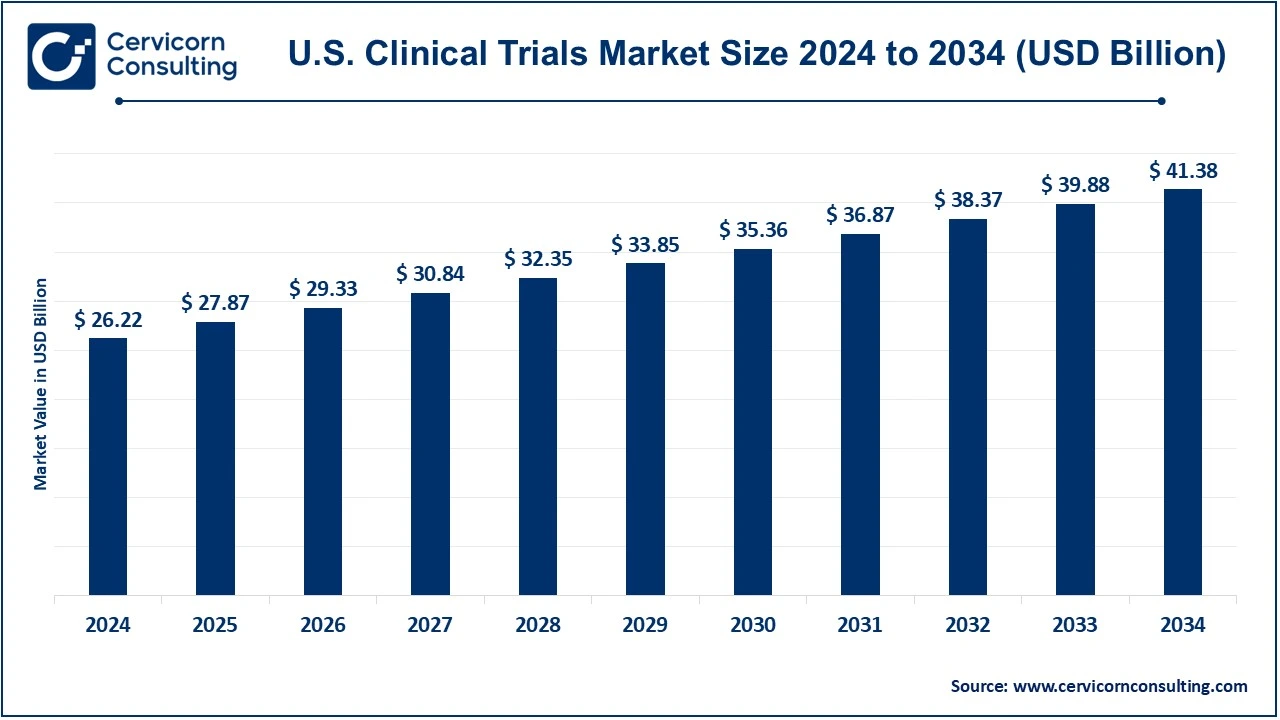

U.S. Clinical Trials Market Size and Growth 2025 to 2034

The U.S. clinical trials market size was valued at USD 26.11 billion in 2024 and is expected to be worth around USD 41.22 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.61% over the forecast period 2025 to 2034.

Robust growth is expected in the U.S. clinical trials market due to rising demands for innovative therapies, improvements in medical research, and increasing prevalence rates of chronic diseases. Other factors driving market growth are the advent of personalized medicine, deployment of AI and big data analytics, and focus on the treatment of rare diseases. In addition, decentralization and virtualization of clinical trials as well as the favourable regulatory framework create massive tailwinds in the growth of the market and improve its accessibility and efficiency for conducting clinical research.

Clinical trials are studies conducted among human subjects aiming at proving the safety, effectiveness, and adverse effects of any kind of medical treatment, drug, device, or intervention. In most cases, these trials are well-systematized and structured into different phases to collect information on how a particular treatment performs in real-world conditions. Clinical trials are helpful in the determination of the effectiveness or safety of a new treatment over existing ones, hence forming an integral part of the process for any new medical therapy. The patients are monitored closely, and findings from such experiments inform medical guidelines as well as regulatory decisions made by bodies such as the FDA.

Report Highlights

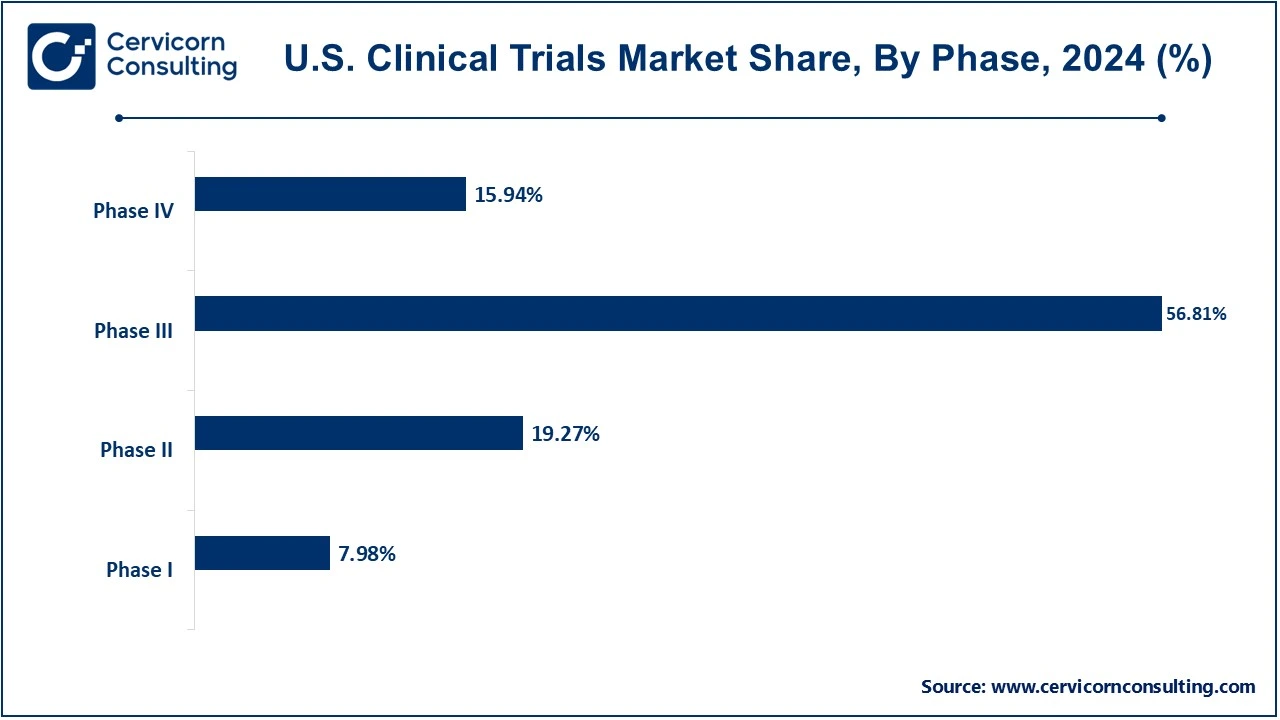

- By phase, the phase III segment accounted for the revenue share of 56.81% in 2024. However, the phase I segment is expected to witness rapid growth during the analysis period.

- By study design, the interventional design segment generated highest revenue share in 2024. However, the observational design segment is projected to hit considerable growth during the forecast period.

- By indication, the oncology segment captured highest revenue share in 2024. However, the cardiovascular segment is expected to hit lucrative growth during the forecast period.

- By service, the patient recruitment segment has held the highest market share in 2024. However, the clinical trial data management services segment hit substantial growth over the forecast period.

- By sponsor, the pharmaceutical & biopharmaceutical companies accounted for the largest share of 68.94% in 2024.

CEO Statements

Ari Bousbib, CEO of IQVIA

"The future of clinical trials is being shaped by the integration of real-world data, advanced analytics, and artificial intelligence. At IQVIA, we are working to transform the clinical development process by making it more efficient, diverse, and patient-centric, ensuring that therapies reach the people who need them most, faster and more effectively."

Peyton Howell, CEO of PAREXEL International Corporation

"At PAREXEL, we are deeply committed to advancing medical innovation through the rigorous and ethical conduct of clinical trials. These trials are the cornerstone of developing new therapies that can transform patient lives. We understand that clinical trials are not just about gathering data—they are about providing hope, improving healthcare outcomes, and ensuring that patients have access to the safest and most effective treatments. Our mission is to collaborate with our partners to streamline the clinical development process, accelerate time-to-market, and uphold the highest standards of safety and integrity in every trial we conduct."

Marc N. Casper, CEO of Thermo Fisher Scientific Inc.

"At Thermo Fisher Scientific, we are committed to enabling the acceleration of scientific discovery and advancing the development of innovative therapies. Through our integrated solutions, from early-stage research to commercial manufacturing, we help our customers navigate the complex landscape of clinical trials. By providing cutting-edge technologies, data insights, and expertise, we empower biopharmaceutical companies to bring new treatments to market faster and with greater precision, ultimately improving patient outcomes."

U.S. Clinical Trials Market Growth Factors

- Increasing Investment in R&D: An ongoing tide of investment in R&D by the combined forces of public and private sectors continues to be the ongoing growth driver for U.S. clinical trials. Pharmaceutical businesses, biotech companies, and the government will continue to invest vast sums in discovering new treatments and enhancing existing ones. Huge funding is continuously offered toward clinical trials in an extremely broad range of therapeutic areas-from oncology and neurology to immunology-and promotes faster innovation as groundbreaking therapies reach the market faster.

- There's an aging population in the U.S. at a relatively fast rate: This shifts the onus of clinical trials for age-related diseases like Alzheimer's, osteoporosis, and cardiovascular diseases. Older adults are mostly chronic health caretakers who need new treatments and management. Such demographic changes have multiplied the number of geriatric clinical research areas in considerable proportions, ensuring treatment options adapted to the elderly and better healthcare outcomes for this increasingly aged population.

- Rare Disorder Interest Growth: Another area that has been rising is that of rare disorders, better known as orphan disorders, an area enhanced by the growth made towards genomics and biotechnology. Incentives such as the Orphan Drug Act have assisted in promoting clinical trials in orphan diseases, and it has thereby become more reasonable for more patients with smaller populations to acquire new treatment options. These trials are, in turn, somewhat of a necessity in providing life-friendly solutions to conditions that, until yesterday, had no solution or remedial option, and opening new avenues for pharmaceutical innovation and patient care.

U.S. Clinical Trials Market Trends

- Artificial Intelligence and Machine Learning: Artificial Intelligence is revolutionizing the implementation of clinical trials through machine learning for the upgrading of patients for recruitment, data analysis, and trial design. Through AI algorithms, vast patient information can be processed and filtered to profile only the best candidates for various trials with predicted outcomes, therefore making clinical research more efficient. Real-time data monitoring and adaptive trial designs enable researchers to change protocols with evolving data, which increases the success rates of a trial and decreases the time-to-market for new treatments.

- Increased Wearable Devices: The use of wearable devices like smartwatches and health trackers is on the rise in clinical trials, as they can monitor patients' health in real-time. This means the devices can enable continuous, non-invasive data gathering. Researchers can monitor vital signs, activity, and other health metrics outside the clinical setting. Such data collection improves accuracy and breadth, and it makes it easier for patients to participate by limiting the requirement for frequent on-site visits. This, in turn, supports decentralized clinical trials.

- Advanced Data Analytics: Advanced data analytics is revolutionizing clinical trials by enabling much more accurate and more personalized trial designs. Large-scale datasets, including both real-world evidence (RWE) and electronic health records (EHRs), have yielded better-informed decisions, identification of potential subgroups with the possibility of differential response to treatments, and streamlined processes in conducting clinical trials. This leads to more effective and targeted interventions, fewer failures in clinical trials, and a quicker overall process of bringing treatments to the market.

Report Scope

| Area of Focus |

Details |

| Market Size in 2024 |

USD 26.11 Billion |

| Expected Market Size in 2034 |

USD 41.22 Billion |

| Projected CAGR |

4.61% |

| Key Segments |

Phase, Study, Indication, Service, Sponsor |

| Key Companies |

IQVIA, Fortrea Inc., PAREXEL International Corporation, Thermo Fisher Scientific Inc., Charles River Laboratories, ICON Plc, Wuxi AppTec Inc., Medpace, Syneos Health, AstraZeneca, Merck & Co., Eli Lilly and Company, Novo Nordisk A/S, Pfizer, Caidya |

U.S. Clinical Trials Market Dynamics

Drivers

- Patient demands for new treatments: Patient demand for innovative treatments, especially in areas like cancer, rare diseases, and chronic conditions, is a very powerful driver for clinical trials. Under this demand for quicker access to therapies that are likely to bring better results or quality of life, pressure mounts against pharmaceutical firms and healthcare organizations. Patient-driven demand, therefore, hastens the process of moving a clinical study by accelerating recruitment, testing, and regulatory approvals for priority healthcare needs.

- Biopharma Investment Growth, in General: There have been considerable sources of private equity, venture capital, and corporate investments, amongst others that have pushed the clinical trial activity in the biopharma sector. Thus, with these increases in capital, new development of drugs and therapies is fueled and, subsequently, spurs the stimulation of trials, which are tested and validated. With biopharma companies investing in frontier technologies and promising research areas, the clinical pipeline tends to expand with greater scientific opportunities for discovery and commercial prospects, especially within specialized fields of immunotherapy and gene editing.

- High Rates of Chronic Diseases: Chronic diseases such as diabetes, heart diseases, and autoimmune disorders are prevalent and on the rise among the American population as aging, lifestyle changes, and genetic factors continue to influence American citizens. The most compelling burden of chronic conditions is motivating clinical trials because researchers seek new treatments and better ways to manage these diseases and cure them. This high prevalence guarantees a constant flow of clinical trial opportunities that attend to public health needs and also opens up market opportunities for new therapies.

Restraints

- Very Expensive to Conduct the Trials: Clinical trials in the U.S. are expensive, as an enormous amount of cost is associated with the recruitment of participants, regulatory compliance, data gathering, and infrastructure. Therefore, the higher costs seem more of a challenge for bigger pharma giants than the smaller biotech firms. Such high costs often delay timelines, reduce scope, and in some cases do not make it possible to start such studies, not a very profitable therapeutic area, such as rare diseases.

- Limited Exposure to Diverse Patient Populations: Most clinical trials conducted in the U.S. face the challenge of not representing diversely the demographics they intend to reach. The lack of minority group representation in the clinical studies, encompassing both race and ethnic minorities, people with impairments, as well as individuals from a relatively lower socio-economic standpoint may compromise the generalizability of the findings. In the context of underrepresentation, the clinical findings will not fairly reflect how treatments operate within the larger population, which in effect does hinder the development of equitable solutions for healthcare.

- Financial and Budgetary Restrictions: Financial resources have traditionally been a sticking point to performing clinical trials, especially for small research houses or studies looking into rare diseases. Larger pharmaceutical companies often carry large budgets, whereas small firms face the problem of raising capital to fund all that a full-scale trial entails. Budgetary constraints lead to restrictions on the number of sites, patients enrolling, and the length of research, all impacting the quality and results of the trial. Funding troubles tend to particularly gnaw in early-stage and pre-clinical trials.

Challenges

- Recruitment and Retention: Recruitment and retention of patients in clinical trials have been the greatest challenge. Even when streamlined, finding eligible candidates through tough eligibility criteria turns out to be time-consuming and costly. At the same time, retaining patients is a challenge too, especially in longer studies, when participants tend to withdraw for whatever reason: side effects, logistical barriers, or failure to engage with the study.Such challenges often result in delays, increased costs, and the development of potential biases in trial outcomes, thus devaluing the validity of clinical research.

- Innovating yet being Safe: In most cases, clinical trials have pioneered what medical science can handle-innovative therapies and technologies. However, it is a colossal challenge to balance innovation with patient safety. New treatments offer so much hope, but they also carry unknown risks at least in early-phase trials. Strong monitoring, strict regulatory oversight, and adaptive trial designs that are sufficiently flexible to address safety concerns while still trying new therapeutic approaches, all will be important to ensure that innovation does not come at the expense of patient well-being.

- Navigating Global Trials and Multinational Regulations: Logistically and in terms of regulation, conducting multinational clinical trials is very challenging. Each country has its own rules and regulation, ethical parameters, and application procedures, which may lead to several delays and complications when implementing multinational clinical trials. Additionally, varying healthcare infrastructures, patient populations, and general cultural attitudes toward clinical research make global clinical trials more difficult to execute. Sponsors and CROs are faced with the significant challenge of trying to ensure compliance across varying regulatory environments while, at the same time, maintaining constant trial protocols across international research.

Opportunity

- More adoptable digital health technologies: Clinical trials have managed to transform due to the emergence of digital health technologies such as wearables, telemedicine, and mobile applications. This has enabled tracking patients in real-time, along with acquisition of remote data collection and conducting virtual visits. Consequently, participation and retention go up. These also make the data more accurate and less expensive in the case of a trial. With digital health tools, remote or decentralized trials become easier and, therefore, it increases access for those rural or underserved community patients. Further, the development time of drugs is also accelerated.

- Focus on pediatric trials: The attention pediatric clinical trials are gaining today results from the need for safe, effective treatments for children. The difference between pediatric and adult trials is that they demand particular regulatory considerations on dosing, safety, and long-term effects. Pharmaceutical companies have started to make investments in this area because regulations around pediatric testing are becoming tighter and awareness increases. This focus leads to a more increased market for pediatric clinical trials and breakthrough treatments that are tailored for the physiological needs of children.

- Post-Market Surveillance and Real-World Evidence: The post-marketing safety and efficacy of drugs highly depend on post-marketing surveillance, with real-world evidence. The clinical trials are now being conducted not only in the controlled settings but also with the help of real-world data of patient registries, electronic health records, and wearables while monitoring the performance of drugs outside the controlled settings. This shall offer a chance for more research that will be fruitful in providing valuable insight about drug effects, thus aiding healthcare providers in making informed decisions towards treatment.

U.S. Clinical Trials Market Segmental Analysis

The U.S. clinical trials market is segmented into phase, study, indication, service, and sponsor. Based on phase, the market is classified into phase I, phase II, phase III, and phase IV. Based on study design, the market is classified into interventional, observational, and expanded access. Based on indication, the market is classified into autoimmune/inflammation, pain management, oncology, CNS conditions, diabetes, obesity, cardiovascular, and others. Based on service, the market is classified into protocol designing, patient recruitment, site identification, bioanalytical testing services, laboratory services, clinical trial data management services and others. Based on sponsor, the market is classified into pharmaceutical & biopharmaceutical companies, medical device companies, and others.

Phase Analysis

The phase III segment has accounted highest revenue share in 2024. Also, the phase I segment is projected to witness highest growth during the analysis period.

Study Design Analysis

Interventional Trials: Interventions are active treatments given to assess their effect on patients. Here, trials involve the assignment of participants to different treatment arms. Experimental drugs, devices, or procedures are tested within some treatment arms, and subjects' outcomes are compared against a control group, typically receiving a placebo, standard treatment, or possibly an active comparator. These trials are conducted to assess the efficacy, safety, and optimal dosages of new therapies. Interventions are important studies for advancing medical care and marketing new treatments across many therapeutic areas.

Observational Studies: Focus on observing and documenting participants' results without intervention or experiment. They collect data by way of naturalistic observation, which contributes to understanding the progression of diseases, risk factors, or treatment effects in real life. The participants in the observational studies do not receive any prescribed treatment or procedure since it is an interventional trial. This strategy is often applied to monitor the efficacy of current treatments and realize emerging patterns of disease while investigating possible environmental or genetic factors in health results.

Expanded Access Trials: Expanded access, also called compassionate use, permits patients with life-threatening or serious conditions to receive an investigational drug outside of an investigation when there are no satisfactory alternatives. It is to enable early access to potentially life-saving drugs before they are approved by the regulatory agencies. Although expanded access trials are not used to collect formal data, they represent a potential alternative for patients who need an intervention in desperate times and are a part of ongoing safety and efficacy assessments of the investigational therapy.

Indication Analysis

Autoimmune/Inflammation: Autoimmune and inflammatory diseases, including rheumatoid arthritis, lupus, and multiple sclerosis, constitute a state in which the immune system attacks the body's tissues, leading to chronic inflammation. Clinical trials in the space test new therapies aimed at reducing inflammation, modulating immune responses, and preventing tissue damage. Advances in biologics, such as monoclonal antibodies and immune checkpoint inhibitors, and the ever-growing understanding of the immune system, are changing the face of treatment options for autoimmune disorders and driving new clinical research innovation.

Pain Management: Pain management trials focus on developing and testing therapies for acute and chronic pain, including pain related to conditions like arthritis, neuropathy, and cancer. These studies are meant to assess novel pain medications, medical devices or non-pharmacologic treatments like nerve stimulators and/or cognitive-behavioral therapy. The opioid epidemic has generated increased research into non-addictive alternatives to traditional opioids, fostering the phenomenal growth in novel approaches for pain management conducted in clinical trials seeking improvements in patients' quality of life and reducing dependence on opioids.

CNS Disorders: CNS-related diseases and conditions encompass neurodegenerative disorders like Alzheimer's, Parkinson's, and Huntington's disease; mental health disorders include depression and schizophrenia. An important set of clinical studies on new drugs, therapies, and devices focused on modifying the pathogenesis of these diseases, or alleviating their symptoms altogether and enhancing brain function. CNS trials are very long-term, highly challenging, and require specialized techniques due to the complexity of the brain and its diseases. However, these are critical for addressing unmet medical needs in these growing patient populations.

Diabetes: Diabetes, assess new treatments and interventions for managing blood glucose levels, improving insulin sensitivity, and preventing complications resulting from diabetes, including kidney damage, neuropathy, cardiovascular disease, among others. These studies are crucial as they forward therapies, such as insulin analogs, GLP-1 receptor agonists, and novel oral medications, to control the disease, thereby fostering patient outcome improvements. As type 2 diabetes continues to rise in U.S. populations, diabetes studies are integral to getting the burden of this chronic illness under control in healthcare systems.

Obesity: Obesity, investigate new and potentially innovative treatments that may reduce body weight, thus enhancing associated health outcomes like low risks for diabetes, hypertension, and cardiovascular diseases. The treatment options under clinical trials usually entail medicinal interventions, lifestyle interventions, or surgical interventions like bariatric surgery. Given the rising obesity levels in the U.S., clinical research in the obesity domain is essential to find effective weight-reduction therapies as well as in controlling the increasing demand for obesity management and ultimately reducing the healthcare costs linked to disease conditions caused by obesity.

Cardiovascular: Cardiovasculars are essential to develop new therapies designed to prevent or treat heart disease, hypertension, stroke, and associated disorders. These trials typically assess drugs, devices (such as stents or pacemakers), and lifestyle interventions to prevent heart attacks; control cholesterol levels; and improve the functioning of the heart. Heart disease is the nation's number one killer, so cardiovascular clinical trials are essential to improving patient outcomes and developing new methods to prevent, diagnose, or treat cardiovascular diseases across a broad population of patients.

Sponser Analysis

The pharmaceutical & biopharmaceutical companies segment is leading the market. The medical device companies segment is expected to witness strong growth over the forcast period.

U.S. Clinical Trials Market Revenue Share, By Sponsor, 2024 (%)

| Sponsor |

Revenue Share, 2024 (%) |

| Pharmaceutical & Biopharmaceutical Companies |

68.94% |

| Medical Device Companies |

19.35% |

| Others |

11.71% |

U.S. Clinical Trials Market Top Companies

- IQVIA

- Fortrea Inc.

- PAREXEL International Corporation

- Thermo Fisher Scientific Inc.

- Charles River Laboratories

- ICON Plc

- Wuxi AppTec Inc.

- Medpace

- Syneos Health

- AstraZeneca

- Merck & Co.

- Eli Lilly and Company

- Novo Nordisk A/S

- Pfizer

- Caidya

Recent Developments

Some of the more recent product launches in the US clinical trials industry focused on the emerging trend of innovation and strategic collaboration between the industry leaders. These include some of the key players like IQVIA, Fortrea Inc., PAREXEL International Corporation, Thermo Fisher Scientific Inc., and Charles River Laboratories, which evolve their offerings with advanced technologies such as AI, data analytics, and automation to make clinical trial processes more efficient and accurate. Innovation has also been aimed at reducing the development time for drugs, thereby saving cost and enhancing patient recruitment and retention. Furthermore, because of the popularity of partnerships between CROs and pharmaceutical firms, drugs are being introduced into the market even faster, with a more tailored approach, which is what the healthcare sector needs.

- In June 2024, IQVIA revealed its new clinical trials technology platform called One Home for Sites, which simplified trial management by managing one and single sign-on application views. This solved the issue of technology overload in research sites as the staff has to deal with multiple usernames and passwords that seriously hamper patient care and trial management. One Home for Sites brought together clinical applications, thereby improving operational efficiency and honing patient recruitment with increased capacity treatment. The platform was developed following input from more than 100 site personnel and is currently being piloted by Prime Sites of IQVIA; ensuing feedback would only make its user experience finer. In addition to that, IQVIA was also partnering with several vendors in the clinical technology space to improve site capacity and accelerate the delivery of new medical treatments.

- In January 2024, Parexel collaborated strategically with the Japanese Foundation for Cancer Research (JFCR) to enhance access to oncology clinical trials in Japan. Under that partnership, JFCR was developed as one of the preferred sites for oncology studies through the expansion of opportunities for Japanese patient participation in cancer research through the addition of more sites in Parexel's Global Site Alliance Network. That collaboration enabled making use of JFCR's knowledge in updating the trial protocols with the standards of health care and regulatory mechanisms in Japan toward making it easier to recruit patients and initiate studies more quickly. It reflected a collective commitment to better cancer care and more significant clinical opportunities for the underrepresented populations of Japan as the country continues to face ever-increasing levels of cancer incidence.

- In October 2024, Thermo Fisher Scientific Launched Accelerator Drug Development which combined clinical trials, manufacturing, and logistics to speed up the drug development process for clients that are biopharma. The company said that at a Milan tradeshow as well and the company planned on growing that suite with an ultra-cold chain facility in the Netherlands and a packaging unit in Switzerland. The company also was building its clinical research business under the brand PPD, which included the new bioanalytical lab located in Sweden, and is partnering with DHL Express to implement the logistics practice, aiming for significant reductions in greenhouse gas emissions.

Market Segmentation

By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By Study

- Interventional

- Observational

- Expanded Access

By Indication

- Autoimmune/Inflammation

- Rheumatoid Arthritis

- Multiple Sclerosis

- Osteoarthritis

- Irritable Bowel Syndrome (IBS)

- Others

- Pain Management

- Oncology

- Blood Cancer

- Solid Tumors

- Other

- CNS Conditions

- Epilepsy

- Parkinson's Disease (PD)

- Huntington's Disease

- Stroke

- Traumatic Brain Injury (TBI)

- Amyotrophic Lateral Sclerosis (ALS)

- Muscle Regeneration

- Others

- Diabetes

- Obesity

- Cardiovascular

- Others

By Service

- Protocol Designing

- Patient Recruitment

- Site Identification

- Bioanalytical Testing Services

- Laboratory Services

- Clinical Trial Data Management Services

- Others

By Sponsor

- Pharmaceutical & Biopharmaceutical Companies

- Medical Device Companies

- Others

...

...