The global ammonia market size was estimated at USD 226.74 billion in 2024 and is expected to be worth around USD 378.61 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 5.26% over the forecast period 2025 to 2034.

The ammonia market is expanding due to rising demand for fertilizers, driven by global population growth and the need for higher agricultural productivity. Increasing applications in industrial chemicals, refrigeration, and wastewater treatment are further contributing to its growth. Additionally, green ammonia, produced using renewable energy, is gaining traction as a sustainable alternative in the energy sector. Moreover, ammonia is emerging as a potential carbon-free fuel for shipping and power generation, aligning with global efforts to reduce greenhouse gas emissions. Government policies promoting sustainable fertilizers and cleaner energy sources are also boosting market growth. However, challenges like environmental concerns, high production costs, and fluctuating raw material prices may affect its expansion.

Ammonia is a colorless gas with a strong, pungent odor. It consists of nitrogen and hydrogen and is highly soluble in water, forming ammonium hydroxide, a weak base. Ammonia is naturally found in the environment, produced by the decomposition of organic matter, and is also synthesized industrially through the Haber-Bosch process, which combines nitrogen from the air with hydrogen under high pressure and temperature. Ammonia is widely used in agriculture as a fertilizer, helping plants grow by providing essential nitrogen. It is also used in industrial processes, including the production of plastics, explosives, and textiles. Additionally, it serves as a key ingredient in cleaning products, refrigeration systems, and water treatment. Though beneficial, ammonia is hazardous in high concentrations, causing respiratory issues and skin irritation. It is transported as a liquid under pressure and must be handled with care.

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 238.67 Billion |

| Expected Market Size in 2034 | USD 378.61 Billion |

| Projected CAGR 2025 to 2034 | 5.26% |

| Benchmark Region | Asia-Pacific |

| Key Segments | Product, Sales Channel, Application, Region |

| Key Companies | Acron, Asahi Kasei Corp, BASF SE, CF Industries Holdings, Inc., Koch Fertilizers, LLC, Mitsui Chemicals, Inc., Nutrien Ltd., Qatar Fertiliser Company, SABIC, Sumitomo Chemical Co., Ltd., Togliattiazot, Yara International |

Rising Hydrogen Economy

Global Trade Expansion

Environmental Concerns

Volatility in Natural Gas Prices

Infrastructure Constraints

Competition from Other Energy Sources

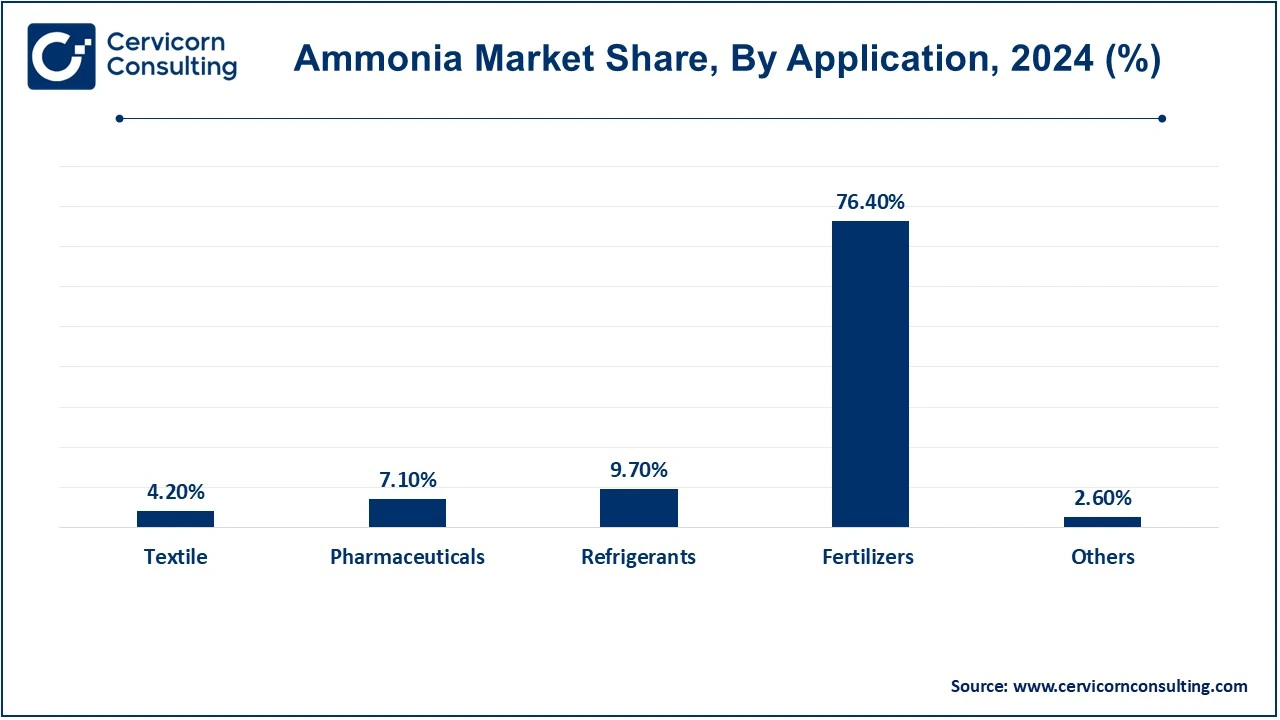

The ammonia market is segmented into product, application, sales channel and region. Based on product, the market is classified into anhydrous and aqueous. Based on sales channel, the market is classified into direct and indirect. Based on application, the market is classified into textile, pharmaceuticals, refrigerants, fertilizers and others.

Aqueous: Aqueous ammonia is a solution of ammonia gas in the water which is widely used in the ammonia market. Its use serves as a medium for application in which ammonia is less volatile and safer. One of the applications is in water treatment plants, where aqueous ammonia is used to neutralize acidic compounds and remove impurities such as chloramine. Aqueous ammonia has wide applications as a cleaning agent and as a precursor for chemicals like ammonium salts. This product has few use limitations; it should be used with care since it is stable and easy to handle compared to other similar products and hence convenient for smaller or urban applications.

Ammonia Market Revenue Share, By Product, 2024 (%)

| Product | Revenue Share, 2024 (%) |

| Anhydrous | 60.20 |

| Aqueous | 39.80 |

Anhydrous: Pure and highly concentrated ammonia is called anhydrous ammonia, which is a primary and key intermediate in ammonia markets. It mainly finds application in agriculture where it is used as a nitrogen fertilizer. Anhydrous ammonia is injected directly into soils for the promotion of crop growth. With the highest nitrogen concentration among commercial fertilizers, anhydrous ammonia is favored among large-scale farmers for being economical and efficient. It is also used for refrigeration and as an intermediate for the production of other chemicals like urea and ammonium nitrate.

Fertilizer: The fertilizer segment has dominated the market in 2024. Ammonia is used in the manufacturing the nitrogen-based fertilizers like urea, ammonium nitrate, and ammonium sulfate. The fertilizers are important soil nutrients that make sure that high crop yields. The food demand is increasing at a global level, and agriculture highly relies on ammonia to improve the productivity of limited arable lands. The cornerstone in agriculture that has been made by the replacement of nitrogen-deficient soil with the vital supply of nitrogen to plants has made ammonia-based fertilizers more efficient. Further, government grants and other policies by governments promote the use of fertilizers in developing areas and increase that application. Fertilizers, therefore, stand as the largest application of ammonia demand.

Refrigerants: Ammonia is primarily used in refrigerating systems for the production of cold. Such usage is due to the greatly superior thermodynamic properties of ammonia over other non-azeotropic refrigerants, in addition to the efficiency in energy use. Moreover, ammonia is an inexpensive, "green" alternative to synthetic refrigerants including chlorofluorocarbons (CFCs) and hydrofluorocarbons (HFCs), which deplete the ozone layer and are classified as greenhouse gases. Ammonia does not contend toxicity to the ozone layer and is rated as having low global warming potential (GWP) and hence can be preferred for applications in the food industry, cold storage, and beverage processing. However, it is also toxic and corrosive, which requires ensuring that very strict handling and even specialized equipment are used to ensure safety in industrial environments.

Pharmaceuticals: Ammonia is widely used in the pharmaceutical industry as a reagent and a raw material for synthesizing active pharmaceutical ingredients (APIs). For instance, it has its application in the formulation of sulfa drugs, vitamins, and antifungal agents. The most important gain from ammonia, which makes it important in many formulations, is its ability to change pH. It is also required in intermediates production for the drug composition which shows its importance in ensuring the steady supply of essential medicines.

Textile: Textile applications of ammonia are specifically in the cotton processing and synthetic fiber industries. Liquid ammonia treatment adds luster and makes the cotton fabric stronger and more dye-affinitive, hence improving durability and aesthetic value. In addition, it uses synthetic fibers, such as nylon and acrylic, which have become part of modern apparel and industrial textiles. Thus, as economies grow and as consumer demand for better textiles continues to rise, and as fabrics and their technologies grow, so with the innovations to improve the performance and sustainability of fabrics will increase ammonia's relevance in this sector.

Others: Ammonia has different uses: being a cleaning agent, water treatment, and even in the mining industry. In water treatment, ammonia helps purify waters and helps ensure that the chlorine levels are balanced, such that you ensure a safe and clean supply of water. It is also included in explosives for mining as well as construction industries. Furthermore, ammonia finds application in the pulp and paper-making industries, rubber plastics, and others.

The ammonia market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

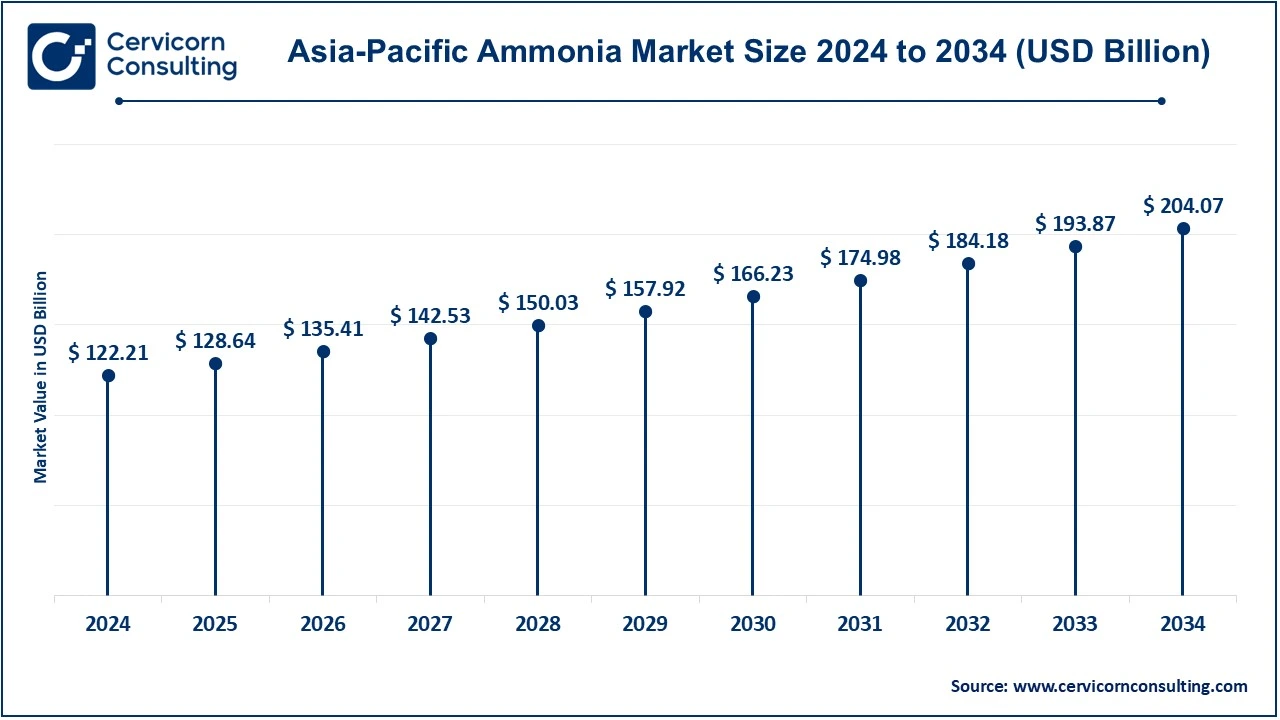

The Asia-Pacific ammonia market size was accounted for USD 122.21 billion in 2024 and is projected to hit around USD 204.07 billion by 2034. The Asia-Pacific region is growing, due to rapid growth rates in population, urbanization, and consequently, agronomy of the area. For example, countries such as China and India, with enormous populations, are proving some of the most significant consumers of ammonia as they need supplementing crops used to meet the ever-increasing demand for food. Ammonia has also found its use through industrial development in textiles, refrigeration, and chemical products. Favorable policy options, such as fertilizer subsidies and the building of agricultural infrastructure, have further improved the use of this compound. Asia-Pacific is fast emerging as the next destination for green ammonia projects and, more critically, is inclined towards sustainable development, notwithstanding the current challenges posed by environmental factors and the energy intensity involved in production processes.

The North America ammonia market size was valued at USD 39.23 billion in 2024 and is expected to reach around USD 65.50 billion by 2034. North America is a big chunk, due to its strong agricultural background and a very good industrial base. The USA itself is a leading producer and user of ammonia. The market is mostly driven by the applications of ammonia in fertilizers and industrial chemicals. Besides, developments in green ammonia on favourable policies that drive renewables and carbon reduction have given an extra push to the market. There is also a well-developed food export industry in North America. The food export increases fertilizer demand always leading to stable ammonia consumption. Furthermore, the region is strengthened by key manufacturers and availabilities of abundant natural gas resources.

The Europe ammonia market size was reached at USD 54.64 billion in 2024 and is forecasted to grow around USD 91.25 billion by 2034. The European continent has a well-entrenched ammonia market, given the versatile industrial applications where ammonia finds place, with compression from the stringent environmental policies. Focus on sustainable agriculture, combined with the introduction of green ammonia technologies, directly supports the climate goals that Europe has set for itself through the European Green Deal. Ammonia is most widely applicable in fertilizers to address agriculture needs of high producers like France, Germany, and many other Eastern European countries. The rising interest in the green ammonia owing to the rising focus towards renewable energy storage along with hydrogen economies. The market also faces challenges from the high energy costs and the stringent regulatory environment from which the European market emerges, necessitating further investment in energy-efficient, low carbon technologies and methods of ammonia production.

Ammonia Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 17.30% |

| Europe | 24.10% |

| Asia-Pacific | 53.90% |

| LAMEA | 4.70% |

The LAMEA ammonia market size was valued at USD 10.66 billion in 2024 and is anticipated to surpass around USD 17.79 billion by 2034. In many ways, the LAMEA region poses an enormous prospect; among them include agricultural growth and industrialization. Most of the South American countries favor using ammonia-rich fertilizers to facilitate the large-scale production of different crops, including soybeans and corn in Brazil and Argentina specifically. The Arab countries in the Middle East greatly benefit in particular from their natural gas, which mostly exists in abundance, and this will ensure that they produce ammonia at a very low cost for exports. Finally, Africa is increasingly focusing on how to enhance productivity through agriculture for food security, which remains a key driver of demand for ammonia; however, certain factors will limit the growth of the sector, such as poor infrastructure, political instability, and environmental issues for Africa. Investments in production and distribution networks that are environmentally sustainable will unlock the potential that the region has.

The emerging players in the ammonia industry are using innovations to build their base and compete against incumbents. A major focus point is the consideration of green ammonia, which denies production through renewables like wind or solar energy-to address heightened environmental concerns and global decarbonization metrics. These start-ups and small companies are building more efficient plants using electrolysis and carbon capture "tech" to minimize greenhouse gas emissions. These companies are also looking at niche markets, such as ammonia as a hydrogen carrier in the coming hydrogen economy and the potential it offers for energy storage and transport. Strategic partnerships with renewable energy companies and government entities are allowing the new players access to high-end infrastructure as well as much-needed capital. Often, these companies also target underserved regions or applications like decentralized agricultural markets or small-scale industrial uses to get a niche in the new ammonia industry.

Market Segmentation

By Product

By Sales Channel

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Ammonia

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Overview

2.2.2 By Sales Channel Overview

2.2.3 By Application Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising Hydrogen Economy

4.1.1.2 Global Trade Expansion

4.1.2 Market Restraints

4.1.2.1 Environmental Concerns

4.1.2.2 Volatility in Natural Gas Prices

4.1.3 Market Challenges

4.1.3.1 Infrastructure Constraints

4.1.3.2 Competition from Other Energy Sources

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Ammonia Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Ammonia Market, By Product

6.1 Global Ammonia Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Anhydrous

6.1.1.2 Aqueous

Chapter 7. Ammonia Market, By Sales Channel

7.1 Global Ammonia Market Snapshot, By Sales Channel

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Direct

7.1.1.2 Indirect

Chapter 8. Ammonia Market, By Application

8.1 Global Ammonia Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Textile

8.1.1.2 Pharmaceuticals

8.1.1.3 Refrigerants

8.1.1.4 Fertilizers

8.1.1.5 Others

Chapter 9. Ammonia Market, By Region

9.1 Overview

9.2 Ammonia Market Revenue Share, By Region 2024 (%)

9.3 Global Ammonia Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Ammonia Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Ammonia Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Ammonia Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Ammonia Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Ammonia Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Ammonia Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Ammonia Market, By Country

9.5.4 UK

9.5.4.1 UK Ammonia Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Ammonia Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Ammonia Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Ammonia Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Ammonia Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Ammonia Market, By Country

9.6.4 China

9.6.4.1 China Ammonia Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Ammonia Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Ammonia Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Ammonia Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Ammonia Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Ammonia Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Ammonia Market, By Country

9.7.4 GCC

9.7.4.1 GCC Ammonia Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Ammonia Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Ammonia Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Ammonia Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 Acron

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Asahi Kasei Corp

11.3 BASF SE

11.4 CF Industries Holdings, Inc.

11.5 Koch Fertilizers, LLC

11.6 Mitsui Chemicals, Inc.

11.7 Nutrien Ltd.

11.8 Qatar Fertiliser Company

11.9 SABIC

11.10 Sumitomo Chemical Co., Ltd.

11.11 Togliattiazot

11.12 Yara International