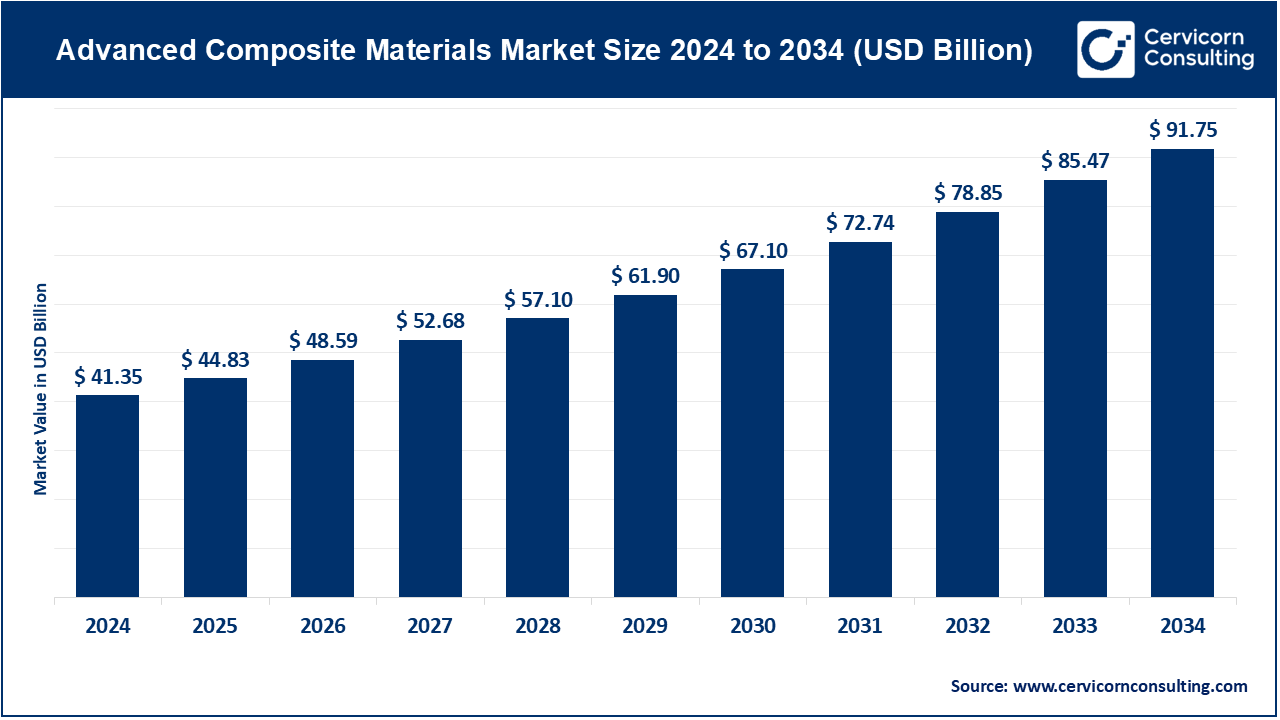

The global advanced composite materials market size was accounted for USD 41.35 billion in 2024 and is expected to reach around USD 91.75 by 2034, growing at a compound annual growth rate (CAGR) of 8.40% over the forecast period 2025 to 2034.

The global advanced composite materials market is experiencing rapid growth due to increased demand from industries focused on weight reduction, sustainability, and improved performance. Aerospace and automotive sectors are particularly significant drivers, as manufacturers continue to adopt advanced composites to enhance fuel efficiency and reduce emissions. Carbon fiber composites, in particular, are gaining traction in the automotive sector for their ability to reduce vehicle weight without compromising structural integrity, contributing to increased adoption. The growth of electric vehicles (EVs) and autonomous vehicles also presents new opportunities for advanced composites, as lightweight materials are essential for maximizing range and efficiency. Globally, Russia, Ukraine, and Peru are the top importers of composite materials, collectively accounting for 76% of total imports. Russia alone represents 41% of these imports. Additionally, advancements in production processes, such as automated fiber placement and resin transfer molding, are driving down costs and making advanced composites more accessible to a broader range of industries.

Advanced composite materials are engineered materials consisting of two or more constituent materials with significantly different physical or chemical properties. These materials work together to achieve superior mechanical, thermal, and electrical properties compared to the individual components. The most common types of advanced composites are fiber-reinforced polymers (FRPs), which use fibers like carbon, glass, or aramid embedded in a polymer matrix. These composites are known for their high strength-to-weight ratios, corrosion resistance, and flexibility in design. Advanced composites are widely used in industries such as aerospace, automotive, marine, and construction, where performance, durability, and weight reduction are critical. These materials offer exceptional advantages, including increased fuel efficiency, better performance, and extended service life, making them essential in modern engineering.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 44.83 Billion |

| Market Growth Rate | CAGR of 8.40% from 2025 to 2034 |

| Market Size by 2034 | USD 91.75 Billion |

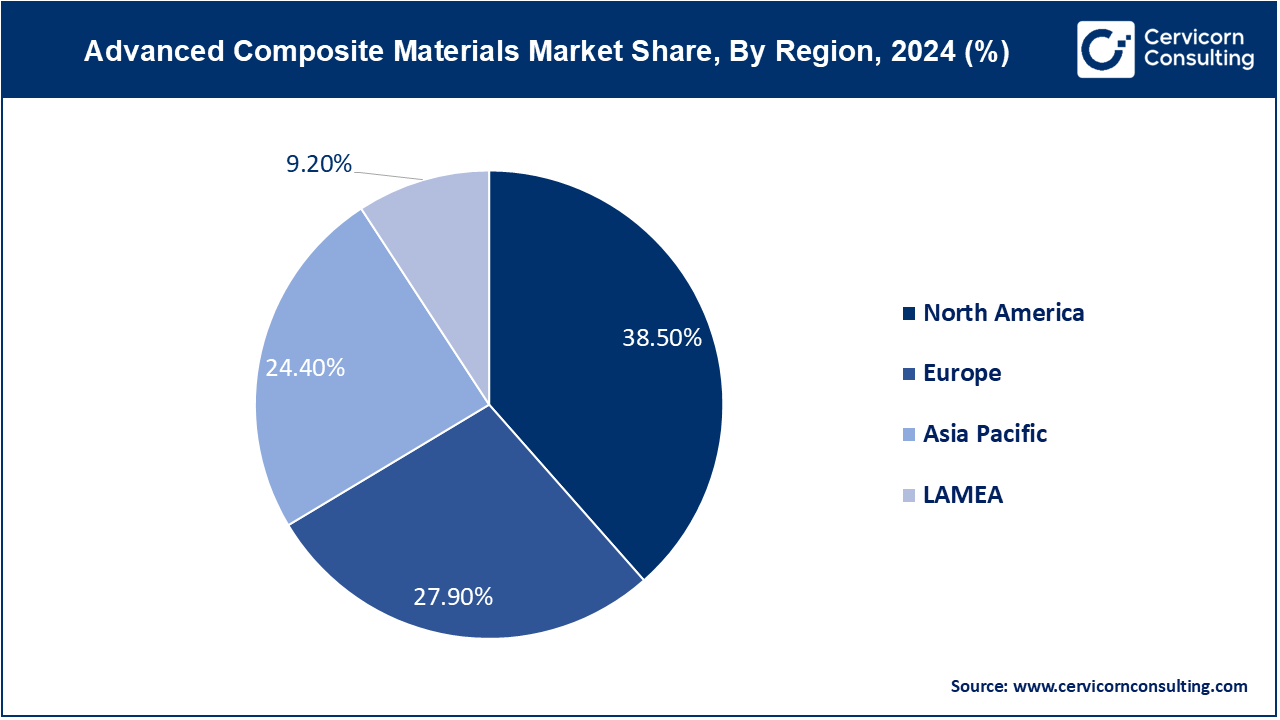

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Segment Coverage | By Product, Type, Application and Regions |

Increased Adoption in Sports and Leisure:

Technological Advancements in Composite Materials:

High Production Costs:

Recycling and Disposal Challenges:

Expansion in the Marine Industry:

Growth in Urban Air Mobility (UAM):

Complex Manufacturing Processes:

The advanced composite materials market is segmented into product, type, application and region. Based on product, the market is classified into aramid fiber, carbon fiber, glass fiber, and others. Based on type, the market is classified into polymer matrix composites (PMCs), metal matrix composites (MMCs), ceramic matrix composites (CMCs), and hybrid composites. Based on application, the market is classified into aerospace & defense, automotive, construction & infrastructure, wind energy, marine, sports & leisure, and others.

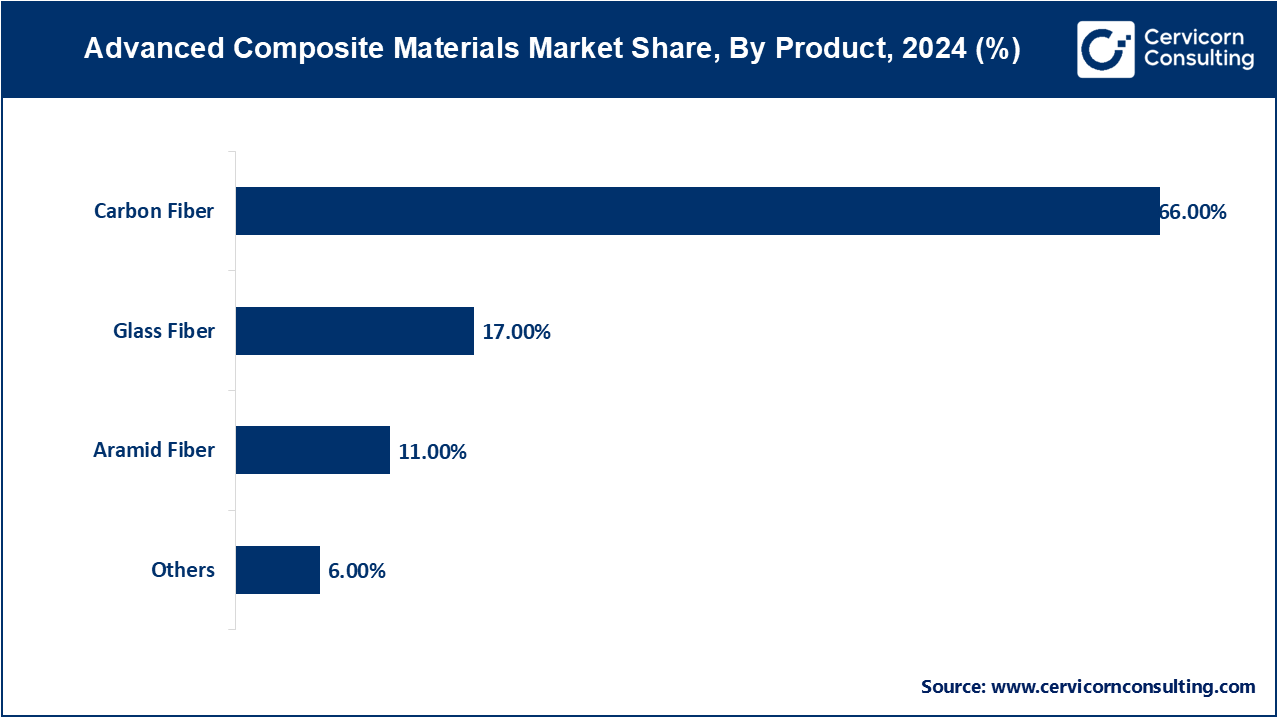

Aramid Fiber: This segment has captured market share of 11% in 2024. Aramid fiber is a class of heat-resistant and strong synthetic fibers used in aerospace and military applications, as well as in the manufacture of ballistic-rated body armor, marine cordage, and sports equipment. The demand for aramid fibers is increasing due to their excellent strength-to-weight ratio and resistance to impact, chemicals, and heat. They are becoming more popular in automotive and aerospace industries for applications requiring high-performance materials, driven by safety and performance improvements.

Carbon Fiber: In 2024, The carbon fiber segment has has calculated dominating market share of 66%. Carbon fiber is a strong, lightweight material made of thin, strong crystalline filaments of carbon. It is commonly used in high-performance applications like aerospace, automotive, sports equipment, and renewable energy. Carbon fiber demand is growing rapidly in sectors focused on weight reduction and fuel efficiency, such as aerospace and automotive. Advances in production technologies are making carbon fibers more affordable, expanding their use in consumer electronics and renewable energy, particularly wind turbines.

Glass Fiber: The glass fiber segment has confired market share of 17% in 2024. Glass fiber, made from fine strands of glass, is a lightweight and cost-effective reinforcement material used in composites for various applications, including construction, automotive, and marine industries. Glass fibers are seeing increased demand due to their versatility and cost-effectiveness, particularly in construction and infrastructure projects. The rise in renewable energy projects, like wind turbine blades, is further driving their use, as glass fibers provide a good balance between performance and cost.

Others: The others segment has registered small market share of 6% in 2024. This category includes other advanced fibers and materials such as basalt fibers, ceramic fibers, and natural fibers, which are used in specialized applications requiring specific performance characteristics. Growing environmental concerns are driving interest in natural and sustainable fibers as alternatives to synthetic materials. Basalt and ceramic fibers are gaining attention for their high-temperature and corrosion resistance, with potential applications in industries such as aerospace, automotive, and construction for enhanced performance and sustainability.

Polymer Matrix Composites (PMCs): Polymer Matrix Composites (PMCs) consist of a polymer resin reinforced with fibers such as carbon, glass, or aramid. They are known for their lightweight, high strength, and versatility. PMCs are increasingly used in automotive and aerospace industries for weight reduction and fuel efficiency. Innovations in thermoplastics and recycling processes are enhancing their environmental sustainability, making PMCs more attractive for a broader range of applications.

Metal Matrix Composites (MMCs): Metal Matrix Composites (MMCs) are composed of metal matrices, such as aluminum or titanium, reinforced with ceramic or metallic fibers. They offer high strength, thermal stability, and wear resistance. MMCs are gaining popularity in the automotive and aerospace sectors for their ability to withstand high temperatures and harsh conditions. Advances in manufacturing techniques, like powder metallurgy and 3D printing, are reducing costs and expanding their applications in electronics and military equipment.

Ceramic Matrix Composites (CMCs): Ceramic Matrix Composites (CMCs) are made from ceramic fibers embedded in a ceramic matrix. They are renowned for their high-temperature resistance, low density, and excellent thermal stability. CMCs are increasingly used in aerospace and power generation industries for applications that require high-temperature performance. Ongoing research focuses on improving their toughness and reducing production costs, facilitating their adoption in new sectors like automotive and energy.

Hybrid Composites: Hybrid Composites combine two or more different types of fibers within the same matrix, offering a balance of properties from each constituent. This results in enhanced mechanical performance and flexibility. Hybrid composites are being adopted in sectors like automotive, sports, and construction for their tailored properties. Advances in material design and processing techniques are enabling the development of more efficient hybrid systems, promoting their use in applications requiring specific mechanical and thermal characteristics.

Aerospace & Defense: Advanced composites are used in aerospace and defense to enhance performance, reduce weight, and improve fuel efficiency. These materials are crucial for aircraft, spacecraft, and military vehicles due to their high strength-to-weight ratio and durability. Increasing demand for lightweight, high-performance materials is driving the use of composites in next-generation aircraft and defense systems. Advancements in composite technology are enabling more efficient and cost-effective solutions.

Automotive: In the automotive industry, advanced composites are used to reduce vehicle weight, improve fuel efficiency, and enhance safety. These materials are applied in structural components, body panels, and interior parts. Growing adoption of electric and hybrid vehicles is boosting the demand for lightweight composites. Innovations in manufacturing processes and material properties are making composites more accessible and cost-effective for mainstream automotive applications.

Construction & Infrastructure: Advanced composites are utilized in construction and infrastructure for their strength, durability, and resistance to environmental factors. They are used in reinforcing structures, building facades, and infrastructure repairs. Increasing focus on sustainable construction and the need for long-lasting materials are driving the use of composites. Their ability to improve the lifespan and reduce maintenance costs of infrastructure is a key factor in their growing adoption.

Wind Energy: In wind energy, advanced composites are essential for manufacturing turbine blades due to their lightweight and high-strength properties. These materials help increase the efficiency and lifespan of wind turbines. The rise in renewable energy initiatives is accelerating the use of composites in wind turbine blades. Technological advancements are improving material performance and reducing costs, supporting the expansion of wind energy capacity.

Marine: Advanced composites are used in the marine industry to enhance the performance and durability of boats, ships, and offshore structures. Their resistance to corrosion and lightweight properties are critical for marine applications. The demand for high-performance and fuel-efficient marine vessels is driving the adoption of composites. Innovations in materials and manufacturing techniques are enhancing the performance and cost-effectiveness of marine composites.

Sports & Leisure: In sports and leisure, advanced composites are employed in equipment such as bicycles, golf clubs, and tennis rackets for their lightweight and high-strength characteristics. They improve performance and durability in athletic gear. Increasing consumer demand for high-performance sports equipment is fueling the use of composites. Advancements in material technology are leading to the development of more innovative and customized sports products.

Others: Other applications of advanced composites include medical devices, consumer goods, and electronics. These materials are used for their strength, lightweight, and specialized properties tailored to various industry needs. Expanding uses in diverse fields are driving innovation in composite materials. Applications in emerging technologies and specialized products are broadening the market for advanced composites, offering new growth opportunities.

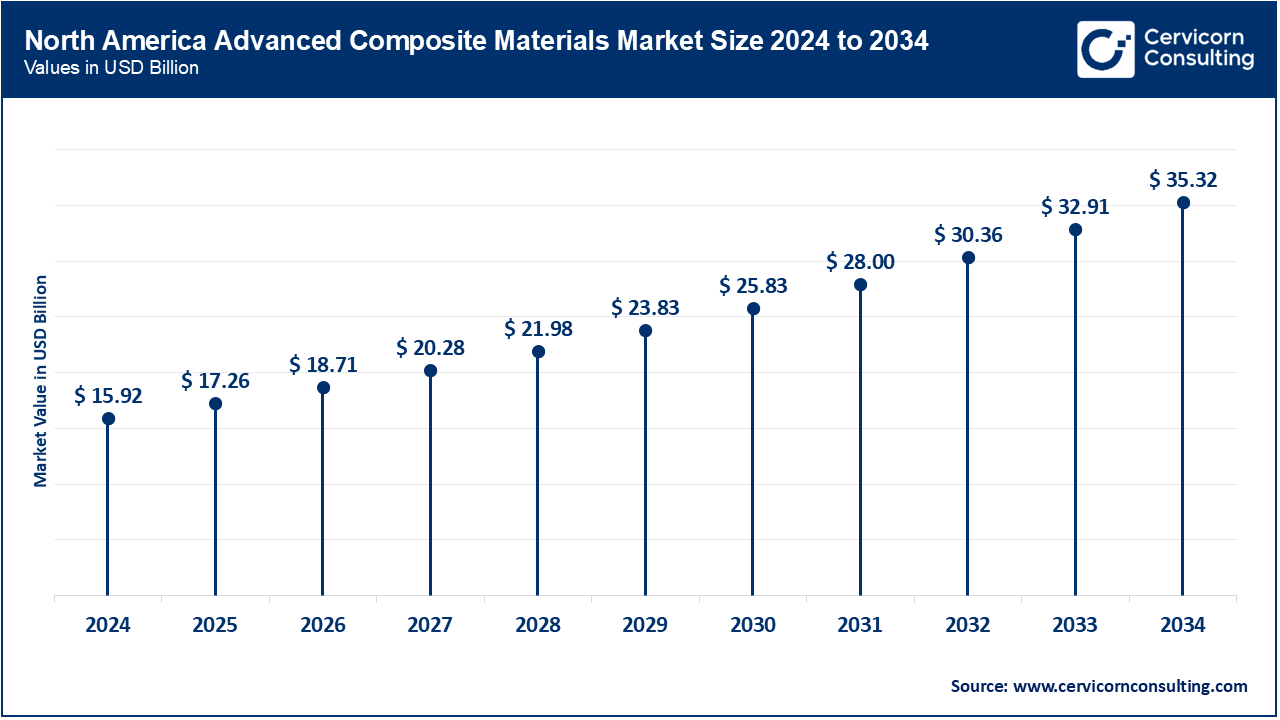

The North America market size is expected to reach around USD 35.32 billion by 2034 increasing from USD 15.92 billion in 2024 with a CAGR of 8.42%. North America, particularly the United States, is a leader in advanced composite materials due to its strong aerospace and defense sectors. The region is experiencing growth driven by increasing demand for lightweight materials in aviation, automotive, and construction industries. Technological advancements and significant R&D investments are also propelling market expansion.

The Asia Pacific market size is calculated at USD 10.09 billion in 2024 and is projected to grow around USD 22.39 billion by 2034 with a CAGR of 8.63%. The Asia-Pacific region is witnessing rapid growth in advanced composites due to booming automotive, construction, and aerospace industries. The increasing industrialization and infrastructure development in countries like China and India are driving demand. Additionally, there is significant investment in research and development to enhance material performance and reduce costs.

The Europe market size is measured at USD 11.54 billion in 2024 and is expected to grow around USD 25.6 billion by 2034 with a CAGR of 8.44%. Europe is focusing on sustainability and innovation in advanced composites, with a strong emphasis on green building practices and renewable energy. The region is seeing growth in wind energy applications and automotive sectors due to regulatory pressures and incentives promoting energy-efficient and environmentally friendly technologies.

The LAMEA market size is forecasted to reach around USD 8.44 billion by 2034 from USD 3.8 billion in 2024 with a CAGR of 8.37%. The LAMEA(Latin America, Middle East, and Africa) region is experiencing gradual growth in advanced composites, primarily driven by infrastructure development and energy projects. The focus is on utilizing composites in construction and renewable energy sectors. However, market growth is slower compared to other regions due to lower industrial activity and limited investment in advanced technologies.

Advanced Navigation is a notable new entrant, leveraging AI and robotics innovations to develop advanced composite materials for autonomous systems. Solomon is also emerging, collaborating with NVIDIA to enhance its 3D vision and augmented intelligence solutions for advanced robotics. Hexcel Corporation and Toray Industries lead the market through extensive R&D, driving advancements in aerospace and automotive applications. Solvay S.A. and Mitsubishi Chemical dominate by providing high-performance composites for diverse industries, backed by robust manufacturing capabilities and global presence.

Market Segmentation

By Product

By Type

By Application

By Region