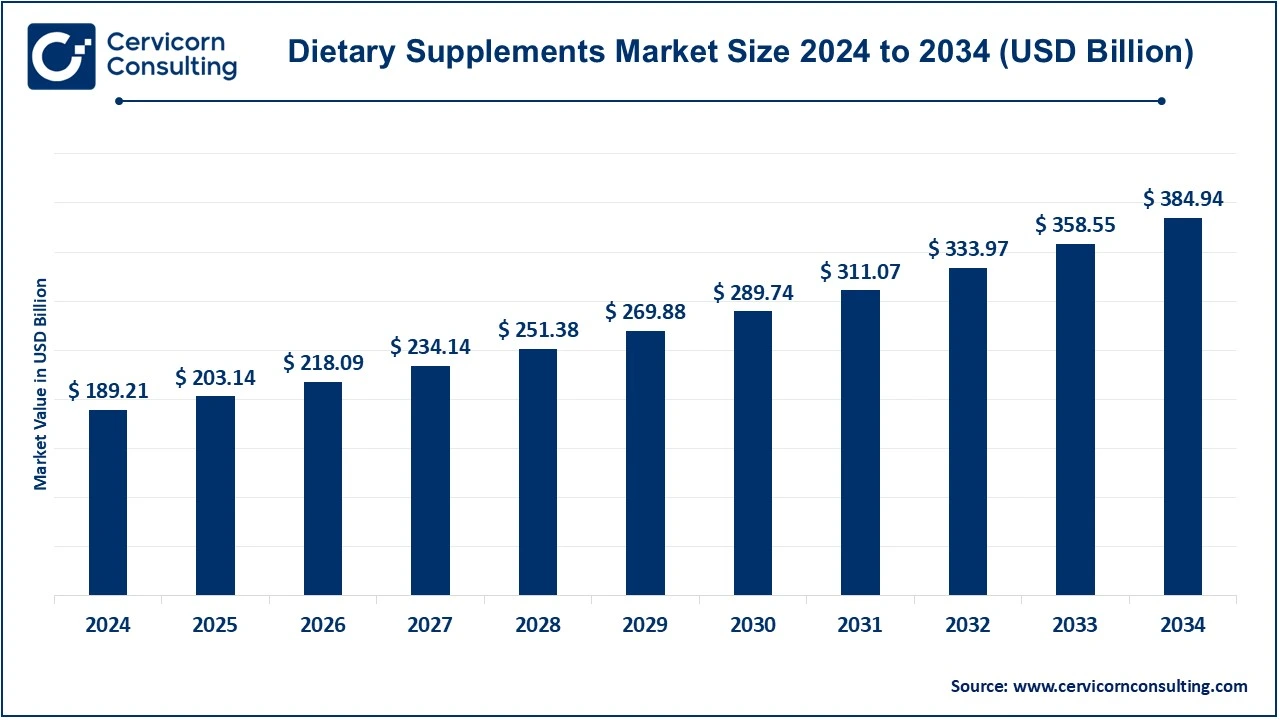

The global dietary supplements market size was estimated at USD 189.21 billion in 2024 and is expected to be worth around USD 384.94 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.36% over the forecast period 2025 to 2034.

The growth in the dietary supplement market is mainly due to awareness of health and wellness issues, an increase in the practice of preventive healthcare measures, and the demand for nutrition customized to specific requirements. Such an increased interest in managing health and wellness triggers more alertness toward diet and better performance in athletics or sports as well as concern with other health issues through supplement intake. Factors behind further growth in the market are an aging population, the rise of fitness culture, and the increasing availability of natural and organic products. A stream of innovative constant innovation in formulation and delivery systems of supplements has continued to integrate more and more supplements into consumer daily practices, thus providing tremendous fuel in the path to growth in this market.

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 189.21 Billion |

| Expected Market Size in 2034 | USD 384.94 Billion |

| Projected CAGR 2025 to 2034 | 7.36% |

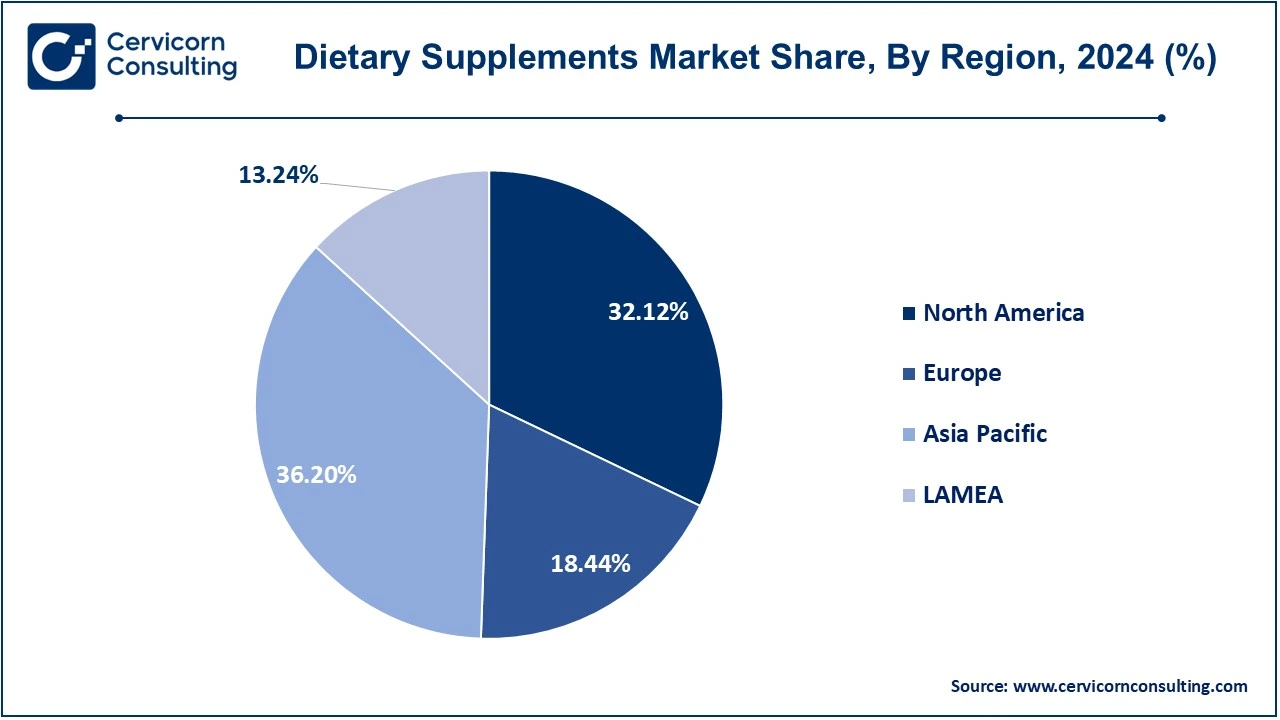

| Dominant Region | Asia Pacific |

| High-growth Region | North America |

| Key Segments | Ingredient, Form, Type, Application, End User, Region |

| Key Companies | Amway Corp., Abbott, Bayer AG, Glanbia plc, Pfizer Inc., Archer Daniels Midland, NU SKIN, GlaxoSmithKline plc., Herbalife Nutrition Ltd., Nature's Sunshine Products, Inc., XanGo, LLC, RBK Nutraceuticals Pty Ltd, American Health, DuPont de Nemours, Inc., Good Health New Zealand, Nature's Bounty, NOW Foods |

The dietary supplements market is segmented into ingredient, form, type, application, end user, region. Based on ingredient, the market is classified into vitamins, botanicals, minerals and others. Based on form, the market is classified into tablets, capsules, soft gels and others. Based on type, the market is classified into OTC and prescribed. Based on application, the market is classified into energy & weight management, general health, bone & joint health, gastrointestinal health and others. Based on end user, the market is classified into infants, children, adults and other. Based on distribution channel, the market is classified into online and offline.

Vitamins: The vitamins segment has dominated the market in 2024. These are essential nutrients for the proper working of many functions in the body, including immunity, metabolism, and tissue repair. The general vitamins include A, B-complex, C, and D. Supplements become necessary when diets fail to deliver some essential nutrients or in life cycles like pregnancy. Vitamins prevent deficiencies and aid in increasing energy levels, keeping skin healthy, and providing immunity. That's why vitamin supplements are popular in people as a supplement to everyday health care.

Botanics: Botanicals are substances that refer to the plant-based substances. These are medicinal and healing in nature. Some examples of herbs include using them for anti-inflammatory, antioxidant, and immune-boosting effects. Products in this category include turmeric, ginseng, echinacea, and ashwagandha, which are all highly commonly used to treat digestive problems, mental acuity, stress relief, and overall health. Many natural alternatives replace pharmaceutical treatments in the use of botanical supplements. Holistic healing can be defined as the process whereby long-term health is obtained through rich concentrations of vitamins, minerals, and active compounds.

Minerals: Calcium, magnesium, iron, and zinc are some minerals which play an important role in human functions like bone health, muscle function, immune response, and metabolism. The deficiency of minerals in the diet causes osteoporosis, anemia, and weakened immunity. Mineral supplements are taken as required for diet correction or for any other specific purpose like improvement in bone density and heart health. They play a very important role in maintaining the general working of the body, so it can act as a precursor to optimal health and wellness.

Protein & Amino Acids: Protein functions in the repair, growth, and general maintenance of muscles and other tissue. It consists of amino acids, which are necessary for the body to function and which provide the building blocks for some amino acids, which are termed essential. Athletes who use protein and some amino acid-based supplements for recovery, increasing performance, or losing weight can attest that these supplements promote muscle build-up, reduce time for recovery after exercise, and keep up a healthy metabolism. Maintaining lean body mass is contingent upon having these supplements.

Fibers & Specialty Carbohydrates: Fiber is an essential component of digestive health as it ensures proper bowel movements, reduces cholesterol levels and manages blood sugar. If people are not consuming adequate fiber, then they will need supplements, like psyllium husk or inulin. Specialty carbohydrates called prebiotics stimulate beneficial gut bacteria to grow and, thus improve digestive health and immunity. These are highly sought after for helping to retain gut health, digest better, and keep blood sugar under control, ultimately bringing a balanced and healthy digestive system into the person's life.

Omega Fatty Acids: Omega-3 and omega-6 are essential fats linked to the functioning of the brain, heart health, and the prevention of inflammation. Omega-3 is known to enhance cardiovascular health, improve cholesterol levels, and enhance cognitive function. Omega fatty acid supplements have been prescribed to improve joint health and reduce inflammation. These are fats, essential for the proper function of cells to stay healthy.

Tablets: The tablets segment has dominated the market in 2024. Form dietary supplements are solid and compressed; many contain a mix of ingredients. They provide controlled dosing and are easy to store and transport. Tablets are often the popular choice for multivitamins, minerals, and herbal supplements; this is a convenient long-term option with precise dosing. They may also contain extra binders or coatings that aid in digestion so the active ingredients are absorbed appropriately. Tablets are available to a wide range of consumers, and they can often be purchased at an affordable cost for daily nutritional supplementation.

Capsules: Capsules are tablets but have a gelatin or vegetarian shell encasing the powdered or liquid supplements. They are easy to swallow and are used more for oils, vitamins, and herbal supplements. Bioavailability is better than tablets, and their contents are absorbed quickly into the bloodstream. Capsules are perfect for someone who likes to dissolve fast. Another advantage of this capsule form is that it hides bitter or bad-tasting and smelly odors. Capsules are provided in different sizes and types.

Soft Gels: Soft gels are capsules that consist of a soft gel-like shell and contain liquid fill which can be either water, herbal extracts, omega-3 oils, and others. Soft gels are preferred by many for their ease of swallowing and faster absorption, as the liquid inside is absorbed more rapidly than solid forms. This format is ideal for those who need supplements in concentrated doses. Soft gels also offer a longer shelf life and minimal risk of spoilage.

Powders: Powder supplements are versatile and can be mixed with liquids, offering flexibility in dosage and use. Powders are commonly used in protein, pre-workout, and fiber supplements, making it easy to vary your intake as needed. Powders are more readily absorbed and have a higher concentration of active ingredients. They tend to be popular among athletes and those with specific nutritional needs. However, powders do require more work to ingest and often need to be mixed or blended with water, smoothies, or shakes.

Gummies: These chewy, candy-like supplements can make a big difference in an individual's life. Chewable gummies are among the best sources in a more enjoyable form because a more palatable supplement can give pleasure in taking it. Also, these soft, gelatin-based products are widely used with fortification of vitamins and minerals or herbal ingredients. There are many flavors with which gummies come along. This makes them popular in place of pills and added sugars may be associated with them. But it will remain one of the main easy and tasty supplementation alternatives people would look for.

Liquid Products: Liquid supplements can either take the form of syrups or are contained as tinctures. All of these dissolves more swiftly compared to solid products and, thus, are helpful with swallowing difficulties. The dosages are more adjustable or may be prepared by consumers, so common liquid formulas usually are herbal extracts, Vitamin D solutions, or mineral solutions. Liquids allow dosing at a definite and flexible level, are advisable because they are rapidly absorbed and very effective, and can be added to beverages or taken directly, providing convenience and ease of use.

Immunity: Immunity boosters are vitamins C and D, minerals like zinc, and herbs such as echinacea and elderberry. These supplements help the immune system build up more strength, increase resistance against infections, and reduce illness duration. They are most taken during cold and flu seasons and are taken to avoid getting sick or to help recover faster. Supporting the immune system, these supplements preserve health and help in effectively warding off pathogens and viruses by the body.

Cardiac Health: Heart health supplements have omega-3 fatty acids, CoQ10, and magnesium that help reduce the inflammation of the body part, lower blood pressure and improve circulation. These serve to maintain the cholesterol at healthy levels, prevent plaques from building up and improve the functioning of the heart by reducing inflammation. Supplements for cardiac health are also in trend among people at the risk of heart conditions or developing good circulation and heart conditions. It supports long-term heart health and can be aptly taken with the medical treatments for cardiovascular diseases.

Diabetes: The supplements that play a good role in the proper management of diabetes are Chromium; Cinnamon; and Berberine: These are natural ingredients known to decrease blood sugar in the bloodstream and enhance or increase insulin sensitivity. End. Diabetes supplements support metabolic health, reduce resistance to insulin, and possibly reduce the risk of complications such as neuropathy. This is most commonly applied by individuals suffering from type 2 diabetes or by people at risk of getting insulin resistance in aiding better blood sugar control.

Anti-cancer: Anticancer supplements are those with antioxidants such as vitamins C and E and herbs such as turmeric, green tea, and garlic because they prevent the growth of cancer cells and promote immunology. These are always taken along with the traditional forms of treatment of cancer. Though they are not medical treatments, they can help reduce inflammation, protect healthy cells, and boost the body's ability to combat the disease. Supplements become useful for either prevention or recovery purposes.

Adults: The adult segment has dominated the market in 2024. Adult supplements cater to a broad scope of health needs, including immune support, energy, and joint health. Common options include multivitamins, omega-3 fatty acids, probiotics, and antioxidants. Supplements help adults maintain optimal health, manage stress, and prevent nutritional deficiencies. They are especially useful for busy lifestyles where diet alone may not provide all the necessary nutrients. Targeted supplements support active lifestyles, promote overall wellness, and address age-related health concerns, including heart, digestive, and cognitive health.

Infants: Infant supplements usually contain vitamins D, A, and iron, which are essential for early development. These nutrients support bone health, immune function, and brain development. Infants will need supplements if their diet is lacking in essential nutrients or if they are exclusively breastfed. Liquid forms are the most common for infants, as they can be easily administered in small, controlled doses. These supplements ensure proper growth and development in the first stages of life, helping babies reach key milestones.

Children: Children's supplements are designed to meet a child's nutritional needs. They contain vitamins D, A, and C, calcium, and omega-3 fatty acids. Gummy vitamins or chewables. Because they taste great and are so easy to make, kids love them. Supplements support all aspects of immune health, contribute to bone development, support proper brain function, and support optimal growth. These products help ensure that children can get the necessary amounts of nutrients through supplementation due to an inadequate diet.

Pregnant Women: Prenatal supplements are designed to provide essential nutrients that support both maternal and fetal health. Key ingredients include folic acid, iron, calcium, and DHA, which aid in brain development, and bone health, and prevent birth defects. Prenatal vitamins help ensure that pregnant women meet their increased nutritional needs during pregnancy. These supplements support a healthy pregnancy, reduce risks of complications, and promote proper fetal growth. They are a critical part of prenatal care for expecting mothers.

Geriatric: Geriatric supplements keep the bones, brain, and energy of the elderly healthy. The usual supplements taken are vitamin D, calcium, omega-3 fatty acids, and CoQ10. Supplements that help prevent osteoporosis, heart disease, cognitive decline, and joint pain. Older bodies tend to absorb nutrients poorly, so such supplements prevent deficiency and aid in quality of life. Geriatric supplements support the elderly in terms of mobility, energy, and mental activity, making sure that older adults are healthy and independent.

The market for dietary supplements is broadly categorized into various key geographies: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Below is the further elaboration of each of these geographies:

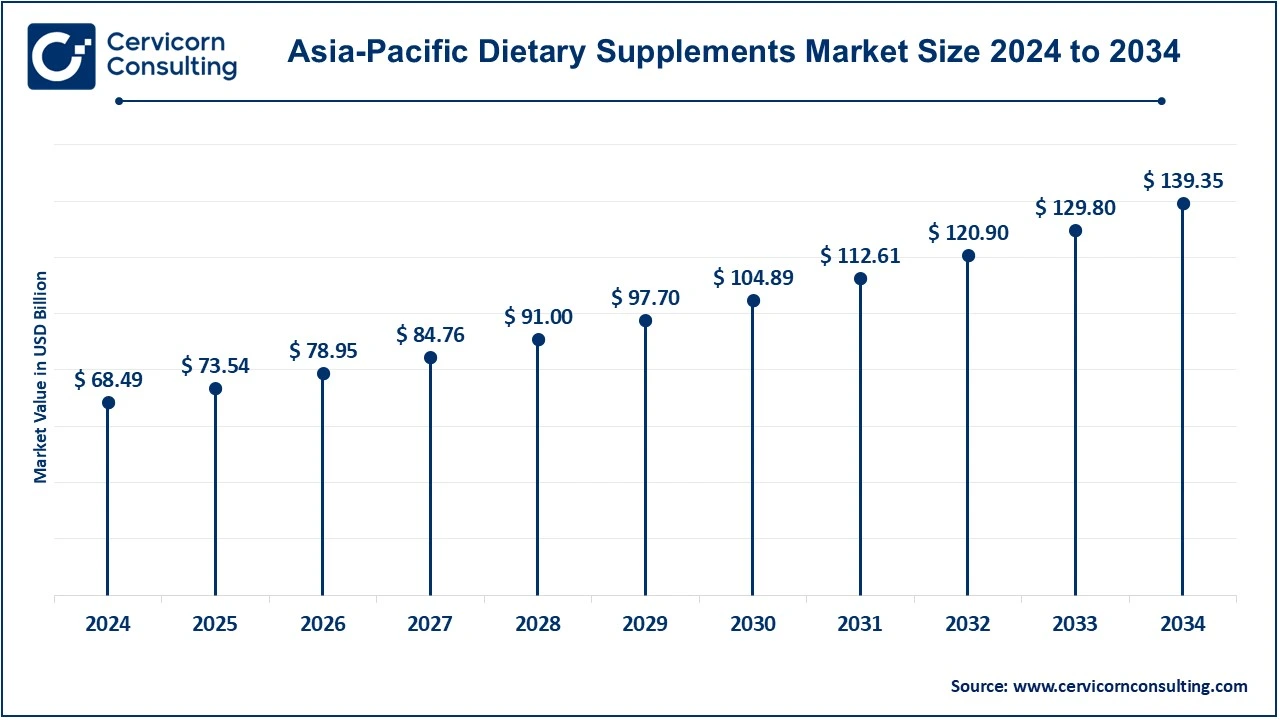

The Asia-Pacific dietary supplements market size was accounetd for USD 68.49 billion in 2024 and is predicted to surpass around USD 139.35 billion by 2034. Asia-Pacific, encompassing countries such as China, Japan, India, South Korea, and Australia, represents one of the fastest-growing markets for dietary supplements. Growing incomes, urbanization, and an aging population are casting a light on health concerns. As a case in point, during the period of January-June 2024, the People's Republic of China approved 720 health foods related to dietary supplements; however, 253 new ones accounted for 35.14% of the total. Most approvals were concentrated in 29 provinces, led by Beijing, Guangdong, and Shandong. The dosage form most approved is the hard capsule. Those drugs that are for keeping a healthy blood sugar level earned the most approvals. The recovery of registration is gradually picking up, meaning moving forward to focus more on the healthcare needs of consumers. In particular, traditional herbal supplements are gaining momentum because of modern health products, with a rising preference for plant-based and organic supplements.

The Europe dietary supplements market size was estimated at USD 34.89 billion in 2024 and is expected to hit around USD 70.98 billion by 2034. The leading countries in dietary supplements in Europe are Germany, the UK, France, and Italy. European consumers emphasized the quality and regulatory compliance of supplements. Quality is indeed one of the aspects emphasized by European consumers, while the market demands natural or organic products. For example, France has agreed to sweeping new controls of maximum permitted levels (MPL) for vitamins and minerals in food supplements following the new regulator DGAL's request to ANSES for a risk assessment. Notably, the MPL for Vitamin C may be reduced from 1,000 mg to 208 mg while for Vitamin B6 from 12.5 mg to 9.4 mg. Some new limits are to be introduced for vitamins without existing MPLs, but increases are proposed for selenium and phosphorus. The changes will then be reviewed by the EU before they are implemented. Healthy trends such as the aging population and increasing consumer interest in preventive healthcare are driving this market growth across the continent.

The North America dietary supplements market size was valued at USD 60.77 billion in 2024 and is expected to reach around USD 123.64 billion by 2034. North America has greater consumer awareness and a growing focus on health and wellness. The U.S. leads this market because of the increasing proportion of population with a high age profile, greater health consciousness, and widespread prevalence of chronic diseases. CNN says that, as of April 2023, "58.5 percent of US adults and 34.8 percent of children took at least one type of supplement between July and December last year, mostly multivitamins". Among adults, supplement consumption has largely been steady or increasing since the start of the COVID-19 pandemic in 2017. Despite being highly popular, experts caution that the majority of supplements have yet to be scientifically proven to have any health benefits and are often poorly regulated - boosting the likelihood of contamination or improper labeling. Amongst consumers here, are the most in-demand vitamins, minerals, and plant-based supplements.

The LAMEA dietary supplements market size was valued at USD 25.05 billion in 2024 and is anticipated to reach around USD 50.97 billion by 2034. The LAMEA region (Latin America, Middle East, and Africa) comprises countries such as Brazil, Mexico, South Africa, Saudi Arabia, and the UAE, and there is significant growth observed in the dietary supplements market. This growth is because of increased health awareness, enhanced disposable incomes, and rising demand for natural and organic products. In Latin America, there is a rising demand for supplements focused on weight management and immune support. In the Middle East and Africa, meanwhile, wellness, fitness, and preventive healthcare are increasingly gaining the attention of consumers, which thus props up the development in these diverse regions.

Newcomers in the dietary supplements market are fighting to occupy market space and gain customers with innovative strategies. Amway Corp., for example, is promoting the Nutrilite brand with personalized wellness solutions, offering supplements tailored based on individual health objectives. Clean, sustainable ingredients, along with sourcing transparency, feature strongly here. They use digital marketing, influencer partnerships, and e-commerce platforms to connect with consumers. Using these kinds of strategies, the company will focus on supplying quality customized goods for this now-emerging health and wellness market.

CEO Statements

Michael Nelson, CEO of Amway Corp.

Robert B. Ford, CEO of Abbott

Bill Anderson, CEO of Bayer AG

Recent strategic initiations and product launches in the dietary supplements industry are focusing on innovations that are more on the aspect of product, personalization, and sustainability. There's increasing customization of supplements available according to the health requirements of an individual, thanks to better technology and data analytics. Health-conscious-based trends in terms of clean, organic, and eco-friendly ingredients have been trending further. Furthermore, more accessible and interactive engagements are added on through influencer partnerships, e-commerce sites, and direct-to-consumer models. Still, giant players build their presence all over the world, developing their space in the marketplace, through acquisitions, partnerships, and investments to satisfy rising customer demand for health and wellness products.

Market Segmentation

By Ingredient

By Form

By Type

By Application

By End User

By Distribution Channel

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Dietary Supplements

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Ingredient Overview

2.2.2 By Form Overview

2.2.3 By Type Overview

2.2.4 By Application Overview

2.2.5 By End User Overview

2.2.6 By Distribution Channel Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Dietary Supplements Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing Consumer Awareness

4.1.1.2 Immune Health Is Highly in Focus

4.1.1.3 Celebrity and Influencer Endorsements

4.1.2 Market Restraints

4.1.2.1 False Claims and Lack of Standardization

4.1.2.2 Expensive Premium Supplements

4.1.2.3 Limited access in developing regions

4.1.3 Market Challenges

4.1.3.1 Counterfeit or Pirated Products

4.1.3.2 Escalating Production Costs

4.1.3.3 Negative Responses and Medical Lack of Overseeing

4.1.4 Market Opportunities

4.1.4.1 Collaboration with Healthcare Providers

4.1.4.2 Organic and Clean Label Market Growth

4.1.4.3 Pet Supplements

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Dietary Supplements Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Dietary Supplements Market, By Ingredient

6.1 Global Dietary Supplements Market Snapshot, By Ingredient

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Vitamins

6.1.1.2 Botanicals

6.1.1.3 Minerals

6.1.1.4 Protein & Amino Acids

6.1.1.5 Fibers & Specialty Carbohydrates

6.1.1.6 Omega Fatty Acids

6.1.1.7 Probiotics

6.1.1.8 Prebiotics & Postbiotics

6.1.1.9 Others

Chapter 7. Dietary Supplements Market, By Form

7.1 Global Dietary Supplements Market Snapshot, By Form

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Tablets

7.1.1.2 Capsules

7.1.1.3 Soft gels

7.1.1.4 Powders

7.1.1.5 Gummies

7.1.1.6 Liquids

7.1.1.7 Others

Chapter 8. Dietary Supplements Market, By Type

8.1 Global Dietary Supplements Market Snapshot, By Type

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 OTC

8.1.1.2 Prescribed

Chapter 9. Dietary Supplements Market, By Application

9.1 Global Dietary Supplements Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Energy & Weight Management

9.1.1.2 General Health

9.1.1.3 Bone & Joint Health

9.1.1.4 Gastrointestinal Health

9.1.1.5 Immunity

9.1.1.6 Cardiac Health

9.1.1.7 Diabetes

9.1.1.8 Anti-cancer

9.1.1.9 Lungs Detox/Cleanse

9.1.1.10 Skin/ Hair/ Nails

9.1.1.11 Sexual Health

9.1.1.12 Brain/Mental Health

9.1.1.13 Insomnia

9.1.1.14 Menopause

9.1.1.15 Anti-aging

9.1.1.16 Others

Chapter 10. Dietary Supplements Market, By End User

10.1 Global Dietary Supplements Market Snapshot, By End User

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Infants

10.1.1.2 Children

10.1.1.3 Adults

10.1.1.4 Pregnant Women

10.1.1.5 Geriatric

Chapter 11. Dietary Supplements Market, By Distribution Channel

11.1 Global Dietary Supplements Market Snapshot, By Distribution Channel

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

11.1.1.1 Online

11.1.1.2 Offline

Chapter 12. Dietary Supplements Market, By Region

12.1 Overview

12.2 Dietary Supplements Market Revenue Share, By Region 2024 (%)

12.3 Global Dietary Supplements Market, By Region

12.3.1 Market Size and Forecast

12.4 North America

12.4.1 North America Dietary Supplements Market Revenue, 2022-2034 ($Billion)

12.4.2 Market Size and Forecast

12.4.3 North America Dietary Supplements Market, By Country

12.4.4 U.S.

12.4.4.1 U.S. Dietary Supplements Market Revenue, 2022-2034 ($Billion)

12.4.4.2 Market Size and Forecast

12.4.4.3 U.S. Market Segmental Analysis

12.4.5 Canada

12.4.5.1 Canada Dietary Supplements Market Revenue, 2022-2034 ($Billion)

12.4.5.2 Market Size and Forecast

12.4.5.3 Canada Market Segmental Analysis

12.4.6 Mexico

12.4.6.1 Mexico Dietary Supplements Market Revenue, 2022-2034 ($Billion)

12.4.6.2 Market Size and Forecast

12.4.6.3 Mexico Market Segmental Analysis

12.5 Europe

12.5.1 Europe Dietary Supplements Market Revenue, 2022-2034 ($Billion)

12.5.2 Market Size and Forecast

12.5.3 Europe Dietary Supplements Market, By Country

12.5.4 UK

12.5.4.1 UK Dietary Supplements Market Revenue, 2022-2034 ($Billion)

12.5.4.2 Market Size and Forecast

12.5.4.3 UKMarket Segmental Analysis

12.5.5 France

12.5.5.1 France Dietary Supplements Market Revenue, 2022-2034 ($Billion)

12.5.5.2 Market Size and Forecast

12.5.5.3 FranceMarket Segmental Analysis

12.5.6 Germany

12.5.6.1 Germany Dietary Supplements Market Revenue, 2022-2034 ($Billion)

12.5.6.2 Market Size and Forecast

12.5.6.3 GermanyMarket Segmental Analysis

12.5.7 Rest of Europe

12.5.7.1 Rest of Europe Dietary Supplements Market Revenue, 2022-2034 ($Billion)

12.5.7.2 Market Size and Forecast

12.5.7.3 Rest of EuropeMarket Segmental Analysis

12.6 Asia Pacific

12.6.1 Asia Pacific Dietary Supplements Market Revenue, 2022-2034 ($Billion)

12.6.2 Market Size and Forecast

12.6.3 Asia Pacific Dietary Supplements Market, By Country

12.6.4 China

12.6.4.1 China Dietary Supplements Market Revenue, 2022-2034 ($Billion)

12.6.4.2 Market Size and Forecast

12.6.4.3 ChinaMarket Segmental Analysis

12.6.5 Japan

12.6.5.1 Japan Dietary Supplements Market Revenue, 2022-2034 ($Billion)

12.6.5.2 Market Size and Forecast

12.6.5.3 JapanMarket Segmental Analysis

12.6.6 India

12.6.6.1 India Dietary Supplements Market Revenue, 2022-2034 ($Billion)

12.6.6.2 Market Size and Forecast

12.6.6.3 IndiaMarket Segmental Analysis

12.6.7 Australia

12.6.7.1 Australia Dietary Supplements Market Revenue, 2022-2034 ($Billion)

12.6.7.2 Market Size and Forecast

12.6.7.3 AustraliaMarket Segmental Analysis

12.6.8 Rest of Asia Pacific

12.6.8.1 Rest of Asia Pacific Dietary Supplements Market Revenue, 2022-2034 ($Billion)

12.6.8.2 Market Size and Forecast

12.6.8.3 Rest of Asia PacificMarket Segmental Analysis

12.7 LAMEA

12.7.1 LAMEA Dietary Supplements Market Revenue, 2022-2034 ($Billion)

12.7.2 Market Size and Forecast

12.7.3 LAMEA Dietary Supplements Market, By Country

12.7.4 GCC

12.7.4.1 GCC Dietary Supplements Market Revenue, 2022-2034 ($Billion)

12.7.4.2 Market Size and Forecast

12.7.4.3 GCCMarket Segmental Analysis

12.7.5 Africa

12.7.5.1 Africa Dietary Supplements Market Revenue, 2022-2034 ($Billion)

12.7.5.2 Market Size and Forecast

12.7.5.3 AfricaMarket Segmental Analysis

12.7.6 Brazil

12.7.6.1 Brazil Dietary Supplements Market Revenue, 2022-2034 ($Billion)

12.7.6.2 Market Size and Forecast

12.7.6.3 BrazilMarket Segmental Analysis

12.7.7 Rest of LAMEA

12.7.7.1 Rest of LAMEA Dietary Supplements Market Revenue, 2022-2034 ($Billion)

12.7.7.2 Market Size and Forecast

12.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 13. Competitive Landscape

13.1 Competitor Strategic Analysis

13.1.1 Top Player Positioning/Market Share Analysis

13.1.2 Top Winning Strategies, By Company, 2022-2024

13.1.3 Competitive Analysis By Revenue, 2022-2024

13.2 Recent Developments by the Market Contributors (2024)

Chapter 14. Company Profiles

14.1 Amway Corp.

14.1.1 Company Snapshot

14.1.2 Company and Business Overview

14.1.3 Financial KPIs

14.1.4 Product/Service Portfolio

14.1.5 Strategic Growth

14.1.6 Global Footprints

14.1.7 Recent Development

14.1.8 SWOT Analysis

14.2 Abbott

14.3 Bayer AG

14.4 Glanbia plc

14.5 Pfizer Inc.

14.6 Archer Daniels Midland

14.7 NU SKIN

14.8 GlaxoSmithKline plc.

14.9 Herbalife Nutrition Ltd.

14.10 Nature's Sunshine Products, Inc.

14.11 XanGo, LLC

14.12 RBK Nutraceuticals Pty Ltd

14.13 American Health

14.14 DuPont de Nemours, Inc.

14.15 Good Health New Zealand

14.16 Nature's Bounty

14.17 NOW Foods