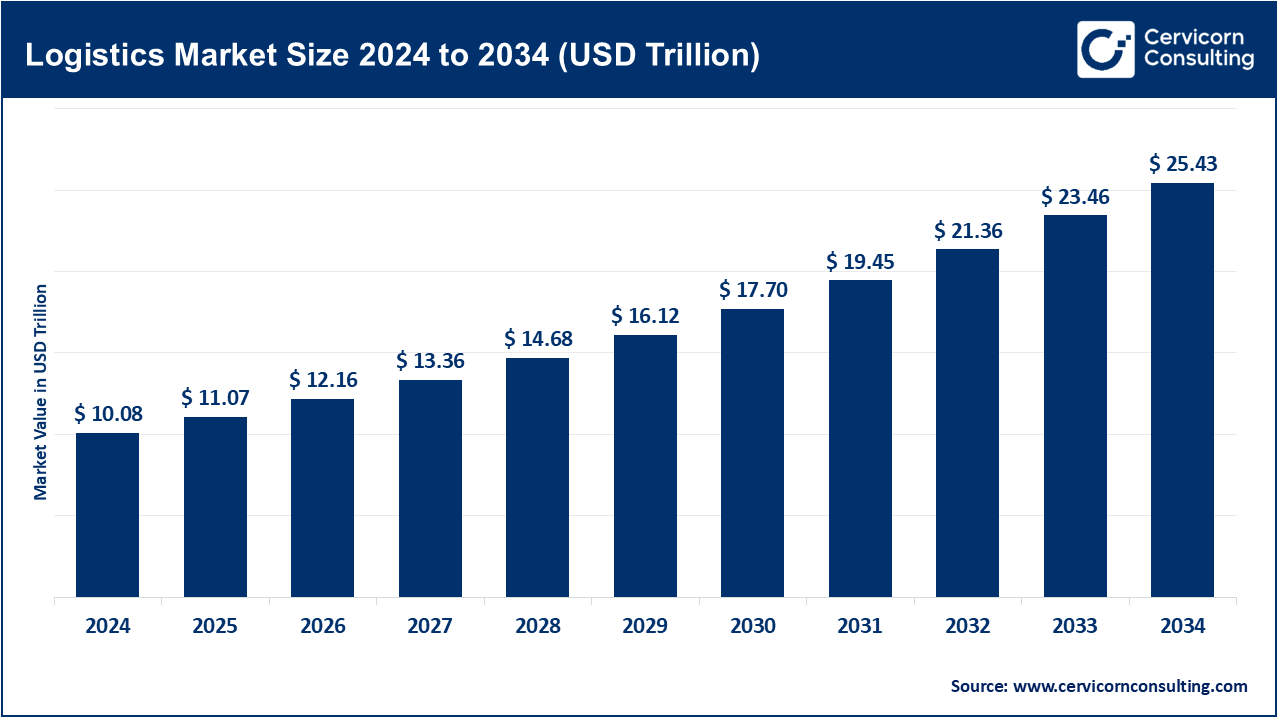

The global logistics market size is calculated at USD 10.08 trillion in 2024 and is projected to grow around USD 25.43 trillion by 2034, growing at a compound annual growth rate (CAGR) of 9.69% from 2025 to 2034.

The logistics market has seen robust growth in recent years and is poised for continued expansion due to several key factors. One of the primary drivers is the explosive growth of e-commerce, which has created an increased need for faster, more efficient logistics solutions. As online shopping continues to surge globally, logistics companies are investing in technology and infrastructure to meet consumer demands for quicker deliveries. E-commerce giants like Amazon and Alibaba have significantly influenced this growth by pushing the boundaries of delivery timelines and raising customer expectations. Furthermore, advancements in technology, such as automation, artificial intelligence (AI), and the internet of things (IoT), are transforming the logistics industry. These innovations allow companies to improve route planning, track shipments in real time, optimize warehouse operations, and enhance overall supply chain management. The integration of AI and machine learning in predictive analytics is helping companies anticipate demand, improve inventory management, and streamline operations.

Logistics refers to the detailed management and transportation of goods and services from their point of origin to the point of consumption. It encompasses a wide range of activities such as transportation, warehousing, inventory management, packaging, and distribution. There are several types of logistics, including inbound logistics (the movement of raw materials to a manufacturing plant), outbound logistics (the transportation of finished goods to customers), reverse logistics (the process of handling returns or recycling), and third-party logistics (3PL), which involves outsourcing logistics functions to third-party service providers. These activities play a critical role in ensuring the efficient movement of goods across various industries, such as retail, manufacturing, and e-commerce.

Report Scope

| Coverage | Details |

| Market Size in 2024 | USD 10.08 Trillion |

| Market Growth Rate | CAGR of 9.69% from 2025 to 2034 |

| Market Size by 2034 | USD 25.43 Trillion |

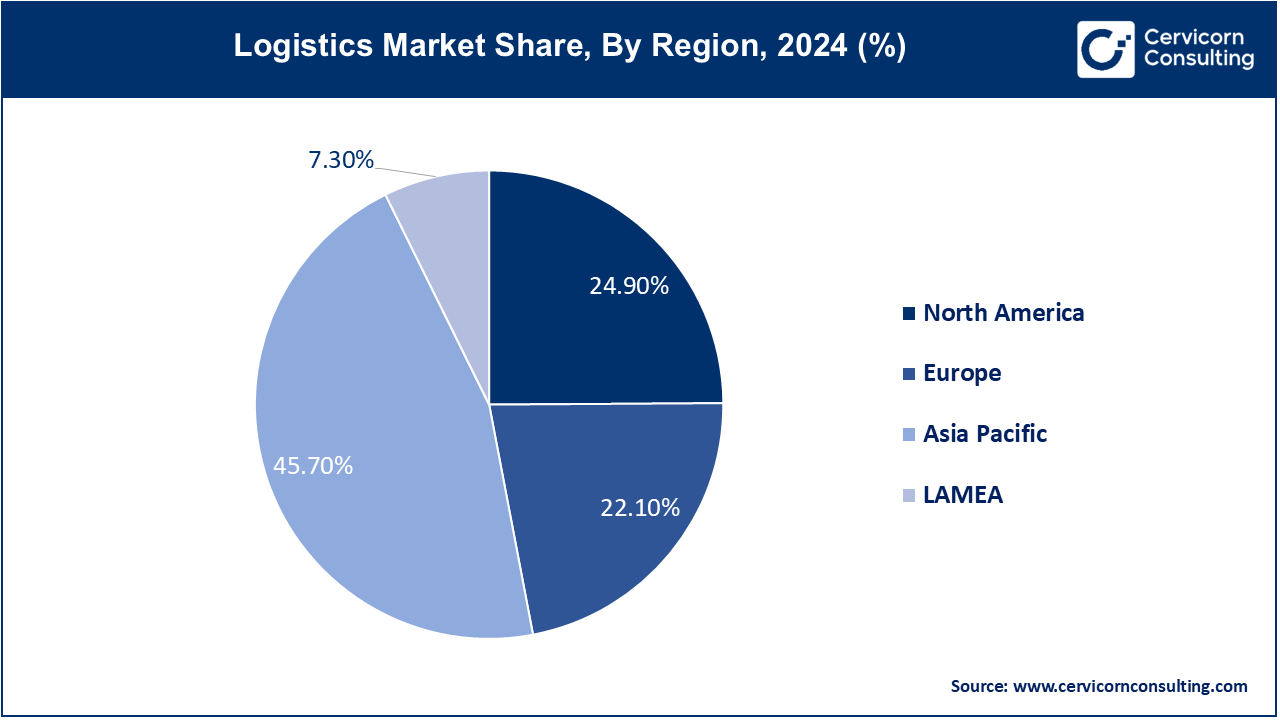

| North America Market Share | 24.9% in 2024 |

| APAC Market Share | 45.7% in 2024 |

Urbanization and Population Growth:

Rise in Outsourcing of Logistics Functions:

High Operational Costs:

Supply Chain Disruptions:

Integration of Advanced Analytics:

Development of Autonomous Vehicles:

Cybersecurity Threats:

Lack of Skill Workers:

1PL (First-Party Logistics): 1PL refers to companies managing their own logistics and transportation operations without external support. They handle all aspects of their supply chain internally, including warehousing and transportation. Trends include increasing investment in in-house technologies and processes to enhance efficiency, and a focus on integrating advanced systems for better control over logistics activities and cost management.

2PL (Second-Party Logistics): 2PL involves companies outsourcing specific logistics functions, such as transportation or warehousing, to third-party providers. This model includes the use of carriers for transportation and warehouse operators for storage. Trends show growth in 2PL due to the need for specialized services and scalability, with an emphasis on improved service levels and cost control through strategic partnerships.

3PL (Third-Party Logistics): 3PL providers offer comprehensive logistics solutions, including transportation, warehousing, and supply chain management. They act as intermediaries between manufacturers and end-users, handling multiple logistics functions. Trends include the integration of advanced technologies like automation and IoT, growth in e-commerce driving demand for flexible logistics solutions, and increased focus on providing value-added services and customized solutions.

4PL (Fourth-Party Logistics): 4PL involves a logistics integrator that manages the entire supply chain on behalf of the client, coordinating multiple 3PL providers and overseeing the logistics strategy. Trends include the rise of digital platforms and data analytics to enhance visibility and coordination, growth in demand for end-to-end supply chain solutions, and a focus on strategic partnerships and continuous improvement in logistics management.

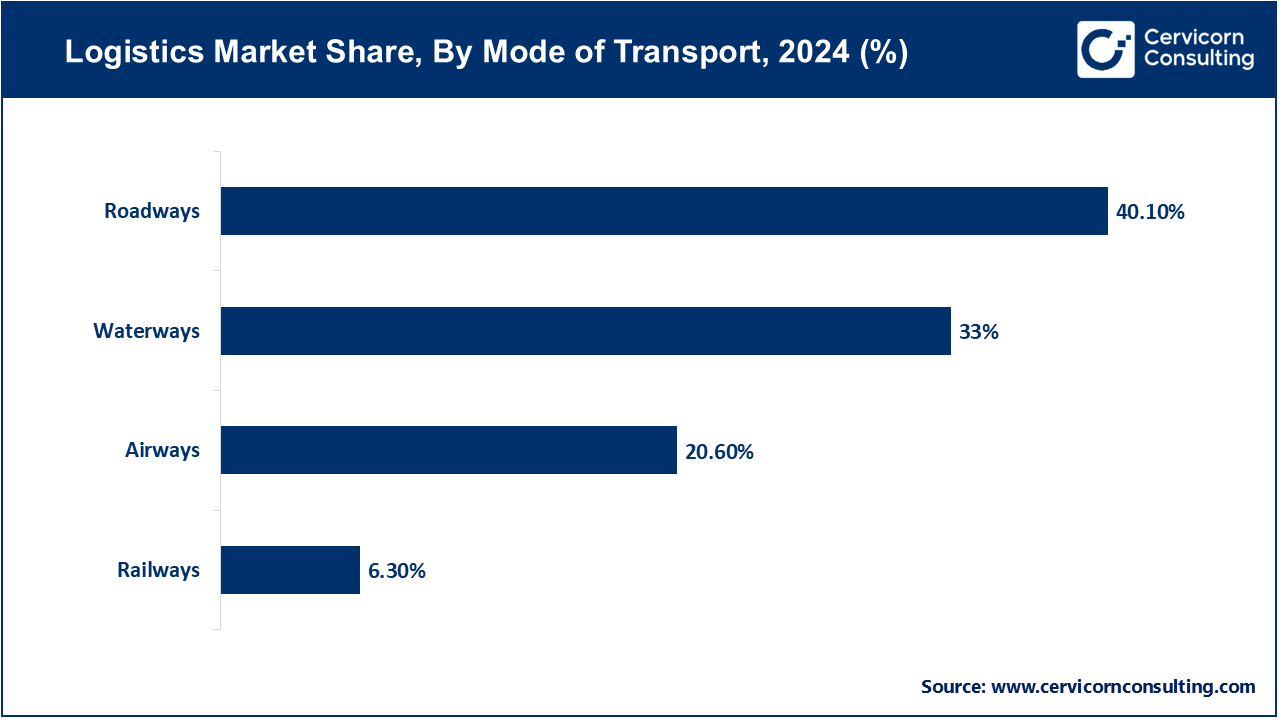

Railways: The railways segment has generated revenue share of 6.3% in 2024. Railways involve the transportation of goods using trains on rail tracks. This mode is known for its cost-effectiveness and efficiency over long distances. Trends include the expansion of rail networks and the adoption of intermodal rail solutions to enhance connectivity. Railways are increasingly used for bulk and containerized freight due to their reliability and lower carbon footprint compared to road transport.

Airways: The airways segment has recorded 20.6% revenue share in 2024. Airways refer to the transport of goods by aircraft. This mode is characterized by speed and is ideal for high-value, time-sensitive shipments. Trends include advancements in air cargo technology and increased capacity through specialized cargo planes. The rise of e-commerce is driving demand for air freight, particularly for international and expedited deliveries, despite higher costs compared to other modes.

Roadways: Roadways segment has accounted highest revenue share of 40.1% in 2024. Roadways involve the movement of goods by trucks and other road vehicles. It offers flexibility and door-to-door delivery, making it crucial for last-mile logistics. Trends include the adoption of advanced telematics and route optimization technologies to improve efficiency. The rise of e-commerce and demand for quick deliveries are boosting the growth of road transport, despite challenges related to congestion and environmental impact.

Waterways: Waterways segment has meajured revenue share of 33% in 2024. Waterways involve the transport of goods by ships and barges over seas, rivers, and canals. This mode is cost-effective for large quantities and bulk cargoes. Trends include the development of larger and more fuel-efficient vessels and increased focus on sustainable shipping practices. Waterways are vital for international trade, with continued investments in port infrastructure and container shipping enhancing global supply chain efficiency.

Healthcare: In the healthcare sector, logistics involves the transportation and storage of pharmaceuticals, medical devices, and equipment. Trends include the growing importance of cold chain logistics to maintain the efficacy of temperature-sensitive products and enhanced tracking systems to ensure timely and accurate deliveries, driven by increased demand for healthcare services and regulatory requirements for safe handling.

Manufacturing: Manufacturing logistics focuses on the supply of raw materials, components, and finished goods. Trends include the adoption of just-in-time (JIT) inventory systems to reduce storage costs and improve efficiency, as well as advanced automation and robotics in warehousing to streamline operations and enhance productivity in response to global competition and technological advancements.

Aerospace: Aerospace logistics involves the management of complex supply chains for aircraft parts and equipment. Trends include the integration of advanced technologies such as 3D printing for parts manufacturing and increased use of predictive maintenance analytics to anticipate and address issues before they impact operations, driven by the sector's focus on efficiency and safety.

Telecommunication: In telecommunication, logistics pertains to the distribution of equipment, infrastructure, and service components. Trends include the expansion of 5G networks driving demand for specialized logistics solutions to handle the complex and sensitive equipment involved, as well as the need for rapid deployment and maintenance to keep up with technological advancements and increasing connectivity demands.

Government and Public Utilities: Logistics for government and public utilities involves managing the supply and distribution of essential services and materials. Trends include the need for robust emergency logistics capabilities to respond to natural disasters and infrastructure failures, as well as increasing investments in digital tools for improved resource management and operational efficiency.

Banking and Financial Services: In banking and financial services, logistics deals with the secure transportation of sensitive documents and physical assets. Trends include heightened emphasis on cybersecurity and secure chain-of-custody practices to protect against fraud and theft, driven by the growing digitalization of financial services and regulatory compliance requirements.

Retail: Retail logistics covers the movement and storage of goods from manufacturers to consumers. Trends include the rise of omnichannel retailing, which integrates online and offline sales channels, and the growing demand for fast, efficient delivery solutions, driven by increased consumer expectations for rapid order fulfillment and personalized shopping experiences.

Media and Entertainment: Logistics in media and entertainment involves the distribution of content and equipment. Trends include the shift towards digital distribution of media content, which drives demand for efficient data transfer and cloud storage solutions, and the need for timely delivery of physical media and production equipment to support global content creation and distribution.

Others: The “Others” category encompasses various niche sectors requiring specialized logistics solutions. Trends include increasing customization of logistics services to meet the unique needs of different industries, such as luxury goods or hazardous materials, and the adoption of innovative technologies to enhance efficiency and address specific logistical challenges.

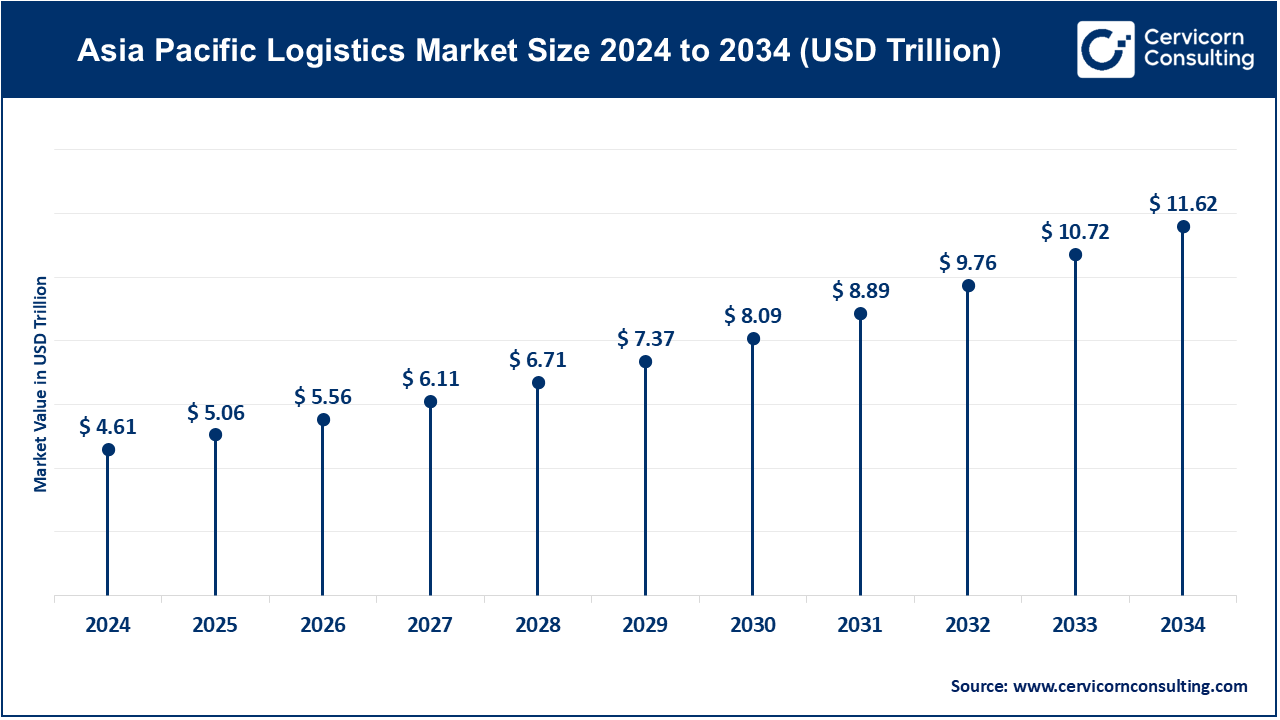

The Asia-Pacific logistics market size was valued at USD 4.61 trillion in 2024 and is expected to reach around 11.62 trillion by 2034. driven by booming industrialization and urbanization. There is a notable trend towards developing smart logistics infrastructure, including advanced warehousing and transportation systems. The region is also seeing increased investment in digital technologies and infrastructure to support the growing demand for efficient supply chain management and cross-border trade.

The North America logistics market size is expected to reach around USD 6.33 trillion by 2034 and growing at a CAGR of 9.90% from 2025 to 2034. North America is seeing significant growth in e-commerce-driven logistics solutions and automation. The rise of online shopping has led to increased demand for efficient warehousing and last-mile delivery services. Additionally, there is a strong emphasis on integrating advanced technologies such as robotics and artificial intelligence to optimize supply chain operations and address labor shortages.

The Europe logistics market size is expected to be worth around USD 5.62 trillion by 2034 and growing at a CAGR 9.88% from 2025 to 2034, increasingly focusing on sustainability and regulatory compliance. There is a growing trend towards green logistics, with companies investing in eco-friendly transportation options and reducing carbon footprints. Moreover, the implementation of stringent environmental regulations and the push for a circular economy are shaping logistics practices and encouraging innovations in sustainable logistics solutions.

In LAMEA, logistics markets are characterized by infrastructure development and modernization efforts. There is a focus on enhancing transportation networks and warehousing facilities to support economic growth and improve logistics efficiency. Additionally, the adoption of technology and digital solutions is gaining momentum to address challenges in logistics management and facilitate smoother trade flows across the region.

New players like Flexport are adopting innovations such as digital freight forwarding platforms and data analytics to streamline supply chain management and enhance visibility. Project44 focuses on real-time supply chain visibility with its advanced tracking solutions. Key market dominators include DHL and FedEx, leveraging their extensive global networks and technology integration to maintain competitive advantages. DHL excels with its advanced logistics technologies and comprehensive services, while FedEx remains dominant through its expansive air and ground network, ensuring reliable and fast delivery solutions worldwide.

The logistics industry has seen several key developments in recent years, with companies seeking to expand their market presence and leverage synergies to improve their offerings and profitability.

Market Segmentation

By Model

By Mode of Transport

By End Use

Regional