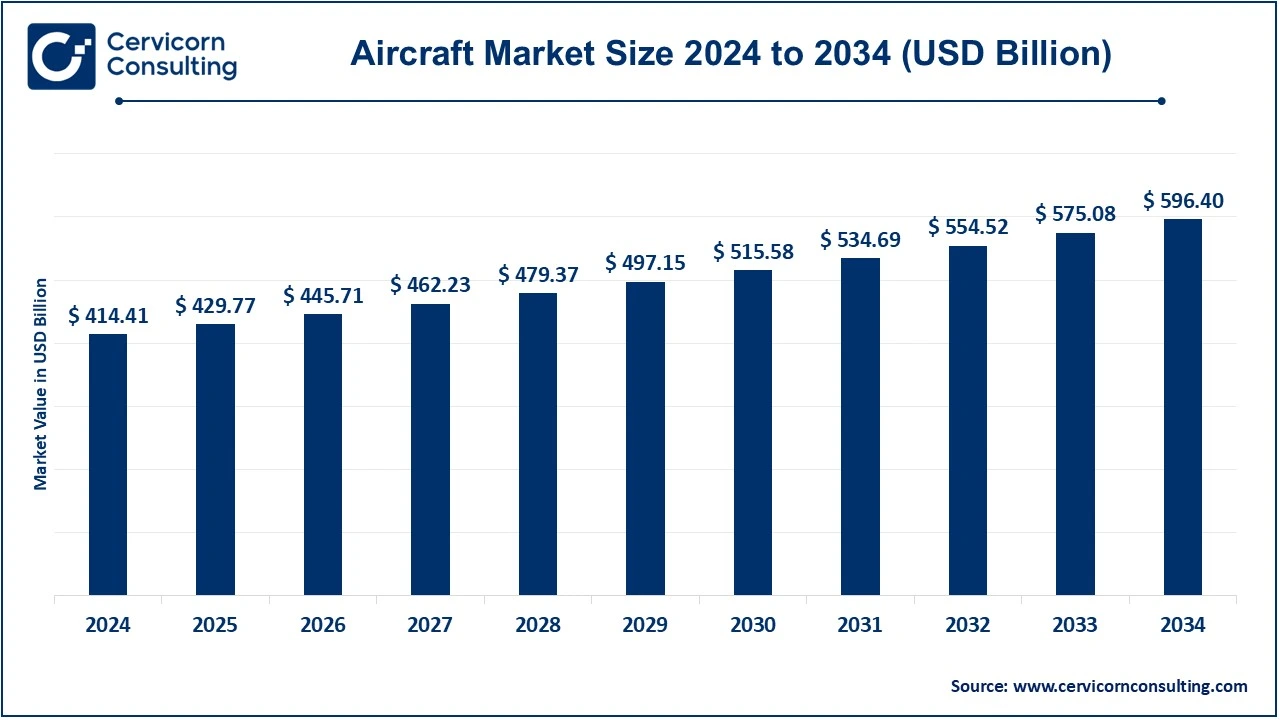

The global aircraft market size was valued at USD 414.41 billion in 2024 and is expected to be worth around USD 596.40 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.70% over the forecast period 2025 to 2034.

The aircraft market is seeing a huge and steady rise, with each year fueling the global demand for air travel mainly from the emerging markets of the world. Rising international tourism, business trips, and cargo transportation are all feeding the demand for commercial and cargo aircraft. A number of technological advancements in aircraft design, especially in terms of efficiency and environmental considerations, have considerably spurred this growth. Other notable contributions to this burgeoning market include the ongoing development of electric aircraft and hybrid aircraft along with many government investments in aviation infrastructure, and growing air traffic in developed and developing economies.

The aircraft market deals with the design, development, manufacture, and sale of different aircraft: commercial airliners, cargo planes, military aircraft, and private jets. This market covers the life cycle of aircraft from conception, design, and manufacture into maintenance. Air travel growth and economic development, growth, and improvement in aviation technologies are the most important factors responsible for increasing demand for aircraft. The future will be focused on innovations around fuel saving, the safety of air journeys, and environmental sustainability. There are rapid developments within the passenger and cargo aircraft markets because of enormous increasing air traffic, and sustainable aviation solutions are being provided.

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 429.77 Billion |

| Expected Market Size in 2034 | USD 596.40 Billion |

| Projected CAGR 2025 to 2034 | 3.70% |

| Dominant Region | North America |

| Growing Region | Asia-Pacific |

| Key Segments | Type, Size, Region |

| Key Companies | The Boeing Company, Airbus SE, Lockheed Martin Corporation, Textron Inc., Embraer S.A., ATR, United Aircraft Corporation |

Commercial Aircraft: It refers to an airplane designed for use in the commercial airline business. Commercial aircraft are aircraft designed for commercial aviation, mostly used to carry passengers and freight. Commercial aircraft are designed with high efficiency, reliability, and safety in mind. Various airline companies have purchased and are using the models of aircraft for a range of different distances from short local flights to global long-haul flights. Commercial aircraft can be of whatever type, size, or configuration is needed to meet the various market demands and needs.

Passenger Aircraft: It fall under the commercial aircraft category. These aircraft are made for carrying people and have seating arrangements, facilities, and safety features for passengers. They come in a variety of sizes, from smaller regional planes to larger intercontinental models. The aircraft are equipped with restrooms, air conditioning, and entertainment systems to make the journey comfortable for the passengers.

Narrow Body Aircraft: They are less spacious planes normally designed to have one aisle to gain passenger access. It is normally used to fly within a short-to-medium range of distance, where fewer passengers can fit inside it. Due to the single-aisle design, this is the most compact and cheapest plane type available, making it suitable for regional travel or routes where passenger demand is relatively low. It is mainly used for local trips or domestic travel or even travels within the same region.

Wide Body Aircraft: It refers to bigger planes, which have more than one aisle and can carry more passengers and have a more spacious cabin. These aircraft have been designed mainly for long-distance international flights; they offer additional comfort and perks to passengers with longer travel time. With bigger ranges and large seating configurations, wide-body aircraft are essential to airlines that ply routes requiring bigger capacity, such as transcontinental and transoceanic flights.

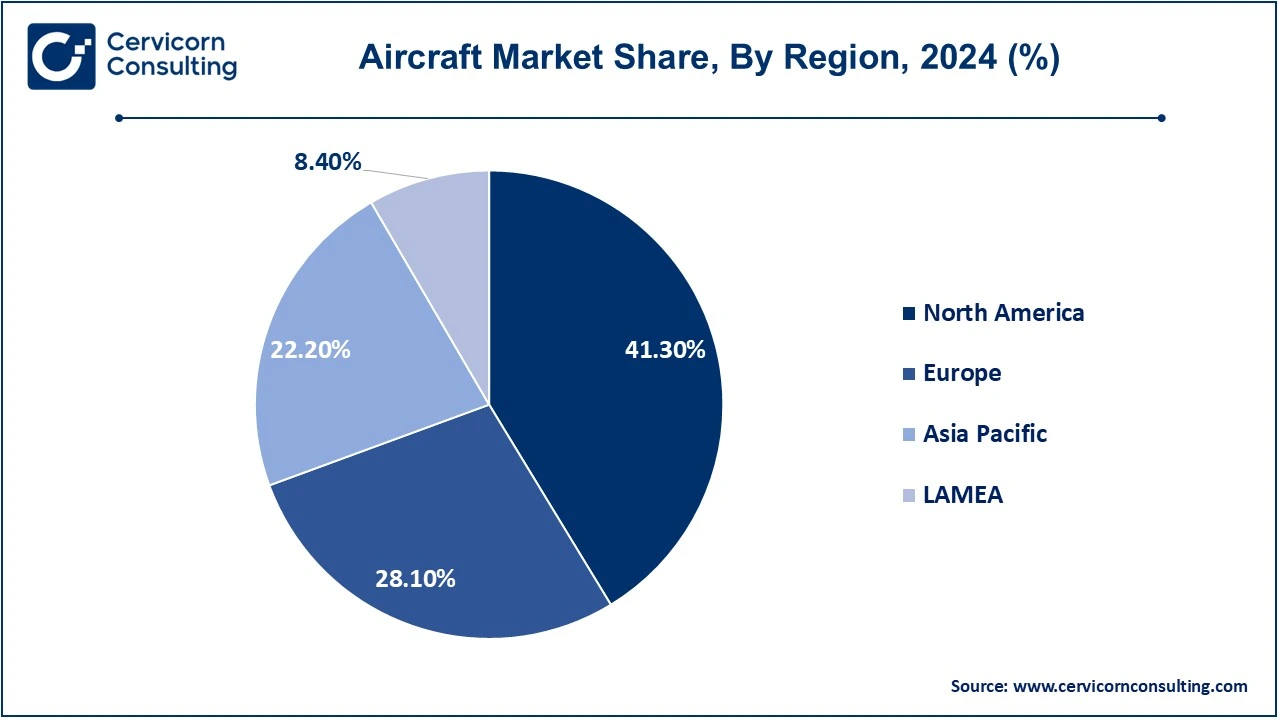

The aircraft market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

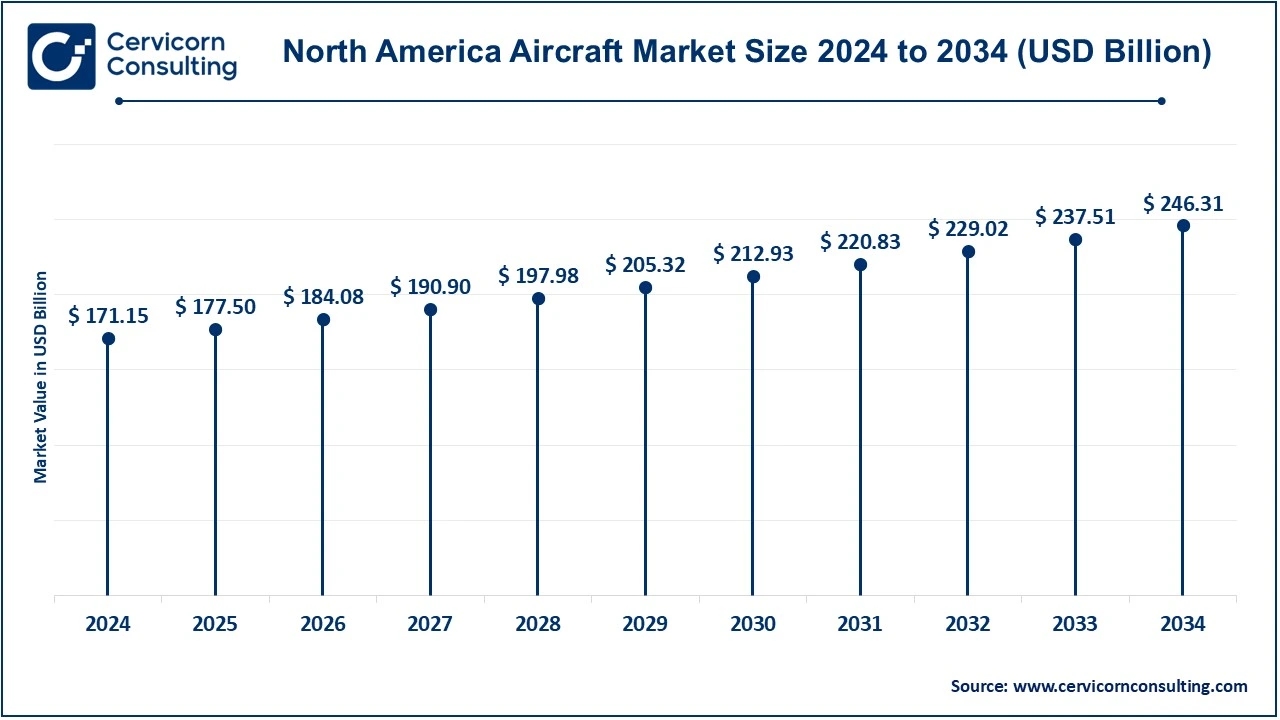

The North America aircraft market size was valued at USD 171.15 billion in 2024 and is expected to reach around USD 246.31 billion by 2034. North America is a leading global market in which the United States and Canada are found to dominate aircraft production and consumption. The world's largest aerospace companies, which include Boeing of the U.S., have huge operations there with airlines operating in the country commanding a huge commercial aircraft fleet. Canada also contributes to the aviation sector with companies like Bombardier and its active participation in regional aviation markets. Aerospace Industries Association, September 2024 the U.S. aerospace and defense sales reached an outstanding performance level in 2023, surging to over USD 955 billion with a rise of 7.1 percent from the prior year. Undoubtedly, it was a massive growth and, therefore calls for emphasis on the economic contributions of the industry where one million dollars of end-use sales supports for jobs both in the end-use manufacturing and the supply chain.

The Europe aircraft market size was estimated at USD 116.45 billion in 2024 and is projected to hit around USD 167.59 billion by 2034. Europe continues to be a very significant market for aircraft and is still largely dominated by the likes of Germany, France, and the UK. France hosts the world's premier aircraft manufacturing industry, Airbus. The region enjoys this very good aviation infrastructure coupled with established airlines which include Lufthansa, Air France, and British Airways, representing a very aggressive high-tech aviation market around Europe. Such new roadmap concepts for modernizing air traffic management in Europe by following a more efficient and sustainable aviation sector till 2045 is the European ATM Master Plan 2025 before the end of December 2024, founded by the two criteria of digitalization and sustainability, providing ten investment priorities as well as twelve development activities. According to these developments, it can make air transport resilient by reducing the emission level down to the mark of up to 400 million tons of CO2 by the end of 2050.

The Asia-Pacific aircraft market size was accounted for USD 92 billion in 2024 and is forecasted to grow around USD 132.40 billion by 2034. Asia-Pacific is the fastest-growing region propelled by the fast-expanding economies of China, Japan, India, and the Southeast Asian countries. China is a very large player in both commercial aviation through Air China and in manufacturing through COMAC. India is also experiencing growth, with increasing demand for air travel due to its large population and expanding middle class. This will, for example, be the case for Boeing when the Commercial Aircraft Corporation of China COMAC brought its C919 narrowbody jet to market with a potential capability to challenge both the Boeing 737 MAX and Airbus A320neo in early 2024. COMAC intended to take as much share from Boeing's commanding leadership in the aerospace space as it takes from Airbus due to strategic investment and ambition made by China for aviation technology.

The LAMEA aircraft market size was valued at USD 34.81 billion in 2024 and is anticipated to reach around USD 50.10 billion by 2034. The area LAMEA consists of Latin America, the Middle East, and Africa with diverse and emerging markets for aircraft, providing a comprehensive market for any aircraft company operating in the aerospace industry. Both the demand from the passengers within the region across countries like Brazil and Mexico within Latin America can be said to grow over time. A key international passenger travel hub would be the countries in the Middle East, in which there exists Emirates, Qatar Airways, and Etihad within the United Arab Emirates, Qatar, and Saudi Arabia. This growing African market with strong growths in the airline sectors of South Africa and Nigeria is an excellent example. Take the air travel industry, which has already achieved over 1 million air movements in the United Arab Emirates in 2024. It is now January 2025 and the turning point for an extremely recovering course from the pandemic. It represented a landmark showing that the country has a strategic location as the world's foremost aviation hub by increased passenger traffic and cargo operations. Growth is the underlining factor for success in building up and expanding aviation infrastructure which the UAE avers to construct.

The new entrants to the aircraft industry are using revolutionary technologies and business models to disrupt traditional aviation. These companies focus on electric and hybrid propulsion systems, reducing emissions and lowering operating costs. Moreover, these companies rely on advanced materials such as lightweight composites for improvement in efficiency in fuel burn and performance. In addition, recent entrants would focus on becoming digitally transformed firms using AI and big data while applying IoT through predictive maintenance as well as towards flight optimization and passenger-experience enhancement. Customer-centric for these companies; they are giving more flexible forms of travel by cost-effective while targeting environmentally-sensitive consumers and other businesses looking forward to more efficiently air-traveled solutions.

CEO Statements

Kelly Ortberg, CEO of The Boeing Company

Guillaume Faury, CEO of Airbus SE

Jim Taiclet, CEO of Lockheed Martin Corporation

Market Segmentation

By Type

By Size

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Aircraft

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Size Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Technological advances

4.1.1.2 The safety and reliability of modern aircraft are increased

4.1.1.3 Increased global trade with the need to transport various goods

4.1.2 Market Restraints

4.1.2.1 High aircraft manufacturing and acquisition cost at the beginning

4.1.2.2 Low level of airport capacity and crowding at large centers

4.1.2.3 Security issues and the regulatory complexities involving airspace

4.1.3 Market Challenges

4.1.3.1 Competition with other modes of transport

4.1.3.2 Managing the uncertainty and risks of global economic conditions

4.1.3.3 Ensuring an easy interface between new technologies with existing systems

4.1.4 Market Opportunities

4.1.4.1 Government incentives for the development of sustainable aviation

4.1.4.2 Aerospace and aviation innovation collaborations

4.1.4.3 Urban air mobility solutions and air taxis

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Aircraft Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Aircraft Market, By Type

6.1 Global Aircraft Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Commercial Aircraft

6.1.1.2 Military Aircraft

Chapter 7. Aircraft Market, By Size

7.1 Global Aircraft Market Snapshot, By Size

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Narrow Body Aircraft

7.1.1.2 Wide Body Aircraft

Chapter 8. Aircraft Market, By Region

8.1 Overview

8.2 Aircraft Market Revenue Share, By Region 2024 (%)

8.3 Global Aircraft Market, By Region

8.3.1 Market Size and Forecast

8.4 North America

8.4.1 North America Aircraft Market Revenue, 2022-2034 ($Billion)

8.4.2 Market Size and Forecast

8.4.3 North America Aircraft Market, By Country

8.4.4 U.S.

8.4.4.1 U.S. Aircraft Market Revenue, 2022-2034 ($Billion)

8.4.4.2 Market Size and Forecast

8.4.4.3 U.S. Market Segmental Analysis

8.4.5 Canada

8.4.5.1 Canada Aircraft Market Revenue, 2022-2034 ($Billion)

8.4.5.2 Market Size and Forecast

8.4.5.3 Canada Market Segmental Analysis

8.4.6 Mexico

8.4.6.1 Mexico Aircraft Market Revenue, 2022-2034 ($Billion)

8.4.6.2 Market Size and Forecast

8.4.6.3 Mexico Market Segmental Analysis

8.5 Europe

8.5.1 Europe Aircraft Market Revenue, 2022-2034 ($Billion)

8.5.2 Market Size and Forecast

8.5.3 Europe Aircraft Market, By Country

8.5.4 UK

8.5.4.1 UK Aircraft Market Revenue, 2022-2034 ($Billion)

8.5.4.2 Market Size and Forecast

8.5.4.3 UKMarket Segmental Analysis

8.5.5 France

8.5.5.1 France Aircraft Market Revenue, 2022-2034 ($Billion)

8.5.5.2 Market Size and Forecast

8.5.5.3 FranceMarket Segmental Analysis

8.5.6 Germany

8.5.6.1 Germany Aircraft Market Revenue, 2022-2034 ($Billion)

8.5.6.2 Market Size and Forecast

8.5.6.3 GermanyMarket Segmental Analysis

8.5.7 Rest of Europe

8.5.7.1 Rest of Europe Aircraft Market Revenue, 2022-2034 ($Billion)

8.5.7.2 Market Size and Forecast

8.5.7.3 Rest of EuropeMarket Segmental Analysis

8.6 Asia Pacific

8.6.1 Asia Pacific Aircraft Market Revenue, 2022-2034 ($Billion)

8.6.2 Market Size and Forecast

8.6.3 Asia Pacific Aircraft Market, By Country

8.6.4 China

8.6.4.1 China Aircraft Market Revenue, 2022-2034 ($Billion)

8.6.4.2 Market Size and Forecast

8.6.4.3 ChinaMarket Segmental Analysis

8.6.5 Japan

8.6.5.1 Japan Aircraft Market Revenue, 2022-2034 ($Billion)

8.6.5.2 Market Size and Forecast

8.6.5.3 JapanMarket Segmental Analysis

8.6.6 India

8.6.6.1 India Aircraft Market Revenue, 2022-2034 ($Billion)

8.6.6.2 Market Size and Forecast

8.6.6.3 IndiaMarket Segmental Analysis

8.6.7 Australia

8.6.7.1 Australia Aircraft Market Revenue, 2022-2034 ($Billion)

8.6.7.2 Market Size and Forecast

8.6.7.3 AustraliaMarket Segmental Analysis

8.6.8 Rest of Asia Pacific

8.6.8.1 Rest of Asia Pacific Aircraft Market Revenue, 2022-2034 ($Billion)

8.6.8.2 Market Size and Forecast

8.6.8.3 Rest of Asia PacificMarket Segmental Analysis

8.7 LAMEA

8.7.1 LAMEA Aircraft Market Revenue, 2022-2034 ($Billion)

8.7.2 Market Size and Forecast

8.7.3 LAMEA Aircraft Market, By Country

8.7.4 GCC

8.7.4.1 GCC Aircraft Market Revenue, 2022-2034 ($Billion)

8.7.4.2 Market Size and Forecast

8.7.4.3 GCCMarket Segmental Analysis

8.7.5 Africa

8.7.5.1 Africa Aircraft Market Revenue, 2022-2034 ($Billion)

8.7.5.2 Market Size and Forecast

8.7.5.3 AfricaMarket Segmental Analysis

8.7.6 Brazil

8.7.6.1 Brazil Aircraft Market Revenue, 2022-2034 ($Billion)

8.7.6.2 Market Size and Forecast

8.7.6.3 BrazilMarket Segmental Analysis

8.7.7 Rest of LAMEA

8.7.7.1 Rest of LAMEA Aircraft Market Revenue, 2022-2034 ($Billion)

8.7.7.2 Market Size and Forecast

8.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 9. Competitive Landscape

9.1 Competitor Strategic Analysis

9.1.1 Top Player Positioning/Market Share Analysis

9.1.2 Top Winning Strategies, By Company, 2022-2024

9.1.3 Competitive Analysis By Revenue, 2022-2024

9.2 Recent Developments by the Market Contributors (2024)

Chapter 10. Company Profiles

10.1 The Boeing Company

10.1.1 Company Snapshot

10.1.2 Company and Business Overview

10.1.3 Financial KPIs

10.1.4 Product/Service Portfolio

10.1.5 Strategic Growth

10.1.6 Global Footprints

10.1.7 Recent Development

10.1.8 SWOT Analysis

10.2 Airbus SE

10.3 Lockheed Martin Corporation

10.4 Textron Inc.

10.5 Embraer S.A.

10.6 ATR

10.7 United Aircraft Corporation