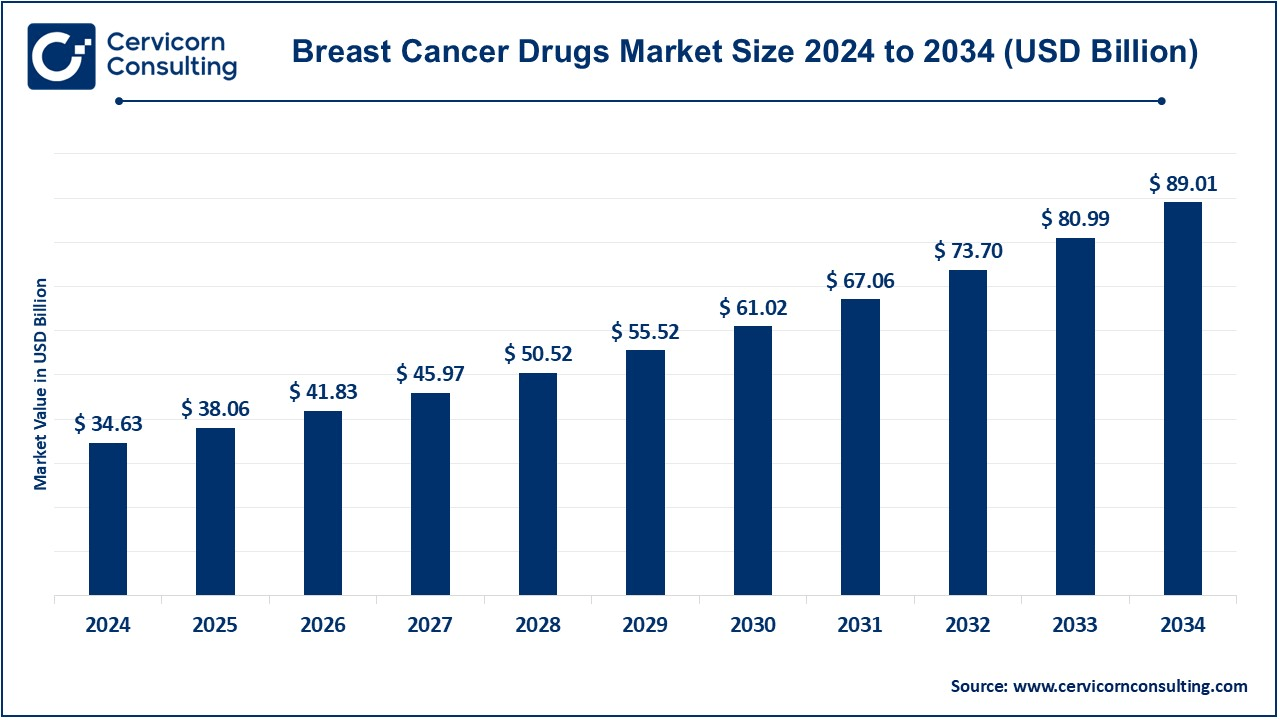

The global breast cancer drugs market size was valued at USD 34.63 billion in 2024 and is expected to be worth around USD 89.01 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.90% over the forecast period 2025 to 2034.

Report Highlights

The key drivers to growth in the breast cancer drugs market are several. First, through research and technological advances, better therapies for cancer are being produced. These include targeted treatments and immunotherapy. These treatments are better at arresting the cell growth of cancer while also producing fewer side effects, hence appealing to patients. More effectively diagnosed cancer cases have improved with screening and genetic testing. Therefore, doctors can detect cancer before it turns to a terminal stage, which increases the success rates of treatments. Third, as the incidence of breast cancer is already high, more people are screened and diagnosed, thus creating a higher demand for treatments. Moreover, with better healthcare systems in developing countries, more patients will be able to access these life-saving therapies. All these factors contribute to the growth of the breast cancer market, and treatments will become more effective, accessible, and widespread in the future.

Breast cancer is a cancerous disease that develops in the cells of the breast, usually in the milk ducts or lobules. It is one of the most common cancers in the world and affects women and, though rarely, men. The disease occurs when the cells in the breast grow uncontrollably, forming a tumor that can spread to other parts of the body, called metastasis. The classifications of breast cancer include several types, and invasive ductal carcinoma is the most common. It is not precisely known what causes it, but several risk factors may increase the possibility of developing breast cancer. They include genetic mutations such as BRCA1 and BRCA2, age, family history, hormonal factors like early menstruation and late menopause, lifestyle factors such as alcohol consumption and a lack of physical activity, and a personal history of other cancers. The common symptoms of breast cancer include lumps in the breast, distortion of the breast shape or size, pain not related to the menstrual cycle, and skin changes. The most critical aspect of detection is screening. Survival rates have increased significantly because of screening. The treatments may be surgery, radiation therapy, chemotherapy, hormone therapy, or targeted therapies. Treatment will depend on the cancer stage, type, and patient-specific factors.

With the improvements that come with the early detection and treatment, this makes breast cancer one of the most curable cancers when discovered in time.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 38.06 Billion |

| Expected Market Size in 2034 | USD 89.01 Billion |

| Projected CAGR 2025 to 2034 | 9.90% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Drug Type, Cancer Type, Distribution Channel, Region |

| Key Companies | F. Hoffmann-La Roche Ltd., Novartis AG, AstraZeneca PLC, Eli Lilly and Company Inc., Pfizer Inc., Merck & Co., Inc., Bristol-Myers Squibb Company, Johnson & Johnson, Genentech Inc., AbbVie Inc., Gilead Sciences, Inc., Takeda Pharmaceutical Company Limited, Eisai Co., Ltd., Celgene Corporation, Inc., Sanofi S.A. |

Increasing breast cancer among the population

Enhance advanced technologies developed in treating breast cancer

Treatment is very costly

Side effects of treatment

Increased support from the government

Increased research and development

A side effect of the treatment involved in breast cancer

High cost of the treatment

The breast cancer drugs market is segmented into drug type, cancer type, distribution channel, region. Based on drug type, the market is classified into chemotherapy drugs, targeted therapy drugs, hormone therapy drugs, immunotherapy drugs and biosimilars. Based on cancer type, the market is classified into hormone receptor and HER2+. Based on distribution channel, the market is classified into hospitals, specialty clinics, retail pharmacies and online pharmacies.

Chemotherapy Drugs: Breast cancer is still treated by chemotherapy, especially for aggressive, advanced, or metastatic cases. Drugs such as doxorubicin, cyclophosphamide, and paclitaxel target cells that divide quickly, including healthy cells, hence causing side effects. The chemotherapy segment is also expected to maintain steady demand since it is administered in all stages of breast cancer, especially as an adjunct therapy. However, these are increasingly being replaced by targeted drugs.

Hormone Therapy Drugs: These are hormone receptor-positive breast cancers that grow in response to hormones like estrogen and progesterone. Such drugs as tamoxifen and aromatase inhibitors (e.g., letrozole, anastrozole) block or lower these hormones and greatly diminish the chance for cancer recurrence. Hormonal therapy is often given for adjuvant therapy and for metastatic patients. This market is one of the largest and continues to grow due to the ongoing approval of new agents and formulations, given their ability to prevent recurrence in early-stage breast cancer.

Targeted therapy drugs: These are a quickly expanding category and include therapies aimed at cancer-specific molecules, so that damage is limited to minimal effect on normal cells. HER2 inhibitors such as trastuzumab and pertuzumab are of use in the treatment of HER2-positive breast cancers, and CDK4/6 inhibitors such as palbociclib are combined with hormonal therapy to treat HR-positive, HER2-negative breast cancers. With the progress of precision medicine, these treatments are gaining more prominence because they are capable of improving survival rates without the side effects of chemotherapy. This segment is enjoying personalized treatment regimens and increasing research investments.

Immunotherapy Drugs: Immunotherapies, including immune checkpoint inhibitors like pembrolizumab and atezolizumab, enhance the body’s immune response to fight cancer by targeting specific checkpoints that inhibit immune activity. Immunotherapy has shown substantial promise in treating triple-negative breast cancer (TNBC), a subtype known for its aggressive nature and lack of targeted treatments. Despite its relatively higher cost, immunotherapy is poised for further growth as clinical trials continue to expand its indications and applications in combination therapies.

Biosimilars: With the mounting incorporation of biologic drugs in the management of breast cancer, the use of biosimilars will permit cost-effective access to high-priced branded biologics, particularly in regions sensitive to price or areas of limited available healthcare resources. The market for drugs treating breast cancer with HER2 inhibitors and other biological agents is expanding based on their ability to achieve similar efficacy at a reduced price point. Their adoption is gaining momentum in developed and emerging markets as healthcare systems look to rein in the rising costs of drugs.

Hospitals: Hospitals are the primary markets of breast cancer drugs, especially when intravenous chemotherapy, targeted therapies, and immunotherapy are involved. In most cases, drugs are mainly given in inpatient or outpatient facilities, considering the difficulty of administration and the need for careful monitoring. Besides, they share a larger percentage in more developed cancers, and hence, they are contributing most in the revenue sector of the breast cancer drugs market. As new, less invasive therapies become available, outpatient treatment options in hospital settings are also on the rise.

Specialty Clinics: These clinics are more specialized in care and are for patients who require a treatment plan with targeted therapy and hormone therapy. As these therapies are mostly outpatient-based, specialty clinics have seen a growing demand, especially in regions that have well-developed health infrastructure. These clinics are very accessible to patients for regular treatments like hormone therapy or follow-up visits for targeted therapies and thus play a significant role in distribution.

Breast Cancer Drugs Market Revenue Share, By Distribution Channel, 2024 (%)

| Distribution Channel | Revenue Share, 2024 (%) |

| Hospitals | 47.89% |

| Retail Pharmacies | 34.78% |

| Others | 17.33% |

Retail Pharmacies: Oral therapies including hormone and targeted drugs, including tamoxifen and aromatase inhibitors, are going to see a big play by retail pharmacies in the distribution area. Higher convenience and accessibility to medication by retail pharmacies have kept the steady growth rate going in this category. Home health and telemedicine are also picking up pace and therefore self-managed treatment plans by patients would also enhance the availability of the drug at retail sites.

Online Pharmacies: These have become the most important pharmacy types in the market, not because they were more significant at first, but because they ensured people could acquire prescriptions for oral therapies when access to the traditional pharmacy or hospital is limited. Online pharmacies are gaining momentum in developed and emerging markets alike as things are increasingly being done digitally, and patients ever more determine what they need to do.

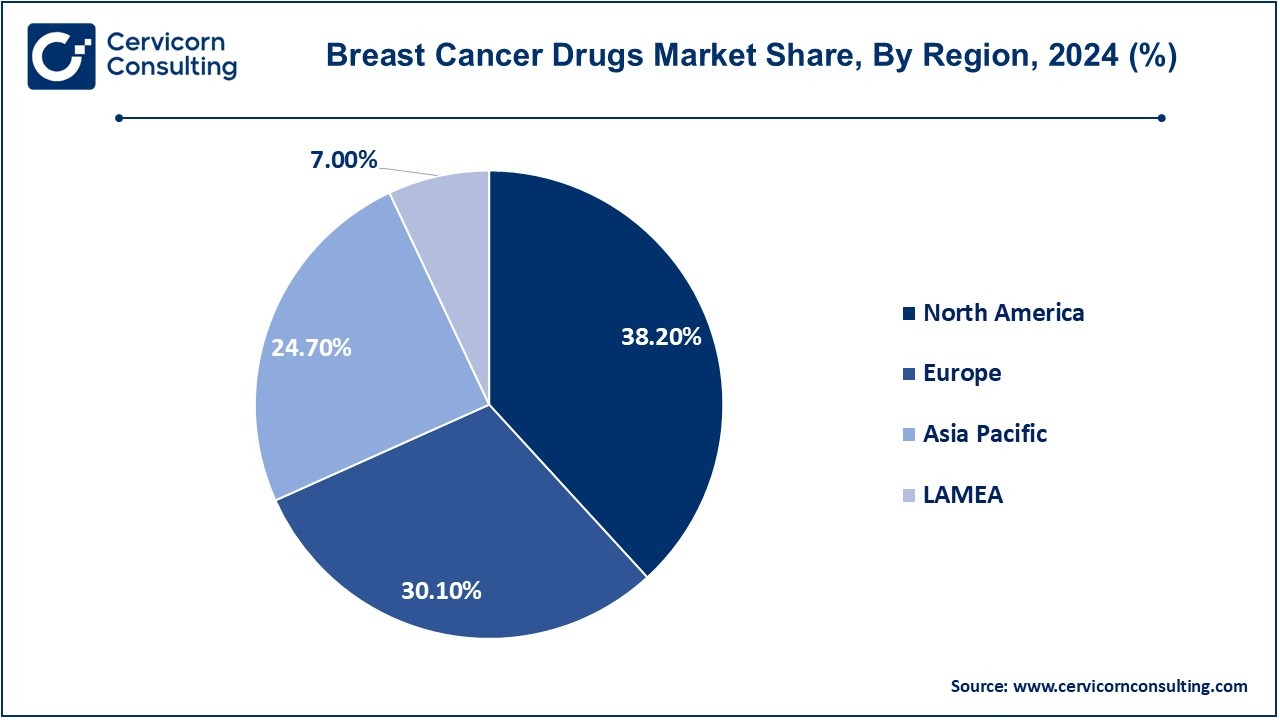

The breast cancer drugs market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

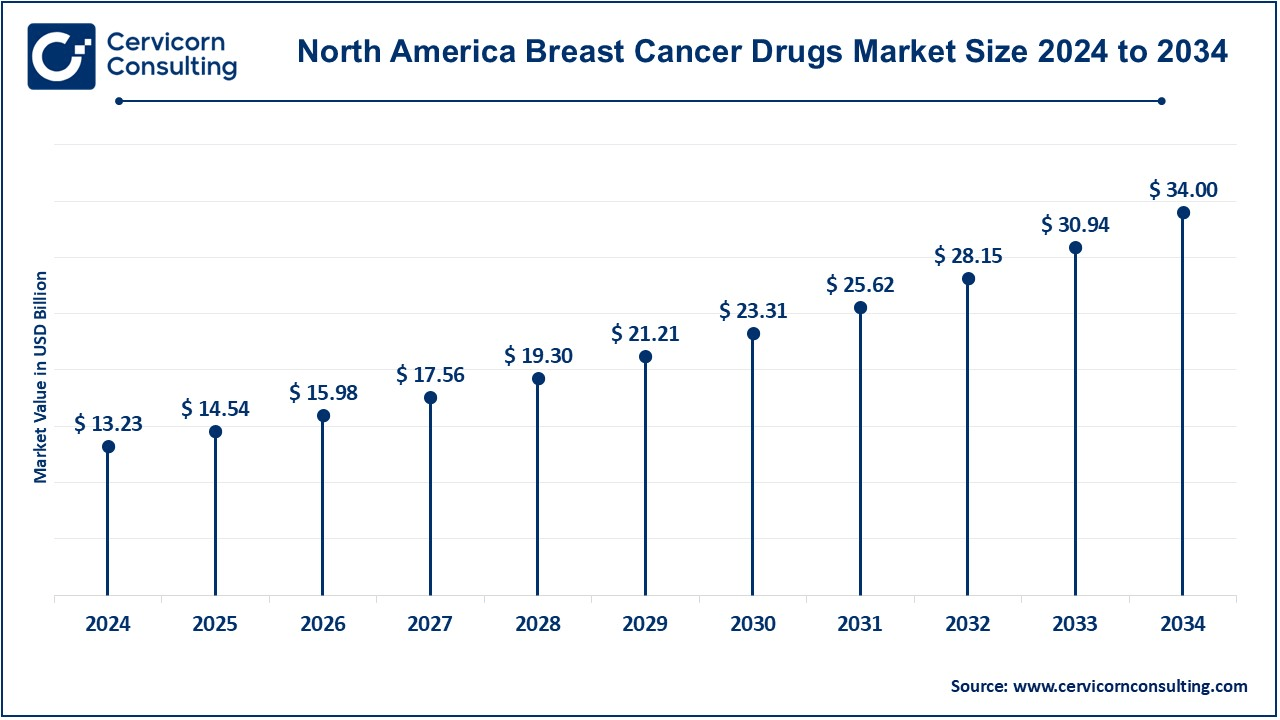

The North America breast cancer drugs market size was valued at USD 13.23 billion in 2024 and is expected to reach around USD 34 billion by 2034. North America has the largest market share, and it is majorly dominated by the U.S., due to an advanced healthcare structure, a higher incidence of breast cancer, and an early embracement of newer therapies such as immunotherapy and targeted treatments. There is high health expenditure in the U.S. and advanced research, plus wider access to cutting-edge therapies, making it the most important geographical region for launches of new drugs and clinical studies.

The Europe breast cancer drugs market size was estimated at USD 10.42 billion in 2024 and is projected to reach around USD 26.79 billion by 2034. The European market is mature and focused on early detection, preventive care, and targeted treatments. High adoption rates for chemotherapy, hormonal therapies, and immunotherapies have stabilized market growth in this region. Broad access to breast cancer treatments within the European Union health care systems makes it a growth area, even though market growth is slower compared to North America because of the more conservative regulatory approach in a few countries.

The Asia-Pacific breast cancer drugs market size was reached at USD 8.55 billion in 2024 and is predicted to surpass around USD 21.99 billion by 2034. The Asia-Pacific region is one of the fastest-growing regions due to the improved healthcare infrastructure, increased awareness, and a higher prevalence of this disease in the populous countries of China and India. Moreover, many governments are supporting breast cancer research and treatment provision. Targeted therapies and immunotherapies are also gaining popularity in this region along with biosimilars, which are available at lower prices.

LAMEA Breast Cancer Drugs Market Trends

The LAMEA breast cancer drugs market was valued at USD 2.42 billion in 2024 and is anticipated to reach around USD 6.23 billion by 2034. The market is developing in Latin America, the Middle East, and African markets. More government expenditure on health care and growing awareness of breast cancer are providing increased access to treatment. However, affordability and lack of access to the latest therapies would put a ceiling on market growth. Nevertheless, with the improvement of healthcare systems, the market is going to grow slowly over time with further expansions in treatment options.

Market Segmentation

By Drug Type

By Cancer Type

By Distribution Channel

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Breast Cancer Drugs

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Drug Type Overview

2.2.2 By Cancer Type Overview

2.2.3 By Distribution Channel Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing breast cancer among the population

4.1.1.2 Enhance advanced technologies developed in treating breast cancer

4.1.2 Market Restraints

4.1.2.1 Infrastructure Challenges

4.1.2.2 Regulatory Barriers

4.1.3 Market Challenges

4.1.3.1 A side effect of the treatment involved in breast cancer

4.1.3.2 High cost of the treatment

4.1.4 Market Opportunities

4.1.4.1 Increased support from the government

4.1.4.2 Increased research and development

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Breast Cancer Drugs Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Breast Cancer Drugs Market, By Drug Type

6.1 Global Breast Cancer Drugs Market Snapshot, By Drug Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Chemotherapy Drugs

6.1.1.2 Targeted Therapy Drugs

6.1.1.3 Hormone Therapy Drugs

6.1.1.4 Immunotherapy Drugs

6.1.1.5 Biosimilars

Chapter 7. Breast Cancer Drugs Market, By Cancer Type

7.1 Global Breast Cancer Drugs Market Snapshot, By Cancer Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Hormone Receptor

7.1.1.2 HER2+

Chapter 8. Breast Cancer Drugs Market, By Distribution Channel

8.1 Global Breast Cancer Drugs Market Snapshot, By Distribution Channel

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Hospitals

8.1.1.2 Specialty Clinics

8.1.1.3 Retail Pharmacies

8.1.1.4 Online Pharmacies

Chapter 9. Breast Cancer Drugs Market, By Region

9.1 Overview

9.2 Breast Cancer Drugs Market Revenue Share, By Region 2024 (%)

9.3 Global Breast Cancer Drugs Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Breast Cancer Drugs Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Breast Cancer Drugs Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Breast Cancer Drugs Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Breast Cancer Drugs Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Breast Cancer Drugs Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Breast Cancer Drugs Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Breast Cancer Drugs Market, By Country

9.5.4 UK

9.5.4.1 UK Breast Cancer Drugs Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Breast Cancer Drugs Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Breast Cancer Drugs Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Breast Cancer Drugs Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Breast Cancer Drugs Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Breast Cancer Drugs Market, By Country

9.6.4 China

9.6.4.1 China Breast Cancer Drugs Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Breast Cancer Drugs Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Breast Cancer Drugs Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Breast Cancer Drugs Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Breast Cancer Drugs Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Breast Cancer Drugs Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Breast Cancer Drugs Market, By Country

9.7.4 GCC

9.7.4.1 GCC Breast Cancer Drugs Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Breast Cancer Drugs Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Breast Cancer Drugs Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Breast Cancer Drugs Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 F. Hoffmann-La Roche Ltd.

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Novartis AG

11.3 AstraZeneca PLC

11.4 Eli Lilly and Company Inc.

11.5 Pfizer Inc.

11.6 Merck & Co., Inc.

11.7 Bristol-Myers Squibb Company

11.8 Johnson & Johnson

11.9 Genentech Inc.

11.10 AbbVie Inc.

11.11 Gilead Sciences, Inc.

11.12 Takeda Pharmaceutical Company Limited

11.13 Eisai Co., Ltd.

11.14 Celgene Corporation, Inc.

11.15 Sanofi S.A.