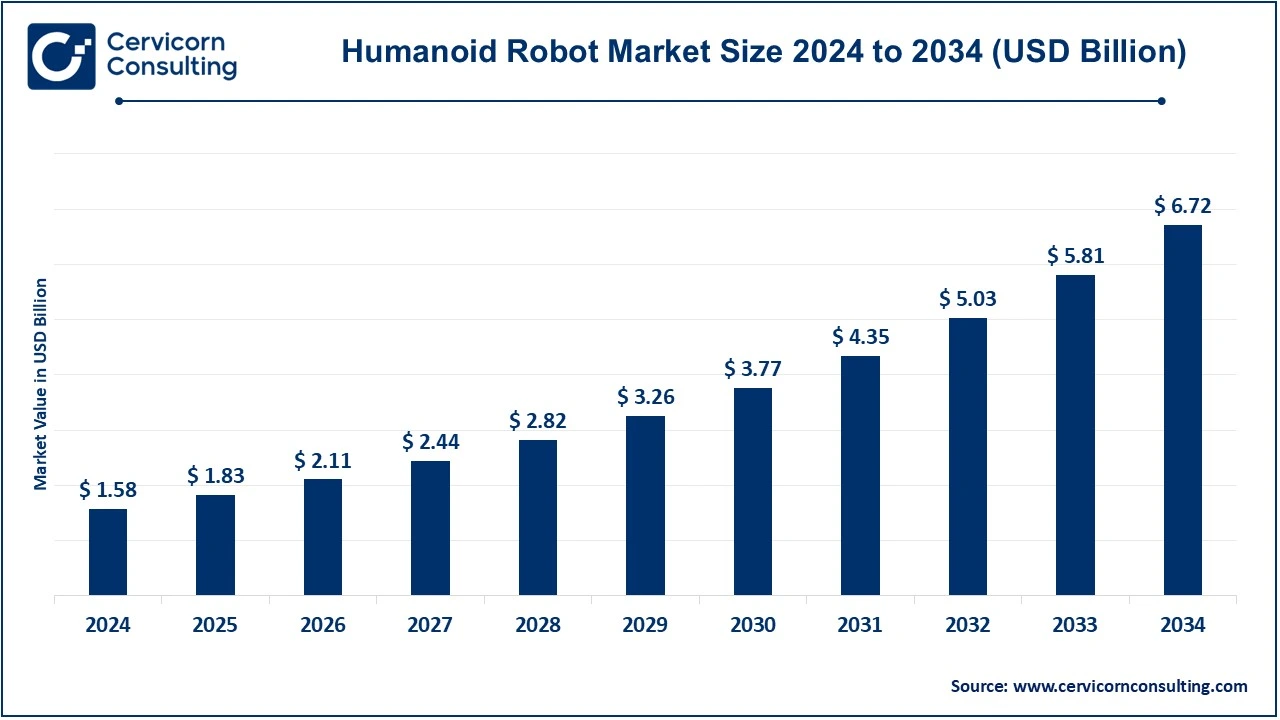

The global humanoid robot market size was valued at USD 1.58 billion in 2024 and is expected to be worth around USD 6.72 billion by 2034, growing at a compound annual growth rate (CAGR) of 15.57% from 2025 to 2034. The U.S. humanoid robot market size was estimated at USD 0.56 billion in 2024.

The humanoid robots market is expected to grow owing to the evolving technologies in AI, ML, and Robotics. These robots are built to resemble how a human behaves and looks hence they are being embraced by many industries, including healthcare, retail, education, and entertainment. In the field of health care, these machines are improving patient care by helping with surgeries, rehabilitation, and taking care of the elderly. In retail and tourism, humanoid robots are deployed to help customers, assist in shopping, and even perform some functions of security. Use of humanoid robots in education concerns interactive teaching and the teaching of mentally challenged students. The main reasons for the market development include the high rate of automation, the increase in the elderly population that requires assistance, and the rise in the technological application of sensors, AI, and computer vision that enhance robot performance.

CEO Statements

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 1.58 Billion |

| Expected Market Size in 2034 | USD 6.72 Billion |

| Predicted CAGR 2025 to 2034 | 15.57% |

| Benchmark Region | North America |

| Hot Growth Region | Asia-Pacific |

| Key Segments | Motion Type, Component, Application, Region |

| Key Companies | Engineered Arts Limited, HANSON ROBOTICS LTD, Honda, HYULIM Robot Co., Ltd, KAWADA Robotics Corporation, ROBOTIS, Sanbot Co, SoftBank Robotics, Toshiba Corporation, Willow Garage |

Growing Popularity of Smart Homes

Government Support and Policies

High Cost of Development and Deployment

Technical Complexity and Reliability Issues

Increased Focus on Human-Robot Collaboration

Rising Demand for Companion Robots

Ethical and Privacy Concerns

Regulatory Challenges

The humanoid robot market is segmented into motion type, component, application and region. Based on motion type, the market is classified into wheel drive and biped. Based on component, the market is classified into software and hardware. Based on application, the market is classified into search and rescue, hospitality, personal assistance and caregiving, education and entertainment, research and space exploration and others.

Wheel Drive: Wheel type segment employ wheels for movement thus affording them the advantage of navigating around an environment much faster and more stable than biped robots. These types of robots are common in places where quickness and balance is fundamental in their operation like industrial spaces, customer care, and logistics. In contrast, biped robots that imitate the anthropomorphic design walking, wheel-based humanoids are stable and can even carry more load without tipping over.

Humanoid Robot Market Revenue Share, By Motion Type, 2024 (%)

| Motion Type | Revenue Share, 2024 (%) |

| Wheel Drive | 66% |

| Biped | 34% |

Biped: Biped motion are made to move like humans. Therefore, fitting the design of these devices in human interactive surrounding where the constraints of stairs, rough terrain and narrow areas are prevalent becomes easy. This movement grants them the ability to perform activities that may require an acrobatic type of performance, such as in houses or offices or hospitals. This is very true however; biped motion is also simultaneously very difficult to address from an engineering standpoint; in order to achieve bipedal movement, it is not enough to simply design the limbs as the locomotive torso that ‘gains its balance’ on two legs makes stability and balance a major issue that presents the necessity for more sophisticated sensors and control systems.

Software: The software aspect is one of the most vital aspects of the implementation of humanoid robots and consists of components such as artificial intelligence, the processing of images, learning algorithms, and the planning of dynamic or static movements. With the use of AI algorithms, robots are able to analyze and react to environmental factors without needing further instructions. The quandaries of machine learning, in this case, concern efficiency with which the humanoid robots operate, changing with respect to the environment and the user’s wishes. Computer vision soft wares, on the other hand, utilize information gathered from cameras to enable the robots to recognize pictures, body language, sounds, and even objects.

Humanoid Robot Market Revenue Share, By Component, 2024 (%)

| Component | Revenue Share, 2024 (%) |

| Hardware | 68% |

| Software | 32% |

Hardware: The hardware of humanoid robots has many constituent parts necessary for its performance such as sensors, actuators, processors, and power apparatus. Sensing devices such as cameras, or microphones, as well as touch sensors enable the robot to sense where it is, visualize and recognize different objects and people, and interact with them. Moving parts such as motors and servos are called actuators and are responsible for the movement of the robot’s arms, head, and even a torso. The processing unit is referred to as the &Mr. ‘Processor’ of the robot as it controls the movement of the robot by processing that process the robot’s sensors and controls its movements.

Personal Assistance and Caregiving: This segment has dominated the market with revenue share of 31.68% in 2024. The use of humanoid robotic caregivers is crucial in personal assistance and caregiving. This is a great help to the aged and physically challenged people. Tasks such as reminding them when to take their medication, helping them move, and responding to their health parameters are for example, some of the tasks they carry out. Further, they recognize the fact that such users need to be cared for, not only through the provision of the services but also through social means, as such users can be quite lonely.

Search and Rescue: The deployment of humanoid robots in the search and rescue sector has dramatically improved the rate of success of these operations. This is because they are able to enter environments that are too dangerous for human responders. These robots are fitted with sensors and cameras to help them find missing persons, evaluate damage on buildings, and give updates to the rescue teams on the situational status. They have a two-legged form due to their ability to step on debris and climb over obstructions, which is very useful for crossing ruined building terrain and rough grounds.

Hospitality: In this line of work, even humanoid robots are being used more often to help the guests as well as the workings of the place. These robots’ welcome customers, check them in, give them instructions, and can even help in finding places to eat or tourist attractions. Since their interaction is facilitated by IT, the services of these robots are personalized towards the guests.

Education and Entertainment: Humanoid robots in educational institutions are used as interactive teaching tools, aides in teaching science, technology, engineering, and mathematics (STEM) and language skills as well as the development of socialization. They can help facilitate watching videos to heal the students, tutoring, and focused attention. In terms of leisure activities, humanoid dolls are used in theme parks, exhibitions, and events, thrilling the audience with their dancing and storytelling and playing with them.

Research and Space Exploration: Humanoid robots are of great importance for research and space expeditions because they are highly adaptable and can perform tasks within a human environment. Research focuses on training robots to imitate human movements for experiments on the study of human biomechanics, AI, and robotics. Space missions employ faces of human-like shapes that can enter space stations and perform various tasks that involve precision skills to aid astronauts.

Others: The other segment comprises retail, security, and domestic assistance. In retail, they help shoppers with product details and help in stock control. Humanoid security robots are used in monitoring of a certain area by observing normal activities and detecting any abnormal behavior or intrusion and notifying the human security. In house settings, household humanoid robots do domestic work and watch over the security of the house while assisting smart home technology in controlling light, temperature, and devices. These multifaceted uses emphasize the flexibility of humanoid robots in fulfilling various demands in both public and private spaces, which improves comfort, safety, and effectiveness in their application.

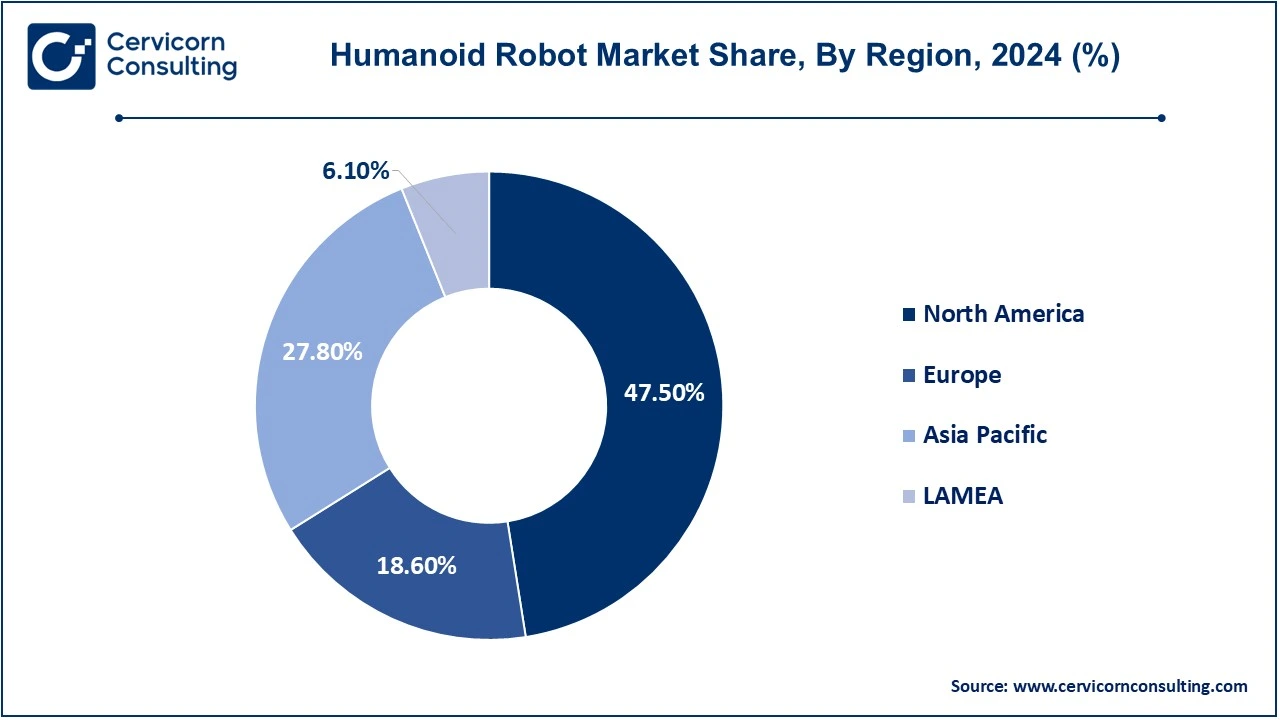

The humanoid robot market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. The North AMerica has dominated the market in 2024.

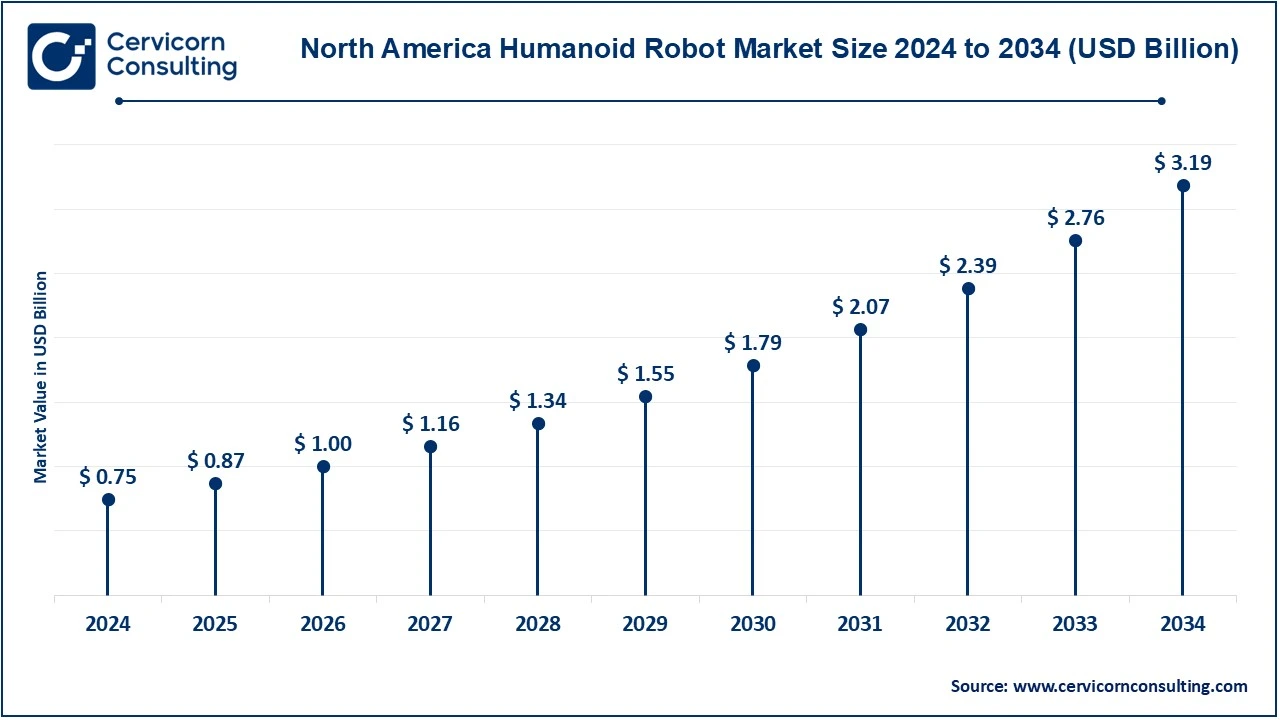

The North America humanoid robot market size was valued at USD 0.75 billion in 2024 and is expected to reach around USD 3.19 billion by 2034. North America is the region where the market owes its existence mainly to technological advancement and massive forex inflow into the robotics and AI market especially in the USA. Industries such as healthcare, retail, and defense have many functions where the use of humanoid robotic systems for applications such as providing customer service and security has rapidly expanded. The Region also has a thriving Technological ecosystem, with several top companies in robotics manufacturing as well as research institutions within the Region that promotes development and high technology.

The Europe humanoid robot market size was estimated at USD 0.29 billion in 2024 and is predicted to hit around USD 1.25 billion by 2034. Europe region is distinguished by a lot of funding based on research and zealousness in advancement of technology with respect to robotic development. Nations such as Germany, France and the UK are the pioneers in use of robotics especially in the manufacturing and health care industries. Ethos of technology ethics in AI and Robotics in the European Union has resulted in development of policies which support its use in the society which dovetails with the integration of humanoid robots within the services i.e. eldercare and customer support.

The Asia-Pacific humanoid robot market size was accounted for USD 0.44 billion in 2024 and is projected to surpass around USD 1.87 billion by 2034. In Asia Pacific newspapers report that the share of humanoid robots is substantial because of country based demand with Japan, South Korea and China leading. Japan, a country that is well known for its advanced robotic technologies, widely employs humanoid robots in the health care sector, hospitality and also in the industrial manufacturing. Countries such as China have increased the use of humanoid robots due to their aggressive investments in artificial intelligence and robotics, more so in the retail sector and education.

The LAMEA humanoid robot market was valued at USD 0.10 billion in 2024 and is anticipated to reach around USD 0.41 billion by 2034. The LAMEA region is expanding gradually with an increasing interest in robotics technology in several industries. In this region, humanoid robots are used mainly in the hospitality, retail and public service sectors as part of improving customer experience and optimizing the processes. Such countries are slowly emplacing the use of humanoid robots especially in education and health sectors aimed at increasing accessibility and enhancing service provision.

New players like Tetra Tech, Inc. and Ramboll Group A/S are driving innovation by integrating advanced technologies such as AI and digital twins into their engineering solutions. They focus on sustainable practices and smart infrastructure development. Dominating the market, AECOM Technology Corporation and Jacobs Engineering Group Inc. lead with their extensive global reach and expertise in large-scale infrastructure projects. They leverage advanced technologies, extensive experience, and a broad service portfolio to maintain their competitive edge and address complex client needs across diverse sectors.

Market Segmentation

By Motion Type

By Component

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Humanoid Robot

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Motion Type Overview

2.2.2 By Component Overview

2.2.3 By Application Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Humanoid Robot Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Growing Popularity of Smart Homes

4.1.1.2 Government Support and Policies

4.1.2 Market Restraints

4.1.2.1 High Cost of Development and Deployment

4.1.2.2 Technical Complexity and Reliability Issues

4.1.3 Market Opportunities

4.1.3.1 Increased Focus on Human-Robot Collaboration

4.1.3.2 Rising Demand for Companion Robots

4.1.4 Market Challenges

4.1.4.1 Ethical and Privacy Concerns

4.1.4.2 Regulatory Challenges

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Humanoid Robot Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Humanoid Robot Market, By Motion Type

6.1 Global Humanoid Robot Market Snapshot, By Motion Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Wheel Drive

6.1.1.2 Biped

Chapter 7. Humanoid Robot Market, By Component

7.1 Global Humanoid Robot Market Snapshot, By Type of Insulator

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Hardware

7.1.1.2 Software

Chapter 8. Humanoid Robot Market, By Application

8.1 Global Humanoid Robot Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Search and Rescue

8.1.1.2 Hospitality

8.1.1.3 Personal Assistance and Caregiving

8.1.1.4 Education and Entertainment

8.1.1.5 Research and Space Exploration

8.1.1.6 Others

Chapter 9. Humanoid Robot Market, By Region

9.1 Overview

9.2 Humanoid Robot Market Revenue Share, By Region 2024 (%)

9.3 Global Humanoid Robot Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Humanoid Robot Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Humanoid Robot Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Humanoid Robot Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Humanoid Robot Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Humanoid Robot Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Humanoid Robot Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Humanoid Robot Market, By Country

9.5.4 UK

9.5.4.1 UK Humanoid Robot Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Humanoid Robot Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Humanoid Robot Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Humanoid Robot Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Humanoid Robot Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Humanoid Robot Market, By Country

9.6.4 China

9.6.4.1 China Humanoid Robot Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Humanoid Robot Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Humanoid Robot Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Humanoid Robot Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Humanoid Robot Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Humanoid Robot Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Humanoid Robot Market, By Country

9.7.4 GCC

9.7.4.1 GCC Humanoid Robot Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Humanoid Robot Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Humanoid Robot Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Humanoid Robot Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 Engineered Arts Limited

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 HANSON ROBOTICS LTD

11.3 Honda

11.4 HYULIM Robot Co. Ltd

11.5 KAWADA Robotics Corporation

11.6 ROBOTIS

11.7 Sanbot Co

11.8 SoftBank Robotics

11.9 Toshiba Corporation

11.10 Willow Garage