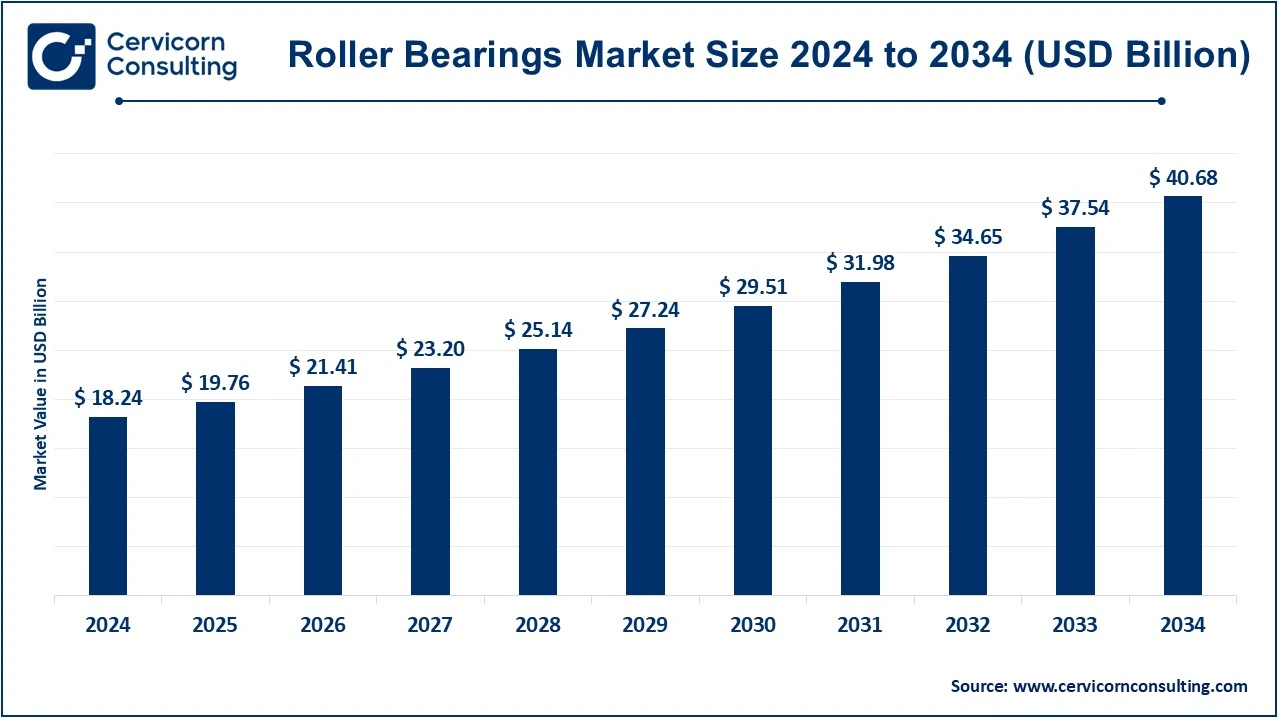

The global roller bearings market size was valued at USD 18.24 billion in 2024 and is expected to be worth around USD 40.68 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.35% from 2025 to 2034.

Rolling bearings are used to create the conditions for relative movement of rotating parts and to transfer loads from moving to stationary parts or vice versa. In addition to sufficient load capacity, the bearing must ensure the required accuracy of the position of the axis of rotating parts in the state of rotation, as well as a sufficiently high rotation speed and allow possible deviations in the position of the axis of rotation, which may be due to production deviations or elastic deformations. The extremely complex function of the bearings requires the use of special manufacturing technologies, and they are manufactured by specialized manufacturers. In addition, a wide range of design solutions has been developed. Shapes and dimensions of rolling bearings, tolerances of dimensions and shapes, material, quality, installation method and control are prescribed by standards. The bearings are supplied assembled and ready for installation, so during design it is only necessary to select the appropriate bearing.

CEO Statements

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 18.24 Billion |

| Expected Market Size in 2034 | USD 40.68 Billion |

| Estimated CAGR 2025-2034 | 8.35% |

| Dominant Region | Asia-Pacific |

| Key Segments | Type, Material, Application, Region |

| Key Companies | Schaeffler India Limited, JTEKT India Limited, NRB Bearings Limited, SKF, Menon Bearings Ltd., SNL Bearings Limited, NTN Corporation, Nachi-Fujikoshi Corp, Bimetal Bearings Limited, National Engineering Industries Ltd (NEI), Boca Bearings, Kennametal India Limited, IKO International Inc., MBP Bearings Ltd., BMW Motorrad, HCH Bearing, RBC Bearings Incorporated, Harbin Bearing Manufacturing Co. Ltd, Zhejiang Tianma Bearing Group, Galaxy Bearings Limited, Fersa Bearings |

Rise of industrial automation

Growing interest in robots and electric cars

Premature Failures

Availability of Counterfeits

Electrification and Hybridization Transition

Developing specialized and application-focused solutions

Improper Lubrication

Concerns with fake brinelling effects are growing

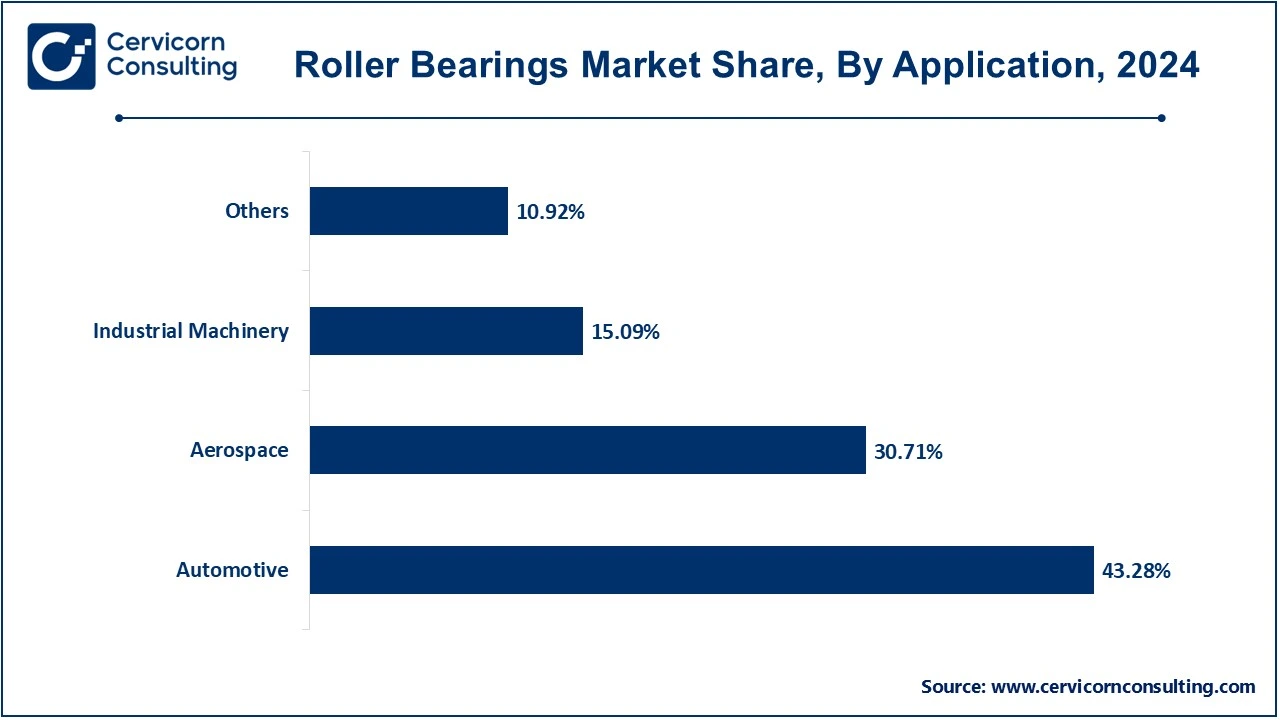

The roller bearings market is segmented into type, material, application and region. Based on type, the market is classified into spherical roller bearings, cylindrical roller bearings, tapered roller bearings, needle roller bearings, and ball bearings. Based on material, the market is classified into metal, steel, resin, synthetic rubber, and ceramic. Based on application, the market is classified into automotive, aerospace, industrial machinery and Others.

Spherical Roller Bearings: Spherical roller bearings are very robust and work on the same principle as spherical bearings, except that they use spherical rollers instead of ball rollers, which allows them to accommodate higher loads. This allows misalignment between the shaft and housing to be compensated. Spherical roller bearings are suitable for accommodating high radial loads and medium axial loads.

Cylindrical Roller Bearings: Cylindrical roller bearings use line contact between the rolling elements and the raceways, which optimizes the distribution of stress factors at the point of contact. This arrangement means that cylindrical roller bearings have a very high radial load rating. Depending on the design, they can also carry limited amounts of axial loads.

Tapered Roller Bearings: Narrow rollers are placed in between both the inner and outer rings of these bearings, characterized by limited raceways. Due to the contact angle, tapered roller bearings can accommodate high radial and axial forces in one direction. Tapered roller bearings are often combined in pairs to accommodate axial forces in both directions.

Needle Roller Bearings: Needle bearings are a special type of cylindrical roller bearing that contains long, thin rolling elements, known as needle rollers. The ratio of diameter to length is between 1:3 and 1:10. Needle bearings have a high load rating and are only suitable for radial forces. In confined spaces, needle bearings can be a good solution.

Metal: Small and medium sized roller bearings use pressed steel cages while high strength roller bearings use carbon steel. Besides these two, depending on the application, nickel, chromium and molybdenum steel are also used mainly in aircraft.

Steel: Steel is used as the main material for roller bearings and ball bearings for both the rolling components and the rings. However, some industrial cases require other properties such as higher corrosion resistance, porosity, cost savings, scuffing resistance, lightweight materials and high durability. Some of the steel roller bearings are made of high carbon chromium bearing steel, carburizing steel and corrosion resistant bearing steel. Steel roller bearings are widely used in heavy machinery.

Resin: A lightweight cage uses resin as a material as it is easy to form into complicated shapes. Although it has lower heat resistance, an application that requires less heat and strength benefits from this property.

Synthetic Rubber: Synthetic rubber with high heat resistance is usually used as a material for roller bearing seals. There are different types of rubber with their properties suitable for the respective applications such as nitrile rubber which has high heat, wear and oil resistance and is suitable for operating temperature of -20 to 120°C. Acrylic rubber has excellent oil resistance and also has the highest heat resistance for rubber. The operating temperature range is -15 to 150°C. Fluororubber is a material with excellent heat, oil and chemical resistance and the operating temperature range is -20 to 230°C.

Ceramic: Ceramic roller bearings are manufactured to produce a highly corrosion resistant and durable bearing using two ceramic rings and a fluororesin retainer. The advantages of using ceramic roller bearings are high hardness, corrosion resistance, durability, light weight, high temperature resistance, low density and low maintenance as no lubrication is required. The applications for ceramic roller bearings are often in high speed and corrosive environments.

Automotive: The automotive segment has dominated the market in 2024. The technological environment is rapidly changing, steering us toward electric and autonomous vehicles while simultaneously increasing production and stimulating the economy. This transition necessitates the development of engines that are lighter yet more resilient, as manufacturers place greater emphasis on performance and fuel efficiency. This is accelerating the development of sophisticated engine technologies with high compression ratios and fast-rotating components. Furthermore, vehicle electrification is boosting the growth. To endure high speeds, electric vehicle motors and gearboxes require high-performance bearings.

Aerospace: The aviation industry is yet another end user that utilizes the rolling element bearings. The growth of the aerospace segment is due to the increasing interest in travel, the need to renew aging fleets while complying with strict environmental regulations, pressure on fuel prices, and the availability of new technologies to improve global and local transportation systems. As aircraft manufacturers develop new aircraft models with advanced engines and systems that provide better fuel efficiency, speed, and reliability, greater emphasis is being placed on long-life bearings.

Industrial Machinery: Industrial machinery such as machine tools, pumps and compressors, and electric motors also adopt cylindrical roller bearings. In light of the growing need for precision and accuracy in contemporary industrial machinery, it is crucial to utilize bearings that can endure substantial loads without experiencing deformation. The effectiveness of bearings in electric motors is subject to various influences, including the operational environment, the demands of the load, and the unique design characteristics of the motor itself. Electric motors typically use roller bearings. In mining and construction machinery, the use of bearings is important. Mining and construction machinery typically operate in harsh and difficult environments such as high loads, high shock, high vibration, and dust. Therefore, roller bearings are used because of their extremely durable and high load capacity, impact resistance, wear resistance, high sealing properties, and other properties to reduce equipment downtime and ensure reliable and smooth operation, so that the machinery operates at its best.

Others: Other applications include agriculture, railroads, and energy. In agriculture, rolling element bearings enable smooth rotation of threshing components and effective separation of grains from the stalks of the crop. Because they can withstand the high loads and dynamic forces of threshing, bearings ensure reliable performance and minimize downtime. Rolling element bearings, which use rolling components like balls or cylinders to efficiently carry loads, are essential in the railway industry. By reducing friction, this design makes operating smooth, especially in high-speed settings like locomotives. Although these bearings have advantages, they can produce noise and may require more regular maintenance than other bearing types in the market. Having effective bearings on generator sets enhances energy sector efficiency. They rely on providing long-term dependability along with high preciseness, both of and they're essential for sustaining steady power output. This cutting-edge innovation is necessary for backing up an uninterrupted and flawless operation of electrical infrastructure.

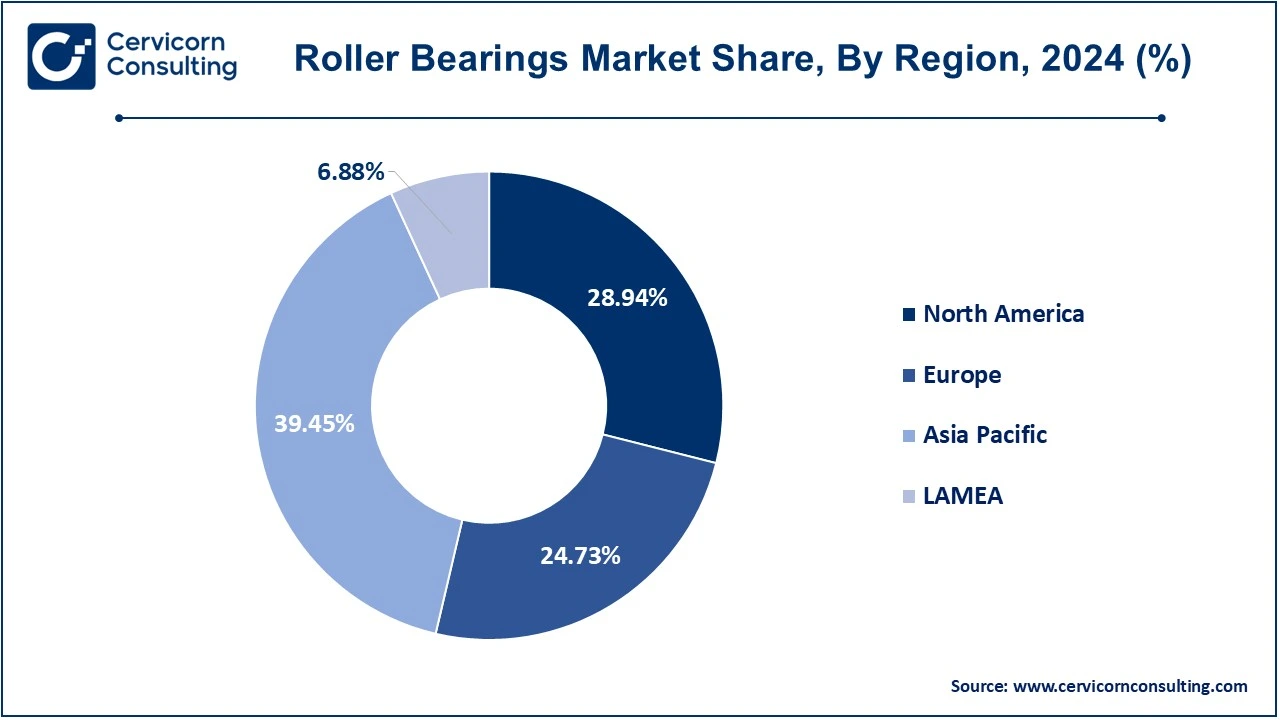

The roller bearings market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

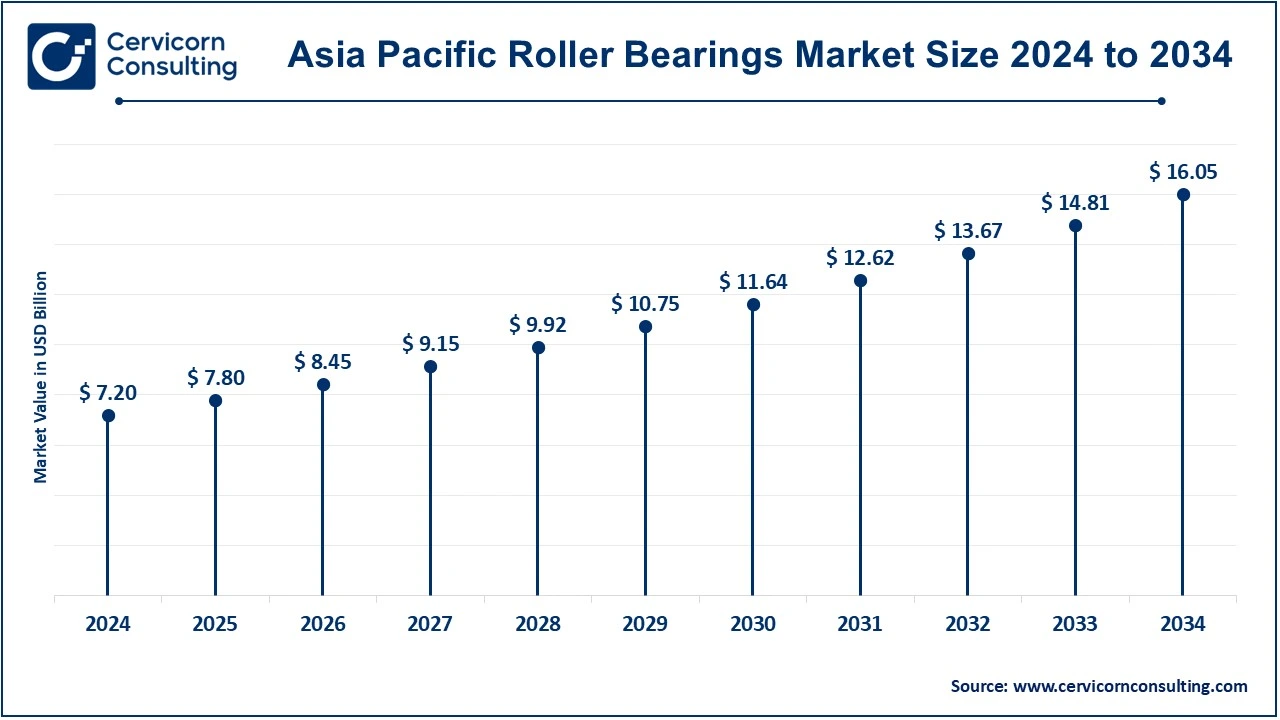

The Asia-Pacific roller bearings market size was accounted for USD 7.20 billion in 2024 and is predicted to surpass around USD 16.05 billion by 2034. In countries like China, India, Japan, and South Korea, the market is growing rapidly due to a variety of factors, including as the growth of infrastructure, urbanization, and industrialization. Numerous industries, which include production process, mineral extraction, engineering, and the automobile industries, place emphasis on these bearings. The advancement of the rolling bearing industries in Asia is severely influenced by China, a major technological marketplace. The criterion for cylindrical roller bearings has enhanced significantly to China's fast economic boom, notably in the automobile sector. Increasing regional use of machinery and automation in various industries has increased the demand for cylindrical roller bearings.

The North America roller bearings market size was valued at USD 5.28 billion in 2024 and is expected to reach around USD 11.77 billion by 2034. Numerous variables such as industrial expansion, technological advancements, and demand from various industries including automotive, aerospace, and engineering industries influence the market in North America. Due to their large radial load capacity and relatively low friction, these bearings are an important part of various applications. SKF, Timken Company, NSK Ltd., NTN Corporation, and Schaeffler AG are worldwide leaders in this region. Product quality, pricing, and distribution tactics all have an impact on market dynamics and innovation, making competition among these enterprises critical.

The Europe roller bearings market size was valued at USD 4.51 billion in 2024 and is projected to hit around USD 10.06 billion by 2034. The European market is projected to experience positive growth due to Industry 4.0 and new manufacturing facilities such as warehouses and distribution centers. The growth of the rolling bearing market in Europe is further driven by the sales and production of electric and hybrid cars, and the expansion and growth of the automotive and automotive industries. In addition, to increase the reliability of the final product, manufacturers are developing innovative bearing assemblies that incorporate bearing connection components, thereby improving bearing performance. In addition, advances in bearing technology, including maintenance monitoring and data sharing, are constantly being researched and developed for wider applications in the future. In addition, smart bearings are being used in key sectors such as defense, rail and aerospace to reduce replacement frequency and cut overhead costs.

The LAMEA roller bearings market was valued at USD 1.25 billion in 2024 and is anticipated to reach around USD 2.80 billion by 2034. The market in Latin America is experiencing steady growth, driven by increasing industrialization and expansion of key sectors such as automotive, mining, energy and construction. There are many local bearing manufacturers in Latin America, but the region is highly dependent on global imports to meet demand. Key regional markets include Mexico, Brazil and Argentina, which import large volumes of bearings from leading international manufacturers. The Latin American market is heavily populated by large international companies such as SKF, NTN, Schaeffler, Timken and NSK. A growing oil and gas industry that requires robust roller bearings to withstand harsh working conditions and increase the reliability of drilling rigs, pipelines and refinery facilities is expected to drive rapid growth of the Middle East and Africa market in the coming years. Additionally, the growing significance of green energy sources like solar and wind contributes to the need for rolling bearings in the businesses which generate solar panels and wind turbines. Furthermore, growing development in the MEA area is creating new prospects in the rolling bearings industry. Moreover, growing applications in the industrial and mining sectors are propelling market growth, particularly in South Africa and Nigeria.

Large companies in the sector are always spending money on research and development to improve the overall quality of their products. In order to create the ideal product that precisely satisfies consumer expectations, several well-known rolling bearing industry participants are spending enormous sums of money on research and development. The growing demand for higher performance in applications is expected to be a major driver for the growth of the rolling bearing industry. In February 2023, the US-based rolling bearing manufacturer The Timken acquired American Roller Bearing Company for an undisclosed amount. With this acquisition, Timken aims to expand its portfolio of engineered bearing solutions, strengthen its market presence in the US, and enhance its competitive position through ARB’s established aftermarket business and customer base.

Key players in the roller bearings industry are pivotal in delivering a variety of innovative construction solutions, such as prefabrication techniques, sustainable materials, and advanced digital technologies.

Market Segmentation

By Type

By Material

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Roller Bearings

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Material Overview

2.2.3 By Application Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Roller Bearings Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rise of industrial automation

4.1.1.2 Growing interest in robots and electric cars

4.1.2 Market Restraints

4.1.2.1 Premature Failures

4.1.2.2 Availability of Counterfeits

4.1.3 Market Challenges

4.1.3.1 Improper Lubrication

4.1.3.2 Concerns with fake brinelling effects are growing

4.1.4 Market Opportunities

4.1.4.1 Electrification and Hybridization Transition

4.1.4.2 Developing specialized and application-focused solutions

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Roller Bearings Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Roller Bearings Market, By Type

6.1 Global Roller Bearings Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Spherical Roller Bearings

6.1.1.2 Cylindrical Roller Bearings

6.1.1.3 Tapered Roller Bearings

6.1.1.4 Needle Roller Bearings

6.1.1.5 Ball Bearings

Chapter 7. Roller Bearings Market, By Material

7.1 Global Roller Bearings Market Snapshot, By Material

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Metal

7.1.1.2 Steel

7.1.1.3 Resin

7.1.1.4 Synthetic Rubber

7.1.1.5 Ceramic

Chapter 8. Roller Bearings Market, By Application

8.1 Global Roller Bearings Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Automotive

8.1.1.2 Aerospace

8.1.1.3 Industrial Machinery

8.1.1.4 Others

Chapter 9. Roller Bearings Market, By Region

9.1 Overview

9.2 Roller Bearings Market Revenue Share, By Region 2024 (%)

9.3 Global Roller Bearings Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Roller Bearings Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Roller Bearings Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Roller Bearings Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Roller Bearings Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Roller Bearings Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Roller Bearings Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Roller Bearings Market, By Country

9.5.4 UK

9.5.4.1 UK Roller Bearings Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Roller Bearings Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Roller Bearings Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Roller Bearings Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Roller Bearings Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Roller Bearings Market, By Country

9.6.4 China

9.6.4.1 China Roller Bearings Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Roller Bearings Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Roller Bearings Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Roller Bearings Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Roller Bearings Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Roller Bearings Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Roller Bearings Market, By Country

9.7.4 GCC

9.7.4.1 GCC Roller Bearings Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Roller Bearings Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Roller Bearings Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Roller Bearings Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 Schaeffler India Limited

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 JTEKT India Limited

11.3 NRB Bearings Limited

11.4 SKF

11.5 Menon Bearings Ltd.

11.6 SNL Bearings Limited

11.7 NTN Corporation

11.8 Nachi-Fujikoshi Corp

11.9 Bimetal Bearings Limited

11.10 National Engineering Industries Ltd (NEI)

11.11 Boca Bearings

11.12 Kennametal India Limited

11.13 IKO International Inc.

11.14 MBP Bearings Ltd.

11.15 BMW Motorrad

11.16 HCH Bearing

11.17 RBC Bearings Incorporated

11.18 Harbin Bearing Manufacturing Co. Ltd

11.19 Zhejiang Tianma Bearing Group

11.20 Galaxy Bearings Limited

11.21 Fersa Bearings