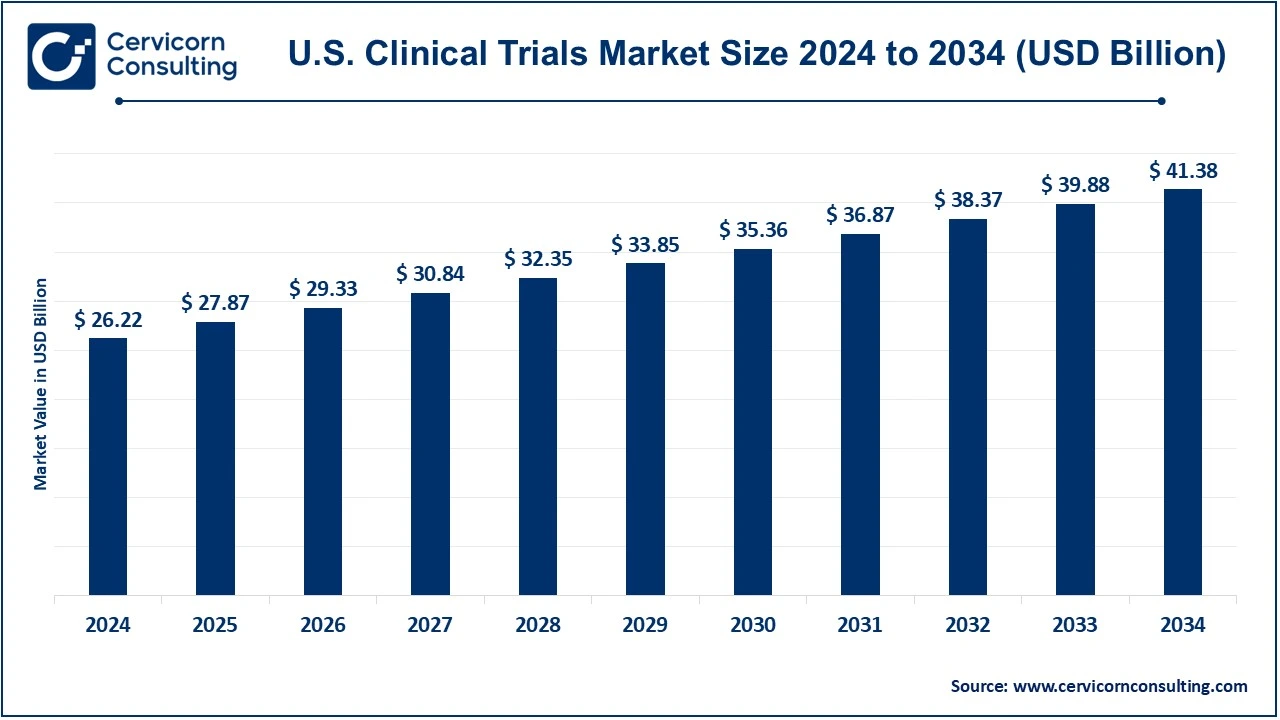

The U.S. clinical trials market size was valued at USD 26.11 billion in 2024 and is expected to be worth around USD 41.22 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.61% over the forecast period 2025 to 2034.

Robust growth is expected in the U.S. clinical trials market due to rising demands for innovative therapies, improvements in medical research, and increasing prevalence rates of chronic diseases. Other factors driving market growth are the advent of personalized medicine, deployment of AI and big data analytics, and focus on the treatment of rare diseases. In addition, decentralization and virtualization of clinical trials as well as the favourable regulatory framework create massive tailwinds in the growth of the market and improve its accessibility and efficiency for conducting clinical research.

Clinical trials are studies conducted among human subjects aiming at proving the safety, effectiveness, and adverse effects of any kind of medical treatment, drug, device, or intervention. In most cases, these trials are well-systematized and structured into different phases to collect information on how a particular treatment performs in real-world conditions. Clinical trials are helpful in the determination of the effectiveness or safety of a new treatment over existing ones, hence forming an integral part of the process for any new medical therapy. The patients are monitored closely, and findings from such experiments inform medical guidelines as well as regulatory decisions made by bodies such as the FDA.

Report Highlights

CEO Statements

Ari Bousbib, CEO of IQVIA

"The future of clinical trials is being shaped by the integration of real-world data, advanced analytics, and artificial intelligence. At IQVIA, we are working to transform the clinical development process by making it more efficient, diverse, and patient-centric, ensuring that therapies reach the people who need them most, faster and more effectively."

Peyton Howell, CEO of PAREXEL International Corporation

"At PAREXEL, we are deeply committed to advancing medical innovation through the rigorous and ethical conduct of clinical trials. These trials are the cornerstone of developing new therapies that can transform patient lives. We understand that clinical trials are not just about gathering data—they are about providing hope, improving healthcare outcomes, and ensuring that patients have access to the safest and most effective treatments. Our mission is to collaborate with our partners to streamline the clinical development process, accelerate time-to-market, and uphold the highest standards of safety and integrity in every trial we conduct."

Marc N. Casper, CEO of Thermo Fisher Scientific Inc.

"At Thermo Fisher Scientific, we are committed to enabling the acceleration of scientific discovery and advancing the development of innovative therapies. Through our integrated solutions, from early-stage research to commercial manufacturing, we help our customers navigate the complex landscape of clinical trials. By providing cutting-edge technologies, data insights, and expertise, we empower biopharmaceutical companies to bring new treatments to market faster and with greater precision, ultimately improving patient outcomes."

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 26.11 Billion |

| Expected Market Size in 2034 | USD 41.22 Billion |

| Projected CAGR | 4.61% |

| Key Segments | Phase, Study, Indication, Service, Sponsor |

| Key Companies | IQVIA, Fortrea Inc., PAREXEL International Corporation, Thermo Fisher Scientific Inc., Charles River Laboratories, ICON Plc, Wuxi AppTec Inc., Medpace, Syneos Health, AstraZeneca, Merck & Co., Eli Lilly and Company, Novo Nordisk A/S, Pfizer, Caidya |

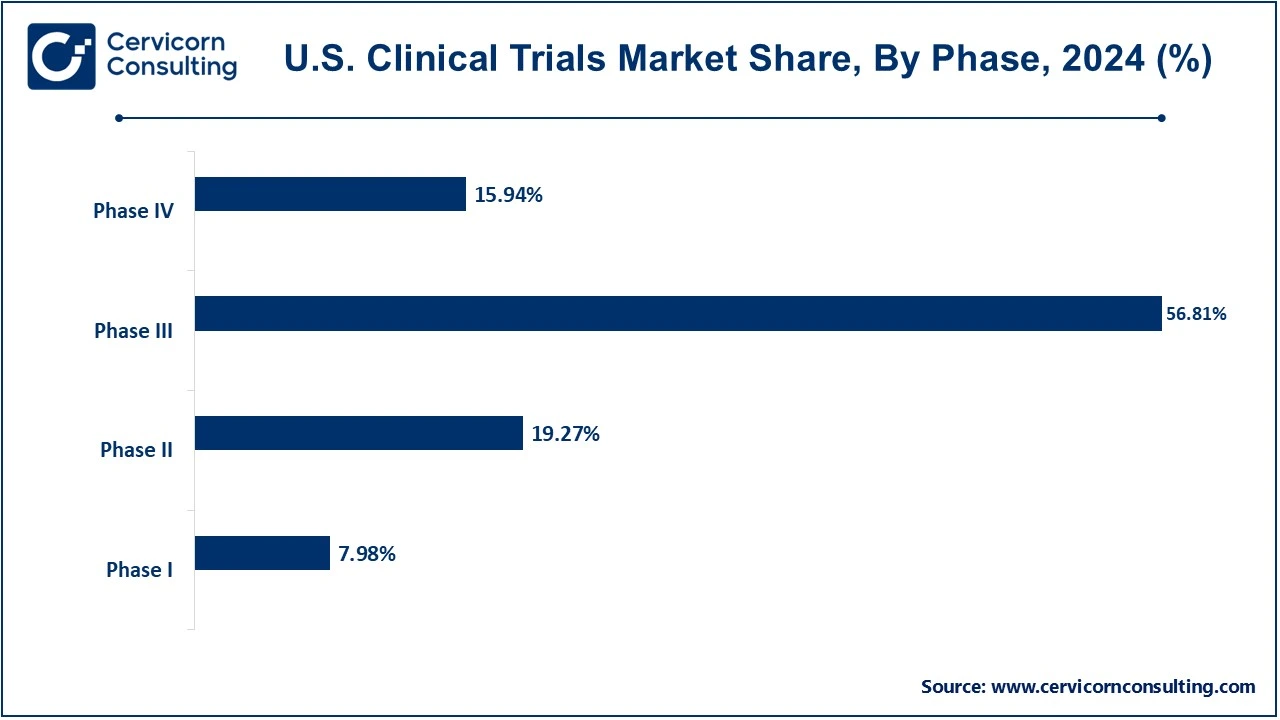

The U.S. clinical trials market is segmented into phase, study, indication, service, and sponsor. Based on phase, the market is classified into phase I, phase II, phase III, and phase IV. Based on study design, the market is classified into interventional, observational, and expanded access. Based on indication, the market is classified into autoimmune/inflammation, pain management, oncology, CNS conditions, diabetes, obesity, cardiovascular, and others. Based on service, the market is classified into protocol designing, patient recruitment, site identification, bioanalytical testing services, laboratory services, clinical trial data management services and others. Based on sponsor, the market is classified into pharmaceutical & biopharmaceutical companies, medical device companies, and others.

The phase III segment has accounted highest revenue share in 2024. Also, the phase I segment is projected to witness highest growth during the analysis period.

Interventional Trials: Interventions are active treatments given to assess their effect on patients. Here, trials involve the assignment of participants to different treatment arms. Experimental drugs, devices, or procedures are tested within some treatment arms, and subjects' outcomes are compared against a control group, typically receiving a placebo, standard treatment, or possibly an active comparator. These trials are conducted to assess the efficacy, safety, and optimal dosages of new therapies. Interventions are important studies for advancing medical care and marketing new treatments across many therapeutic areas.

Observational Studies: Focus on observing and documenting participants' results without intervention or experiment. They collect data by way of naturalistic observation, which contributes to understanding the progression of diseases, risk factors, or treatment effects in real life. The participants in the observational studies do not receive any prescribed treatment or procedure since it is an interventional trial. This strategy is often applied to monitor the efficacy of current treatments and realize emerging patterns of disease while investigating possible environmental or genetic factors in health results.

Expanded Access Trials: Expanded access, also called compassionate use, permits patients with life-threatening or serious conditions to receive an investigational drug outside of an investigation when there are no satisfactory alternatives. It is to enable early access to potentially life-saving drugs before they are approved by the regulatory agencies. Although expanded access trials are not used to collect formal data, they represent a potential alternative for patients who need an intervention in desperate times and are a part of ongoing safety and efficacy assessments of the investigational therapy.

Autoimmune/Inflammation: Autoimmune and inflammatory diseases, including rheumatoid arthritis, lupus, and multiple sclerosis, constitute a state in which the immune system attacks the body's tissues, leading to chronic inflammation. Clinical trials in the space test new therapies aimed at reducing inflammation, modulating immune responses, and preventing tissue damage. Advances in biologics, such as monoclonal antibodies and immune checkpoint inhibitors, and the ever-growing understanding of the immune system, are changing the face of treatment options for autoimmune disorders and driving new clinical research innovation.

Pain Management: Pain management trials focus on developing and testing therapies for acute and chronic pain, including pain related to conditions like arthritis, neuropathy, and cancer. These studies are meant to assess novel pain medications, medical devices or non-pharmacologic treatments like nerve stimulators and/or cognitive-behavioral therapy. The opioid epidemic has generated increased research into non-addictive alternatives to traditional opioids, fostering the phenomenal growth in novel approaches for pain management conducted in clinical trials seeking improvements in patients' quality of life and reducing dependence on opioids.

CNS Disorders: CNS-related diseases and conditions encompass neurodegenerative disorders like Alzheimer's, Parkinson's, and Huntington's disease; mental health disorders include depression and schizophrenia. An important set of clinical studies on new drugs, therapies, and devices focused on modifying the pathogenesis of these diseases, or alleviating their symptoms altogether and enhancing brain function. CNS trials are very long-term, highly challenging, and require specialized techniques due to the complexity of the brain and its diseases. However, these are critical for addressing unmet medical needs in these growing patient populations.

Diabetes: Diabetes, assess new treatments and interventions for managing blood glucose levels, improving insulin sensitivity, and preventing complications resulting from diabetes, including kidney damage, neuropathy, cardiovascular disease, among others. These studies are crucial as they forward therapies, such as insulin analogs, GLP-1 receptor agonists, and novel oral medications, to control the disease, thereby fostering patient outcome improvements. As type 2 diabetes continues to rise in U.S. populations, diabetes studies are integral to getting the burden of this chronic illness under control in healthcare systems.

Obesity: Obesity, investigate new and potentially innovative treatments that may reduce body weight, thus enhancing associated health outcomes like low risks for diabetes, hypertension, and cardiovascular diseases. The treatment options under clinical trials usually entail medicinal interventions, lifestyle interventions, or surgical interventions like bariatric surgery. Given the rising obesity levels in the U.S., clinical research in the obesity domain is essential to find effective weight-reduction therapies as well as in controlling the increasing demand for obesity management and ultimately reducing the healthcare costs linked to disease conditions caused by obesity.

Cardiovascular: Cardiovasculars are essential to develop new therapies designed to prevent or treat heart disease, hypertension, stroke, and associated disorders. These trials typically assess drugs, devices (such as stents or pacemakers), and lifestyle interventions to prevent heart attacks; control cholesterol levels; and improve the functioning of the heart. Heart disease is the nation's number one killer, so cardiovascular clinical trials are essential to improving patient outcomes and developing new methods to prevent, diagnose, or treat cardiovascular diseases across a broad population of patients.

The pharmaceutical & biopharmaceutical companies segment is leading the market. The medical device companies segment is expected to witness strong growth over the forcast period.

U.S. Clinical Trials Market Revenue Share, By Sponsor, 2024 (%)

| Sponsor | Revenue Share, 2024 (%) |

| Pharmaceutical & Biopharmaceutical Companies | 68.94% |

| Medical Device Companies | 19.35% |

| Others | 11.71% |

Some of the more recent product launches in the US clinical trials industry focused on the emerging trend of innovation and strategic collaboration between the industry leaders. These include some of the key players like IQVIA, Fortrea Inc., PAREXEL International Corporation, Thermo Fisher Scientific Inc., and Charles River Laboratories, which evolve their offerings with advanced technologies such as AI, data analytics, and automation to make clinical trial processes more efficient and accurate. Innovation has also been aimed at reducing the development time for drugs, thereby saving cost and enhancing patient recruitment and retention. Furthermore, because of the popularity of partnerships between CROs and pharmaceutical firms, drugs are being introduced into the market even faster, with a more tailored approach, which is what the healthcare sector needs.

Market Segmentation

By Phase

By Study

By Indication

By Service

By Sponsor

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Clinical Trials

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Phase Overview

2.2.2 By Study Design Overview

2.2.3 By Indication Overview

2.2.4 By Service Overview

2.2.5 By Sponsor Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Clinical Trials Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Patient demands for new treatments

4.1.1.2 Biopharma Investment Growth, in General

4.1.1.3 High Rates of Chronic Diseases

4.1.2 Market Restraints

4.1.2.1 Very Expensive to Conduct the Trials

4.1.2.2 Limited Exposure to Diverse Patient Populations

4.1.2.3 Financial and Budgetary Restrictions

4.1.3 Market Challenges

4.1.3.1 Recruitment and Retention

4.1.3.2 Innovating yet being Safe

4.1.3.3 Navigating Global Trials and Multinational Regulations

4.1.4 Market Opportunities

4.1.4.1 More adoptable digital health technologies

4.1.4.2 Focus on pediatric trials

4.1.4.3 Post-Market Surveillance and Real-World Evidence

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 U.S. Clinical Trials Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Clinical Trials Market, By Phase

6.1 U.S. Clinical Trials Market Snapshot, By Phase

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Phase I

6.1.1.2 Phase II

6.1.1.3 Phase III

6.1.1.4 Phase IV

Chapter 7. Clinical Trials Market, By Study

7.1 U.S. Clinical Trials Market Snapshot, By Study

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Interventional

7.1.1.2 Observational

7.1.1.3 Expanded Access

Chapter 8. Clinical Trials Market, By Indication

8.1 U.S. Clinical Trials Market Snapshot, By Indication

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Autoimmune/Inflammation

8.1.1.2 Pain Management

8.1.1.3 Oncology

8.1.1.4 CNS Conditions

8.1.1.5 Diabetes

8.1.1.6 Obesity

8.1.1.7 Cardiovascular

8.1.1.8 Others

Chapter 9. Clinical Trials Market, By Service

9.1 U.S. Clinical Trials Market Snapshot, By Service

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Protocol Designing

9.1.1.2 Patient Recruitment

9.1.1.3 Site Identification

9.1.1.4 Bioanalytical Testing Services

9.1.1.5 Laboratory Services

9.1.1.6 Clinical Trial Data Management Services

9.1.1.7 Others

Chapter 10. Clinical Trials Market, By Sponsor

10.1 U.S. Clinical Trials Market Snapshot, By Sponsor

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Pharmaceutical & Biopharmaceutical Companies

10.1.1.2 Medical Device Companies

10.1.1.3 Others

Chapter 11. Clinical Trials Market, By Region

11.1 Overview

11.2 U. S. Clinical Trials Market Revenue Share, 2024 (%)

11.3 U.S. Clinical Trials Market Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 IQVIA

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Fortrea Inc.

13.3 PAREXEL International Corporation

13.4 Thermo Fisher Scientific Inc.

13.5 Charles River Laboratories

13.6 ICON Plc

13.7 Wuxi AppTec Inc.

13.8 Medpace

13.9 Syneos Health

13.10 AstraZeneca

13.11 Merck & Co.

13.12 Eli Lilly and Company

13.13 Novo Nordisk A/S

13.14 Pfizer

13.15 Caidya