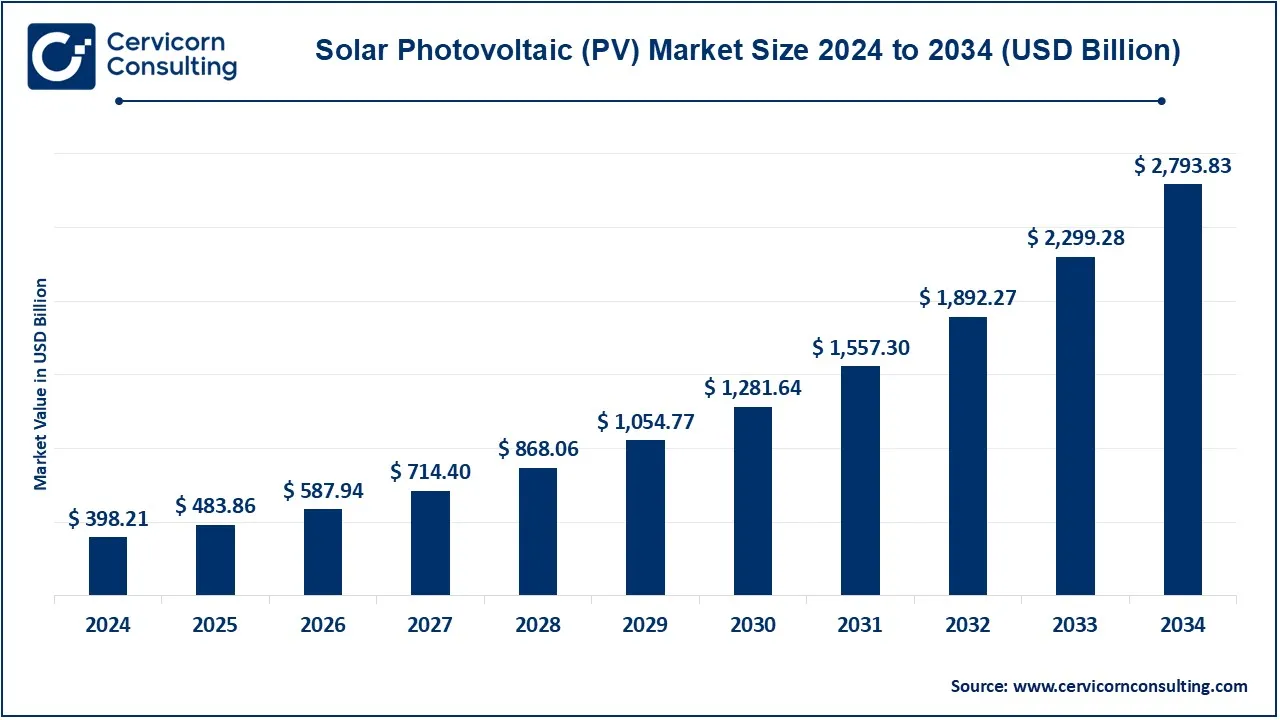

The global solar photovoltaic (PV) market size was reached at USD 398.21 billion in 2024 and is expected to be worth around USD 2,793.83 billion by 2034, growing at a compound annual growth rate (CAGR) of 21.50% from 2025 to 2034. The solar PV market has experienced rapid growth due to rising environmental concerns, government incentives, and declining costs of solar technology. Countries worldwide are investing in renewable energy to reduce carbon emissions and achieve energy security. Technological innovations, including improved efficiency and energy storage solutions, are making solar power more viable. The increasing demand for decentralized power systems, particularly in remote areas, is further boosting market adoption. The global push for clean energy, combined with policy support such as tax credits, feed-in tariffs, and net metering, has accelerated solar PV installations. Companies are investing in large-scale solar farms, while residential installations are also on the rise. Emerging economies are rapidly adopting solar technology, contributing to significant market expansion.

Solar Photovoltaic (PV) is a technology that converts sunlight directly into electricity using semiconductor materials, typically silicon. When sunlight hits the PV cells, it generates an electric current through the photovoltaic effect. These cells are assembled into solar panels, which can be installed on rooftops, ground-mounted systems, or large solar farms. Solar PV is widely used for residential, commercial, and industrial applications due to its renewable nature, low maintenance, and decreasing installation costs. The energy produced can be used immediately, stored in batteries, or fed into the power grid. Unlike fossil fuels, solar PV systems do not produce greenhouse gases, making them a sustainable and eco-friendly solution for energy generation. Advancements in technology, such as bifacial panels and high-efficiency cells, continue to improve the efficiency and affordability of solar PV, making it an essential part of the global energy transition.

Key Insights related to the Solar Photovoltaic (PV)

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 483.86 Billion |

| Expected Market Size in 2034 | USD 2,793.83 Billion |

| Estimated CAGR (2025 to 2034) | 21.50% |

| Leading Region | Asia-Pacific |

| Key Segments | Type, Installation, Grid Type, End User, Region |

| Key Companies | First Solar Inc., Sharp Corporation, Suntech Power Holding Co. Ltd., JinkoSolar Holding Co. Ltd., JA Solar Holdings Co. Ltd., Trina Solar Ltd., Hanwha Q Cells Co. Ltd., Acciona SA, Canadian Solar Inc., SunPower Corporation, LONGi Green Energy Technology Co. Ltd. |

The solar photovoltaic market is segmented into type, installation, grid type, end user and region. Based on type, the market is classified into thin film, multi-Si, mono-Si and others. Based on installation, the market is classified into ground mounted, roof oounted and others. Based on grid type, the market is classified into on-grid and off-grid. Based on end user, the market is classified into residential, commercial and utility.

Thin Film: The thin-film solar cell is a flexible, lightweight material, with layers of the photovoltaic materials having a thickness of a few micrometers only. Therefore, the thin-film part needs lower efficiency to compete with conventional silicon cells, but with lower production costs and flexible installation. Thin-film technology finds use when weight and flexibility are the important issues such as in building-integrated photovoltaics (BIPVs) and portable solar panels. Recent increased interest in such thin films is based chiefly on the enhancement of their fabrication efficiencies and decreased cost of manufacturing, making them a compelling option for applications.

Multi-Si (Multicrystalline Silicon): Multi-Si solar cells are made from multiple silicon crystals and offer a good balance of efficiency and cost. Those usually rated at an efficiency between 15% and 20% are widely used in both residential and commercial installations. Their production is less expensive than monocrystalline silicon, making them favoured among consumers. The multi-Si segment is likely to flourish with manufacturers improving production techniques and economies of scale, thus lowering the cost and promoting their use in both developed and emerging markets.

Mono-Si (Monocrystalline Silicon): Mono-Si cells typically deliver high efficiency and a long life, and allow higher than 20% efficiency. Made from one crystalline structure, these cells can do better than their multi-Si and thin film cousins, but also tend to be the costliest of the three. Because of their space-efficient design, these cells can be used in residential installations and commercial applications where space is limited. The rising demand for sustainable energy solutions and call for higher efficiency solar panels are providing impetus for the growth of the mono-Si segment in the global market.

Residential: The residential sector deals with solar photovoltaic systems being installed on individual homes, usually either for self-consumption or for net metering. This is endorsed by an increase in adoption of residential solar due to the demands of consumer energy-cost reduction and energy independence. Government incentives and the dropping installation price are making solar energy very attractive. Some other trends aiding this market are the prevalent homebuilding of energy-efficient and intelligent technologies, combining sustainability with affordable utility bills in the minds of the owners.

Commercial: The commercial segment consists of the placing of solar PV into businesses, schools, and other institutions. Management thus talk about the details of the feasibility study for solar energy applications in industries that use solar energy for different reasons. Businesses are investing in solar energy to cut down on operational costs, meet sustainability targets, and meet government regulations. For this segment, economies of scale offer benefits since they allow big installations to adopt advanced technologies for higher efficiencies. The increasing cost of electric power surged up with a stringent focus on corporate responsibility, and commercial solar installations achieved legitimacy during that period. In addition, PPAs are making financing options possible, which is further helping this segment in its adoption.

Solar Photovoltaic (PV) Market Revenue Share, By End User, 2024 (%)

| End User | Revenue Share, 2024 (%) |

| Residential | 27.10% |

| Commercial | 33.50% |

| Utility | 39.40% |

Utility: The utility segment refers to large solar PV installations by energy providers where most users supply the grid. Utility-scale projects certainly do benefit from serious economies of scale and often 20- or 30-year PPAs that make them attractive measures. This segment is essential to the attainment of several renewable energy targets for governments across the globe and sees some serious investment as countries move towards cleaner energy. The improving competitiveness of solar against conventional energy sources is driving growth in utility-scale projects and making a significant contribution to the overall growth of solar PV markets.

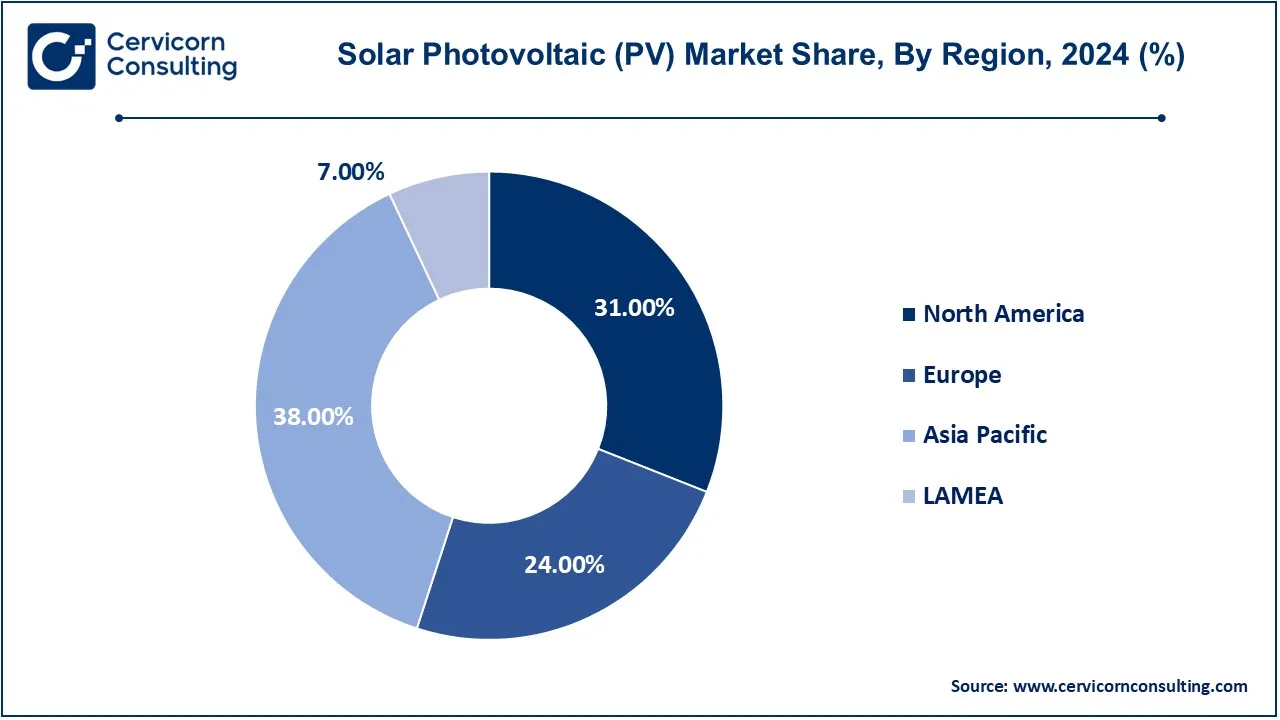

The solar PV market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). The Asia-Pacific region has dominated the market in 2024.

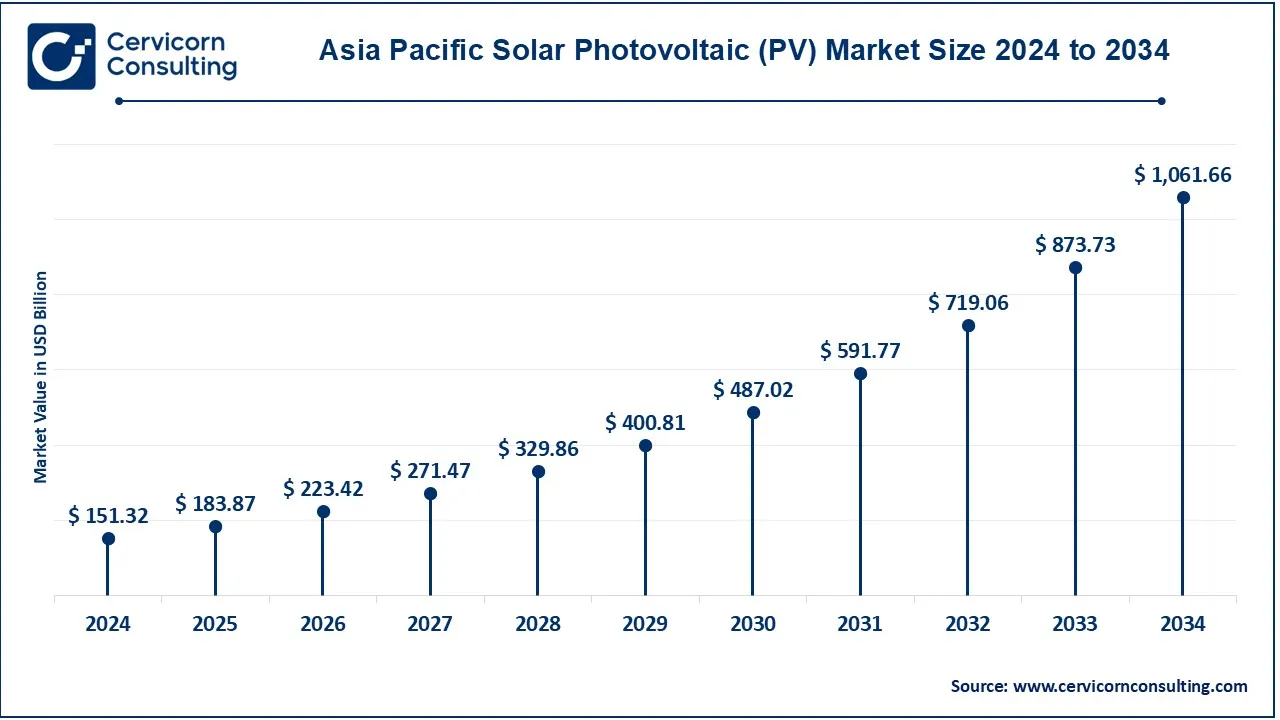

The Asia-Pacific solar PV market size was accounted for USD 151.32 billion in 2024 and is predicted to surpass around USD 1,061.66 billion by 2034. Asia-Pacific is the fastest-growing region, mainly driven by countries like China, Japan, and India. China is the principal solar manufacturer and is the largest player in this market, significantly impacting the growth of the market owing to ambitious renewable energy targets. India is also investing heavily in its solar infrastructure, aiming for a marked increase in capacity for solar energy to meet increased demand. Following Fukushima, Japan has been focused on renewable energy and is also aiding the region in rapidly expanding solar technology. The growth in this region is spurred by government policies coupled with energy demand.

The North America solar PV market size was valued at USD 123.45 billion in 2024 and is expected to be worth around USD 866.09 billion by 2034. In North America, which mainly includes the United States and Canada, incentive support by government, technology evolution, and awareness of renewable energy among consumers mark this region as one of the foremost in the Solar PV market. With its share in the topmost of the U.S. market, California, Texas, and Florida are the leading states for solar installations. Recent years have been characterized by an upsurge in utility-scale performance and residential installations in the region, aided mainly by low costs and favorable policies. Canada is also working to increase its solar capacity, especially in Ontario and Alberta.

The Europe solar PV market size was estimated at USD 95.57 billion in 2024 and is projected to hit around USD 670.52 billion by 2034. Solar energy has been pioneered in Europe with countries like Germany, France, and Spain taking the lead. For long, Germany has been at the forefront of solar energy, given wide feed-in tariffs and remarkable government support. The EU climate and sustainability objectives have served to direct some investment into solar technologies in its member states. Italy and the Netherlands are also increasing their solar installations. Growth in solar PV is largely being driven by the region's emphasis on network modernization as it relates to renewable energy transition.

The LAMEA solar PV market was valued at USD 27.87 billion in 2024 and is anticipated to reach around USD 195.57 billion by 2034. The LAMEA region is witnessing growing interest in solar PV, driven by abundant sunlight and rising energy needs. In Latin America, countries like Brazil and Chile are leading the way, with Chile's solar capacity rapidly expanding due to favorable regulatory frameworks. The Middle East, particularly the UAE and Saudi Arabia, is investing heavily in solar projects to diversify energy sources. Africa has significant solar potential, with countries like South Africa leading solar deployment efforts, although infrastructure and investment challenges remain. The region's future growth in solar energy is expected to accelerate as technologies become more accessible and cost-effective.

CEO Statements

Mark Widmar, CEO of First Solar

Jifan Gao, CEO of Suntech Power

Frank Yu, CEO of JA Solar

Market Segmentation

By Type

By Installation

By Grid Type

By End user

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Solar Photovoltaic (PV)

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Tyre Overview

2.2.2 By Installation Overview

2.2.3 By Grid Type Overview

2.2.4 By End user Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Solar Photovoltaic (PV) Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising Fossil Fuel Prices

4.1.1.2 Technical Innovation

4.1.1.3 Increased Investment

4.1.1.4 Supportive Ecosystem

4.1.2 Market Restraints

4.1.2.1 Upfront Investment is High

4.1.2.2 Intermittency

4.1.2.3 Regulatory Difficulties

4.1.3 Market Challenges

4.1.3.1 Technological Improvements

4.1.3.2 Public Acceptance

4.1.3.3 Competition from Other Renewables

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Solar Photovoltaic (PV) Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Solar Photovoltaic (PV) Market, By Type

6.1 Global Solar Photovoltaic (PV) Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Thin film

6.1.1.2 Multi-Si

6.1.1.3 Mono-Si

6.1.1.4 Others

Chapter 7. Solar Photovoltaic (PV) Market, By Installation

7.1 Global Solar Photovoltaic (PV) Market Snapshot, By Installation

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Ground Mounted

7.1.1.2 Roof Mounted

7.1.1.3 Others

Chapter 8. Solar Photovoltaic (PV) Market, By Grid Type

8.1 Global Solar Photovoltaic (PV) Market Snapshot, By Grid Type

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 On-grid

8.1.1.2 Off-Grid

Chapter 9. Solar Photovoltaic (PV) Market, By End user

9.1 Global Solar Photovoltaic (PV) Market Snapshot, By End user

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Residential

9.1.1.2 Commercial

9.1.1.3 Utility

Chapter 10. Solar Photovoltaic (PV) Market, By Region

10.1 Overview

10.2 Solar Photovoltaic (PV) Market Revenue Share, By Region 2024 (%)

10.3 Global Solar Photovoltaic (PV) Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Solar Photovoltaic (PV) Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Solar Photovoltaic (PV) Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Solar Photovoltaic (PV) Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Solar Photovoltaic (PV) Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Solar Photovoltaic (PV) Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Solar Photovoltaic (PV) Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Solar Photovoltaic (PV) Market, By Country

10.5.4 UK

10.5.4.1 UK Solar Photovoltaic (PV) Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Solar Photovoltaic (PV) Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Solar Photovoltaic (PV) Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Solar Photovoltaic (PV) Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Solar Photovoltaic (PV) Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Solar Photovoltaic (PV) Market, By Country

10.6.4 China

10.6.4.1 China Solar Photovoltaic (PV) Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Solar Photovoltaic (PV) Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Solar Photovoltaic (PV) Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Solar Photovoltaic (PV) Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Solar Photovoltaic (PV) Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Solar Photovoltaic (PV) Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Solar Photovoltaic (PV) Market, By Country

10.7.4 GCC

10.7.4.1 GCC Solar Photovoltaic (PV) Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Solar Photovoltaic (PV) Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Solar Photovoltaic (PV) Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Solar Photovoltaic (PV) Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 First Solar Inc.

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Sharp Corporation

12.3 Suntech Power Holding Co. Ltd.

12.4 JinkoSolar Holding Co. Ltd.

12.5 JA Solar Holdings Co. Ltd.

12.6 Trina Solar Ltd.

12.7 Hanwha Q Cells Co. Ltd.

12.8 Acciona SA

12.9 Canadian Solar Inc.

12.10 SunPower Corporation

12.11 LONGi Green Energy Technology Co. Ltd.