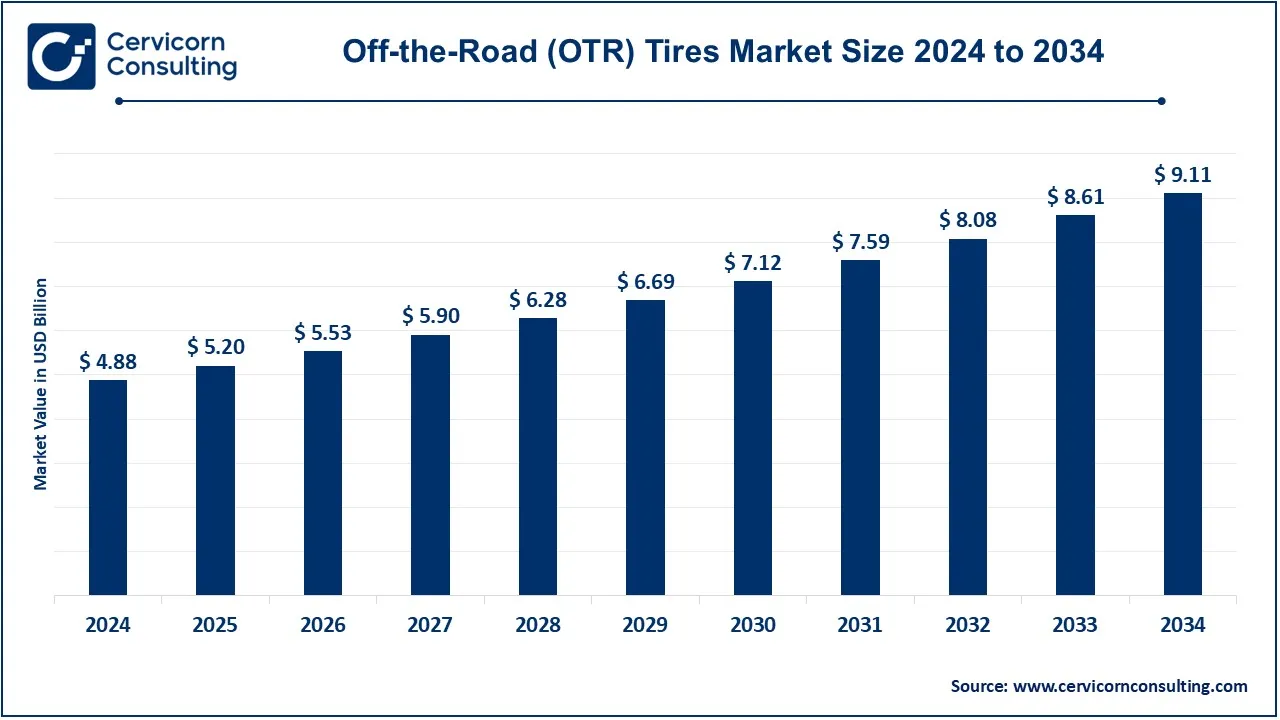

The global off-the-road (OTR) tires market size was reached at USD 4.88 billion in 2024 and is expected to be worth around USD 9.11 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.51% from 2025 to 2034.

The OTR tire market has experienced steady growth due to expanding construction, mining, and industrial activities worldwide. Government investments in infrastructure projects, including roads, highways, and commercial buildings, have fueled the demand for heavy-duty vehicles, thereby boosting OTR tire sales. Additionally, the increasing use of advanced rubber compounds and sustainable materials in tire manufacturing has improved performance and longevity, further driving market expansion. The rise in mechanized farming and the growing need for efficient agricultural vehicles have also contributed to market growth. Developing economies, particularly in Asia-Pacific and Latin America, are witnessing rapid urbanization and industrialization, leading to a higher demand for OTR tires. Moreover, technological advancements such as intelligent tires with real-time monitoring capabilities are enhancing operational efficiency and reducing downtime, making them more attractive to industries.

Off-the-road (OTR) tires are specially designed for heavy-duty vehicles used in challenging terrains such as construction sites, mining areas, and agricultural fields. These tires provide enhanced durability, deep treads for superior traction, and resistance to punctures, cuts, and extreme conditions. OTR tires are commonly used in machinery like loaders, dump trucks, graders, and bulldozers, ensuring reliable performance in harsh environments. Manufacturers design OTR tires using advanced rubber compounds and reinforced sidewalls to withstand heavy loads and rough surfaces. The three main types of OTR tires include radial, bias, and solid tires. Radial tires offer better heat resistance and fuel efficiency, while bias tires provide superior load-bearing capacity.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 5.20 Billion |

| Projected Market Size in 2034 | USD 9.11 Billion |

| CAGR (2025 to 2034) | 6.51% |

| High-impact Region | Asia Pacific |

| Key Segments | Tire Type, Industry, Vehicle Type, Material, Sales Channel, Tire Size, Tire Weight, Region |

| Key Companies | Bridgestone Corporation, The Goodyear Tire & Rubber Company, Balkrishna Tyres Ltd. (BKT), Guizhou Tire Co. Ltd., Linglong Tire, Pirelli, PrinxChengshan (Shandong) Tire Co. Ltd. (Chengshan Group), Double Coin Holdings, Zhongce Rubber Group Co. Ltd., Shandong Taishan Tyre, Shandong Yinbao, Aeolus Tyre Co. Ltd. |

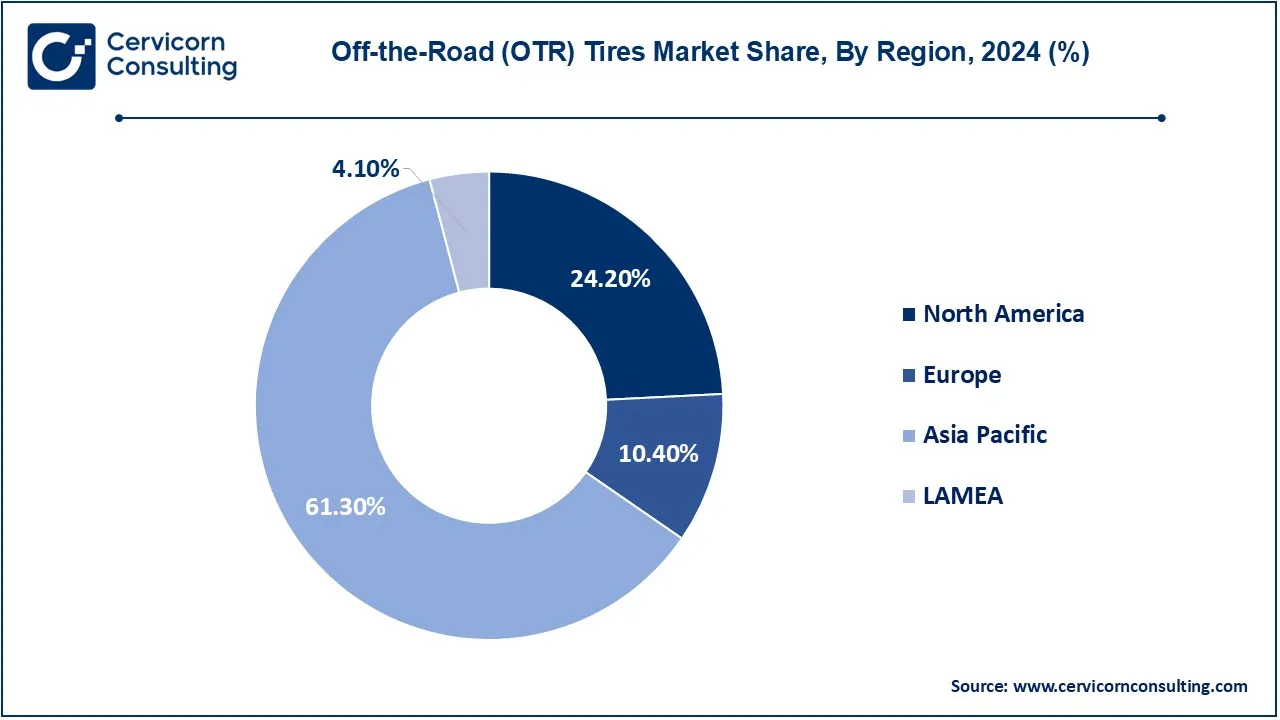

The OTR tires market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). The Asia-Pacific region has dominated the market in 2024.

The Asia-Pacific OTR tires market size was accounted for USD 2.99 billion in 2024 and is predicted to surpass around USD 5.58 billion by 2034. The Asia-Pacific region has lead the OTR tire market. Demand for the regions is driven by China, India, and Australia. China is one of the huge industrial centers that has gigantic demands for OTR tires in the mining and construction industries. Infrastructures are growing fast in India, and agriculture is getting expanded, and this gives a boost to market growth. Advanced OTR tire solutions are in high demand within Australia's mining industry, especially in the coal and iron ore sectors. In terms of infrastructure investment and industrial activity trends, Asia-Pacific plays an important developing role within the OTR tire industry.

The North America OTR tires market size was valued at USD 1.18 billion in 2024 and is expected to reach around USD 2.20 billion by 2034. North America is the largest marketplace for OTR tires since this market is powered by one of the largest mining sectors, along with a prominent construction sector. The markets that drive this demand consist of the United States and Canada, whose demand surges due to the continuance of infrastructure and the advancement in mining and mineral industries. Specifically, among all the major markets worldwide, the United States contributes most to heavy-duty applications because of the large scope of construction activities and farms that require these heavy-duty tires.

The Europe OTR tires market size was estimated at USD 0.51 billion in 2024 and is projected to hit around USD 0.95 billion by 2034. The European region is diversified with leaders in OTR tires from Germany, France, and the UK. Emphasis is placed on sustainability and innovation. Manufacturers have designed environmentally friendly solutions for the tires of this region. The growth factor is contributed to by booming construction and agricultural sectors through governmental initiatives in improving the efficiency of infrastructure and agriculture productivity. The European market carries features of high-end technologies and regulations that are rather inclined towards minimizing the degradation of the environment, thus enhancing the demand for premium OTR tires.

The LAMEA OTR tires market was valued at USD 0.20 billion in 2024 and is expected to reach around USD 0.37 billion by 2034. The LAMEA countries are different for every economy in Brazil, South Africa, and the United Arab Emirates. Brazil has the biggest market in agriculture in OTR tires; there is a huge mining industry in South Africa, heavily influencing the dynamics of the market. In the case of the UAE, huge investments in construction and infrastructure are driving demand. LAMEA is a growing market, and mining, construction, and agricultural industries are expected to grow in this region, thus offering potential to OTR tire manufacturers.

The OTR tires market is segmented into tire type, industry, vehicle type, material, sales channel, tire size, tire weight and region. Based on tire, the market is classified into radial, bias and solid. Based on industry, the market is classified into construction, agriculture, mining, industrial and port. Based on vehicle type, the market is classified into earthmovers, loaders & dozers, tractors, forklift and others. Based on material, the market is classified into rubber compound, reinforcing material and others. Based on sales channel, the market is classified into OEM and aftermarket. Based on tire size, the market is classified into below 31 Inches, 31-40 Inches, 41-45 Inches and Above 45 Inches. Based on tire weight, the market is classified into upto 2000 lbs, 2001 to 4000 lbs, and above 4000 lbs.

Radial Tires: The fabric cord in layers on a radially outward run running through the center point of a radial tire makes that far more flexible for their distribution of heat out instead of building it around hot in the middle. Improving also upon designs can produce better fuel efficiencies for improving traction and treading all the while along increases on lives of the tire due to tread wear in long processes. Heavy loads such usage in construction along with use in agricultural type for terrains.

Bias Tires: Layers of cloth cords are crisscrossed and laid at angles to one another on bias tires. The sidewall will be stiffer as a result, making it more resistant to punctures and, sometimes, stability; however, bias tires often run hotter and wear faster than radial tires. In industrial and agricultural machines, for example, bias tires are used frequently because durability is more important than fuel economy.

Rigid Tyres: Solid rubber or any other material can be made into one and more unbreakable pieces such that the tires cannot possibly blow out or puncture. Its durability and stability are quite good. As applied, it will be very nice for heavy machinery working inside very tough environments such as building construction and warehouses. With these, there is good grip but is less to undergo maintenance as compared to a pneumatic tire although they give a rugged ride, as opposed to pneumatic tires.

Construction: The construction & industrial equipment has a held revenue share of 39% in 2024. Construction industries heavily employ specialized tires for large machinery like excavators, bulldozers, and cranes. Construction tire designs need to be able to tolerate various demanding conditions, such as rough terrain and heavy loads. They have to be equipped with excellent traction and stability features to ensure safety and effectiveness on job sites.

Agriculture: Tires play a very important role in agriculture, as tractors, combines, and most other farm implements run on them. Such tires allow the vehicle to navigate soft ground with minimal soil compaction. Large, deep treads improve traction in muddy conditions-essential features to plant, grow, and harvest crops.

Mining: This requires tires that are tough for handling extreme conditions such as sharp rocks and abrasive surfaces. Tires for mining purposes are designed with high load capacities and higher durability. Specialized tread patterns for off-road performance provide grip, which is necessary for trucks and equipment used in mines.

Industrial: Applications for this industry sector are divided between warehouses and factories. This industry needs durability as well as stability in forklift and pallet jack tires. By navigating confined places, an industrial tire can provide more traction for applications on smooth surfaces.

Port: The heavy containers and other equipment at the ports would stress out the tires because of pressure and movement. They are therefore designed to withstand all the heavy loads and resistance in wear ascribed to constant movement on other surfaces. Port tires would typically have particular tread designs for maximum traction and port loading and unloading activities.

Earthmovers: The earthmovers segment has accounted highest revenue share in 2024. These earthmovers consist of excavators and backhoes that are required to ride on very tough terrains without compromising their traction. Earthmover tires will have loads to carry heavy machinery and withstand extreme conditions, making these tires a mainstay in construction and mining.

Loaders & Dozers: Tires for loaders and dozers need to be heavy-duty, as they have heavy loads and are needed on uneven ground. Such tires are usually made to maximize traction and durability in tread patterns with the intent of performing effectively in construction and earthmoving operations.

Market Revenue Share, By Vehicle Type, 2024 (%)

| Vehicle Type | Revenue Share, 2024 (%) |

| Earthmovers | 24.10% |

| Loaders & Dozers | 14.20% |

| Tractors | 18.40% |

| Forklift | 12.50% |

| Others | 30.80% |

Tractors: It provides the farm tractor with balanced tread tires, which, comparatively speaking, disturb less soil compared to conventional agricultural tools since their larger dimensions facilitate a deep tread design of the machine that can handle diverse farming conditions by being applicable in various farm environments as well as terrains.

Forklift: For example, forklifts have tires meant to provide stability and movement through warehouse spaces. Tires may also differ from solid to pneumatic depending on the type of working environment and loads they encounter.

Others: This category encompasses different automobiles, which might not fit into the ones discussed earlier, and encompasses specialty equipment used in various industries. Tires for such automobiles are produced considering the specific needs of certain operations concerning load capacity, terrain, and durability.

Rubber Compound: The rubber compound segment has captured highest revenue share in 2024. This greatly impacts the performance of the rubber compound in such attributes as traction, toughness, and heat resistance. Such compounds can be tweaked based on factors like hardness for longevity versus softness for grip.

Reinforcing Material: The tires contain reinforcing materials. For instance, the steel belts or nylon would stiffen and stabilize the tire. Such materials make the tire puncture resistant as well as support heavier loads; very important factors in construction, agricultural, and mining uses.

Others: Other raw materials in tire production are employed, although they are not classified as either rubber or reinforcement. Some examples would be alternatives or new agents that improve performance, durability, and environmental sustainability in tire manufacturing.

CEO Statements

Shuichi ISHIBASHI, CEO of Bridgestone Corporation

Mark Stewart, CEO ofThe Goodyear Tire & Rubber Company

Arvind Poddar, CEO of Balkrishna Tyres Ltd. (BKT):

Market Segmentation

By Tire Type

By Industry

By Vehicle Type

By Material

By Sales Channel

By Tire Size

By Tire Weight

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Off-the-Road (OTR) Tires

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Tire Type Overview

2.2.2 By Industry Overview

2.2.3 By Vehicle Type Overview

2.2.4 By Material Overview

2.2.5 By Sales Channel Overview

2.2.6 By Tire Size Overview

2.2.7 By Tire Weight Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Off-the-Road (OTR) Tires Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 More Project on Construction-Line

4.1.1.2 Economic Growth

4.1.1.3 Usage of heavy machinery

4.1.2 Market Restraints

4.1.2.1 High Costs

4.1.2.2 Limited Awareness

4.1.2.3 Supply Chain Disruptions

4.1.3 Market Challenges

4.1.3.1 Maintaining Quality Standards

4.1.3.2 Technological Adaptation

4.1.3.3 Logistics Issues

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Off-the-Road (OTR) Tires Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Off-the-Road (OTR) Tires Market, By Tire Type

6.1 Global Off-the-Road (OTR) Tires Market Snapshot, By Tire Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Radial

6.1.1.2 Bias

6.1.1.3 Solid

Chapter 7. Off-the-Road (OTR) Tires Market, By Industry

7.1 Global Off-the-Road (OTR) Tires Market Snapshot, By Industry

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Construction

7.1.1.2 Agriculture

7.1.1.3 Mining

7.1.1.4 Industrial

7.1.1.5 Port

Chapter 8. Off-the-Road (OTR) Tires Market, By Vehicle Type

8.1 Global Off-the-Road (OTR) Tires Market Snapshot, By Vehicle Type

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Earthmovers

8.1.1.2 Loaders & Dozers

8.1.1.3 Tractors

8.1.1.4 Forklift

8.1.1.5 Others

Chapter 9. Off-the-Road (OTR) Tires Market, By Material

9.1 Global Off-the-Road (OTR) Tires Market Snapshot, By Material

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Rubber Compound

9.1.1.2 Reinforcing Material

9.1.1.3 Others

Chapter 10. Off-the-Road (OTR) Tires Market, By Sales Channel

10.1 Global Off-the-Road (OTR) Tires Market Snapshot, By Sales Channel

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 OEM

10.1.1.2 Aftermarket

Chapter 11. Off-the-Road (OTR) Tires Market, By Tire Size

11.1 Global Off-the-Road (OTR) Tires Market Snapshot, By Tire Size

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

11.1.1.1 Below 31 Inches

11.1.1.2 31-40 Inches

11.1.1.3 41-45 Inches

11.1.1.4 Above 45 Inches

Chapter 12. Off-the-Road (OTR) Tires Market, By Tire Weight

12.1 Global Off-the-Road (OTR) Tires Market Snapshot, By Tire Weight

12.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

12.1.1.1 Upto 2000 lbs

12.1.1.2 2001 to 4000 lbs

12.1.1.3 Above 4000 lbs

Chapter 13. Off-the-Road (OTR) Tires Market, By Region

13.1 Overview

13.2 Off-the-Road (OTR) Tires Market Revenue Share, By Region 2024 (%)

13.3 Global Off-the-Road (OTR) Tires Market, By Region

13.3.1 Market Size and Forecast

13.4 North America

13.4.1 North America Off-the-Road (OTR) Tires Market Revenue, 2022-2034 ($Billion)

13.4.2 Market Size and Forecast

13.4.3 North America Off-the-Road (OTR) Tires Market, By Country

13.4.4 U.S.

13.4.4.1 U.S. Off-the-Road (OTR) Tires Market Revenue, 2022-2034 ($Billion)

13.4.4.2 Market Size and Forecast

13.4.4.3 U.S. Market Segmental Analysis

13.4.5 Canada

13.4.5.1 Canada Off-the-Road (OTR) Tires Market Revenue, 2022-2034 ($Billion)

13.4.5.2 Market Size and Forecast

13.4.5.3 Canada Market Segmental Analysis

13.4.6 Mexico

13.4.6.1 Mexico Off-the-Road (OTR) Tires Market Revenue, 2022-2034 ($Billion)

13.4.6.2 Market Size and Forecast

13.4.6.3 Mexico Market Segmental Analysis

13.5 Europe

13.5.1 Europe Off-the-Road (OTR) Tires Market Revenue, 2022-2034 ($Billion)

13.5.2 Market Size and Forecast

13.5.3 Europe Off-the-Road (OTR) Tires Market, By Country

13.5.4 UK

13.5.4.1 UK Off-the-Road (OTR) Tires Market Revenue, 2022-2034 ($Billion)

13.5.4.2 Market Size and Forecast

13.5.4.3 UKMarket Segmental Analysis

13.5.5 France

13.5.5.1 France Off-the-Road (OTR) Tires Market Revenue, 2022-2034 ($Billion)

13.5.5.2 Market Size and Forecast

13.5.5.3 FranceMarket Segmental Analysis

13.5.6 Germany

13.5.6.1 Germany Off-the-Road (OTR) Tires Market Revenue, 2022-2034 ($Billion)

13.5.6.2 Market Size and Forecast

13.5.6.3 GermanyMarket Segmental Analysis

13.5.7 Rest of Europe

13.5.7.1 Rest of Europe Off-the-Road (OTR) Tires Market Revenue, 2022-2034 ($Billion)

13.5.7.2 Market Size and Forecast

13.5.7.3 Rest of EuropeMarket Segmental Analysis

13.6 Asia Pacific

13.6.1 Asia Pacific Off-the-Road (OTR) Tires Market Revenue, 2022-2034 ($Billion)

13.6.2 Market Size and Forecast

13.6.3 Asia Pacific Off-the-Road (OTR) Tires Market, By Country

13.6.4 China

13.6.4.1 China Off-the-Road (OTR) Tires Market Revenue, 2022-2034 ($Billion)

13.6.4.2 Market Size and Forecast

13.6.4.3 ChinaMarket Segmental Analysis

13.6.5 Japan

13.6.5.1 Japan Off-the-Road (OTR) Tires Market Revenue, 2022-2034 ($Billion)

13.6.5.2 Market Size and Forecast

13.6.5.3 JapanMarket Segmental Analysis

13.6.6 India

13.6.6.1 India Off-the-Road (OTR) Tires Market Revenue, 2022-2034 ($Billion)

13.6.6.2 Market Size and Forecast

13.6.6.3 IndiaMarket Segmental Analysis

13.6.7 Australia

13.6.7.1 Australia Off-the-Road (OTR) Tires Market Revenue, 2022-2034 ($Billion)

13.6.7.2 Market Size and Forecast

13.6.7.3 AustraliaMarket Segmental Analysis

13.6.8 Rest of Asia Pacific

13.6.8.1 Rest of Asia Pacific Off-the-Road (OTR) Tires Market Revenue, 2022-2034 ($Billion)

13.6.8.2 Market Size and Forecast

13.6.8.3 Rest of Asia PacificMarket Segmental Analysis

13.7 LAMEA

13.7.1 LAMEA Off-the-Road (OTR) Tires Market Revenue, 2022-2034 ($Billion)

13.7.2 Market Size and Forecast

13.7.3 LAMEA Off-the-Road (OTR) Tires Market, By Country

13.7.4 GCC

13.7.4.1 GCC Off-the-Road (OTR) Tires Market Revenue, 2022-2034 ($Billion)

13.7.4.2 Market Size and Forecast

13.7.4.3 GCCMarket Segmental Analysis

13.7.5 Africa

13.7.5.1 Africa Off-the-Road (OTR) Tires Market Revenue, 2022-2034 ($Billion)

13.7.5.2 Market Size and Forecast

13.7.5.3 AfricaMarket Segmental Analysis

13.7.6 Brazil

13.7.6.1 Brazil Off-the-Road (OTR) Tires Market Revenue, 2022-2034 ($Billion)

13.7.6.2 Market Size and Forecast

13.7.6.3 BrazilMarket Segmental Analysis

13.7.7 Rest of LAMEA

13.7.7.1 Rest of LAMEA Off-the-Road (OTR) Tires Market Revenue, 2022-2034 ($Billion)

13.7.7.2 Market Size and Forecast

13.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 14. Competitive Landscape

14.1 Competitor Strategic Analysis

14.1.1 Top Player Positioning/Market Share Analysis

14.1.2 Top Winning Strategies, By Company, 2022-2024

14.1.3 Competitive Analysis By Revenue, 2022-2024

14.2 Recent Developments by the Market Contributors (2024)

Chapter 15. Company Profiles

15.1 Bridgestone Corporation

15.1.1 Company Snapshot

15.1.2 Company and Business Overview

15.1.3 Financial KPIs

15.1.4 Product/Service Portfolio

15.1.5 Strategic Growth

15.1.6 Global Footprints

15.1.7 Recent Development

15.1.8 SWOT Analysis

15.2 The Goodyear Tire & Rubber Company

15.3 Balkrishna Tyres Ltd. (BKT)

15.4 Guizhou Tire Co. Ltd.

15.5 Linglong Tire

15.6 Pirelli

15.7 PrinxChengshan (Shandong) Tire Co. Ltd. (Chengshan Group)

15.8 Double Coin Holdings

15.9 Zhongce Rubber Group Co. Ltd.

15.10 Shandong Taishan Tyre

15.11 Shandong Yinbao

15.12 Aeolus Tyre Co. Ltd.