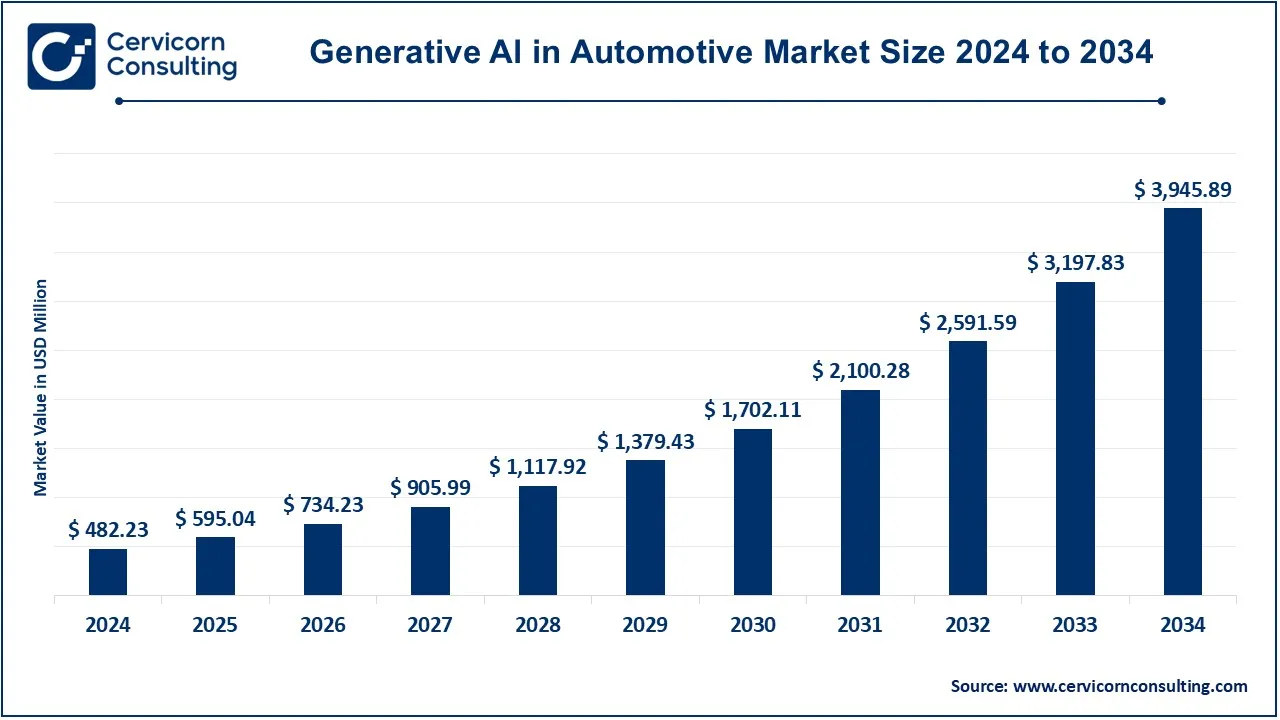

The global generative Al in automotive market size was valued at USD 482.23 million in 2024 and is expected to reach around USD 3,945.89 million by 2034, growing at a compound annual growth rate (CAGR) of 25.65% over the forecast period 2025 to 2034.

The market for generative AI in automotive is expanding rapidly due to the industry's increasing reliance on AI to enhance efficiency, reduce costs, and foster innovation. As the automotive sector embraces electric vehicles (EVs), autonomous driving, and smart manufacturing, generative AI plays a crucial role in optimizing designs and processes. Automakers are leveraging generative AI to accelerate prototyping, test various configurations, and create advanced driver assistance systems. The growing demand for energy-efficient designs, coupled with increasing investments in AI-driven technologies, positions the automotive industry for a transformative future. In addition, generative AI's potential to improve vehicle safety and reduce time-to-market for new models further boosts its adoption.

Generative AI in the automotive industry refers to the use of artificial intelligence technologies to autonomously generate design, solutions, and components, enabling innovation and optimization. Unlike traditional AI, which often focuses on predefined patterns, generative AI creates new possibilities by analyzing vast amounts of data and generating original outputs. This technology is employed in various automotive applications, such as designing vehicle parts, optimizing manufacturing processes, enhancing autonomous driving capabilities, and improving overall vehicle performance. For instance, generative AI can design parts with specific requirements, such as strength or weight reduction, by using algorithms that generate multiple solutions and test them in a simulated environment. Additionally, it is utilized in driver assistance systems, improving safety features, and streamlining supply chain logistics.

Key Insights on Generative Al in Automotive:

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 482.23 Million |

| Projected Market Size in 2034 |

USD 3,945.89 Million |

| CAGR (2025 to 2034) | 25.65% |

| Dominant Region | North America |

| Fastest Expanding Region | Asia-Pacific |

| Key Segments | Vehicle, Technology, Application, Region |

| Key Companies | Microsoft, AUDI AG, Intel Corporation, Tesla Inc, Uber Technologies, Volvo Car Corporation, Honda Motors, Ford Motor Company, NVIDIA Corporation, Tencent, BMW AG |

The generative AI in automotive market is segmented into vehicle type, technology, application and region. Based on vehicle type, the market is segmented into passenger vehicles and commercial vehicles. Based on technology, the market is segmented into machine learning, natural language processing, context-aware computing, computer vision and others, Based on application, the market is segmented into vehicle design, manufacturing optimization, transportation & logistics, autonomous driving and ADAS.

Passenger vehicles: Generative AI builds upon the in-car experience by enhancing the driver and happy passengers with advanced AI virtual assistants, personalized infotainment systems, and real-time insights into driving. This involves sophisticated AI systems that digest internal data and signal when maintenance will be needed and offer voice assistance and adaptive navigation. It provides the ability to create interactive environments inside the car that will adapt to the preferences of the driver and other conditions to provide a journey that's high on engagement and safety and very efficient. AI-based modifications are mixed with features like speech pattern recognition and visual data analytics to offer an enhanced and individualized experience for all passengers.

Commercial Vehicles: The highest demands for generative AI in managing a fleet, maintenance planning, and fuel efficiency come from the commercial sector. The AI tools analyze a vast amount of data in scenarios such as route planning, vehicle health, and operational cost minimization. In transition and distribution industries, AI serves to alert the driver on the prevailing traffic conditions in order to assist the driver in making the best possible and quickest delivery. This advances driver assistance since it allows for the use of automated the dispatch system and also enhances the management of resources within a commercial vehicle fleet.

Machine Learning (ML): ML contributes to building vehicles from the way drivers drive, knowledge-sharing on maintenance, and route selection through data-driven insights. In automotive applications, ML algorithms apply processing on large datasets for improving autonomous driving features, optimization in fuel consumption, and enhancing user experiences. Based on learning vehicle and driver data, ML applications customize settings for vehicles based on performance features that make driving more intuitive and efficient for users.

Natural Language Processing (NLP): In automotive applications, NLP allows people to communicate with car systems smoothly. Thanks to NLP-enabled virtual assistants, drivers can give freedom-control of navigation, entertainment, and settings, making driving more convenient and safer. Generative AI in NLP gives conversational, context-aware responses, allowing the driver and passengers to communicate with on-board systems performing actions more efficiently.

Computer Vision: Computer vision endows vehicles with advanced image processing abilities-examples being object detection, lane-keeping, and control of autonomous navigation. Generative AI applications in computer vision further aid in helping the vehicle analyze real-time pictures through good navigation with an ability to avoid obstacles. Computer vision further aids the intelligent creation of a situational observation of self-driving and advanced driver-assistance systems by interpreting the surroundings of the vehicle for increasing safety during navigation.

Context-Aware Computing: This technology enables vehicles to accommodate situational contexts (location, climate change, and way of driving) into various settings. Simple examples of generative AI involve adjusting the climate control system or lighting system according to passenger comfort. Meaningful commercial applications of context-aware computing provide route optimization and resource allocation. Understandably therefore, the system assures users, within any given driving circumstance and user needs, continuity and adaptability in experience.

Others: This segment includes new technologies such as the edge technology or sensor fusion, which are incorporating other AI components for the best results possible. These technologies facilitate the functioning of advanced self-driving vehicles, inter-vehicle communication, and forecasting, which helps future changes in the automobile industry. The “Others” category is often focused on specialized technologies that are not the main ones but serve to improve the AI systems implemented within vehicles.

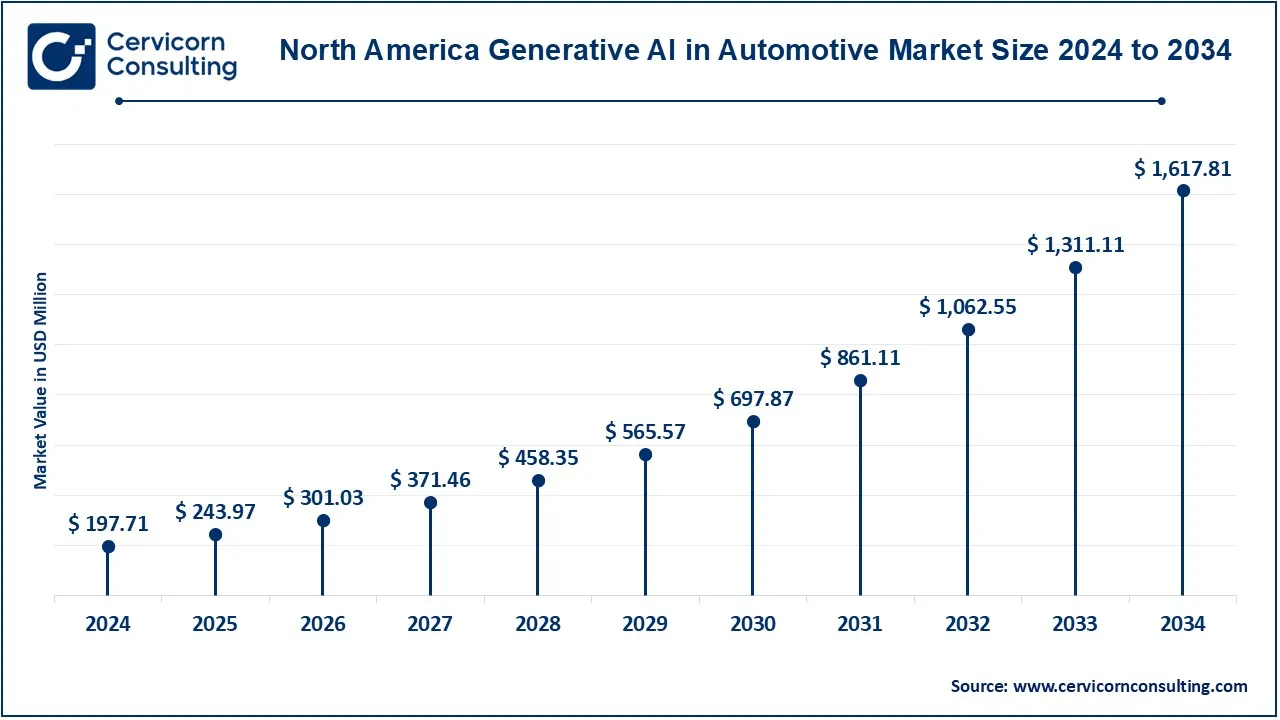

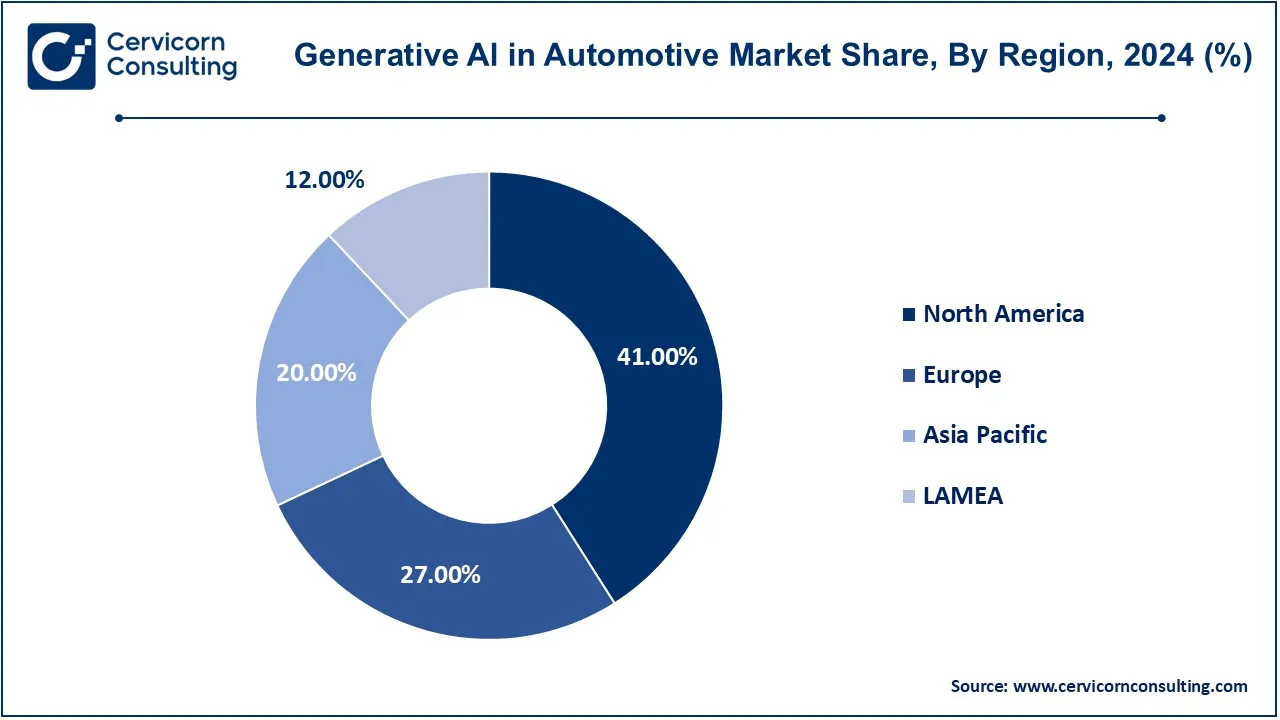

The generative Al in automotive market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). The North America has dominated the market in 2024.

The North America generative Al in automotive market size was valued at USD 197.71 million in 2024 and is expected to be worth around USD 1,617.81 million by 2034. North America, owing to the very strong presence in R&D domains, substantial automotive manufacturing base, and readiness for the adoption of state-of-the-art technology, has always been on the forefront. This acceleration is especially seen in the U.S., which is home to some of the major players such as Tesla and General Motors as they deploy generative AI in making their vehicles safer, more autonomous, and more personalized for the user. In turn, Canada too provides a strong base on this front as the government promotes several campaigns that would spur further AI innovations. The region is a key player thanks to the strategic investments to develop start-up companies on AI and joint collaborations that much strengthen this technology around natural language processing and machine learning.

The Europe generative Al in automotive market size was estimated at USD 130.20 million in 2024 and is projected to surpass around USD 1,065.39 million by 2034. Europe market is driven by robust policies for autonomous vehicle development and sustainability goals. Countries like Germany, France, and the UK are front-runners, with companies like BMW and Volkswagen integrating AI-driven safety and predictive analytics into their vehicles. The EU’s strong regulatory environment supports safe AI adoption, and various programs fund AI research to foster competitive automotive innovation. Growing consumer demand for smarter in-car experiences and the region’s high adoption rate of electric vehicles further boost AI integration in vehicles.

The Asia-Pacific generative Al in automotive market size was accounted for USD 96.45 million in 2024 and is predicted to hit around USD 789.18 million by 2034. The Asia-Pacific, potentially the fastest growing market, expanding under the lead of China, Japan, and South Korea. The growth in automotive generative AI is fuelled by the high demand for vehicles, new technologies, and a strong consumer base eager for innovative in-car experience. China has become the world hub of companies investing heavily in AI technology for autonomous and connected vehicles, with local giants such as Baidu and Alibaba commanding the area. It is such that Japan and South Korea are quite influential, lending their ranks into the improvements of generative AI to work on achieving vehicle autonomy and energy efficiency to serve technology-obsessed end-users.

The LAMEA generative Al in automotive market size was recorded at USD 57.87 million in 2024 and is anticipated to reach USD 473.51 million by 2034. LAMEA’s adoption of generative AI in automotive is in the early stages, though certain nations show promising growth potential. The Middle East, particularly the UAE and Saudi Arabia, is investing in AI to enhance smart transportation systems, with a focus on building smart cities. Latin American countries like Brazil show increasing interest in connected automotive solutions, with generative AI promising to boost road safety and efficiency. Despite infrastructure challenges, the region’s market is projected to grow as economic stability and urbanization fuel demand for advanced automotive technology.

CEO Statements

Satya Nadella, CEO of Microsoft

Mike Schoofs, Chief Revenue Officer at TomTom

Elon Musk, CEO of Tesla Inc.

These developments underscore significant advancements in the generative AI in automotive industry, with companies like Microsoft, AUDI AG, Intel Corporation, and Tesla Inc. enhancing their product offerings to incorporate cutting-edge AI technologies. These enhancements focus on improving vehicle functionalities, including advanced driver assistance systems, personalized user experiences, and more intuitive interfaces. By integrating generative AI capabilities, these companies are striving to revolutionize how consumers interact with their vehicles, leading to safer and more efficient driving experiences. As the competition heats up, the push for innovative solutions continues to drive the automotive sector forward.

Market Segmentation

By Vehicle Type

By Technology

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Generative Al in Automotive

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Vehicle Type Overview

2.2.2 By Technology Overview

2.2.3 By Application Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Generative Al in Automotive Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increased Safety Demand

4.1.1.2 Consumer Demand for AI-Driven Experiences

4.1.1.3 Anticipated Maintenance is on Mobile Rise

4.1.1.4 Increase in regulatory push towards reduced emissions

4.1.2 Market Restraints

4.1.2.1 Expensive Up-front Investment

4.1.2.2 Privacy Challenge

4.1.2.3 Training Regularization

4.1.3 Market Challenges

4.1.3.1 Increased regulatory burden

4.1.3.2 Vulnerabilities in cybersecurity

4.1.3.3 Data privacy concerns

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Generative Al in Automotive Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Generative Al in Automotive Market, By Vehicle Type

6.1 Global Generative Al in Automotive Market Snapshot, By Vehicle Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Passenger Vehicles

6.1.1.2 Commercial Vehicles

Chapter 7. Generative Al in Automotive Market, By Technology

7.1 Global Generative Al in Automotive Market Snapshot, By Technology

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Machine Learning

7.1.1.2 Natural Language Processing

7.1.1.3 Context-aware Computing

7.1.1.4 Computer Vision

7.1.1.5 Others

Chapter 8. Generative Al in Automotive Market, By End User

8.1 Global Generative Al in Automotive Market Snapshot, By End User

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Residential

8.1.1.2 Commercial

8.1.1.3 Institutional

Chapter 9. Generative Al in Automotive Market, By Application

9.1 Global Generative Al in Automotive Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Vehicle Design

9.1.1.2 Manufacturing Optimization

9.1.1.3 Transportation & Logistics

9.1.1.4 Autonomous Driving

9.1.1.5 ADAS

Chapter 10. Generative Al in Automotive Market, By Region

10.1 Overview

10.2 Generative Al in Automotive Market Revenue Share, By Region 2024 (%)

10.3 Global Generative Al in Automotive Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Generative Al in Automotive Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Generative Al in Automotive Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Generative Al in Automotive Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Generative Al in Automotive Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Generative Al in Automotive Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Generative Al in Automotive Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Generative Al in Automotive Market, By Country

10.5.4 UK

10.5.4.1 UK Generative Al in Automotive Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Generative Al in Automotive Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Generative Al in Automotive Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Generative Al in Automotive Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Generative Al in Automotive Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Generative Al in Automotive Market, By Country

10.6.4 China

10.6.4.1 China Generative Al in Automotive Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Generative Al in Automotive Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Generative Al in Automotive Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Generative Al in Automotive Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Generative Al in Automotive Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Generative Al in Automotive Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Generative Al in Automotive Market, By Country

10.7.4 GCC

10.7.4.1 GCC Generative Al in Automotive Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Generative Al in Automotive Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Generative Al in Automotive Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Generative Al in Automotive Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Microsoft

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 AUDI AG

12.3 Intel Corporation

12.4 Tesla Inc

12.5 Uber Technologies

12.6 Volvo Car Corporation

12.7 Honda Motors

12.8 Ford Motor Company

12.9 NVIDIA Corporation

12.10 Tencent

12.11 BMW AG