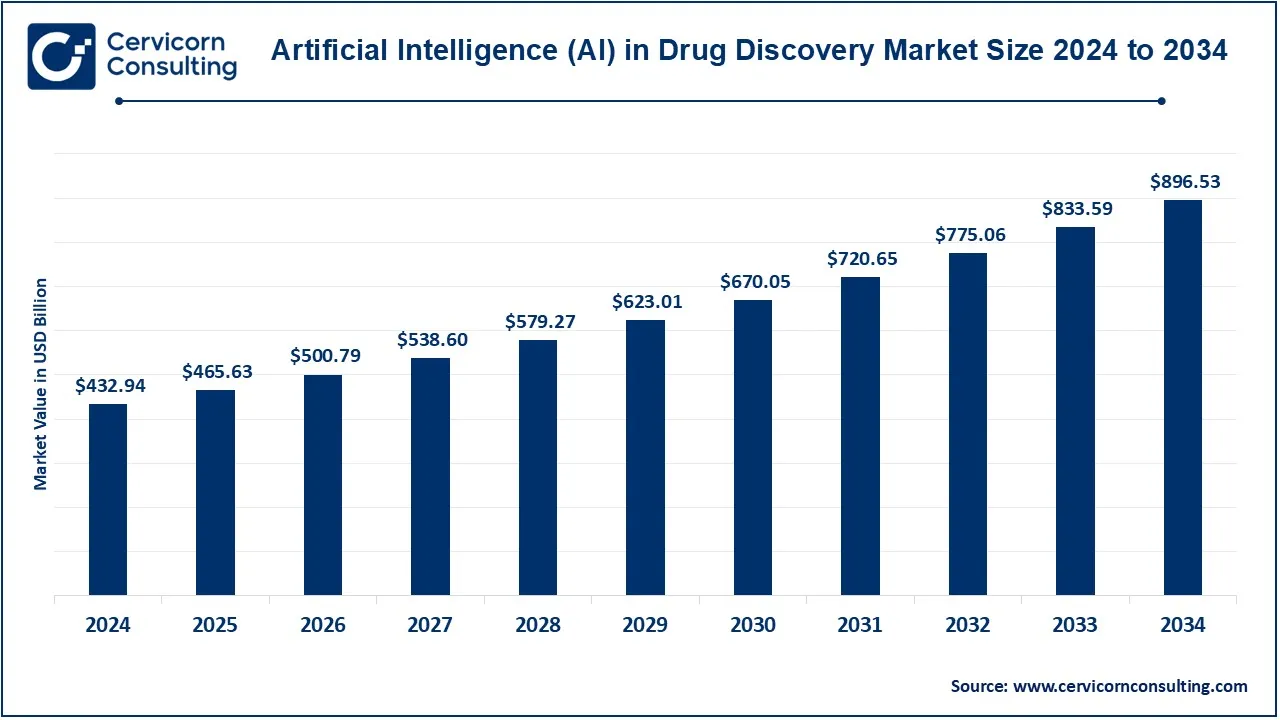

The global artificial intelligence (AI) in drug discovery market size was reached at USD 1.98 billion in 2024 and is expected to surpass around USD 20.31 billion by 2034, exhibiting at a compound annual growth rate (CAGR) of 26.21% over the forecast period 2025 to 2034.

There has been a significant growth in the artificial intelligence (AI) in drug discovery market. The increase in AI technology usage to achieve greater efficiencies and be faster in the process of drug development drives investment in AI-powered solutions by companies for target identification, optimizing a discovery of molecules and prediction of clinical trials outcomes, all to help accelerate the process and reduce time and costs normally incurred with traditional methods. Inclusion of machine learning, deep learning as well as natural language processing allows analyses of enormous datasets and discovers insights impossible otherwise.

Among the market boosting factors are an increased investment in biotechnology and pharmaceutical research and development, demand for precision medicine. Collaborations between technology companies and drug developers also increase hype and awareness in the market, with mentioned factors affecting the market in emerging economies. Although the industry suffers numerous challenges, including regulatory bottlenecks and data privacy concerns, they are expected to break through with advances in AI algorithms and also improvements in the power of computers, thus propelling the market further into transforming methods of drug discovery, thereby bringing innovations in the healthcare sector.

Guadalupe Hayes-Mota: CEO and Founder of Healr Solutions

“The biopharmaceutical industry stands on the cusp of a revolution, with artificial intelligence (AI) emerging as a transformative force in drug development. AI's ability to reduce the time and cost of bringing new drugs to market is not just a promise; it is becoming a reality.”

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 1.98 Billion |

| Projected Market Size in 2034 | USD 20.31 Billion |

| Expected CAGR 2025 to 2034 | 26.21% |

| Dominant Region | North America |

| High Growth Region | Asia Pacific |

| Key Segments | Therapeutic Area, Application, Offering, Technology, Use Case, Deployment, Process, Player Type, End Use, Region |

| Key Companies | IBM, Atomwise Inc., BenevolentAI, Berg Health, BioSymetrics, Inc., BPGbio Inc., CYCLICA, Exscientia, GNS Healthcare, Google, Insilico Medicine, insitro |

Integration of Genomics and AI

Increasing Government and Private Funding

High Implementation Costs

Data Privacy and Security Concern

Increased Adoption of AI in Drug Design

Emerging Technological Innovations in Biomarker Discovery

Regulatory and Ethical Challenges

Limited Access to Quality Data

Oncology: The Oncology segment has dominated the market in 2024. Oncology is one These therapeutic areas where AI has made much contribution to the development of drugs through discovery. AI is used to evaluate enormous pieces of data like genomic profiles and tumour biology, and from that information, develop new targets for the invention of new drugs and precision therapy. Very huge benefits of AI lie on its capability to discover "biomarkers," which used to steer almost any development of targeted treatment like these immunotherapies or personal cancer drugs. Not forgetting, the repurposing of already known medicines to be used differently for cancer types is much faster due to AI, as well as predicting how patients will respond to therapies.

Infectious Diseases: The forms of artificial intelligence that spread across different medical or life discovering areas such as discovery of new drugs in infectious diseases. It would lead to the rapid identification of novel therapeutics that are effective against bacterial, viral or parasitic infections that leave a disease behind. For example, the occurrence of global health crises like COVID-19 has put a greater spotlight on "timeliness," where AI played significant roles in repurposing drugs, developing vaccines, as well as increasing knowledge on pathogen behavior. For example, AI-based algorithms not only analyze pathogen genomes in record time, but also predict drug-resistance patterns and potential candidates for drug discovery.

Metabolic Diseases: Currently, using AI, drug discovery is becoming more advanced by applying it in the areas of metabolic diseases, which include diabetes and obesity, through analysis of complex biological networks, thereby finding novel therapeutic targets. Such diseases are typically managed with key and complex hypothalamic and metabolic pathways as well as peripheral organ functions in hormones, metabolism and organ functions. Normally, biological complexes are difficult to decipher and, therefore, difficult to treat using standard methods. AI tools convert multi-omics data such as genomic, proteomic and metabolomic data and enable discovering novel mechanisms of disease. AI increases efficacy by modelling metabolism interactions and predicts drug effectiveness and accelerates personalized therapies.

Cardiovascular Diseases: Cardiovascular diseases like hypertension, atherosclerosis, or even heart failures, are few of the paramount mortality rates around the world. Artificial Intelligence has brought a revolution in drug discovery methods for these diseases by evaluating large datasets compiled from electronic health records, imaging, and genetic studies, which can help identify additional drug targets and biomarkers for these diseases. Such AI algorithms virtually help simulate the effects of any candidate drug on cardiovascular systems and substitute preclinical experimentation.

Neurodegenerative Diseases: AI is increasingly proving its worth value in drug discoveries for neurodegenerative diseases that are very hard to treat, such as Alzheimer's, Parkinson's, and Huntington's disease. These diseases have pathways in the human brain that are by no means simple, and their understanding at molecular and cellular levels is hard to acquire. AI facilitates the investigations of large datasets of brain imaging with genetic and clinical trial data for new therapeutic targets. AI contributes to drug and clinical trials' design by prediction of disease trajectory and outcome.

Preclinical Testing: Drug discovery is continuously transformed by the artificial intelligence revolution that improves drug prediction concerning safety, efficacy, and toxicity before clinical trials. Traditional preclinical tests have animal studies that are usually very expensive and time-consuming and have a poor translation into humans. AI models use complex biological data including genomics, proteomics, and chemical properties of inform drugs on biological systems. This would enable the capture of earlier potential issues in the pipeline, minimizing animal models and increasing the success rate of clinical trials.

Artificial Intelligence (AI) In Drug Discovery Market Revenue Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Preclinical Testing | 28.80% |

| Drug Optimization and Repurposing | 53.40% |

| Others | 17.80% |

Drug Optimization & Repurposing: AI is an important part of drug optimization and repurposing by identifying potential new therapeutic indications for already existing drugs and improving the drug effect of drug candidates. In fact, an AI would analyze enormous amount of molecular structures, biological targets, and real patient data, to develop new indications for already approved drugs. Hence, it reduces development and costs of traditional drug discovery. More than this, AI even paves way for lead optimization through predicting modifications which enhance efficacy, minimize toxicity, or improve pharmacokinetics.

Based on end user, the market is segmented into pharmaceutical and biotechnology companies, contract research organization (CROs) and others. The pharmaceutical and biotechnology companies has dominated the market in 2024.

AI in Drug Discovery Market Revenue Share, By End User, 2024 (%)

| End User | Revenue Share, 2024 (%) |

| Pharmaceutical and biotechnology companies | 61.7% |

| Contract research organization (CROs) | 26.4% |

| Others | 11.90% |

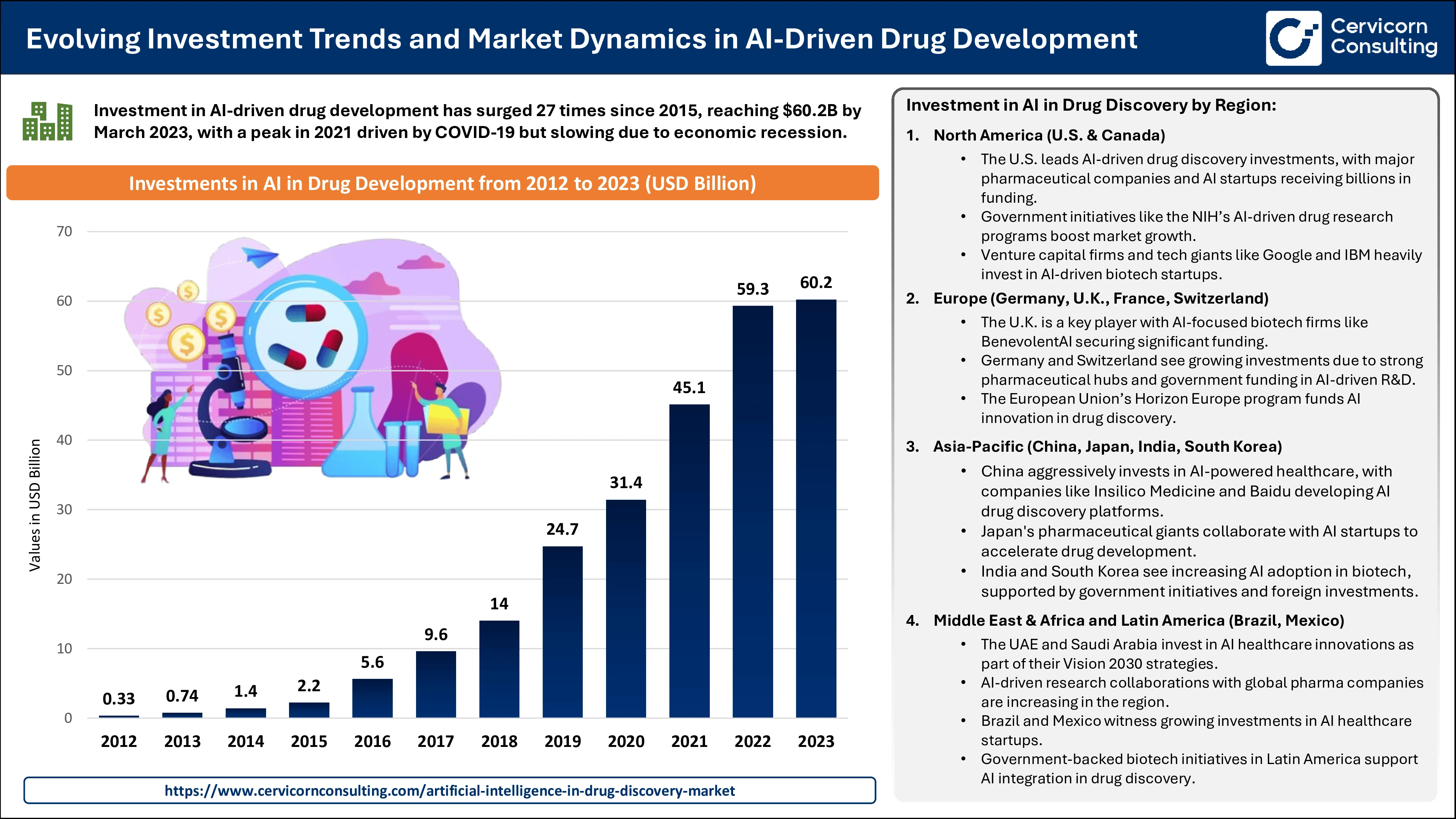

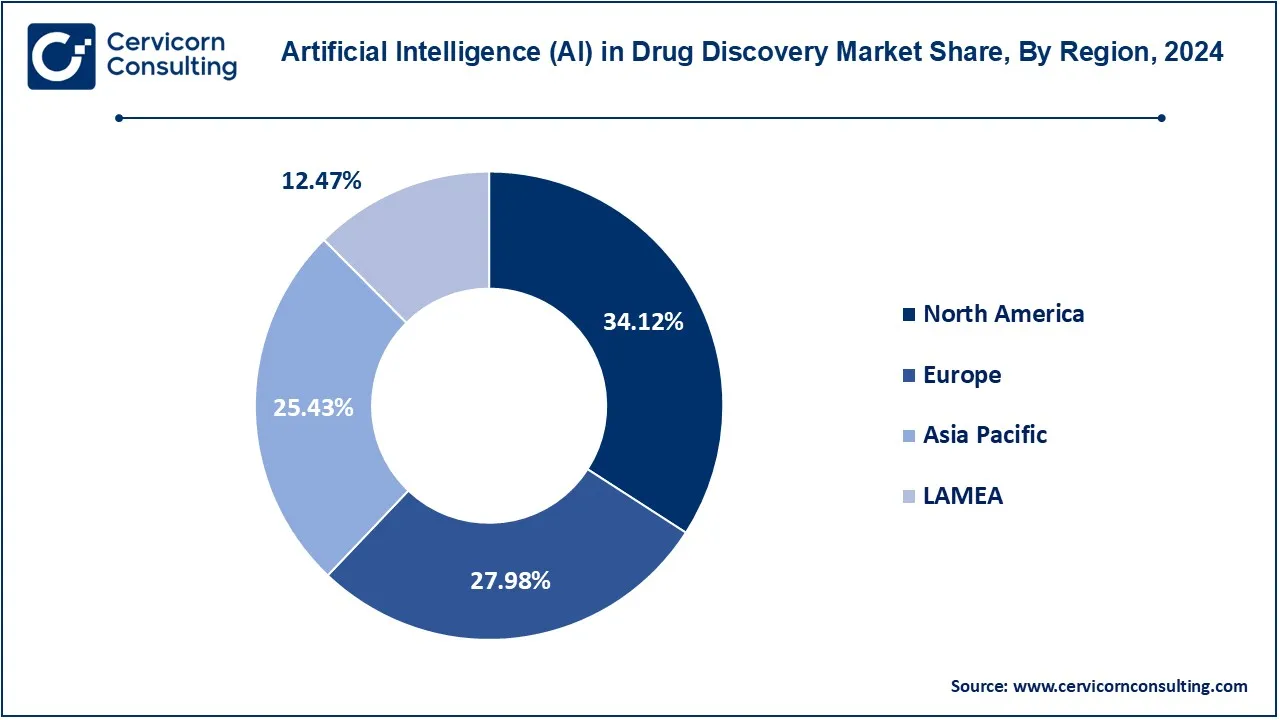

The AI in drug discovery market is segmented into various regions, including North America, Europe, Asia-Pacific, andLAMEA. Here is a brief overview of each region:

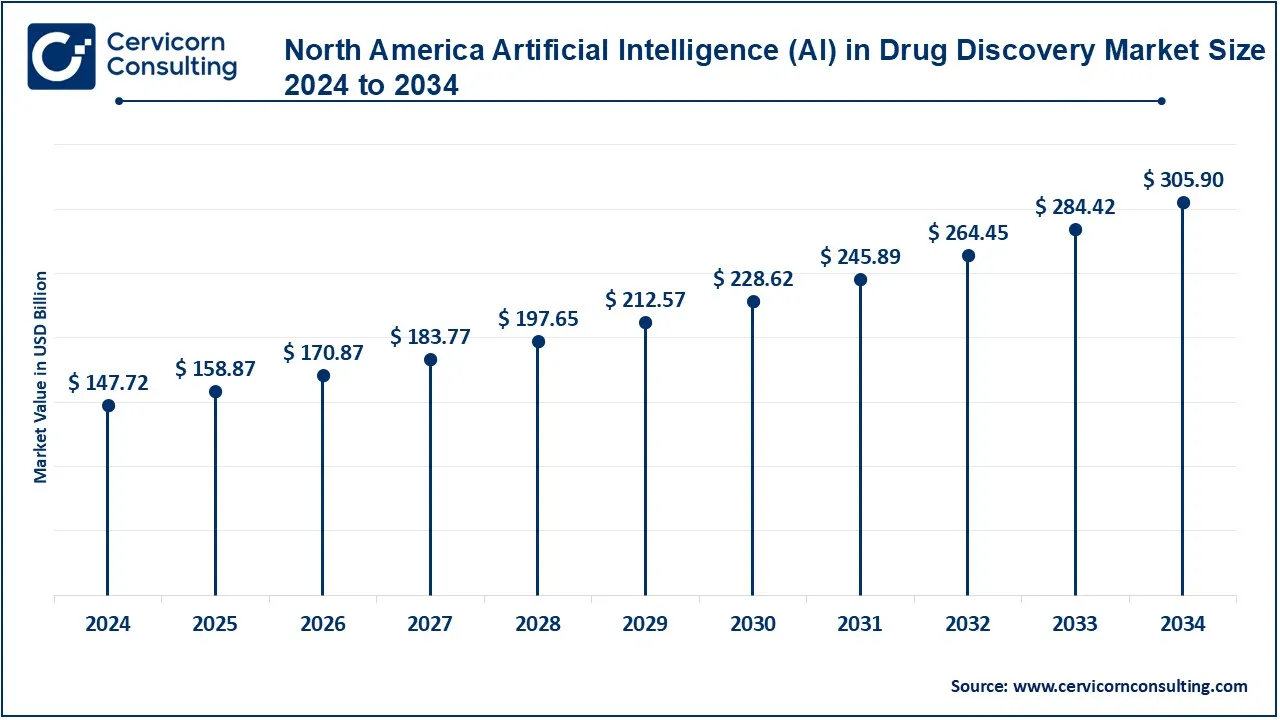

The North America AI in drug discovery market size was reached at USD 1.14 billion in 2024 and is expected to reach around USD 11.70 billion by 2034. North America is leading the market owing to the enormous investments in pharmaceutical research, sufficient advanced healthcare infrastructure, and greater use of innovative technologies. Moreover, the region has a number of biotech companies, research institutions, and leading pharmaceutical companies that focus on utilizing AI in drug discovery processes.

The Europe AI in drug discovery market size was accounted for USD 0.42 billion in 2024 and is projected to hit around USD 4.35 billion by 2034. Europe is propelled by well-built respective pharmaceuticals and biotechnology industries. In addition, the region enjoys large funding from its governments in AI and health research while building collaborations between academic institutions, start-ups, and major pharmaceutical companies. Germany, U.K., and France are top countries absorbing the technologies of AI in drug discovery.

The Asia Pacific AI in drug discovery market size was estimated at USD 0.28 billion in 2024 and is predicted to reach around USD 2.86 billion by 2034. Asia-Pacific region is growing very fast in the market. The government decides to invest massively in healthcare and technology, China, Japan, and India are few countries on the front lines using AI to simplify drug discovery as they are challenged by rising chronic diseases. Government promotions on fresh initiatives of AI innovation and growing biotechnological industry in the region are some of the key elements powering market growth.

The LAMEA AI in drug discovery market was valued at USD 0.16 billion in 2024 and is anticipated to reach around USD 1.60 billion by 2034. The region known as LAMEA now gradually undergoes actualization of what AI can do in drug discovery as investments in healthcare increase and people learn about the promise of AI. Advancements are being seen in Latin America, especially Brazil, as local universities and international organizations collaborate to achieve biomedical innovation. In the Middle East, the UAE and Saudi Arabia are focusing on channeling investment into AI research as part of wider moves to modernize healthcare.

The new entrants in AI drug discovery leverage new technologies to disrupt the traditional drug development processes. The technology focuses on predictive modelling, drug repurposing, and biomarker discovery. For target identification, lead compound optimization, time, and cost reduction in conventional drug discovery, advanced AI algorithms, machine learning, and big data analytics are used. Most of these incoming firms are opting for strategic partnerships with an already-existing pharmaceutical company so that they could combine clinical and market knowledge with AI expertise. New entrants also try out some innovative business models such as offering an AI platform as a service or collaborating with others on risk-sharing agreements, wherein the rewards would be tied to the success of the drug. Additionally, these players emphasize cloud computing, real-world data integration, and multi-omics analysis, allowing for scalable solutions.

Market Segmentation

By Therapeutic Area

By Application

By Offering

By Technology

By Use Case

By Deployment

By Process

By Player Type

By End Use

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of AI in Drug Discovery

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Therapeutic Area Overview

2.2.2 By Application Overview

2.2.3 By Offering Overview

2.2.4 By Technology Overview

2.2.5 By Use Case Overview

2.2.6 By Deployment Overview

2.2.7 By Process Overview

2.2.8 By Player Type Overview

2.2.9 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on AI in Drug Discovery Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Integration of Genomics and AI

4.1.1.2 Increasing Government and Private Funding

4.1.2 Market Restraints

4.1.2.1 High Implementation Costs

4.1.2.2 Data Privacy and Security Concern

4.1.3 Market Opportunities

4.1.3.1 Increased Adoption of AI in Drug Design

4.1.3.2 Emerging Technological Innovations in Biomarker Discovery

4.1.4 Market Challenges

4.1.4.1 Regulatory and Ethical Challenges

4.1.4.2 Limited Access to Quality Data

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global AI in Drug Discovery Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. AI in Drug Discovery Market, By Therapeutic Area

6.1 Global AI in Drug Discovery Market Snapshot, By Therapeutic Area

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Oncology

6.1.1.2 Infectious Disease

6.1.1.3 Metabolic Disease

6.1.1.4 Cardiovascular Disease

6.1.1.5 Neurodegenerative Disease

6.1.1.6 Others

Chapter 7. AI in Drug Discovery Market, By Application

7.1 Global AI in Drug Discovery Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Preclinical Testing

7.1.1.2 Drug Optimization and Repurposing

7.1.1.3 Others

Chapter 8. AI in Drug Discovery Market, By Offering

8.1 Global AI in Drug Discovery Market Snapshot, By Offering

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Software

8.1.1.2 Services

Chapter 9. AI in Drug Discovery Market, By Technology

9.1 Global AI in Drug Discovery Market Snapshot, By Technology

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Machine learning

9.1.1.2 Natural Language Processing (NLP)

9.1.1.3 Computer Vision

9.1.1.4 Others

Chapter 10. AI in Drug Discovery Market, By Use Case

10.1 Global AI in Drug Discovery Market Snapshot, By Use Case

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Drug Repurposing

10.1.1.2 De Novo Drug Design

10.1.1.3 Drug Optimization

10.1.1.4 Safety and Toxicity

Chapter 11. AI in Drug Discovery Market, By Deployment

11.1 Global AI in Drug Discovery Market Snapshot, By Deployment

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

11.1.1.1 On-premise

11.1.1.2 Cloud Based

11.1.1.3 SaaS-Based

Chapter 12. AI in Drug Discovery Market, By Process

12.1 Global AI in Drug Discovery Market Snapshot, By Process

12.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

12.1.1.1 Target

12.1.1.2 Lead

Chapter 13. AI in Drug Discovery Market, By End User

13.1 Global AI in Drug Discovery Market Snapshot, By End User

13.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

13.1.1.1 Pharmaceutical and biotechnology companies

13.1.1.2 Contract research organization (CROs)

13.1.1.3 Others

Chapter 14. AI in Drug Discovery Market, By Player Type

14.1 Global AI in Drug Discovery Market Snapshot, By Player Type

14.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

14.1.1.1 End-To-End Solution Providers

14.1.1.2 Niche/Point Solution Providers

14.1.1.3 Business Process Service Providers

Chapter 15. AI in Drug Discovery Market, By Region

15.1 Overview

15.2 AI in Drug Discovery Market Revenue Share, By Region 2024 (%)

15.3 Global AI in Drug Discovery Market, By Region

15.3.1 Market Size and Forecast

15.4 North America

15.4.1 North America AI in Drug Discovery Market Revenue, 2022-2034 ($Billion)

15.4.2 Market Size and Forecast

15.4.3 North America AI in Drug Discovery Market, By Country

15.4.4 U.S.

15.4.4.1 U.S. AI in Drug Discovery Market Revenue, 2022-2034 ($Billion)

15.4.4.2 Market Size and Forecast

15.4.4.3 U.S. Market Segmental Analysis

15.4.5 Canada

15.4.5.1 Canada AI in Drug Discovery Market Revenue, 2022-2034 ($Billion)

15.4.5.2 Market Size and Forecast

15.4.5.3 Canada Market Segmental Analysis

15.4.6 Mexico

15.4.6.1 Mexico AI in Drug Discovery Market Revenue, 2022-2034 ($Billion)

15.4.6.2 Market Size and Forecast

15.4.6.3 Mexico Market Segmental Analysis

15.5 Europe

15.5.1 Europe AI in Drug Discovery Market Revenue, 2022-2034 ($Billion)

15.5.2 Market Size and Forecast

15.5.3 Europe AI in Drug Discovery Market, By Country

15.5.4 UK

15.5.4.1 UK AI in Drug Discovery Market Revenue, 2022-2034 ($Billion)

15.5.4.2 Market Size and Forecast

15.5.4.3 UKMarket Segmental Analysis

15.5.5 France

15.5.5.1 France AI in Drug Discovery Market Revenue, 2022-2034 ($Billion)

15.5.5.2 Market Size and Forecast

15.5.5.3 FranceMarket Segmental Analysis

15.5.6 Germany

15.5.6.1 Germany AI in Drug Discovery Market Revenue, 2022-2034 ($Billion)

15.5.6.2 Market Size and Forecast

15.5.6.3 GermanyMarket Segmental Analysis

15.5.7 Rest of Europe

15.5.7.1 Rest of Europe AI in Drug Discovery Market Revenue, 2022-2034 ($Billion)

15.5.7.2 Market Size and Forecast

15.5.7.3 Rest of EuropeMarket Segmental Analysis

15.6 Asia Pacific

15.6.1 Asia Pacific AI in Drug Discovery Market Revenue, 2022-2034 ($Billion)

15.6.2 Market Size and Forecast

15.6.3 Asia Pacific AI in Drug Discovery Market, By Country

15.6.4 China

15.6.4.1 China AI in Drug Discovery Market Revenue, 2022-2034 ($Billion)

15.6.4.2 Market Size and Forecast

15.6.4.3 ChinaMarket Segmental Analysis

15.6.5 Japan

15.6.5.1 Japan AI in Drug Discovery Market Revenue, 2022-2034 ($Billion)

15.6.5.2 Market Size and Forecast

15.6.5.3 JapanMarket Segmental Analysis

15.6.6 India

15.6.6.1 India AI in Drug Discovery Market Revenue, 2022-2034 ($Billion)

15.6.6.2 Market Size and Forecast

15.6.6.3 IndiaMarket Segmental Analysis

15.6.7 Australia

15.6.7.1 Australia AI in Drug Discovery Market Revenue, 2022-2034 ($Billion)

15.6.7.2 Market Size and Forecast

15.6.7.3 AustraliaMarket Segmental Analysis

15.6.8 Rest of Asia Pacific

15.6.8.1 Rest of Asia Pacific AI in Drug Discovery Market Revenue, 2022-2034 ($Billion)

15.6.8.2 Market Size and Forecast

15.6.8.3 Rest of Asia PacificMarket Segmental Analysis

15.7 LAMEA

15.7.1 LAMEA AI in Drug Discovery Market Revenue, 2022-2034 ($Billion)

15.7.2 Market Size and Forecast

15.7.3 LAMEA AI in Drug Discovery Market, By Country

15.7.4 GCC

15.7.4.1 GCC AI in Drug Discovery Market Revenue, 2022-2034 ($Billion)

15.7.4.2 Market Size and Forecast

15.7.4.3 GCCMarket Segmental Analysis

15.7.5 Africa

15.7.5.1 Africa AI in Drug Discovery Market Revenue, 2022-2034 ($Billion)

15.7.5.2 Market Size and Forecast

15.7.5.3 AfricaMarket Segmental Analysis

15.7.6 Brazil

15.7.6.1 Brazil AI in Drug Discovery Market Revenue, 2022-2034 ($Billion)

15.7.6.2 Market Size and Forecast

15.7.6.3 BrazilMarket Segmental Analysis

15.7.7 Rest of LAMEA

15.7.7.1 Rest of LAMEA AI in Drug Discovery Market Revenue, 2022-2034 ($Billion)

15.7.7.2 Market Size and Forecast

15.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 16. Competitive Landscape

16.1 Competitor Strategic Analysis

16.1.1 Top Player Positioning/Market Share Analysis

16.1.2 Top Winning Strategies, By Company, 2022-2024

16.1.3 Competitive Analysis By Revenue, 2022-2024

16.2 Recent Developments by the Market Contributors (2024)

Chapter 17. Company Profiles

17.1 IBM

17.1.1 Company Snapshot

17.1.2 Company and Business Overview

17.1.3 Financial KPIs

17.1.4 Product/Service Portfolio

17.1.5 Strategic Growth

17.1.6 Global Footprints

17.1.7 Recent Development

17.1.8 SWOT Analysis

17.2 Atomwise Inc.

17.3 Insilico Medicine

17.4 BenevolentAI

17.5 Berg Health

17.6 BioSymetrics, Inc.

17.7 BPGbio Inc.

17.8 CYCLICA

17.9 Exscientia

17.10 GNS Healthcare

17.11 Google