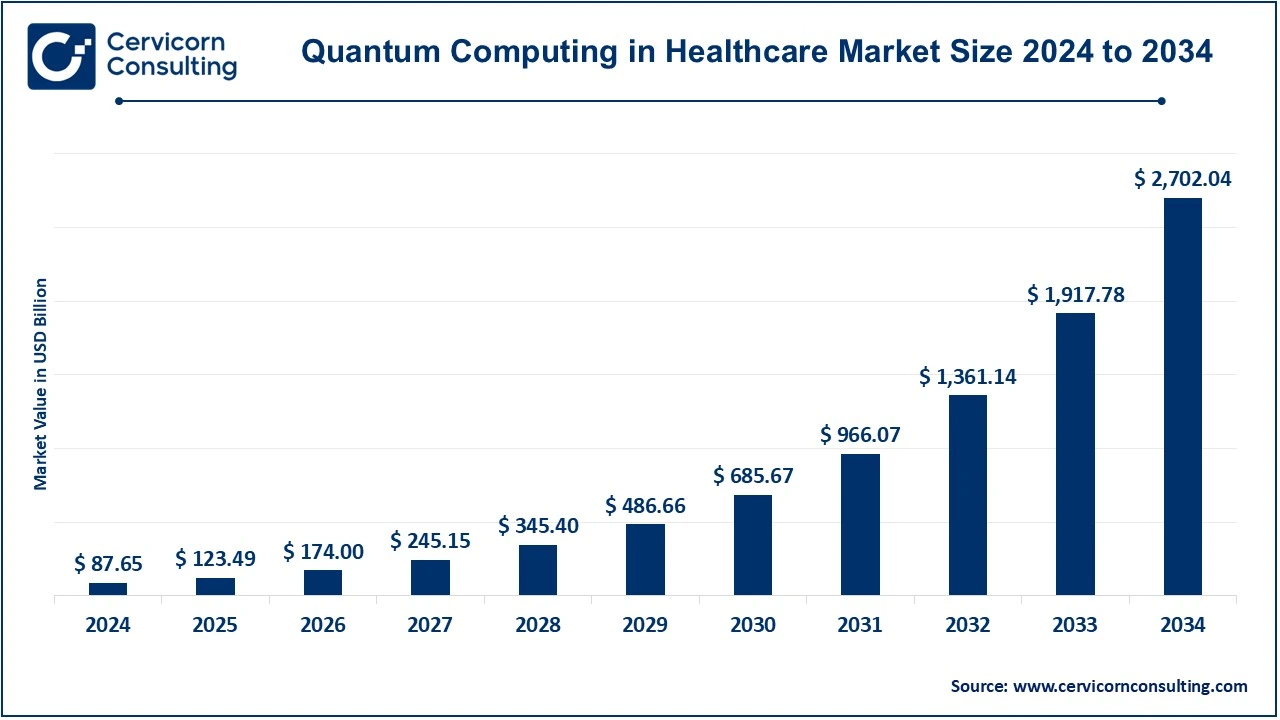

The global quantum computing in healthcare market size was valued at USD 87.65 billion in 2024 and is expected to be worth around USD 2,702.04 billion by 2034, growing at a compound annual growth rate (CAGR) of 40.89% from 2025 to 2034. The U.S. quantum computing in healthcare market size was estimated at USD 40.10 billion in 2024.

The healthcare sector faces complex challenges that require innovative solutions to improve diagnostic accuracy, treatment efficacy, and data management. Quantum computing, with its unique capabilities, has the potential to revolutionize various aspects of healthcare. The capacity of quantum computing to process massive, complicated data sets more effectively than traditional computers has the potential to have a substantial influence on fields such as genetics, medical imaging, and customized medicine. Quantum algorithms can accelerate the identification of genetic markers associated with diseases, facilitate the analysis of medical images, and optimize treatment plans based on individual genetic profiles. Furthermore, quantum cryptography provides a strong security solution for sensitive patient data, which is crucial as healthcare depends more on digital platforms.

Current examples of cutting-edge technology utilized in healthcare companies include e-health records, accessible MRI and CT scanners, and sophisticated bioinformatics tools for genomes. These advancements nevertheless face several challenges, including handling large amounts of data and the need for precise analysis and quick processing. EHR systems, for example, frequently face interoperability challenges that impede efficient patient data exchange across various healthcare platforms. By using quantum algorithms, doctors could tailor treatments to each patient's unique genetic profile, improving treatment outcomes and reducing side effects. Additionally, the development of new diagnostic techniques diagnostics and therapeutics tools could be facilitated by quantum computing, improving the accuracy of medical conditions.

CEO Statements

Tomislav Mihaljevic, CEO of Cleveland Clinic

Steve Brierley, Founder and CEO of Riverlane

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 87.65 Billion |

| Predicted Market Size in 2034 | USD 2702.04 Billion |

| CAGR 2025 to 2034 | 40.89% |

| Dominant Region | North America |

| Booming Region | Asia-Pacific |

| Key Segments | Quantum Computer Type, Application, End User, Deployment, Region |

| Key Companies | Atos SE, IonQ Inc., Classiq Technologies, Inc., Xanadu Quantum Technologies Inc., Pasqal, Fujitsu, Intel Corporation, Sandbox AQ, IBM, Google, Inc., Rigetti & Co, LLC., Quandela, D-Wave Quantum Inc., Quantinuum, Ltd., Accenture plc, Quintessence Labs, Qnami, SEEQC, Protiviti Inc., ID Quantiques |

Increased Government Support and Incentives

Growing Availability of High-Speed Networks for Data Processing

Technical Limitations

Strict Regulatory Framework

Development of Hybrid Systems

Growing Collaborations Across Several Disciplines

Growing Ethical Concerns

Susceptibility to Errors

The quantum computing in healthcare market is segmented into quantum computer type, application and region. Based on quantum computer type, the market is classified into quantum annealer, analog quantum, universal quantum, and superconducting qubits. Based on application, the market is classified into radiotherapy, drug discovery and interactions, healthcare information, genomics, and imaging solutions. Based on end user, the market is classified into pharmaceutical and biopharmaceutical companies, labs and research institutes, healthcare providers, and healthcare payers. Based on deployment, the market is classified into on premises, and cloud based.

Superconducting Qubits: The superconducting qubits segment has dominated the market in 2024. Superconducting circuits are often used to apply superconducting circuits to implement superconducting qubits based on superconductivity theory. These qubits can have long consistency periods and handle stimulating quantum complications. Some of the most advanced and commercially available quantum computers today use superconducting qubits.

Quantum Annealer: This type of quantum computer is the least powerful and most limiting. It is the easiest to construct but can only perform a single function. Moreover, the scientific consensus of the community indicates that it offers no advantage over conventional computers.

Analog Quantum: The analog quantum computer allows modeling of complicated quantum interactions between any combination of conventional electronics. It can also contain between 50 and 100 qubits. In addition, it is faster than conventional systems and has a higher computational capacity.

Universal Quantum: This quantum computer is the most efficient, versatile and difficult to construct. It also has several technological obstacles. In addition, according to current estimates, this machine will contain more than one hundred thousand physical qubits.

Radiotherapy: Radiotherapy is a widely used cancer treatment. Moreover, radiation can eliminate malignant cells or prevent them from multiplying. Moreover, it is important to develop a radiation strategy to minimize damage to healthy tissues and organs. It also deals with optimization challenges that involve hundreds of variables. Hence, many simulations are required to get an ideal radiation strategy. Consequently, quantum computing considers a wide range of possibilities between each simulation. Hence, it allows healthcare professionals to run many simulations while developing the ideal approach.

Drug discovery and interactions: The most important and crucial aspect of drug discovery and development is the comparison of molecules. Quantum computing can facilitate the comparison of more giant molecules. Hence, it will pave the way for more pharmacological innovations and cures for various diseases. Quantum computing also enables healthcare providers to simulate complex molecular interactions at the atomic level. Hence, it plays a significant role in medical research and drug development. Consequently, specialists will be able to simulate all 20,000 human DNA proteins. It will also begin to simulate interactions with models of new and current drugs.

Health information: Patients want security and protection for their medical and health information, so it is important to study and evaluate all hacking approaches. ID Quantique, for example, is a company that uses quantum physics to protect data. Quantum cryptography preserves the data, making quantum entanglement one of its most practical applications.

Genomics: Genomics is the study of the basic genetic components of an organism. It therefore includes recombinant DNA, DNA sequencing techniques, and bioinformatics. In addition, it requires the sequencing, assembly, and analysis of genomic structures and functions. Due to its increased processing power and storage capacity, quantum computing is the optimal way forward. In addition, the results will be more precise, allowing for more accurate diagnoses and tailored treatments. Furthermore, specialists can create a genomic database to find unidentified biomarkers and mutations. It will also transform therapy by taking environmental and lifestyle variables into account.

Imaging solutions: Quantum imaging technologies help in creating accurate images that allow observation of individual molecules. Moreover, machine learning and quantum computing help in interpreting findings by doctors and other experts. Quantum informatics enables interpretation of the data and remediation of the same. Moreover, quantum imaging technologies also help in providing more accurate images by facilitating tissue classification.

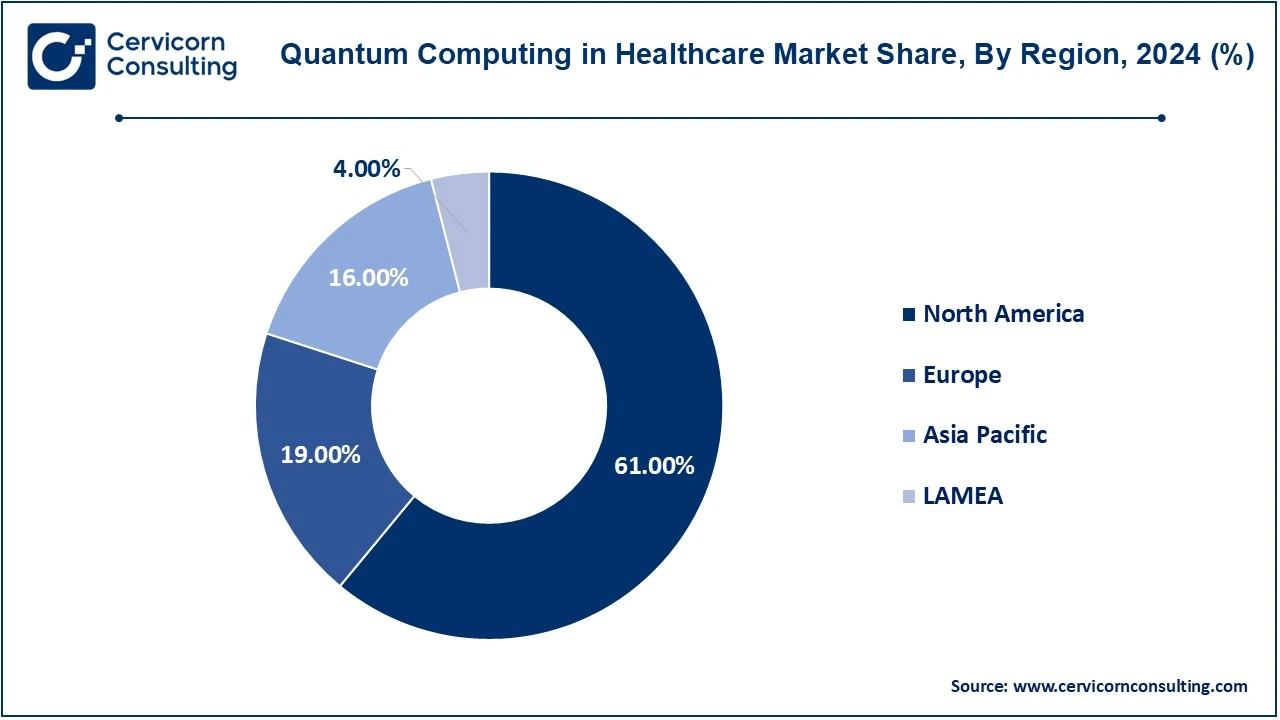

The quantum computing in healthcare market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. The North America has dominated the market in 2024 and accounted highest revenue share.

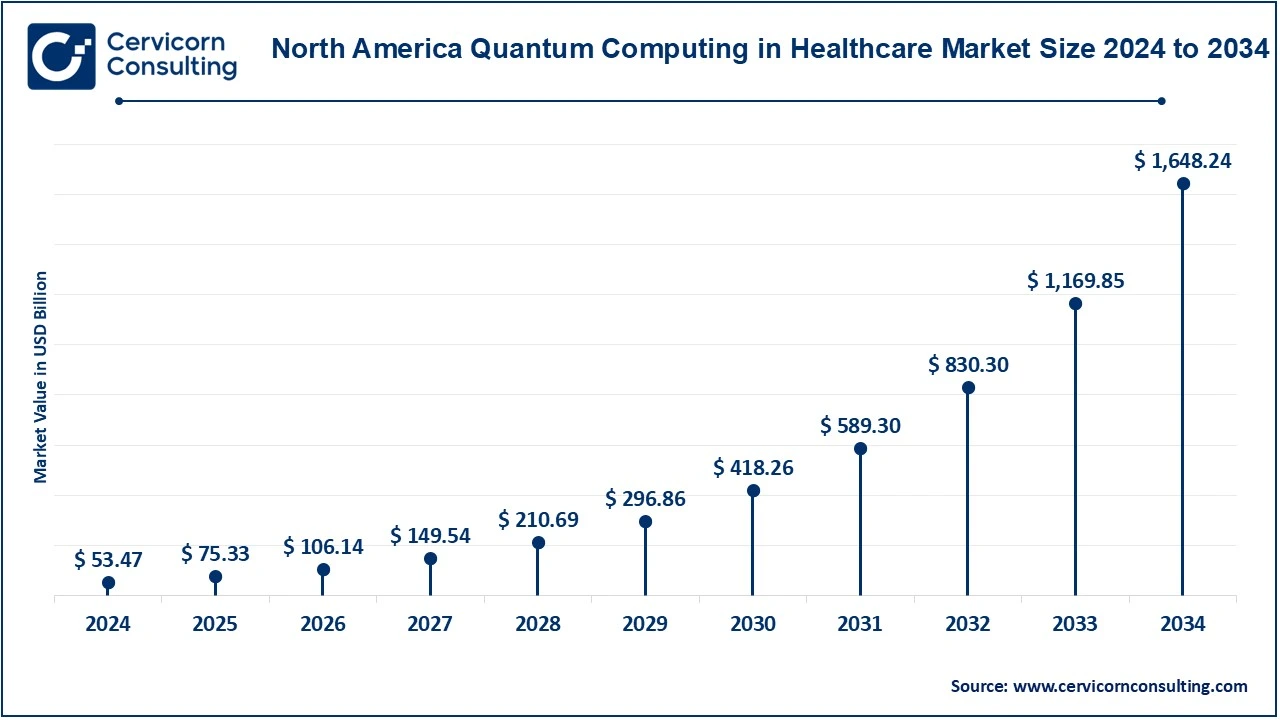

The North America quantum computing in healthcare market size was valued at USD 53.47 billion in 2024 and is expected to be worth around USD 1,648.24 billion by 2034. Due to increased investment & government assistance in this sector, as well as the growing number of quantum computing companies catering to the healthcare business in the area, North America has a sizable portion of the healthcare quantum computing market. Geographically, various companies and academic institutions in the North American region are focusing on healthcare applications of quantum computing. Strong technological advancements and collaborations between universities and industries are driving the region forward.

The Europe quantum computing in healthcare market size was estimated at USD 16.65 billion in 2024 and is projected to surpass around USD 513.39 billion by 2034. The QuTech Institute in the Netherlands and the Quantum Flagship initiative are just two of the established hubs and centers of excellence for quantum research in Europe. These institutions have promoted research into quantum cures for health problems and strengthened collaboration between healthcare professionals, technology companies and quantum researchers. In addition, the UK market grew the fastest in the European region, while the German healthcare industry had the largest market share.

The Asia-Pacific quantum computing in healthcare market size was accounted for USD 14.02 billion in 2024 and is predicted to hit around USD 432.33 billion by 2034. In Asia Pacific, quantum hubs are forming in countries such as China, Australia, and Japan. These facilities are making significant investments in advancing quantum technology, including applications in medicine. In this field, quantum innovation is being driven by partnerships between academic institutions, entrepreneurs, and healthcare organizations. In addition, China's quantum computing in healthcare market had the largest market share, and India's quantum computing in healthcare market was the fastest-growing market in Asia Pacific.

The LAMEA quantum computing in healthcare market was valued at USD 3.51 billion in 2024 and is anticipated to reach around USD 108.08 billion by 2034. Quantum computing is poised to revolutionize industries by solving complex healthcare challenges. The market in Latin America has seen significant growth in recent years, driven by a mix of public and private initiatives that position the country as a key player in the quantum technology race. Kipu Quantum and QCentroid have formed a strategic partnership to advance quantum computing projects in Bizkaia, Spain, Latin America and beyond, with a focus on industry-specific applications in healthcare. In the Middle East, Saudi Arabia, the United Arab Emirates and Qatar are working to create ecosystems for quantum startups. Local governments are seeking to position themselves as a technology hub for the region by promoting startup activities to encourage local innovation in industry verticals. In addition, quantum computing, an emerging technology that processes complex data at unprecedented speeds, promises enormous potential to revolutionize healthcare in Africa.

Market players are also taking a number of strategic actions to expand their global presence. The major market developments include new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaborations with other organizations. To expand and survive in a more competitive and emerging market environment, the healthcare quantum computing industry needs to offer cost-effective products. In recent years, the healthcare quantum computing industry has brought some of the most significant benefits to the medical field. Major players in the healthcare quantum computing market including IBM Corporation, Microsoft Corporation, Google LLC, D-Wave Systems, IonQInc, Rigetti Computing, Fujitsu Ltd, Intel Corporation, Honeywell International Inc, and AT&T Inc. and others are trying to increase the market demand by investing in research and development activities.

Key players in the quantum computing in healthcare sector are pivotal in delivering a variety of innovative construction solutions, such as prefabrication techniques, sustainable materials, and advanced digital technologies.

These advances mark a significant expansion of quantum computing in this industry, fuelled by innovative research and tactical collaborations. The primary goals are to improve building efficiency, increase sustainability, and increase product possibilities while adhering to different construction rules.

Market Segmentation

By Service

By Quantum Computer Type

By Application

By End User

By Deployment

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Quantum Computing in Healthcare

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Service Overview

2.2.2 By Quantum Computer Type Overview

2.2.3 By Application Overview

2.2.4 By End User Overview

2.2.5 By Deployment Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Quantum Computing in Healthcare Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increased Government Support and Incentives

4.1.1.2 Growing Availability of High-Speed Networks for Data Processing

4.1.2 Market Restraints

4.1.2.1 Technical Limitations

4.1.2.2 Strict Regulatory Framework

4.1.3 Market Challenges

4.1.3.1 Growing Ethical Concerns

4.1.3.2 Susceptibility to Errors

4.1.4 Market Opportunities

4.1.4.1 Development of Hybrid Systems

4.1.4.2 Growing Collaborations Across Several Disciplines

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Quantum Computing in Healthcare Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Quantum Computing in Healthcare Market, By Service

6.1 Global Quantum Computing in Healthcare Market Snapshot, By Service

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Hardware

6.1.1.2 Software

6.1.1.3 Services

Chapter 7. Quantum Computing in Healthcare Market, By Quantum Computer Type

7.1 Global Quantum Computing in Healthcare Market Snapshot, By Quantum Computer Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Quantum Annealer

7.1.1.2 Analog Quantum

7.1.1.3 Universal Quantum

7.1.1.4 Superconducting Qubits

Chapter 8. Quantum Computing in Healthcare Market, By Application

8.1 Global Quantum Computing in Healthcare Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Radiotherapy

8.1.1.2 Drug Discovery and Interactions

8.1.1.3 Healthcare Information

8.1.1.4 Genomics

8.1.1.5 Imaging Solutions

Chapter 9. Quantum Computing in Healthcare Market, By End User

9.1 Global Quantum Computing in Healthcare Market Snapshot, By End User

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Pharmaceutical and Biopharmaceutical Companies

9.1.1.2 Labs and Research Institutes

9.1.1.3 Healthcare Providers

9.1.1.4 Healthcare Payers

Chapter 10. Quantum Computing in Healthcare Market, By Deployment

10.1 Global Quantum Computing in Healthcare Market Snapshot, By Deployment

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 On premises

10.1.1.2 Cloud Based

Chapter 11. Quantum Computing in Healthcare Market, By Region

11.1 Overview

11.2 Quantum Computing in Healthcare Market Revenue Share, By Region 2024 (%)

11.3 Global Quantum Computing in Healthcare Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Quantum Computing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Quantum Computing in Healthcare Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Quantum Computing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Quantum Computing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Quantum Computing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Quantum Computing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Quantum Computing in Healthcare Market, By Country

11.5.4 UK

11.5.4.1 UK Quantum Computing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Quantum Computing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Quantum Computing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Quantum Computing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Quantum Computing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Quantum Computing in Healthcare Market, By Country

11.6.4 China

11.6.4.1 China Quantum Computing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Quantum Computing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Quantum Computing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Quantum Computing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Quantum Computing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Quantum Computing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Quantum Computing in Healthcare Market, By Country

11.7.4 GCC

11.7.4.1 GCC Quantum Computing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Quantum Computing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Quantum Computing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Quantum Computing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 Atos SE

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 IonQ Inc.

13.3 Classiq Technologies, Inc.

13.4 Xanadu Quantum Technologies Inc.

13.5 Pasqal

13.6 Fujitsu

13.7 Intel Corporation

13.8 Sandbox AQ

13.9 IBM

13.10 Google, Inc.

13.11 Rigetti & Co, LLC.

13.12 Quandela

13.13 D-Wave Quantum Inc.

13.14 Quantinuum, Ltd.

13.15 Accenture plc

13.16 Quintessence Labs

13.17 Qnami

13.18 SEEQC

13.19 Protiviti Inc.

13.20 ID Quantiques