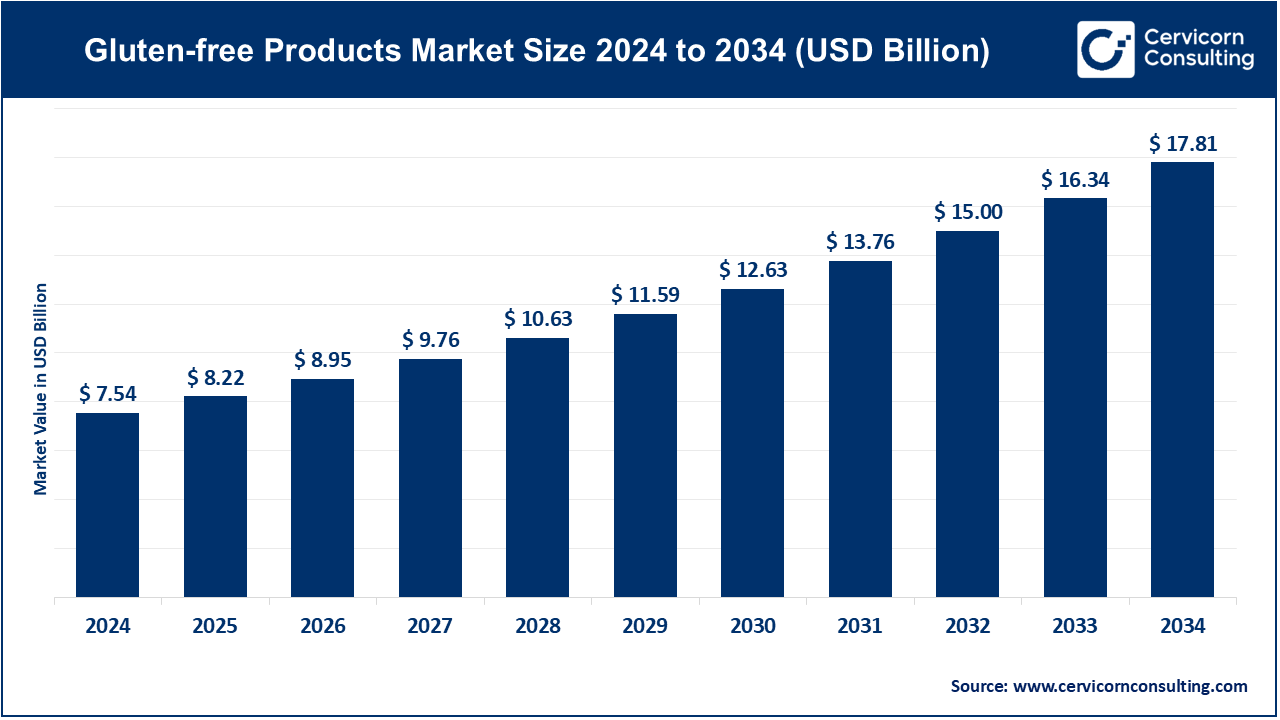

The global gluten-free products market size was accounted for USD 7.54 billion in 2024 and is estimated to exceed around USD 17.81 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.97% during the forecast period from 2025 to 2034. The gluten-free products market is driven by factors such as the increasing prevalence of celiac disease and gluten intolerance, rising consumer awareness of digestive health, the growing adoption of healthy eating trends, and the expansion of gluten-free product portfolios by manufacturers to meet diverse dietary preferences and lifestyles.

Gluten-free products are those food and beverage items that have been especially formulated to avoid containing gluten, a type of protein found in wheat, barley, rye and their products. These products are mainly consumed by people suffering from celiac disease or who are gluten sensitive as well as wheat allergic because they develop worst digestive problems and other health issues after consuming gluten. However, gluten-free products are increasingly becoming popular among health-related consumers who prefer clear, allergen-free food. They range from bread, pasta, snacks, drinks, and confectionery, made from alternative grains like rice, quinoa, millet, and sorghum, that have nutritional and safe consumption benefits for those with gluten intolerance.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 8.22 Billion |

| Expected Market Size in 2034 | USD 17.81 Billion |

| Projected CAGR 2025 to 2034 | 8.97% |

| Dominant Region | North America |

| Fastest Expanding Area | Asia-Pacific |

| Key Segments | Source, Type, Form, Distribution Channel, Region |

| Key Companies | Vitrolife AB, Cook Medical, Merck KGaA, Thermo Fisher Scientific, Inc., Esco Micro Pte Ltd, Genea Limited, Ferring Pharmaceuticals, Hamilton Thorne, Inc., Nidacon International AB, Rocket Medical plc, EMD Serono, Kitazato Corporation, IVFtech Aps, Zeiss Group, Labotect GmbH, Esco Medical, The Baker Company, Inc., Boston IVF, Invitrocare Fertility Laboratories Pvt. Ltd., EMD Serono, Inc. |

Animal Source: The animal-source-based gluten-free products include the products like gluten-free cheese, yogurt, and processed meat. They help meet the need of protein-wealthy diet free from gluten to those in whom specific diet is required. Increasing awareness regarding gluten intolerance necessitates manufacturers ensuring the absence of gluten cross-contamination during the process of processing such products. Animal-sourced gluten-free products are also in demand among low-carb or ketogenic diet followers, which increases their demand. Their appeal is somewhat limited among vegetarians or vegans, thus offering opportunities for diversification in product offerings.

Plant Source: With wide applicability and consumer preference for natural, wholesome ingredients, plant-based gluten-free products led the market. Other demanding products included gluten-free flours such as almond, rice, or sorghum, as well as vegan snacks with variations of typical snacks and non-dairy alternatives for vegan dairy applications. With increasing clean-label trends, the plant-derived gluten-free products that ensure nutritional completeness drive more sales. It is due to the adaptability and sustainability of the plant-based gluten-free product that makes it the core of the gluten-free market, providing potential for limitless innovation.

Bakery Products: Gluten-free bakery products, including bread, cakes, and pastries, form a huge market. These are for the consumers who are in search of a gluten-free alternative to the traditional baked products made from wheat. The food technology revolution has made it possible for the gluten-free baked product manufacturers to leave the gluten-free ones nearly inconspicuous from the latter. These are bakery products in high demand among consumers suffering from celiac disease, those who have gluten intolerance, and other people who adopt gluten-free diets for health reasons.

Snacks & RTE Products: Snacks & RTE products would focus on healthy & easy-to-eat snacks that are gluten-free, such as chips, protein bars, and granola, etc. Those snacks would help fast-moving consumers to have some gluten-free options while they eat on the go. Innovation here is nutrient-rich snack options, that is, those with high protein and fiber for those who are health-oriented.

Pizzas & Pastas: Several consumer demand for the comfort foods indulgent alternatives, free of gluten, gave an immense boost to the market for gluten-free pizzas and pastas. These goods are mainly prepared using rice flour, quinoa, or chickpea flour, which very nearly resemble 'traditional' wheat-based offerings in their taste as well as texture. Increased visibility on retail shelves and restaurant chains have enhanced growth a lot.

Condiments & Dressings: Gluten-free condiments, dressings, and sauces are developed to satisfy consumer demands about removing hidden sources of gluten from diets. Such products include gluten-free soy sauce, ketchup, as well as salad dressings. Consumers positively respond to a growing demand from consumers for everyday meal preparation involving allergen-free options.

Seasonings & Spreads: Gluten-free seasonings and spreads are spice blends, peanut butter, jams, and other spreads without gluten thickeners or additives. Such products are in very high demand among consumers who would like to flavor their foods without risking gluten contamination.

Desserts & Ice Creams: Such desserts and ice creams are in more demand today since the indulgent treats of a consumer with gluten intolerance are deemed in consideration.The varieties of them include gluten-free brownies, cakes, cookies, and different ice cream flavors. Manufacturers come up with innovative, appealing replacement versions that do not deprive the dessert of its richness.

Rice: Due to the natural composition of rice flour, rice noodles, and rice-based snacks, these products are now gaining popularity because of their gluten-free origin. Rice as a versatile, affordable staple gains appeal to diverse consumers, starting from gluten-sensitive patients to those adhering to the gluten-free diet.

Others: They are specialty gluten-free products, including soups, drinks, and special flours. Thus, this category includes other forms of specialty gluten-free products, which include products concerning special dietary requirements, with both general and gourmet kitchen needs.

Based on distribution channel, the market is classified into convenience stores, supermarkets & hypermarkets, specialty stores, online and others. The supermarkets & hypermarkets was leading the market in 2024.

Gluten-free Products Market Revenue Share, By Distribution Channel, 2024 (%)

| Distribution Channel | Revenue Share, 2024 (%) |

| Convenience Stores | 17.60% |

| Supermarkets & Hypermarkets | 29.10% |

| Specialty Stores | 19.80% |

| Online | 23.70% |

| Others | 9.80% |

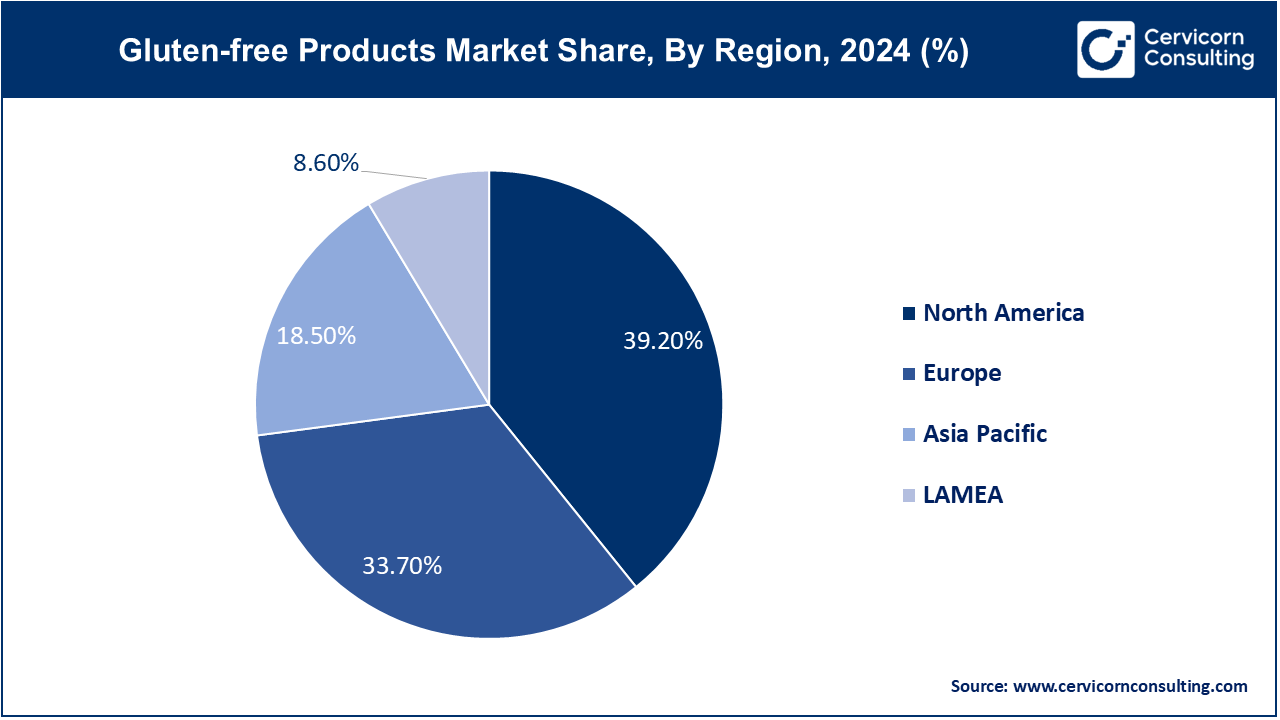

North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa) are some of the key regions included in the gluten-free products market. Each of these has been covered in detail

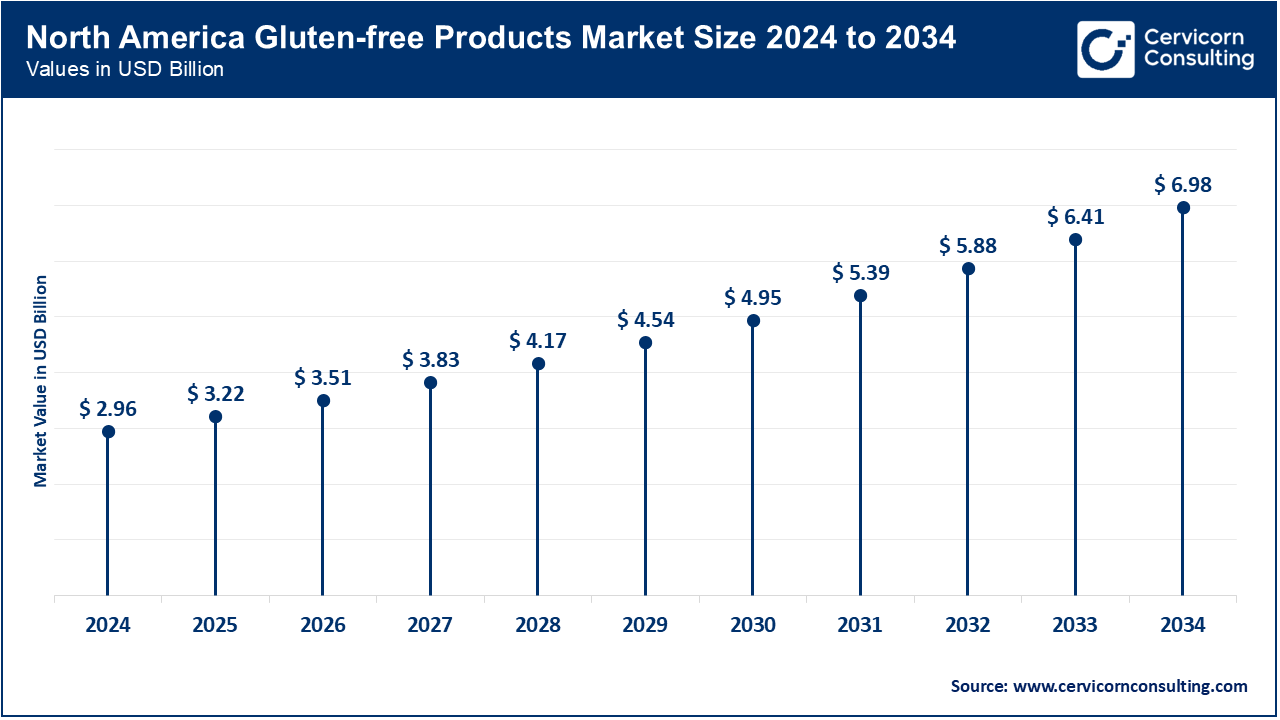

North America is dominating the market due to high prevalence of celiac disease, gluten intolerance, and strong consumer awareness regarding the health benefits of gluten-free diets. The U.S. and Canada lead the region, with an increased demand for gluten-free bakery items, snacks, and ready-to-eat products. Retail giants and specialty stores of this region are accepting gluten-free offerings, increasing its accessibility. Robust promotion campaigns and the support of government policies for food labeling regulations also foster growth in this market.

There is a healthy percentage of this market share present in Europe mainly due to surging health concerns and an amplified diagnosis of sensitivity to gluten in people. A majority of demand comes from such highly developed food processing industries like those of the UK, Germany, and Italy. There are still a lot of gluten-free pizzas, pasta, and pastries, which the population here is in huge demand for. Plus, there is strict regulation over labeling products so that consumers know exactly what they're getting.

In the Asia-Pacific region, high growth is happening in the market because of increasing urbanization, disposable income, and growing awareness of gluten-related disorders. Countries like China, Japan, and India are driving demand for gluten-free snacks, baked goods, and beverages. The main growth drivers have been the increase in popularity of Western-style diets and the entry of international gluten-free brands into the market. The biggest challenge to consumer education remains the lack of understanding of gluten sensitivity in rural areas.

LAMEA is an emerging market, driven mainly by increasing health awareness and urbanization. The whole Latin America region is growing in Latin America countries, of which Brazil and Argentina are the most significant. In the Middle East and Africa, improvement in economic conditions and a growing retail network supports expansion. However, limited availability of products and lesser awareness about gluten intolerance in some regions have been acting as deterrents to market growth. Nonetheless, the region provides unexplored opportunities for market players.

Market Segmentation

By Source

By Type

By Form

By Distribution Channel

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Gluten-free Products

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Source Overview

2.2.2 By Type Overview

2.2.3 By Form Overview

2.2.4 By Distribution Channel Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Health awareness around gluten-free foods

4.1.1.2 Increasing Diagnosis of Celiac Disease

4.1.2 Market Restraints

4.1.2.1 Gluten-free product production is highly costlier as compared to a regular product

4.1.2.2 Less awareness of celiac disease in underdeveloped areas

4.1.2.3 Competition from other dietary trends, such as keto or paleo diets

4.1.3 Market Challenges

4.1.3.1 Educating consumers on the health benefits of gluten-free diets

4.1.3.2 Mass-market appeal

4.1.4 Market Opportunities

4.1.4.1 Growing middle-class populations in emerging markets

4.1.4.2 Increase gluten-free products in the vegan and organic lines

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Gluten-free Products Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Gluten-free Products Market, By Source

6.1 Global Gluten-free Products Market Snapshot, By Source

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Animal Source

6.1.1.2 Plant Source

Chapter 7. Gluten-free Products Market, By Type

7.1 Global Gluten-free Products Market Snapshot, By Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Bakery Products

7.1.1.2 Dairy/ Dairy Alternatives

7.1.1.3 Snacks & RTE Products

7.1.1.4 Pizzas & Pastas

7.1.1.5 Condiments & Dressings

7.1.1.6 Seasonings & Spreads

7.1.1.7 Desserts & Ice Creams

7.1.1.8 Rice

7.1.1.9 Others

Chapter 8. Gluten-free Products Market, By Form

8.1 Global Gluten-free Products Market Snapshot, By Form

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Solid

8.1.1.2 Liquid

Chapter 9. Gluten-free Products Market, By Distribution Channel

9.1 Global Gluten-free Products Market Snapshot, By Distribution Channel

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Convenience Stores

9.1.1.2 Supermarkets & Hypermarkets

9.1.1.3 Specialty Stores

9.1.1.4 Online

9.1.1.5 Others

Chapter 10. Gluten-free Products Market, By Region

10.1 Overview

10.2 Gluten-free Products Market Revenue Share, By Region 2024 (%)

10.3 Global Gluten-free Products Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Gluten-free Products Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Gluten-free Products Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Gluten-free Products Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Gluten-free Products Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Gluten-free Products Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Gluten-free Products Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Gluten-free Products Market, By Country

10.5.4 UK

10.5.4.1 UK Gluten-free Products Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Gluten-free Products Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Gluten-free Products Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Gluten-free Products Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Gluten-free Products Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Gluten-free Products Market, By Country

10.6.4 China

10.6.4.1 China Gluten-free Products Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Gluten-free Products Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Gluten-free Products Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Gluten-free Products Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Gluten-free Products Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Gluten-free Products Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Gluten-free Products Market, By Country

10.7.4 GCC

10.7.4.1 GCC Gluten-free Products Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Gluten-free Products Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Gluten-free Products Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Gluten-free Products Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Vitrolife AB

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Cook Medical

12.3 Merck KGaA

12.4 General Electric (GE)

12.5 Thermo Fisher Scientific, Inc.

12.6 Esco Micro Pte Ltd

12.7 Genea Limited

12.8 Ferring Pharmaceuticals

12.9 Hamilton Thorne, Inc.

12.10 Nidacon International AB

12.11 Rocket Medical plc

12.12 EMD Serono

12.13 Kitazato Corporation

12.14 IVFtech Aps

12.15 Zeiss Group