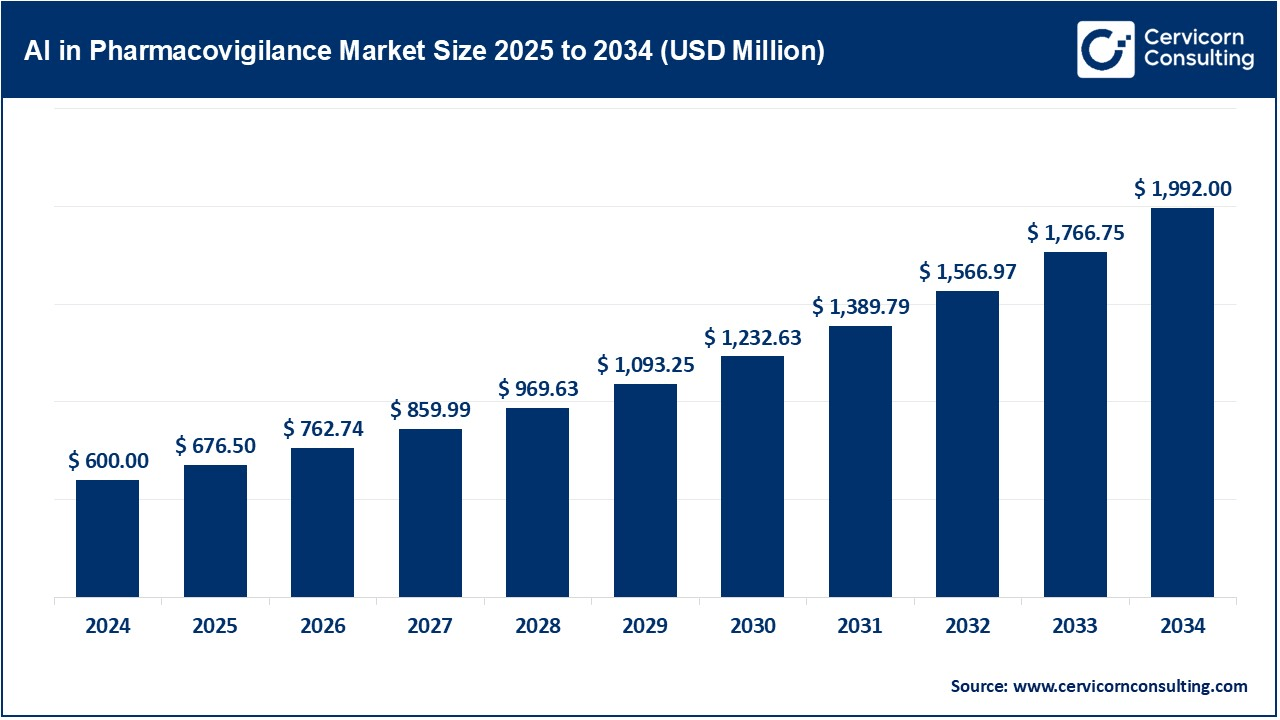

The global artificial intelligence in pharmacovigilance market size was valued at USD 600 million in 2024 and is expected to hit around USD 1,992 million by 2034, growing at a compound annual growth rate (CAGR) of 21.5% over the forecast period 2025 to 2034. The pharmacovigilance market is increasing with the use of artificial intelligence for better drug safety. Companies quickly analyze huge volumes of data, which allows the detection of side effects and risks faster with AI. The strict rules by the governments and health agencies regarding the safety of the drugs push the companies to employ advanced monitoring systems. Moreover, the increase in new medicines and vaccines necessitates better safety checks. Pharmaceutical companies want to reduce costs and improve efficiency. Therefore, they invest in AI-based solutions. More partnerships between tech companies and drug firms are driving innovation. As patient safety becomes a top priority, AI-powered pharmacovigilance is becoming essential for faster, more accurate monitoring of medicines worldwide.

It is the use of smart computer systems in monitoring and improving drug safety for pharmacovigilance. AI assists in detecting side effects, detecting risks, and processing vast volumes of medical data speedily. This market is growing because drug companies and health agencies need better ways to track medicine safety. Some trends in this market are machine learning, automation, and real-time data analysis. Increasingly, companies are utilizing AI to observe stringent drug safety regulations and decrease expenses. Future growth for AI will come through improved technology, more partnerships, and new government policies. The more medicines available on the market, the more AI systems will be required for rapid and precise monitoring of drugs worldwide.

AI Technologies Adaptation

Increasing interest in patient safety

Regulatory pressure and compliance requirements

Post-Market Surveillance Demand

Thriving Pharmaceutical Industry

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 600 Million |

| Expected Market Size in 2034 | USD 1,992 Million |

| Projected CAGR 2025 to 2034 | 21.50% |

| Dominant Region | North America |

| Growing Region | Asia-Pacific |

| Key Segments | Technology, Application, End User, Region |

| Key Companies | Accenture, Capgemini, Cognizant, IBM, Wipro, Aris Global, BioClinica, ICON, IQVIA, ITClinical, LabCorp, Linical Accelovance, Parexel International, United BioSource, TAKE Solutions |

AI with RWD

AI in Signal Detection and Risk Management

Artificial Intelligence-empowered Pharmacovigilance Collaboration

Use AI for post-marketing surveillance

AI and Personalized Drug Safety Monitoring

Advanced AI technology

Stricter Drug Safety Rules

High implementation costs of AI

Privacy and Data Security Issues

Application of Real World Data in Drug Safety

Growth in Emerging Markets

Automation Replaces Manual Labor

New Controls over the Use of AI in Medication Safety

Lack of Standardized AI Regulations

Limited AI Experience in Pharmacovigilance

Adverse Event Detection and Reporting: AI finds and reports the adverse effects of medicines quickly by thoroughly analyzing immense data extracted from hospitals, social media, and medical records to identify risks early on. It thereby enables doctors and drug companies to take remedial steps faster to ensure a patient's safety. AI makes the reporting of such incidents to health authorities more accurate and reduces human errors. Automation has freed the drug safety teams of paperwork rather than bringing the focus to solving problems. It ensures better patient care and that medicines are apt for the use of individuals.

Signal Detection and Data Mining: AI checks vast amounts of data for its sensors, as it always maintains hidden safety issues about a drug for which a new signal is detected. It is also reading schemes in patient pages, doctor's notes, and even social media for signs or symptoms of their unusual actions. By now, pharmaceutical companies and regulators can easily take precautionary actions concerning any safe event before danger smacks. Machine learning makes the process better with time, which means that the drug safety check ends up being more accurate. AI is very helpful in sorting big data so that identifying a pattern that would be hard for a human expert is easy. Today, early detection of risks will convert into more and better process medicines available.

Case Processing and Automation: AI speeds up the gathering and processing of reports about drug reactions. It checks and organizes data automatically, preventing time and human mistakes. This shortens the time pharmaceutical companies need to address safety concerns. AI verifies that the document complies with health regulations, thereby blocking possible lawsuits. With automated case processing, drug safety teams work more efficiently; most of it is spent on considering innovations for improving medicine safety rather than clerking. This saves a lot of time money, and better drug monitoring at large.

Predictive Analytics: AI can predict medical risks before they become serious problems. It can give warnings to doctors and drug companies before side effects become apparent for actions to be taken avoiding the damage to anybody. Predictive AI will increase safety in medicine by studying trends that would otherwise go unnoticed. Such modifications to medicine guidelines reduce dangerous reactions from companies' and regulators' views. Preventing problems before they occur tends to make drugs safer and, at the same time, protects the public at large.

Machine Learning (ML): Machine learning (ML) helps AI exploit its memory for old drug data to discover patterns. It can comb through millions of reports to decide where the bad reactions to medicine were. It is becoming increasingly accurate with time, so drug safety monitoring is seeing possible improvements. Pharmaceutical companies can quickly spot problems with ML, thus shortening the gap in safety -reporting time for adverse effects or even eliminating the gap. On top of this, ML will make better predictions concerning new drugs to warrant their use by the masses. It has improved drug tracking dramatically, making it faster and more efficient in the process.

Natural Language Processing (NLP): NLP helps AI to know the doctor's notes and online reviews of the patients. Such texts become easy for NLP to evaluate as a result of massive volumes into detection of potential unnoticed warning signs for medicines in huge blocks of text. NLP allows drug safety teams to draft side effects from various sources, hence more accurate reporting. This improves the situation for pharmaceutical companies and regulators, as it becomes easier to profile medicines. By taking data and processing it effectively, NLP makes the move toward corrective action possible whenever a safety concern develops.

Robotic Process Automation (RPA): RPA is of great help in carrying out similar drug safety work, that is, automating the data entry, filing of reports, and processing of documents with minimal human error. This will speed up the tracking and reporting of adverse drug events by the companies. With robotic process automation, drug safety teams can devote their time to solving issues rather than admin-related tasks. It not only increases productivity but also enables compliance with regulatory standards. This also entails the removal of redundant work as a cost-saving avenue and improvement of accuracy in tracking medicines' safety.

Deep Learning: Deep learning is a subcategory in AI that understands data complexity. Therefore, this processing deals with the bulk of information to detect problems in the early phases. Deep learning can already learn along with metrics in old cases to anticipate risks of medicines that are not clear. It can modify message warnings and thus help to provide faster and more accurate monitoring of drugs. Companies use deep learning in their mission to make internal decisions and develop smarter drugs. In the future, as deep learning gets better, it will only increase its involvement in preventing reactions between medicines and patients.

Pharmaceutical Companies: Pharmaceutical companies are now embracing AI to make their drugs markedly safe. Early detection of side effects by AI makes medicines more secure. With these automated systems, fewer mistakes are made, and the safety checks are carried out much faster, making compliance a lot easier for AI- as countries become stricter with the rules, AI helps keep them legally compliant and even protects patients according to regulatory guidelines. All this is dependent on how safety regulations will likely be increasingly tighter; thus, AI will help compliance and patient protection while saving time and money for many manual tasks. AI ensures that drug monitoring by pharmaceutical companies is better to ensure that the public is safe.

Contract Research Organizations (CROs): CROs assist drug companies in testing medicine safety. AI speeds things up for drug companies and brings ever-more accurate results. It is useful in the collection of data and analysis of patient safety data, which can enhance the research quality. AI speeds up report writing and checks data for compliance with safety regulations. All this enables CROs to better their services that help drug companies sell safer medicines with the help of AI. Tools driven by AI will lessen the chances of human error and ensure early identification and reporting of drug safety issues.

Regulatory Agencies: These regulatory agencies-that is, the FDA and the EMA- have incorporated AI into their systems to check medicine safety through upload. Because of this, AI makes a huge amount of safety data scanned, thus improving diagnosis on drug safety, as well as identifying potential threats to public health. Besides, governments can combine AI with effective control, analysis, and collection of dissimilar safety data from around the globe. Applications of AI can learn from the massive toll of all existing safety databases. AI will analyze the symptoms that would show safety-concern signs across all the countries just to get a preliminary warning about adverse events that deal with medicines.

Healthcare professionals: Hospitals and clinics use AI to monitor medicine reactions in patients. AI helps doctors identify side effects early, thus preventing serious health problems. It analyzes patient data to find hidden drug risks. This allows healthcare providers to change treatments if needed, improving patient safety. Through AI, better treatment plans are prepared, as it knows how different patients react to medicines. Hospitals provide drugs safely and better care to patients through the application of AI.

The AI in pharmacovigilance market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

North America: The AI user is mostly dominated by the North American region. The U.S. is the most advanced in technology, and it also has the most stringent regulations to force companies into using AI. Most of the pharmaceutical companies and hospitals are using AI to enhance medicine monitoring. The FDA also encourages AI-driven safety checks, which means faster and safer approval of drugs. As more investments grow in healthcare technology, North America will lead in AI-driven pharmacovigilance.

Europe: Europe is embracing AI in drug safety since health regulations are stringent. The European Medicines Agency (EMA) is encouraging the adoption of AI to enhance the monitoring of medicine. European pharmaceutical companies are exploiting AI to detect side effects faster, upon which they report them fast. AI ensures that strict European safety standards are met while becoming efficient. AI adoption in pharmacovigilance is emerging in Europe as the requirement for safer medicines surges.

Asia Pacific: Asia Pacific is burgeoning in AI-driven drug safety rapidly. China and India are looking to invest heavily in AI as a way to enhance healthcare monitoring. Because pharmaceutical research has been growing steadily in the region, AI allows companies to follow medicine safety far better. It is also compelling governments to be more encouraging with AI adoption toward better regulation of drugs. Awareness of drug safety is increasing. AI plays an increasingly significant role in medicine quality across the Asia Pacific.

LAMEA: Pharmacovigilance AI use is slowly growing in Latin America, the Middle East, and Africa. The drug safety system in these areas is still under development, though enthusiasm for AI is growing. Governments and healthcare systems are now utilizing AI to better monitor medicine safety. In these regions, as infrastructures about healthcare grow, more usage of AI will emerge, and with it, safer medicines for patients.

CEO Statements

Kristof Huysentruyt, Senior Director and Head of Safety Data Management and Systems at UCB Pharma:

John Balian, Senior Vice President of Global Pharmacovigilance and Epidemiology at Bristol-Myers Squibb:

Market Segmentation

By Technology

By Application

By End-User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Artificial Intelligence in Pharmacovigilance

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Application Overview

2.2.3 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Advanced AI technology

4.1.1.2 Stricter Drug Safety Rules

4.1.2 Market Restraints

4.1.2.1 High implementation costs of AI

4.1.2.2 Privacy and Data Security Issues

4.1.3 Market Challenges

4.1.3.1 Lack of Standardized AI Regulations

4.1.3.2 Limited AI Experience in Pharmacovigilance

4.1.4 Market Opportunities

4.1.4.1 Application of Real World Data in Drug Safety

4.1.4.2 Growth in Emerging Markets

4.1.4.3 Automation Replaces Manual Labor

4.1.4.4 New Controls over the Use of AI in Medication Safety

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Artificial Intelligence in Pharmacovigilance Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Artificial Intelligence in Pharmacovigilance Market, By Technology

6.1 Global Artificial Intelligence in Pharmacovigilance Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Machine Learning

6.1.1.2 Natural Language Processing (NLP)

6.1.1.3 Deep Learning

Chapter 7. Artificial Intelligence in Pharmacovigilance Market, By Application

7.1 Global Artificial Intelligence in Pharmacovigilance Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Adverse Event Detection

7.1.1.2 Signal Detection

7.1.1.3 Data Integration & Management

7.1.1.4 Drug Safety Monitoring

7.1.1.5 Automated Report Generation

Chapter 8. Artificial Intelligence in Pharmacovigilance Market, By End-User

8.1 Global Artificial Intelligence in Pharmacovigilance Market Snapshot, By End-User

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Pharmaceutical & Biotechnology Companies

8.1.1.2 Contract Research Organizations (CROs)

8.1.1.3 Regulatory Agencies

8.1.1.4 Healthcare Providers

Chapter 9. Artificial Intelligence in Pharmacovigilance Market, By Region

9.1 Overview

9.2 Artificial Intelligence in Pharmacovigilance Market Revenue Share, By Region 2024 (%)

9.3 Global Artificial Intelligence in Pharmacovigilance Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Artificial Intelligence in Pharmacovigilance Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Artificial Intelligence in Pharmacovigilance Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Artificial Intelligence in Pharmacovigilance Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Artificial Intelligence in Pharmacovigilance Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Artificial Intelligence in Pharmacovigilance Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Artificial Intelligence in Pharmacovigilance Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Artificial Intelligence in Pharmacovigilance Market, By Country

9.5.4 UK

9.5.4.1 UK Artificial Intelligence in Pharmacovigilance Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Artificial Intelligence in Pharmacovigilance Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Artificial Intelligence in Pharmacovigilance Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Artificial Intelligence in Pharmacovigilance Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Artificial Intelligence in Pharmacovigilance Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Artificial Intelligence in Pharmacovigilance Market, By Country

9.6.4 China

9.6.4.1 China Artificial Intelligence in Pharmacovigilance Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Artificial Intelligence in Pharmacovigilance Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Artificial Intelligence in Pharmacovigilance Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Artificial Intelligence in Pharmacovigilance Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Artificial Intelligence in Pharmacovigilance Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Artificial Intelligence in Pharmacovigilance Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Artificial Intelligence in Pharmacovigilance Market, By Country

9.7.4 GCC

9.7.4.1 GCC Artificial Intelligence in Pharmacovigilance Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Artificial Intelligence in Pharmacovigilance Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Artificial Intelligence in Pharmacovigilance Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Artificial Intelligence in Pharmacovigilance Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 Accenture

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Capgemini

11.3 Cognizant

11.4 IBM

11.5 Wipro

11.6 Aris Global

11.7 BioClinica

11.8 ICON

11.9 IQVIA

11.10 ITClinical

11.11 LabCorp

11.12 Linical Accelovance

11.13 Parexel International

11.14 United BioSource

11.15 TAKE Solutions