size in 2034 | USD 387.23 Billion |

| CAGR from 2025 to 2034 | 7.60% |

| Most Prominent Region | Europe |

| Highest Growth Region | Asia-Pacific |

| Key Segments | Product, Type, End User, Region |

| Key Companies | Ballard Power Systems, Plug Power Inc, ITM Power PLC, Intelligent Energy Limited, PowerCell Sweden AB, Cummins Inc., AVL, Nedstack Fuel Cell Technology BV, Horizon Fuel Cell Technologies, Altergy, NUVERA FUEL CELLS, LLC, ElringKlinger AG, Infinity Fuel Cell and Hydrogen, Inc., Doosan Fuel Cell Co., Ltd., Toshiba Corporation, Loop energy, Pragma Industries, SFC Energy AG, Shanghai Shenli Technology Co., Ltd., W. L. Gore & Associates |

Envelope: Performance-directed envelope retrofitting generally focuses on the exterior portion of the building, including the walls, roofs, windows, etc. The primary function performed in the retrofitting is to improve thermal performance to reduce energy loss. The retrofitting process can include achieving an insulated and air-sealed building envelope in the ground-floor zone. Reductions in cost through less energy required to beat the indoor heat transfer lend to tremendous savings in heating and cooling while improving occupant comfort. The embrace and application of energy efficiency codes and standards have initiated increasing investments into envelope retrofitting by all sorts of industries.

LED Retrofit Lighting: LED retrofit lighting transforms standard lighting into energy-efficient LED technology. Besides that, the effects of transforming the energy of light into effective other lights make LEDs operate longer. With greater emphasis on sustainability, LED retrofitting has become an integral part of retrofit strategies being put in place by a multitude of companies that have made the switch. Lower placement of electricity bills and minimal maintenance costs is what makes LED retread quite appealing in residential and commercial spaces.

Energy Retrofit Systems Market Revenue Share, By Product, 2024 (%)

| Product | Revenue Share, 2024 (%) |

| Envelope | 51.34% |

| LED Retrofit Lighting | 12.43% |

| HVAC Retrofit | 24.78% |

| Appliances | 11.45% |

HVAC Retrofit: Retrofitting heating, ventilation, and air-conditioning (HVAC) systems with upgraded, more efficient units or optimized existing systems to give customers the most bang for their buck might easily include the addition of smart thermostats or high-efficiency boilers and advanced filtration systems into the retrofitting equation. It will greatly reduce energy use and improve indoor air quality through improved comfort and health. HVAC retrofitting is becoming an increasingly vital step in the whole energy efficiency management plan that companies are putting in place as regulatory pressure for energy efficiency starts rising in an average between the last 3 to 5 years.

Appliances: Energy-efficient appliances utilize much less energy than regular refrigerators, washers, and dryers. Replacing such appliances with more modern Energy-Star rated devices will drastically cut back energy usage and utility bills for the consumer or business itself and others. Both consumer and business appliance retrofits are becoming important aspects in reaching their sustainability and operational efficiencies. Accordingly, the rise of awareness to save energy and available rebates and incentives is inducing energy-efficient appliances to be embraced in several organizations, thus promoting the energy retrofitting process.

Residential Sector: Weak competition for the house does prevail in the energy retrofit market. The owners prefer energy-efficient options to the maximum in order to get more utility savings and comfort. Energy retrofit in this sector typically refers to improvement in insulations of the primary HVAC systems and appliances. The increasing awareness among residents regarding sustainability enables the prospect of investing in energy retrofits continuously recommended by various government incentives and in the form of financing launched to support energy retargeting initiatives to bring down energy consumption and reduce the carbon footprint.

Commercial Sector: Companies making use of energy retrofits as methods of improving efficiency and lowering operating expenses. Modifications generally include the upgrade of lighting and HVAC systems as well as the renovation of building envelopes in accordance with energy standard codes. The pressure on the corporate world owing to increasing competition to implement sustainable practices has contributed to the growth in demand for energy retrofitting solutions. With an enhancement in energy performance, cost saving, and improvement of the working environment, it has now become imperative for businesses with an edge over others in the cut-throat competitive market.

Energy Retrofit Systems Market Revenue Share, By End User, 2024 (%)

| End User | Revenue Share, 2024 (%) |

| Residential | 29.64% |

| Commercial | 56.12% |

| Institutional | 14.24% |

Institutional Sector: The institutional sector generally concerns schools, hospitals, and government buildings. The sector is the same for the energy retrofit market. All institutions face pressure on improving energy efficiency and sustainability. The sector retrofits mostly deploy advanced technologies including smart building systems and renewable energy sources. Through energy retrofits, the institutions can effectively reduce energy consumption, lower operational costs, along with enhancing the comfort and wellbeing of occupants.

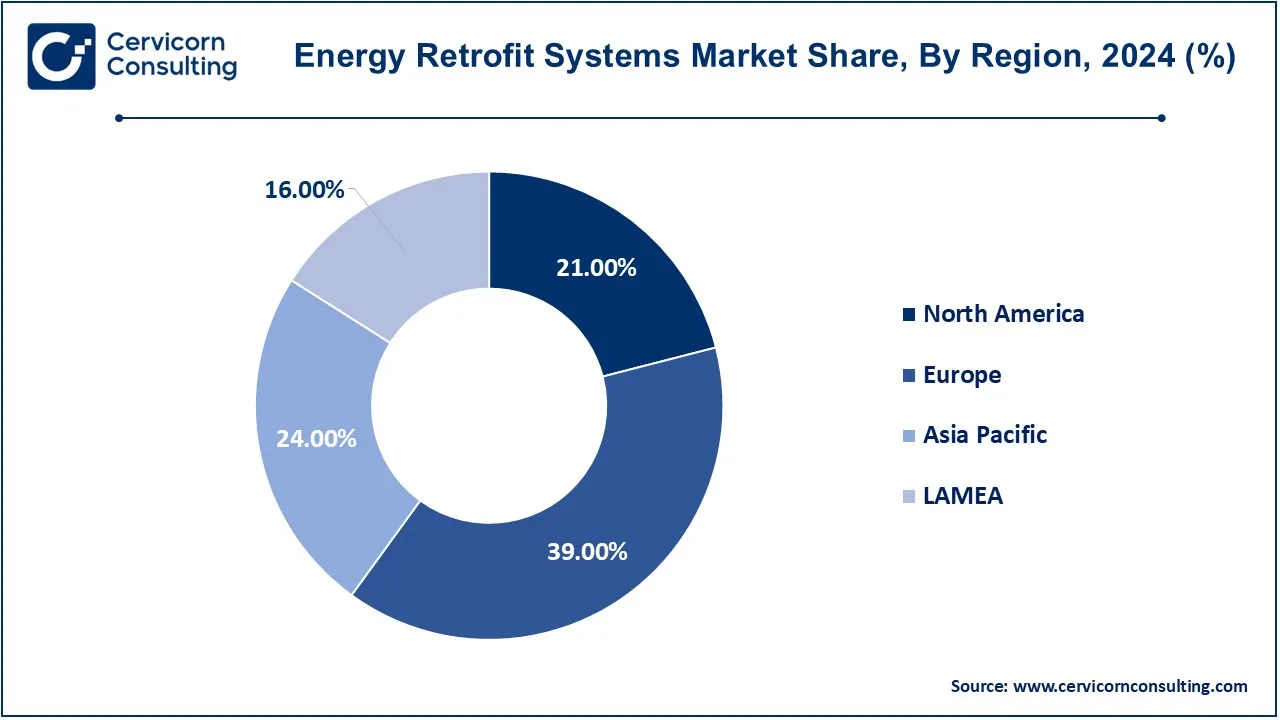

The energy retrofit systems market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). The Europe region has dominated the market in 2024.

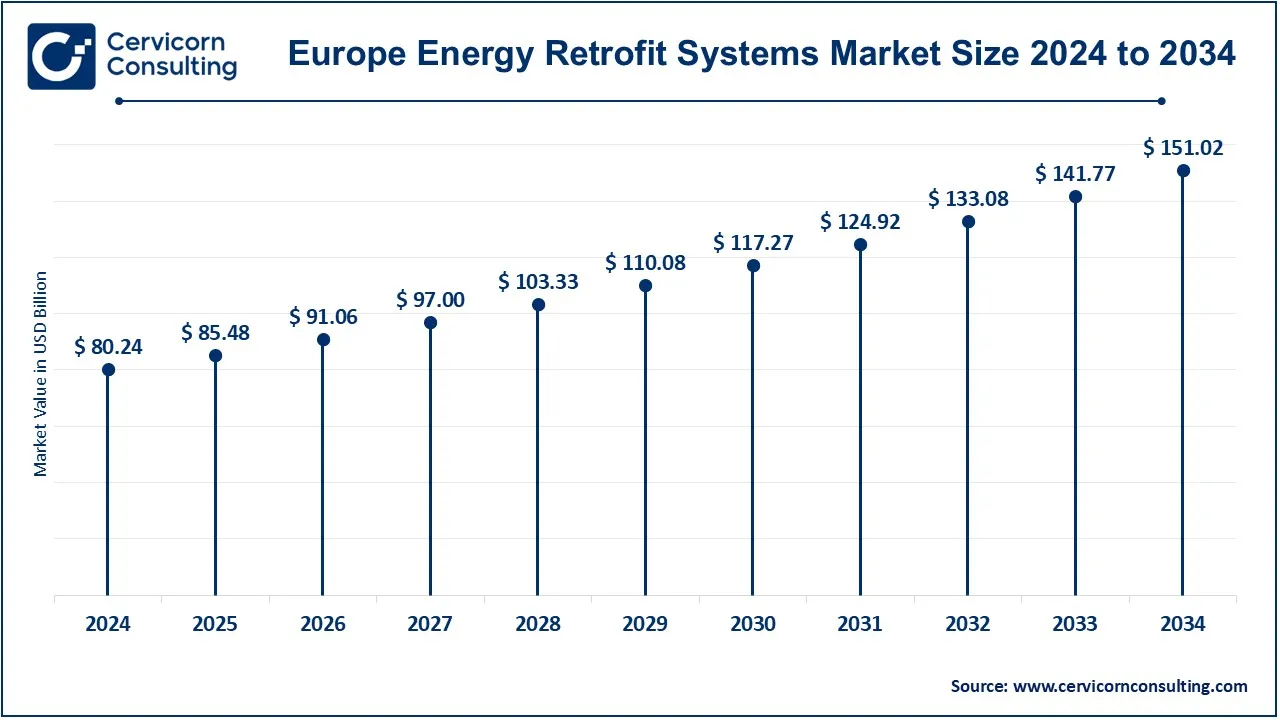

The Europe energy retrofit systems market size was estimated at USD 80.24 billion in 2024 and is projected to hit around USD 151.02 billion by 2034. The europe hit tremendous growth, characterized by theEuropean Union's daunting climate targets and strict energy efficiency directives. Germany, France, and the UK are the major countries where energy-efficient retrofits have been introduced, especially in the residential buildings sector. The EU Green Deal plays a fundamental role in vigorous encouragement to a plethora of programs that aim at rigorous investments in retrofitting with a view of becoming carbon neutral by 2050. Moreover, financial incentives and grants are available to support energy efficiency upgrades, so Europe remains at the helm of energy retrofit innovations.

The North America energy retrofit systems market size was valued at USD 43.21 billion in 2024 and is expected to reach around USD 81.32 billion by 2034. North America, led by strong energy efficiency rules and an emphasis on sustainability, stands at the forefront of the energy retrofit systems marketplace. With tremendous investments in retrofitting operations intended to reduce energy use and greenhouse gas emissions, the United States, particularly California and New York, is in a prime position for retrofitting and energy efficiency efforts. In addition to this, Canada is dealing with issues related to energy-efficiency, again promoting both residential and commercial retrofits. Government incentives and financing programs have further reinforced this movement, which makes North America as the dominant position in energy retrofit developments.

The Asia-Pacific energy retrofit systems market size was accounted for USD 49.38 billion in 2024 and is predicted to surpass around USD 92.94 billion by 2034. The Asia-Pacific region hit rapid growth, mainly due to urbanization and growing energy demand. Investment in energy efficiency retrofitting is rising in major markets such as China and India to enhance energy efficiency in the building to mitigate environmental impact. Carbon neutrality by 2060 dictates China's strong interest in investing in energy-efficient technologies. Moreover, Australia focuses its effort on retrofitting of the commercial building sector to infrastructural sustainability objectives. A mixture of government support and heightened awareness of energy conservation are thereby causing the fast expansion of the market in this region.

The LAMEA energy retrofit systems market was valued at USD 32.92 billion in 2024 and is anticipated to reach around USD 61.96 billion by 2034. In LAMEA region, slow and gradual acceptance of energy retrofit systems is seen in the LAMEA region, where countries in Latin America, the Middle East, and Africa are aware of energy efficiency. Brazil and Mexico lead the Latin American countries in various programs for improving energy performance in buildings. The UAE is investing in sustainable retrenching in the commercial sectors. Africa faces unique challenges, though initiatives backed by international partnerships and funding are already in place to promote energy efficiency and sustainability.

The energy retrofit systems market is significantly dominated by key players such as Ballard Power Systems, Plug Power Inc., ITM Power PLC, Intelligent Energy Limited, PowerCell Sweden AB, and Cummins Inc. These companies use their developed technologies and their huge Research and Development departments in order to come up with new energy-time systems that help enhance efficiency while minimising carbon emissions. They try to improve their market positions through joint ventures, acquisitions and slanting towards sustainable development. For example, Plug Power has integrated hydrogen fuel cell systems, while Ballard Power is enhancing its clean energy technologies to meet the increasing demand for energy efficient systems worldwide. Collaboration with various governments and other interested parties is also another strategy that increases their power in the retrofit systems market.

CEO Statements

Kevin Knobloch, CEO of Plug Power Inc.

Amory Lovins, CEO of RMI

Eric Doub, CEO of a low-energy home building firm

Market Segmentation

By Product

By Type

By End User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Energy Retrofit Systems

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Product Overview

2.2.3 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Energy Retrofit Systems Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Energy Efficiency Standards

4.1.1.2 Corporate Sustainability Goals

4.1.1.3 Utility Incentives

4.1.1.4 Market Demands

4.1.2 Market Restraints

4.1.2.1 Cost Implications

4.1.2.2 Market Fragmentation

4.1.2.3 Technological Changeovers

4.1.3 Market Challenges

4.1.3.1 Resistance to Change

4.1.3.2 Performance Measurement

4.1.3.3 Adoption of New Technologies

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Energy Retrofit Systems Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Energy Retrofit Systems Market, By Type

6.1 Global Energy Retrofit Systems Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Quick Wins Retrofit

6.1.1.2 Deep Retrofit

Chapter 7. Energy Retrofit Systems Market, By Product

7.1 Global Energy Retrofit Systems Market Snapshot, By Product

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Envelope

7.1.1.2 LED Retrofit Lighting

7.1.1.3 HVAC Retrofit

7.1.1.4 Appliances

Chapter 8. Energy Retrofit Systems Market, By End User

8.1 Global Energy Retrofit Systems Market Snapshot, By End User

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Residential

8.1.1.2 Commercial

8.1.1.3 Institutional

Chapter 9. Energy Retrofit Systems Market, By Region

9.1 Overview

9.2 Energy Retrofit Systems Market Revenue Share, By Region 2024 (%)

9.3 Global Energy Retrofit Systems Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Energy Retrofit Systems Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Energy Retrofit Systems Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Energy Retrofit Systems Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Energy Retrofit Systems Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Energy Retrofit Systems Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Energy Retrofit Systems Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Energy Retrofit Systems Market, By Country

9.5.4 UK

9.5.4.1 UK Energy Retrofit Systems Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Energy Retrofit Systems Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Energy Retrofit Systems Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Energy Retrofit Systems Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Energy Retrofit Systems Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Energy Retrofit Systems Market, By Country

9.6.4 China

9.6.4.1 China Energy Retrofit Systems Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Energy Retrofit Systems Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Energy Retrofit Systems Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Energy Retrofit Systems Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Energy Retrofit Systems Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Energy Retrofit Systems Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Energy Retrofit Systems Market, By Country

9.7.4 GCC

9.7.4.1 GCC Energy Retrofit Systems Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Energy Retrofit Systems Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Energy Retrofit Systems Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Energy Retrofit Systems Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 Ballard Power Systems

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Plug Power Inc

11.3 ITM Power PLC

11.4 Intelligent Energy Limited

11.5 PowerCell Sweden AB

11.6 Cummins Inc.

11.7 AVL

11.8 Nedstack Fuel Cell Technology BV

11.9 Horizon Fuel Cell Technologies

11.10 Altergy

11.11 NUVERA FUEL CELLS, LLC

11.12 ElringKlinger AG

11.13 Infinity Fuel Cell and Hydrogen, Inc.

11.14 Doosan Fuel Cell Co., Ltd.

11.15 Toshiba Corporation

11.16 Loop energy

11.17 Pragma Industries

11.18 SFC Energy AG

11.19 Shanghai Shenli Technology Co., Ltd.

11.20 W. L. Gore & Associates