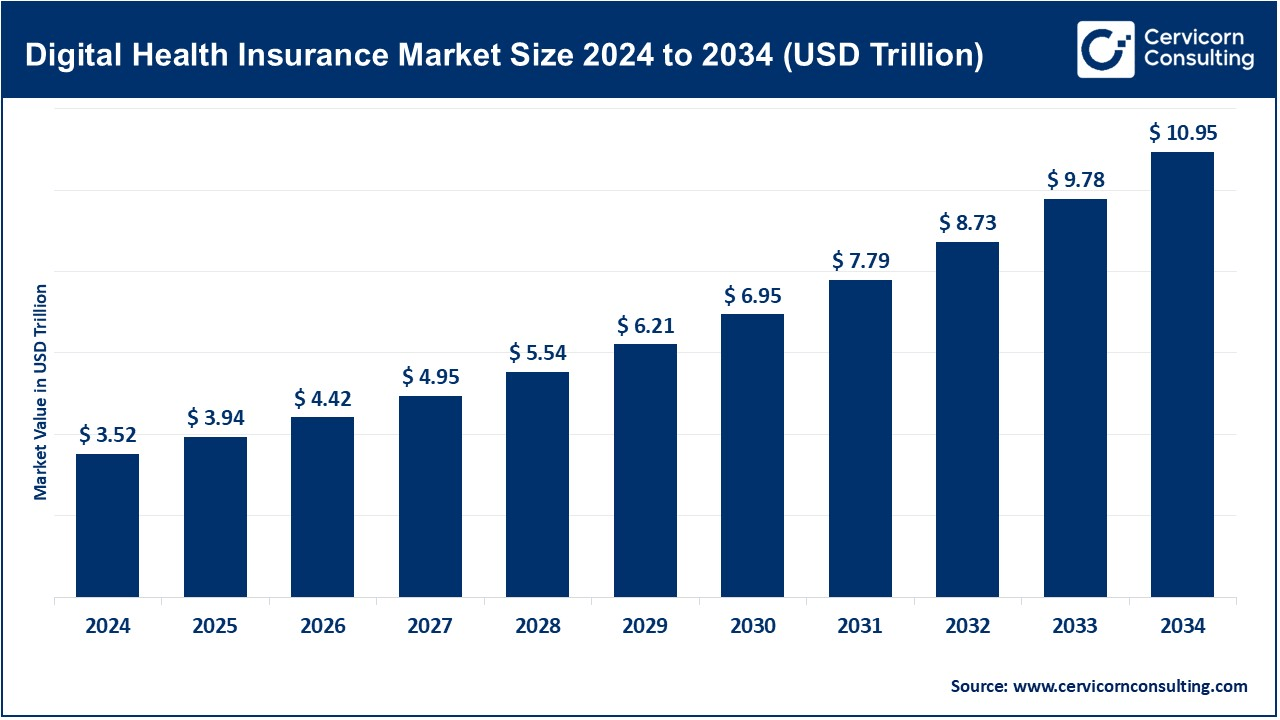

The global digital health insurance market size was valued at USD 3.52 trillion in 2024 and is expected to be worth around USD 10.95 trillion by 2034, growing at a compound annual growth rate (CAGR) of 12.01% over the forecast period from 2025 to 2034. The digital health insurance market is witnessing swift expansion, primarily as a result of technological advancements, shifting consumer demands, and a movement towards healthcare frameworks that focus on value. The insurance industry will undergo further transformation as more companies integrate digital technologies, ultimately resulting in the availability of tailored, easily accessible, and budget-friendly healthcare choices for consumers. Ensuring the long-term viability of the digital health insurance market hinges on effectively resolving challenges surrounding data protection, integration, and accessibility.

With rapid technological advancements, the healthcare industry is also undergoing significant changes. Digital health insurance is leading the way in revolutionizing healthcare and reshaping the insurance landscape. Digital health insurance is a major breakthrough that includes quick insurance transactions, online consultations with doctors, laboratory tests that can be done at home, and the ease of getting medical data via mobile devices. Digital health insurance is a modern approach that leverages technology and simplifies the insurance experience for customers by incorporating digital platforms such as mobile applications, websites and AI instead of extensive paperwork and face-to-face interactions. This digital transformation in the healthcare industry has made health insurance much more effective, affordable, accessible, efficient and user-friendly.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 3.94 Trillion |

| Expected Market Size in 2034 | USD 10.95 Trillion |

| Projected CAGR 2025 to 2034 | 12.01% |

| Key Segments | Product Type, Deployment Mode, Payment Model, End-Users, and, Region |

| Key Companies | Oscar Health, Cigna, Aetna (CVS Health), UnitedHealth Group, Anthem Inc., Humana, Bupa Global, Benevolent Health, Lemonade Health, Clover Health, Zocdoc, Forward, Alan, Metromile, Bright Health, Lively, MediSprout, Gusto Health, Kaiser Permanente, Truvian Health, HealthSherpa, One Medical, Wellth, Payershield, Haven Health, GoHealth, Simply Insured, Health Plan One, Vero Health, Shoreline Health |

Increasing Penetration of Smartphones and Internet

Improved Customer Experience and Application Process

Regulatory Obstacles and Evaluation Procedures

Insufficient Accessibility

Rise in mHealth Apps and Digital Health Startups

Adopting Data-Driven Decisions in Healthcare

Risk Assessment and Underwriting Challenges

Scalability and Sustainability Concerns

Insurance Apps: Mobile apps enable users to monitor their health, review insurance details, process claims, and communicate with medical experts.

Pay-Per-Use Insurance Plans: Digital insurance plans that use data tracking and telematics to enable customers to pay according to their actual use of medical services.

Blockchain-Based Health Insurance: Insurance frameworks utilizing blockchain technology for the secure, transparent, and efficient management of claims processing and data handling.

AI-Powered Insurance: Plans that use AI and machine learning algorithms for more accurate risk assessment, personalized premiums, and claims processing.

Cloud-Based: Digital health insurance solutions that are cloud-hosted deliver increased scalability, enable remote access, and foster improved collaboration between users and healthcare providers.

On-Premise: Digital health insurance systems installed and operated within the insurance company's infrastructure, offering greater control over data security and integration.

Subscription-Based: Anyone looking for digital health insurance options that are comparable to traditional systems will have to pay a monthly or annual premium.

As-You-Go Payment: Unleash the power of the payment system that operates on a utilization model, not locking you into a rigid fixed fee. It's all about telemedicine consultations and healthcare visits shaping your journey.

Microinsurance: Online, low-income people may obtain cheap, short-term health insurance packages with flexible payment options.

Individuals: Digital health insurance plans targeted at individual consumers who want flexibility, personalization, and direct control over their healthcare services.

Families: Health insurance products tailored to meet the needs of entire families, with features such as family doctor services, emergency medical cover, and telemedicine consultations.

Employers: Companies provide their employees with group health insurance policies, which include digital health tools for managing workplace health, virtual care services, and wellness programs.

Government Programs: Public sector programs that leverage digital technologies to improve access to health insurance, such as government-run exchanges or digital public health initiatives.

Healthcare Providers: Partnerships between insurance companies and healthcare providers to offer digital health insurance solutions, integrating claims management and healthcare services.

The digital health insurance market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The major factors driving the expansion of the digital health insurance market in the region include the rise in overall healthcare expenditure, which includes both private and public spending on the programs, and the increasing demand for health insurance among those who have employer-sponsored health insurance as well as individual health insurance portfolio. Furthermore, most people in the U.S. and Canada have health insurance policies as they offer a number of benefits including bearing pre-hospitalization costs, covering medical expenses, and protection against critical illnesses. This is considered to be a major factor supporting the growth of the health insurance industry in North America. Due to the high adoption of private insurance, rising number of chronically ill people, and increased disposable money, the demand for health insurance is also increasing in the region. The three largest health insurers and health insurance specialists in the United States are UnitedHealth, Kaiser Foundation, and Anthem, Inc. They supply an array of health insurance products and services through their partnerships and subsidiaries, which in turn generates opportunities throughout North America.

The Europe is experiencing significant growth due to increased technological adoption and consumer demand for personalized, accessible, and effective health insurance. The European regulatory framework is undergoing changes to accommodate digital health insurance products. The European Union is enforcing regulations on digital health and insurance technology to guarantee consumer protection, data privacy, and fair market practices. Insurtech companies in Europe are transforming the insurance industry by utilizing digital platforms to provide more efficient, transparent, and cost-effective insurance solutions. While digital tools and internet access can sometimes pose challenges, the European health insurance sector is projected to see growth, particularly in rural areas, driven by customer preferences and advancements in technology. Despite the obstacles that come with digital tools and internet accessibility, it is heartening to know that the European health insurance market, especially in rural regions, is poised for expansion thanks to the evolving needs and expectations of customers as well as ongoing technological enhancements.

The Asia Pacific's market is rapidly expanding due to the integration of digital technology, the growing demand for healthcare services, and the shift towards personalized and efficient insurance products. Asia Pacific has the world's greatest population. Rapid urbanization and increasing penetration of insurance companies are driving the market growth. Changing lifestyle of consumers, unhealthy eating habits, and increasing obesity are the major factors driving the increasing prevalence of chronic diseases in the region. Rising disposable income, improved access to the internet, rising literacy rate, increasing investments in developing advanced healthcare infrastructure, and rising awareness among the population about health insurance are the major factors expected to drive the growth of the Asia Pacific digital health insurance market in the coming years. Although there are challenges related to market fragmentation, data privacy and technology access, the future of digital health insurance in Asia Pacific looks promising, driven by technological innovation, changing consumer expectations and regulatory support.

The LAMEA region is emerging as a key segment of the global insurance industry. While it faces unique challenges due to varying levels of healthcare infrastructure, digital adoption and regulatory frameworks in the region, it also offers significant opportunities due to the increasing demand for affordable and accessible healthcare solutions. The integration of telemedicine services into health insurance policies is increasing across the LAMEA region, driven by the need for accessible healthcare in regions with limited physical healthcare infrastructure. Digital health insurance solutions are being incorporated into health insurance policies to make healthcare more accessible, particularly in rural regions of LAMEA countries. Providing these solutions enables remote access to services at an affordable cost, which in turn enhances the efficiency and affordability of healthcare. The healthcare infrastructure in the LAMEA region displays significant discrepancies, with advanced countries like the UAE, South Africa, and Brazil possessing more complex healthcare systems. In places like Africa and portions of Latin America, access to healthcare is limited. The ever-changing nature of these areas presents challenges for insurance providers in integrating digital health initiatives. Middle Eastern nations like the UAE and Saudi Arabia are leading the way in developing advanced digital health insurance systems, despite facing challenges, promoting healthcare accessibility and cost-effectiveness for disadvantaged populations.

Market Segmentation

By Product Type

By Deployment Mode

By Payment Model

By End-Users

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Digital Health Insurance

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Type Overview

2.2.2 By Deployment Mode Overview

2.2.3 By Payment Model Overview

2.2.4 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing Penetration of Smartphones and Internet

4.1.1.2 Improved Customer Experience and Application Process

4.1.2 Market Restraint

4.1.2.1 Regulatory Obstacles and Evaluation Procedures

4.1.2.2 Insufficient Accessibility

4.1.3 Market Opportunity

4.1.3.1 Rise in mHealth Apps and Digital Health Startups

4.1.3.2 Adopting Data-Driven Decisions in Healthcare

4.1.4 Market Challenges

4.1.4.1 Risk Assessment and Underwriting Challenges

4.1.4.2 Scalability and Sustainability Concerns

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Digital Health Insurance Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Digital Health Insurance Market, By Product Type

6.1 Global Digital Health Insurance Market Snapshot, By Product Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Insurance Apps

6.1.1.2 Telemedicine/Telehealth

6.1.1.3 Pay-Per-Use Insurance Plans

6.1.1.4 Blockchain-Based Health Insurance

6.1.1.5 AI-Powered Insurance

Chapter 7. Digital Health Insurance Market, By Deployment Mode

7.1 Global Digital Health Insurance Market Snapshot, By Deployment Mode

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Cloud-Based

7.1.1.2 On-Premise

Chapter 8. Digital Health Insurance Market, By Payment Model

8.1 Global Digital Health Insurance Market Snapshot, By Payment Model

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Subscription-Based

8.1.1.2 Pay-As-You-Go

8.1.1.3 Microinsurance

Chapter 9. Digital Health Insurance Market, By End-User

9.1 Global Digital Health Insurance Market Snapshot, By End-User

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Individuals

9.1.1.2 Families

9.1.1.3 Employers

9.1.1.4 Government Programs

9.1.1.5 Healthcare Providers

Chapter 10. Digital Health Insurance Market, By Region

10.1 Overview

10.2 Digital Health Insurance Market Revenue Share, By Region 2024 (%)

10.3 Global Digital Health Insurance Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Digital Health Insurance Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Digital Health Insurance Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Digital Health Insurance Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Digital Health Insurance Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Digital Health Insurance Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Digital Health Insurance Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Digital Health Insurance Market, By Country

10.5.4 UK

10.5.4.1 UK Digital Health Insurance Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Digital Health Insurance Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Digital Health Insurance Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Digital Health Insurance Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Digital Health Insurance Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Digital Health Insurance Market, By Country

10.6.4 China

10.6.4.1 China Digital Health Insurance Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Digital Health Insurance Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Digital Health Insurance Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Digital Health Insurance Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Digital Health Insurance Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Digital Health Insurance Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Digital Health Insurance Market, By Country

10.7.4 GCC

10.7.4.1 GCC Digital Health Insurance Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Digital Health Insurance Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Digital Health Insurance Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Digital Health Insurance Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Oscar Health

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Cigna

12.3 Aetna (CVS Health)

12.4 UnitedHealth Group

12.5 Anthem Inc.

12.6 Humana

12.7 Bupa Global

12.8 Benevolent Health

12.9 Lemonade Health

12.10 Clover Health

12.11 Zocdoc

12.12 Forward

12.13 Alan

12.14 Metromile

12.15 Bright Health

12.16 Lively

12.17 MediSprout

12.18 Gusto Health

12.19 Kaiser Permanente

12.20 Truvian Health

12.21 HealthSherpa

12.22 One Medical

12.23 Wellth

12.24 Payershield

12.25 Haven Health

12.26 GoHealth

12.27 Simply Insured

12.28 Health Plan One

12.29 Vero Health

12.30 Shoreline Health