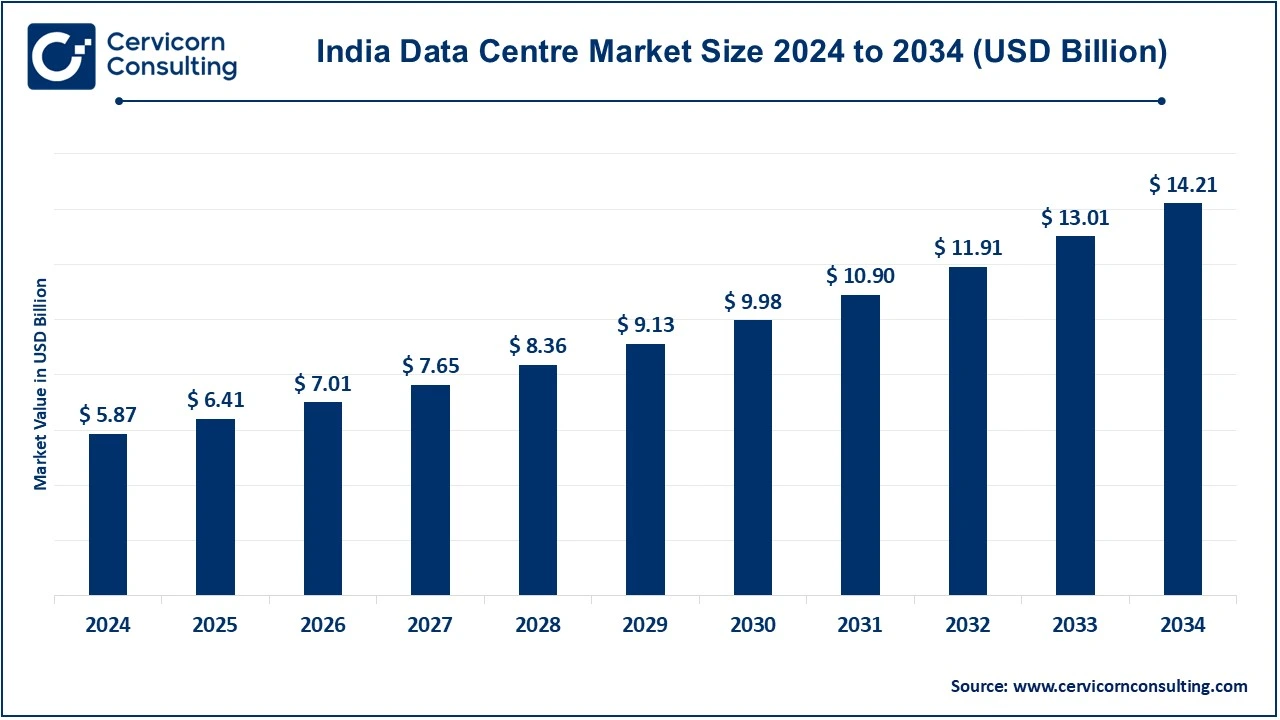

The India data centre market size was valued at USD 5.87 billion in 2024 and is expected to be worth around USD 14.21 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.24% over the forecast period 2025 to 2034.

The india data centre market is growing very fast due to the vast demand for scalable and efficient data storage and processing solutions from IT, telecommunications, BFSI, healthcare, and e-commerce industries. The expansion of cloud computing, IoT, and big data analytics has further amplified the requirement for advanced data centre facilities. With an increasing focus on energy efficiency, green data centres, and high-speed connectivity, innovative technologies like AI-enabled cooling systems and modular data centres are gaining traction. Enhanced R&D investments and strategic partnerships continue to fuel advancements, ensuring that data centres meet the evolving needs of global industries.

CEO Statements

Google – Sundar Pichai, CEO

Tata Consultancy Services (TCS)– Rajesh Gopinathan, CEO

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 6.41 Billion |

| Projected Market Size 2034 | USD 14.21 Billion |

| Estimated CAGR 2025 to 2034 | 9.24% |

| Key Segments | Type, Component, Tier Level, Data Center Size, Industry |

| Key Companies | Adani Group, Arshiya Limited, CTRLS Datacenters Ltd., Equinix Inc, ESDS Software Solution Ltd., NetDataVault (NGBPS Limited), Nikom InfraSolutions Pvt. Ltd, Nippon Telegraph and Telephone Corporation, Nxtra Data Limited (Bharti Airtel Limited), Sify Technologies Limited, Sterling and Wilson Pvt. Ltd., Web Werks India Pvt. Ltd. |

Green Data Centers

IT Hubs of the World

Hybrid Cloud Development

High Electricity Rates

Poor Infrastructure

Lack of Trained Working Force

Regional Expansion

5G Infrastructure Support

Integration with Smart Cities

Barriers to Regulation

High Energy Consumption

Obsolescence through technology

The India data centre market is segmented into type, component, tier level, data center size, and industry. Based on type, the market is classified into enterprise data centers, colocation data centers, edge data centers, hyperscale data centers. Based on component, the market is classified into hardware, software, and service. Based on tier level, the market is classified into tier 1 and tier 2, tier 3, and tier 4. Based on data center size, the market is classified into small, medium, and large, Based on industry, the market is classified into BFSI, IT & telecom, healthcare, government, manufacturing, retail & e-commerce, and others (media & entertainment).

Enterprise Data Centers: Enterprise data centers are owned and operated by an organization to execute its internal IT infrastructure. They are usually private, with a specific design for business. Companies like Tata Consultancy Services (TCS) operate enterprise data centers in India, which can take care of the volumes of business-critical data in addition to enhancing security. Enterprises have excellent control over their data privacy and internal resources and can support industries demanding higher standards of compliance requirements.

Colocation Data Centers: Colocation data centers offer the room for companies to rent servers, storage, and network equipment. Such data centers enable a business to manage its IT infrastructure without the need to build their own facilities. Companies such as CtrlS Datacenters are in India providing colocation facility services: they afford power and cooling with reliable network connectivity. This service helps businesses save costs and become convenient in their operation through outsourcing data center needs while still having full control of their equipment.

Edge Data Centers: Edge data centers put processing power closer to where data is generated and consumed, which reduces latency. They are becoming very important in the world of IoT, autonomous vehicles, and real-time data analytics. In India, NexGen Data Centers is at the forefront in offering edge computing solutions to speed up the processing of data and reduce reliance on a centralized data center. These localized hubs promise rapid delivery of data to support high-bandwidth applications such as streaming and real-time analytics.

Hyperscale Data Centers: Hyperscale data centers are for providers of big-scale cloud services and giant technology giants since they are built for extremely large storage and processing capacities. In India, companies like Amazon Web Services (AWS) and Google Cloud are developing hyperscale data centers in response to the growing demand for cloud services. Varying in size, these centers boast tremendous computing power and scalable architecture, combined with strong security, to take care of massive data needs of enterprises, thereby allowing fast and reliable, cost-effective connectivity for global cloud service offerings.

Hardware: The components of a data center hardware include servers, storage systems, network switches, and physical infrastructure for the housing of cooling systems. Twomost major datacentre integrators at the Indian arch are HPE and Cisco Systems. The systems assure high availability and energy efficiency and scalability, all very critical for businesses involved in bulk data processing and storing, particularly when cloud and hybrid are used.

Software: Software in the data centers helps monitor and manage hardware, virtualized environments, and the databases stored. The key pillar delivers virtualization tools, operating systems, and cloud management platforms. VMware and Microsoft offer essential software solutions for Indian data centers to our businesses to better streamline data operations and enhance their flexibility. These will optimize performance and automate tasks such as load balancing, resource allocation, and data security.

Service: Services related to data centers include managed services, cloud hosting, network services, and consulting. STT GDC India provides such services, wherein it provides enterprises with scalable and reliable data center solutions. The demand for these services is growing as businesses increasingly rely on outsourcing their IT operations. These services help businesses improve operational efficiency, ensure business continuity and, more so, reduce capital expenditure from the knowledge base and investments of third-party providers.

The new entrants in the India data centre sector are employing technology to devise the most efficient and energy-efficient solutions, focusing on the integration of renewable energy sources, advanced cooling systems, and automation. These innovations are designed to optimize operational efficiency while reducing costs and environmental impact. Companies are also leveraging AI, machine learning, and edge computing to enhance the speed and reliability of data processing, enabling faster service delivery and greater scalability. This technological approach is reshaping the data centre landscape for the future.

Recent strategic expansion and investment in the data centre market reflect a strong commitment to enhancing infrastructure, supporting growing demand for data storage, and driving technological innovation. These efforts highlight the industry's focus on sustainability, energy efficiency, and meeting the increasing need for scalable and secure data solutions. By capitalizing on emerging technologies and expanding capacity, companies aim to reinforce their market position and meet the rising demands of digital transformation across sectors. Some notable examples of key developments in the Data Centre Market include:

Market Segmentation

By Type

By Component

By Tier Level

By Data Center Size

By Industry

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Data Centre

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Component Overview

2.2.3 By Tier Level Overview

2.2.4 By Data Centre Size Overview

2.2.5 By Industry Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Green Data Centres

4.1.1.2 IT Hubs of the World

4.1.1.3 Hybrid Cloud Development

4.1.2 Market Restraints

4.1.2.1 High Electricity Rates

4.1.2.2 Poor Infrastructure

4.1.2.3 Lack of Trained Working Force

4.1.3 Market Challenges

4.1.3.1 Barriers to Regulation

4.1.3.2 High Energy Consumption

4.1.3.3 Obsolescence through technology

4.1.4 Market Opportunities

4.1.4.1 Regional Expansion

4.1.4.2 5G Infrastructure Support

4.1.4.3 Integration with Smart Cities

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Data Centre Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. India Data Centre Market, By Type

6.1 Data Centre Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Enterprise Data Centers

6.1.1.2 Colocation Data Centers

6.1.1.3 Edge Data Centers

6.1.1.4 Hyperscale Data Centers

Chapter 7. India Data Centre Market, By Component

7.1 India Data Centre Market Snapshot, By Component

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Hardware

7.1.1.2 Software

7.1.1.3 Service

Chapter 8 India Data Centre Market, By Tier Level

8.1 India Data Centre Market Snapshot, By Tier Level

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Tier 1 and Tier 2

8.1.1.2 Tier 3

8.1.1.3 Tier 4

Chapter 9. India Data Centre Market, By Data Center Size

9.1 India Data Centre Market Snapshot, By Data Center Size

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Small

9.1.1.2 Medium

9.1.1.3 Large

Chapter 10. India Data Centre Market, By Industry

10.1 India Data Centre Market Snapshot, By Industry

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 BFSI

10.1.1.2 IT & Telecom

10.1.1.3 Government

10.1.1.4 Manufacturing

10.1.1.5 Retail & E-commerce

10.1.1.6 Others

Chapter 11. India Data Centre Market, By States

11.1 Overview

11.2 India Data Centre Market Revenue Share, By Region 2024 (%)

11.3 India Data Centre Market, By States

11.4 India Market Size and Forecast

11.5 India Data Centre Market Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 Adani Group

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Arshiya Limited

13.3 CTRLS Datacenters Ltd.

13.4 Equinix Inc

13.5 ESDS Software Solution Ltd.

13.6 NetDataVault (NGBPS Limited)

13.7 Nikom InfraSolutions Pvt. Ltd

13.8 Nippon Telegraph and Telephone Corporation

13.9 Nxtra Data Limited (Bharti Airtel Limited)

13.10 Sify Technologies Limited

13.11 Sterling and Wilson Pvt. Ltd.

13.12 Web Werks India Pvt. Ltd.